UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE

SECURITIES EXCHANGE ACT OF 1934

DATE

OF REPORT: June 22, 2015

DATE

OF EARLIEST EVENT REPORTED: June 22, 2015

001-35922

(Commission

file number)

PEDEVCO

CORP.

(Exact

name of registrant as specified in its charter)

| Texas |

|

22-3755993 |

(State

or other jurisdiction of

incorporation or organization) |

|

(IRS

Employer

Identification No.) |

4125

Blackhawk Plaza Circle, Suite 201

Danville,

California 94506

(Address

of principal executive offices)

(855)

733-2685

(Issuer’s

telephone number)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

[X] Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[X] Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

ITEM

8.01 OTHER EVENTS.

On

June 22, 2015, PEDEVCO Corp. (the “Company”) issued a press release announcing its participation in seven new wells

located in the Wattenberg Area of Weld County, Colorado, and the Company’s plans to fund its participation through a funding

arrangement to be entered into with Dome Energy AB and/or other parties. A copy of the press

release is furnished as Exhibit 99.1 hereto.

The

information responsive to Item 8.01 of this Form 8-K and Exhibit 99.1 attached hereto, shall not be deemed “filed”

for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that section, nor shall it be deemed

incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly

set forth by specific reference in such a filing.

ITEM

9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

| Exhibit

No. |

|

Description |

| |

|

|

| 99.1* |

|

Press Release,

dated June 22, 2015 |

* Furnished

herewith.

Important

Information

In

connection with the proposed business combination between PEDEVCO Corp. (“PEDEVCO”) and Dome Energy, Inc.,

a wholly-owned subsidiary of DOME Energy AB (“Dome Energy”), PEDEVCO currently intends to file a registration

statement containing a proxy statement/prospectus with the Securities and Exchange Commission (the “SEC”).

This communication is not a substitute for any proxy statement, registration statement, proxy statement/prospectus or other document

PEDEVCO may file with the SEC in connection with the proposed transaction. Prospective investors are urged to read the registration

statement and the proxy statement/prospectus, when filed as it will contain important information. Any definitive proxy statement(s)

(if and when available) will be mailed to stockholders of PEDEVCO and Dome Energy (as applicable). Prospective investors may obtain

free copies of the registration statement and the proxy statement/prospectus, when filed, as well as other filings containing

information about PEDEVCO, without charge, at the SEC’s website (www.sec.gov). Copies of PEDEVCO’s SEC filings may

also be obtained from PEDEVCO without charge at PEDEVCO’s website (www.pacificenergydevelopment.com) or by directing a request

to PEDEVCO at (855) 733-3826. This document does not constitute an offer to sell or the solicitation of an offer to buy any securities

or a solicitation of any vote or approval nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

INVESTORS

SHOULD READ THE PROSPECTUS/PROXY STATEMENT AND OTHER DOCUMENTS TO BE FILED WITH THE SEC CAREFULLY BEFORE MAKING A DECISION CONCERNING

THE MERGER.

Participants

in Solicitation

PEDEVCO

and its directors and executive officers and other members of management and employees are potential participants in the solicitation

of proxies in respect of the proposed merger. Information regarding PEDEVCO’s directors and executive officers is available

in PEDEVCO’s Annual Report on Form 10-K for the year ended December 31, 2014, filed with the SEC on March 31, 2015 and PEDEVCO

Corp.’s definitive proxy statement on Schedule 14A, filed with the SEC on May 16, 2014. Additional information regarding

the interests of such potential participants will be included in the registration statement and proxy statement/prospectus to

be filed with the SEC by PEDEVCO and Dome Energy in connection with the proposed combination transaction and in other relevant

documents filed by PEDEVCO with the SEC. These documents can be obtained free of charge from the sources indicated above. Additional

information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by

security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with

the SEC when they become available.

Forward

Looking Statements

Certain

statements in this communication regarding the proposed transaction between PEDEVCO and Dome Energy are “forward-looking”

statements. The words “anticipate,” “believe,” “ensure,” “expect,”

“if,” “intend,” “estimate,” “probable,” “project,”

“forecasts,” “predict,” “outlook,” “aim,” “will,”

“could,” “should,” “would,” “potential,” “may,”

“might,” “anticipate,” “likely” “plan,” “positioned,”

“strategy,” and similar expressions, and the negative thereof, are intended to identify forward-looking statements.

