UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): June 2, 2015

ABM

Industries Incorporated

(Exact

name of registrant as specified in its charter)

|

Delaware

(State or

other jurisdiction

of incorporation) |

|

1-8929

(Commission

File Number) |

|

94-1369354

(IRS Employer

Identification No.) |

551 Fifth Avenue, Suite 300

New York, New York

(Address of principal executive offices) |

|

10176

(Zip Code) |

Registrant's telephone number, including area

code: (212) 297-0200

N/A

(Former name

or former address, if changed since last report)

Check the appropriate box below if the Form

8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions

(see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial

Condition.

On June 2, 2015, ABM Industries Incorporated (the “Company”)

issued a press release announcing financial results related to the second quarter of fiscal year 2015. A copy of the press release

is attached as Exhibit 99.1, which is incorporated into this item by reference.

Item 8.01. Other Events.

On June 2, 2015, the Company announced that the Board of Directors

of the Company declared a quarterly dividend of $0.16 per share, payable on August 3, 2015 to stockholders of record on July 2,

2015. A copy of the press release announcing the declaration of the dividend is attached as Exhibit 99.1, which is incorporated

into this item by reference.

As disclosed in the press release attached as Exhibit 99.1, the

Company will hold a live web cast on June 3, 2015 relating to the Company’s financial results for the second quarter of fiscal

year 2015. A copy of the slides to be presented at the Company’s web cast and discussed in the conference call relating to

such financial results is being furnished as Exhibit 99.2 to this Form 8-K.

Item 9.01. Financial Statements and Exhibits.

| 99.1 | Press Release issued by ABM Industries Incorporated, dated June 2, 2015, announcing financial results related to the second

quarter of fiscal year 2015 and the declaration of a dividend payable August 3, 2015 to stockholders of record on July 2, 2015. |

| 99.2 | Slides of ABM Industries Incorporated dated June 3, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

ABM INDUSTRIES INCORPORATED |

| |

|

|

|

| Dated: |

June 2, 2015 |

|

By: |

/s/ Sarah H. McConnell |

| |

|

|

|

Sarah H. McConnell |

| |

|

|

|

Executive Vice President and

General Counsel |

EXHIBIT INDEX

| 99.1 | Press Release issued by ABM Industries Incorporated, dated June 2, 2015, announcing financial results related to the second

quarter of fiscal year 2015 and the declaration of a dividend payable August 3, 2015 to stockholders of record on July 2, 2015. |

| 99.2 | Slides of ABM Industries Incorporated dated June 3, 2015. |

Exhibit 99.1

ABM INDUSTRIES ANNOUNCES

2015 SECOND QUARTER FINANCIAL RESULTS

Revenues Increase 3.2%

to a Q2 record $1.27 billion

Adjusted Net Income Increases

13.3%; net income up 20.4%

Declares 197th Consecutive

Quarterly Dividend

New York, NY - June 2, 2015 - ABM (NYSE:ABM),

a leading provider of facility solutions, today announced financial results for the fiscal 2015 second quarter that ended April 30,

2015.

| |

|

Three Months Ended

April 30, |

|

Increase/

(Decrease) |

|

Six Months Ended

April 30, |

|

Increase/

(Decrease) |

($ in millions, except per share amounts)

(unaudited) |

|

2015 |

|

2014 |

|

|

2015 |

|

2014 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

1,270.1 |

|

|

$ |

1,231.3 |

|

|

3.2 |

% |

|

$ |

2,559.5 |

|

|

$ |

2,457.8 |

|

|

4.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating profit |

|

$ |

30.8 |

|

|

$ |

27.9 |

|

|

10.4 |

% |

|

$ |

50.0 |

|

|

$ |

51.8 |

|

|

(3.5 |

)% |

| Adjusted operating profit |

|

$ |

35.9 |

|

|

$ |

34.2 |

|

|

5.0 |

% |

|

$ |

61.7 |

|

|

$ |

59.8 |

|

|

3.2 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

18.3 |

|

|

$ |

15.2 |

|

|

20.4 |

% |

|

$ |

36.0 |

|

|

$ |

28.3 |

|

|

27.2 |

% |

| Net income per diluted share |

|

$ |

0.32 |

|

|

$ |

0.27 |

|

|

18.5 |

% |

|

$ |

0.63 |

|

|

$ |

0.50 |

|

|

26.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net income |

|

$ |

21.3 |

|

|

$ |

18.8 |

|

|

13.3 |

% |

|

$ |

42.8 |

|

|

$ |

32.9 |

|

|

30.1 |

% |

| Adjusted net income per diluted share |

|

$ |

0.37 |

|

|

$ |

0.33 |

|

|

12.1 |

% |

|

$ |

0.75 |

|

|

$ |

0.58 |

|

|

29.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

$ |

71.4 |

|

|

$ |

76.6 |

|

|

(6.8 |

)% |

|

$ |

39.0 |

|

|

$ |

37.7 |

|

|

3.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

52.5 |

|

|

$ |

49.4 |

|

|

6.3 |

% |

|

$ |

93.8 |

|

|

$ |

90.9 |

|

|

3.2 |

% |

This release refers to non-GAAP financial measures described

as “Adjusted EBITDA”, “Adjusted net income”, “Adjusted net income per diluted share” (or “Adjusted

EPS”) and “Adjusted operating profit”. Refer to the accompanying financial schedules for supplemental financial

data and corresponding reconciliation of these non-GAAP financial measures to certain GAAP financial measures.

