UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) July 23, 2015

WESCO International, Inc.

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware (State or other jurisdiction of incorporation) | | 001-14989 (Commission File Number) | | 25-1723342 (IRS Employer Identification No.) |

| | | | |

225 West Station Square Drive Suite 700 Pittsburgh, Pennsylvania (Address of principal executive offices) | | | | 15219 (Zip Code)

|

(412) 454-2200

(Registrant's telephone number, including area code)

Not applicable.

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| |

Item 2.02 | Results of Operations and Financial Condition. |

The information in this Item 2.02 is being furnished and shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information in this Item 2.02 shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

On July 23, 2015, WESCO International, Inc. (the “Company”) issued a press release announcing its financial results for the second quarter of 2015. A copy of the press release is attached hereto as Exhibit 99.1.

| |

Item 7.01 | Regulation FD Disclosure. |

The information in this Item 7.01 is being furnished and shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. The information in this Item 7.01 shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended.

A slide presentation to be used by senior management of the Company in connection with its discussions with investors regarding the Company's financial results for the second quarter of 2015 is included in Exhibit 99.2 to this report and is being furnished in accordance with Regulation FD of the Securities and Exchange Commission.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following are furnished as exhibits to this report.

99.1 Press Release dated July 23, 2015

99.2 Slide presentation for investors

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | WESCO International, Inc. |

| | (Registrant) |

|

| | |

July 23, 2015 | By: | /s/ Kenneth S. Parks |

(Date) | | Kenneth S. Parks |

| | Senior Vice President and Chief Financial Officer |

|

| |

| NEWS RELEASE |

WESCO International, Inc. / Suite 700, 225 West Station Square Drive / Pittsburgh, PA 15219 |

WESCO International, Inc. Reports Second Quarter 2015 Results

Second quarter highlights:

•Consolidated sales of $1.9 billion

•Operating profit of $90.3 million

•Earnings per diluted share of $1.00

| |

• | Financial leverage ratio of 3.3x following the acquisition of Hill Country Electric Supply and buyback of approximately 750,000 shares |

PITTSBURGH, July 23, 2015/PRNewswire/ -- WESCO International, Inc. (NYSE: WCC), a leading provider of electrical, industrial, and communications MRO and OEM products, construction materials, and advanced supply chain management and logistics services, announces its 2015 second quarter results.

The following are results for the three months ended June 30, 2015 compared to the three months ended June 30, 2014:

| |

• | Net sales were $1,916.7 million for the second quarter of 2015, compared to $2,005.2 million for the second quarter of 2014, a decrease of 4.4%. Normalized organic sales decreased 3.0%; foreign exchange rates negatively impacted sales by 3.0% and were partially offset by a 1.6% positive impact from acquisitions. Sequentially, sales increased 5.5%, and normalized organic sales increased 1.1%. |

| |

• | Gross profit was $381.6 million, or 19.9% of sales, for the second quarter of 2015, compared to $411.8 million, or 20.5% of sales, for the second quarter of 2014. |

| |

• | Selling, general and administrative ("SG&A") expenses were $275.2 million, or 14.4% of sales, for the second quarter of 2015, compared to $278.7 million, or 13.9% of sales, for the second quarter of 2014. |

| |

• | Operating profit was $90.3 million for the current quarter, compared to $115.9 million for the second quarter of 2014. Operating profit as a percentage of sales was 4.7% in 2015, compared to 5.8% in 2014. |

| |

• | Interest expense for the second quarter of 2015 was $18.6 million, compared to $20.3 million for the second quarter of 2014. Non-cash interest expense, which includes convertible debt interest, interest related to uncertain tax positions, amortization of deferred financing fees and accrued interest, for the second quarter of 2015 and 2014 was $1.6 million and $2.2 million, respectively. |

| |

• | The effective tax rate for the current quarter was 29.3%, compared to 28.0% for the prior year second quarter. |

| |

• | Net income attributable to WESCO International, Inc. of $51.8 million for the current quarter was down 24.8% from $68.9 million for the prior year quarter. |

| |

• | Earnings per diluted share for the second quarter of 2015 was $1.00 per share, based on 51.9 million diluted shares, compared to $1.29 per share in the second quarter of 2014, based on 53.5 million diluted shares. |

| |

• | Free cash flow for the second quarter of 2015 was $34.9 million compared to a net cash outflow of $2.7 million for the second quarter of 2014. |

