UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 24, 2015

____________________

SPIRIT AIRLINES, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

|

| |

001-35186 (Commission File Number) | 38-1747023 (IRS Employer Identification Number) |

2800 Executive Way

Miramar, Florida 33025

(Address of principal executive offices, including Zip Code)

(954) 447-7920

(Registrant's telephone number, including area code)

____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

[] | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

[] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

[] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

[] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

The information in this report furnished pursuant to Item 2.02 shall not be deemed “filed” for the purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. It may only be incorporated by reference in another filing under the Exchange Act or the Securities Act of 1933, as amended (the “Securities Act”), if such subsequent filing specifically references the information furnished pursuant to Item 2.02 of this report.

| |

Item 2.02. | Results of Operations and Financial Condition. |

On July 24, 2015, Spirit Airlines, Inc. (the “Company” or “Spirit”) issued a press release announcing its unaudited financial results for the second quarter 2015; a copy of which is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Non-GAAP financial measures that reflect adjustments from historical financial data prepared under GAAP, including adjustments for special items, are included in the press release as supplemental disclosures because the Company believes they are useful indicators of the Company's operating performance for comparative purposes. These non-GAAP financial measures are well recognized performance measurements in the airline industry that are frequently used by investors, securities analysts and other interested parties in comparing the operating performance of companies in the airline industry. The non-GAAP financial measures provided have limitations as an analytical tool. Because of these limitations determinations of our operating performance adjusted for special items should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP. The Company has also provided in the press release reconciliations of these non-GAAP financial measures to the appropriate GAAP financial measures.

| |

Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

The following is furnished as an exhibit to this report and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act:

|

| | |

Exhibit No. | Description |

| |

99.1 | Press Release regarding second quarter 2015 financial results. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Date: July 24, 2015 | SPIRIT AIRLINES, INC. |

By: /s/ Thomas Canfield

Name: Thomas Canfield

Title: Senior Vice President and General Counsel

EXHIBIT INDEX

|

| | |

Exhibit No. | Description |

| |

99.1 | Press Release regarding second quarter 2015 financial results. |

EXHIBIT 99.1

Spirit Airlines Reports Second Quarter 2015

Adjusted Pre-Tax Margin of 21.3 Percent

MIRAMAR, FL. (July 24, 2015) - Spirit Airlines, Inc. (NASDAQ: SAVE) today reported second quarter 2015 financial results.

| |

• | Adjusted net income for the second quarter 2015 increased 12.6 percent to $74.8 million ($1.03 per diluted share) compared to the second quarter 20141. GAAP net income for the second quarter 2015 increased 18.3 percent year over year to $76.7 million ($1.05 per diluted share). |

| |

• | Adjusted pre-tax margin for the second quarter 2015 was 21.3 percent1. On a GAAP basis, pre-tax margin for the second quarter 2015 was 21.8 percent. |

| |

• | Spirit ended the second quarter 2015 with unrestricted cash and cash equivalents of $769.3 million. |

| |

• | Spirit's return on invested capital (before taxes and excluding special items) for the twelve months ended June 30, 2015 was 29.4 percent2. |

"Our second quarter 2015 performance was negatively impacted by an unusual number of storms and I want to thank our team members and business partners for their hard work and dedication in serving our customers and helping us to restore our operations to normal," said Ben Baldanza, Spirit’s Chief Executive Officer. "In addition to an unusual number of storms, we’ve recently seen a noticeable change in competitive pricing behavior. But, the fundamentals of our business haven’t changed: we continue to grow our network while maintaining high margins, delivering strong returns, and offering our customers low fares."

During June, Spirit experienced consecutive storm systems in Dallas, Chicago, New York, and Detroit followed by Tropical Storm Bill that sat over Houston before moving north to Dallas. The timing and location of these storm systems produced a domino effect on the Company's operation resulting in over 500 flight cancellations and numerous flight delays. Due to the sheer volume of flights affected, the Company was unable to flex up staffing levels enough to mitigate the impact of crews being displaced or being unable to work due to them reaching their contractual or regulatory work hour maximums. These challenges lengthened the span of the irregular operation and the time it took to restore the system to normal. With its high aircraft utilization, low daily flight frequency and point-to-point network, severe irregular operations typically create a unique set of challenges for the Company; however, the Company believes the unusual number and location of storms in June exacerbated the operational difficulty and made this event unlike others. The Company estimates the impact of the cancellations, delays, and other non-recurring expenses during the quarter negatively impacted operating income by $20 million ($5 million lower revenue, $15 million higher costs). Adjusting for these items, the Company estimates it would have reported adjusted net income of $87.5 million ($1.20 per diluted share).