These forward-looking statements, which are subject to risks, uncertainties and assumptions about PEDEVCO and Dome Energy, may

include projections of their respective future financial performance, their respective anticipated growth strategies and anticipated

trends in their respective businesses. These statements are only predictions based on current expectations and projections about

future events. There are important factors that could cause actual results, level of activity, performance or achievements to

differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking

statements, including the risk factors set forth in PEDEVCO’s most recent reports on Form 10-K, Form 10-Q and other documents

on file with the SEC and the factors given below:

● termination

of the proposed combination by either party subject to the terms of the Agreement and Plan of Reorganization;

● failure

to obtain the approval of the shareholders of PEDEVCO or Dome in connection with the proposed transaction;

● the

failure to consummate or delay in consummating the proposed transaction for other reasons;

● the

timing to consummate the proposed transaction;

● the

risk that a condition to closing of the proposed transaction may not be satisfied;

● the

risk that PEDEVCO will be required to pay a $1 million termination fee;

● the

risk that a regulatory approval that may be required for the proposed transaction is delayed, is not obtained, or is

obtained subject to conditions that are not anticipated;

● PEDEVCO’s

ability to achieve the synergies and value creation contemplated by the proposed transaction;

● the

ability of PEDEVCO to effectively integrate Dome’s operations; and

● the

diversion of management time on transaction-related issues.

PEDEVCO’s

forward-looking statements are based on assumptions that PEDEVCO believes to be reasonable but that may not prove to be accurate.

PEDEVCO cannot guarantee future results, level of activity, performance or achievements. Moreover, PEDEVCO does not assume responsibility

for the accuracy and completeness of any of these forward-looking statements. PEDEVCO assumes no obligation to update or revise

any forward-looking statements as a result of new information, future events or otherwise, except as may be required by law. Readers

are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

| |

PEDEVCO

CORP. |

| |

|

|

| Date:

June 22, 2015 |

By: |

/s/

Frank C. Ingriselli |

| |

|

Frank C.

Ingriselli |

| |

|

Chairman and Chief

Executive Officer |

EXHIBIT

INDEX

| Exhibit

No. |

|

Description |

| |

|

|

| 99.1* |

|

Press Release,

dated June 22, 2015 |

* Furnished

herewith.

Pacific

Energy Development Announces Participation in Seven New Wattenberg Wells

Danville,

CA, Monday, June 22, 2015 – PEDEVCO Corp. d/b/a Pacific Energy Development (NYSE MKT: PED) (the “Company”)

announced today that it has recently elected to participate for its full 25% working interest in seven horizontal wells planned

to be drilled and completed by a third party operator in the Wattenberg Area of Weld County, Colorado, which wells are expected

to commence drilling in June 2015. These horizontal wells will be located in the same area that the three Pronghorn wells operated

by Bonanza Creek are located, in which wells the Company also holds a 25% working interest. These first three Pronghorn wells

are among the Company’s best performing wells in the D-J Basin, yielding 24-hour peak initial production rates as estimated

by the Company of 529.2 BOE/D (459 Bbl oil and 421 Mcf/d gas), 556.2 BOE/D (458.7 Bbl oil and 585 Mcf/d gas), and 542.6 BOE/D

(459.2 Bbl oil and 500 Mcf/d gas).

The Company

plans to fund these wells through entry into a funding arrangement with Dome Energy AB (“Dome”), the Swedish company

with which the Company has recently entered into an Agreement and Plan of Reorganization, and/or other parties, which funding

arrangement is planned to provide for the full funding of these wells.

Commenting

on these wells and the anticipated funding arrangement with Dome, Mr. Frank Ingriselli, the Company’s Chairman and Chief

Executive Officer, stated: “We are very excited to participate in these seven additional Pronghorn wells given that our

first three Pronghorn wells in this same section yielded such outstanding production rates. We are equally pleased to be working

with Dome Energy to structure funding arrangements, with the goal of costing Pacific Energy Development nothing out of pocket.

We believe that this planned transaction with Dome will further unify our interests and demonstrates how we believe the combined

company will be able to capitalize on development opportunities going forward.”

About

Pacific Energy Development (PEDEVCO Corp.)

