UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15 (d) of The Securities Exchange Act of 1934

Date of Report: June 19, 2015

(Date of earliest event reported)

KB HOME

(Exact name of registrant as specified in charter)

|

| | | | |

| | | | |

Delaware | | 1-9195 | | 95-3666267 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | |

10990 Wilshire Boulevard, Los Angeles, California | | 90024 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (310) 231-4000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On June 19, 2015, KB Home issued a press release announcing its results of operations for the three months and six months ended May 31, 2015. A copy of the press release is furnished as Exhibit 99.1 to this report and is incorporated herein.

The information in this report, including Exhibit 99.1 attached hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| |

99.1 | Press release dated June 19, 2015 announcing KB Home’s results of operations for the three months and six months ended May 31, 2015. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: June 19, 2015

|

| | | |

| KB Home |

| |

By: | /s/ Jeff J. Kaminski |

| Jeff J. Kaminski |

| Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

| | |

99.1 | | Press release dated June 19, 2015, announcing KB Home’s results of operations for the three months and six months ended May 31, 2015. |

|

| | |

FOR RELEASE, Friday, June 19, 2015 | | For Further Information Contact: |

5:30 a.m. Pacific Daylight Time | | Katoiya Marshall, Investor Relations Contact |

| | (310) 893-7446 or kmarshall@kbhome.com |

| | Susan Martin, Media Contact |

| | (310) 231-4142 or smartin@kbhome.com |

KB HOME REPORTS 2015 SECOND QUARTER RESULTS

Net Orders Up 33%; Net Order Value Up 38% to $1.1 Billion

Backlog Value Increases to $1.6 Billion

LOS ANGELES (June 19, 2015) — KB Home (NYSE: KBH), one of the nation’s largest and most recognized homebuilders, today reported results for its second quarter ended May 31, 2015. Highlights and developments include the following:

Three Months Ended May 31, 2015

| |

• | Total revenues of $623.0 million grew 10% from $565.0 million in the year-earlier quarter, extending the Company’s trend of year-over-year revenue increases to 15 consecutive quarters. The current quarter revenue growth was driven by increases in the Company’s housing and land sale revenues. |

| |

◦ | Housing revenues rose 8% to $604.9 million from $559.8 million for the year-earlier quarter, reflecting expanded delivery volume and a higher overall average selling price. |

| |

▪ | The Company delivered 1,787 homes, up 2% from 1,751 homes in the year-earlier quarter. |

| |

▪ | The overall average selling price of homes delivered advanced 6% to $338,500, compared to $319,700 for the corresponding period of 2014. Average selling prices increased in the Company’s West Coast, Central and Southeast regions, while its Southwest region’s average selling price was essentially even. |

| |

◦ | Land sale revenues increased to $15.9 million from $2.6 million a year ago, reflecting sales in three of the Company’s four regions. |

| |

• | Homebuilding operating income totaled $17.9 million, compared to $34.3 million in the 2014 second quarter. |

Housing gross profits of $96.6 million declined $9.1 million from $105.7 million in the year-earlier quarter. Land sales had minimal impact on operating income for the second quarters of 2015 and 2014.

| |

◦ | The Company’s housing gross profit margin of 16.0% decreased 290 basis points from 18.9% in the year-earlier quarter. On a sequential basis, the housing gross profit margin improved 90 basis points from the first quarter of 2015. |

| |

▪ | The year-over-year decline in the housing gross profit margin was primarily due to higher land and construction costs, increased pricing pressure in certain markets, start-up field costs associated with new community openings, and an increase in the amortization of previously capitalized interest. |

| |

▪ | Excluding the amortization of previously capitalized interest and land option contract abandonment charges in each period, which had a combined year-over-year impact of 60 basis points, the Company’s second quarter adjusted housing gross profit margin was 20.3% in 2015 and 22.6% in 2014. |