Revenue Performance

For the second quarter 2015, Spirit's total operating revenue was $553.4 million, an increase of 10.8 percent compared to the second quarter 2014, driven by an increase in flight volume, partially offset by a decrease in operating yields.

Total revenue per passenger flight segment ("PFS") for the second quarter 2015 decreased 12.4 percent year over year to $122.59, primarily driven by a 19.4 percent decrease in ticket revenue per PFS. The decline in ticket revenue per PFS was driven by lower fare levels as a result of increased competitive pressures as well as a higher percentage of the Company’s markets being under development compared to the same period last year. Although slightly lower year over year on a per PFS basis, non-ticket revenue continues to provide a stable revenue stream that is increasingly important during periods of lower passenger yields. Non-ticket revenue per PFS only declined 1.7 percent year over year to $54.24. The decrease in non-ticket revenue per PFS was primarily attributable to lower bag revenue per PFS and the outsourcing of the Company's onboard catering to a third-party provider under a revenue share agreement.

Total revenue per available seat mile (“RASM”) for the second quarter 2015 decreased 14.8 percent compared to the second quarter 2014 on a capacity increase of 30.1 percent. The RASM decrease was driven by lower fare levels as a result of increased competitive pressures as well as the ramp up growth in the Company's new and mature markets.

Cost Performance

Total operating expenses for the second quarter 2015, excluding $2.9 million of credits related to special items, increased 10.4 percent to $434.0 million3. Including special items, total operating expenses increased 9.4 percent year over year to $431.1 million. Operating expenses benefited from economic fuel expense decreasing 14.8 percent, or $22.8 million, on a fuel volume increase of 27.8 percent.

Spirit reported second quarter 2015 cost per available seat mile ("ASM") excluding special items and fuel (“Adjusted CASM ex-fuel”)3 of 5.80 cents, a decrease of 2.5 percent compared to the same period last year, driven primarily by lower aircraft rent per ASM, lower distribution expense per ASM, and lower labor expense per ASM. These benefits were partially offset by higher passenger re-accommodation expense per ASM. The decrease in aircraft rent per ASM was driven by a change in the mix of leased (rent recorded under aircraft rent) and purchased (depreciation recorded under depreciation and amortization) aircraft. Lower distribution expense per ASM was in part driven by lower credit card rates related to the modification and extension of Spirit's credit card processor agreement in late 2014. Labor expense per ASM in the second quarter 2015 was lower compared to the same period last year primarily due to scale benefits from overall growth and from larger gauge aircraft, partially offset by higher health care costs. Passenger re-accommodation expense (recorded under other operating expense) per ASM was primarily higher year over year due to the impact from an unusual number of storm systems that disrupted the Company's operations.

"Due to the financial impact of the unusual number of cancellations, delays, and other non-recurring items during the quarter, as well as higher healthcare costs, we have revised our full year 2015 Adjusted CASM ex-fuel range and now estimate it will be down 5 to 6 percent year over year,” said Ted Christie, Spirit's Chief Financial Officer. "Despite these adjustments, I am encouraged about how the business is performing, which establishes a solid base for improved cost performance in 2016 and beyond."

Share Repurchase

Spirit repurchased approximately 1 million shares during the second quarter, which equated to approximately $67.5 million of the total $100 million authorization.

Fleet

In the second quarter 2015, Spirit took delivery of 3 new A320 aircraft, ending the quarter with 73 aircraft in its fleet.

Other Second Quarter 2015 Highlights

| |

• | Maintained its commitment to offer low fares to its valued customers; average ticket revenue per PFS for the second quarter 2015 was $68.35 with total revenue per PFS of $122.59. |

| |

• | Launched service on 24 new nonstop routes in the second quarter 2015. |

| |

• | Delivered our first SpaceFlex certified A320, which provides the cabin flexibility to add four additional Big Front Seats to this aircraft and our entire A320 fleet. |

| |

• | Received FAA certification to add ten additional seats to the A321 aircraft scheduled for delivery this year and beyond. |

Conference Call/Webcast Detail

Spirit will conduct a conference call to discuss these results today, July 24, 2015, at 10:00 a.m. ET. A live audio webcast of the conference call will be available to the public on a listen-only basis at http://ir.spirit.com. An archive of the webcast will be available under Webcasts & Presentations for 60 days.