Mr. John J. Engel, WESCO’s Chairman and Chief Executive Officer, stated, “Our second quarter sales declined 4% reflecting continued foreign exchange headwinds and weakness in the industrial market as well as a slow seasonal start in the non-residential construction market. For the quarter, organic sales in the U.S. were flat while organic sales in Canada declined 7%. Business mix, rebate accruals, and a continued competitive pricing environment drove gross margin lower while cost reduction actions partially mitigated the impact on earnings per share, which was lower than prior year. Free cash flow was solid and exceeds 120% of net income on a year-to-date basis. We repurchased approximately 750 thousand shares in the second quarter bringing year-to-date repurchases to approximately 1.1 million shares or $75 million of the $300 million share repurchase authorization. Based on our second quarter results and a challenging market outlook, we are revising our full year outlook for sales growth of (3)% to flat and $4.50 to $4.90 earnings per diluted share from our previous outlook of (3)% to 3% sales growth and $5.00 to $5.40 earnings per diluted share.”

The following results are for the six months ended June 30, 2015 compared to the six months ended June 30, 2014:

| |

• | Net sales were $3,733.0 million for the first six months of 2015, compared to $3,816.0 million for the first six months of 2014, a decrease of 2.2%. Normalized organic sales decreased 0.1%; acquisitions positively impacted sales by 1.4%, and foreign exchange rates and number of workdays negatively impacted sales by 2.7% and 0.8%, respectively. |

| |

• | Gross profit of $749.3 million, or 20.1% of sales, for the first six months of 2015 compared to $786.5 million, or 20.6% of sales, for the first six months of 2014. |

| |

• | Selling, general and administrative ("SG&A") expenses were $539.8 million, or 14.5% of sales, for the first six months of 2015, compared to $544.2 million, or 14.3% of sales, for the first six months of 2014. |

| |

• | Operating profit was $177.4 million for the first six months of 2015 compared to $208.7 million for the first six months of 2014. Operating profit as a percentage of sales was 4.8% in 2015 compared to 5.5% in 2014. |

| |

• | Interest expense for the first six months of 2015 was $39.5 million, compared to $41.0 million for the first six months of 2014. Non-cash interest expense, which includes convertible debt interest, interest related to uncertain tax positions, amortization of deferred financing fees and accrued interest, for the first six months of 2015 and 2014 was $7.0 million and $4.7 million, respectively. |

| |

• | The effective tax rate was 29.4% for the six months ended June 30, 2015, compared to 28.1% for the six months ended June 30, 2014. |

| |

• | Net income attributable to WESCO International, Inc. of $98.7 million for the six months ended June 30, 2015 was down 18.2% from $120.7 million for the six months ended June 30, 2014. |

| |

• | Earnings per diluted share for the first six months of 2015 was $1.90 per share, based on 52.1 million diluted shares, versus $2.26 per share for the first six months of 2014, based on 53.4 million diluted shares. |

| |

• | Free cash flow for the six months ended June 30, 2015 was $120.0 million, or 122% of net income, compared to free cash flow of $39.0 million, or 32% of net income for the six months ended June 30, 2014. |

Mr. Engel continued, “We expect reduced demand in commodity-driven end markets in the near term and foreign exchange headwinds to continue for the remainder of the year. Actions initiated in the second quarter to accelerate our One WESCO sales initiatives and simplify and streamline the business are expected to help improve profitability in the second half of the year. We are pleased with the acquisition of Hill Country in the second quarter, and they are off to a solid start. Our capital structure is in good shape, and we will continue to take a disciplined approach to supplement our growth strategy by strengthening our electrical core and expanding our portfolio of products and services through acquisitions. As consolidation and outsourcing accelerates in our industry, customers are looking for a one-stop-shop to manage their global supply chain needs. Our One WESCO value proposition provides customers with the comprehensive product and service solutions they need to meet their MRO, OEM and Capital Project management requirements."

Webcast and Teleconference Access

WESCO will conduct a webcast and teleconference to discuss the second quarter earnings as described in this News Release on Thursday, July 23, 2015, at 11:00 a.m. E.T. The call will be broadcast live over the Internet and can be accessed from the Company's Website at http://www.wesco.com. The call will be archived on this Internet site for seven days.

WESCO International, Inc. (NYSE: WCC), a publicly traded Fortune 500 holding company headquartered in Pittsburgh, Pennsylvania, is a leading provider of electrical, industrial, and communications maintenance, repair and operating (“MRO”) and original equipment manufacturers (“OEM”) product, construction materials, and advanced supply chain management and logistic services. 2014 annual sales were approximately $7.9 billion. The Company employs approximately 9,400 people, maintains relationships with over 25,000 suppliers, and serves over 75,000 active customers worldwide. Customers include commercial and industrial businesses, contractors, government agencies, institutions, telecommunications providers and utilities. WESCO operates nine fully automated distribution centers and approximately 485 full-service branches in North America and international markets, providing a local presence for customers and a global network to serve multi-location businesses and multi-national corporations.

