UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): June 30, 2015

Mercury Systems, Inc.

(Exact Name of Registrant as Specified in Charter)

|

| | | | |

| | | | |

Massachusetts | | 000-23599 | | 04-2741391 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

201 Riverneck Road, Chelmsford, Massachusetts 01824

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (978) 256-1300

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

Item 1.01 | Entry into a Material Definitive Agreement. |

In connection with its annual corporate governance review, the Nominating and Governance Committee of the Board of Directors of Mercury Systems, Inc. (the “Company”) reviewed the Company’s shareholder rights plan which by its terms would expire on December 23, 2015. Upon the recommendation of the Nominating and Governance Committee, the Board of Directors approved an amendment, effective June 30, 2015 (the “Amendment”), to the Company’s Shareholder Rights Agreement (the “Rights Agreement”), dated as of December 14, 2005, by and between the Company and Computershare Trust Company, N.A. (formerly EquiServe Trust Company, N.A.), terminating the Rights Agreement and the associated Rights (as defined below).

The Amendment accelerates the expiration date of the Company’s preferred stock purchase rights (the “Rights”) from the close of business on December 23, 2015 to June 30, 2015 and has the effect of terminating the Rights Agreement on June 30, 2015. At the time of the termination of the Rights Agreement, all of the Rights distributed to holders of the Company’s common stock pursuant to the Rights Agreement will expire.

The foregoing is a summary of the terms of the Amendment. The summary does not purport to be complete and is qualified in its entirety by reference to the Amendment, a copy of which is attached as Exhibit 4.1 and incorporated herein by reference.

Item 1.02 Termination of a Material Definitive Agreement.

The information set forth under Item 1.01 is incorporated herein by reference.

Item 3.03 Material Modification to Rights of Security Holders.

The information set forth under Item 1.01 is incorporated herein by reference.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

In connection with the adoption of the Rights Agreement, on December 15, 2005, the Company filed Articles of Amendment to the Company’s Restated Articles of Organization classifying and designating the Series B Junior Participating Cumulative Preferred Stock with the Secretary of State of The Commonwealth of Massachusetts, setting forth the rights, powers, and preferences of the Series B Junior Participating Cumulative Preferred Stock issuable upon exercise of the Rights (the “Preferred Shares”).

Promptly following the expiration of the Rights and the termination of the Rights Agreement, the Company will file Articles of Amendment (“Articles of Amendment”) to the Company’s Restated Articles of Organization with the Secretary of State of The Commonwealth of Massachusetts eliminating the Preferred Shares and returning them to authorized but undesignated shares of the Company’s preferred stock.

The foregoing is a summary of the terms of the Articles of Amendment. The summary does not purport to be complete and is qualified in its entirety by reference to the Articles of Amendment, a copy of which is attached as Exhibit 3.1 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| |

3.1 | Articles of Amendment of Mercury Systems, Inc. eliminating the Series B Junior Participating Cumulative Preferred Stock. |

| |

4.1 | Amendment No. 1 to Shareholder Rights Agreement by and between the Mercury Systems, Inc. and Computershare Trust Company, N.A., dated as of June 29, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Dated: June 30, 2015 MERCURY SYSTEMS, INC.

By: _/s/ Gerald M. Haines II__________________

Gerald M. Haines II

Executive Vice President, Chief Financial Officer, and Treasurer

Exhibit Index

| |

3.1 | Articles of Amendment of Mercury Systems, Inc. eliminating the Series B Junior Participating Cumulative Preferred Stock. |

| |

4.1 | Amendment No. 1 to Shareholder Rights Agreement by and between the Mercury Systems, Inc. and Computershare Trust Company, N.A., dated as of June 29, 2015. |

Exhibit 4.1

AMENDMENT NO. 1 TO SHAREHOLDER RIGHTS AGREEMENT

This AMENDMENT NO. 1 TO SHAREHOLDER RIGHTS AGREEMENT (this “Amendment”) is dated as of June 29, 2015 (the “Effective Date”) and amends that certain Shareholder Rights Agreement, dated as of December 14, 2005 (the “Rights Agreement”), by and between Mercury Systems, Inc. (formerly Mercury Computer Systems, Inc.), a Massachusetts corporation (the “Company”), and Computershare Trust Company, N.A. (formerly EquiServe Trust Company, N.A.) (the “Rights Agent”). All capitalized terms used herein, but not defined, shall have the meaning given to such terms in the Rights Agreement.

