Current Report Filing (8-k)

July 22 2015 - 10:26AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) July 22, 2015

AMPHENOL CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware |

|

1-10879 |

|

22-2785165 |

|

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

358 Hall Avenue, Wallingford, Connecticut |

|

06492 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (203) 265-8900

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On July 22, 2015, Amphenol Corporation (“the Company”) issued a press release setting forth the Company’s 2015 second quarter earnings and announcing the approval of an increase in its quarterly dividend on its Common Stock from $.125 to $.14 per share. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

Statements in this Form 8-K which are other than historical facts are intended to be “forward-looking statements” within the meaning of the Securities Exchange Act of 1934, the Private Securities Litigation Reform Act of 1995 and other related laws. While the Company believes such statements are reasonable, the actual results and effects could differ materially from those currently anticipated. Please refer to Part I, Item 1A of the Company’s Form 10-K for the year ended December 31, 2014, for some factors that could cause the actual results to differ from estimates. In providing forward-looking statements, the Company is not undertaking any duty or obligation to update these statements publicly as a result of new information, future events or otherwise.

Item 9.01 Financial Statements and Exhibits.

Exhibit 99.1 Press Release dated July 22, 2015

2

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

AMPHENOL CORPORATION |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Craig A. Lampo |

|

|

|

Craig A. Lampo |

|

|

|

Senior Vice President |

|

|

|

and Chief Financial Officer |

|

|

|

|

Date: July 22, 2015

3

Exhibit 99.1

World Headquarters

358 Hall Avenue

P. O. Box 5030

Wallingford, CT 06492-7530

Telephone (203) 265-8900

FOR IMMEDIATE RELEASE

|

|

For Further Information: |

|

|

Craig A. Lampo |

|

|

Senior Vice President and |

|

|

|

Chief Financial Officer |

|

|

203-265-8625 |

|

|

www.amphenol.com |

SECOND QUARTER 2015 RESULTS

AND INCREASE IN DIVIDEND

REPORTED BY AMPHENOL CORPORATION

Wallingford, Connecticut. July 22, 2015. Amphenol Corporation (NYSE:APH) reported today second quarter 2015 diluted earnings per share excluding one-time items of $0.58 compared to $0.54 for the comparable 2014 period. (All per share and share amounts included herein have been adjusted to reflect the Company’s 2-for-1 stock split effective October 9, 2014.) On an as reported basis, diluted earnings per share for the second quarter of 2015 was $0.56. Such per share amount for the 2015 quarter includes a charge for acquisition-related transaction costs of $6 million ($0.02 per share). Sales for the second quarter of 2015 were $1.351 billion compared to $1.314 billion for the 2014 period. Currency translation had the effect of decreasing sales by approximately $51 million in the second quarter of 2015 compared to the 2014 period.

For the six months ended June 30, 2015, diluted earnings per share excluding one-time items was $1.15, compared to $1.04 for the comparable 2014 period. On an as reported

basis diluted earnings per share for the six months ended June 30, 2015 was $1.13, compared to $1.03 for the comparable 2014 period. The 2015 period includes the one-time charge for acquisition-related transaction costs described above. The 2014 period includes a one-time charge of $2 million ($.01 per share) related to the amortization of the value associated with acquired backlog relating to an acquisition completed by the Company in the fourth quarter of 2013. Sales for the six months ended June 30, 2015 were $2.679 billion compared to $2.560 billion for the 2014 period. Currency translation had the effect of decreasing sales by approximately $101 million for the first six months of 2015 compared to the 2014 period.

The Company’s Board of Directors has approved an increase in the quarterly dividend from $.125 to $.14 per share to be paid on or about October 2, 2015 to holders of record of the Company’s Class A Common stock as of September 9, 2015.

Amphenol President and Chief Executive Officer, R. Adam Norwitt, stated, “For the second quarter 2015, we are pleased to report sales of $1.351 billion, up 3% in US dollars and 7% in local currencies, a strong performance. Our sales growth was driven by increases in the automotive, mobile device, industrial, information technology and data communications and military markets. This growth was driven both organically and through the Company’s successful acquisition program, and was partially offset by the negative impact of translation from the stronger dollar. EPS excluding one-time items was $0.58 and grew 7% over the comparable 2014 quarter. The Company’s unique entrepreneurial culture continues to drive strong operating leverage in the business, resulting in a 20 basis point year-over-year increase in operating margins (excluding one-time items) to 19.7% in the second quarter 2015. This excellent performance is a direct

result of our dynamic management team’s ability to drive margin expansion through outstanding operational execution and an unrelenting focus on all elements of cost. I am very proud of our organization as we continue to execute well.”