The matters discussed herein may contain forward-looking statements that are subject to certain risks and uncertainties that could cause actual results to differ materially from expectations. Certain of these risks are set forth in the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2014, as well as the Company's other reports filed with the Securities and Exchange Commission.

Contact: Kenneth S. Parks, Senior Vice President and Chief Financial Officer

WESCO International, Inc. (412) 454-2392, Fax: (412) 222-7566

http://www.wesco.com

WESCO INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(dollar amounts in millions, except per share amounts)

(Unaudited)

|

| | | | | | | | | | | |

| Three Months Ended | |

| June 30,

2015 | | | June 30,

2014 | |

Net sales | $ | 1,916.7 |

| | | $ | 2,005.2 |

| |

Cost of goods sold (excluding | 1,535.1 |

| 80.1 | % | | 1,593.4 |

| 79.5 | % |

depreciation and amortization below) | | | | | |

Selling, general and administrative expenses | 275.2 |

| 14.4 | % | | 278.7 |

| 13.9 | % |

Depreciation and amortization | 16.1 |

| | | 17.2 |

| |

Income from operations | 90.3 |

| 4.7 | % | | 115.9 |

| 5.8 | % |

Interest expense, net | 18.6 |

| | | 20.3 |

| |

Income before income taxes | 71.7 |

| 3.7 | % | | 95.6 |

| 4.8 | % |

Provision for income taxes | 21.0 |

| | | 26.7 |

| |

Net income | 50.7 |

| 2.6 | % | | 68.9 |

| 3.4 | % |

Net loss attributable to noncontrolling interests | (1.1 | ) | | | — |

| |

Net income attributable to WESCO International, Inc. | $ | 51.8 |

| 2.7 | % | | $ | 68.9 |

| 3.4 | % |

| | | | | |

Earnings per diluted common share | $ | 1.00 |

| | | $ | 1.29 |

| |

Weighted-average common shares outstanding and common | | | | | |

share equivalents used in computing earnings per diluted | | | | | |

share (in millions) | 51.9 |

| | | 53.5 |

| |

WESCO INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(dollar amounts in millions, except per share amounts)

(Unaudited)

|

| | | | | | | | | | | |

| Six Months Ended | |

| June 30,

2015 | | | June 30,

2014 | |

Net sales | $ | 3,733.0 |

| | | $ | 3,816.0 |

| |

Cost of goods sold (excluding | 2,983.7 |

| 79.9 | % | | 3,029.5 |

| 79.4 | % |

depreciation and amortization below) | | | | | |

Selling, general and administrative expenses | 539.8 |

| 14.5 | % | | 544.2 |

| 14.3 | % |

Depreciation and amortization | 32.1 |

| | | 33.6 |

| |

Income from operations | 177.4 |

| 4.8 | % | | 208.7 |

| 5.5 | % |

Interest expense, net | 39.5 |

| | | 41.0 |

| |

Income before income taxes | 137.9 |

| 3.7 | % | | 167.7 |

| 4.4 | % |

Provision for income taxes | 40.5 |

| | | 47.1 |

| |

Net income | 97.4 |

| 2.6 | % | | 120.6 |

| 3.2 | % |

Net loss attributable to noncontrolling interests | (1.3 | ) | | | (0.1 | ) | |

Net income attributable to WESCO International, Inc. | $ | 98.7 |

| 2.6 | % | | $ | 120.7 |

| 3.2 | % |

| | | | | |

Earnings per diluted common share | $ | 1.90 |

| | | $ | 2.26 |

| |

Weighted-average common shares outstanding and common | | | | | |

share equivalents used in computing earnings per diluted | | | | | |

share (in millions) | 52.1 |

| | | 53.4 |

| |

WESCO INTERNATIONAL, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(dollar amounts in millions)

(Unaudited)

