UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported) July 23, 2015

Juniper Networks, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-34501 |

|

770422528 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

| 1133 Innovation Way,

Sunnyvale, California |

|

94089 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (408) 745-2000

Not Applicable

Former

name or former address, if changed since last report

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On July 23, 2015, Juniper Networks, Inc. (“we”, “us”, “our” or “the Company”) issued a press release in which we

announced preliminary financial results for the quarter ended June 30, 2015. The Company also posted on the Investor Relations section of its website (www.juniper.net) prepared remarks with respect to the quarter ended June 30, 2015.

Copies of the press release and prepared remarks by the Company are furnished as Exhibits 99.1 and 99.2, respectively, to this report. Information on our website is not, and will not be deemed, a part of this report or incorporated into any

other filings the Company makes with the Securities and Exchange Commission.

The information furnished pursuant to this Item 2.02, including

Exhibits 99.1 and 99.2, shall not be deemed as “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall

not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference

in such filing.

Item 7.01 Regulation FD Disclosure.

On July 23, 2015, the Company also announced in the press release that our Board of Directors has authorized an increase to our stock repurchase

authorization by $500 million. A copy of the press release is furnished as Exhibit 99.1 to this report and the portions thereof with respect to the stock repurchase authorization are incorporated by reference herein. The information furnished

pursuant to this Item 7.01, including Exhibit 99.1, shall not be deemed as “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, and shall not be incorporated by reference

into any registration statement or other document filed under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits.

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press release issued by Juniper Networks, Inc. on July 23, 2015 |

|

|

| 99.2 |

|

Prepared remarks by Juniper Networks, Inc. dated as of July 23, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Juniper Networks, Inc. |

|

|

|

|

| July 23, 2015 |

|

|

|

By: |

|

/s/ Mitchell L. Gaynor |

|

|

|

|

|

|

Name: Mitchell L. Gaynor |

|

|

|

|

|

|

Title: Executive Vice President and General Counsel |

Exhibit Index

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press release issued by Juniper Networks, Inc. on July 23, 2015 |

|

|

| 99.2 |

|

Prepared remarks by Juniper Networks, Inc. dated as of July 23, 2015 |

Exhibit 99.1

Investor Relations:

Ryan Miyasato

Juniper Networks

(408) 936-7497

rmiyasato@juniper.net

Media Relations:

Cindy Ta

Juniper Networks

(408) 936-6131

cta@juniper.net

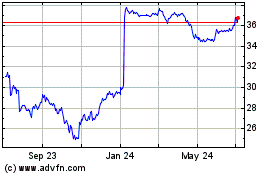

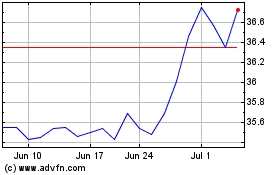

JUNIPER NETWORKS REPORTS PRELIMINARY SECOND QUARTER 2015 FINANCIAL RESULTS

Company delivers strong sequential revenue and earnings growth

SUNNYVALE, Calif., July 23, 2015 – Juniper Networks (NYSE: JNPR), the industry leader in network innovation, today reported preliminary

financial results for the three months ended June 30, 2015 and provided its outlook for the three months ending Sept. 30, 2015.

Net revenues for the

second quarter of 2015 were $1,222 million, a decrease of 1% year-over-year and an increase of 15% sequentially.

Juniper’s operating margin for the

second quarter of 2015 increased to 19.9% on a GAAP basis, a year-over-year increase of 10.5 points and an increase of 7.6 points sequentially. Non-GAAP operating margin for the second quarter of 2015 increased to 25.2%, an improvement of 2.9 points

year-over-year and 6.7 points sequentially.

Juniper posted GAAP net income of $158.0 million, or $0.40 per diluted share for the second quarter of 2015,

a decrease of 29% year-over-year and an increase of 97% sequentially. Non-GAAP net income was $208.8 million, or $0.53 per diluted share for the second quarter of 2015, an increase of 33% year-over-year and an increase of 66% sequentially.

The reconciliation between GAAP and non-GAAP results of operations is provided in a table immediately following the Preliminary Net Revenues by Market table

below.

“We are pleased to report strong sequential revenue growth from the first quarter across all technologies, which reflects the strength of our

innovative product portfolio as well as our continued focus on execution,” said Rami Rahim, chief executive officer of Juniper Networks. “Overall, this quarter is a good proof point that Juniper’s strategy is winning and the

investments we have made are producing positive results. Our results reflect the diversity of our customer base and we believe this positions us well to capitalize on the market opportunity throughout 2015 and beyond.”

“We exceeded both our revenue and earnings expectations for the quarter, a reflection of the strength in our underlying business and the focused

execution of our strategy,” said Robyn Denholm, chief financial and operations officer of Juniper Networks. “We remain committed to our strong focus on operational fundamentals and the effective management of our cost structure. I want to

commend our team for remaining laser focused on driving revenue growth and operating efficiency.”

Page 1 of 12

Other Financial Highlights

Total cash, cash equivalents, and investments as of June 30, 2015 were $3,076 million, compared to $3,451 million as of March 31, 2015, and $3,960

million as of June 30, 2014.

Juniper’s net cash flow provided by operations for the second quarter of 2015 was $263 million, compared to net

cash provided by operations of $219 million in the first quarter of 2015, and $424 million in the second quarter of 2014. Cash flow in the second quarter of 2014 reflected the gain of $75 million related to the Company’s litigation settlement.

Days sales outstanding in accounts receivable or “DSO” was 39 days in the second quarter of 2015, compared to 43 days in the prior quarter, and

41 days in the second quarter of 2014.

Capital expenditures were $40 million and depreciation and amortization of intangible assets expense was $40

million during the second quarter of 2015.

Juniper’s Board of Directors has declared a quarterly cash dividend of $0.10 per share to be paid on

Sept. 22, 2015 to shareholders of record as of the close of business on Sept. 1, 2015.

During the second quarter of 2015, the Company repurchased $600

million of common stock, completing its commitment to repurchase a total of $1.0 billion of shares from January through June 2015. Additionally, the Board of Directors has approved an incremental $500 million share repurchase authorization. Juniper

now has a total of approximately $675 million remaining on its share repurchase authorization.

