UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(D) OF

THE

SECURITIES EXCHANGE ACT OF 1934

DATE

OF REPORT: July 17, 2015

DATE

OF EARLIEST EVENT REPORTED: July 15, 2015

001-35922

(Commission

file number)

PEDEVCO

CORP.

(Exact

name of registrant as specified in its charter)

| Texas |

|

22-3755993 |

| (State

or other jurisdiction of |

|

(IRS

Employer |

| incorporation

or organization) |

|

Identification

No.) |

4125

Blackhawk Plaza Circle, Suite 201

Danville,

California 94506

(Address

of principal executive offices)

(855)

733-2685

(Issuer’s

telephone number)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

| [X] |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| [X] |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| [ ] |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| [ ] |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM

1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

On

July 15, 2015, PEDEVCO Corp. (the “Company”, “PEDEVCO”, “we” and “us”)

entered into an Amendment No. 1 to Agreement and Plan of Reorganization (the “Amendment”) with PEDEVCO Acquisition

Subsidiary, Inc., a newly formed wholly-owned subsidiary of the Company (“Exchange Sub”), Dome Energy AB (“Dome

AB”), and Dome Energy, Inc. a wholly-owned subsidiary of Dome AB (“Dome US”, and collectively with

Dome AB, “Dome Energy”). In order to provide Dome Energy additional time to prepare and deliver necessary disclosure

schedules and audited financial statements, the parties entered into the Amendment, which (i) extended the deadline from July

15, 2015 to August 17, 2015, for delivery of copies of the parties’ disclosure schedules and Dome US’s audited financial

statements as contemplated by the Agreement and Plan of Reorganization entered into by and among the Company, Exchange Sub, Dome

AB and Dome US on May 21, 2015 (the “Reorganization Agreement”), and (ii) extended the deadline from July 4,

2015 to July 15, 2015 for delivery of copies of Dome Energy’s material contracts as required by the Reorganization Agreement.

The

Reorganization Agreement is disclosed in greater detail in a Current Report on Form 8-K filed by the Company with the Securities

and Exchange Commission on May 26, 2015.

The

Company and Dome Energy continue to move forward with the transactions contemplated by the Reorganization Agreement, as amended,

including the preparation of a registration statement containing a proxy statement/prospectus with the Securities and Exchange

Commission (the “SEC”), provided that because the closing of the transactions contemplated by the Reorganization

Agreement is subject to various closing conditions, described in greater detail in the May 26, 2015, Form 8-K, no assurance can

be made that the transactions contemplated by the Reorganization Agreement, as amended, will be completed.

The

foregoing description of the Amendment is not complete and is qualified in its entirety by reference to the Amendment, which is

filed herewith as Exhibit 2.1 and incorporated by reference herein.

ITEM

5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS

OF CERTAIN OFFICERS.

Effective

July 15, 2015, the Board of Directors of the Company increased the number of members of the Board of Directors to four, pursuant

to the power provided to the Board of Directors in the Company’s Bylaws, and appointed David Z. Steinberg as a member of

the Board of Directors to fill the newly created vacancy, also pursuant to the power provided to the Board of Directors in the

Company’s Bylaws. At the time of appointment, the Board of Directors made the affirmative determination that Mr. Steinberg

was ‘independent’ pursuant to applicable NYSE MKT and Securities and Exchange Commission rules and regulations. Mr.

Steinberg serves as one of the appointed representatives on the Company’s Board of Directors designated by the holders of

the Company’s Series A Convertible Preferred Stock (as described in greater detail below). Mr. Steinberg has not been appointed

to any committees of the Board of Directors to date and it is not anticipated that Mr. Steinberg will be appointed to any committees.

David

Z. Steinberg

Mr.

Steinberg, age 33, joined Platinum Management (NY) LLC (“PM LLC”), a New York based investment management firm,

in May 2009, and currently serves as a portfolio manager at PM LLC and heads its structured products credit group. Mr. Steinberg

received his Masters of Business Administration degree, with a concentration in finance, cum laude, from The New York Institute

of Technology in 2009.