|

| | | | | | | |

| June 30,

2015 | | December 31,

2014 |

Assets | | | |

Current Assets | | | |

Cash and cash equivalents | $ | 174.3 |

| | $ | 128.3 |

|

Trade accounts receivable, net | 1,124.9 |

| | 1,117.4 |

|

Inventories, net | 847.0 |

| | 819.5 |

|

Current deferred income taxes | 36.7 |

| | 35.9 |

|

Other current assets | 185.2 |

| | 249.2 |

|

Total current assets | 2,368.1 |

| | 2,350.3 |

|

Other assets | 2,358.3 |

| | 2,404.0 |

|

Total assets | $ | 4,726.4 |

| | $ | 4,754.3 |

|

| | | |

| | | |

Liabilities and Stockholders' Equity | | | |

Current Liabilities | | | |

Accounts payable | $ | 770.6 |

| | $ | 765.1 |

|

Current debt and short-term borrowings | 49.2 |

| | 49.1 |

|

Other current liabilities | 192.0 |

| | 249.6 |

|

Total current liabilities | 1,011.8 |

| | 1,063.8 |

|

| | | |

Long-term debt | 1,436.8 |

| | 1,366.4 |

|

Other noncurrent liabilities | 411.9 |

| | 396.0 |

|

Total liabilities | 2,860.5 |

| | 2,826.2 |

|

| | | |

Stockholders' Equity | | | |

Total stockholders' equity | 1,865.9 |

| | 1,928.1 |

|

Total liabilities and stockholders' equity | $ | 4,726.4 |

| | $ | 4,754.3 |

|

WESCO INTERNATIONAL, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(dollar amounts in millions)

(Unaudited)

|

| | | | | | | |

| Six Months Ended |

| June 30,

2015 | | June 30,

2014 |

Operating Activities: | | | |

Net income | $ | 97.4 |

| | $ | 120.6 |

|

Add back (deduct): | | | |

Depreciation and amortization | 32.1 |

| | 33.6 |

|

Deferred income taxes | 16.7 |

| | 13.7 |

|

Change in trade receivables, net | (3.8 | ) | | (122.1 | ) |

Change in inventories, net | (26.7 | ) | | (44.9 | ) |

Change in accounts payable | 0.8 |

| | 47.1 |

|

Other | 16.1 |

| | 2.8 |

|

Net cash provided by operating activities | 132.6 |

| | 50.8 |

|

| | | |

Investing Activities: | | | |

Capital expenditures | (12.6 | ) | | (11.8 | ) |

Acquisition payments | (68.5 | ) | | (133.3 | ) |

Other | 1.4 |

| | — |

|

Net cash used in investing activities | (79.7 | ) | | (145.1 | ) |

| | | |

Financing Activities: | | | |

Debt borrowings, net of repayments | 74.4 |

| | 76.3 |

|

Equity activity, net | (79.1 | ) | | (0.4 | ) |

Other | 2.7 |

| | (0.5 | ) |

Net cash (used in) provided by financing activities | (2.0 | ) | | 75.4 |

|

| | | |

Effect of exchange rate changes on cash and cash equivalents | (4.9 | ) | | (3.2 | ) |

| | | |

Net change in cash and cash equivalents | 46.0 |

| | (22.1 | ) |

Cash and cash equivalents at the beginning of the period | 128.3 |

| | 123.7 |

|

Cash and cash equivalents at the end of the period | $ | 174.3 |

| | $ | 101.6 |

|

NON-GAAP FINANCIAL MEASURES

This earnings release includes certain non-GAAP financial measures. These financial measures include normalized organic sales growth, gross profit, financial leverage and free cash flow. The Company believes that these non-GAAP measures are useful to investors in order to provide a better understanding of the Company's organic growth trends, capital structure position and liquidity on a comparable basis. Management does not use these non-GAAP financial measures for any purpose other than the reasons stated above.

WESCO INTERNATIONAL, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(dollar amounts in millions, except sales growth data)

(Unaudited)

|

| | | | | |

| Three Months Ended | | Six Months Ended |

Normalized Organic Sales Growth - Year-Over-Year: | June 30,

2015 | | June 30,

2015 |

| | | |

Change in net sales | (4.4 | )% | | (2.2 | )% |

Impact from acquisitions | 1.6 | % | | 1.4 | % |

Impact from foreign exchange rates | (3.0 | )% | | (2.7 | )% |

Impact from number of workdays | — | % | | (0.8 | )% |

Normalized organic sales growth | (3.0 | )% | | (0.1 | )% |

|

| | |

| Three Months Ended |

Normalized Organic Sales Growth - Sequential: | June 30,

2015 |

| |

Change in net sales | 5.5 | % |

Impact from acquisitions | 1.5 | % |

Impact from foreign exchange rates | (0.3 | )% |

Impact from number of workdays | 3.2 | % |

Normalized organic sales growth | 1.1 | % |

Note: Normalized organic sales growth is provided by the Company as an additional financial measure to provide a better understanding of the Company's sales growth trends. Normalized organic sales growth is calculated by deducting the percentage impact from acquisitions, foreign exchange rates and number of workdays from the overall percentage change in consolidated net sales.