PEDEVCO

Corp, d/b/a Pacific Energy Development (NYSE MKT: PED), is a publicly-traded energy company engaged in the acquisition and development

of strategic, high growth energy projects, including shale oil and gas assets, in the United States. The Company’s principal

asset is its D-J Basin Asset located in the D-J Basin in Colorado. Pacific Energy Development is headquartered in Danville, California,

with an operations office in Houston, Texas.

Cautionary

Statement Regarding Forward Looking Statements

All statements

in this press release that are not based on historical fact are “forward-looking statements” within the meaning of

the Private Securities Litigation Reform Act of 1995 and the provisions of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. While management has based any forward-looking statements

contained herein on its current expectations, the information on which such expectations were based may change. These forward-looking

statements rely on a number of assumptions concerning future events and are subject to a number of risks, uncertainties, and other

factors, many of which are outside of the Company’s control, that could cause actual results to materially differ from such

statements. Such risks, uncertainties, and other factors include, but are not necessarily limited to, those set forth under Item

1A “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014. The Company

operates in a highly competitive and rapidly changing environment, thus new or unforeseen risks may arise. Accordingly, investors

should not place any reliance on forward-looking statements as a prediction of actual results. The Company disclaims any intention

to, and undertakes no obligation to, update or revise any forward-looking statements. Readers are also urged to carefully review

and consider the other various disclosures in the Company’s public filings with the SEC.

Important

Information

In connection

with the proposed business combination between PEDEVCO Corp. (“PEDEVCO”) and Dome Energy, Inc., a wholly-owned

subsidiary of DOME Energy AB (“Dome”), PEDEVCO currently intends to file a registration statement containing

a proxy statement/prospectus with the Securities and Exchange Commission (the “SEC”). This communication is

not a substitute for any proxy statement, registration statement, proxy statement/prospectus or other document PEDEVCO may file

with the SEC in connection with the proposed transaction. Prospective investors are urged to read the registration statement and

the proxy statement/prospectus, when filed as it will contain important information. Any definitive proxy statement(s) (if and

when available) will be mailed to stockholders of PEDEVCO and Dome (as applicable). Prospective investors may obtain free copies

of the registration statement and the proxy statement/prospectus, when filed, as well as other filings containing information

about PEDEVCO, without charge, at the SEC’s website (www.sec.gov). Copies of PEDEVCO’s SEC filings may also be obtained

from PEDEVCO without charge at PEDEVCO’s website (www.pacificenergydevelopment.com) or by directing a request to PEDEVCO

at (855) 733-3826. This document does not constitute an offer to sell or the solicitation of an offer to buy any securities or

a solicitation of any vote or approval nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

INVESTORS

SHOULD READ THE PROSPECTUS/PROXY STATEMENT AND OTHER DOCUMENTS TO BE FILED WITH THE SEC CAREFULLY BEFORE MAKING A DECISION CONCERNING

THE MERGER.

Participants

in Solicitation

PEDEVCO

and its directors and executive officers and other members of management and employees are potential participants in the solicitation

of proxies in respect of the proposed merger. Information regarding PEDEVCO’s directors and executive officers is available

in PEDEVCO’s Annual Report on Form 10-K for the year ended December 31, 2014, filed with the SEC on March 31, 2015 and PEDEVCO

Corp.’s definitive proxy statement on Schedule 14A, filed with the SEC on May 16, 2014. Additional information regarding

the interests of such potential participants will be included in the registration statement and proxy statement/prospectus to

be filed with the SEC by PEDEVCO and Dome in connection with the proposed combination transaction and in other relevant documents

filed by PEDEVCO with the SEC. These documents can be obtained free of charge from the sources indicated above. Additional information

regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings

or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when they

become available.

Contacts

Bonnie Tang

Pacific

Energy Development

1-855-733-3826

ext. 21 (Media)

PR@pacificenergydevelopment.com

Investor

Relations:

Stonegate,

Inc.

Casey Stegman

1-214-987-4121

casey@stonegateinc.com

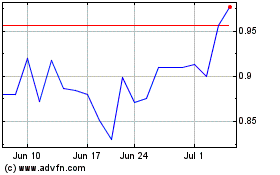

PEDEVCO (AMEX:PED)

Historical Stock Chart

From Mar 2024 to Apr 2024

PEDEVCO (AMEX:PED)

Historical Stock Chart

From Apr 2023 to Apr 2024