UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of report (date of earliest

event reported): July 22, 2015

ACME UNITED CORPORATION

(Exact name of registrant as specified

in its charter)

__________________

| Connecticut |

001-07698 |

06-0236700 |

| (State or other jurisdiction of incorporation or organization) |

(Commission file number)

|

(I.R.S. Employer

Identification No.) |

|

55 Walls Drive, Fairfield, Connecticut |

06824 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number,

including area code: (203) 254-6060

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| □ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| □ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| □ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| □ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On July 22, 2015, Acme United Corporation (the “Company”)

issued a press release announcing its financial results for the quarter ended June 30, 2015. A copy of the press release is attached

as Exhibit 99.1 to this current report.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(c) Exhibits

| Exhibit Number |

Description |

| |

|

| 99.1 |

Press release dated July 22, 2015. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| ACME UNITED CORPORATION |

| |

|

|

| By |

/s/ Walter C. Johnsen |

|

| |

Walter C. Johnsen |

|

| |

Chairman and |

|

| |

Chief Executive Officer |

|

| |

|

|

| Dated: July 22, 2015 |

| |

|

|

| |

|

|

| |

|

|

| By |

/s/ Paul

G. Driscoll |

|

| |

Paul G. Driscoll |

|

| |

Vice President and |

|

| |

Chief Financial Officer |

|

| |

|

|

| Dated: July 22, 2015 |

EXHIBIT INDEX

| |

Exhibit Number |

Description |

| |

|

|

| |

99.1 |

Press release dated July 22, 2015. |

Exhibit

99.1

| ACME UNITED

CORPORATION |

NEWS

RELEASE |

| CONTACT: |

Paul G. Driscoll |

Acme United Corporation |

55 Walls Drive |

Fairfield, CT 06824 |

| |

|

Phone: (203) 254-6060 |

FAX: (203) 254-6521 |

|

| FOR

IMMEDIATE RELEASE July 22, 2015 |

|

ACME

UNITED REPORTS SECOND QUARTER SALES AND EARNINGS

New

Camillus® Knives, First Aid Only® and Westcott® Initiatives Planned for 2H 2015

FAIRFIELD,

CONN. – July 22, 2015 – Acme United Corporation (NYSE MKT:ACU) today announced that net sales for the second quarter

ended June 30, 2015 were $34.0 million, compared to $33.4 million in the comparable period of 2014, an increase of 2%, or 4% in

constant currency. Net sales for the six months ended June 30, 2015 were $56.8 million, compared to $52.5 million in the same

period in 2014, an increase of 8%, or 10% in constant currency.

Net

income for the quarter ended June 30, 2015 was $2.7 million, or $0.74 per diluted share, compared to $2.5 million, or $0.72 per

diluted share, for the 2014 period, an increase in net income of 6%. Net income for the six months ended June 30, 2015 was $3.1

million, or $0.85 per diluted share, compared to $2.9 million, or $0.83 per diluted share, in last year’s period, an 8%

increase in net income.

Chairman

and CEO Walter C. Johnsen said, “We set new sales and earnings records for the quarter despite being impacted by store closures

at large office supply retail chains. Our diversification into the hardware, industrial, safety, and sporting goods channels has

broadened our customer base, thereby offsetting the softness of the office market. We have a number of new first aid, hunting,

and office product initiatives underway for the coming quarters, which are intended to increase sales and earnings. These programs

reflect our emphasis on penetrating additional markets, offering innovative products, and bringing greater value to our customers.”

In

the U.S. segment, net sales for the quarter ended June 30, 2015 increased 6% compared to the same period in 2014 due to increased

sales of first aid products, Camillus knives, and Cuda fishing tools. Year over year, net sales for the first six months of 2015

grew 13% due to increased sales of first aid products and Westcott scissors.

Net

sales in Canada for the three months ended June 30, 2015 decreased 23% in U.S. dollars and 13% in local currency compared to the

prior-year period. Year over year, net sales for the six months ended June 30, 2015 decreased 22% in U.S. dollars and 11% in local

currency. These decreases were primarily due to a large retail chain exiting the Canadian market and weak economic conditions.

Net

sales in Europe for the three months ended June 30, 2015 decreased 19% in U.S. dollars but were constant in local currency compared

to the 2014 period. Net sales for the first half of 2015 decreased 13% in U.S. dollars but rose 6% in local currency.

Gross

margins were 36.9% in the second quarter of 2015 compared to 35.1% in the 2014 period. Gross margins were 36.9% for the six months

ended June 30, 2015 compared to 35.4% for last year’s period. The gross margin improvement for both periods was primarily

due to a favorable product mix.

The

Company’s bank debt less cash on June 30, 2015 was $28.2 million compared to $28.9 million on June 30, 2014.

ACME

UNITED CORPORATION is a leading worldwide supplier of innovative cutting, measuring and safety products to the school, home,

office, hardware, sporting goods and industrial markets. Its leading brands include Westcott®, Clauss®, Camillus®,

Cuda®, PhysiciansCare®, First Aid Only® and Pac-Kit®. For more information, visit www.acmeunited.com

Forward-looking

statements in this report, including without limitation, statements related to the Company’s plans, strategies, objectives,

expectations, intentions and adequacy of resources, are made pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Investors are cautioned that such forward-looking statements involve risks and uncertainties including,

without limitation, the following: (i) changes in the Company’s plans, strategies, objectives, expectations and intentions,

which may be made at any time at the discretion of the Company; (ii) the impact of uncertainties in global economic conditions,

including the impact on the Company’s suppliers and customers; (iii) changes in client needs and consumer spending habits;

(iv) the impact of competition and technological changes on the Company; (v) the Company’s ability to manage its growth

effectively, including its ability to successfully integrate any business it might acquire; (vi) currency fluctuations; and (vii)

other risks and uncertainties indicated from time to time in the Company’s filings with the Securities and Exchange Commission.