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

Gross Profit: | June 30,

2015 | | June 30,

2014 | | June 30,

2015 | | June 30,

2014 |

| | | | | | | |

Net Sales | $ | 1,916.7 |

| | $ | 2,005.2 |

| | $ | 3,733.0 |

| | $ | 3,816.0 |

|

Cost of goods sold (excluding depreciation and amortization) | 1,535.1 |

| | 1,593.4 |

| | 2,983.7 |

| | 3,029.5 |

|

Gross profit | $ | 381.6 |

| | $ | 411.8 |

| | $ | 749.3 |

| | $ | 786.5 |

|

Gross margin | 19.9 | % | | 20.5 | % | | 20.1 | % | | 20.6 | % |

Note: Gross profit is provided by the Company as an additional financial measure. Gross profit is calculated by deducting cost of goods sold, excluding depreciation and amortization, from net sales. This amount represents a commonly used financial measure within the distribution industry. Gross margin is calculated by dividing gross profit by net sales.

WESCO INTERNATIONAL, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(dollar amounts in millions)

(Unaudited)

|

| | | | | | | |

| Twelve Months Ended |

Financial Leverage: | June 30,

2015 | | December 31,

2014 |

| | | |

Income from operations | $ | 434.9 |

| | $ | 466.2 |

|

Depreciation and amortization | 66.5 |

| | 68.0 |

|

EBITDA | $ | 501.4 |

| | $ | 534.2 |

|

| | | |

| June 30,

2015 | | December 31,

2014 |

Current debt and short-term borrowings | $ | 49.2 |

| | $ | 49.1 |

|

Long-term debt | 1,436.8 |

| | 1,366.4 |

|

Debt discount related to convertible debentures and term loan(1) | 167.0 |

| | 170.4 |

|

Total debt including debt discount | 1,653.0 |

| | 1,585.9 |

|

| | | |

Financial leverage ratio | 3.3 |

| | 3.0 |

|

| |

(1) | The convertible debentures and term loan are presented in the condensed consolidated balance sheets in long-term debt, net of the unamortized discount. |

Note: Financial leverage is a non-GAAP financial measure provided by the Company to illustrate its capital structure position. Financial leverage ratio is calculated by dividing total debt, including debt discount, by EBITDA. EBITDA is defined as the trailing twelve months earnings before interest, taxes, depreciation and amortization.

|

| | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

Free Cash Flow: | June 30,

2015 | | June 30,

2014 | | June 30,

2015 | | June 30,

2014 |

| | | | | | | |

Cash flow provided by operations | $ | 42.5 |

| | $ | 4.1 |

| | $ | 132.6 |

| | $ | 50.8 |

|

Less: Capital expenditures | (7.6 | ) | | (6.8 | ) | | (12.6 | ) | | (11.8 | ) |

Free cash flow | $ | 34.9 |

| | $ | (2.7 | ) | | $ | 120.0 |

| | $ | 39.0 |

|

Percent of net income attributable to | | | | | | | |

WESCO International, Inc. | 68 | % | | (4 | )% | | 122 | % | | 32 | % |

Note: Free cash flow is provided by the Company as an additional liquidity measure. Capital expenditures are deducted from operating cash flow to determine free cash flow. Free cash flow is available to fund the Company's financing needs.

Webcast Presentation July 23, 2015 Q2 2015 Earnings

2 Q2 2015 Earnings Webcast, 07/23/2015 Safe Harbor Statement Note: All statements made herein that are not historical facts should be considered as “forward- looking statements” within the meaning of the Private Securities Litigation Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results to differ materially. Such risks, uncertainties and other factors include, but are not limited to: adverse economic conditions; increase in competition; debt levels, terms, financial market conditions or interest rate fluctuations; risks related to acquisitions, including the integration of acquired businesses; disruptions in operations or information technology systems; expansion of business activities; litigation, contingencies or claims; product, labor or other cost fluctuations; exchange rate fluctuations; and other factors described in detail in the Form 10-K for WESCO International, Inc. for the year ended December 31, 2014 and any subsequent filings with the Securities & Exchange Commission. Any numerical or other representations in this presentation do not represent guidance by management and should not be construed as such. The following presentation includes a discussion of certain non-GAAP financial measures. Information required by Regulation G with respect to such non-GAAP financial measures can be found in the appendix and obtained via WESCO’s website, www.wesco.com.