“The Company continues to expand its growth opportunities through an ongoing strategy of market and geographic diversification, a deep commitment to developing enabling technologies for customers in all markets, as well as an active acquisition program. As part of that program, in late June, the Company acquired both ProCom A/S (ProCom) and DoCharm Plastics Company Ltd (DoCharm). ProCom is a European supplier of antennas, primarily for the industrial market, with annual sales of approximately $20 million. DoCharm is a China-based manufacturer of highly engineered interconnect assemblies for the automotive market, with annual sales of approximately $50 million. These acquisitions strengthen the Company’s global capabilities and product offering in these important markets. In addition, subsequent to our recent announcement that we had entered into exclusive negotiations and had made a binding offer to acquire 100% of the shares of FCI Asia Pte Ltd (FCI) for $1.275 billion (subject to a closing adjustment), we have now entered into a definitive acquisition agreement to purchase FCI. Completion of the transaction remains subject to certain regulatory consents and approvals and we continue to expect the transaction to close by the end of 2015.”

“In addition to the Company’s successful acquisition program, the Company continues to deploy its financial strength in a variety of ways to increase shareholder value. This includes the purchase, during the quarter, of 1.4 million shares of the Company’s stock pursuant to our stock repurchase plan as well as a 12% increase in the quarterly dividend from $.125 to $.14 per share beginning in October 2015.”

“There is an increasing level of uncertainty in the global marketplace. Considering these dynamics, and based on current currency exchange rates, we expect third quarter 2015 sales in the range of $1.435 billion to $1.475 billion and diluted EPS (excluding one-time items) in the range of $0.64 to $0.66. For the full year 2015, we now expect to achieve sales in the range of $5.540 billion to $5.620 billion, an increase over 2014 in US dollars of 4% to 5%, in local currencies of 7% to 9% and organically (excluding the impact of currency translation and acquisitions) of 3% to 4%. We expect diluted EPS of $2.43 to $2.47 for the full year 2015, an increase of 8% to 10% over 2014 (excluding one-time items). Notwithstanding the many challenges in the global economy, we believe we can perform well in the dynamic electronics marketplace due to our leading technology, increasing positions with our customers in diverse markets, worldwide presence, lean cost structure, and agile, experienced and entrepreneurial management team.”

“The electronics revolution continues to accelerate, with new applications and higher performance requirements driving increased demand for our high technology products across all of our end markets. This creates a significant, long-term growth opportunity for Amphenol. Our ongoing actions to enhance our competitive advantages and build sustained financial strength, as well as our initiatives to broaden and diversify our high technology product offering both organically and through our successful acquisition program, have created a solid base for future performance. I am confident in the ability of our outstanding management team to dynamically adjust to the constantly changing market environment, to continue to generate strong profitability and to further capitalize on the many opportunities to expand our market position.”

The Company will host a conference call to discuss its second quarter results at 1:00 PM (EDT) Wednesday, July 22, 2015. The toll free dial-in number to participate in this call is 888-395-9624; International dial-in number is 517-623-4547; Passcode: LAMPO. There will be a replay available until 10:59 P.M. (EDT) on Saturday, August 22, 2015. The replay numbers are toll free 866-479-2464; International toll number is 203-369-1538; Passcode: 7183.

A live broadcast as well as a replay will also be available on the Internet at http://www.amphenol.com/investors/webcasts.php.

Amphenol Corporation is one of the world’s largest designers, manufacturers and marketers of electrical, electronic and fiber optic connectors, interconnect systems, antennas, sensors and sensor-based products and coaxial and high-speed specialty cable. Amphenol designs, manufactures and assembles its products at facilities in the Americas, Europe, Asia, Australia and Africa and sells its products through its own global sales force, independent representatives and a global network of electronics distributors. Amphenol has a diversified presence as a leader in high growth areas of the interconnect market including: Automotive, Broadband Communications, Commercial Aerospace, Industrial, Information Technology and Data Communications, Military, Mobile Devices and Mobile Networks.

