UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported)

June 8, 2015

(June 8, 2015)

MID-AMERICA APARTMENT COMMUNITIES, INC.

(Exact name of registrant as specified in

its charter)

| TENNESSEE |

1-12762 |

62-1543819 |

| (State of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

| 6584 Poplar Avenue, Suite 300 |

|

| Memphis, Tennessee |

38138 |

| (Address of principal executive offices) |

(Zip Code) |

(901) 682-6600

(Registrant's telephone number, including

area code)

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| ITEM 7.01 |

Regulation FD Disclosure |

The information included as Exhibit 99.1 to this report will

be made available to investors beginning June 9, 2015

Exhibit 99.1, furnished by the Registrant pursuant to Item 9.01

of Form 8-K, is not to be considered "filed" under the Exchange Act, and shall not be incorporated by reference into

any previous or future filing by the Registrant under the Securities Act or the Exchange Act.

| ITEM 9.01 |

Financial Statements and Exhibits |

| |

Exhibit Number |

|

Description |

| |

99.1 |

|

REITWeek 2015: NAREIT’s Investor Forum Presentation |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

MID-AMERICA APARTMENT COMMUNITIES, INC. |

| Date: June 8, 2015 |

/s/Albert M. Campbell, III |

| |

Albert M. Campbell, III |

| |

Executive Vice President and Chief Financial Officer |

| |

(Principal Financial and Accounting Officer) |

Exhibit 99.1

REITWEEK 2015: NAREIT’S INVESTOR FORUM JUNE 9 – 11, 2015 WWW.MAAC.COM

2 DISCIPLINED CAPITAL DEPLOYMENT; HIGH QUALITY ASSETS 3 ESTABLISHED COMPETITIVE STRENGTHS AND ADVANTAGES 4 INVESTMENT GRADE BALANCE SHEET A PROVEN SUCCESSFUL FULL - CYCLE STRATEGY • Well diversified across the high - growth Southeast/Southwest region • Strong balance sheet productivity; established record of high return on invested capital • Minimal joint - venture and non - recurring revenue stream; high quality earnings 2 • Scale advantages drives overhead and operating efficiencies; sophisticated, strong platform • Long - term cost of capital advantages over many local market participants • Long - term regional focus along with strong execution capabilities drive robust deal flow • Steady access to full range of capital markets • Strong coverage ratios and significant capacity to execute on opportunities • Well laddered debt maturities • 21 - year public company platform; long - tenured management • Record of strong, long - term shareholder returns • 85 quarters of consistent and growing dividends; never reduced 5 PROVEN AND EXPERIENCED PLATFORM 1 STEADY, GROWING, RECURRING CASH FLOW; FULL CYCLE OBJECTIVE • Diversified across both large and secondary markets; cycle diversification benefits • Diversified across urban and suburban locations; diversified across mid to upper price points • Opportunistic acquisition of new properties and select new development projects; high ROIC

BALANCED PORTFOLIO SUPPORTS FULL CYCLE PERFORMANCE 3 DIVISION OFFICES ATLANTA Ɣ CHARLOTTE Ɣ DALLAS Ɣ JACKSONVILLE Ɣ NASHVILLE Top Large Markets % of Q1 2015 NOI 1 Atlanta, GA 8.3% 2 Austin, TX 7.9% 3 Charlotte, NC 7.0% 4 Raleigh/Durham, NC 6.9% 5 Fort Worth, TX 5.9% 6 Dallas, TX 5.6% 7 Nashville, TN 5.3% 8 Tampa, FL 4.5% 9 Orlando, FL 4.3% 10 Houston, TX 3.5% Top Secondary Markets % of Q1 2015 NOI 1 Jacksonville, FL 4.4% 2 Charleston, SC 4.1% 3 Savannah, GA 3.3% 4 Richmond, VA 2.4% 5 Memphis, TN 2.0% 6 Birmingham, AL 2.0% 7 Greenville, SC 1.9% 8 San Antonio, TX 1.6% 9 Huntsville, AL 1.5% 10 Norfolk/Hampton/ Virginia Beach, VA 1.5% (1) Distribution based on total Same Store NOI for the period presented. 64 % o f total 1 36 % o f total 1 Nevada Arizona Texas Mississippi Arkansas Kentucky Missouri Virginia North Carolina South Carolina Alabama Florida Georgia Tennessee LARGE MARKET* SECONDARY MARKET* * Individual MSAs 0.7% or greater of Q1 2015 total S ame Store NOI presented » Approximately 80,000 apartment homes in high - growth Large and Secondary markets across the Southeast and Southwest US » Properties diversified across Urban and Suburban locations » Wide diversity of industry exposure - tech, finance, logistics and distribution, manufacturing, education, energy » Mix of high - quality A and B class product catering to broad segment of the rental market

