UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 23, 2015

ALTERA CORPORATION

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 0-16617 | | 77-0016691 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

101 Innovation Drive, San Jose, California | | 95134 |

(Address of principal executive offices) | | (Zip Code) |

Registrant's telephone number, including area code: (408) 544-7000

|

|

Not Applicable |

(Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

On July 23, 2015, Altera Corporation (the "Company") issued a press release announcing its financial results for the second quarter of 2015. A copy of the press release is furnished as Exhibit 99.1 to this report.

Item 8.01. Other Events.

On July 20, 2015, the Company's board of directors declared a quarterly cash dividend of $0.18 per common share. The quarterly dividend will be paid on September 1, 2015 to stockholders of record on August 10, 2015.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

99.1 Press release dated July 23, 2015

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

ALTERA CORPORATION |

|

/s/ RONALD J. PASEK

|

Ronald J. Pasek Senior Vice President, Finance and Chief Financial Officer |

Dated: July 23, 2015

EXHIBIT INDEX

Exhibit No. Description

| |

99.1 | Press release dated July 23, 2015 |

|

| | |

INVESTOR CONTACT | | MEDIA CONTACT |

Scott Wylie - Vice President | | Sue Martenson - Senior Manager |

Investor Relations | | Public Relations |

(408) 544-6996 | | (408) 544-8158 |

swylie@altera.com | | newsroom@altera.com |

ALTERA ANNOUNCES SECOND QUARTER RESULTS

San Jose, Calif., July 23, 2015 — Altera Corporation (NASDAQ: ALTR) today announced second quarter sales of $414.2 million, down 5 percent from the first quarter of 2015 and down 16 percent from the second quarter of 2014. Second quarter net income was $70.3 million, $0.23 per diluted share, compared with net income of $94.9 million, $0.31 per diluted share, in the first quarter of 2015 and $127.0 million, $0.41 per diluted share, in the second quarter of 2014.

Year-to-date cash flow from operating activities was $225.9 million. Altera's board of directors has declared a quarterly cash dividend of $0.18 per share, to be paid on September 1, 2015 to shareholders of record on August 10, 2015.

"Our wireless customers reduced demand on us this quarter, as expected, in reaction to continuing adverse market conditions. This pause in wireless spend more than offset growth across many of our vertical markets," said John Daane, president, chief executive officer, and chairman of the board. "The most important news for the second quarter was the June 1st announcement of an agreement for Intel to acquire Altera. Over the past several years we have worked closely with Intel, the world's largest semiconductor company and a proven technology leader. Through that interaction, we understand well the benefits this transaction will bring to our customers through development of innovative market-leading FPGAs and SoCs that will be enabled by Intel and Altera joining forces."

Second Quarter Business Summary

As previously forecasted, Altera's sales declined sequentially with Telecom and Wireless sales down sharply, attributable in large measure to the company's wireless business. With a few exceptions, there was broad growth across the remainder of the company. Gross margin was 69.4%, significantly improved from first quarter levels, as a result of favorable vertical market mix. Operating expense increased sequentially, largely the result of $18.5 million in merger-related expenses. The company's tax rate was 17.7%, higher than anticipated, largely due to adverse geographic mix of earnings. Altera did not repurchase any of its shares during the quarter.

In light of the company's pending acquisition by Intel, Altera will no longer provide forward-looking guidance.