| |

◦ | Selling, general and administrative expenses rose year over year mainly due to higher staffing levels and community opening-related expenses in connection with the Company’s community count expansion strategy and to support delivery growth anticipated for the second half of 2015. As a percentage of housing revenues, selling, general and administrative expenses increased slightly to 13.0% from 12.8% for the prior-year quarter. Compared to the first quarter of 2015, this ratio improved 50 basis points. |

| |

• | Interest expense decreased to $8.1 million from $8.6 million in the year-earlier quarter, with an increase in interest incurred, stemming from a higher debt level, more than offset by a greater amount of interest capitalized due to an increase in qualifying inventory in the current quarter. |

| |

• | Financial services operations generated pretax income of $3.2 million, rising 82% from $1.8 million in the year-earlier quarter. The current quarter results included $2.0 million of pretax income from Home Community Mortgage, LLC, the Company’s mortgage banking joint venture with Nationstar Mortgage LLC, which commenced operations in July 2014. |

| |

• | Net income totaled $9.6 million, or $.10 per diluted share, compared to $26.6 million, or $.27 per diluted share, for the second quarter of 2014. |

| |

◦ | Income tax expense increased to $3.1 million from $.3 million in the year-earlier quarter. Income tax expense for the 2014 second quarter reflected the Company’s full deferred tax asset valuation allowance, which was substantially reversed in the fourth quarter of 2014. |

| |

▪ | Income tax expense in the current quarter was reduced by $1.7 million of federal energy tax credits the Company earned from building high-efficiency homes, resulting in an effective tax rate of 24.5%. |

Six Months Ended May 31, 2015

| |

• | Total revenues rose to $1.20 billion, up 18% from $1.02 billion in the year-earlier period. |

| |

• | Homes delivered increased 6% to 3,380, compared to 3,193 homes delivered in the six months ended May 31, 2014. |

| |

• | The overall average selling price of $334,200 increased 7% from $313,200 for the year-earlier period. |

| |

• | Homebuilding operating income was $32.3 million, compared to $52.0 million in the corresponding period of 2014. |

| |

• | Net income totaled $17.4 million, or $.18 per diluted share, compared to $37.2 million, or $.40 per diluted share for the year-earlier period. |

| |

◦ | Income tax expense was $5.8 million versus $.5 million for the six months ended May 31, 2014, with the 2014 period impacted by the Company’s full deferred tax asset valuation allowance, which was largely reversed at the end of 2014. |

Backlog and Net Orders

| |

• | Potential future housing revenues in backlog grew 57% to $1.61 billion at May 31, 2015, from $1.03 billion at May 31, 2014, reflecting substantial year-over-year increases in each of the Company’s four regions. These increases ranged from 38% in its Central region, which mainly consists of the Company’s operations in Texas, to 199% in its Southwest region. |

| |

◦ | The Company’s backlog at May 31, 2015 increased 39% to 4,733 homes, compared to 3,398 homes in backlog at May 31, 2014. |

| |

◦ | The number of homes in backlog and corresponding backlog value at May 31, 2015 reached their highest second-quarter levels since 2008 and 2007, respectively. |

| |

• | The value of net orders generated in the current quarter rose 38% to $1.05 billion from $763.2 million in the year-earlier period, marking the Company’s 13th consecutive quarter of year-over-year increases. |

| |

◦ | Each of the Company’s four regions generated year-over-year growth in net order value, ranging from 23% in its Central region to 165% in its Southwest region. |

| |

• | Net orders grew 33% to 3,015 in the current quarter, compared to 2,269 in the year-earlier quarter, largely driven by expansion in the Company’s average community count. |

| |

◦ | The cancellation rate as a percentage of gross orders improved to 22% from 28% in the second quarter of 2014, and as a percentage of beginning backlog was 25% versus 30% a year ago. |

| |

• | The Company’s overall average community count for the second quarter increased 30% to 248 from 191 for the year-earlier quarter. |

| |

◦ | The Company ended the current quarter with 261 communities open for sales, up 35% from 194 communities a year ago. On a sequential basis, the current quarter ending community count increased 11% from the first quarter of 2015. |