▪ Scale and efficiency ▪ Recruit/retain top talent ▪ Margin outperformance STRATEGIC COMPETITIVE CAPABILITIES 4 BUYING OPPORTUNISTICALLY SUPERIOR CAPITAL MANAGEMENT OPERATING AT A SUPERIOR LEVEL ASSET MANAGEMENT SUPERIORITY IN LOCAL MARKETS EXITING INVESTMENTS OPPORTUNISTICALLY ▪ Off market transactions ▪ Pre - purchase deals ▪ Pressured timing ▪ Experienced revenue mgmt. ▪ Web based technology ▪ National contracts/scale ▪ 13K+ units since 2010 (1) ▪ 13.5% average IRRs (leveraged) (1) ▪ Investment Grade rated ▪ Multiple sources of capital ▪ Significant capacity Stonefield Commons; Charlottesville, VA Strategy Supports Quality Long - term Returns Enhancing Shareholder Value 13 % ANNUALIZED 10 YEAR TOTAL SHAREHOLDER RETURN At 3/31/15 (1) Includes disposals from 1/1/2010 through 4/30/2015 as well as 2015 transactions under contract

61.5% 54.1% Acquired Sold 740 bps (3) Acquisition metrics reflect expected stabilization performance for acquired non - stabilized deals. SIGNIFICANT PORTFOLIO REPOSITIONING SINCE 2010 5 Improved Margin and Internal Growth Prospects Transaction Volume (1) (in millions) Age (2) (in years) Effective Rent per Unit (2)(3) Units (2) NOI Margin (2)(3) After Capex NOI Margin (2)(3) $ 1,936 $751 Acquired Sold $ 1,194 $715 Acquired Sold 57.7% 44.1% Acquired Sold 1,360 bps (1) Includes midpoint of 2015 transaction guidance (2) Inclusive of transactions from 2010 through 2015 (closed and under contract) 12,031 13,064 Acquired Sold 4 26 Acquired Sold

$716 $750 $799 $863 $910 $965 $4,463 $4,684 $5,164 $5,766 $6,141 $6,259 $4,000 $4,500 $5,000 $5,500 $6,000 $6,500 $700 $750 $800 $850 $900 $950 $1,000 2010* 2011* 2012* 2013* 2014^ 2015F^ Same Store Effective Rent/Unit After Capex NOI/Unit MAA TODAY – A HIGHER QUALITY PORTFOLIO AND STRONGER INTERNAL GROWTH PROSPECTS 6 Same Store NOI Margin after Capex Same Store Effective Rent & A fter Capex NOI/Unit Rent CAGR of 6.1% After Capex NOI/Unit CAGR of 7% 47.9% 48.0% 49.9% 51.8% 52.0% 53.4% 47.0% 48.0% 49.0% 50.0% 51.0% 52.0% 53.0% 54.0% 2010* 2011* 2012* 2013* 2014^ 2015F^ * Legacy MAA portfolio ^ Combined portfolio Enclave; Charlotte, NC CR at Medical District; Dallas, TX 550bps Improvement

MAA TODAY 7 Residences at Burlington Creek; Kansas City, MO Year Completed: 2014 Retreat at Vintage Park; Houston, TX Year Completed: 2014 Bulverde Oaks; San Antonio, TX Year Completed: 2014 Cityscape at Market Center; Dallas, TX Year Completed: 2013 Stonefield Commons; Charlottesville, VA Year Completed: 2013 CG at Lake Mary, Phase III; Orlando, FL Year Completed: 2014 2015 2014 2014 2014 2014 2014

MAA TODAY 8 CG at Randal Lakes; Orlando, FL Year Completed: 2014 CR at South End; Charlotte, NC Year Completed: 2014 Highlands of West Village, Atlanta, GA Year Completed: 2006/2012 Rivers Walk; Charleston, SC Year Completed: 2013 CR at Frisco Bridges; Dallas, TX Year Completed: 2013 1225 South Church, Phase II; Charlotte, NC Year Completed: 2013 2014 2014 2014 2013 2013 2013