Recent accomplishments mark Altera's continuing progress:

| |

• | Altera has revealed architectural and product details of its Stratix® 10 FPGAs and SoCs, the next generation of high-end programmable logic devices, delivering breakthrough levels of performance, integration, density and security. |

| |

◦ | Stratix 10 FPGAs and SoCs leverage Altera’s revolutionary HyperFlex™ FPGA fabric architecture, the FPGA industry’s most significant fabric architecture innovation in over a decade. The HyperFlex fabric and Altera's use of Intel's® 14 nm Tri-Gate process, with its full process node advantage, provides 2X higher core performance over Altera's previous high-end family. |

| |

◦ | All members of the Stratix 10 FPGA and SoC family leverage heterogeneous 3D SiP (System in Package) integration to efficiently and economically integrate a high-density monolithic FPGA core fabric (up to 5.5M logic elements) with other advanced components, thereby increasing the scalability and flexibility of Stratix 10 FPGAs and SoCs. Altera’s heterogeneous SiP integration is enabled through the use of Intel’s proprietary EMIB (Embedded Multi-die Interconnect Bridge) technology, which provides higher performance, reduced complexity, lower cost and enhanced signal integrity compared with interposer-based approaches. |

| |

◦ | All densities in the Stratix 10 family will also be available with an integrated 64-bit ARM® quad-core CortexTM-A53 hard processor system. With these Stratix10 SoCs, Altera will extend its industry leadership position as the only vendor to offer high-end SoC FPGAs. |

| |

• | Altera has announced its Spectra-Q™ engine, a new technology at the heart of the company’s proven Quartus® II software, to improve design productivity and time-to-market for next-generation programmable devices. As FPGAs and SoCs deliver dramatically increased capabilities with multi-million logic element devices, the Spectra-Q engine is a combination of software technologies that dramatically accelerate the design process by reducing design iterations, while continuing to deliver the industry's fastest compile times. The Spectra-Q engine features faster algorithms and allows for incremental design changes without needing to perform a full design compile. Built on top of the Spectra-Q engine is an industry-first platform design tool called BluePrint that allows designers to assign interfaces with greater efficiency. This tool reduces design iterations by 10X compared to the number of design iterations without the use of this tool by allowing designers to explore and create legal IO placements up-front with real-time fitter-checking. The Spectra-Q engine is available today to early access customers. |

| |

• | Altera has joined the Industrial Internet Consortium, a collaborative industry organization facilitating development of a global ecosystem for the Internet of Things (IoT). Founded by AT&T, Cisco, General Electric, IBM and Intel in March 2014, the Industrial Internet Consortium catalyzes and coordinates the priorities and enabling technologies of the Industrial Internet. Altera FPGA, SoC and power products already play a significant role in enabling connectivity in RF wireless systems and machine-to-machine communication networks. Programmable logic is applied extensively in factory automation and smart grid applications, supporting high-performance control and analytics that enhance the efficiency, safety and security in advanced manufacturing and power systems. FPGAs are also being deployed in next-generation automotive and medical IoT systems, and in smart city applications, such as intelligent lighting and traffic management systems that incorporate high-performance embedded vision and video analytics capabilities. |

SELECTED SECOND QUARTER RATIOS AND RELATED RESULTS

|

| | | | | | | | |

($ in thousands) Key Ratios & Information | | June 26, 2015 | | March 27, 2015 |

Current Ratio | | 5:1 |

| | 5:1 |

|

Liabilities/Equity | | 3:4 |

| | 3:4 |

|

Quarterly Operating Cash Flows | | $ | 89,220 |

| | $ | 136,633 |

|

TTM Return on Equity | | 12 | % | | 13 | % |

Quarterly Depreciation Expense | | $ | 11,985 |

| | $ | 12,777 |

|

Quarterly Capital Expenditures | | $ | 7,696 |

| | $ | 33,245 |

|

Inventory MSOH (1): Altera | | 4.2 |

| | 3.0 |

|

Inventory MSOH (1): Distribution | | 0.7 |

| | 0.7 |

|

Cash Conversion Cycle (Days) | | 162 |

| | 149 |

|

Turns | | 46 | % | | 41 | % |

Book to Bill | | <1.0 |

| | <1.0 |

|

| | | | |

Note (1): MSOH: Months Supply On Hand | | | | |

ALTERA CORPORATION

NET SALES SUMMARY

(Unaudited)