Since the first quarter of 2014, inclusive of share

repurchases and dividends, the Company has returned approximately $3.4 billion of capital to shareholders against its commitment to return a total of $4.1 billion by the end of 2016.

Outlook

Industry trends continue to unfold largely as

the Company expected. Consistent with its views last quarter, the Company anticipates an improvement in revenue in the second half of 2015 relative to both the first half of the year and the second half of 2014.

Juniper Networks estimates that for the quarter ending Sept. 30, 2015:

| |

• |

|

Revenues will be approximately $1,230 million, plus or minus $20 million. |

| |

• |

|

Non-GAAP gross margin will be approximately 64%, plus or minus 0.5%, consistent with the Company’s long-term model. |

| |

• |

|

Non-GAAP operating expenses will be $485 million, plus or minus $5 million. |

| |

• |

|

Non-GAAP operating margin will be roughly 24.5% at the midpoint of revenue guidance. |

| |

• |

|

Non-GAAP net income per share will range between $0.50 and $0.54 on a diluted basis. This assumes a share count of 390 million and a non-GAAP tax rate flat from the second quarter, and assumes no renewal of the

R&D tax credit for 2015. |

All forward-looking non-GAAP measures exclude estimates for amortization of intangible assets, share-based

compensation expenses, acquisition-related charges, restructuring and other (credit) charges, impairment charges, professional services related to non-routine stockholder matters, litigation settlement and resolution charges, professional fees and

other income and expenses associated with the sale of Junos Pulse, gain or loss on equity investments, retroactive impact of certain tax settlements, non-recurring income tax adjustments, valuation allowance on deferred tax assets, and income tax

effect of non-GAAP exclusions. A reconciliation of non-GAAP guidance measures to corresponding GAAP measures is not available on a forward-looking basis.

Page 2 of 12

Second Quarter Financial Commentary Available Online

A commentary by Robyn Denholm, chief financial and operations officer, reviewing the Company’s second quarter 2015 financial results and third

quarter 2015 financial outlook will be furnished to the SEC on Form 8-K and published on the Company’s website at http://investor.juniper.net. Analysts and investors are encouraged to review this commentary prior to

participating in the conference call webcast.

Conference Call Webcast

Juniper Networks will host a conference call webcast today, July 23, 2015, at 2:00 pm PT, to be broadcast live over the Internet at

http://investor.juniper.net. To participate via telephone in the US, the toll free dial-in number is 1-877-407-8033. Outside the US, dial +1-201-689-8033. Please call 10 minutes prior to the scheduled conference call time. The webcast replay

will be archived on the Juniper Networks website.

About Juniper Networks

Juniper Networks (NYSE: JNPR) delivers innovation across routing, switching and security. Juniper Networks’ innovations in software, silicon and systems

transform the experience and economics of networking. Additional information can be found at Juniper Networks (www.juniper.net) or connect with Juniper on Twitter and Facebook.

Investors and others should note that the Company announces material financial and operational information to its investors using its Investor Relations

website, press releases, SEC filings and public conference calls and webcasts. The Company also intends to use the Twitter accounts @JuniperNetworks and @Juniper_IR and the Company’s blogs as a means of disclosing information about the Company

and for complying with its disclosure obligations under Regulation FD. The social media channels that the Company intends to use as a means of disclosing information described above may be updated from time to time as listed on the Company’s

Investor Relations website.

Juniper Networks and Junos, are registered trademarks of Juniper Networks, Inc. in the United States and other countries.

The Juniper Networks logo and the Junos logo are trademarks of Juniper Networks, Inc. All other trademarks, service marks, registered trademarks, or registered service marks are the property of their respective owners.

Safe Harbor

Statements in this release concerning

Juniper Networks’ business outlook, economic and market outlook, future financial and operating results, ability to deliver significant margin expansion, innovation pipeline, capital return program, and overall future prospects are

forward-looking statements that involve a number of uncertainties and risks. Actual results or events could differ materially from those anticipated in those forward-looking statements as a result of several factors, including: general economic and

political conditions globally or regionally; business and economic conditions in the networking industry; changes in overall technology spending and spending by communication service providers and major customers; the network capacity requirements

of communication service providers; contractual terms that may result in the deferral of revenue; increases in and the effect of competition; the timing of orders and their fulfillment; manufacturing and supply chain constraints; availability of key

product components; ability to establish and maintain relationships with distributors, resellers and other partners; variations in the expected mix of products sold; changes in customer mix; changes in geography mix; customer and industry analyst

perceptions of Juniper Networks and its technology, products and future prospects; delays in scheduled product availability; market acceptance of Juniper Networks products and services; rapid technological and market change; adoption of regulations

or standards affecting Juniper Networks products, services or the networking industry; the ability to successfully acquire, integrate and manage businesses and technologies; product defects, returns or vulnerabilities; the ability to recruit and

retain key personnel; significant effects of tax legislation and judicial or administrative interpretation of tax regulations; currency fluctuations; litigation settlements and resolutions; the potential impact of activities related to the execution

of capital return and product rationalization; and other factors listed in Juniper Networks’ most recent report on Form 10-Q filed with the Securities and Exchange Commission. All statements made in this press release are made only as of the

date set forth at the beginning of this release. Juniper Networks undertakes no obligation to update the information in this release in the event facts or circumstances subsequently change after the date of this press release.

Page 3 of 12

Juniper Networks believes that the presentation of non-GAAP financial information provides important supplemental

information to management and investors regarding financial and business trends relating to the company’s financial condition and results of operations. For further information regarding why Juniper Networks believes that these non-GAAP

measures provide useful information to investors, the specific manner in which management uses these measures, and some of the limitations associated with the use of these measures, please refer to the discussion below. The following tables and

reconciliations can also be found on our Investor Relations website at http://investor.juniper.net.

Page 4 of 12

Juniper Networks, Inc.