Related

party transactions:

PM

LLC is an advisor to the entity which owns RJ Credit LLC (“RJC”), who has loaned the Company approximately

$5.9 million to date in principal in connection with the Company’s March 2014 senior note funding. In connection with the

March 2014 funding we also have the right, from time to time, subject to the terms and conditions of the Note Purchase Agreement

relating to the March 2014 senior funding, to request additional loans from RJC, of up to an additional $13.5 million in funding.

The terms of the March 2014 funding and the conditions relating to our ability to borrow additional funds under the Note Purchase

Agreement, are described in greater detail in our Current Report on Form 8-K filed with the Securities and Exchange Commission

on March 10, 2014.

PM

LLC is also an advisor to the entity that owns Golden Globe Energy (US), LLC (“GGE”), a greater than 5% stockholder

of the Company. On February 23, 2015, our wholly-owned subsidiary, Red Hawk Petroleum, LLC, completed the acquisition of approximately

12,977 net acres of oil and gas properties and interests in 53 gross wells located in the Denver-Julesburg Basin, Colorado (the

“Acquired Assets”) from GGE. As consideration for the acquisition of the Acquired Assets, the Company (i) issued

to GGE 3,375,000 restricted shares of the Company’s common stock (representing approximately 9.9% of our then outstanding

shares of common stock) and 66,625 restricted shares of the Company’s newly-designated Amended and Restated Series A Convertible

Preferred Stock (the “Series A Preferred”), (ii) assumed approximately $8.35 million of subordinated notes

payable from GGE to RJC, and (iii) provided GGE with a one-year option to acquire the Company’s interest in its Kazakhstan

opportunity for $100,000 payable upon exercise of the option pursuant to a Call Option Agreement. The Series A Preferred shares

(a) have a liquidation preference senior to all of the Company’s common stock equal to $400 per share; (b) accrue a dividend,

payable annually, of 10% of the liquidation preference; (c) have voting rights on all matters, with each share having 1 vote;

and (d) have a conversion feature at GGE’s option, which must be approved by a majority of the shareholders’ of the

Company which will allow the Series A Preferred shares to be converted into shares of the Company’s common stock on a 1,000:1

basis. The Series A Preferred shares terms are modified automatically at such time as we receive shareholder approval for the

issuance of the shares (i.e., the dividend ceases accruing and all accrued and unpaid dividends are forgiven and the liquidation

preference drops to $0.001 per share). Additionally, the Series A Preferred includes various redemption and other rights described

in more detail in our Current Report on Form 8-K filed with the Securities and Exchange Commission on February 24, 2015.

GGE,

as the sole holder of our Series A Preferred, has the right to appoint two designees to the Company’s Board of Directors

for as long as GGE continues to hold 15,000 shares of Series A Preferred designated as “Tranche One Shares” under

the Company’s Amended and Restated Certificate of Designations of PEDEVCO Corp. Establishing the Designations, Preferences,

Limitations, and Relative Rights of its Series A Convertible Preferred Stock. Mr. Steinberg is one of the Series A Preferred’s

designees to the Board of Directors in connection with such right, provided that GGE has decided not to designate any further

members of the Board of Directors at this time.

ITEM

9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

| Exhibit

No. |

|

Description |

| |

|

|

| 2.1* |

|

Amendment

No. 1 to Agreement and Plan of Reorganization dated as of July 15, 2015, by and among PEDEVCO Corp., PEDEVCO Acquisition Subsidiary,

Inc., Dome Energy, Inc. and Dome Energy AB. |

*Filed herewith.

Important

Information

In

connection with the proposed business combination between PEDEVCO Corp. (“PEDEVCO”) and Dome Energy, Inc.,

a wholly-owned subsidiary of DOME Energy AB (“Dome Energy”), PEDEVCO currently intends to file a registration

statement containing a proxy statement/prospectus with the Securities and Exchange Commission (the “SEC”).

