UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 10, 2015 (June 8, 2015)

Alnylam Pharmaceuticals, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

001-36407 |

|

77-0602661 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 300 Third Street, Cambridge, MA |

|

02142 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (617) 551-8200

Not applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02. Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal

Officers; Compensatory Arrangements of Certain Officers.

Effective June 8, 2015, Alnylam Pharmaceuticals, Inc. (the “Company”)

appointed David-Alexandre Gros, M.D. to the position of Senior Vice President, Chief Business Officer of the Company.

Prior to joining the Company,

Dr. Gros, 42, served as Executive Vice President and Chief Strategy Officer at Sanofi from September 2011 to May 2015, where he was a member of the Executive Committee and the Global Leadership Team. His responsibilities included leading

corporate strategy, business development and licensing, mergers and acquisitions, alliance management, and structured investments including the corporate venture fund. Prior to Sanofi, Dr. Gros held management positions with a focus on the

pharmaceutical industry in investment banking at Centerview Partners, from 2009 to 2011 and Merrill Lynch & Co., from 2006 to 2009, and in consulting at McKinsey & Co., from 2002 to 2006. Dr. Gros holds an M.D. from The Johns

Hopkins University School of Medicine, an M.B.A. from Harvard Business School and a B.A. from Dartmouth College.

In connection with his employment with

the Company, pursuant to the terms of his offer letter, Dr. Gros will receive an annual base salary of $425,000. Dr. Gros will also receive an initial sign-on bonus of $200,000 upon commencement of employment (the “Initial

Bonus”) and an additional bonus of $100,000 following the first anniversary of his employment start date (the “Subsequent Bonus”). In the event Dr. Gros voluntarily terminates his employment with the Company, other than for good

reason, or is terminated by the Company for cause, within twelve months of (i) the Initial Bonus or (ii) the Subsequent Bonus, Dr. Gros will be required to repay the full amount of either the Initial Bonus, if he leaves within the

first twelve months, or the Subsequent Bonus, if he leaves within months twelve through twenty-four.

Dr. Gros will also be eligible for an annual

cash bonus (commencing with a pro-rated bonus for 2015) under the Company’s 2015 Annual Incentive Program that targets 40% of his annual base salary and is subject to the achievement of certain performance goals established by the Company.

Achievement of Company goals will be determined by the Compensation Committee of the Company’s Board of Directors and any cash bonus paid will be calculated in accordance with the terms of the 2015 Annual Incentive Program. The Compensation

Committee also approved the grant of a stock option award to purchase 140,000 shares of common stock of the Company, at an exercise price equal to the fair market value of the common stock on the date of grant, $129.97 per share, under the

Company’s Amended and Restated 2009 Stock Incentive Plan. The stock option has a ten-year term and vests as to 25% of the shares on the first anniversary of the grant date and as to the remaining shares ratably at the end of each three-month

period thereafter over the following three years. Dr. Gros will also be eligible for all other compensation and benefit plans available to the Company’s executive officers.

Item 7.01. Regulation FD Disclosure

On June 8, 2015, the Company issued a press release announcing Dr. Gros’ appointment as Senior Vice President, Chief Business Officer. A copy of

this press release is furnished as Exhibit 99.1 to this Report on Form 8-K.

The information in this Item 7.01 and Exhibit 99.1 attached hereto is

intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed

incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

|

(d) |

|

Exhibits |

|

|

|

|

|

|

|

|

|

|

99.1 |

|

Press Release dated June 8, 2015, furnished herewith. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

ALNYLAM PHARMACEUTICALS, INC. |

|

|

|

|

| Date: June 10, 2015 |

|

|

|

By: |

|

/s/ Michael P. Mason |

|

|

|

|

|

|

Michael P. Mason Vice President, Finance and

Treasurer |

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press Release dated June 8, 2015, furnished herewith. |