Preliminary Condensed Consolidated Statements of Operations

(in millions, except per share amounts)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Net revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product |

|

$ |

899.7 |

|

|

$ |

929.2 |

|

|

$ |

1,663.8 |

|

|

$ |

1,805.2 |

|

| Service |

|

|

322.5 |

|

|

|

300.3 |

|

|

|

625.8 |

|

|

|

594.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total net revenues |

|

|

1,222.2 |

|

|

|

1,229.5 |

|

|

|

2,289.6 |

|

|

|

2,399.6 |

|

| Cost of revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Product |

|

|

311.7 |

|

|

|

359.3 |

|

|

|

600.5 |

|

|

|

685.9 |

|

| Service |

|

|

129.0 |

|

|

|

122.0 |

|

|

|

250.3 |

|

|

|

245.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total cost of revenues |

|

|

440.7 |

|

|

|

481.3 |

|

|

|

850.8 |

|

|

|

931.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross margin |

|

|

781.5 |

|

|

|

748.2 |

|

|

|

1,438.8 |

|

|

|

1,468.3 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

251.6 |

|

|

|

255.5 |

|

|

|

500.3 |

|

|

|

519.5 |

|

| Sales and marketing |

|

|

232.4 |

|

|

|

258.0 |

|

|

|

452.6 |

|

|

|

531.4 |

|

| General and administrative |

|

|

56.3 |

|

|

|

60.6 |

|

|

|

111.5 |

|

|

|

135.5 |

|

| Restructuring and other (credit) charges |

|

|

(1.9 |

) |

|

|

58.2 |

|

|

|

(0.5 |

) |

|

|

172.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

538.4 |

|

|

|

632.3 |

|

|

|

1,063.9 |

|

|

|

1,358.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

243.1 |

|

|

|

115.9 |

|

|

|

374.9 |

|

|

|

109.7 |

|

| Other (expense) income, net |

|

|

(17.1 |

) |

|

|

178.6 |

|

|

|

(32.9 |

) |

|

|

332.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

226.0 |

|

|

|

294.5 |

|

|

|

342.0 |

|

|

|

442.5 |

|

| Income tax provision |

|

|

68.0 |

|

|

|

73.4 |

|

|

|

103.8 |

|

|

|

110.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

158.0 |

|

|

$ |

221.1 |

|

|

$ |

238.2 |

|

|

$ |

331.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.41 |

|

|

$ |

0.47 |

|

|

$ |

0.60 |

|

|

$ |

0.69 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.40 |

|

|

$ |

0.46 |

|

|

$ |

0.59 |

|

|

$ |

0.68 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares used in computing net income per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

389.9 |

|

|

|

470.3 |

|

|

|

398.4 |

|

|

|

478.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

397.2 |

|

|

|

476.5 |

|

|

|

406.1 |

|

|

|

487.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash dividends declared per common stock |

|

$ |

0.10 |

|

|

$ |

— |

|

|

$ |

0.20 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 5 of 12

Juniper Networks, Inc.

Preliminary Net Revenues by Product and Service

(in millions)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Routing |

|

$ |

602.4 |

|

|

$ |

617.8 |

|

|

$ |

1,107.2 |

|

|

$ |

1,167.6 |

|

| Switching |

|

|

190.2 |

|

|

|

199.8 |

|

|

|

356.7 |

|

|

|

391.8 |

|

| Security |

|

|

107.1 |

|

|

|

111.6 |

|

|

|

199.9 |

|

|

|

245.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total product |

|

|

899.7 |

|

|

|

929.2 |

|

|

|

1,663.8 |

|

|

|

1,805.2 |

|

| Total service |

|

|

322.5 |

|

|

|

300.3 |

|

|

|

625.8 |

|

|

|

594.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

1,222.2 |

|

|

$ |

1,229.5 |

|

|

$ |

2,289.6 |

|

|

$ |

2,399.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Juniper Networks, Inc.

Preliminary Net Revenues by Geographic Region

(in millions)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Americas |

|

$ |

735.8 |

|

|

$ |

711.0 |

|

|

$ |

1,324.8 |

|

|

$ |

1,392.5 |

|

| Europe, Middle East, and Africa |

|

|

316.3 |

|

|

|

324.8 |

|

|

|

620.1 |

|

|

|

620.5 |

|

| Asia Pacific |

|

|

170.1 |

|

|

|

193.7 |

|

|

|

344.7 |

|

|

|

386.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

1,222.2 |

|

|

$ |

1,229.5 |

|

|

$ |

2,289.6 |

|

|

$ |

2,399.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Juniper Networks, Inc.

Preliminary Net Revenues by Market

(in millions)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Service Provider |

|

$ |

835.3 |

|

|

$ |

831.8 |

|

|

$ |

1,552.3 |

|

|

$ |

1,614.5 |

|

| Enterprise |

|

|

386.9 |

|

|

|

397.7 |

|

|

|

737.3 |

|

|

|

785.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

1,222.2 |

|

|

$ |

1,229.5 |

|

|

$ |

2,289.6 |

|

|

$ |

2,399.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 6 of 12

Juniper Networks, Inc.

Reconciliation between GAAP and non-GAAP Financial Measures

(in millions, except percentages and per share amounts)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