This communication is not a substitute for any proxy statement, registration statement, proxy statement/prospectus or other document

PEDEVCO may file with the SEC in connection with the proposed transaction. Prospective investors are urged to read the registration

statement and the proxy statement/prospectus, when filed as it will contain important information. Any definitive proxy statement(s)

(if and when available) will be mailed to stockholders of PEDEVCO and Dome Energy (as applicable). Prospective investors may obtain

free copies of the registration statement and the proxy statement/prospectus, when filed, as well as other filings containing

information about PEDEVCO, without charge, at the SEC’s website (www.sec.gov). Copies of PEDEVCO’s SEC filings may

also be obtained from PEDEVCO without charge at PEDEVCO’s website (www.pacificenergydevelopment.com) or by directing a request

to PEDEVCO at (855) 733-3826. This document does not constitute an offer to sell or the solicitation of an offer to buy any securities

or a solicitation of any vote or approval nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

INVESTORS

SHOULD READ THE PROSPECTUS/PROXY STATEMENT AND OTHER DOCUMENTS TO BE FILED WITH THE SEC CAREFULLY BEFORE MAKING A DECISION CONCERNING

THE MERGER.

Participants

in Solicitation

PEDEVCO

and its directors and executive officers and other members of management and employees are potential participants in the solicitation

of proxies in respect of the proposed merger. Information regarding PEDEVCO’s directors and executive officers is available

in PEDEVCO’s Annual Report on Form 10-K for the year ended December 31, 2014, filed with the SEC on March 31, 2015 and PEDEVCO

Corp.’s definitive proxy statement on Schedule 14A, filed with the SEC on May 16, 2014. Additional information regarding

the interests of such potential participants will be included in the registration statement and proxy statement/prospectus to

be filed with the SEC by PEDEVCO and Dome Energy in connection with the proposed combination transaction and in other relevant

documents filed by PEDEVCO with the SEC. These documents can be obtained free of charge from the sources indicated above. Additional

information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by

security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with

the SEC when they become available.

Forward

Looking Statements

Certain

statements in this communication regarding the proposed transaction between PEDEVCO and Dome Energy are “forward-looking”

statements. The words “anticipate,” “believe,” “ensure,” “expect,”

“if,” “intend,” “estimate,” “probable,” “project,”

“forecasts,” “predict,” “outlook,” “aim,” “will,”

“could,” “should,” “would,” “potential,” “may,”

“might,” “anticipate,” “likely” “plan,” “positioned,”

“strategy,” and similar expressions, and the negative thereof, are intended to identify forward-looking statements.

These forward-looking statements, which are subject to risks, uncertainties and assumptions about PEDEVCO and Dome Energy, may

include projections of their respective future financial performance, their respective anticipated growth strategies and anticipated

trends in their respective businesses. These statements are only predictions based on current expectations and projections about

future events. There are important factors that could cause actual results, level of activity, performance or achievements to

differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking

statements, including the risk factors set forth in PEDEVCO’s most recent reports on Form 10-K, Form 10-Q and other documents

on file with the SEC and the factors given below:

| |

● |

termination

of the proposed combination by either party subject to the terms of the Agreement and Plan of Reorganization; |

| |

|

|

| |

● |

failure

to obtain the approval of the shareholders of PEDEVCO or Dome in connection with the proposed transaction; |

| |

|

|

| |

● |

the

failure to consummate or delay in consummating the proposed transaction for other reasons; |

| |

|

|

| |

● |

the

timing to consummate the proposed transaction; |

| |

|

|

| |

● |

the

risk that a condition to closing of the proposed transaction may not be satisfied; |

| |

|

|

| |

● |

the

risk that PEDEVCO will be required to pay a $1 million termination fee; |

| |

|

|

| |

● |

the

risk that a regulatory approval that may be required for the proposed transaction is delayed, is not obtained, or is obtained

subject to conditions that are not anticipated; |

| |

|

|

| |

● |

PEDEVCO’s

ability to achieve the synergies and value creation contemplated by the proposed transaction; |

| |

|

|

| |

● |

the

ability of PEDEVCO to effectively integrate Dome’s operations; and |

| |

|

|

| |

● |

the

diversion of management time on transaction-related issues. |

PEDEVCO’s

forward-looking statements are based on assumptions that PEDEVCO believes to be reasonable but that may not prove to be accurate.