3 Q2 2015 Earnings Webcast, 07/23/2015 (1.8) (1.2) 1.6 1.5 1.6 6.0 6.7 8.1 3.2 (3.0) Q1 Q2 Q3 Q4 2013 2014 2015 Q2 2015 Highlights Organic Growth (%) …challenging year, driven by industrial, Canada & foreign exchange • Organic sales were flat in the U.S. and down 7% in Canada • Oil and gas sales down approximately 30% • Month-to-date July sales down approximately 3% consolidated and 2% organic • Cost controls partially mitigated margin decline; additional cost reduction actions launched • Strong free cash flow and financial leverage within target range • Approximately 750,000 shares repurchased; 1.1 million YTD • Robust acquisition pipeline April Flat May (4)% June (6)% Note: Workday adjusted; see appendix for non-GAAP reconciliations. Q1 Q2 Q3 Q4 Q1 Q2

4 Q2 2015 Earnings Webcast, 07/23/2015 2.1% 5.0% 7.0% 5.8% (4.1)% (10.2)% Industrial End Market • Q2 2015 Sales − Down 10.2% versus prior year − Down 0.6% sequentially − Sales declines driven by oil and gas, metals and mining, and OEM customers • Weak commodity prices and strong U.S. dollar weighing on manufacturing sector causing deferred maintenance and project spending. • Channel inventory levels remain tight. • Global Accounts and Integrated Supply bidding activity levels remain strong. • Customer trends include higher expectations for supply chain process improvements, cost reductions, and supplier consolidation. Industrial Core Sales Growth versus Prior Year 41% Industrial • Global Accounts • Integrated Supply • OEM • General Industrial Note: Excludes acquisitions during the first year of ownership. Workday adjusted. 2014 5.0% Awarded a multi-year contract to supply electrical MRO products across multiple plants for a global food manufacturer. Q2 2014 Q1 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015

5 Q2 2015 Earnings Webcast, 07/23/2015 • Q2 2015 Sales − Down 7.7% versus prior year, with U.S. down 4%, and Canada down 3% in C$ − Up 6.4% sequentially − Sales declines driven by weakness with contractors serving industrial market partially offset by growth with commercial construction contractors • U.S. construction sales down 3.7%; Canada construction sales down 2.9% organically. • Backlog flat versus year end and down 7% from prior year. • Non-residential construction market leading indicators are generally positive in U.S. outside of oil and gas, metals and mining. • Non-residential construction market still well below its prior peak in 2008. (7.7)% Construction • Non- Residential • Residential 31% Core Sales Growth versus Prior Year Construction End Market Construction Note: Excludes acquisitions during the first year of ownership. Workday adjusted. Q2 2014 Q1 2014 2.3% 3.8% Awarded a contract with a public water company to provide an upgraded switchgear and electrical package to replace original equipment installed over 50 years ago. (5.9)% Q3 2014 Q4 2014 5.2% Q1 2015 3.9% 2014 1.5% Q2 2015

6 Q2 2015 Earnings Webcast, 07/23/2015 Utility End Market Core Sales Growth versus Prior Year 15% Utility • Investor Owned • Public Power • Utility Contractors • Q2 2015 Sales − Up 5.7% versus prior year − Up 9.5% sequentially • Seventeenth consecutive quarter of year-over- year sales growth. • Scope expansion and value creation with IOU, public power, and generation customers providing utility sales growth. • Housing market expected to be positive catalyst for future distribution grid spending. • Increased capital spending is underway and planned for certain investor owned utilities. • Continued interest for Integrated Supply solution offerings. Utility Note: Excludes acquisitions during the first year of ownership. Workday adjusted. 1.5% 6.1% 10.6% 7.9% 6.5% 5.7% Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Awarded two transmission project contracts with an Investor Owned Utility. One award was for a multi-year project to provide transmission material procurement and supply chain management services. The second award was for transmission material procurement. 2014 6.6%

7 Q2 2015 Earnings Webcast, 07/23/2015 CIG End Market • Q2 2015 Sales − Down 0.5% versus prior year − Up 7.4% sequentially • Bidding levels remain active in commercial, institutional, and government markets. • Focus remains on energy efficiency (lighting, automation, metering) and security. • Opportunities exist to support data center construction and retrofits and cloud technology projects. Government Core Sales Growth versus Prior Year CIG • Commercial • Institutional • Government 13% Note: Excludes acquisitions during the first year of ownership. Workday adjusted. Awarded a multi-year contract to provide data communications, security and fiber connectivity products for multiple data center locations with a large technology company. 3.3% 5.2% 2.3% 7.4% 4.3% (0.5)% 2014 4.5% Q2 2014 Q1 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015

8 Q2 2015 Earnings Webcast, 07/23/2015 Q2 2015 Results Outlook Actual YOY Sales (3)% growth to flat $1.92B (4.4)% growth (3.0)% organic Gross Margin 19.9% Down 60 bps SG&A $275M, 14.4% Down 1%, Up 50 bps Operating Profit $90M Down 22% Operating Margin 5.3% to 5.5% 4.7% Down 110 bps Effective Tax Rate 29% to 30% 29.3% Up 1.3% 160 bps (0.3)% Growth 170 bps 20 bps $1.92B $2.01B Q2 2015 Sales Acquisitions Foreign Exchange Rest of World Canada U.S. Q2 2014 Sales 300 bps 110 bps (6.9)% Growth (18.8)% Growth (3.0)% Organic Growth (4.4)% Growth