Three Months Ended |

|

| |

|

|

|

|

June 30,

2015 |

|

|

March 31,

2015 |

|

|

June 30,

2014 |

|

| GAAP operating income |

|

|

|

|

|

$ |

243.1 |

|

|

$ |

131.8 |

|

|

$ |

115.9 |

|

| GAAP operating margin |

|

|

|

|

|

|

19.9 |

% |

|

|

12.3 |

% |

|

|

9.4 |

% |

| Share-based compensation expense |

|

|

C |

|

|

|

58.9 |

|

|

|

46.0 |

|

|

|

59.3 |

|

| Share-based payroll tax expense |

|

|

C |

|

|

|

2.0 |

|

|

|

2.9 |

|

|

|

2.7 |

|

| Amortization of purchased intangible assets |

|

|

A |

|

|

|

5.6 |

|

|

|

11.9 |

|

|

|

9.8 |

|

| Restructuring and other (credit) charges |

|

|

B |

|

|

|

(1.9 |

) |

|

|

1.4 |

|

|

|

72.0 |

|

| Memory-related, supplier component remediation charge |

|

|

B |

|

|

|

— |

|

|

|

— |

|

|

|

13.7 |

|

| Professional services related to non-routine stockholder matters |

|

|

B |

|

|

|

— |

|

|

|

3.0 |

|

|

|

0.4 |

|

| Other |

|

|

A,B |

|

|

|

0.5 |

|

|

|

— |

|

|

|

0.1 |

|

| Non-GAAP operating income |

|

|

|

|

|

$ |

308.2 |

|

|

$ |

197.0 |

|

|

$ |

273.9 |

|

| Non-GAAP operating margin |

|

|

|

|

|

|

25.2 |

% |

|

|

18.5 |

% |

|

|

22.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP net income |

|

|

|

|

|

$ |

158.0 |

|

|

$ |

80.2 |

|

|

$ |

221.1 |

|

| Share-based compensation expense |

|

|

C |

|

|

|

58.9 |

|

|

|

46.0 |

|

|

|

59.3 |

|

| Share-based payroll tax expense |

|

|

C |

|

|

|

2.0 |

|

|

|

2.9 |

|

|

|

2.7 |

|

| Amortization of purchased intangible assets |

|

|

A |

|

|

|

5.6 |

|

|

|

11.9 |

|

|

|

9.8 |

|

| Restructuring and other (credit) charges |

|

|

B |

|

|

|

(1.9 |

) |

|

|

1.4 |

|

|

|

72.0 |

|

| Memory-related, supplier component remediation charge |

|

|

B |

|

|

|

— |

|

|

|

— |

|

|

|

13.7 |

|

| Professional services related to non-routine stockholder matters |

|

|

B |

|

|

|

— |

|

|

|

3.0 |

|

|

|

0.4 |

|

| Other |

|

|

A,B |

|

|

|

(3.0 |

) |

|

|

(1.1 |

) |

|

|

0.1 |

|

| Gain on legal settlement, net |

|

|

B |

|

|

|

— |

|

|

|

— |

|

|

|

(195.3 |

) |

| Income tax effect of non-GAAP exclusions |

|

|

B |

|

|

|

(10.8 |

) |

|

|

(12.7 |

) |

|

|

6.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net income |

|

|

|

|

|

$ |

208.8 |

|

|

$ |

131.6 |

|

|

$ |

190.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP diluted net income per share |

|

|

|

|

|

$ |

0.40 |

|

|

$ |

0.19 |

|

|

$ |

0.46 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP diluted net income per share |

|

|

D |

|

|

$ |

0.53 |

|

|

$ |

0.32 |

|

|

$ |

0.40 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares used in computing diluted net income per share |

|

|

|

|

|

|

397.2 |

|

|

|

414.2 |

|

|

|

476.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 7 of 12

Discussion of Non-GAAP Financial Measures

This press release, including the tables above, includes the following non-GAAP financial measures derived from our Preliminary Condensed Consolidated

Statements of Operations: operating income; operating margin; net income; and diluted net income per share. These measures are not presented in accordance with, nor are they a substitute for U.S. generally accepted accounting principles, or GAAP. In

addition, these measures may be different from non-GAAP measures used by other companies, limiting their usefulness for comparison purposes. The non-GAAP financial measures used in the table above should not be considered in isolation from measures

of financial performance prepared in accordance with GAAP. Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool. In particular, many of the adjustments to our GAAP

financial measures reflect the exclusion of items that are recurring and will be reflected in our financial results for the foreseeable future.

We

utilize a number of different financial measures, both GAAP and non-GAAP, in analyzing and assessing the overall performance of our business, in making operating decisions, forecasting and planning for future periods, and determining payments under

compensation programs. We consider the use of the non-GAAP measures presented above to be helpful in assessing the performance of the continuing operation of our business. By continuing operations we mean the ongoing revenue and expenses of the

business, excluding certain items that render comparisons with prior periods or analysis of on-going operating trends more difficult, such as expenses not directly related to the actual cash costs of development, sale, delivery or support of our

products and services, or expenses that are reflected in periods unrelated to when the actual amounts were incurred or paid. Consistent with this approach, we believe that disclosing non-GAAP financial measures to the readers of our financial

statements provides such readers with useful supplemental data that, while not a substitute for financial measures prepared in accordance with GAAP, allows for greater transparency in the review of our financial and operational performance. In

addition, we have historically reported non-GAAP results to the investment community and believe that continuing to provide non-GAAP measures provides investors with a tool for comparing results over time. In assessing the overall health of our

business for the periods covered by the table above and, in particular, in evaluating the financial line items presented in the table above, we have excluded items in the following three general categories, each of which are described below:

Acquisition-Related Charges, Other Items, and Share-Based Compensation Related Items. We also provide additional detail below regarding the shares used to calculate our non-GAAP net income per share. Notes identified for line items in the table

above correspond to the appropriate note description below. Additionally, with respect to future financial guidance provided on a non-GAAP basis, we have excluded estimates for amortization of intangible assets, share-based compensation expenses,

acquisition-related charges, restructuring and other (credit) charges, impairment charges, professional services related to non-routine stockholder matters, litigation settlement and resolution charges, professional fees and other income and

expenses associated with the sale of Junos Pulse, gain or loss on equity investments, retroactive impact of certain tax settlements, non-recurring income tax adjustments, valuation allowance on deferred tax assets, and income tax effect of non-GAAP

exclusions.

Note A: Acquisition-Related Charges. We exclude certain expense items resulting from acquisitions including the following, when

applicable: (i) amortization of purchased intangible assets associated with our acquisitions; and (ii) acquisition-related charges. The amortization of purchased intangible assets associated with our acquisitions results in our recording

expenses in our GAAP financial statements that were already expensed by the acquired company before the acquisition and for which we have not expended cash. Moreover, had we internally developed the products acquired, the amortization of intangible

assets, and the expenses of uncompleted research and development would have been expensed in prior periods. Accordingly, we analyze the performance of our operations in each period without regard to such expenses. In addition, acquisitions result in

non-continuing operating expenses, which would not otherwise have been incurred by us in the normal course of our business operations. We believe that providing non-GAAP information for acquisition-related expense items in addition to the

corresponding GAAP information allows the users of our financial statements to better review and understand the historic and current results of our continuing operations, and also facilitates comparisons to less acquisitive peer companies.

