UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________

FORM 8-K

________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 23, 2015

________________________________________

Accretive Health, Inc.

(Exact Name of Registrant as Specified in Charter)

|

| | | | |

Delaware | | 001-34746 | | 02-0698101 |

| | | | |

(State or Other Juris- diction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

401 North Michigan Avenue, Suite 2700, Chicago, Illinois | | 60611 |

| | |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant's telephone number, including area code: (312) 324-7820

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| | |

o | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

o | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

o | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

o | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

On June 23, 2015, Accretive Health, Inc. (the “Company”) announced its audited results for the year ended December 31, 2014. The full text of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K. The slide presentation to be used in conjunction with the investor conference call referenced in the press release is furnished as Exhibit 99.2 to this Current Report on Form 8-K and will be posted on the Company’s website.

The information in this Form 8-K (including Exhibits 99.1 and 99.2) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The following exhibits relating to Item 2.02 shall be deemed to be furnished, and not filed:

| |

99.1 | Press Release issued by the Company on June 23, 2015 |

| |

99.2 | June 23, 2015 Slide Presentation |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

| ACCRETIVE HEALTH, INC. |

Date: June 23, 2015 | By: /s/ Peter P. Csapo |

| Peter P. Csapo Chief Financial Officer and Treasurer |

EXHIBIT INDEX

|

| |

Exhibit No. | Description |

99.1 | Press Release issued by the Company on June 23, 2015 |

99.2 | June 23, 2015 Slide Presentation |

Exhibit 99.1

Accretive Health Announces 2014 Results

and Provides Business Update

| |

• | Files 2014 10-K and 10-Qs |

| |

• | 2014 results in-line with guidance |

| |

• | Company serves 79 hospitals with collective net patient revenue of $16.5 billion |

| |

• | Provides updated financial outlook for 2015 |

CHICAGO - June 23, 2015 - Accretive Health, Inc. (OTC Pink: ACHI) today announced results for the twelve months ended December 31, 2014. Earlier today, the company filed its Annual Report on Form 10-K for the year ended December 31, 2014, as well as its Quarterly Reports on Form 10-Q for the quarters ended March 31, June 30, and September 30, 2014.

2014 Financial Summary:

| |

• | On a GAAP basis, net services revenue was $210.1 million in 2014 as compared to $504.8 million in 2013. On a non-GAAP basis, gross cash generated from customer contracting activities was $233.6 million in 2014 as compared to $251.6 million in 2013. |

| |

• | On a GAAP basis, net loss was $79.6 million in 2014 as compared to net income of $130.1 million in 2013. On a non-GAAP basis, adjusted EBITDA was a loss of $15.7 million in 2014 as compared to $268.7 million in 2013 and net cash generated from customer contracting activities was $7.8 million in 2014 as compared to $15.6 million in 2013. |

Emad Rizk, M.D., President and Chief Executive Officer of Accretive Health stated: “Filing of our 2014 Form 10-K and the upcoming filing of the Form 10-Q for the first quarter of 2015 are major steps toward the company becoming current with its SEC filings. We are on a firm pathway to executing our strategy and believe the Company is laying a solid foundation for future growth."

Peter Csapo, Chief Financial Officer and Treasurer, commented, “We are pleased with the progress we have achieved in the process of becoming current with our filings, and expect to be back to a normal reporting cycle as a publicly-traded company in the coming months.”

The Company currently serves 79 hospitals with collective net patient revenue (NPR) of $16.5 billion. NPR represents net revenue collected annually by the Company’s customers from their patients and is not a measure of the revenue the Company recognizes.

“Over the past six months, we have continued to improve our core revenue cycle operations while at the same time developing new capabilities to meet the future needs of our customers," added Rizk. "Our core value proposition remains focused on reducing the cost of our customers’ revenue cycle operations, maximizing appropriate fee-for-service revenue, and preparing for value-based reimbursement.”

Updated 2015 Outlook and Preliminary Results for the First Quarter of 2015

Accretive Health expects to generate gross cash from customer contracting activities of $230 million to $240 million for 2015. The Company expects net cash from contracting activities to be at the lower end of the $30 million to $40 million guidance range previously provided. The Company’s PAS business continues to experience headwinds from the Two-Midnight Rule, a regulatory change in the healthcare industry.