MAA TODAY 9 Market Station; Kansas City, MO Year Completed: 2010 2013 2013 2013 2013 2013 2012 CG at Double Creek; Austin, TX Year Completed: 2013 CG at Windermere; Orlando, FL Year Completed: 2009 Station Square at Cosner’s Corner; Fredericksburg, VA Year Completed: 2012 CG at Ayrsley , II; Charlotte, NC Year Completed: 2013 Seasons at Celebrate VA, II; Fredericksburg, VA Year Completed: 2013

MAA TODAY 10 Haven at Blanco; San Antonio, TX Year Completed: 2010 Venue at Cool Springs; Nashville, TN Year Completed: 2012 Allure at Brookwood ; Atlanta, GA Year Completed: 2008 Allure in Buckhead Village; Atlanta, GA Year Completed: 2002 ; Redeveloped: 2014 Alamo Ranch; San Antonio, TX Year Completed: 2009 Avala at Savannah Quarters; Savannah, GA Year Completed: 2009 2012 2012 2012 2012 2011 2011

DEVELOPMENT STRATEGY; STRONG VALUE CREATION Recently completed and active development pipeline totaling approximately $450 million with an average NOI yield of 7.5% and average rents of $1,270 Expected Cost Active Developments MSA Total Units Total (in millions) Per Unit (in thousands) CG at Bellevue, II Nashville 220 $ 31.1 $ 141 220 Riverside Jacksonville 294 $ 42.7 $ 145 Station Square at Cosner's Corner, II Fredericksburg 120 $ 20.1 $ 168 River’s Walk, II Q3 2015 Start Charleston 78 $ 14.7 $ 188 CG at Randal Lakes, II Q3 2015 Start Orlando 314 $ 41.2 $ 131 Total Active Development 1,026 $ 149.8 $ 153 11 Completed Developments MSA Year Venue at Cool Springs Nashville 2012 Ridge at Chenal Valley Little Rock 2012 1225 South Church, II Charlotte 2013 River’s Walk Charleston 2013 CG at Randal Lakes Orlando 2014 CR at South End Charlotte 2014 CG at Lake Mary, III Orlando 2014 Venue at Cool Springs; Nashville, TN

MEANINGFUL REDEVELOPMENT OPPORTUNITY; STRONG VALUE CREATION 12 Redevelopment Opportunity • Redevelopments performed on turn at select communities with minimized down time providing efficiency in evaluating effectiveness of program for real - time improvements to product mix and scope • 30 % - 50 % of the legacy CLP portfolio identified as a target for redevelopment ; 15 , 000 to 20 , 000 units across same store portfolio with potential to create $ 245 million to $ 327 million of new value ( $ 3 - $ 4 per share) • 4 , 549 units redeveloped in 2014 at an average cost of $ 3 , 649 /unit and achieving an average rental rate increase of 9 . 3 % • Approximately 4 , 000 units identified for redevelopment in 2015 at an average cost of $ 4 , 350 /unit – in Q 1 of 2015 , we redeveloped 1 , 022 units at an average cost of $ 4 , 455 per unit, achieving rental rate increases of 9 . 4 % • Assuming an $ 80 per month incremental increase above market level rent growth, every 4 , 000 units redeveloped creates $ 3 . 6 million of additional NOI opportunity once fully leased (assuming 95 % occupancy) or $ 65 million of additional value at a 5 . 5 % cap rate Allure in Buckhead Village; Atlanta, GA • Cabinets and Countertops • New Appliances • Plumbing and Light Fixtures • Flooring Unit Redevelopment Updates

STRONG OPERATING PLATFORM DRIVES COMPETITIVE ADVANTAGES AND SUPERIOR OPERATING MARGINS Regional Market Leading Expertise • 21 years of institutional property management experience in markets we serve • Onsite teams have seen multiple cycles of the apartment markets in the same cities • We understand up and down performance at the market, sub - market and property level • 9 years of yield and revenue management system expertise • Competitive advantage in key markets vs. less sophisticated fee managers and smaller owner/ operators…ability to generate returns on capital that are higher than “market norms” Innovative Asset Management Programs • Robust revenue management capabilities • Unit interior redevelopment program • Centrally monitored delinquency, screening and resident selection process • Expertise in optimizing customer integration and interface through technology, onsite sales and customer service • Technical experts dedicated to supporting onsite service lowering resident turnover and increasing efficiency • Landscape group focused on superior curb appeal, vendor management and cost efficiency Proven Performance; CLP Portfolio Turn - Around • Improved CLP operating margin 80 bps • Revenue management platform drove 150bps of above market comparison effective rent per unit • Proprietary system customizations increased fee collections performance • Reduced bad debt from 0.57% of rent to 0.35% of rent • Reduced same store personnel costs by 7% 13 COMPETITIVE ADVANTAGES ADD VALUE During 2014:

BEST ONLINE REPUTATION Among Public Multifamily REITs and NMHC’s Top 50 Apartment Managers (1 ) FOCUSED ON EXCEPTIONAL SERVICE GENERATING COMPETITIVE ADVANTAGES ACROSS REGION Implemented training and customer service process on CLP portfolio following merger; active ongoing focus across the portfolio Since merger, increased “recommend rate” for CLP portfolio on national third party rating site by 37 percentage points * Third party administered customer service survey jumped 6 percentage points and is now 12 percentage points above our competitors * Key customer focus on overall product and quality with 2,600 resident engagement events and over 360,000 surveys distributed annually * 14 DEDICATED TO EXCEEDING OUR RESIDENTS’ EXPECTATIONS; SUPPORTING SUPERIOR RESIDENT RETENTION, PRICING PERFORMANCE AND CORE GROWTH PERFORMANCE (1) J Turner ORA© Power Ranking at 4/30/2015 *Data as of 12/31/14

SOLID INVESTMENT GRADE BALANCE SHEET 15 Credit metrics MAA BBB Peers BBB+ Peers Total unencumbered assets to book value 70.5% 81.8% 73.0% Net debt / recurring EBITDA 6.2x 5.8x 6.2x Net d ebt / gross assets 1 42.1% 35.1% 39.2% Secured debt / gross assets 1 17.7% 15.0% 18.8% Fixed charge coverage ratio 2 4.0x 3.8x 3.8x Note: As of 3/31/15 (1) Gross assets is defined as total assets plus accumulated depreciation (2) Fixed charge coverage represents Recurring EBITDA divided by interest expense adjusted for mark - to - market debt adjustment $316 $193 $490 $474 $2,006 2015 2016 2017 2018 2019+ 0.0% 10.8% 6.1% 13.5% 57.0% % maturing 12.6% Credit ratings Agency Rating Outlook Fitch Ratings 3 BBB Positive Moody’s Investors Service 4 Baa2 Stable S&P Ratings Services 3 BBB Stable Debt maturity profile (in millions) (3) Mid - America Apartment Communities, Inc. & Mid - America Apartments , LP (4) Mid - America Apartments LP only • Completed 2 public bond offerings in the last 18 months; over $1 billion of public bonds outstanding • Over $335 million in cash and debt capacity as of 3/31/2015

SOLID INVESTMENT GRADE BALANCE SHEET 16 Debt Summary ($ in millions) Secured Debt , 15% Unsecured Debt , 21% Common Equity , 64% Total Capitalization (1) at March 31, 2015 $6.15B Common Equity $ 3.48B Debt 93 % DEBT FIXED OR HEDGED 03/31/15 Secured Debt Fixed or Hedged Rate $1,348.3 Variable Rate 80.8 Total Secured Debt 1,429.1 Unsecured Debt Unsecured Bonds 1,321.4 Unsecured Term Loans 550.0 Unsecured Credit Facilities 179.0 Total Unsecured Debt 2,050.4 Total Debt $3,479.5 (1) Total Capitalization equals the total number of shares of common stock and units times the closing stock price at period end plus total debt outstanding.

SUCCESSFUL MERGER STRENGTHENS PLATFORM; BUILDS VALUE 17 Synergy Opportunity Core FFO/Share Comments Identified at Merger 2014 Impact Marginal 2015 Impact Cumulative 2016+ Impact G&A Synergies $0.32 $0.32* $0.00 $0.32 Full Impact captured in 2014; expect to maintain in 2015 NOI Operating Synergies $0.05 - $0.11 $0.08 $0.03 $0.12 Margin improvement due to pricing; personnel; R&M; insurance; 70bp margin improvement from 2013 to 2015 Stabilize Development Pipeline $0.10 - $0.14 $0.05 $0.05 $0.12 Full year impact of 7% - 7.5%; NOI yield achieved in 2016 as the last of the development projects stabilizes in early 2016 Recycle Non - Earning Assets $0.05 - $0.08 $0.01 $0.01 $0.06 Bulk of this transaction activity to occur in 2015 with material earnings impact in 2016 as funds are invested Redevelopment of CLP Assets $0.10 - $0.17 $0.01 $0.02 $0.20 15k to 20k units of opportunity; 2k units completed in 2014; 3k in 2015; program to continue for several years; every 4k units creates an additional $65 million of value at a 5.5% cap rate Total Opportunity $0.62 - $0.82 $0.47 $0.11 $0.82 *Excludes integration costs Value Creation of Merger Transaction Value Premium Paid 1 ($226.5 million) Deal Costs ($68.0 million) Total Cost ($294.5 million) Value of Synergy & Redevelopment ($42M) 2 $579.6 million Net Value Created $285.1 million (1) Implied price paid based on day of announcement at .360x exchange rate (05/31/2013: $67.97 - MAA; $24.47 - CLP) (2) Using pre - merger announcement FFO multiple of 13.8 and midpoint of synergy opportunity; at current sector multiple of approximat ely 19.9, net value increases to $541.3m