|

| | | | | | | | | | | | | | |

| Three Months Ended | | Quarterly Growth Rate |

| June 26,

2015 | | March 27,

2015 | | June 27,

2014 | | Sequential Change | | Year- Over-Year Change |

Geography | | | | | | | | | |

Americas | 20 | % | | 17 | % | | 16 | % | | 10 | % | | 6 | % |

Asia Pacific | 41 | % | | 45 | % | | 43 | % | | (11 | )% | | (18 | )% |

EMEA | 27 | % | | 27 | % | | 27 | % | | (7 | )% | | (17 | )% |

Japan | 12 | % | | 11 | % | | 14 | % | | 3 | % | | (28 | )% |

Net Sales | 100 | % | | 100 | % | | 100 | % | | (5 | )% | | (16 | )% |

|

| | | | | | | | | | | | | | |

Product Category | | | | | | | | | |

New | 53 | % | | 59 | % | | 53 | % | | (14 | )% | | (14 | )% |

Mainstream | 23 | % | | 19 | % | | 21 | % | | 13 | % | | (11 | )% |

Mature and Other | 24 | % | | 22 | % | | 26 | % | | 5 | % | | (22 | )% |

Net Sales | 100 | % | | 100 | % | | 100 | % | | (5 | )% | | (16 | )% |

|

| | | | | | | | | | | | | | |

Vertical Market | | | | | | | | | |

Telecom & Wireless | 31 | % | | 42 | % | | 46 | % | | (31 | )% | | (44 | )% |

Industrial Automation, Military & Automotive | 27 | % | | 21 | % | | 21 | % | | 22 | % | | 10 | % |

Networking, Computer & Storage | 18 | % | | 17 | % | | 15 | % | | 3 | % | | 4 | % |

Other | 24 | % | | 20 | % | | 18 | % | | 15 | % | | 11 | % |

Net Sales | 100 | % | | 100 | % | | 100 | % | | (5 | )% | | (16 | )% |

|

| | | | | | | | | | | | | | |

FPGAs and CPLDs | | | | | | | | | |

FPGA | 83 | % | | 84 | % | | 84 | % | | (7 | )% | | (17 | )% |

CPLD | 11 | % | | 8 | % | | 8 | % | | 23 | % | | 11 | % |

Other Products | 6 | % | | 8 | % | | 8 | % | | (17 | )% | | (31 | )% |

Net Sales | 100 | % | | 100 | % | | 100 | % | | (5 | )% | | (16 | )% |

Product Category Description

| |

• | New Products include the Arria® 10, Stratix® V, Stratix IV, Arria V, Arria II, Cyclone® V, Cyclone IV, MAX® 10, MAX V, HardCopy® IV devices and Enpirion PowerSoCs. |

| |

• | Mainstream Products include the Stratix III, Cyclone III, MAX II and HardCopy III devices. |

| |

• | Mature and Other Products include the Stratix II, Stratix, Arria GX, Cyclone II, Cyclone, MAX 3000A, MAX 7000, MAX 7000A, MAX 7000B, MAX 7000S, MAX 9000, HardCopy II, HardCopy, FLEX® series, APEX™ series, Mercury™, Excalibur™ devices, configuration and other devices, intellectual property cores, and software and other tools. |