For the first quarter of 2015, on a GAAP basis, the Company expects net services revenue of $9 million to $11 million and a net loss of $29 million to $31 million. On a non-GAAP basis, the Company expects gross cash generated from customer contracting activities of $53 million to $55 million, adjusted EBITDA of a loss of $41 million to $43 million and net cash generated from customer contracting activities of $1 million to $3 million. The Company anticipates filing its Form 10-Q for the quarter ended March 31, 2015 in July 2015.

Conference Call and Webcast Details

Accretive Health’s management will host a conference call today at 3:30 p.m. CT (4:30 p.m. ET) to discuss its 2014 and first quarter 2015 results and business outlook. To participate, please dial 877-280-4954 (857- 244-7311 from outside the U.S. and Canada) using conference code number 70316750, or visit the Investor Relations section of Accretive Health’s web site at www.accretivehealth.com to access the live webcast. A replay will be available for one week following the conference call at 888-286-8010 (617-801-6888 from outside the U.S. and Canada) using conference code number 74907423. A replay of the conference call will also be available online at www.accretivehealth.com.

Accompanying slides have been posted to the Investor Relations section of Accretive Health’s web site at www.accretivehealth.com.

Non-GAAP Financial Measures

In order to provide a more comprehensive understanding of the information used by Accretive Health’s management team in financial and operational decision making, the Company supplements its GAAP consolidated financial statements with certain non-GAAP financial measures, which are included in this press release. These include gross and net cash generated from customer contracting activities, and adjusted EBITDA. Our Board and management team use these non-GAAP measures as (i) one of the primary methods for planning and forecasting overall expectations and for evaluating actual results against such expectations; and (ii) as a performance evaluation metric in determining achievement of certain executive incentive compensation programs, as well as for incentive compensation plans for employees.

Gross cash generated from customer contracting activities is defined as GAAP net services revenue, plus the change in deferred customer billings. Accordingly, gross cash generated from customer contracting activities is the sum of (i) invoiced or accrued net operating fees, (ii) cash collections on incentive fees and (iii) other services fees. Net cash generated from customer contracting activities reflects non-GAAP adjusted EBITDA and the change in deferred customer billings.

Adjusted EBITDA is defined as net income before net interest income (expense), income tax provision, depreciation and amortization expense, share-based compensation expense, restatement-related expense, reorganization-related expense and certain non-recurring items. The use of adjusted EBITDA to measure operating and financial performance is limited by our revenue recognition criteria, pursuant to which GAAP net services revenue is recognized at the end of a contract or other contractual agreement event. Adjusted EBITDA does not adequately match corresponding cash flows from customer contracting activities. As a result, the Company uses gross cash and net cash generated from customer contracting activities to better compare cash flows to operating performance.

Deferred customer billings include the portion of both (i) invoiced or accrued net operating fees and (ii) cash collections of incentive fees, in each case, that have not met our revenue recognition criteria. Deferred customer billings are included in the detail of our customer liabilities balance in the consolidated balance sheet available in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014.

Table 4 presents a reconciliation of GAAP revenue to gross cash generated from customer contracting activities, and Table 5 presents a reconciliation of GAAP net income (loss), the most comparable GAAP measure, to adjusted EBITDA and net cash generated from customer contracting activities, in each case, for each of the periods indicated. These adjusted measures are non-GAAP and should be considered in addition to, but not as a substitute for, the information prepared in accordance with GAAP.

Safe Harbor

This press release contains forward-looking statements, including the Company’s ability to generate specified levels of cash from contracting activities, reduce the cost of customers’ revenue cycle operations, maximize appropriate fee-for-service revenue, and become current with its SEC filings. All forward-looking statements contained in this press release involve risks and uncertainties. The Company’s actual results and outcomes could differ materially from those anticipated in these forward-looking statements as a result of various factors, including the factors set forth in its Annual Report on Form 10-K for the year ended December 31, 2014, filed with the SEC on June 23, 2015, under the heading “Risk Factors”. The words “strive,” “objective,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “vision,” “would,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. The Company has based these forward-looking statements on its current expectations and projections about future events. Although the Company believes that the expectations underlying any of its forward-looking statements are reasonable, these expectations may prove to be incorrect and all of these statements are subject to risks and uncertainties. Should one or more of these risks and uncertainties materialize, or should underlying assumptions,

projections, or expectations prove incorrect, actual results, performance, financial condition, or events may vary materially and adversely from those anticipated, estimated, or expected.

