UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 16, 2015

Accretive Health, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

001-34746 |

|

02-0698101 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

401 North Michigan Avenue, Suite 2700, Chicago, Illinois

|

|

60611

|

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (312) 324-7820

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01 Other Events.

On July 16, 2015, Accretive Health, Inc. (the “Company”) issued a press release announcing, among other things, that its Board of Directors has

resolved to undertake a review of strategic alternatives to enhance stockholder value. A copy of this press release is filed and attached as Exhibit 99.1 hereto and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

|

|

|

| Exhibit Number |

|

Description of Exhibit |

|

|

| 99.1 |

|

Press release issued by Accretive Health, Inc. dated July 16, 2015. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

ACCRETIVE HEALTH, INC. |

|

|

|

|

|

By: |

|

/s/ Peter P. Csapo |

| Date: July 16, 2015 |

|

|

|

Name: |

|

Peter P. Csapo |

|

|

|

|

Title: |

|

Chief Financial Officer and Treasurer |

3

EXHIBIT INDEX

|

|

|

| Exhibit Number |

|

Description of Exhibit |

|

|

| 99.1 |

|

Press release issued by Accretive Health, Inc. dated July 16, 2015. |

4

Exhibit 99.1

Accretive Health to Explore Strategic Alternatives

CHICAGO – July 16, 2015 - Accretive Health, Inc. (OTC Pink: ACHI) announced today that its Board of Directors has resolved to undertake a

review of strategic alternatives to enhance stockholder value. While the review is ongoing, the Company’s strengthened management team will continue to focus on a number of strategic and operational initiatives intended to drive the

Company’s long term growth and financial performance.

Ascension Health (“Ascension”), whose affiliated hospital systems represent

approximately 50% of the Company’s total gross cash generated from contracting activities for the year ended December 31, 2014, sent a letter to the Company that stated it was open to discussing a potential transaction under which

Accretive would be taken private by Ascension (alone or with co-investment partners of its choosing) and remain a standalone, for profit company servicing Revenue Cycle Management customers. In that regard, Ascension provided a preliminary per

share value range of the Company, with the midpoint of the range being approximately 50% of the Company’s market value at the closing stock price on July 16, 2015. After consulting with its legal and financial advisors, the Board of

Directors of the Company unanimously concluded that Ascension’s current proposal is not in the best interests of Accretive or its stockholders. Ascension also indicated in the letter, that at this time, Ascension does not anticipate entering

into a new master professional services agreement with the Company once the current agreement between the parties expires on August 6, 2017.

“While we appreciate Ascension’s interest in acquiring Accretive Health, Ascension’s offer substantially undervalues Accretive Health and is

not in the best interests of stockholders. Consistent with our commitment to acting in the best interests of stockholders, the Board believes it is appropriate to conduct a thorough evaluation of all strategic alternatives,” said Steve Shulman,

Chairman of Accretive Health’s Board of Directors.

1

“Accretive Health has made tremendous progress in improving our operating rigor and driving improved performance and predictable results for our customers. We are confident in our strategic

plan and the significant value we can create by capitalizing on the substantial and fast-growing opportunity for our Revenue Cycle Management offerings. At the same time, we will evaluate alternatives to ensure that Accretive is maximizing value for

all stockholders.”

The Company has not made a decision to pursue any specific strategic transaction or any other strategic alternative. There can be

no assurance that the exploration of strategic alternatives will result in the completion of any transaction or other alternative. The Company has not set a timetable for completion of the evaluation process, and it does not expect to comment

further unless and until its board of directors has approved a specific transaction, or it otherwise deems further disclosure is appropriate or required by law.

The Company has retained Kirkland & Ellis LLP, as its legal advisor, to assist the Board in its evaluation of potential strategic alternatives.

Safe Harbor

This press release contains forward-looking

statements, including the statements regarding the plans, strategies and objectives of management for future operations, effects of current or future economic conditions or performance and industry trends and other matters that do not relate

strictly to historical facts or statements of assumptions underlying any of the foregoing. All forward-looking statements contained in this press release involve risks and uncertainties. The Company’s actual results and outcomes could differ

materially from those anticipated in these forward-looking statements as a result of various factors, including the factors set forth in the Company’s quarterly report on Form 10-Q for the quarter ended March 31, 2015, filed with the SEC

on July 7, 2015, under the heading “Risk Factors”. The words “strive,” “objective,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,”

“plans,” “projects,” “vision,” “would,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. The Company has

based

2

these forward-looking statements on its current expectations and projections about future events. Although the Company believes that the expectations underlying any of its forward-looking

statements are reasonable, these expectations may prove to be incorrect and all of these statements are subject to risks and uncertainties. Should one or more of these risks and uncertainties materialize, or should underlying assumptions,

projections, or expectations prove incorrect, actual results, performance, financial condition, or events may vary materially and adversely from those anticipated, estimated, or expected.

All forward-looking statements included in this press release are expressly qualified in their entirety by these cautionary statements. The Company cautions

readers not to place undue reliance on any forward-looking statement that speaks only as of the date made and to recognize that forward-looking statements are predictions of future results, which may not occur as anticipated. Actual results could

differ materially from those anticipated in the forward-looking statements and from historical results, due to the uncertainties and factors described above, as well as others that the Company may consider immaterial or does not anticipate at this

time. Although the Company believes that the expectations reflected in its forward-looking statements are reasonable, the Company does not know whether its expectations may prove correct. The Company’s expectations reflected in its

forward-looking statements can be affected by inaccurate assumptions it might make or by known or unknown uncertainties and factors, including those described above. The risks and uncertainties described above are not exclusive, and further

information concerning the Company and its business, including factors that potentially could materially affect its financial results or condition or relationships with customers and potential customers, may emerge from time to time. The Company

assumes no, and it specifically disclaims any, obligation to update, amend, or clarify forward-looking statements to reflect actual results or changes in factors or assumptions affecting such forward-looking statements. The Company advises

investors, however, to consult any further disclosures it makes on related subjects in our periodic reports that it files with or furnishes to the SEC.

3

About Accretive Health

At Accretive Health, our mission is to partner with healthcare communities to serve as a catalyst for a healthier future for all. For more information, visit

www.accretivehealth.com.

Contact:

Accretive Health,

Inc.

Investor and Media Relations:

Atif Rahim

312.324.5476

investorrelations@accretivehealth.com

4

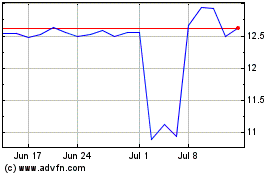

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

From Mar 2024 to Apr 2024

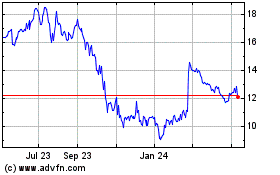

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

From Apr 2023 to Apr 2024