Exhibit 99.1

Contacts:

|

|

|

| Alnylam Pharmaceuticals, Inc. |

|

|

| Michael Mason

Vice President, Finance and Treasurer

617-551-8327

Liz Bryan (Media)

Spectrum

202-955-6222 x2526 |

|

|

Alnylam Appoints David-Alexandre Gros, M.D.,

Senior Vice President, Chief Business Officer

Cambridge, Mass., June 8, 2015 – Alnylam Pharmaceuticals, Inc. (Nasdaq: ALNY), a leading RNAi therapeutics company, today announced

the appointment of David-Alexandre “DA” Gros, M.D. to the position of Senior Vice President, Chief Business Officer. Dr. Gros joins Alnylam with extensive experience in the pharmaceutical industry and in healthcare investment banking

and consulting. At Alnylam, he will be responsible for the company’s corporate and business development, finance, corporate communications, and investor relations functions. In addition, Dr. Gros will be joining the Alnylam Management

Board.

“We are in a very exciting period of growth at Alnylam, as we aim to execute on our ‘Alnylam 2020’ goals and transition from a

late-stage clinical development company to become a multi-product, commercial stage company with a sustainable development pipeline,” said John Maraganore, Ph.D., Chief Executive Officer of Alnylam. “DA brings to Alnylam an impressive

array of experiences in the pharmaceutical industry and in healthcare investment banking and management consulting. In addition, his background in corporate strategy will prove invaluable as we execute on our Alnylam 2020 goals. We’re thrilled

to have him join our team.”

“Alnylam is a remarkably innovative company, leading the advancement of RNAi therapeutics as a new class of

innovative medicines to address major unmet needs for a wide range of diseases globally, with a history of building significant alliances,” said Dr. Gros. “I’m particularly excited to join the team during this pivotal period, in

capitalizing on the company’s potential and contributing to its continued success.”

Most recently, Dr. Gros was Executive Vice President

and Chief Strategy Officer at Sanofi, where he was a member of the Executive Committee and the Global Leadership Team. His responsibilities included leading corporate strategy, business development and licensing, mergers and acquisitions, alliance

management, and structured investments including the corporate venture fund. During his tenure, he oversaw the execution of over 100 successful transactions and the launch of Sanofi’s corporate venture activities, and he was closely involved in

the company’s key alliances with Alnylam and Regeneron. Prior to Sanofi, he held management positions with a focus on the pharmaceutical industry in investment banking at Centerview Partners and Merrill Lynch & Co, and in consulting at

McKinsey & Co. Dr. Gros holds an M.D. from The Johns Hopkins University School of Medicine, an M.B.A. from Harvard Business School, and a B.A. from Dartmouth College.

About RNAi

RNAi (RNA interference) is a revolution in biology, representing a breakthrough in understanding how genes are turned on and off in cells, and a completely new

approach to drug discovery and development. Its discovery has been heralded as “a major scientific breakthrough that happens once every decade or so,” and represents one of the most promising and rapidly advancing frontiers in biology and

drug discovery today which was awarded the 2006 Nobel Prize for Physiology or Medicine. RNAi is a natural process of gene silencing that occurs in organisms ranging from plants to mammals. By harnessing the natural biological process of RNAi

occurring in our cells, the creation of a major new class of medicines, known as RNAi therapeutics, is on the horizon. Small interfering RNA (siRNA), the molecules that mediate RNAi and comprise Alnylam’s RNAi therapeutic platform, target the

cause of diseases by potently silencing specific mRNAs, thereby preventing disease-causing proteins from being made. RNAi therapeutics have the potential to treat disease and help patients in a fundamentally new way.