All forward-looking statements included in this press release are expressly qualified in their entirety by these cautionary statements. The Company cautions readers not to place undue reliance on any forward-looking statement that speaks only as of the date made and to recognize that forward-looking statements are predictions of future results, which may not occur as anticipated. Actual results could differ materially from those anticipated in the forward-looking statements and from historical results, due to the uncertainties and factors described above, as well as others that the Company may consider immaterial or does not anticipate at this time. Although the Company believes that the expectations reflected in its forward-looking statements are reasonable, the Company does not know whether its expectations may prove correct. The Company’s expectations reflected in its forward-looking statements can be affected by inaccurate assumptions it might make or by known or unknown uncertainties and factors, including those described above. The risks and uncertainties described above are not exclusive, and further information concerning the Company and its business, including factors that potentially could materially affect its financial results or condition or relationships with customers and potential customers, may emerge from time to time. The Company assumes no, and it specifically disclaims any, obligation to update, amend, or clarify forward-looking statements to reflect actual results or changes in factors or assumptions affecting such forward-looking statements. The Company advises investors, however, to consult any further disclosures it makes on related subjects in our periodic reports that it files with or furnishes to the SEC.

About Accretive Health

At Accretive Health, our mission is to partner with healthcare communities to serve as a catalyst for a healthier future for all. For more information, visit www.accretivehealth.com.

Contact:

Accretive Health, Inc.

Investor and Media Relations:

Atif Rahim

312.324.5476

investorrelations@accretivehealth.com

Table 1

Accretive Health, Inc.

Condensed Balance Sheet

($ in thousands)

|

| | | | | | | | |

| | December 31, |

| | 2014 | | 2013 |

Assets | | | | |

Current assets: | | | | |

Cash and cash equivalents | | $ | 145,167 |

| | $ | 228,891 |

|

Restricted cash | | 5,000 |

| | — |

|

Accounts receivable, net | | 4,438 |

| | 24,557 |

|

Prepaid income taxes | | 6,138 |

| | 9,738 |

|

Current deferred tax assets | | 62,322 |

| | 105,015 |

|

Other current assets | | 7,389 |

| | 6,943 |

|

Total current assets | | 230,454 |

| | 375,144 |

|

Property, equipment and software, net | | 14,594 |

| | 16,275 |

|

Non-current deferred tax asset | | 201,163 |

| | 112,993 |

|

Restricted cash | | — |

| | 5,000 |

|

Goodwill and other assets, net | | 162 |

| | 579 |

|

Total assets | | 446,373 |

| | 509,991 |

|

Liabilities and stockholders’ equity (deficit) | | | | |

Current liabilities: | | | | |

Accounts payable | | 12,488 |

| | 4,254 |

|

Current portion of customer liabilities | | 219,998 |

| | 356,694 |

|

Accrued compensation and benefits | | 14,983 |

| | 11,810 |

|

Other accrued expenses | | 15,680 |

| | 20,046 |

|

Total current liabilities | | 263,149 |

| | 392,804 |

|

Non-current portion of customer liabilities | | 317,065 |

| | 195,392 |

|

Other non-current liabilities | | 8,405 |

| | 7,407 |

|

Total liabilities | | 588,619 |

| | 595,603 |

|

Stockholders’ equity (deficit): | | | | |

Common stock, $0.01 par value, 500,000,000 shares authorized, 102,890,241 shares issued and 98,112,019 shares outstanding at December 31, 2014; 100,525,241 shares issued and 96,010,911 shares outstanding at December 31, 2013 | | 1,029 |

| | 1,005 |

|

Additional paid-in capital | | 307,075 |

| | 283,439 |

|

Accumulated deficit | | (397,517 | ) | | (317,897 | ) |

Accumulated other comprehensive loss | | (1,763 | ) | | (1,459 | ) |

Treasury stock | | (51,070 | ) | | (50,700 | ) |

Total stockholders’ equity (deficit) | | (142,246 | ) | | (85,612 | ) |

Total liabilities and stockholders’ equity (deficit) | | 446,373 |

| | 509,991 |

|

Table 2

Accretive Health, Inc.