About Spirit Airlines:

Spirit Airlines (NASDAQ: SAVE) is committed to offering the lowest total price to the places we fly, on average much lower than other airlines. Our customers start with an unbundled, stripped-down Bare Fare™ and get Frill Control™ which allows them to pay only for the options they choose - like bags, seat assignments and refreshments - the things other airlines bake right into their ticket prices. We help people save money and travel more often, create new jobs and stimulate business growth in the communities we serve. With our modern and fuel-efficient all-Airbus fleet, we operate more than 360 daily flights to 57 destinations in the U.S., Latin America and the Caribbean. Come save with us at www.spirit.com.

Investors are encouraged to read the Company's periodic and current reports filed with or furnished to the Securities and Exchange Commission, including its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K, for additional information regarding the Company.

End Notes

| |

(1) | See "Reconciliation of Adjusted Net Income to GAAP Net Income" table below for more details. |

| |

(2) | See "Calculation for Return on Invested Capital" table below for more details. |

| |

(3) | See "Reconciliation of Adjusted Operating Expense to GAAP Operating Expense" table below for more details. |

Forward-Looking Statements

Statements in this release and certain oral statements made from time to time by representatives of the Company contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which represent the Company's expectations or beliefs concerning future events. The words “expects,” “estimates,” “plans,” “anticipates,” “indicates,” “believes,” “forecast,” “guidance,” “outlook,” “may,” “will,” “should,” “seeks,” “targets” and similar expressions are intended to identify forward-looking statements. Similarly, statements that describe the Company's objectives, plans or goals, or actions the Company may take in the future, are forward-looking statements. Forward-looking statements include, without limitation, statements regarding the Company's intentions and expectations regarding revenues, cost of operations, the delivery schedule of aircraft on order, and announced new service routes. All forward-looking statements are based upon information available to the Company at the time the statement is made. The Company has no intent, nor undertakes any obligation, to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Forward-looking statements are subject to a number of factors that could cause the Company's actual results to differ materially from the Company's expectations, including the competitive environment in the airline industry; the Company's ability to keep costs low; changes in fuel costs; the impact of worldwide economic conditions on customer travel behavior; the Company's ability to generate non-ticket revenues; and government regulation. Additional information concerning these and other factors is contained in the Company's Securities and Exchange Commission filings, including but not limited to the Company's Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K.

SPIRIT AIRLINES, INC.

Statement of Operations

(in thousands, except per share data)

(unaudited)

|

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| | | Six Months Ended | | |