Note B: Other Items. We exclude certain other items that are the result of either unique or unplanned events including the following, when applicable:

(i) restructuring and other (credit) charges; (ii) impairment charges; (iii) professional fees and other income and expenses associated with the sale of Junos Pulse; (iv) gain or loss on legal settlement, net of related

transaction costs; (v) memory-related, supplier component remediation charge; (vi) retroactive impacts of certain tax settlements; (vii) the income tax effect on our financial statements of excluding items related to our non-GAAP

financial measures; and (viii) professional services related to non-routine stockholder matters. It is difficult to estimate the amount or timing of these items in advance. Restructuring and impairment charges result from events, which arise

from unforeseen circumstances, which often occur outside of the ordinary course of continuing operations. Although these events are reflected in our GAAP financials, these unique transactions may limit the comparability of our on-going operations

with prior and future periods. The significant effects of retroactive tax legislation are unique events that occur in periods that are generally unrelated to the level of business activity to which such settlement or legislation applies. We believe

this limits comparability with prior periods and that these expenses do not accurately reflect the underlying performance of our continuing business operations for the period in which they are incurred. Whether we realize gains or losses on equity

investments is based primarily on the performance and market value of those independent companies. Accordingly, we believe that these gains and losses do not reflect the underlying performance of our continuing operations. We also believe providing

financial information with and without the income tax effect of excluding items related to our non-GAAP financial measures provide our management and users of the financial statements with better clarity regarding the on-going performance and future

liquidity of our business. Because of these factors, we assess our operating performance with these amounts both included and excluded, and by providing this information, we believe the users of our financial statements are better able to understand

the financial results of what we consider our continuing operations.

Note C: Share-Based Compensation Related Items. We provide non-GAAP

information relative to our expense for share-based compensation and related payroll tax. We began to include share-based compensation expense in our GAAP financial measures in accordance with Financial Accounting Standards Board (“FASB”)

Accounting Standards Codification (“ASC”) Topic 718, Compensation - Stock Compensation (“FASB ASC Topic 718”), in January 2006. Because of varying available valuation methodologies, subjective assumptions

Page 8 of 12

and the variety of award types, which affect the calculations of share-based compensation, we believe that the exclusion of share-based compensation allows for more accurate comparisons of our

operating results to our peer companies. Further, we believe that excluding share-based compensation expense allows for a more accurate comparison of our financial results to previous periods during which our equity-based awards were not required to

be reflected in our income statement. Share-based compensation is very different from other forms of compensation. A cash salary or bonus has a fixed and unvarying cash cost. For example, the expense associated with a $10,000 bonus is equal to

exactly $10,000 in cash regardless of when it is awarded and who it is awarded by. In contrast, the expense associated with an award of an option for 1,000 shares of stock is unrelated to the amount of compensation ultimately received by the

employee; and the cost to the company is based on a share-based compensation valuation methodology and underlying assumptions that may vary over time and that does not reflect any cash expenditure by the company because no cash is expended.

Furthermore, the expense associated with granting an employee an option is spread over multiple years unlike other compensation expenses which are more proximate to the time of award or payment. For example, we may be recognizing expense in a year

where the stock option is significantly underwater and is not going to be exercised or generate any compensation for the employee. The expense associated with an award of an option for 1,000 shares of stock by us in one quarter may have a very

different expense than an award of an identical number of shares in a different quarter. Finally, the expense recognized by us for such an option may be very different than the expense to other companies for awarding a comparable option, which makes

it difficult to assess our operating performance relative to our competitors. Similar to share-based compensation, payroll tax on stock option exercises is dependent on our stock price and the timing and exercise by employees of our share-based

compensation, over which our management has little control, and as such does not correlate to the operation of our business. Because of these unique characteristics of share-based compensation and the related payroll tax, management excludes these

expenses when analyzing the organization’s business performance. We also believe that presentation of such non-GAAP information is important to enable readers of our financial statements to compare current period results with periods prior to

the adoption of FASB ASC Topic 718.

Note D: Non-GAAP Net Income Per Share Items. We provide diluted non-GAAP net income per share. The diluted

non-GAAP income per share includes additional dilution from potential issuance of common stock, except when such issuances would be anti-dilutive.

Page 9 of 12

Juniper Networks, Inc.

Preliminary Condensed Consolidated Balance Sheets

(in millions)

(unaudited)

|

|

|

|

|

|

|

|

|

| |

|

June 30,

2015 |

|

|

December 31,

2014 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

1,330.3 |

|

|

$ |

1,639.6 |

|

| Short-term investments |

|

|

517.7 |

|

|

|

332.2 |

|

| Accounts receivable, net of allowances |

|

|

533.0 |

|

|

|

598.9 |

|

| Deferred tax assets, net |

|

|

138.3 |

|

|

|

147.0 |

|

| Prepaid expenses and other current assets |

|

|

207.6 |

|

|

|

239.9 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

2,726.9 |

|

|

|

2,957.6 |

|

| Property and equipment, net |

|

|

921.2 |

|

|

|

904.3 |

|

| Long-term investments |

|

|

1,228.3 |

|

|

|

1,133.1 |

|

| Restricted cash and investments |

|

|

45.7 |

|

|

|

46.0 |

|

| Purchased intangible assets, net |

|

|

44.8 |

|

|

|

62.4 |

|

| Goodwill |

|

|

2,981.3 |

|

|

|

2,981.5 |

|

| Other long-term assets |

|

|

334.6 |

|

|

|

303.9 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

8,282.8 |

|

|

$ |

8,388.8 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Short-term debt |

|

$ |

299.9 |

|

|

$ |

— |

|

| Accounts payable |

|

|

222.6 |

|

|

|

234.6 |

|

| Accrued compensation |

|

|

227.3 |

|

|

|

225.0 |

|

| Deferred revenue |

|

|

795.4 |

|

|

|

780.8 |

|

| Other accrued liabilities |

|

|

217.3 |

|

|

|

273.0 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

1,762.5 |

|

|

|

1,513.4 |

|

| Long-term debt |

|

|

1,648.7 |

|

|

|

1,349.0 |

|

| Long-term deferred revenue |

|

|

309.0 |

|

|

|

294.9 |

|

| Long-term income taxes payable |

|

|

180.2 |

|

|

|

177.5 |

|

| Other long-term liabilities |

|

|

134.5 |

|

|

|

134.9 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

4,034.9 |

|

|

|

3,469.7 |

|

| Total stockholders’ equity |

|

|

4,247.9 |

|

|

|

4,919.1 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

8,282.8 |

|

|

$ |

8,388.8 |

|

|

|

|

|

|

|

|

|

|

* Certain

amounts in the prior year Condensed Consolidated Financial Statements contained in this press release have been reclassified to conform to the current year presentation.