Balance Sheet

| |

• | Cash, cash equivalents and restricted cash increased to $467.1 million at May 31, 2015, compared to $383.6 million at November 30, 2014, largely due to proceeds received from a senior notes offering completed in the 2015 first quarter, partly offset by cash used in operating activities. |

| |

◦ | The Company’s investments in land acquisition and development totaled $454.7 million for the six months ended May 31, 2015 and $859.6 million for the corresponding period of 2014. |

| |

◦ | The Company had no cash borrowings outstanding under its $200 million unsecured revolving credit facility at May 31, 2015. |

| |

• | Inventories increased to $3.39 billion at May 31, 2015 from $3.22 billion at November 30, 2014, reflecting the Company’s investments in land acquisition and development during the year. |

| |

◦ | At May 31, 2015, the Company maintained a geographically diverse land pipeline comprised of 49,905 lots, with 41,191 lots owned and 8,714 lots controlled under land option contracts. |

| |

• | Notes payable of $2.82 billion at May 31, 2015 rose from $2.58 billion at November 30, 2014, due to the Company’s first quarter underwritten public issuance of $250 million in aggregate principal amount of senior notes. |

| |

◦ | Subsequent to the end of the second quarter, on June 15, 2015, the Company repaid the remaining $199.9 million in aggregate principal amount of its 6 1/4% senior notes at their maturity. |

| |

◦ | The Company’s ratio of debt to capital was 63.6% as of May 31, 2015, compared to 61.8% as of November 30, 2014. The ratio of net debt to capital was 59.3% at May 31, 2015 and 57.9% at November 30, 2014. |

Management Comments

“Our strong net order performance during the spring selling season underscores the success of our community expansion initiative and the broad appeal of our products and distinctive home-buying experience, as well as healthy demand in our served markets,” said Jeffrey Mezger, president and chief executive officer of KB Home. “With the positive momentum we have generated across our business, we ended the second quarter with significantly higher backlog levels in each of our four regions relative to a year ago, providing excellent visibility on our deliveries and revenues for the remainder of the year. We are confident that we have the strategic drivers

in place to produce measurable year-over-year earnings growth in the second half of 2015 as we realize higher revenues from our larger operational platform and anticipate generating further sequential margin improvement from our recently opened communities and additional scale as the year progresses.”

Earnings Conference Call

The conference call on the second quarter 2015 earnings will be broadcast live TODAY at 8:30 a.m. Pacific Daylight Time, 11:30 a.m. Eastern Daylight Time. To listen, please go to the Investor Relations section of the Company’s website at www.kbhome.com.

About KB Home

KB Home is one of the largest and most recognized homebuilding companies in the United States. Since its founding in 1957, the company has built more than half a million quality homes. KB Home's unique homebuilding approach lets each buyer customize their new home from lot location to floor plan and design features. As a leader in utilizing state-of-the-art sustainable building practices, all KB homes are highly energy efficient and meet strict ENERGY STAR® guidelines. This helps to lower monthly utility costs for homeowners, which the company demonstrates with its proprietary KB Home Energy Performance Guide® (EPG®). KB Home has been named an ENERGY STAR Partner of the Year Sustained Excellence Award winner for five straight years and a WaterSense® Partner of the Year for four consecutive years. A FORTUNE 1,000 company, Los Angeles-based KB Home was the first homebuilder listed on the New York Stock Exchange, and trades under the ticker symbol "KBH." For more information about KB Home, call 888-KB-HOMES, visit www.kbhome.com, or connect with KB Home on Facebook.com/KBHome and Twitter.com/KBHome.