9 Q2 2015 Earnings Webcast, 07/23/2015 EPS Walk Q2 2014 $1.29 Core Operations ~(0.25) Acquisitions 0.02 Foreign Exchange Impact (0.07) Tax Rate (0.02) Share Count 0.03 Q2 2015 $1.00

10 Q2 2015 Earnings Webcast, 07/23/2015 1.5 2 2.5 3 3.5 4 4.5 5 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 39.0 120.0 YTD Q2 2014 YTD Q2 2015 Cash Generation Free Cash Flow ($ Millions) See appendix for non-GAAP reconciliations. 122% of net income 32% of net income ~ $1B of free cash flow over last 5 years 2013 2014 Target Leverage 2.0x – 3.5x 3.3X Leverage (Total Par Debt to TTM EBITDA) 2015

11 Q2 2015 Earnings Webcast, 07/23/2015 2015 Outlook Q3 FY Sales (3)% growth to flat (3)% growth to flat Operating Margin 5.7% to 5.9% 5.3% to 5.5% Effective Tax Rate 29% to 30% ~ 29% EPS $4.50 to $4.90 Free Cash Flow >80% of net income Notes: Excludes unannounced acquisitions. Assumes a CAD/USD exchange rate of 0.79.

12 Q2 2015 Earnings Webcast, 07/23/2015 Appendix

13 Q2 2015 Earnings Webcast, 07/23/2015 WESCO Profile 2015 41% 31% 15% 13% 41% 14% 15% 11% 10% 9% Controls & Motors Lighting & Controls General Supplies Data & Broadband Communications Wire, Cable & Conduit Distribution Equipment Note: Markets & Customers and Products & Services percentages reported on a TTM consolidated basis. Products & Services Markets & Customers Utility CIG Industrial Construction Investor Owned | Public Power Utility Contractors Commercial | Institutional | Government Global Accounts | Integrated Supply OEM | General Industrial Non-Residential | Contractors

14 Q2 2015 Earnings Webcast, 07/23/2015 Sales Growth 2013 2014 2015 Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Q1 Q2 Consolidated 12.6 13.2 16.6 14.3 14.2 0.2 5.9 7.6 6.1 5.0 0.3 (4.4) Acquisition Impact 16.0 14.6 14.1 13.8 14.6 0.5 1.6 1.8 1.6 1.4 1.2 1.6 Core (3.4) (1.4) 2.5 0.5 (0.4) (0.3) 4.3 5.8 4.5 3.6 (0.9) (6.0) FX Impact 0.0 (0.2) (0.7) (1.0) (0.4) (1.9) (1.7) (0.9) (2.0) (1.6) (2.5) (3.0) Organic (3.4) (1.2) 3.2 1.5 0.0 1.6 6.0 6.7 6.5 5.2 1.6 (3.0) WD Impact (1.6) 1.6 (1.6) (0.4) (1.6) Normalized Organic (1.8) (1.2) 1.6 1.5 0.0 1.6 6.0 6.7 8.1 5.6 3.2 (3.0) Estimated Price Impact 1.0 0.0 0.0 0.0 0.2 0.5 0.5 0.5 0.5 0.5 0.0 0.0 (%)

15 Q2 2015 Earnings Webcast, 07/23/2015 Q2 2015 Sales Growth – Geography U.S. Canada International Total Change in net sales 2.0 (17.8) (25.0) (4.4) Impact from acquisitions 2.3 - - 1.6 Impact from foreign exchange rates - (10.9) (6.2) (3.0) Impact from number of workdays - - - - Normalized organic sales growth (0.3) (6.9) (18.8) (3.0) (%)

16 Q2 2015 Earnings Webcast, 07/23/2015 Note: The prior period end market amounts noted above may contain reclassifications to conform to current period presentation. ($ Millions) Sales Growth – End Markets Q2 2015 vs. Q2 2014 Q2 2015 vs. Q1 2015 Q20 Q20 Q20 Q10 2015 2014 %00 Growth 2015 2015 %00 Growth Industrial Core 755 841 (10.2)% 755 760 (0.6)% Construction Core 583 632 (7.7)% 583 547 6.4% Utility Core 293 277 5.7% 298 272 9.5% CIG Core 261 262 (0.5)% 261 243 7.4% Total Core Gross Sales 1,892 2,012 (6.0)% 1,897 1,822 4.1% Total Gross Sales from Acquisitions 32 - - 27 - - Total Gross Sales 1,924 2,012 (4.4)% 1,924 1,822 5.5% Gross Sales Reductions/Discounts (7) (7) - (7) (6) - Total Net Sales 1,917 2,005 (4.4)% 1,917 1,816 5.5%