Page 10 of 12

Juniper Networks, Inc.

Preliminary Condensed Consolidated Statements of Cash Flows

(in millions)

(unaudited)

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

| Cash flows from operating activities: |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

238.2 |

|

|

$ |

331.7 |

|

| Adjustments to reconcile net income to net cash provided by operating

activities: |

|

|

|

|

|

|

|

|

| Share-based compensation expense |

|

|

104.9 |

|

|

|

120.1 |

|

| Depreciation, amortization, and accretion |

|

|

89.0 |

|

|

|

95.6 |

|

| Restructuring and other (credit) charges |

|

|

(0.6 |

) |

|

|

194.4 |

|

| Deferred income taxes |

|

|

23.9 |

|

|

|

(82.3 |

) |

| Gain on investments, net |

|

|

(0.8 |

) |

|

|

(167.0 |

) |

| Gain on legal settlement, net |

|

|

— |

|

|

|

(120.3 |

) |

| Excess tax benefits from share-based compensation |

|

|

(4.3 |

) |

|

|

(8.0 |

) |

| Loss on disposal of fixed assets |

|

|

0.4 |

|

|

|

0.8 |

|

| Changes in operating assets and liabilities, net of effects from acquisitions: |

|

|

|

|

|

|

|

|

| Accounts receivable, net |

|

|

29.0 |

|

|

|

21.4 |

|

| Prepaid expenses and other assets |

|

|

(27.4 |

) |

|

|

(3.9 |

) |

| Accounts payable |

|

|

(13.8 |

) |

|

|

52.5 |

|

| Accrued compensation |

|

|

3.6 |

|

|

|

(39.5 |

) |

| Income taxes payable |

|

|

56.7 |

|

|

|

113.5 |

|

| Other accrued liabilities |

|

|

(44.9 |

) |

|

|

(62.7 |

) |

| Deferred revenue |

|

|

28.6 |

|

|

|

101.9 |

|

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

482.5 |

|

|

|

548.2 |

|

|

|

|

|

|

|

|

|

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

| Purchases of property and equipment |

|

|

(83.8 |

) |

|

|

(98.6 |

) |

| Purchases of available-for-sale investments |

|

|

(841.3 |

) |

|

|

(1,577.6 |

) |

| Proceeds from sales of available-for-sale investments |

|

|

450.9 |

|

|

|

1,504.6 |

|

| Proceeds from maturities of available-for-sale investments |

|

|

115.9 |

|

|

|

234.2 |

|

| Purchases of trading investments |

|

|

(2.5 |

) |

|

|

(2.4 |

) |

| Proceeds from sales of privately-held investments |

|

|

— |

|

|

|

2.5 |

|

| Purchases of privately-held investments |

|

|

(3.2 |

) |

|

|

(5.0 |

) |

| Payments for business acquisitions, net of cash and cash equivalents acquired |

|

|

— |

|

|

|

(27.1 |

) |

| Changes in restricted cash |

|

|

— |

|

|

|

25.0 |

|

|

|

|

|

|

|

|

|

|

| Net cash (used in) provided by investing activities |

|

|

(364.0 |

) |

|

|

55.6 |

|

|

|

|

|

|

|

|

|

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

| Proceeds from issuance of common stock |

|

|

63.0 |

|

|

|

121.2 |

|

| Purchases and retirement of common stock |

|

|

(1,004.7 |

) |

|

|

(907.1 |

) |

| Purchase of equity forward contract |

|

|

— |

|

|

|

(300.0 |

) |

| Issuance of long-term debt, net |

|

|

594.6 |

|

|

|

346.5 |

|

| Payment for capital lease obligation |

|

|

0.4 |

|

|

|

(0.4 |

) |

| Customer financing arrangements |

|

|

— |

|

|

|

0.7 |

|

| Excess tax benefits from share-based compensation |

|

|

4.3 |

|

|

|

8.0 |

|

| Payment of cash dividends |

|

|

(79.5 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Net cash used in financing activities |

|

|

(421.9 |

) |

|

|

(731.1 |

) |

|

|

|

|

|

|

|

|

|

| Effect of foreign currency exchange rates on cash and cash equivalents |

|

|

(5.9 |

) |

|

|

3.1 |

|

|

|

|

|

|

|

|

|

|

| Net decrease in cash and cash equivalents |

|

|

(309.3 |

) |

|

|

(124.2 |

) |

| Cash and cash equivalents at beginning of period |

|

|

1,639.6 |

|

|

|

2,284.0 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of period |

|

$ |

1,330.3 |

|

|

$ |

2,159.8 |

|

|

|

|

|

|

|

|

|

|

* Certain

amounts in the prior year Condensed Consolidated Financial Statements contained in this press release have been reclassified to conform to the current year presentation.

Page 11 of 12

Juniper Networks, Inc.

Cash, Cash Equivalents, and Investments

(in millions)

(unaudited)

|

|

|

|

|

|

|

|

|

| |

|

June 30,

2015 |

|

|

December 31,

2014 |

|

| Cash and cash equivalents |

|

$ |

1,330.3 |

|

|

$ |

1,639.6 |

|

| Short-term investments |

|

|

517.7 |

|

|

|

332.2 |

|

| Long-term investments |

|

|

1,228.3 |

|

|

|

1,133.1 |

|

|

|

|

|

|

|

|

|

|

| Total |

|

$ |

3,076.3 |

|

|

$ |

3,104.9 |

|

|

|

|

|

|

|

|

|

|

Page 12 of 12

Exhibit 99.2

Juniper

Networks, Inc.