Forward-Looking and Cautionary Statements

Certain matters discussed in this press release, including any statements that are predictive in nature or concern future market and economic conditions, business and prospects, our future financial and operational performance, or our future actions and their expected results are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on current expectations and projections about future events and are not guarantees of future performance. We do not have a specific policy or intent of updating or revising forward-looking statements. Actual events and results may differ materially from those expressed or forecasted in forward-looking statements due to a number of factors. The most important risk factors that could cause our actual performance and future events and actions to differ materially from such forward-looking statements include, but are not limited to the following: general economic, employment and business conditions; population growth, household formations and demographic trends; adverse market conditions, including an increased supply of unsold homes, declining home prices and greater foreclosure and short sale activity, among other things, that could negatively affect our consolidated financial statements, including due to additional impairment or land option contract abandonment charges, lower revenues and operating and other losses; conditions in the capital, credit and financial markets (including residential mortgage lending standards, the availability of residential mortgage financing and mortgage foreclosure rates); material prices and availability; subcontracted trade labor costs and availability; changes in interest rates; inflation; our debt level, including our ratio of debt to capital, and our ability to adjust our debt level, maturity schedule and structure and to access the equity, credit, capital or other financial markets or other external financing sources, including raising capital through the public or private issuance of common stock, debt or other securities, and/or project financing, on favorable terms; our compliance with the terms and covenants of our revolving credit facility; weak or declining consumer confidence, either generally or specifically with respect to purchasing homes; competition for home sales from other sellers of new and resale homes, including lenders and other sellers of homes obtained through foreclosures or short sales; weather events, significant natural disasters and other climate and environmental factors, including the severe prolonged serious drought and related water-constrained conditions in the southwest United States and California; government actions, policies, programs and regulations directed at or affecting the housing market (including the Dodd-Frank Act, tax credits, tax incentives and/or subsidies for home purchases, tax deductions for residential mortgage interest payments and property taxes, tax exemptions for profits on home sales, programs intended to modify existing mortgage loans and to prevent mortgage foreclosures and the standards, fees and size limits applicable to the purchase or insuring of mortgage loans by government-sponsored enterprises and government agencies), the homebuilding industry, or construction activities; decisions regarding federal fiscal and monetary policies, including those relating to taxation, government spending, interest rates and economic stimulus measures; the availability and cost of land in desirable areas; our warranty claims experience with respect to homes previously delivered and actual warranty costs incurred, including our warranty claims and costs experience at certain of our communities in Florida; costs and/or charges arising from regulatory compliance requirements or from legal, arbitral or regulatory proceedings, investigations, claims or settlements, including unfavorable outcomes in any such matters resulting in actual or potential monetary damage awards, penalties, fines or other direct or indirect payments, or injunctions, consent decrees or other voluntary or involuntary restrictions or adjustments to our business operations or practices that are beyond our current expectations and/or accruals; our ability to use/realize the net deferred tax assets we have generated; our ability to successfully implement our current and planned strategies and initiatives with respect to product, geographic and market positioning (including our efforts to expand our inventory base/pipeline with desirable land positions or interests at reasonable cost and to expand our community count, open additional new home communities for sales, sell higher-priced homes and more design options, increase the size and value of our backlog, and our operational and investment concentration in markets in California), revenue growth, asset optimization (including by effectively balancing home sales prices and sales pace in our new home communities), asset activation and/or monetization, local field management and talent investment, containing and leveraging overhead costs, gaining share in our served markets and increasing our housing gross profit margins and profitability; consumer traffic to our new home communities and consumer interest in our product designs and offerings, particularly from higher-income consumers; cancellations and our ability to realize our backlog by converting net orders to home deliveries and revenues; our home sales and delivery performance, particularly in key markets in California; our ability to generate cash from our operations, enhance our asset efficiency, increase our operating income margin and/or improve our return on invested capital; the manner in which our homebuyers are offered and whether they are able to obtain residential mortgage loans and mortgage banking services, including from Home Community Mortgage; the performance of Home Community Mortgage; information technology failures

and data security breaches; and other events outside of our control. Please see our periodic reports and other filings with the Securities and Exchange Commission for a further discussion of these and other risks and uncertainties applicable to our business.