| June 30, | | Percent | | June 30, | | Percent |

| 2015 |

| 2014 |

| Change | | 2015 | | 2014 | | Change |

Operating revenues: |

|

|

|

|

| | | | | | |

Passenger | $ | 308,573 |

|

| $ | 302,487 |

|

| 2.0 |

| | $ | 582,039 |

| | $ | 556,365 |

| | 4.6 |

|

Non-ticket | 244,848 |

|

| 196,850 |

|

| 24.4 |

| | 464,737 |

| | 380,959 |

| | 22.0 |

|

Total operating revenues | 553,421 |

|

| 499,337 |

|

| 10.8 |

| | 1,046,776 |

| | 937,324 |

| | 11.7 |

|

|

|

|

|

|

| | | | | | |

Operating expenses: |

|

|

|

|

| | | | | | |

Aircraft fuel | 127,907 |

|

| 154,852 |

|

| (17.4 | ) | | 240,333 |

| | 303,323 |

| | (20.8 | ) |

Salaries, wages and benefits | 97,037 |

|

| 77,440 |

|

| 25.3 |

| | 186,094 |

| | 153,689 |

| | 21.1 |

|

Aircraft rent | 53,127 |

|

| 48,222 |

|

| 10.2 |

| | 105,915 |

| | 94,609 |

| | 12.0 |

|

Landing fees and other rents | 33,364 |

|

| 25,831 |

|

| 29.2 |

| | 63,910 |

| | 49,847 |

| | 28.2 |

|

Distribution | 22,349 |

|

| 20,159 |

|

| 10.9 |

| | 42,846 |

| | 38,728 |

| | 10.6 |

|

Maintenance, materials and repairs | 21,271 |

|

| 19,205 |

|

| 10.8 |

| | 40,431 |

| | 36,819 |

| | 9.8 |

|

Depreciation and amortization | 17,139 |

|

| 11,344 |

|

| 51.1 |

| | 32,002 |

| | 22,465 |

| | 42.5 |

|

Other operating | 58,173 |

|

| 36,408 |

|

| 59.8 |

| | 101,920 |

| | 71,856 |

| | 41.8 |

|

Loss on disposal of assets | 415 |

|

| 715 |

|

| na |

| | 1,010 |

| | 865 |

| | na |

|

Special charges | 324 |

|

| 17 |

|

| na |

| | 749 |

| | 26 |

| | na |

|

Total operating expenses | 431,106 |

|

| 394,193 |

|

| 9.4 |

| | 815,210 |

| | 772,227 |

| | 5.6 |

|

|

|

|

|

|

|

|

|

| | | | | | |

Operating income | 122,315 |

|

| 105,144 |

|

| 16.3 |

| | 231,566 |

| | 165,097 |

| | 40.3 |

|

|

|

|

|

|

| | | | | | |

Other (income) expense: |

|

|

|

|

| | | | | | |

Interest expense | 4,419 |

|

| 103 |

|

| na |

| | 7,231 |

| | 210 |

| | na |

|

Capitalized interest | (2,829 | ) |

| (103 | ) |

| na |

| | (5,362 | ) | | (210 | ) | | na |

|

Interest income | (177 | ) |

| (83 | ) |

| 113.3 |

| | (311 | ) | | (151 | ) | | 106.0 |

|

Other expense | 44 |

|

| 1,439 |

|

| (96.9 | ) | | 116 |

| | 1,476 |

| | (92.1 | ) |

Total other (income) expense | 1,457 |

|

| 1,356 |

|

| 7.4 |

| | 1,674 |

| | 1,325 |

| | 26.3 |

|

|

|

|

|

|

|

|

| | | | | | |

Income before income taxes | 120,858 |

|

| 103,788 |

|

| 16.4 |

| | 229,892 |

| | 163,772 |

| | 40.4 |

|

Provision for income taxes | 44,154 |

|

| 38,939 |

|

| 13.4 |

| | 84,186 |

| | 61,217 |

| | 37.5 |

|

Net income | $ | 76,704 |

|

| $ | 64,849 |

|

| 18.3 |

| | $ | 145,706 |

| | $ | 102,555 |

| | 42.1 |

|

Basic earnings per share | $ | 1.06 |

|

| $ | 0.89 |

|

| 19.1 |

| | $ | 2.00 |

| | $ | 1.41 |

| | 41.8 |

|

Diluted earnings per share | $ | 1.05 |

|

| $ | 0.88 |

|

| 19.3 |

| | $ | 1.99 |

| | $ | 1.40 |

| | 42.1 |

|

|

|

|

|

|

| | | | | | |

Weighted average shares, basic | 72,518 |

|

| 72,740 |

|

| (0.3 | ) | | 72,784 |

| | 72,712 |

| | 0.1 |

|

Weighted average shares, diluted | 72,801 |

|

| 73,294 |

|

| (0.7 | ) | | 73,083 |

| | 73,274 |

| | (0.3 | ) |

SPIRIT AIRLINES, INC.

Statements of Comprehensive Income

(unaudited, in thousands)

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, 2015 |

| 2015 | | 2014 | | 2015 | | 2014 |

Net income | $ | 76,704 |

| | $ | 64,849 |

| | $ | 145,706 |

| | $ | 102,555 |

|

Unrealized gain (loss) on interest rate derivative instruments, net of deferred taxes of $749, $0, ($191) and $0 | 1,238 |

| | — |

| | (356 | ) | | — |

|

Other comprehensive income (loss) | $ | 1,238 |

| | $ | — |

| | $ | (356 | ) | | $ | — |

|

Comprehensive income | $ | 77,942 |

| | $ | 64,849 |

| | $ | 145,350 |

| | $ | 102,555 |

|

SPIRIT AIRLINES, INC.

Balance Sheets

(unaudited, in thousands)