17 Q2 2015 Earnings Webcast, 07/23/2015 Outstanding at December 31, 2014 Outstanding at June 30, 2015 Debt Maturity Schedule AR Revolver (V) 430 478 2016 Inventory Revolver (V) 8 78 2016 Senior Notes (F) 500 500 2021 2019 Term Loans (V) 252 202 2019 2029 Convertible Bonds (F) 345 345 2029 (1) Other (V) 51 50 N/A Total Par Debt 1,586 1,653 Capital Structure Key Financial Metrics Q2 2014 YE 2014 Q2 2015 Cash 102 128 174 Capital Expenditures (YTD) 12 21 13 Free Cash Flow (YTD) 39 231 120 Liquidity (2) 542 638 527 ($ Millions) V = Variable Rate Debt 1 = No put; first callable date September 2016. F = Fixed Rate Debt 2 = Asset-backed credit facilities total availability plus invested cash.

18 Q2 2015 Earnings Webcast, 07/23/2015 Financial Leverage Twelve Months Ended June 30, 2015 Financial leverage ratio: Income from operations $ 435 Depreciation and amortization 67 EBITDA $ 502 June 30, 2015 Current debt and short-term borrowings $ 49 Long-term debt 1,437 Debt discount related to convertible debentures and term loan (1) 167 Total debt including debt discount $ 1,653 Financial leverage ratio 3.3X (1)The convertible debentures and term loan are presented in the condensed consolidated balance sheets in long-term debt net of the unamortized discount. ($ Millions)

19 Q2 2015 Earnings Webcast, 07/23/2015 ($ Millions) Maturity Par Value of Debt Debt Discount Debt per Balance Sheet 2029 344.9 (165.4) 179.5 Convertible Debt At June 30, 2015 Non-Cash Interest Expense ($ Millions) 2013 2014 YTD Q2 2015 Convertible Debt 4.3 4.1 3.2 Amortization of Deferred Financing Fees 4.9 4.4 3.4 FIN 48 0.6 1.0 0.3 Accrued Interest in Excess of Paid 0.4 0.0 0.1 Total 10.2 9.5 7.0 Convertible Debt and Non-Cash Interest

20 Q2 2015 Earnings Webcast, 07/23/2015 EPS Dilution Weighted Average Quarterly Share Count Stock Price Incremental Shares from 2029 Convertible Debt (in millions)3 Incremental Shares from Equity Awards (in millions) Total Diluted Share Count (in millions)4 $50.00 5.05 0.47 49.52 $60.00 6.20 0.55 50.75 $70.00 7.02 0.75 51.77 Q2 2015 Average $71.71 7.14 0.77 51.91 $80.00 7.64 0.87 52.51 $90.00 8.12 0.96 53.08 $100.00 8.50 1.07 53.57 2029 Convertible Debt Details Conversion Price $28.8656 Conversion Rate 34.6433 1 Underlying Shares 11,947,671 2 Footnotes: 2029 Convertible Debenture 1 1000/28.8656 2 $344.9 million/1,000 x 34.6433 3 (Underlying Shares x Avg. Quarterly. Stock Price) minus $344.9 million Avg. Quarterly Stock Price 4 Basic Share Count of 44.00 million shares

21 Q2 2015 Earnings Webcast, 07/23/2015 Work Days Q1 Q2 Q3 Q4 FY 2014 63 64 64 62 253 2015 62 64 64 63 253

22 Q2 2015 Earnings Webcast, 07/23/2015 Free Cash Flow Reconciliation Q2 2014 Q2 2015 YTD Q2 2014 YTD Q2 2015 Cash flow provided by operations 4.1 42.5 50.8 132.6 Less: Capital expenditures (6.8) (7.6) (11.8) (12.6) Free Cash Flow (2.7) 34.9 39.0 120.0 Note: Free cash flow is provided by the Company as an additional liquidity measure. Capital expenditures are deducted from operating cash flow to determine free cash flow. Free cash flow is available to fund the Company's financing needs. ($ Millions)

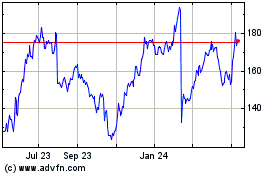

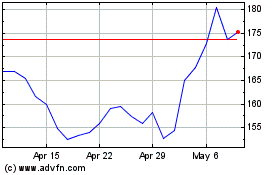

WESCO (NYSE:WCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

WESCO (NYSE:WCC)

Historical Stock Chart

From Apr 2023 to Apr 2024