Second Quarter 2015 Results:

| • | Revenues for the quarter totaled $1.27 billion,

an increase of 3.2% compared to $1.23 billion in the second quarter of 2014, due to contributions from acquisitions and organic

growth. |

| • | Adjusted net income rose 13.3% to $21.3 million,

from $18.8 million in the second quarter of 2014, while adjusted net income per diluted share improved 12.1% to $0.37 from $0.33

in the prior-year period. |

| • | Net income rose 20.4% to $18.3 million, compared with $15.2 million for the second quarter of 2014.

Net income per diluted share rose 18.5% to $0.32, compared with $0.27 in last year's second quarter. |

| • | Adjusted EBITDA increased 6.3% to $52.5 million from $49.4 million. |

Management Commentary

“Our results in the second quarter

reflect the success of our people and their continued commitment to providing a level of services our clients have come to expect,”

said Scott Salmirs, ABM’s president and chief executive officer. "I am encouraged by how the firm continues to evolve

toward a customer-centric approach.”

Second quarter revenues increased by $39

million or 3.2% to $1.27 billion. Adjusted net income rose by $2.5 million or 13.3% to $21.3 million compared to the prior-year

period, driven primarily from enhancements to in-year risk management safety programs, operational efficiencies, contributions

from acquisitions, and new business. Partially offsetting these benefits was one additional day of labor expense, and an increase

in expenses to support sales and IT initiatives.

ABM’s Onsite organization was able

to drive higher operating margins among its divisions, through cancellation or loss of low margin business, the continuing benefit

from enhancements to in-year risk management and safety programs, and improved operational efficiencies.

The

Building & Energy Solutions Group ("BESG") achieved revenue growth of 2.5% to $121.5 million compared to $118.5 million,

but experienced a decline in operating profit of $0.3 million or 8.6% compared to the second quarter of fiscal 2014. A portion

of our BESG business is project related and seasonal, typically showing significantly stronger performance in the third and fourth

quarters. The company continues to expect year-over-year double digit growth in revenue and operating profit in this business and

anticipates the balanced portfolio mix of project and recurring maintenance businesses will deliver long-term profitable growth

for the enterprise.

The Air Serv business (Other Segment), had

another quarter of exceptional revenue growth with an increase of 12.8% to $96.1 million from $85.2 million compared to the second

quarter of fiscal 2014. The Air Serv service capabilities continue to resonate in the aviation industry. Operating profit for Air

Serv increased by $0.6 million, or 25.0% to $3.0 million due to lower amortization, and enhancements to in-year risk management

and safety programs.

Salmirs continued, “Since the announcement

of my promotion to chief executive officer I have spent considerable time with our employees, our clients, and our shareholders.

I firmly believe we have the opportunity to build on the solid foundation we created over the last few years. To help accomplish

this, we launched a broad strategic review and we recently enlisted the Boston Consulting Group to assist us in developing the

framework for a comprehensive long-term strategic plan. In the fall, we expect to share the details of the strategic plan. Our

intention is to enhance our financial performance and improve shareholder value.”

Liquidity & Capital Structure

The Company’s liquidity remains strong,

with capacity of up to $376.9 million under the Company’s $800.0 million line of credit subject to certain covenant restrictions.

As of quarter end, total debt outstanding was $307.0 million. The Company's operations generated $71.4 million in cash. During

the quarter, the

Company paid a quarterly cash dividend of

$9.0 million and repurchased 313,242 shares at a cost of $10.0 million; $7.9 million settled in the quarter while the remaining

$2.1 million settled in the third fiscal quarter.

Captive Insurance Company

Anthony Scaglione, executive vice president

and chief financial officer, noted, “During the second quarter, the Company launched its wholly owned captive insurance subsidiary

(IFM Assurance Company). The captive should provide ABM with increased flexibility in the end-to-end management of its insurance

programs with the intent to develop an enterprise wide multi-year insurance strategy. In addition, for fiscal 2015, the Company

anticipates a cash tax benefit of $15.0 million to $20.0 million relating to the captive.”

Acquisition of CTS Services/Facility Support Services

Effective May 1st, ABM’s

BESG business acquired certain assets and assumed certain liabilities of CTS Services/Facility Support Services, a provider of

HVAC service and energy solutions in government, commercial, and industrial buildings for a purchase price of $20.0 million. CTS

Services/Facility Support Services are headquartered in Beltsville, Maryland and maintain operations in Texas and West Virginia,

in addition to the greater DC and Baltimore areas. In 2014, annual revenues exceeded $35 million. The Company anticipates that

this acquisition will not materially impact adjusted net income per diluted share in fiscal 2015, and will be slightly accretive

in fiscal 2016.