Forward-Looking Statements

Statements in this press release that are not historical are "forward-looking statements" as the term is defined in the Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally written in the future tense and/or preceded by words such as "will," "expects," "anticipates," or other words that imply or predict a future state. Forward-looking statements include, but are not limited to, statements regarding absolute and relative product performance and features, Stratix® 10 FPGA competitive advantages and market expansion potential, future product availability, and the potential benefits that may be delivered through the pending acquisition of Altera by Intel. Investors are cautioned that all forward-looking statements in this release involve risks and uncertainty that can cause actual results to differ materially from those currently anticipated, due to a number of factors, including without limitation, the risk that the acquisition of Altera by Intel will not be completed, current global economic conditions, customer business environment, customer inventory levels, product availability, vertical market mix, market acceptance of the company's products, the performance of products once introduced, product introduction schedules, the rate of growth of the company's new products including Cyclone® V, Cyclone IV, Arria® 10, Arria V, Arria II, Stratix V, Stratix IV, MAX® 10 FPGAs, MAX V CPLDs, HardCopy® IV device families and Enpirion PowerSoCs, as well as changes in economic conditions and other risk factors discussed in documents filed by the company with the Securities and Exchange Commission (SEC) from time to time. Copies of Altera's SEC filings are posted on the company's website and are available from the company without charge. Forward-looking statements are made as of the date of this release, and, except as required by law, the company does not undertake an obligation to update its forward-looking statements to reflect future events or circumstances.

About Altera

Altera® programmable solutions enable designers of electronic systems to rapidly and cost effectively innovate, differentiate and win in their markets. Altera offers FPGA, SoC, CPLD products, and complementary technologies, such as power solutions, to provide high-value solutions to customers worldwide. Visit www.altera.com.

###

ALTERA, ARRIA, CYCLONE, ENPIRION, MAX, MEGACORE, NIOS, QUARTUS and STRATIX words and logos are trademarks of Altera Corporation and registered in the U.S. Patent and Trademark Office and in other countries. All other words and logos identified as trademarks or service marks are the property of their respective holders as described at www.altera.com/legal.

###

ALTERA CORPORATION

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

(In thousands, except per share amounts) | | June 26,

2015 | | March 27,

2015 | | June 27,

2014 | | June 26,

2015 | | June 27,

2014 |

| | | | | | | | | | |

Net sales | | $ | 414,162 |

| | $ | 435,485 |

| | $ | 491,517 |

| | $ | 849,647 |

| | $ | 952,609 |

|

Cost of sales | | 126,590 |

| | 156,263 |

| | 162,391 |

| | 282,853 |

| | 314,259 |

|

Gross margin | | 287,572 |

| | 279,222 |

| | 329,126 |

| | 566,794 |

| | 638,350 |

|

Operating expense | | | | | | | | | | |

Research and development expense | | 105,345 |

| | 103,231 |

| | 101,121 |

| | 208,576 |

| | 198,778 |

|

Selling, general, and administrative expense | | 75,011 |

| | 70,506 |

| | 78,974 |

| | 145,517 |

| | 153,481 |

|

Amortization of acquisition-related intangible assets | | 2,427 |

| | 2,464 |

| | 2,464 |

| | 4,891 |

| | 4,929 |

|

Merger expenses | | 18,458 |

| | — |

| | — |

| | 18,458 |

| | — |

|

Total operating expense | | 201,241 |

| | 176,201 |

| | 182,559 |

| | 377,442 |

| | 357,188 |

|

Operating margin (2) | | 86,331 |

| | 103,021 |

| | 146,567 |

| | 189,352 |

| | 281,162 |

|

Compensation expense — deferred compensation plan | | 2,732 |

| | 27 |

| | 3,126 |

| | 2,759 |

| | 4,580 |

|

Gain on deferred compensation plan securities | | (2,732 | ) | | (27 | ) | | (3,126 | ) | | (2,759 | ) | | (4,580 | ) |

Interest income and other | | (8,495 | ) | | (6,596 | ) | | (7,819 | ) | | (15,091 | ) | | (13,804 | ) |

Gain reclassified from other comprehensive income | | (1,463 | ) | | (2,506 | ) | | (43 | ) | | (3,969 | ) | | (91 | ) |