1133 Innovation Way

Sunnyvale, CA 94089

July 23, 2015

CFO

Commentary on Second Quarter 2015 Financial Results

Related Information

The following commentary is provided by management and should be referenced in conjunction with Juniper Networks’ second quarter 2015

financial results press release available on its Investor Relations website at http://investor.juniper.net. These remarks represent management’s current views of the Company’s financial and operational performance and outlook and

are provided to give investors and analysts further insight into its performance in advance of the earnings call webcast.

Q2 2015 Financial Results

GAAP

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions, except per share amounts and percentages) |

|

Q2’15 |

|

|

Q1’15 |

|

|

Q2’14 |

|

|

Q/Q Change |

|

|

Y/Y Change |

|

| Revenue |

|

$ |

1,222.2 |

|

|

$ |

1,067.4 |

|

|

$ |

1,229.5 |

|

|

|

15 |

% |

|

|

(1 |

)% |

| Product |

|

|

899.7 |

|

|

|

764.1 |

|

|

|

929.2 |

|

|

|

18 |

% |

|

|

(3 |

)% |

| Service |

|

|

322.5 |

|

|

|

303.3 |

|

|

|

300.3 |

|

|

|

6 |

% |

|

|

7 |

% |

| Gross margin % |

|

|

63.9 |

% |

|

|

61.6 |

% |

|

|

60.9 |

% |

|

|

2.3 |

pts |

|

|

3.0 |

pts |

| Research and development |

|

|

251.6 |

|

|

|

248.7 |

|

|

|

255.5 |

|

|

|

1 |

% |

|

|

(2 |

)% |

| Sales and marketing |

|

|

232.4 |

|

|

|

220.2 |

|

|

|

258.0 |

|

|

|

6 |

% |

|

|

(10 |

)% |

| General and administrative |

|

|

56.3 |

|

|

|

55.2 |

|

|

|

60.6 |

|

|

|

2 |

% |

|

|

(7 |

)% |

| Restructuring and other (credit) charges |

|

|

(1.9 |

) |

|

|

1.4 |

|

|

|

58.2 |

|

|

|

(236 |

)% |

|

|

(103 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

538.4 |

|

|

|

525.5 |

|

|

|

632.3 |

|

|

|

2 |

% |

|

|

(15 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating margin % |

|

|

19.9 |

% |

|

|

12.3 |

% |

|

|

9.4 |

% |

|

|

7.6 |

pts |

|

|

10.5 |

pts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

158.0 |

|

|

$ |

80.2 |

|

|

$ |

221.1 |

|

|

|

97 |

% |

|

|

(29 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EPS (Diluted) |

|

$ |

0.40 |

|

|

$ |

0.19 |

|

|

$ |

0.46 |

|

|

|

111 |

% |

|

|

(13 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions, except per share amounts

and percentages) |

|

Q3’15 Guidance |

|

Q2’15 |

|

|

Q1’15 |

|

|

Q2’14 |

|

|

Q/Q Change |

|

|

Y/Y Change |

|

| Revenue(*) |

|

$1,230 +/-$20 |

|

$ |

1,222.2 |

|

|

$ |

1,067.4 |

|

|

$ |

1,198.1 |

|

|

|

15 |

% |

|

|

2 |

% |

| Product(*) |

|

|

|

|

899.7 |

|

|

|

764.1 |

|

|

|

913.3 |

|

|

|

18 |

% |

|

|

(1 |

)% |

| Service(*) |

|

|

|

|

322.5 |

|

|

|

303.3 |

|

|

|

284.8 |

|

|

|

6 |

% |

|

|

13 |

% |

| Gross margin % |

|

64% +/- 0.5% |

|

|

64.8% |

|

|

|

63.1 |

% |

|

|

64.2 |

% |

|

|

1.7 |

pts |

|

|

0.6 |

pts |

| Research and development |

|

|

|

|

218.4 |

|

|

|

216.8 |

|

|

|

222.9 |

|

|

|

1 |

% |

|

|

(2 |

)% |

| Sales and marketing |

|

|

|

|

217.6 |

|

|

|

212.8 |

|

|

|

241.5 |

|

|

|

2 |

% |

|

|

(10 |

)% |

| General and administrative |

|

|

|

|

47.7 |

|

|

|

47.1 |

|

|

|

50.8 |

|

|

|

1 |

% |

|

|

(6 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

$485 +/- $5 |

|

|

483.7 |

|

|

|

476.7 |

|

|

|

515.2 |

|

|

|

1 |

% |

|

|

(6 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating margin % |

|

24.5% (mdpt. of rev.) |

|

|

25.2 |

% |

|

|

18.5 |

% |

|

|

22.3 |

% |

|

|

6.7 |

pts |

|

|

2.9 |

pts |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

|

|

$ |

208.8 |

|

|

$ |

131.6 |

|

|

$ |

190.3 |

|

|

|

59 |

% |

|

|

10 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EPS (Diluted) |

|

$0.50 - $0.54 |

|

$ |

0.53 |

|

|

$ |

0.32 |

|

|

$ |

0.40 |

|

|

|

66 |

% |

|

|

33 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (*) |

Revenue numbers are GAAP, other than for Q2’14, which have been normalized for the sale

of Junos Pulse. |

The following CFO Commentary contains non-GAAP financial measures, and the reconciliations to GAAP can

be found at the end of this document. Also, prior year revenue has been normalized for the sale of Junos Pulse.

Overview

For the second quarter of 2015, we delivered strong financial results, which reflects the strength in our underlying business and the focused

execution of our strategy. Our results exceeded both our revenue and earnings expectations for the quarter and reflect solid sequential growth across routing, switching, and security. The following factors contributed to the revenue outperformance

this quarter:

| |

• |

|

Revenue recognized from product deferred revenue, the majority of which was due to the delivery of product and feature commitments, and a sell

through of channel inventory. |

| |

• |

|

Demand was also better than we anticipated in the following areas: Cloud and Cable Providers, Enterprise, and to a lesser extent, a sequential

improvement from regional Carriers in the Americas. |

| |

• |

|

This improved demand was also reflected in Security, which had a growth quarter due to the timing of high-end SRX deployments.

|

The underlying demand metrics were healthy this quarter with product book-to-bill greater than 1. Product backlog

increased both sequentially and year-over-year. As noted above, the sequential decline of approximately 19% in product deferred revenue positively contributed to our results this quarter.