# # #

(Tables Follow)

# # #

KB HOME

CONSOLIDATED STATEMENTS OF OPERATIONS

For the Six Months and Three Months Ended May 31, 2015 and 2014

(In Thousands, Except Per Share Amounts — Unaudited)

|

| | | | | | | | | | | | | | | |

| Six Months | | Three Months |

| 2015 | | 2014 | | 2015 | | 2014 |

Total revenues | $ | 1,203,090 |

| | $ | 1,015,694 |

| | $ | 622,969 |

| | $ | 565,007 |

|

Homebuilding: | | | | | | | |

Revenues | $ | 1,198,692 |

| | $ | 1,010,663 |

| | $ | 620,804 |

| | $ | 562,396 |

|

Costs and expenses | (1,166,432 | ) | | (958,652 | ) | | (602,942 | ) | | (528,104 | ) |

Operating income | 32,260 |

| | 52,011 |

| | 17,862 |

| | 34,292 |

|

Interest income | 255 |

| | 283 |

| | 152 |

| | 115 |

|

Interest expense | (13,456 | ) | | (19,834 | ) | | (8,118 | ) | | (8,558 | ) |

Equity in income (loss) of unconsolidated joint ventures | (758 | ) | | 1,912 |

| | (411 | ) | | (678 | ) |

Homebuilding pretax income | 18,301 |

| | 34,372 |

| | 9,485 |

| | 25,171 |

|

Financial services: | | | | | | | |

Revenues | 4,398 |

| | 5,031 |

| | 2,165 |

| | 2,611 |

|

Expenses | (1,892 | ) | | (1,704 | ) | | (928 | ) | | (852 | ) |

Equity in income (loss) of unconsolidated joint ventures | 2,365 |

| | (12 | ) | | 1,951 |

| | (6 | ) |

Financial services pretax income | 4,871 |

| | 3,315 |

| | 3,188 |

| | 1,753 |

|

Total pretax income | 23,172 |

| | 37,687 |

| | 12,673 |

| | 26,924 |

|

Income tax expense | (5,800 | ) | | (500 | ) | | (3,100 | ) | | (300 | ) |

Net income | $ | 17,372 |

| | $ | 37,187 |

| | $ | 9,573 |

| | $ | 26,624 |

|

Earnings per share: | | | | | | | |

Basic | $ | .19 |

| | $ | .43 |

| | $ | .10 |

| | $ | .30 |

|

Diluted | $ | .18 |

| | $ | .40 |

| | $ | .10 |

| | $ | .27 |

|

Weighted average shares outstanding: | | | | | | | |

Basic | 91,974 |

| | 86,668 |

| | 91,995 |

| | 89,529 |

|

Diluted | 101,470 |

| | 96,759 |

| | 101,544 |

| | 99,508 |

|

KB HOME

CONSOLIDATED BALANCE SHEETS

(In Thousands — Unaudited)