Interest expense | | 10,859 |

| | 10,408 |

| | 10,877 |

| | 21,267 |

| | 21,365 |

|

Income before income taxes | | 85,430 |

| | 101,715 |

| | 143,552 |

| | 187,145 |

| | 273,692 |

|

Income tax expense | | 15,091 |

| | 6,863 |

| | 16,548 |

| | 21,954 |

| | 30,174 |

|

Net income | | 70,339 |

| | 94,852 |

| | 127,004 |

| | 165,191 |

| | 243,518 |

|

| | | | | | | | | | |

Other comprehensive (loss)/income: | | | | | | | | | | |

Unrealized (loss)/gain on investments: | | | | | | | | | | |

Unrealized holding (loss)/gain on investments arising during period, net of tax of ($460), $41, $23, ($419) and $46 | | (24,805 | ) | | 16,785 |

| | 14,471 |

| | (8,020 | ) | | 27,031 |

|

Less: Reclassification adjustments for gain on investments included in net income, net of tax of $9, $6, $6, $15 and $10 | | (1,454 | ) | | (2,500 | ) | | (37 | ) | | (3,954 | ) | | (81 | ) |

Other comprehensive (loss)/income | | (26,259 | ) | | 14,285 |

| | 14,434 |

| | (11,974 | ) | | 26,950 |

|

Comprehensive income | | $ | 44,080 |

| | $ | 109,137 |

| | $ | 141,438 |

| | $ | 153,217 |

| | $ | 270,468 |

|

| | | | | | | | | | |

Net income per share: | | | | | | | | | | |

Basic | | $ | 0.23 |

| | $ | 0.31 |

| | $ | 0.41 |

| | $ | 0.55 |

| | $ | 0.78 |

|

Diluted | | $ | 0.23 |

| | $ | 0.31 |

| | $ | 0.41 |

| | $ | 0.54 |

| | $ | 0.77 |

|

| | | | | | | | | | |

Shares used in computing per share amounts: | | |

| | | | |

| | | | |

Basic | | 301,799 |

| | 301,308 |

| | 311,000 |

| | 301,561 |

| | 313,713 |

|

Diluted | | 304,604 |

| | 303,285 |

| | 313,513 |

| | 303,951 |

| | 316,145 |

|

| | | | | | | | | | |

Dividends per common share | | $ | 0.18 |

| | $ | 0.18 |

| | $ | 0.15 |

| | $ | 0.36 |

| | $ | 0.30 |

|

| | | | | | | | | | |

Tax rate | | 17.7 | % | | 6.7 | % | | 11.5 | % | | 11.7 | % | | 11.0 | % |

% of Net sales: | | | | | | | | | | |

Gross margin | | 69.4 | % | | 64.1 | % | | 67.0 | % | | 66.7 | % | | 67.0 | % |

Research and development (1) | | 26.0 | % | | 24.3 | % | | 21.1 | % | | 25.1 | % | | 21.4 | % |

Selling, general, and administrative | | 18.1 | % | | 16.2 | % | | 16.1 | % | | 17.1 | % | | 16.1 | % |

Operating margin(2) | | 20.8 | % | | 23.7 | % | | 29.8 | % | | 22.3 | % | | 29.5 | % |

Net income | | 17.0 | % | | 21.8 | % | | 25.8 | % | | 19.4 | % | | 25.6 | % |

|

| | | | | | | | | | | | | | | | | | | | |

Notes: | | | | | | | | | | |

(1) Research and development expense as a percentage of Net sales includes amortization of acquisition-related intangible assets.

(2) We define operating margin as gross margin less research and development expense, selling, general and administrative expense, amortization of acquisition-related intangible assets, and merger expenses, as presented above. This presentation differs from income from operations as defined by U.S. Generally Accepted Accounting Principles ("GAAP"), as it excludes the effect of compensation associated with the deferred compensation plan obligations. Since the effect of compensation associated with our deferred compensation plan obligations is offset by losses/(gains) from related securities, we believe this presentation provides a more meaningful representation of our ongoing operating performance. A reconciliation of operating margin to income from operations follows: |