Solid execution, focus on revenue growth, effective management of our cost structure, and the significant reduction in share count enabled us

to deliver strong year-over-year and quarter-over-quarter non-GAAP operating margin and earnings per share expansion.

In the quarter, we

completed $600 million of share repurchases. Since Q1 2014, inclusive of share repurchases and dividends, we have returned approximately $3.4 billion of capital to shareholders against our commitment to return $4.1 billion by the end of 2016.

Revenue

Product & Service

| |

• |

|

Routing product revenue: $602 million, down 2% year-over-year and up 19% from the prior quarter. The year-over-year decline was due to

expected softness from large US Carriers, partially offset by continued momentum from Cloud and Cable Providers and an increase from Enterprise in EMEA and the Americas. Sequentially, the increase was due to similar factors but we also saw good

quarter-over-quarter growth from regional US Carriers which was partially offset by weakness from China and the timing of demand with Middle East Carriers. |

| |

• |

|

Switching product revenue: $190 million, a decrease of 5% year-over-year, primarily due to a decrease in Enterprise campus and branch

partially offset by an increase in data center and Service Providers. Quarter-over-quarter, switching product revenue increased 14% due to strength in Enterprise and growth from Cloud Providers and Carriers. |

| |

• |

|

Security product revenue: $107 million, up 12% year-over-year and 15% sequentially. The year-over-year increase was due to growth in the

Americas from Cloud and Cable Providers, as well as Enterprise. The sequential increase resulted from growth in Service Providers in the Americas, as well as strength from the Enterprise market in EMEA. |

SRX Platform and Security Software was up 22% year-over-year and 18% quarter-over-quarter, while our Screen OS and Other Legacy

products were down 34% year-over-year and flat from the prior quarter.

Despite the improvement in security revenue this

quarter, there is still work to do to stabilize this area of our business and we remain focused on executing our strategy.

| |

• |

|

Service revenue: $323 million, up 13% year-over-year and 6% quarter-over-quarter. The year-over-year and sequential increase in

service revenue was primarily driven by new service contracts, the delivery of certain projects, and strong contract renewals. |

Geography

| |

• |

|

Americas: $736 million, up 6% year-over-year and 25% quarter-over-quarter. The year-over-year increase was primarily due to growth from

Cloud and Cable Providers and Enterprise partially offset by the expected decline from large US Carriers. The quarter-over-quarter strength was primarily due to good growth from Service Providers—despite continued softness from large

Carriers—across all technologies and growth from routing and switching in Enterprise. |

| |

• |

|

EMEA: $316 million, flat year-over-year and up 4% from the prior quarter. Year-over-year and sequentially, we saw good growth in the

Enterprise market offset by modest declines in Service Providers. The sequential strength from Cloud and Cable Providers was partially offset by lower revenues from Carriers due to the timing of deployments specifically in the Middle East and

Scandinavia. |

| |

• |

|

APAC: $170 million, down 10% year-over-year and 3% quarter-over-quarter. The year-over-year and sequential decrease was primarily due to

significant revenue declines in China, and to a lesser extent Japan and Korea. APAC revenue, excluding China, would have grown 11% sequentially. |

Market

| |

• |

|

Service Provider: $835 million, up 1% year-over-year and 16% from the prior quarter. Cloud and Cable Providers increased year-over-year and

sequentially. As expected, Carriers were down from the prior year but increased modestly quarter-over-quarter primarily due to regional US Carriers. By technology, we saw good sequential growth across routing, switching and security.

|

| |

• |

|

Enterprise: $387 million, up 4% from the prior year and 10% from last quarter. Overall, in Enterprise we saw continued year-over-year and

quarter-over-quarter momentum in the data center. Campus and branch declined from the prior year but increased sequentially. |

Gross

Margins

| |

• |

|

Non-GAAP gross margins: 64.8%, compared to 64.2% from prior year and 63.1% from last quarter. |

| |

• |

|

Non-GAAP product gross margins: 66.1%, up seven tenths of a point from a year ago and 2.2 points from last quarter due to lower costs,

higher revenue, and product mix. While the pricing environment is consistently competitive, we remain focused on delivering innovation and continued improvements to our cost structure. |

| |

• |

|

Non-GAAP service gross margins: 61.3%, up eight tenths of a point from a year ago and flat quarter-over-quarter. The year-over-year increase

was due to higher service contracts and lower delivery costs. Sequentially, the favorable variance due to higher revenue was offset by higher service delivery costs primarily for spare parts. |

Operating Expenses

| |

• |

|

Non-GAAP operating expenses: $484 million, a reduction of $32 million, or 6% year-over-year. We are pleased with our continued focus on

managing our operating expenses. We were able to deliver operating expenses close to our guidance range despite significant additional variable costs due to higher revenues. Operating expenses were 39.6% of revenue, as reported for the quarter, down

2.3 points year-over-year and 5.1 points quarter-over-quarter, demonstrating good progress towards our long-term model of 39%. |

Operating Margins

| |

• |

|

Non-GAAP operating margins: 25.2%, an improvement of 2.9 points year-over-year and 6.7 points sequentially. This reflects our continued

focus on top line growth and cost management. |

Tax Rate

| |

• |

|

Non-GAAP tax rate: 27.4%, an increase compared to 26.9% last quarter, mainly due to a change in the geographic mix of earnings.

|

Diluted Earnings Per Share

| |

• |

|

Non-GAAP diluted earnings per share: $0.53, increased $0.13 year-over-year primarily due to the positive impact from reduced share count,

cost reductions, and higher revenue. The sequential increase of $0.21 was primarily due to higher revenue and gross margins and the positive impact from reduced share count. |

Balance Sheet, Cash Flow, and Capital Return

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

|

Q2’15 |

|

|

Q1’15 |

|

|

Q4’14 |

|

|

Q3’14 |

|

|

Q2’14 |

|

| Cash(1) |

|

$ |

3,076.3 |

|

|

$ |

3,450.6 |

|

|

$ |

3,104.9 |

|

|

$ |

3,321.0 |

|

|

$ |

3,960.4 |

|

| Debt |

|

|

1,948.6 |

|

|

|

1,948.6 |

|

|

|

1,349.0 |

|

|

|