|

| | | | | | | |

| May 31,

2015 | | November 30, 2014 |

Assets | | | |

Homebuilding: | | | |

Cash and cash equivalents | $ | 439,920 |

| | $ | 356,366 |

|

Restricted cash | 27,213 |

| | 27,235 |

|

Receivables | 151,578 |

| | 125,488 |

|

Inventories | 3,393,672 |

| | 3,218,387 |

|

Investments in unconsolidated joint ventures | 77,935 |

| | 79,441 |

|

Deferred tax assets, net | 819,532 |

| | 825,232 |

|

Other assets | 117,745 |

| | 114,915 |

|

| 5,027,595 |

| | 4,747,064 |

|

Financial services | 11,465 |

| | 10,486 |

|

Total assets | $ | 5,039,060 |

| | $ | 4,757,550 |

|

| | | |

Liabilities and stockholders’ equity | | | |

Homebuilding: | | | |

Accounts payable | $ | 164,614 |

| | $ | 172,716 |

|

Accrued expenses and other liabilities | 437,115 |

| | 409,882 |

|

Notes payable | 2,819,510 |

| | 2,576,525 |

|

| 3,421,239 |

| | 3,159,123 |

|

Financial services | 1,985 |

| | 2,517 |

|

Stockholders’ equity | 1,615,836 |

| | 1,595,910 |

|

Total liabilities and stockholders’ equity | $ | 5,039,060 |

| | $ | 4,757,550 |

|

KB HOME

SUPPLEMENTAL INFORMATION

For the Six Months and Three Months Ended May 31, 2015 and 2014

(In Thousands, Except Average Selling Price — Unaudited) |

| | | | | | | | | | | | | | | |

| Six Months | | Three Months |

| 2015 | | 2014 | | 2015 | | 2014 |

Homebuilding revenues: | | | | | | | |

Housing | $ | 1,129,762 |

| | $ | 999,942 |

| | $ | 604,921 |

| | $ | 559,815 |

|

Land | 68,930 |

| | 10,721 |

| | 15,883 |

| | 2,581 |

|

Total | $ | 1,198,692 |

| | $ | 1,010,663 |

| | $ | 620,804 |

| | $ | 562,396 |

|

| | | | | | | |

| Six Months | | Three Months |

| 2015 | | 2014 | | 2015 | | 2014 |

Homebuilding costs and expenses: | | | | | | | |

Construction and land costs | | | | | | | |

Housing | $ | 953,659 |

| | $ | 816,208 |

| | $ | 508,276 |

| | $ | 454,102 |

|

Land | 63,169 |

| | 9,626 |

| | 16,134 |

| | 2,458 |

|

Subtotal | 1,016,828 |

| | 825,834 |

| | 524,410 |

| | 456,560 |

|

Selling, general and administrative expenses | 149,604 |

| | 132,818 |

| | 78,532 |

| | 71,544 |

|

Total | $ | 1,166,432 |

| | $ | 958,652 |

| | $ | 602,942 |

| | $ | 528,104 |

|

| | | | | | | |

| Six Months | | Three Months |

| 2015 | | 2014 | | 2015 | | 2014 |

Interest expense: | | | | | | | |

Interest incurred | $ | 94,202 |

| | $ | 82,438 |

| | $ | 49,199 |

| | $ | 43,158 |

|

Interest capitalized | (80,746 | ) | | (62,604 | ) | | (41,081 | ) | | (34,600 | ) |

Total | $ | 13,456 |

| | $ | 19,834 |

| | $ | 8,118 |

| | $ | 8,558 |

|

| | | | | | | |

| Six Months | | Three Months |

| 2015 | | 2014 | | 2015 | | 2014 |

Other information: | | | | | | | |

Depreciation and amortization | $ | 5,560 |

| | $ | 4,386 |

| | $ | 2,835 |

| | $ | 2,319 |

|

Amortization of previously capitalized interest | 47,736 |

| | 37,702 |

| | 25,443 |

| | 20,217 |

|

| | | | | | | |

| Six Months | | Three Months |

| 2015 | | 2014 | | 2015 | | 2014 |

Average selling price: | | | | | | | |

West Coast | $ | 565,500 |

| | $ | 532,600 |

| | $ | 579,000 |

| | $ | 537,900 |

|

Southwest | 275,400 |

| | 281,200 |

| | 275,800 |

| | 276,500 |

|

Central | 237,900 |

| | 216,900 |

| | 237,800 |

| | 222,000 |

|

Southeast | 271,800 |

| | 252,500 |

| | 278,800 |

| | 248,700 |

|

Total | $ | 334,200 |

| | $ | 313,200 |

| | $ | 338,500 |

| | $ | 319,700 |

|

|

| | | | | | | | | | | | | | | |

KB HOME SUPPLEMENTAL INFORMATION For the Six Months and Three Months Ended May 31, 2015 and 2014 (Dollars in Thousands — Unaudited) |

