UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the Securities Exchange Act of 1934

July

23, 2015

Date

of Report (Date of earliest event reported)

AGENUS INC.

(Exact

name of registrant as specified in its charter)

|

DELAWARE

|

000-29089

|

06-1562417

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

3 Forbes Road

Lexington, MA

|

02421

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

781-674-4400

(Registrant’s

telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2. below):

⃞

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

⃞

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

⃞

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

⃞

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

|

Item 2.02

|

|

Results of Operations and Financial Condition.

|

|

|

|

|

|

|

|

On July 23, 2015, Agenus Inc. announced its financial results for

the quarter ended June 30, 2015. The full text of the press release

issued in connection with the announcement is being furnished as

Exhibit 99.1 to this current report on Form 8-K.

|

|

|

|

|

|

|

|

The information set forth under Item 2.02 and in Exhibit 99.1

attached hereto is intended to be furnished and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of

1934 or otherwise subject to the liabilities of that section, nor

shall it be deemed incorporated by reference in any filing under the

Securities Act of 1933, except as expressly set forth by specific

reference in such filing.

|

|

|

|

|

|

Item 9.01

|

|

Financial Statements and Exhibits.

|

(d) Exhibits

The following exhibit is furnished herewith:

|

|

99.1 Press Release dated July 23, 2015

|

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, the Registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

AGENUS INC.

|

|

|

|

|

Date: July 23, 2015

|

By:

|

/s/ C. Evan Ballantyne

|

|

|

|

|

|

C. Evan Ballantyne

|

|

|

Chief Executive Officer

|

EXHIBIT INDEX

|

Exhibit No.

|

|

Description of Exhibit

|

|

|

|

|

|

99.1

|

|

Press Release dated July 23, 2015

|

Exhibit 99.1

Agenus

Reports Second Quarter 2015 Financial Results

Corporate

Update Conference Call at 11 am ET Today

LEXINGTON, Mass.--(BUSINESS WIRE)--July 23, 2015--Agenus Inc.

(NASDAQ:AGEN), an immunology company discovering and developing

innovative treatments for cancers and other diseases, today announced

its financial results for the second quarter ended June 30, 2015.

“During the second quarter, we made meaningful advances across all areas

of our business which include our proprietary clinical-stage programs,

our immuno-oncology portfolio, strategic acquisitions and our balance

sheet,” said Dr. Garo H. Armen, Chairman and CEO of Agenus. “Of note, we

presented updated Phase 2 results at ASCO for our autologous heat shock

protein vaccine, Prophage, in newly diagnosed glioblastoma multiforme,

demonstrating impressive median overall survival for patients with low

levels of PD-L1 on their monocytes at baseline, compared to historical

standard of care data. Our recent acquisition of novel CEACAM1

antibodies reflects our continued commitment to build a broad, yet

complementary, portfolio of immuno-modulators with the potential to

create best-in-class combination therapies for the treatment of cancer.

This was preceded by our acquisition in April of the SECANT®

yeast display platform from Celexion, a platform which is complementary

to our Retrocyte DisplayTM platform, and which will allow us

to enhance the speed and efficiency of our antibody generation. We

expanded our management team including the addition of Evan Ballantyne

as our CFO, and we successfully raised $74.6 million in net proceeds

from a public offering in May to support further development of our

programs. Looking ahead, we are on track to deliver on our milestones

for 2015, including the filing of two IND’s for check point modulator

programs by year end and advancing Prophage into a Phase 3 study in

newly diagnosed glioblastoma.”

Second Quarter 2015 Financial Results

The company reported a

net loss attributable to common stockholders of $40.5 million, or $0.53

per share, basic and diluted, for the second quarter ended June 30, 2015

compared with a net loss attributable to common stockholders for the

second quarter of 2014 of $7.8 million, or $0.12 per share, basic and

diluted.

For the six months ended June 30, 2015, the company reported a net loss

attributable to common stockholders of $59.3 million, or $0.83 per

share, basic and diluted, compared with a net loss attributable to

common stockholders of $8.5 million, $0.15 per share, basic and diluted,

for the six months ended June 30, 2014.

The increase in net loss attributable to common stockholders for the six

months ended June 30, 2015, compared to the net loss attributable to

common stockholders for the same period in 2014, was primarily due to

the advancement of the check point modulator programs, the $20.7 million

non-cash expense from fair value adjustments of the contingent

obligations and the $13.2 million charge for the purchase of the SECANT

yeast display platform in 2015. During the same period in 2014, the

company recorded non-cash non-operating income of $11.0 million related

to the fair value adjustment of a contingent obligation.