About Alnylam Pharmaceuticals

Alnylam is a

biopharmaceutical company developing novel therapeutics based on RNA interference, or RNAi. The company is leading the translation of RNAi as a new class of innovative medicines. Alnylam’s pipeline of investigational RNAi therapeutics is

focused in 3 Strategic Therapeutic Areas (STArs): Genetic Medicines, with a broad pipeline of RNAi therapeutics for the treatment of rare diseases; Cardio-Metabolic Disease, with a pipeline of RNAi therapeutics toward genetically validated,

liver-expressed disease targets for unmet needs in cardiovascular and metabolic diseases; and Hepatic Infectious Disease, with a pipeline of RNAi therapeutics that address the major global health challenges of hepatic infectious diseases. In early

2015, Alnylam launched its “Alnylam 2020” guidance for the advancement and commercialization of RNAi therapeutics as a whole new class of innovative medicines. Specifically, by the end of 2020, Alnylam expects to achieve a company profile

with 3 marketed products, 10 RNAi therapeutic clinical programs – including 4 in late stages of development – across its 3 STArs. The company’s demonstrated commitment to RNAi therapeutics has enabled it to form major alliances with

leading companies including Merck, Medtronic, Novartis, Biogen, Roche, Takeda, Kyowa Hakko Kirin, Cubist, GlaxoSmithKline, Ascletis, Monsanto, The Medicines Company, and Genzyme, a Sanofi company. In addition, Alnylam holds an equity position in

Regulus Therapeutics Inc., a company focused on discovery, development, and commercialization of microRNA therapeutics. Alnylam scientists and collaborators have published their research on RNAi therapeutics in over 200 peer-reviewed papers,

including many in the world’s top scientific journals such as Nature, Nature Medicine, Nature Biotechnology, Cell, New England Journal of Medicine, and The Lancet. Founded in 2002, Alnylam maintains headquarters in Cambridge,

Massachusetts. For more information about Alnylam’s pipeline of investigational RNAi therapeutics, please visit www.alnylam.com.

Alnylam

Forward Looking Statements

Various statements in this release concerning Alnylam’s future expectations, plans and prospects, including without

limitation, Alnylam’s expectations regarding its “Alnylam 2020” guidance, Alnylam’s views with respect to the potential for RNAi therapeutics, and its plans regarding commercialization of RNAi therapeutics, constitute

forward-looking statements for the

purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995. Actual results may differ materially from those indicated by these forward-looking statements as

a result of various important factors, including, without limitation, Alnylam’s ability to manage operating expenses, Alnylam’s ability to discover and develop novel drug candidates and delivery approaches, successfully demonstrate the

efficacy and safety of its drug candidates, the pre-clinical and clinical results for its product candidates, which may not be replicated or continue to occur in other subjects or in additional studies or otherwise support further development of

product candidates, actions of regulatory agencies, which may affect the initiation, timing and progress of clinical trials, obtaining, maintaining and protecting intellectual property, Alnylam’s ability to enforce its patents against

infringers and defend its patent portfolio against challenges from third parties, obtaining regulatory approval for products, competition from others using technology similar to Alnylam’s and others developing products for similar uses,

Alnylam’s ability to obtain additional funding to support its business activities and establish and maintain strategic business alliances and new business initiatives, Alnylam’s dependence on third parties for development, manufacture,

marketing, sales and distribution of products, the outcome of litigation, and unexpected expenditures, as well as those risks more fully discussed in the “Risk Factors” filed with Alnylam’s most recent Quarterly Report on Form 10-Q

filed with the Securities and Exchange Commission (SEC) and in other filings that Alnylam makes with the SEC. In addition, any forward-looking statements represent Alnylam’s views only as of today and should not be relied upon as representing

its views as of any subsequent date. Alnylam explicitly disclaims any obligation to update any forward-looking statements.

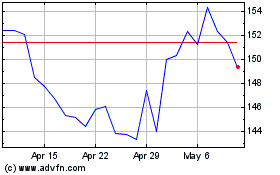

Alnylam Pharmaceuticals (NASDAQ:ALNY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alnylam Pharmaceuticals (NASDAQ:ALNY)

Historical Stock Chart

From Apr 2023 to Apr 2024