PEDEVCO cannot guarantee future results, level of activity, performance or achievements. Moreover, PEDEVCO does not assume responsibility

for the accuracy and completeness of any of these forward-looking statements. PEDEVCO assumes no obligation to update or revise

any forward-looking statements as a result of new information, future events or otherwise, except as may be required by law. Readers

are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

| |

PEDEVCO

CORP. |

| |

|

|

| Date: July 17,

2015 |

By: |

/s/

Frank C. Ingriselli |

| |

|

Frank C. Ingriselli

|

| |

|

Chairman and Chief

Executive Officer |

EXHIBIT

INDEX

| Exhibit

No. |

|

Description |

| |

|

|

| 2.1* |

|

Amendment

No. 1 to Agreement and Plan of Reorganization dated as of July 15, 2015, by and among PEDEVCO Corp., PEDEVCO Acquisition Subsidiary,

Inc., Dome Energy, Inc. and Dome Energy AB. |

*Filed herewith.

AMENDMENT

NO. 1 TO

AGREEMENT

AND PLAN OF REORGANIZATION

THIS

AMENDMENT NO. 1 TO AGREEMENT AND PLAN OF REORGANIZATION (the “Amendment”) is executed as of this July 15, 2015

(the “Effective Date”) by and among DOME ENERGY, INC., a Texas corporation (the “Company”),

DOME ENERGY AB, a Swedish corporation and the sole shareholder of the Company (“DOME AB”), PEDEVCO CORP., a

Texas corporation (“PEDEVCO”), and PEDEVCO ACQUISITION SUBSIDIARY, INC., a Texas corporation and wholly-owned

subsidiary of PEDEVCO (“Acquisition Subsidiary”). Capitalized terms used below and otherwise not defined herein

shall have the meanings given to them in the Reorganization Agreement (as defined below).

W

I T N E S S E T H

WHEREAS,

on May 21, 2015, the Company, DOME AB, PEDEVCO and Acquisition Subsidiary entered into that certain Agreement and Plan of

Reorganization (the “Reorganization Agreement”), which agreement contemplates, among other things, the acquisition

by PEDEVCO of substantially all of the assets of Dome AB through an exchange of certain of the shares of PEDEVCO’s common

stock for 100% of the outstanding shares of the Company (the “Exchange”);

WHEREAS,

pursuant to the Reorganization Agreement, on or prior to July 15, 2015, the Parties agreed to deliver to each other true,

accurate and complete copies of their respective Disclosure Schedules and, in the case of the Company, the Company GAAP Financial

Statements, and the Company further agreed to deliver each Company Material Contract to PEDEVCO within 45 days of May 21, 2015;

WHEREAS,

due to unforeseen delays in the Company’s preparation of the Company GAAP Financial Statements, the Company was unable

to deliver the Company GAAP Financial Statements by July 15, 2015, and the Company Material Contracts were not delivered to PEDEVCO

until on or about July 15, 2015; and

WHEREAS,

the Parties desire to amend the Reorganization Agreement to provide additional time for the Parties to deliver their respective

Disclosure Schedules, and in the case of the Company, the Company GAAP Financial Statement and the Company Material Contracts,

as set forth herein.

NOW

THEREFORE, in consideration of the premises and the mutual promises and covenants herein contained, and for other good and

valuable consideration, the receipt and sufficiency of which is hereby acknowledged, and intending to be legally bound, the parties

hereto agree as follows:

1. Amendment

to Section 7.15(a) of the Reorganization Agreement. The reference to “July 15, 2015” as set forth in the first

sentence of Section 7.15(a) of the Reorganization Agreement shall be amended and restated to read “August 17, 2015.”

For the sake of clarity and in an abundance of caution, the definition of “Due Diligence Delivery Deadline” as set

forth in Section 7.15(a) of the Reorganization Agreement is amended to read “August 17, 2015” (provided that “Due

Diligence Delivery Date” as used in the Reorganization Agreement shall similarly refer to the same extended date).

2. Amendment

to Section 8.3(c) of the Reorganization Agreement. Section 8.3(c) of the Reorganization Agreement is amended and restated

in its entirety to read as follows:

“(c) PEDEVCO

shall have received copies of each Company Material Contract which would be deemed a “material contract”

within the meaning of Item 601(b)(10) of SEC Regulation S-K on or before July 15, 2015, along with English language translations

thereof;”

3. Amendment

to Sections 9.1(h) and 9.1(n) of the Reorganization Agreement. Sections 9.1(h) and 9.1(n) of the Reorganization Agreement

are hereby amended by deleting the term “Due Diligence Delivery Date” and replacing it with the insertion of the term

“Due Diligence Delivery Deadline”.