Cash, cash equivalents and short-term investments were $139.6 million as

of June 30, 2015.

Second Quarter 2015 and Recent Corporate Highlights

-

In July, Agenus announced the acquisition of novel antibodies

targeting Carcinoembryonic Antigen Cell Adhesion Molecule 1 (CEACAM1)

from Diatheva s.r.l., an Italian biotech company controlled by SOL

S.pA.

-

In June, Agenus announced the appointment of C. Evan Ballantyne as the

Company’s Chief Financial Officer.

-

In June, Merck and Agenus extended the research term of their existing

collaboration and licensing agreement by one year to April 2016,

allowing Agenus to discover and optimize fully human antibodies

against two undisclosed Merck checkpoint targets.

-

At the 2015 ASCO meeting in June, Orin Bloch, M.D. presented updated

Phase 2 survival data for Prophage, Agenus’ individualized heat shock

protein-based cancer vaccine, in newly diagnosed Glioblastoma

Multiforme (GBM) patients. In patients who had less PD-L1 expression

on their white blood cells (monocytes) at baseline, the median Overall

Survival was approximately 45 months, with more than one-third of

these patients alive without progression for more than three years.

-

In May, the company completed a public offering of 12,650,000 shares

of common stock, offered at $6.30 per share, which includes the

exercise in full by the underwriters of their option to purchase

1,650,000 additional shares of common stock. The offering resulted in

net proceeds in of $74.6 million.

-

In April, Agenus acquired the SECANT® yeast display platform for the

generation of novel monoclonal antibodies from Celexion LLC, a

privately held biotech company in Cambridge, MA. The acquired assets

also include Celexion’s novel approaches to generate antibodies

against membrane bound protein targets such as G protein–coupled

receptors and ion channels, which will be used to assess antibody

binding and help determine functional attributes of agonist and

antagonist antibodies in a highly efficient manner.

-

In April, primary and secondary endpoint data from GlaxoSmithKline’s

(GSK) successful Phase 3 trial of HZ/su, a vaccine candidate for the

prevention of shingles in adults age 50 or over, were simultaneously

presented at the 25th Scientific Conference of the European Society of

Clinical Microbiology and Infectious Disease in Copenhagen, and

published in the New England Journal of Medicine. GSK’s

HZ/su incorporates Agenus' QS-21 Stimulon® adjuvant, which is designed

to increase immune response to antigens. The vaccine demonstrated a

97.2% rate of prevention of the onset of shingles in the study

population over four years.

-

In April, final results from the successful Phase 3 study of GSK’s

malaria vaccine candidate, RTS,S, which also incorporates QS-21

Stimulon, were published in The Lancet.

Target Milestones for 2015

-

Submission to a peer reviewed journal of the Phase 2 data for Prophage

in newly diagnosed GBM. Advancement of Prophage for newly diagnosed

GBM to a Phase 3 trial.

-

EMA regulatory decision on GSK’s malaria vaccine candidate RTS,S,

which contains Agenus’s QS-21 Stimulon. Agenus is eligible to receive

low single-digit royalties on potential sales of GSK’s malaria vaccine.

-

File Investigational New Drug (IND) applications for two checkpoint

modulator antibody programs, one of which is part of our alliance with

Incyte.

-

Leverage Agenus capabilities through further corporate partnerships.

Conference Call and Web Cast Information

Agenus executives will host a conference call at 11:00 a.m. Eastern Time

today. To access the live call, dial 1-866-233-4585 (U.S.) or

1-416-640-5946 (international). The call will also be webcast and will

be accessible from the company’s website at www.agenusbio.com/webcast/.

A replay will be available on the company’s website approximately two

hours after the call and will remain available for 60 days. The replay

number is 1-866-245-6755 (U.S.) 1-416-915-1035 (international), and the

access code is 857826.

About Agenus

Agenus is an immunology company discovering and developing novel

checkpoint modulators, vaccines and adjuvants to treat cancer and other

diseases. Using its proprietary platforms Retrocyte DisplayTM

and SECANT®, the Company is discovering and developing novel antibodies

to target GITR, OX40, CTLA-4, LAG-3, TIM-3, PD-1 and other undisclosed

checkpoints in partnered and internal programs. Agenus’ heat shock

protein vaccine, Prophage, has successfully completed Phase 2 studies in

newly diagnosed glioblastoma multiforme. The Company’s QS-21 Stimulon®

adjuvant is extensively partnered with GlaxoSmithKline plc and Janssen

Sciences Ireland Uc, and two vaccine candidates containing QS-21 have

successfully completed Phase 3 trials. For more information, please

visit www.agenusbio.com, or follow the company on Twitter

@Agenus_Bio; information that may be important to investors will be

routinely posted in these locations.