Statements in this press release which are other than historical facts are intended to be “forward-looking statements” within the meaning of the Securities Exchange Act of 1934, the Private Securities Litigation Reform Act of 1995 and other related laws. While the Company believes such statements are reasonable, the actual results and effects could

differ materially from those currently anticipated. Please refer to Part I, Item 1A of the Company’s Form 10-K for the year ended December 31, 2014, for some factors that could cause the actual results to differ from estimates. In providing forward-looking statements, the Company is not undertaking any duty or obligation to update these statements publicly as a result of new information, future events or otherwise.

AMPHENOL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

(dollars in millions, except per share data)

|

|

|

Three Months Ended |

|

Six Months Ended |

|

|

|

|

June 30, |

|

June 30, |

|

|

|

|

2015 |

|

2014 (1) |

|

2015 |

|

2014 (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

1,351.5 |

|

$ |

1,314.2 |

|

$ |

2,678.6 |

|

$ |

2,560.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

919.0 |

|

897.4 |

|

1,821.6 |

|

1,754.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

432.5 |

|

416.8 |

|

857.0 |

|

805.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition-related expenses |

|

5.7 |

|

— |

|

5.7 |

|

2.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expense |

|

166.1 |

|

161.0 |

|

330.4 |

|

315.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

260.7 |

|

255.8 |

|

520.9 |

|

487.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

(17.1 |

) |

(20.1 |

) |

(34.1 |

) |

(39.2 |

) |

|

Other income, net |

|

4.2 |

|

4.3 |

|

8.3 |

|

8.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

247.8 |

|

240.0 |

|

495.1 |

|

457.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

(67.2 |

) |

(63.6 |

) |

(132.7 |

) |

(120.9 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

180.6 |

|

176.4 |

|

362.4 |

|

336.2 |

|

|

Less: Net income attributable to noncontrolling interests |

|

(1.6 |

) |

(1.5 |

) |

(3.6 |

) |

(2.8 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to Amphenol Corporation |

|

$ |

179.0 |

|

$ |

174.9 |

|

$ |

358.8 |

|

$ |

333.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per common share - Basic |

|

$ |

0.58 |

|

$ |

0.56 |

|

$ |

1.16 |

|

$ |

1.06 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - Basic |

|

308,899,937 |

|

314,229,370 |

|

309,470,068 |

|

314,640,882 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income per common share - Diluted (2) (3) |

|

$ |

0.56 |

|

$ |

0.54 |

|

$ |

1.13 |

|

$ |

1.03 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - Diluted |

|

316,878,100 |

|

321,582,270 |

|

317,428,813 |

|

321,966,158 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends declared per common share |

|

$ |

0.125 |

|

$ |

0.10 |

|

$ |

0.25 |

|

$ |

0.20 |

|

|

Note 1 |

Prior period results have been restated to reflect a two-for-one stock split which was effective in October 2014. |

|

|

|

|

Note 2 |

Earnings per share in the six months ended June 30, 2014 included acquisition-related expenses of $2.0 million ($1.3 million after-tax), or $.01 per share, relating to the amortization of the value associated with acquired backlog relating to an acquisition completed by the Company in the fourth quarter of 2013. Excluding this effect, diluted earnings per share was $1.04 for the six months ended June 30, 2014. |

|

|

|

|

Note 3 |

Earnings per share in the three and six months ended June 30, 2015 included acquisition-related expenses of $5.7 million ($5.7 million after-tax), or $.02 per share, relating to acquisitions closed as well as announced in the second quarter of 2015. Excluding this effect, diluted earnings per share was $0.58 and $1.15 for the three and six months ended June 30, 2015, respectively. |

AMPHENOL CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(dollars in millions)

|

|

|

June 30, |

|

December 31, |

|

|

|

|

2015 |

|

2014 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,242.8 |

|

$ |

968.9 |

|

|

Short-term investments |

|

154.4 |

|

360.7 |

|

|

Total cash, cash equivalents and short-term investments |

|

1,397.2 |

|

1,329.6 |

|

|

Accounts receivable, less allowance for doubtful accounts of $21.1 and $20.2, respectively |

|

1,089.5 |

|

1,123.7 |

|

|

Inventories |

|

893.0 |

|

865.6 |

|

|

Other current assets |

|

213.1 |

|

185.2 |

|

|

|

|

|

|

|

|

|

Total current assets |

|

3,592.8 |

|

3,504.1 |

|

|

|

|

|

|

|

|

|

Land and depreciable assets, less accumulated depreciation of $885.0 and $849.6, respectively |