4. Limited

Effect. Except as amended hereby, the Reorganization Agreement shall remain in full force and effect, and the valid and binding

obligation of the Parties thereto.

5. Consideration.

Each of the Parties agrees and confirms by signing below that they have received valid consideration in connection with this Amendment

and the transactions contemplated herein.

6. Effect

of Amendment. Upon the effectiveness of this Amendment, each reference in the Reorganization Agreement to “Agreement,”

“hereunder,” “hereof,” “herein” or words of like import shall mean and be a reference to such

Reorganization Agreement as modified or amended hereby.

7. Reconfirmation

of Reorganization Agreement. The Parties hereby reaffirm all terms and conditions made in the Reorganization Agreement, to

the extent the same are not amended hereby.

8. Governing

Law. THIS AMENDMENT, AND ANY DISPUTES ARISING OUT OF OR RELATING TO THIS AMENDMENT OR THE PARTIES’ RELATIONSHIP TO EACH

OTHER, SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE INTERNAL LAWS OF THE STATE OF TEXAS, REGARDLESS OF THE LAWS

THAT MIGHT OTHERWISE GOVERN UNDER APPLICABLE PRINCIPLES OF CONFLICTS OF LAW THEREOF.

9. Counterparts.

This Amendment may be executed in two or more counterparts, each of which shall be deemed to be an original, but all of which

shall constitute one and the same agreement.

10. Delivery

by Facsimile or in .pdf Format. This Amendment and any signed agreement or instrument entered into in connection with this

Amendment, and any amendments hereto or thereto, to the extent signed and delivered by means of a facsimile machine or in .pdf

format, shall be treated in all manner and respects as an original agreement or instrument and shall be considered to have the

same binding legal effect as if it were the original signed version thereof delivered in person. At the request of any Party hereto

or to any such agreement or instrument, each other Party hereto or thereto shall re-execute original forms thereof and deliver

them to all other Parties. No Party hereto or to any such agreement or instrument shall raise the delivery of an agreement or

signature by facsimile machine or in .pdf format as a defense to the formation of a contract and each such Party forever waives

any such defense.

11. Further

Assurances. The Parties agree that, from time to time, each of them will take such other action and to execute, acknowledge

and deliver such contracts, deeds, or other documents as may be reasonably requested and necessary or appropriate to carry out

the purposes and intent of this Amendment and the transactions contemplated herein.

[Signature

Pages Follow]

IN

WITNESS WHEREOF, the parties hereto, have caused this Amendment to Agreement and Plan of Reorganization to be duly executed and

delivered as of the date first written above.

| |

“Company” |

| |

|

| |

DOME

ENERGY, INC. |

| |

|

| |

By: |

/s/

Paul Morch |

| |

|

Paul Morch |

| |

|

CEO |

| |

|

|

| |

“Dome

AB” |

| |

|

|

| |

DOME

ENERGY AB |

| |

|

| |

By: |

/s/

Paul Morch |

| |

|

Paul Morch |

| |

|

CEO |

| |

|

|

| |

100%

Shareholder of the Company |

| |

|

| |

“PEDEVCO” |

| |

|

| |

PEDEVCO

CORP. |

| |

|

| |

By: |

/s/

Frank C. Ingriselli |

| |

|

Frank C. Ingriselli |

| |

|

Chairman and Chief

Executive Officer |

| |

|

|

| |

“Acquisition

Subsidiary” |

| |

|

|

| |

PEDEVCO

ACQUISITION SUBSIDIARY, INC. |

| |

|

|

| |

By: |

/s/

Frank C. Ingriselli |

| |

|

Frank C. Ingriselli |

| |

|

Chairman and Chief

Executive Officer |

Signature

Page to Amendment No. 1 to Agreement and Plan of Reorganization

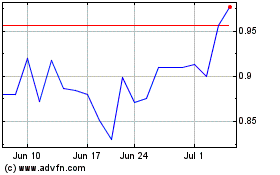

PEDEVCO (AMEX:PED)

Historical Stock Chart

From Mar 2024 to Apr 2024

PEDEVCO (AMEX:PED)

Historical Stock Chart

From Apr 2023 to Apr 2024