RECITALS

WHEREAS, in accordance with Section 27 of the Rights Agreement, prior to the occurrence of a Section 11(a)(ii) Event, the Company and the Rights Agent shall, if the Board of Directors of the Company so directs, amend any provision of the Rights Agreement without the approval of the holders of Common Stock of the Company; and

WHEREAS, the Rights Agent is hereby directed to join in this Amendment.

AGREEMENT

NOW, THEREFORE, in consideration of the premises and the mutual agreements set forth herein, the parties hereby agree as follows:

1. Amendment of the Rights Agreement. The definition of the term “Final Expiration Date” as defined in Section 7(a) of the Rights Agreement is hereby amended and restated as follows: the language set forth below contained in clause (i) of the first sentence of Section 7(a) of the Rights Agreement:

“(i) the Close of Business on the tenth anniversary of the Record Date (the “Final Expiration Date”),”

is hereby removed in its entirety and replaced with:

“(i) June 30, 2015 (the “Final Expiration Date”),”.

2. Amendment of Exhibits. The exhibits to the Rights Agreement shall be deemed to be restated to reflect this Amendment, including all conforming changes.

3. Other Amendment; Effect of Amendment. This Amendment will be deemed an amendment to the Rights Agreement and will become effective on the Effective Date. In the event of a conflict or inconsistency between this Amendment and the Rights Agreement and the exhibits thereto, the provisions of this Amendment will govern.

4. Counterparts. This Amendment may be executed in any number of counterparts and each of such counterparts will for all purposes be deemed to be an original, and all such counterparts will together constitute one and the same instrument, it being understood that all parties need not sign the same counterpart. A signature to this Amendment transmitted electronically (including by fax and .pdf) will have the same authority, effect and enforceability as an original signature. No party hereto may raise the use of such electronic transmission to deliver a signature, or the fact that any signature or agreement or instrument was transmitted or communicated through such electronic transmission, as a defense to the formation of a contract, and each party forever waives any such defense, except to the extent such defense relates to lack of authenticity.

5. Severability. If any term, provision, covenant or restriction of this Amendment is held by a court of competent jurisdiction or other authority to be invalid, void or unenforceable, the remainder of the terms, provisions, covenants and restrictions of this Amendment will remain in full force and effect and will in no way be affected, impaired or invalidated.

6. Further Assurances. Each of the parties to this Amendment will cooperate and take such action as may be reasonably requested by the other party in order to carry out the provisions and purposes of this Amendment, the Rights Agreement and the transactions contemplated hereunder and thereunder.

IN WITNESS WHEREOF, the parties hereto have caused this Amendment to be duly executed as of the date first written above.

MERCURY SYSTEMS, INC.

By: _/s/ Gerald M. Haines II________

Name: Gerald M. Haines II

Title: Executive Vice President, Chief Financial Officer,

Treasurer, Chief Legal Officer, and Secretary

COMPUTERSHARE TRUST COMPANY, N.A.

By: _/s/ Dennis V. Moccia_____________

Name: Dennis V. Moccia

Title: Manager, Contract Administration

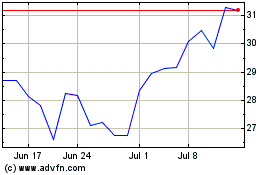

Mercury Systems (NASDAQ:MRCY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mercury Systems (NASDAQ:MRCY)

Historical Stock Chart

From Apr 2023 to Apr 2024