|

609.9 |

|

590.7 |

|

|

Goodwill |

|

2,709.0 |

|

2,616.7 |

|

|

Intangibles and other long-term assets |

|

317.0 |

|

315.5 |

|

|

|

|

|

|

|

|

|

|

|

$ |

7,228.7 |

|

$ |

7,027.0 |

|

|

|

|

|

|

|

|

|

LIABILITIES & EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

559.5 |

|

$ |

618.4 |

|

|

Accrued salaries, wages and employee benefits |

|

106.0 |

|

109.9 |

|

|

Accrued income taxes |

|

79.0 |

|

90.8 |

|

|

Other accrued expenses |

|

201.2 |

|

186.2 |

|

|

Accrued dividends |

|

38.6 |

|

38.7 |

|

|

Current portion of long-term debt |

|

0.4 |

|

1.6 |

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

984.7 |

|

1,045.6 |

|

|

|

|

|

|

|

|

|

Long-term debt, less current portion |

|

2,759.2 |

|

2,672.3 |

|

|

Accrued pension benefit obligations and other long-term liabilities |

|

382.0 |

|

371.2 |

|

|

|

|

|

|

|

|

|

Equity: |

|

|

|

|

|

|

Common stock |

|

0.3 |

|

0.3 |

|

|

Additional paid-in capital |

|

729.6 |

|

659.4 |

|

|

Retained earnings |

|

2,591.3 |

|

2,453.5 |

|

|

Accumulated other comprehensive loss |

|

(256.1 |

) |

(205.8 |

) |

|

|

|

|

|

|

|

|

Total shareholders’ equity attributable to Amphenol Corporation |

|

3,065.1 |

|

2,907.4 |

|

|

|

|

|

|

|

|

|

Noncontrolling interests |

|

37.7 |

|

30.5 |

|

|

|

|

|

|

|

|

|

Total equity |

|

3,102.8 |

|

2,937.9 |

|

|

|

|

|

|

|

|

|

|

|

$ |

7,228.7 |

|

$ |

7,027.0 |

|

AMPHENOL CORPORATION

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOW

(Unaudited)

(dollars in millions)

|

|

|

Six months ended |

|

|

|

|

June 30, |

|

|

|

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

Cash from operating activities: |

|

|

|

|

|

|

Net income |

|

$ |

362.4 |

|

$ |

336.2 |

|

|

Adjustments to reconcile net income to cash provided by operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