Condensed Statement of Operations

($ in thousands, except per share data)

|

| | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2014 | | 2013 | | 2012 |

Net services revenue | | $ | 210,140 |

| | $ | 504,768 |

| | $ | 72,254 |

|

Operating expenses: | | | | | | |

Cost of services | | 182,144 |

| | 186,752 |

| | 188,666 |

|

Selling, general and administrative | | 69,883 |

| | 79,951 |

| | 67,750 |

|

Restatement and other | | 86,766 |

| | 33,963 |

| | 3,714 |

|

Total operating expenses | | 338,793 |

| | 300,666 |

| | 260,130 |

|

Income (loss) from operations | | (128,653 | ) | | 204,102 |

| | (187,876 | ) |

Net interest income | | 302 |

| | 330 |

| | 141 |

|

Income (loss) before income tax provision | | (128,351 | ) | | 204,432 |

| | (187,735 | ) |

Income tax provision (benefit) | | (48,731 | ) | | 74,349 |

| | (67,995 | ) |

Net income (loss) | | $ | (79,620 | ) | | $ | 130,083 |

| | $ | (119,740 | ) |

Net income (loss) per common share: | | | | | | |

Basic | | $ | (0.83 | ) | | $ | 1.36 |

| | $ | (1.21 | ) |

Diluted | | $ | (0.83 | ) | | $ | 1.34 |

| | $ | (1.21 | ) |

Weighted average shares used in calculating net income (loss) per common share: | | | | | | |

Basic | | 95,760,762 |

| | 95,687,940 |

| | 98,602,099 |

|

Diluted | | 95,760,762 |

| | 96,845,664 |

| | 98,602,099 |

|

Consolidated statements of comprehensive income (loss) | | | | | | |

Net income (loss) | | (79,620 | ) | | 130,083 |

| | (119,740 | ) |

Other comprehensive loss: | | | | | | |

Foreign currency translation adjustments | | (304 | ) | | (703 | ) | | (46 | ) |

Comprehensive income (loss) | | $ | (79,924 | ) | | $ | 129,380 |

| | $ | (119,786 | ) |

Table 3

Accretive Health, Inc.

Consolidated Statement of Cash Flows

($ in thousands)

|

| | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2014 | | 2013 | | 2012 |

Operating activities | | | | | | |

Net income (loss) | | $ | (79,620 | ) | | $ | 130,083 |

| | $ | (119,740 | ) |

Adjustments to reconcile net income (loss) to net cash provided by (used in) operations: | | | | |

Depreciation and amortization | | 6,047 |

| | 6,823 |

| | 6,355 |

|

Share-based compensation | | 27,181 |

| | 25,025 |

| | 25,298 |

|

Loss on disposal | | 1,604 |

| | — |

| | — |

|

Provision (recovery) for doubtful receivables | | (430 | ) | | 634 |

| | 183 |

|

Deferred income taxes | | (49,227 | ) | | 79,356 |

| | (76,887 | ) |

Excess tax benefit from share-based awards | | (176 | ) | | (15 | ) | | (4,403 | ) |

Changes in operating assets and liabilities: | | | | | | |

Accounts receivable | | 20,548 |

| | 658 |

| | (8,926 | ) |

Prepaid income taxes | | 3,794 |

| | (4,836 | ) | | 6,980 |

|

Other assets | | (47 | ) | | 14,434 |

| | (1,571 | ) |

Accounts payable | | 8,251 |

| | 3,378 |

| | (358 | ) |

Accrued compensation and benefits | | 3,174 |

| | 3,813 |

| | (7,581 | ) |

Other liabilities | | (3,312 | ) | | (2,955 | ) | | 2,166 |

|

Customer liabilities | | (15,023 | ) | | (201,975 | ) | | 207,650 |

|

Net cash provided by (used in) operating activities | | (77,236 | ) | | 54,423 |

| | 29,166 |

|

Investing activities | | | | | | |

Purchases of property, equipment, and software | | (6,034 | ) | | (1,877 | ) | | (10,544 | ) |

Net cash used in investing activities | | (6,034 | ) | | (1,877 | ) | | (10,544 | ) |

Financing activities | | | | | | |

Excess tax benefit from share-based awards | | 176 |

| | 15 |

| | 4,403 |

|

Exercise of vested stock options | | — |

| | 46 |

| | 7,396 |

|

Purchase of treasury stock | | (370 | ) | | (161 | ) | | (50,160 | ) |

Collection of non-executive employee loans | | — |

| | — |

| | — |

|

Net cash used in financing activities | | (194 | ) | | (100 | ) | | (38,361 | ) |

Effect of exchange rate changes in cash | | (260 | ) | | (511 | ) | | (30 | ) |

Net increase (decrease) in cash and cash equivalents | | (83,724 | ) | | 51,935 |

| | (19,769 | ) |

Cash and cash equivalents, at beginning of year | | 228,891 |

| | 176,956 |

| | 196,725 |

|

Cash and cash equivalents, at end of year | | $ | 145,167 |

| | $ | 228,891 |

| | $ | 176,956 |

|

Supplemental disclosures of cash flow information | | | | | | |

Income taxes paid | | $ | (801 | ) | | $ | (1,742 | ) | | $ | (1,531 | ) |

Income taxes refunded | | $ | 3,014 |

| | $ | 754 |

| | $ | 87 |

|

Supplemental disclosure of non-cash operating activities | | | | | | |

Non-cash increase in litigation liability and related insurance receivable included in other liabilities and other assets, respectively | | $ | — |

| | $ | — |

| | $ | 14,000 |

|

Table 4

Accretive Health, Inc.