| | | |

| Six Months | | Three Months |

| 2015 | | 2014 | | 2015 | | 2014 |

Homes delivered: | | | | | | | |

West Coast | 873 |

| | 830 |

| | 459 |

| | 484 |

|

Southwest | 516 |

| | 336 |

| | 279 |

| | 175 |

|

Central | 1,390 |

| | 1,360 |

| | 737 |

| | 765 |

|

Southeast | 601 |

| | 667 |

| | 312 |

| | 327 |

|

Total | 3,380 |

| | 3,193 |

| | 1,787 |

| | 1,751 |

|

| | | | | | | |

| Six Months | | Three Months |

| 2015 | | 2014 | | 2015 | | 2014 |

Net orders: | | | | | | | |

West Coast | 1,322 |

| | 1,089 |

| | 770 |

| | 583 |

|

Southwest | 921 |

| | 392 |

| | 532 |

| | 211 |

|

Central | 2,046 |

| | 1,842 |

| | 1,176 |

| | 1,085 |

|

Southeast | 915 |

| | 711 |

| | 537 |

| | 390 |

|

Total | 5,204 |

| | 4,034 |

| | 3,015 |

| | 2,269 |

|

| | | | | | | |

| Six Months | | Three Months |

| 2015 | | 2014 | | 2015 | | 2014 |

Net order value: | | | | | | | |

West Coast | $ | 756,311 |

| | $ | 643,954 |

| | $ | 438,754 |

| | $ | 344,671 |

|

Southwest | 258,213 |

| | 104,900 |

| | 149,555 |

| | 56,512 |

|

Central | 535,424 |

| | 419,354 |

| | 308,381 |

| | 250,381 |

|

Southeast | 256,094 |

| | 195,120 |

| | 156,176 |

| | 111,592 |

|

Total | $ | 1,806,042 |

| | $ | 1,363,328 |

| | $ | 1,052,866 |

| | $ | 763,156 |

|

| | | | | | | |

| May 31, 2015 | | May 31, 2014 |

| Backlog Homes | | Backlog Value | | Backlog Homes | | Backlog Value |

Backlog data: | | | | | | | |

West Coast | 1,042 |

| | $ | 617,354 |

| | 679 |

| | $ | 389,402 |

|

Southwest | 729 |

| | 200,697 |

| | 244 |

| | 67,060 |

|

Central | 2,145 |

| | 558,681 |

| | 1,830 |

| | 405,850 |

|

Southeast | 817 |

| | 234,091 |

| | 645 |

| | 163,565 |

|

Total | 4,733 |

| | $ | 1,610,823 |

| | 3,398 |

| | $ | 1,025,877 |

|

KB HOME

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

For the Six Months and Three Months Ended May 31, 2015 and 2014

(In Thousands, Except Percentages — Unaudited)

This press release contains, and Company management’s discussion of the results presented in this press release may include, information about the Company’s adjusted housing gross profit margin and ratio of net debt to capital, both of which are not calculated in accordance with generally accepted accounting principles (“GAAP”). The Company believes these non-GAAP financial measures are relevant and useful to investors in understanding its operations and the leverage employed in its operations, and may be helpful in comparing the Company with other companies in the homebuilding industry to the extent they provide similar information. However, because the adjusted housing gross profit margin and the ratio of net debt to capital are not calculated in accordance with GAAP, these financial measures may not be completely comparable to other companies in the homebuilding industry and, therefore, should not be considered in isolation or as an alternative to operating performance and/or financial measures prescribed by GAAP. Rather, these non-GAAP financial measures should be used to supplement their respective most directly comparable GAAP financial measures in order to provide a greater understanding of the factors and trends affecting the Company’s operations.

Adjusted Housing Gross Profit Margin

The following table reconciles the Company’s housing gross profit margin calculated in accordance with GAAP to the non-GAAP financial measure of the Company’s adjusted housing gross profit margin:

|

| | | | | | | | | | | | | | | |

| Six Months | | Three Months |

| 2015 | | 2014 | | 2015 | | 2014 |

Housing revenues | $ | 1,129,762 |

| | $ | 999,942 |

| | $ | 604,921 |

| | $ | 559,815 |

|

Housing construction and land costs | (953,659 | ) | | (816,208 | ) | | (508,276 | ) | | (454,102 | ) |