|

| | | | | | | |

| June 30, | | December 31, |

| 2015 | | 2014 |

Assets | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 769,324 |

| | $ | 632,784 |

|

Accounts receivable, net | 30,856 |

| | 22,685 |

|

Deferred income taxes | 9,643 |

| | 9,643 |

|

Prepaid expenses and other current assets | 62,088 |

| | 66,029 |

|

Total current assets | 871,911 |

| | 731,141 |

|

| | | |

Property and equipment: | | | |

Flight equipment | 549,517 |

| | 204,462 |

|

Ground and other equipment | 66,290 |

| | 57,012 |

|

Less accumulated depreciation | (47,219 | ) | | (36,099 | ) |

| 568,588 |

| | 225,375 |

|

Deposits on flight equipment purchase contracts | 267,344 |

| | 242,881 |

|

Aircraft maintenance deposits | 217,932 |

| | 213,147 |

|

Deferred heavy maintenance, net | 108,051 |

| | 123,108 |

|

Other long-term assets | 71,511 |

| | 66,744 |

|

Total assets | $ | 2,105,337 |

| | $ | 1,602,396 |

|

| | | |

Liabilities and shareholders’ equity | | | |

Current liabilities: | | | |

Accounts payable | $ | 21,751 |

| | $ | 13,402 |

|

Air traffic liability | 270,185 |

| | 188,870 |

|

Current maturities of long-term debt | 29,676 |

| | 10,431 |

|

Other current liabilities | 207,879 |

| | 152,921 |

|

Total current liabilities | 529,491 |

| | 365,624 |

|

| | | |

Long-term debt less current maturities | 398,975 |

| | 135,232 |

|

Long-term deferred income taxes | 76,378 |

| | 76,010 |

|

Deferred gains and other long-term liabilities | 18,213 |

| | 22,455 |

|

Shareholders’ equity: | | | |

Common stock | 7 |

| | 7 |

|

Additional paid-in-capital | 539,443 |

| | 526,173 |

|

Treasury stock, at cost | (83,336 | ) | | (3,921 | ) |

Retained earnings | 627,240 |

| | 481,534 |

|

Accumulated other comprehensive loss | (1,074 | ) | | (718 | ) |

Total shareholders’ equity | 1,082,280 |

| | 1,003,075 |

|

Total liabilities and shareholders’ equity | $ | 2,105,337 |

| | $ | 1,602,396 |

|

SPIRIT AIRLINES, INC.

Statement of Cash Flows

(unaudited, in thousands) |

| | | | | | | |

| Six Months Ended June 30, |

| 2015 | | 2014 |

Operating activities: | | | |

Net income | $ | 145,706 |

| | $ | 102,555 |

|

Adjustments to reconcile net income to net cash provided by operations: | | | |

Unrealized (gains) losses on open fuel derivative contracts, net | 4,257 |

| | — |

|

Equity-based compensation, net | 4,743 |

| | 3,872 |

|

Allowance for doubtful accounts (recoveries) | 8 |

| | (33 | ) |

Amortization of deferred gains and losses | 397 |

| | (178 | ) |

Depreciation and amortization | 32,002 |

| | 22,465 |

|

Deferred income tax expense (benefit) | 559 |

| | (395 | ) |

Loss on disposal of assets | 1,010 |

| | 865 |

|

Capitalized interest | (5,362 | ) | | (210 | ) |

Changes in operating assets and liabilities: | | | |

Accounts receivable | (8,137 | ) | | (14,188 | ) |

Prepaid maintenance reserves | (4,621 | ) | | (14,286 | ) |

Long-term deposits and other assets | (10,930 | ) | | (27,020 | ) |

Accounts payable | 7,856 |

| | (1,462 | ) |

Air traffic liability | 90,056 |

| | 64,331 |

|

Other liabilities | 39,327 |

| | 7,819 |

|

Net cash provided by operating activities | 296,871 |

| | 144,135 |

|

| | | |

Investing activities: | | | |

Pre-delivery deposits for flight equipment, net of refunds | (70,971 | ) | | (94,009 | ) |

Purchase of property and equipment | (308,163 | ) | | (7,430 | ) |

Net cash used in investing activities | (379,134 | ) | | (101,439 | ) |

Financing activities: | | | |

Proceeds from issuance of long-term debt | 296,000 |

| | — |

|

Proceeds from stock options exercised | 23 |

| | 63 |

|

Payments on debt and capital lease obligations | (8,940 | ) | | (511 | ) |

Proceeds from sale and leaseback transactions | 7,300 |

| | — |

|

Payments to pre-IPO shareholders pursuant to tax receivable agreement | — |

| | (5,643 | ) |

Excess tax benefits from equity-based compensation | 8,504 |

| | 1,225 |

|

Repurchase of common stock | (79,415 | ) | | (1,222 | ) |

Debt issuance costs | (4,669 | ) | | — |

|

Net cash provided by financing activities | 218,803 |

| | (6,088 | ) |

Net increase in cash and cash equivalents | 136,540 |

| | 36,608 |

|

Cash and cash equivalents at beginning of period | 632,784 |

| | 530,631 |

|

Cash and cash equivalents at end of period | $ | 769,324 |

| | $ | 567,239 |

|

Supplemental disclosures | | | |

Cash payments for: | | | |

Interest (net of capitalized interest) | $ | 1,758 |

| | $ | 326 |

|

Taxes | $ | 54,198 |

| | $ | 52,093 |

|

SPIRIT AIRLINES, INC.