Reconciliation of GAAP revenue to Gross Cash Generated from Customer Contracting Activities

($ in thousands)

|

| | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2014 | | 2013 | | 2012 |

| | (In thousands) |

Consolidated Statement of Operations Data: | | | | | | |

RCM services: net operating fees | | $ | 77,456 |

| | $ | 224,937 |

| | $ | 9,888 |

|

RCM services: incentive fees | | 99,934 |

| | 210,303 |

| | 928 |

|

Other service fees | | 32,750 |

| | 69,528 |

| | 61,438 |

|

Total net services revenue | | 210,140 |

| | 504,768 |

| | 72,254 |

|

Change in deferred customer billings | | 23,427 |

| | (253,127 | ) | | 200,114 |

|

Gross cash generated from customer contracting activities | | $ | 233,567 |

| | $ | 251,641 |

| | $ | 272,368 |

|

RCM services: net operating fees | | $ | 121,730 |

| | $ | 106,453 |

| | $ | 118,030 |

|

RCM services: incentive fees | | 77,239 |

| | 75,660 |

| | 92,900 |

|

Other service fees | | 34,598 |

| | 69,528 |

| | 61,438 |

|

Gross cash generated from customer contracting activities | | $ | 233,567 |

| | $ | 251,641 |

| | $ | 272,368 |

|

Table 5

Accretive Health, Inc.

Reconciliation of GAAP net income (loss) to Net Cash Generated from Customer Contracting Activities

($ in thousands)

|

| | | | | | | | | | | | |

| | Year End December 31, |

| | 2014 | | 2013 | | 2012 |

| | (in thousands) |

Net income (loss) | | $ | (79,620 | ) | | $ | 130,083 |

| | $ | (119,740 | ) |

Net interest (income) expense | | (302 | ) | | (330 | ) | | (141 | ) |

Income tax provision (benefit) | | (48,731 | ) | | 74,349 |

| | (67,995 | ) |

Depreciation and amortization expense | | 6,047 |

| | 6,823 |

| | 6,355 |

|

Share-based compensation expense | | 20,172 |

| | 23,801 |

| | 25,298 |

|

Restatement and other | | 86,766 |

| | 33,963 |

| | 3,714 |

|

Adjusted EBITDA | | (15,668 | ) | | 268,689 |

| | (152,509 | ) |

Change in deferred customer billings | | 23,427 |

| | (253,127 | ) | | 200,114 |

|

Net cash generated from customer contracting activities | | $ | 7,759 |

| | $ | 15,562 |

| | $ | 47,605 |

|

Table 6

Accretive Health, Inc.

Share-Based Compensation Expense

($ in thousands)

|

| | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2014 | | 2013 | | 2012 |

| | | | | | |

Cost of services | | $ | 6,668 |

| | $ | 10,740 |

| | $ | 11,625 |

|

Selling, general and administrative | | 13,503 |

| | 13,061 |

| | 13,673 |

|

Restatement and other costs | | 8,761 |

| | 1,224 |

| | — |

|

Total share-based compensation expense | | $ | 28,932 |

| | $ | 25,025 |

| | $ | 25,298 |

|

Table 7

Accretive Health, Inc.

Depreciation and Amortization Expense

($ in thousands)

|

| | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2014 | | 2013 | | 2012 |

Cost of services | | $ | 4,603 |

| | $ | 4,697 |

| | $ | 3,957 |

|

Selling, general and administrative | | 1,444 |

| | 2,126 |

| | 2,398 |

|

Total depreciation and amortization | | $ | 6,047 |

| | $ | 6,823 |

| | $ | 6,355 |

|

Table 8

Accretive Health, Inc.