#

# #

| ACME UNITED CORPORATION |

| CONDENSED CONSOLIDATED STATEMENTS

OF INCOME |

| SECOND QUARTER REPORT 2015 |

| (Unaudited) |

| | |

|

| | |

| |

|

| | |

| Three

Months Ended | | |

| Three

Months Ended | |

| Amounts

in 000's except per share data | |

| June

30, 2015 | | |

| June

30, 2014 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Net sales | |

$ | 33,954 | | |

$ | 33,396 | |

| Cost of goods sold | |

| 21,419 | | |

| 21,875 | |

| Gross profit | |

| 12,535 | | |

| 11,521 | |

| Selling, general, and administrative

expenses | |

| 8,660 | | |

| 7,983 | |

| Income from operations | |

| 3,875 | | |

| 3,538 | |

| Interest expense | |

| 142 | | |

| 108 | |

| Interest income | |

| (2 | ) | |

| (2 | ) |

| Net interest expense | |

| 141 | | |

| 106 | |

| Other (income) expense,

net | |

| (18 | ) | |

| (204 | ) |

| Total other (income) expense, net | |

| 123 | | |

| (98 | ) |

| Pre-tax income | |

| 3,752 | | |

| 3,636 | |

| Income tax expense | |

| 1,044 | | |

| 1,093 | |

| Net income | |

$ | 2,708 | | |

$ | 2,543 | |

| | |

| | | |

| | |

| Shares outstanding - Basic | |

| 3,300 | | |

| 3,210 | |

| Shares outstanding - Diluted | |

| 3,682 | | |

| 3,539 | |

| | |

| | | |

| | |

| Earnings per share basic | |

$ | 0.82 | | |

$ | 0.79 | |

| Earnings per share diluted | |

| 0.74 | | |

| 0.72 | |

| ACME UNITED CORPORATION |

| CONDENSED CONSOLIDATED STATEMENTS

OF INCOME |

| SECOND QUARTER REPORT 2015 (cont.) |

| (Unaudited) |

| | |

| |

|

| | |

| |

|

| | |

| Six

Months Ended | | |

| Six

Months Ended | |

| Amounts

in 000's except per share data | |

| June

30, 2015 | | |

| June

30, 2014 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Net sales | |

$ | 56,791 | | |

$ | 52,548 | |

| Cost of goods sold | |

| 35,821 | | |

| 34,150 | |

| Gross profit | |

| 20,970 | | |

| 18,398 | |

| Selling, general, and administrative

expenses | |

| 16,269 | | |

| 14,235 | |

| Income from operations | |

| 4,702 | | |

| 4,163 | |

| Interest expense | |

| 274 | | |

| 197 | |

| Interest income | |

| (3 | ) | |

| (9 | ) |

| Net interest expense | |

| 270 | | |

| 188 | |

| Other (income) expense,

net | |

| 60 | | |

| (184 | ) |

| Total other (income) expense,

net | |

| 329 | | |

| 4 | |

| Pre-tax income | |

| 4,373 | | |

| 4,159 | |

| Income tax expense | |

| 1,229 | | |

| 1,248 | |

| Net income | |

$ | 3,144 | | |

$ | 2,911 | |

| | |

| | | |

| | |

| Shares outstanding - Basic | |

| 3,315 | | |

| 3,206 | |

| Shares outstanding - Diluted | |

| 3,705 | | |

| 3,487 | |

| | |

| | | |

| | |

| Earnings per share basic | |

$ | 0.95 | | |

$ | 0.91 | |

| Earnings per share diluted | |

| 0.85 | | |

| 0.83 | |

| ACME UNITED CORPORATION |

| CONDENSED CONSOLIDATED BALANCE

SHEETS |

| SECOND QUARTER REPORT 2015 |

| (Unaudited) |

| | |

| |

|

| | |

| |

|

| Amounts

in 000's | |

| June

30, 2015 | | |

| June

30, 2014 | |

| | |

| | | |

| | |

| Assets: | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash | |

$ | 1,941 | | |

$ | 2,426 | |

| Accounts receivable, net | |

| 27,123 | | |

| 30,795 | |

| Inventories | |

| 36,217 | | |

| 30,885 | |

| Prepaid

and other current assets | |

| 2,425 | | |

| 1,969 | |

| Total current assets | |

| 67,706 | | |

| 66,075 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 7,195 | | |

| 6,577 | |

| Intangible assets, less amortization | |

| 12,174 | | |

| 12,876 | |

| Goodwill | |

| 1,375 | | |

| 1,375 | |

| Other

assets | |

| 971 | | |

| 1,084 | |

| Total assets | |

$ | 89,421 | | |

$ | 87,987 | |

| | |

| | | |

| | |

| Liabilities and stockholders'

equity: | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 9,332 | | |

$ | 10,919 | |

| Other

current liabilities | |

| 7,039 | | |

| 7,466 | |

| Total current liabilities | |

| 16,371 | | |

| 18,385 | |

| Bank debt | |

| 30,179 | | |

| 31,325 | |

| Other non current liabilities | |

| 336 | | |

| 439 | |

| | |

| 46,886 | | |

| 50,150 | |

| Total stockholders' equity | |

| 42,535 | | |

| 37,838 | |

| Total liabilities and

stockholders' equity | |

$ | 89,421 | | |

$ | 87,987 | |

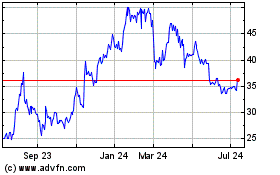

Acme United (AMEX:ACU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Acme United (AMEX:ACU)

Historical Stock Chart

From Apr 2023 to Apr 2024