Selected Operating Statistics (unaudited)

|

| | | | | | | | |

| Three Months Ended June 30, |

| |

Operating Statistics | 2015 |

| 2014 |

| Change |

Available seat miles (ASMs) (thousands) | 5,213,299 |

|

| 4,008,507 |

|

| 30.1 | % |

Revenue passenger miles (RPMs) (thousands) | 4,481,064 |

|

| 3,506,459 |

|

| 27.8 | % |

Load factor (%) | 86.0 |

|

| 87.5 |

|

| (1.5) pts |

|

Passenger flight segments (thousands) | 4,514 |

|

| 3,569 |

|

| 26.5 | % |

Block hours | 83,861 |

|

| 65,732 |

|

| 27.6 | % |

Departures | 32,164 |

|

| 25,353 |

|

| 26.9 | % |

Operating revenue per ASM (RASM) (cents) | 10.62 |

|

| 12.46 |

|

| (14.8 | )% |

Average yield (cents) | 12.35 |

|

| 14.24 |

|

| (13.3 | )% |

Average ticket revenue per passenger flight segment ($) | 68.35 |

|

| 84.75 |

|

| (19.4 | )% |

Average non-ticket revenue per passenger flight segment ($) | 54.24 |

|

| 55.15 |

|

| (1.7 | )% |

Total revenue per passenger flight segment ($) | 122.59 |

|

| 139.90 |

|

| (12.4 | )% |

CASM (cents) | 8.27 |

|

| 9.83 |

|

| (15.9 | )% |

Adjusted CASM (cents) (1) | 8.33 |

|

| 9.80 |

|

| (15.0 | )% |

Adjusted CASM ex-fuel (cents) (2) | 5.80 |

|

| 5.95 |

|

| (2.5)% |

|

Fuel gallons consumed (thousands) | 63,134 |

|

| 49,401 |

|

| 27.8 | % |

Average economic fuel cost per gallon ($) | 2.08 |

|

| 3.13 |

|

| (33.5 | )% |

Aircraft at end of period | 73 |

|

| 57 |

|

| 28.1 | % |

Average daily aircraft utilization (hours) | 12.9 |

|

| 12.8 |

|

| 0.8% |

|

Average stage length (miles) | 974 |

|

| 976 |

|

| (0.2 | )% |

Airports served in the period | 57 |

|

| 54 |

|

| 5.6% |

|

|

| | | | | | | | |

| Six Months Ended June 30, | | |

Operating Statistics | 2015 |

| 2014 |

| Change |

Available seat miles (ASMs) (thousands) | 9,942,762 |

|

| 7,793,234 |

|

| 27.6 | % |

Revenue passenger miles (RPMs) (thousands) | 8,498,622 |

|

| 6,795,746 |

|

| 25.1 | % |

Load factor (%) | 85.5 |

|

| 87.2 |

|

| (1.7 | ) pts |

Passenger flight segments (thousands) | 8,494 |

|

| 6,833 |

|

| 24.3 | % |

Block hours | 160,896 |

|

| 128,870 |

|

| 24.9 | % |

Departures | 61,208 |

|

| 48,914 |

|

| 25.1 | % |

Operating revenue per ASM (RASM) (cents) | 10.53 |

|

| 12.03 |

|

| (12.5 | )% |

Average yield (cents) | 12.32 |

|

| 13.79 |

|

| (10.7 | )% |

Average ticket revenue per passenger flight segment ($) | 68.52 |

|

| 81.43 |

|

| (15.9 | )% |

Average non-ticket revenue per passenger flight segment ($) | 54.71 |

|

| 55.76 |

|

| (1.9 | )% |

Total revenue per passenger flight segment ($) | 123.23 |

|

| 137.19 |

|

| (10.2 | )% |

CASM (cents) | 8.20 |

|

| 9.91 |

|

| (17.3 | )% |

Adjusted CASM (cents) (1) | 8.20 |

|

| 9.89 |

|

| (17.1 | )% |

Adjusted CASM ex-fuel (cents) (2) | 5.76 |

|

| 6.01 |

|

| (4.2 | )% |

Fuel gallons consumed (thousands) | 119,857 |

|

| 96,078 |

|

| 24.7 | % |

Average economic fuel cost per gallon ($) | 2.02 |

|

| 3.15 |

|

| (35.9 | )% |

Average daily aircraft utilization (hours) | 12.8 |

|

| 12.8 |

|

| — |

|

Average stage length (miles) | 982 |

|

| 988 |

|

| (0.6 | )% |

| |

(1) | Excludes special items. |

| |

(2) | Excludes economic fuel expense and special items. |

The Company is providing a reconciliation of GAAP financial information to non-GAAP financial information as it believes that non-GAAP financial measures provide management and investors the ability to measure the performance of the Company on a consistent basis. These non-GAAP financial measures have limitations as an analytical tool. Because of these limitations, determinations of the Company's operating performance excluding unrealized gains and losses or special items should not be considered in isolation or as a substitute for performance measures calculated in accordance with GAAP.