Condensed Non-GAAP Financial Information

($ in thousands)

|

| | | | | | | | | | | | |

| | Year ended December 31, |

| | 2014 | | 2013 | | 2012 |

| | | | | | |

GAAP net services revenue | | $ | 210,140 |

| | $ | 504,768 |

| | $ | 72,254 |

|

Increase (decrease) in deferred customer billings | | 23,427 |

| | (253,127 | ) | | 200,114 |

|

Gross cash generated from customer contracting activities | | 233,567 |

| | 251,641 |

| | 272,368 |

|

| | | | | | |

Operating Expenses1: | | | | |

Cost of services | | 170,873 |

| | 171,315 |

| | 173,084 |

|

Selling, general and administrative | | 54,935 |

| | 64,764 |

| | 51,679 |

|

Sub-total | | 225,808 |

| | 236,079 |

| | 224,763 |

|

| | | | | | |

Net cash generated from customer contracting activities | $ | 7,759 |

| | $ | 15,562 |

| | $ | 47,605 |

|

| | | | | | |

Net cash generated margin | | 3.3 | % | | 6.2 | % | | 17.5 | % |

| | | | | | |

1Excludes share-based compensation, depreciation and amortization, and restatement and other costs. |

©2015 Accretive Health Inc.1 Financial Results Conference Call Exhibit 99.2 EDITABLE CONTENT June 23, 2015

©2015 Accretive Health Inc.2 Safe Harbor This presentation contains forward-looking statements, including the Company’s ability to generate specified levels of cash from contracting activities, reduce the cost of customers’ revenue cycle operations, maximize appropriate fee-for- service revenue, and become current with its SEC filings. All forward-looking statements contained in this presentation involve risks and uncertainties. The Company’s actual results and outcomes could differ materially from those anticipated in these forward-looking statements as a result of various factors, including the factors set forth in our Annual Report on Form 10-K for the year ended December 31, 2014, filed with the SEC on June 23, 2015, under the heading “Risk Factors”. The words “strive,” “objective,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “vision,” “would,” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. The Company has based these forward-looking statements on its current expectations and projections about future events. Although the Company believes that the expectations underlying any of its forward-looking statements are reasonable, these expectations may prove to be incorrect and all of these statements are subject to risks and uncertainties. Should one or more of these risks and uncertainties materialize, or should underlying assumptions, projections, or expectations prove incorrect, actual results, performance, financial condition, or events may vary materially and adversely from those anticipated, estimated, or expected. All forward-looking statements included in this presentation are expressly qualified in their entirety by these cautionary statements. The Company cautions readers not to place undue reliance on any forward-looking statement that speaks only as of the date made and to recognize that forward-looking statements are predictions of future results, which may not occur as anticipated. Actual results could differ materially from those anticipated in the forward-looking statements and from historical results, due to the uncertainties and factors described above, as well as others that the Company may consider immaterial or does not anticipate at this time. Although the Company believes that the expectations reflected in its forward-looking statements are reasonable, the Company does not know whether its expectations may prove correct. The Company’s expectations reflected in its forward-looking statements can be affected by inaccurate assumptions it might make or by known or unknown uncertainties and factors, including those described above. The risks and uncertainties described above are not exclusive, and further information concerning the Company and its business, including factors that potentially could materially affect its financial results or condition or relationships with customers and potential customers, may emerge from time to time. The Company assumes no, and it specifically disclaims any, obligation to update, amend, or clarify forward-looking statements to reflect actual results or changes in factors or assumptions affecting such forward-looking statements. The Company advises investors, however, to consult any further disclosures it makes on related subjects in our periodic reports that it files with or furnishes to the SEC.

©2015 Accretive Health Inc.3 Emad Rizk, M.D. President & CEO

©2015 Accretive Health Inc.4 Agenda CEO Perspectives square4 Improved operating performance and execution square4 Expanding our capabilities square4 Market dynamics and demand for our services CFO Perspectives square4 Status of SEC filings and stock exchange listing square4 Review of 2014 results square4 2015 outlook and preliminary 1Q’15 results Q&A

©2015 Accretive Health Inc.5 Operating Performance has Improved Implementing discipline and operating rigor across the organization Performance has improved 21 core metrics correlated to hospital financial performance 20 of 21 metrics showed year-over-year % improvement in most recent quarter 16 of 21 metrics showed double-digit % improvement y/y in most recent quarter Focused on delivering predictable and consistent results for our customers

©2015 Accretive Health Inc.6 We Are Expanding our Capabilities and Platform New shared service center in Michigan • Increases capacity to serve customers • Provides scalable infrastructure as we grow the business Investing in technology and analytical capabilities Tools to assist providers with managing value- based payments Improving the Flexibility of Our Offerings • Developing modular solutions targeting specific components of revenue cycle • Expanding beyond our end-to-end offering