RELATIVE PERFORMANCE COMPARED TO RELATIVE PRICING PROVIDES INVESTMENT OPPORTUNITY 18 Source: Greenstreet Advisors; Company Data; SNL -8.0% -6.0% -4.0% -2.0% 0.0% 2.0% 4.0% 6.0% 8.0% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 Same Store NOI Growth MAA Sector Average (excluding MAA) MAA Average Growth: 2.4% Sector Average Growth: 2.1% MAA Std Dev: 3.4% Sector Std Dev: 4.3% MAA Current Multiple: 14.6 Sector Current Multiple: 19.9

$ 3.09 $3.30 $ 3.99 $ 4.33 $ 4.28 (1) $ 4.55 (2) $2.46 $2.51 $2.64 $2.78 $2.92 $3.08 2010 2011 2012 2013 2014 2015F Core AFFO/Share Dividends PROVEN PLATFORM HAS BECOME EVEN STRONGER 19 • Increased market capitalization to over $ 9 . 6 billion ; higher liquidity and efficiencies • Portfolio transformation/focus on high - growth region drives robust full cycle performance • Higher efficiencies from larger scale improving earnings potential • Balance sheet strength creating growth opportunities • Significant portfolio transformation driving higher cash flow margins and core growth rate • 21 year history of secure and growing dividend (1) Reflects additional capital spending to reposition the Legacy CLP portfolio. (2) Guidance for 2015 core AFFO is in the range $4.43 - $4.67 with a midpoint of $4.55. Improving Cash Flow And Dividend Coverage 5 year Core AFFO CAGR of 8%

FORWARD LOOKING STATEMENTS 20 Certain matters in this presentation may constitute forward - looking statements within the meaning of Section 27 - A of the Securities Act of 1933 and Section 21 E of the Securities and Exchange Act of 1934 . Such statements include, but are not limited to, statements made about anticipated economic and market conditions, expectations for future demographics , expectations for future performance and capture of synergies, and expectations for acquisition and disposition transaction activity . Actual results and the timing of certain events could differ materially from those projected in or contemplated by the forward - looking statements due to a number of factors, including a downturn in general economic conditions or the capital markets, competitive factors including overbuilding or other supply/demand imbalances in some or all of our markets, changes in interest rates and other items that are difficult to control such as the impact of legislation, as well as the other general risks inherent in the apartment and real estate businesses . We undertake no duty to update these statements . Reference is hereby made to the filings of Mid - America Apartment Communities, Inc . , with the Securities and Exchange Commission, including quarterly reports on Form 10 - Q, reports on Form 8 - K, and its annual report on Form 10 - K, particularly including the risk factors contained in the latter filing . Eric Bolton Chairman and CEO 901 - 248 - 4127 eric.bolton@maac.com Al Campbell EVP, CFO 901 - 248 - 4169 al.campbell@maac.com Tim Argo SVP, Finance 901 - 248 - 4149 tim.argo@maac.com Jennifer Patrick Investor Relations 901 - 435 - 5371 jennifer.patrick@maac.com Contact

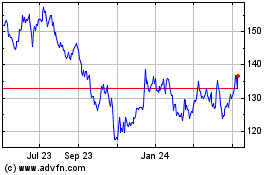

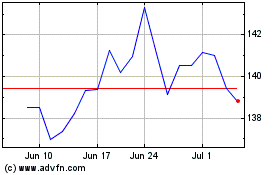

Mid America Apartment Co... (NYSE:MAA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mid America Apartment Co... (NYSE:MAA)

Historical Stock Chart

From Apr 2023 to Apr 2024