Forward-Looking Statement

This press release contains forward-looking statements that are made

pursuant to the safe harbor provisions of the federal securities laws,

including statements regarding Agenus’ target milestones for 2015. These

forward-looking statements are subject to risks and uncertainties that

could cause actual results to differ materially. These risks and

uncertainties include, among others, the factors described under the

Risk Factors section of our Prospectus Supplement filed with the

Securities and Exchange Commission on May 21, 2015. Agenus cautions

investors not to place considerable reliance on the forward-looking

statements contained in this release. These statements speak only as of

the date of this press release, and Agenus undertakes no obligation to

update or revise the statements, other than to the extent required by

law. All forward-looking statements are expressly qualified in their

entirety by this cautionary statement.

|

|

|

Summary Consolidated Financial Information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statements of Operations Data

|

|

(in thousands, except per share data)

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended June 30,

|

|

Six months ended June 30,

|

|

|

|

2015

|

|

2014

|

|

2015

|

|

2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

6,377

|

|

|

$

|

3,074

|

|

|

$

|

10,330

|

|

|

$

|

3,795

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

24,773

|

|

|

|

5,223

|

|

|

|

33,993

|

|

|

|

9,695

|

|

|

General and administrative

|

|

|

8,016

|

|

|

|

5,847

|

|

|

|

13,503

|

|

|

|

11,290

|

|

|

Non-cash contingent consideration fair value adjustment

|

|

|

6,783

|

|

|

|

224

|

|

|

|

14,321

|

|

|

|

1,133

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss

|

|

|

(33,195

|

)

|

|

|

(8,220

|

)

|

|

|

(51,487

|

)

|

|

|

(18,323

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Other (expense) income, net

|

|

|

(7,215

|

)

|

|

|

458

|

|

|

|

(7,665

|

)

|

|

|

9,924

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

|

(40,410

|

)

|

|

|

(7,762

|

)

|

|

|

(59,152

|

)

|

|

|

(8,399

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Dividends on Series A-1 convertible preferred stock

|

|

|

(51

|

)

|

|

|

(51

|

)

|

|

|

(101

|

)

|

|

|

(102

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to common stockholders

|

|

$

|

(40,461

|

)

|

|

$

|

(7,813

|

)

|

|

$

|

(59,253

|

)

|

|

$

|

(8,501

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Per common share data, basic and diluted:

|

|

|

|

|

|

|

|

|

|

Net loss attributable to common stockholders

|

|

$

|

(0.53

|

)

|

|

$

|

(0.12

|

)

|

|

$

|

(0.83

|

)

|

|

$

|

(0.15

|

)

|

|

Weighted average number of common shares outstanding, basic and

diluted

|

|

|

76,375

|

|

|

|

62,608

|

|

|

|

71,548

|

|

|

|

56,616

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Balance Sheet Data

|

|

|

|

(in thousands)

|

|

|

|

(unaudited)

|

|

|

|

|

|

|

|

|

|

June 30, 2015

|

|

December 31, 2014

|

|

|

|

|

|

|

|

Cash, cash equivalents and short-term investments

|

|

$

|

139,642

|

|

$

|

40,224

|

|

Total assets

|

|

|

180,110

|

|

|

74,527

|

|

Total stockholders' equity

|

|

|

87,190

|

|

|

23,018

|

|

|

|

|

|

|

|

|

CONTACT:

Media:

Brad Miles, 646-513-3125

BMC

Communications

bmiles@bmccommunications.com

or

Investors:

Andrea

Rabney/Jamie Maarten, 212-600-1902

Argot Partners

andrea@argotpartners.com

jamie@argotpartners.com

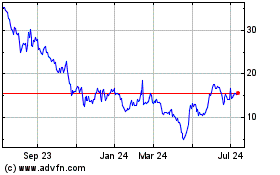

Agenus (NASDAQ:AGEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

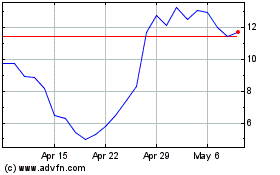

Agenus (NASDAQ:AGEN)

Historical Stock Chart

From Apr 2023 to Apr 2024