UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 22, 2015

NN, INC.

(Exact name of

registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

0-23486 |

|

62-1096725 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

| 207 Mockingbird Lane |

|

37604 |

| (Address of principal executive offices) |

|

(Zip Code) |

(423) 743-9151

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d- 2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

The Company has announced the commencement of a follow-on offering of

6,000,000 shares of its common stock led by KeyBanc Capital Markets Inc. as sole book-running manager. William Blair & Company, L.L.C., Stephens Inc., Stifel, Nicholaus, & Company, Incorporated, Avondale Partners, LLC, CJS

Securities, Inc. and Regions Securities LLC are serving as co-managers in connection with the offering.

More detailed information on the

equity offering can be found in the preliminary prospectus supplement and accompanying prospectus relating to the equity offering that were filed today with the U.S. Securities and Exchange Commission.

| ITEM 9.01 |

FINANCIAL STATEMENTS AND EXHIBITS |

(d) Exhibits.

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release of NN, Inc. dated June 22, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date: June 22, 2015

|

|

|

| NN, INC. |

|

|

| By: |

|

/s/ William C. Kelly, Jr. |

| Name: |

|

William C. Kelly, Jr. |

| Title: |

|

Vice President and Chief Administrative Officer |

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release of NN, Inc. dated June 22, 2015. |

Exhibit 99.1

|

|

|

|

|

RE: NN, Inc. |

|

|

207 Mockingbird Lane |

|

|

3rd Floor |

|

|

Johnson City, TN 37604 |

|

|

| FOR FURTHER INFORMATION: |

|

|

|

|

| AT THE COMPANY |

|

AT FINANCIAL RELATIONS BOARD |

| Robbie Atkinson |

|

Marilynn Meek |

| Corporate Treasurer & Investor Relations |

|

(General info) |

| (423) 434-8398 |

|

212-827-3773 |

FOR IMMEDIATE RELEASE

June 22, 2015

NN, INC. ANNOUNCES PUBLIC

OFFERING OF COMMON STOCK

Johnson City, Tennessee, June 22, 2015 –NN, Inc., (NASDAQ: NNBR) a diversified industrial company, today

announced that it is commencing an underwritten registered public offering of 6,000,000 shares of its common stock. In connection with this offering, NN expects to grant the underwriters a 30-day option to purchase up to an additional 900,000

shares. There can be no assurance as to whether or when the offering may be completed, or as to the actual size or terms of the offering.

NN intends to

use the net proceeds from the offering to repay debt under its term loan and asset-backed revolving credit facility, and the remainder of the net proceeds will be used for other general corporate purposes, including to fund acquisitions and

investments, to finance capital expenditures, to repay or refinance other borrowings and to provide working capital.

KeyBanc Capital Markets Inc. is

acting as sole book-running manager for the offering and William Blair & Company, L.L.C., Stephens Inc., Stifel, Nicholaus, & Company, Incorporated, Avondale Partners, LLC, CJS Securities, Inc. and Regions Securities LLC are acting

as co-managers.

The shares are being offered pursuant to a shelf registration statement on Form S-3 filed with the Securities Exchange Commission on

December 29, 2014 and declared effective on February 23, 2015. A preliminary prospectus supplement and accompanying prospectus relating to the offering have been filed with the SEC. A copy of the preliminary prospectus supplement and

accompanying prospectus relating to the offering are available on the SEC’s website at www.sec.gov. Copies may also be obtained from KeyBanc Capital Markets Inc., Attention: Equity Syndicate, 127 Public Square, 4th Floor, Cleveland, Ohio 44114

or by telephone at (800) 859-1783.

This press release shall not constitute an offer to sell or a solicitation of an offer to buy these securities,

nor shall there be any sale of these securities in any state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such state or other

jurisdiction.

NN, Inc., a diversified industrial company manufactures and supplies high precision metal bearing components,

industrial plastic and rubber products and precision metal components to a variety of markets on a global basis. Headquartered in Johnson City, Tennessee, NN has 26 manufacturing plants in the United States, Western Europe, Eastern Europe, South

America and China.

Except for specific historical information, many of the matters discussed in this press release may express or imply projections of

revenues or expenditures, statements of plans and objectives or future operations or statements of future economic performance. These, and similar statements, are forward-looking statements concerning matters that involve risks, uncertainties and

other factors which may cause the actual performance of NN, Inc. and its subsidiaries to differ materially from those expressed or implied by this discussion. All forward-looking information is provided by the Company pursuant to the safe harbor

established under the Private Securities Litigation Reform Act of 1995 and should be evaluated in the context of these factors. Forward-looking statements generally can be identified by the use of forward-looking terminology such as

“assumptions”, “target”, “guidance”, “outlook”, “plans”, “projection”, “may”, “will”, “would”, “expect”, “intend”, “estimate”,

“anticipate”, “believe”, “potential” or “continue” (or the negative or other derivatives of each of these terms) or similar terminology. Factors which could materially affect actual results include, but are

not limited to: general economic conditions and economic conditions in the industrial sector, inventory levels, regulatory compliance costs and the Company’s ability to manage these costs, start-up costs for new operations, debt reduction,

competitive influences, risks that current customers will commence or increase captive production, risks of capacity underutilization, quality issues, availability and price of raw materials, currency and other risks associated with international

trade, the Company’s dependence on certain major customers, and the successful implementation of the global growth plan including development of new products. Similarly, statements made herein and elsewhere regarding pending or completed

acquisitions are also forward-looking statements, including statements relating to the anticipated closing date of an acquisition, the Company’s ability to obtain required regulatory approvals or satisfy closing conditions, the costs of an

acquisition and the Company’s source(s) of financing, the future performance and prospects of an acquired business, the expected benefits of an acquisition on the Company’s future business and operations and the ability of the Company to

successfully integrate recently acquired businesses.

For additional information concerning such risk factors and cautionary statements, please see

the section titled “Risk Factors” in the Company’s periodic reports filed with the Securities and Exchange Commission, including, but not limited to, the Company’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2014. Except as required by law, we undertake no obligation to update or revise any forward-looking statements we make in our press releases, whether as a result of new information, future events or otherwise.

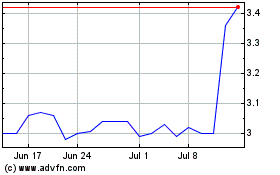

NN (NASDAQ:NNBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

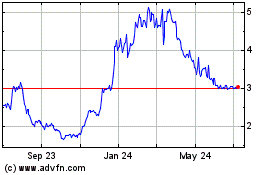

NN (NASDAQ:NNBR)

Historical Stock Chart

From Apr 2023 to Apr 2024