Special Items

|

| | | | | | | |

| Three Months Ended |

| June 30, |

(in thousands) | 2015 |

| 2014 |

Operating special items include the following: | | | |

Unrealized losses (gains) related to fuel derivative contracts | $ | (3,669 | ) | | $ | 467 |

|

Loss on disposal of assets | 415 |

| | 715 |

|

Special charges | 324 |

| | 17 |

|

Total operating special items | $ | (2,930 | ) | | $ | 1,199 |

|

| | | |

Non-operating special items include the following: | | | |

Settlement paid to Pre-IPO Stockholders | $ | — |

| | $ | 1,388 |

|

Total non-operating special items (1) | $ | — |

| | $ | 1,388 |

|

Reconciliation of Adjusted Operating Expense to GAAP Operating Expense

(unaudited)

|

| | | | | | | |

| Three Months Ended |

| June 30, |

(in thousands, except CASM data in cents) | 2015 |

| 2014 |

Total operating expenses, as reported | $ | 431,106 |

| | $ | 394,193 |

|

Less operating special items (2) | (2,930 | ) | | 1,199 |

|

Adjusted operating expenses, non-GAAP (3) | 434,036 |

| | 392,994 |

|

Less: Economic fuel expense | 131,576 |

| | 154,385 |

|

Adjusted operating expenses excluding fuel, non-GAAP (4) | $ | 302,460 |

| | $ | 238,609 |

|

| | | |

Available seat miles | 5,213,299 |

| | 4,008,507 |

|

| | | |

CASM (cents) | 8.27 |

| | 9.83 |

|

Adjusted CASM (cents) (3) | 8.33 |

| | 9.80 |

|

Adjusted CASM ex-fuel (cents) (4) | 5.80 |

| | 5.95 |

|

| |

(1) | Non-operating special charges relate to the settlement paid to the Pre-IPO Stockholders in excess of the liability the Company had previously estimated related to the Company's Tax Receivable Agreement. |

| |

(2) | See "Special Items" for more detail. |

| |

(3) | Excludes operating special items. |

| |

(4) | Excludes operating special items and economic fuel expense as described in the "Reconciliation of Economic Fuel Expense to GAAP Fuel Expense" table below. |

Reconciliation of Adjusted Net Income to GAAP Net Income

(unaudited)

|

| | | | | | | |

| Three Months Ended |

| June 30, |

(in thousands, except per share data) | 2015 | | 2014 |

Net income, as reported | $ | 76,704 |

| | $ | 64,849 |

|

Add: Provision for income taxes | 44,154 |

| | 38,939 |

|

Income before income taxes, as reported | 120,858 |

| | 103,788 |

|

Pre-tax margin, GAAP | 21.8 | % | | 20.8 | % |

Add operating special items (1) | (2,930 | ) | | 1,199 |

|

Add: non-operating special charges (1) | — |

| | 1,388 |

|

Income before income taxes, non-GAAP (2) | 117,928 |

| | 106,375 |

|

Adjusted pre-tax margin, non-GAAP (2) | 21.3 | % | | 21.3 | % |

Provision for income taxes (3) | 43,084 |

| | 39,910 |

|

Adjusted net income, non-GAAP (2) | $ | 74,844 |

| | $ | 66,465 |

|

| | | |

Weighted average shares, diluted | 72,801 |

| | 73,294 |

|

| | | |

Adjusted net income per share, diluted (2) | $1.03 | | $0.91 |

| | | |

Estimated impact from unusual number of cancellations, delays, and other non-recurring items: |

Revenue loss | $ | 5,000 |

| | |

Total operating revenues (4) | $ | 558,421 |

| | |

|

| | |

Expense impact | $ | 15,000 |

| | |

Total adjusted operating expense (2)(4) | $ | 419,036 |

| | |

|

| | |

Net income impact | $ | 12,694 |

| | |

Total adjusted net income (2)(4) | $ | 87,538 |

| | |

|

| | |

Total adjusted net income per share, diluted (2)(4) | $ | 1.20 |

| | |

| |

(1) | See "Special Items" for more details. |

| |

(2) | Excludes operating and non-operating special items. |

| |

(3) | Assumes same marginal tax rate as is applicable to GAAP net income. |

| |

(4) | Excludes the impact from the unusual number of cancellations, delays, and other non-recurring items during the second quarter 2015. |