©2015 Accretive Health Inc.7 Revenue Cycle is a Top Priority for Providers square4 Reimbursement pressure from Commercial & Government Payers square4 Department of Health & Human Services announced a roadmap to shift volume from fee-for-service to fee-for-value square4 Health systems continue to consolidate but standardization is lacking Providers need deeper insight into reimbursement dynamics across entire care continuum

©2015 Accretive Health Inc.8 Sales Traction is Building square4 Emerging from a challenging period as a stronger company square4 Pipeline is building; assessments are underway square4 Customer retention and growth is top priority Combination of software, services and analytics Proven methodology and tools Independent organization with no conflicts of interest Co-governance model Our Competitive Positioning is Strong

©2015 Accretive Health Inc.9 Peter Csapo Chief Financial Officer & Treasurer

©2015 Accretive Health Inc.10 Expected Timeline of Upcoming Events and Filings 2014 SEC filings Today Formally apply for stock exchange listing After current with SEC filings 1Q’15 10-Q filing July Annual shareholder meeting August 14th Ongoing: Remediate internal control deficiencies 2Q’15 10-Q filing Early August

©2015 Accretive Health Inc.11 From RCM Contract to Cash to GAAP Revenue Deferred customer billings include the portion of services delivered which have not yet met revenue recognition criteria

©2015 Accretive Health Inc.12 Non-GAAP Measures Gross Cash Generated from Customer Contracting Activities GAAP revenue plus change in deferred customer billings Net Cash Generated from Customer Contracting Activities GAAP net income less interest, taxes, depreciation and amortization expense, share-based compensation, restatement-related expenses, reorganization-related expenses and certain non-recurring items, plus change in deferred customer billings We use two non-GAAP measures to supplement GAAP measures

©2015 Accretive Health Inc.13 2014 Results (Non-GAAP) ($ in millions) Y/Y Variance %Fav/(Unfav.) KeyDriver(s) Gross Cash Generated $233.6 (7.2%) • Contraction of PAS business Cost of Services $170.9 0.3% • Lower volumes in PAS business SG&A $54.9 15.2% • Cost reduction initiatives Net Cash Generated $7.8 (50.1%) • Contraction of PAS business • Benefit from settlement in 2013 CapEx $6.0 N/A • Increased investment in IT and shared services centers' capabilities Restatement and other costs $86.8 N/M • Restatement • Restructuring/reorganization actions

©2015 Accretive Health Inc.14 1Q’15 Preliminary Results (Non-GAAP) ($ in millions) 1Q’14 (Actual) 1Q’15* (Preliminary) Key change driver(s) Gross Cash Generated $57.5 $53 - $55 • Continued pressure in PAS business Cost of Services $42.3 $40 - $42 • Lower volumes in PAS business SG&A $13.8 $12 - $13 • Restructuring and cost reduction initiatives Net Cash Generated $1.4 $1 - $3 • Combination of above factors CapEx $1.2 $1.5 - $2.5 • IT infrastructure Restatement and other costs $35.3 $1 - $2 • Completion of restatement * On a GAAP basis Company expects net services revenue of $9 million to $11 million and a net loss of $29 million to $31 million

©2015 Accretive Health Inc.15 2015 Guidance (Non-GAAP) ($ in millions) 2015 Gross Cash Generated $230 - $240 Cost of Services $150 - $160 SG&A $50 - $60 Net Cash Generated $30 - $40 CapEx $12 - $16 Restatement and other costs $6 - $9