Housing gross profits | 176,103 |

| | 183,734 |

| | 96,645 |

| | 105,713 |

|

Add: Amortization of previously capitalized interest | 47,736 |

| | 37,702 |

| | 25,443 |

| | 20,217 |

|

Land option contract abandonment charges | 984 |

| | 790 |

| | 536 |

| | 357 |

|

Adjusted housing gross profits | $ | 224,823 |

| | $ | 222,226 |

| | $ | 122,624 |

| | $ | 126,287 |

|

Housing gross profit margin as a percentage of housing revenues | 15.6 | % | | 18.4 | % | | 16.0 | % | | 18.9 | % |

Adjusted housing gross profit margin as a percentage of housing revenues | 19.9 | % | | 22.2 | % | | 20.3 | % | | 22.6 | % |

Adjusted housing gross profit margin is a non-GAAP financial measure, which the Company calculates by dividing housing revenues less housing construction and land costs excluding amortization of previously capitalized interest and land option contract abandonment charges recorded during a given period, by housing revenues. The most directly comparable GAAP financial measure is housing gross profit margin. The Company believes adjusted housing gross profit margin is a relevant and useful financial measure to investors in evaluating the Company’s performance as it measures the gross profits the Company generated specifically on the homes delivered during a given period. This non-GAAP financial measure isolates the impact that the amortization of previously capitalized interest and land option contract abandonments have on housing gross profit margins and allows investors to make comparisons with the Company’s competitors that adjust housing gross profit margins in a similar manner. The Company also believes investors will find adjusted housing gross profit margin relevant and useful because it represents a profitability measure that may be compared to a prior period without regard to variability of the amortization of previously capitalized interest and land option contract abandonment charges. This financial measure assists management in making strategic decisions regarding product mix, product pricing and construction pace.

KB HOME

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(In Thousands, Except Percentages — Unaudited)

Ratio of Net Debt to Capital

The following table reconciles the Company’s ratio of debt to capital calculated in accordance with GAAP to the non-GAAP financial measure of the Company’s ratio of net debt to capital:

|

| | | | | | | |

| May 31, | | November 30, |

| 2015 | | 2014 |

Notes payable | $ | 2,819,510 |

| | $ | 2,576,525 |

|

Stockholders’ equity | 1,615,836 |

| | 1,595,910 |

|

Total capital | $ | 4,435,346 |

| | $ | 4,172,435 |

|

Ratio of debt to capital | 63.6 | % | | 61.8 | % |

| | | |

Notes payable | $ | 2,819,510 |

| | $ | 2,576,525 |

|

Less: Cash and cash equivalents and restricted cash | (467,133 | ) | | (383,601 | ) |

Net debt | 2,352,377 |

| | 2,192,924 |

|

Stockholders’ equity | 1,615,836 |

| | 1,595,910 |

|

Total capital | $ | 3,968,213 |

| | $ | 3,788,834 |

|

Ratio of net debt to capital | 59.3 | % | | 57.9 | % |

The ratio of net debt to capital is a non-GAAP financial measure, which the Company calculates by dividing notes payable, net of homebuilding cash and cash equivalents and restricted cash, by capital (notes payable, net of homebuilding cash and cash equivalents and restricted cash, plus stockholders’ equity). The most directly comparable GAAP financial measure is the ratio of debt to capital. The Company believes the ratio of net debt to capital is a relevant and useful financial measure to investors in understanding the leverage employed in the Company’s operations.

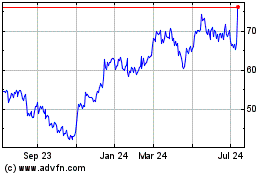

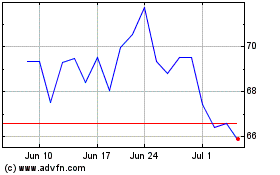

KB Home (NYSE:KBH)

Historical Stock Chart

From Mar 2024 to Apr 2024

KB Home (NYSE:KBH)

Historical Stock Chart

From Apr 2023 to Apr 2024