83.5 |

|

77.6 |

|

|

Stock-based compensation expense |

|

20.2 |

|

19.2 |

|

|

Excess tax benefits from stock-based compensation payment arrangements |

|

(9.1 |

) |

(18.1 |

) |

|

Net change in components of working capital |

|

(44.3 |

) |

(41.2 |

) |

|

Net change in other long-term assets and liabilities |

|

10.1 |

|

9.6 |

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

422.8 |

|

383.3 |

|

|

|

|

|

|

|

|

|

Cash from investing activities: |

|

|

|

|

|

|

Purchases of land and depreciable assets |

|

(85.2 |

) |

(105.9 |

) |

|

Proceeds from disposals of land and depreciable assets |

|

2.3 |

|

1.4 |

|

|

Purchases of short-term investments |

|

(113.6 |

) |

(356.0 |

) |

|

Sales and maturities of short-term investments |

|

319.8 |

|

293.4 |

|

|

Acquisitions, net of cash acquired |

|

(171.8 |

) |

(19.5 |

) |

|

|

|

|

|

|

|

|

Net cash used in investing activities |

|

(48.5 |

) |

(186.6 |

) |

|

|

|

|

|

|

|

|

Cash from financing activities: |

|

|

|

|

|

|

Proceeds from issuance of senior notes |

|

— |

|

748.8 |

|

|

Long-term borrowings under credit facilities |

|

— |

|

398.1 |

|

|

Repayments of long-term debt |

|

— |

|

(936.6 |

) |

|

Net commercial paper borrowings |

|

86.5 |

|

— |

|

|

Payment of costs related to debt financing |

|

— |

|

(5.7 |

) |

|

Proceeds from exercise of stock options |

|

40.2 |

|

58.3 |

|

|

Excess tax benefits from stock-based compensation payment arrangements |

|

9.1 |

|

18.1 |

|

|

Distributions to shareholders of noncontrolling interests |

|

(4.4 |

) |

(1.7 |

) |

|

Purchase and retirement of treasury stock |

|

(143.6 |

) |

(250.2 |

) |

|

Dividend payments |

|

(77.5 |

) |

(31.4 |

) |

|

|

|

|

|

|

|

|

Net cash used in financing activities |

|

(89.7 |

) |

(2.3 |

) |

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash and cash equivalents |

|

(10.7 |

) |

(1.1 |

) |

|

|

|

|

|

|

|

|

Net change in cash and cash equivalents |

|

273.9 |

|

193.3 |

|

|

Cash and cash equivalents balance, beginning of period |

|

968.9 |

|

886.8 |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents balance, end of period |

|

$ |

1,242.8 |

|

$ |

1,080.1 |

|

|

|

|

|

|

|

|

|

Cash paid for: |

|

|

|

|

|

|

Interest |

|

$ |

32.0 |

|

$ |

29.7 |

|

|

Income taxes |

|

128.7 |

|

119.3 |

|

AMPHENOL CORPORATION

SEGMENT INFORMATION

(Unaudited)

(dollars in millions)

|

|

|

Three months ended |

|

Six months ended |

|

|

|

|

June 30, |

|

June 30, |

|

|

|

|

2015 |

|

2014 |

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales: |

|

|

|

|

|

|

|

|

|

|

Interconnect Products and Assemblies |

|

$ |

1,268.7 |

|

$ |

1,222.3 |

|

$ |

2,511.3 |

|

$ |

2,381.4 |

|

|

Cable Products and Solutions |

|

82.8 |

|

91.9 |

|

167.3 |

|

178.8 |

|

|

Consolidated |

|

$ |

1,351.5 |

|

$ |

1,314.2 |

|

$ |

2,678.6 |

|

$ |

2,560.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income: |

|

|

|

|

|

|

|

|

|

|

Interconnect Products and Assemblies |

|

$ |

277.9 |

|

$ |

264.3 |

|

$ |

548.8 |

|

$ |

507.0 |

|

|

Cable Products and Solutions |

|

9.7 |

|

11.7 |

|

20.0 |

|

22.3 |

|

|

Stock-based compensation expense |

|

(10.1 |

) |

(10.0 |

) |

(20.2 |

) |

(19.2 |

) |

|

Other operating expenses |

|

(11.1 |

) |

(10.2 |

) |

(22.0 |

) |

(20.2 |

) |

|

Operating income, excluding one-time items |

|

$ |

266.4 |

|

$ |

255.8 |

|

$ |

526.6 |

|

$ |

489.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition-related expenses |

|

(5.7 |

) |

— |

|

(5.7 |

) |

(2.0 |

) |

|

Consolidated |

|

$ |

260.7 |

|

$ |

255.8 |

|

$ |

520.9 |

|

$ |

487.9 |

|

|

|

|

|

|

|

|

|

|

|

|

|

ROS%: |

|

|

|

|

|

|

|

|

|

|

Interconnect Products and Assemblies |

|

21.9 |

% |

21.6 |

% |

21.9 |

% |

21.3 |

% |

|

Cable Products and Solutions |

|

11.8 |

% |

12.7 |

% |

11.9 |

% |

12.5 |

% |

|

Stock-based compensation expense |

|

-0.7 |

% |

-0.8 |

% |

-0.8 |

% |

-0.8 |

% |

|

Other operating expenses |

|

-0.8 |

% |

-0.8 |

% |

-0.8 |

% |

-0.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

ROS, excluding one-time items |

|

19.7 |

% |

19.5 |

% |

19.7 |

% |

19.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition-related expenses |

|

-0.4 |

% |

0.0 |

% |

-0.3 |

% |

0.0 |

% |

|

Consolidated |

|

19.3 |

% |

19.5 |

% |

19.4 |

% |

19.1 |

% |

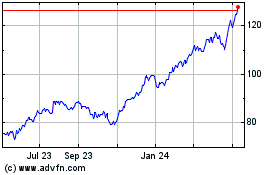

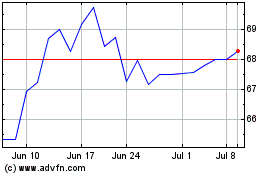

Amphenol (NYSE:APH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amphenol (NYSE:APH)

Historical Stock Chart

From Apr 2023 to Apr 2024