©2015 Accretive Health Inc.16 Questions and Answers

©2015 Accretive Health Inc.17 Appendix

©2015 Accretive Health Inc.18 Use of Non-GAAP Financial Measures In order to provide a more comprehensive understanding of the information used by Accretive Health’s management team in financial and operational decision making, the Company supplements its GAAP consolidated financial statements with certain non-GAAP financial measures, which are included in this presentation. These include gross and net cash generated from customer contracting activities, and adjusted EBITDA. Our Board and management team use these non-GAAP measures as (i) one of the primary methods for planning and forecasting overall expectations and for evaluating actual results against such expectations; and (ii) as a performance evaluation metric in determining achievement of certain executive incentive compensation programs, as well as for incentive compensation plans for employees. Gross cash generated from customer contracting activities is defined as GAAP net services revenue, plus the change in deferred customer billings. Accordingly, gross cash generated from customer contracting activities is the sum of (i) invoiced or accrued net operating fees, (ii) cash collections on incentive fees and (iii) other services fees. Net cash generated from customer contracting activities reflects non-GAAP adjusted EBITDA and the change in deferred customer billings. Adjusted EBITDA is defined as net income before net interest income (expense), income tax provision, depreciation and amortization expense, share-based compensation, restatement-related expense, reorganization-related expense and certain non-recurring items. The use of adjusted EBITDA to measure operating and financial performance is limited by our revenue recognition criteria, pursuant to which GAAP net services revenue is recognized at the end of a contract or other contractual agreement event. Adjusted EBITDA does not adequately match corresponding cash flows from customer contracting activities. As a result, the Company uses gross cash and net cash generated from customer contracting activities to better compare cash flows to operating performance. Deferred customer billings include the portion of both (i) invoiced or accrued net operating fees and (ii) cash collections of incentive fees, in each case, that have not met our revenue recognition criteria. Deferred customer billings are included in the detail of our customer liabilities balance in the consolidated balance sheet available in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014. Slide 20 presents a reconciliation of GAAP revenue to gross cash generated from customer contracting activities, and slide 21 presents a reconciliation of GAAP net income (loss), the most comparable GAAP measure, to adjusted EBITDA and net cash generated from customer contracting activities, in each case, for each of the periods indicated. These adjusted measures are non-GAAP and should be considered in addition to, but not as a substitute for, the information prepared in accordance with GAAP.

©2015 Accretive Health Inc.19 Consolidated Statement of Operations - GAAP ($ in thousands, except per share data) Year Ended December 31, 2014 2013 2012 Net services revenue $ 210,140 $ 504,768 $ 72,254 Operating expenses: Cost of services 182,144 186,752 188,666 Selling, general and administrative 69,883 79,951 67,750 Restatement and other 86,766 33,963 3,714 Total operating expenses 338,793 300,666 260,130 Income (loss) from operations (128,653) 204,102 (187,876) Net interest income 302 330 141 Income (loss) before income tax provision (128,351) 204,432 (187,735) Income tax provision (benefit) (48,731) 74,349 (67,995) Net income (loss) $ (79,620) $ 130,083 $ (119,740) Net income (loss) per common share: Basic $ (0.83) $ 1.36 $ (1.21) Diluted $ (0.83) $ 1.34 $ (1.21) Weighted average shares used in calculating net income (loss) per common share: Basic 95,760,762 95,687,940 98,602,099 Diluted 95,760,762 96,845,664 98,602,099

©2015 Accretive Health Inc.20 Reconciliation of GAAP revenue to Gross Cash Generated from Customer Contracting Activities ($ in thousands) Year Ended December 31, 2014 2013 2012 Consolidated Statement of Operations Data: RCM services: net operating fees $ 77,456 $ 224,937 $ 9,888 RCM services: incentive fees 99,934 210,303 928 Other service fees 32,750 69,528 61,438 Total net services revenue 210,140 504,768 72,254 Change in deferred customer billings 23,427 (253,127) 200,114 Gross cash generated from customer contracting activities $ 233,567 $ 251,641 272,368 RCM services: net operating fees $ 121,730 $ 106,453 118,030 RCM services: incentive fees 77,239 75,660 92,900 Other service fees 34,598 69,528 61,438 Gross cash generated from customer contracting activities $ 233,567 $ 251,641 $ 272,368

©2015 Accretive Health Inc.21 Reconciliation of GAAP net income (loss) to Net Cash Generated from Customer Contracting Activities ($ in thousands) Year Ended December 31, 2014 2013 2012 Net income (loss) $ (79,620) $ 130,083 $ (119,740) Net interest income (302) (330) (141) Income tax provision (benefit) (48,731) 74,349 (67,995) Depreciation and amortization expense 6,047 6,823 6,355 Share-based compensation expense 20,172 23,801 25,298 Restatement and other 86,766 33,963 3,714 Adjusted EBITDA (15,668) 268,689 (152,509) Change in deferred customer billings 23,427 (253,127) 200,114 Net cash generated from customer contracting activities $ 7,759 $ 15,562 $ 47,605

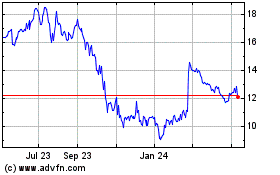

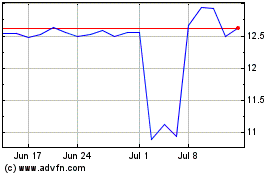

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

From Mar 2024 to Apr 2024

R1 RCM (NASDAQ:RCM)

Historical Stock Chart

From Apr 2023 to Apr 2024