Reconciliation of Adjusted Operating Income to GAAP Operating Income

(unaudited)

|

| | | | | | | |

| Three Months Ended |

| June 30, |

(in thousands) | 2015 | | 2014 |

Operating income, as reported | $ | 122,315 |

|

| $ | 105,144 |

|

Operating margin, GAAP | 22.1 | % |

| 21.1 | % |

Add operating special items (1) | (2,930 | ) | | 1,199 |

|

Operating income, non-GAAP (2) | $ | 119,385 |

|

| $ | 106,343 |

|

Operating margin (2) | 21.6 | % |

| 21.3 | % |

| |

(1) | See "Special Items" for more detail. |

| |

(2) | Excludes operating special items. |

The Company believes economic fuel expense is the best measure of the effect fuel prices are currently having on our business, because it most closely approximates the net cash outflow associated with purchasing fuel used for our operations during the period. Economic fuel expense is defined as into-plane fuel expense, realized gains or losses on derivative contracts, plus the economic premium expense related to fuel option contracts in the period the option is benefiting. The key difference between aircraft fuel expense as recorded in our statement of operations and economic fuel expense is unrealized mark-to-market changes in the value of aircraft fuel derivatives outstanding and the timing of premium gain or loss recognition on our outstanding fuel option contracts. Many industry analysts evaluate airline results using economic fuel expense, and it is used in our internal management reporting.

Reconciliation of Economic Fuel Expense to GAAP Fuel Expense

(unaudited)

|

| | | | | | | |

| Three Months Ended |

| June 30, |

(in thousands, except per gallon data) | 2015 | | 2014 |

Fuel expense |

|

|

|

Aircraft fuel, as reported | $ | 127,907 |

|

| $ | 154,852 |

|

Less Unrealized losses (gains) related to fuel derivative contracts | (3,669 | ) | | 467 |

|

Economic fuel expense, non-GAAP | $ | 131,576 |

|

| $ | 154,385 |

|

|

|

|

|

Fuel gallons consumed | 63,134 |

|

| 49,401 |

|

|

|

|

|

Economic fuel cost per gallon, non-GAAP | $ | 2.08 |

|

| $ | 3.13 |

|

Calculation of Return on Invested Capital

(unaudited)

|

| | | |

| Twelve Months Ended |

(in thousands) | June 30, 2015 |

Operating Income | $ | 421,732 |

|

Add operating special items (1) | 14,639 |

|

Adjustment for aircraft rent | 207,133 |

|

Adjusted operating income (2) | 643,504 |

|

Tax (35.9%) (3) | 231,018 |

|

Adjusted operating income, after-tax | 412,486 |

|

Invested Capital | |

Total debt | $ | 428,651 |

|

Book equity | 1,082,280 |

|

Less: Unrestricted cash | 769,324 |

|

Add: Capitalized aircraft operating leases (7x Aircraft Rent) | 1,449,931 |

|

Total invested capital | 2,191,538 |

|

| |

Return on invested capital (ROIC), pre-tax (2) | 29.4 | % |

Return on invested capital (ROIC), after-tax (2)(3) | 18.8 | % |

| |

(1) | Special items include unrealized gains or losses related to fuel derivative contracts, loss on disposal of assets, special charges (credits), and additional federal excise tax on a minority of fuel volume for the period beginning July 1, 2009 through December 31, 2013 recorded in the third quarter 2014. |

| |

(2) | Excludes special items as described above. |

| |

(3) | Assumes same marginal tax rate as is applicable to GAAP net income for the twelve months ended June 30, 2015. |

###

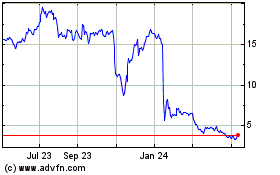

Spirit Airlines (NYSE:SAVE)

Historical Stock Chart

From Mar 2024 to Apr 2024

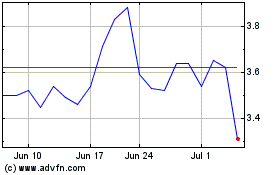

Spirit Airlines (NYSE:SAVE)

Historical Stock Chart

From Apr 2023 to Apr 2024