| | | | | | |

| | Three Months Ended | | Six Months Ended |

(In thousands, except per share amounts) | | June 26,

2015 | | March 27,

2015 | | June 27,

2014 | | June 26,

2015 | | June 27,

2014 |

Operating margin (non-GAAP) | | $ | 86,331 |

| | $ | 103,021 |

| | $ | 146,567 |

| | $ | 189,352 |

| | $ | 281,162 |

|

Compensation expense — deferred compensation plan | | 2,732 |

| | 27 |

| | 3,126 |

| | 2,759 |

| | 4,580 |

|

Income from operations (GAAP) | | $ | 83,599 |

| | $ | 102,994 |

| | $ | 143,441 |

| | $ | 186,593 |

| | $ | 276,582 |

|

ALTERA CORPORATION

CONSOLIDATED BALANCE SHEETS

(Unaudited) |

| | | | | | | | |

(In thousands, except par value amount) | | June 26,

2015 | | December 31,

2014 |

| | | | |

Assets | | | | |

Current assets: | | | | |

Cash and cash equivalents | | $ | 1,852,753 |

| | $ | 2,426,367 |

|

Short-term investments | | 221,333 |

| | 151,519 |

|

Total cash, cash equivalents, and short-term investments | | 2,074,086 |

| | 2,577,886 |

|

Accounts receivable, net | | 424,427 |

| | 377,964 |

|

Inventories | | 177,654 |

| | 153,387 |

|

Deferred income taxes — current | | 58,645 |

| | 56,048 |

|

Deferred compensation plan — marketable securities | | 65,378 |

| | 69,367 |

|

Deferred compensation plan — restricted cash equivalents | | 14,484 |

| | 14,412 |

|

Other current assets | | 53,888 |

| | 39,479 |

|

Total current assets | | 2,868,562 |

| | 3,288,543 |

|

Property and equipment, net | | 210,980 |

| | 194,840 |

|

Long-term investments | | 2,448,942 |

| | 1,942,343 |

|

Deferred income taxes — non-current | | 18,669 |

| | 20,077 |

|

Goodwill | | 74,341 |

| | 74,341 |

|

Acquisition-related intangible assets, net | | 67,400 |

| | 72,291 |

|

Other assets, net | | 95,562 |

| | 81,791 |

|

Total assets | | $ | 5,784,456 |

| | $ | 5,674,226 |

|

| | | | |

Liabilities and stockholders' equity | | | | |

Current liabilities: | | | | |

Accounts payable | | $ | 51,618 |

| | $ | 49,140 |

|

Accrued liabilities | | 44,421 |

| | 28,384 |

|

Accrued compensation and related liabilities | | 57,384 |

| | 69,837 |

|

Deferred compensation plan obligations | | 79,862 |

| | 83,779 |

|

Deferred income and allowances on sales to distributors | | 394,921 |

| | 344,168 |

|

Total current liabilities | | 628,206 |

| | 575,308 |

|

Income taxes payable — non-current | | 336,173 |

| | 313,447 |

|

Long-term debt | | 1,493,406 |

| | 1,492,759 |

|

Other non-current liabilities | | 6,878 |

| | 6,886 |

|

Total liabilities | | 2,464,663 |

| | 2,388,400 |

|

Stockholders' equity: | | | | |

Common stock: $.001 par value; 1,000,000 shares authorized; outstanding - 302,467 shares at June 26, 2015 and 302,430 shares at December 31, 2014 | | 302 |

| | 302 |

|

Capital in excess of par value | | 1,207,688 |

| | 1,165,259 |

|

Retained earnings | | 2,114,132 |

| | 2,110,620 |

|

Accumulated other comprehensive (loss)/income | | (2,329 | ) | | 9,645 |

|

Total stockholders' equity | | 3,319,793 |

| | 3,285,826 |

|

Total liabilities and stockholders' equity | | $ | 5,784,456 |

| | $ | 5,674,226 |

|

| | | | |

ALTERA CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, in thousands)

|

| | | | | | | | |

| | Six Months Ended |

(In thousands) | | June 26,

2015 | | June 27,

2014 |

| | | | |

Cash Flows from Operating Activities: | | | | |

Net income | | $ | 165,191 |

| | $ | 243,518 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

Depreciation and amortization | | 27,981 |

| | 28,731 |

|

Amortization of acquisition-related intangible assets | | 4,891 |

| | 4,929 |

|

Amortization of debt discount and debt issuance costs | | 1,558 |

| | 1,558 |

|

Stock-based compensation | | 42,342 |

| | 48,068 |

|

Net gain on sale of available-for-sale securities | | (3,969 | ) | | (91 | ) |

Amortization of investment discount/premium | | 5,243 |

| | 1,300 |

|

Deferred income tax expense | | 1,770 |

| | 1,573 |

|

Tax effect of employee stock plans | | 2,776 |

| | 121 |

|

Excess tax benefit from employee stock plans | | (2,881 | ) | | (612 | ) |

Changes in assets and liabilities: | | | | |

Accounts receivable, net | | (46,463 | ) | | 30,473 |

|

Inventories | | (24,267 | ) | | (12,848 | ) |

Other assets | | (9,990 | ) | | (2,751 | ) |

Accounts payable and other liabilities | | 6,558 |

| | 5,703 |

|

Deferred income and allowances on sales to distributors | | 50,753 |

| | (72,547 | ) |

Income taxes payable and receivable, net | | 11,036 |

| | 30,592 |

|

Deferred compensation plan obligations | | (6,676 | ) | | (6,329 | ) |

Net cash provided by operating activities | | 225,853 |

| | 301,388 |

|

Cash Flows from Investing Activities: | | | | |

Purchases of property and equipment | | (43,339 | ) | | (21,614 | ) |

Sales of deferred compensation plan securities, net | | 6,676 |

| | 6,329 |

|

Purchases of available-for-sale securities | | (1,298,609 | ) | | (204,810 | ) |

Proceeds from sale of available-for-sale securities | | 634,838 |

| | 58,015 |

|

Proceeds from maturity of available-for-sale securities | | 69,711 |

| | 134,212 |

|

Purchases of intangible assets | | (5,257 | ) | | (535 | ) |

Purchases of other investments | | (2,000 | ) | | (8,224 | ) |

Net cash used in investing activities | | (637,980 | ) | | (36,627 | ) |

Cash Flows from Financing Activities: | | |

| | |

|

Proceeds from issuance of common stock through stock plans | | 18,709 |

| | 22,696 |

|

Shares withheld for employee taxes | | (17,125 | ) | | (11,240 | ) |

Payment of dividends to stockholders | | (108,445 | ) | | (94,179 | ) |

Holdback payment for prior acquisition | | — |

| | (3,353 | ) |

Long-term debt and credit facility issuance costs | | — |

| | (1,321 | ) |

Repurchases of common stock | | (57,507 | ) | | (358,808 | ) |

Excess tax benefit from employee stock plans | | 2,881 |

| | 612 |

|

Net cash used in financing activities | | (161,487 | ) | | (445,593 | ) |

Net decrease in cash and cash equivalents | | (573,614 | ) | | (180,832 | ) |

Cash and cash equivalents at beginning of period | | 2,426,367 |

| | 2,869,158 |

|

Cash and cash equivalents at end of period | | $ | 1,852,753 |

| | $ | 2,688,326 |

|

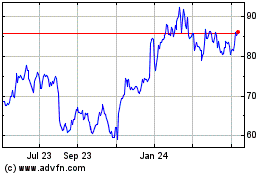

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From Mar 2024 to Apr 2024

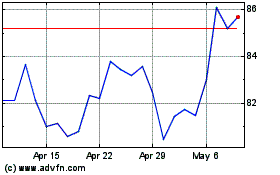

Altair Engineering (NASDAQ:ALTR)

Historical Stock Chart

From Apr 2023 to Apr 2024