Dividend

The Company also announced that the Board

of Directors has declared a third quarter cash dividend of $0.160 per common share payable on August 3, 2015 to stockholders of

record on July 2, 2015. This will be ABM’s 197th consecutive quarterly cash dividend.

Fiscal 2015 Guidance

The Company is maintaining guidance for

adjusted net income of $1.75 to $1.85 per diluted share and net income of $1.55 to $1.65 per diluted share. This guidance

excludes potential benefits associated with an

extension of the Work Opportunity Tax Credit

("WOTC") for calendar 2015. If Congress were to extend the WOTC for calendar 2015 prior to October 31, 2015, the Company

could have a further benefit of $0.08 per diluted share.

Earnings Webcast

On Wednesday, June 3, 2015 at 9:00 a.m.

ET, ABM will host a live webcast of remarks by president and chief executive officer Scott Salmirs and executive vice president

and chief financial officer Anthony Scaglione. A supplemental presentation will accompany the webcast and will be accessible through

the Investor Relations portion of ABM’s website by clicking on the “Events” tab.

The

webcast will be accessible at: http://investor.abm.com/events.cfm.

Listeners are asked to be online at least

15 minutes early to register, as well as to download and install any complimentary audio software that might be required. Following

the call, the webcast will be available at this URL for a period of 90 days.

In addition to the webcast, a limited number

of toll-free telephone lines will also be available for listeners who are among the first to call (877) 664-7395 within 15 minutes

before the event. Telephonic replays will be accessible during the period from two hours to seven days after the call by dialing

(855) 859-2056 and then entering ID # 50392894.

Earnings Webcast Presentation

In connection with the webcast to discuss

earnings (see above), a slide presentation related to earnings and operations will be available on the Company’s website

at www.abm.com and can be accessed through the Investor Relations section of ABM’s website by clicking on the “Events

and Presentations” tab.

ABOUT ABM

ABM (NYSE: ABM) is a leading provider of

end-to-end facility solutions with revenues of approximately $5.0 billion and 118,000 employees in over 300 offices deployed throughout

the United States and various international locations. ABM's comprehensive capabilities include facilities engineering, commercial

cleaning, energy solutions, HVAC, electrical, landscaping, parking and security, provided through stand-alone or integrated solutions.

ABM provides custom facility solutions in urban, suburban and rural areas to properties of all sizes - from schools and commercial

buildings to hospitals, manufacturing plants and

airports. ABM Industries Incorporated, which

operates through its subsidiaries, was founded in 1909. For more information, visit www.abm.com.

Cautionary Statement under the Private Securities Litigation

Reform Act of 1995

This press release contains forward-looking

statements that set forth management’s anticipated results based on management’s current plans and assumptions. Any

number of factors could cause actual results to differ materially from those anticipated. These factors include, but are not limited

to the following: (1) risks relating to our acquisition strategy may adversely impact our results of operations; (2) our strategy

of moving to an integrated facility solutions provider platform, which focuses on vertical markets, may not generate the organic

growth in revenues or profitability that we expect; (3) we are subject to intense competition that can constrain our ability to

gain business as well as our profitability; (4) our business success depends on our ability to preserve our long-term relationships

with clients; (5) increases in costs that we cannot pass on to clients could affect our profitability; (6) we have high deductibles

for certain insurable risks, and therefore we are subject to volatility associated with those risks; (7) our restructuring initiatives

may not achieve the expected cost reductions; (8) our business success depends on retaining senior management and attracting and

retaining qualified personnel; (9) we are at risk of losses stemming from accidents or other incidents at facilities in which we

operate, which could cause significant damage to our reputation and financial loss; (10) negative or unexpected tax consequences

could adversely affect our results of operations; (11) federal health care reform legislation may adversely affect our business

and results of operations; (12) changes in energy prices and government regulations could adversely impact the results of operations

of our Building & Energy Solutions business; (13) significant delays or reductions in appropriations for our government contracts

may negatively affect our business and could have an adverse effect on our financial position, results of operations, and cash

flows; (14) we conduct some of our operations through joint ventures, and our ability to do business may be affected by the failure

of our joint venture partners to perform their obligations; (15) our business may be negatively affected by adverse weather conditions;

(16) we are subject to business continuity risks associated with centralization of certain administrative functions; (17) our services

in areas of military conflict expose us to additional risks; (18) we are subject to cyber-security risks arising out of breaches

of security relating to sensitive company, client, and employee information and to the technology that manages our operations and

other business processes; (19) a decline in commercial office building occupancy and rental rates could affect our revenues and

profitability; (20) deterioration in general economic conditions could reduce the demand for facility services and, as a result,

reduce our earnings and adversely affect our financial condition; (21) financial difficulties or bankruptcy of one or more of our

clients could adversely affect our results; (22) any future increase in the level of our debt or in interest rates could affect

our results of operations; (23) our ability to operate and pay our debt obligations depends upon our access to cash; (24) goodwill

impairment charges could have a material adverse effect on our financial condition and results of operations; (25) impairment of

long-lived assets may adversely affect our operating results; (26) we are defendants in class and representative actions and other

lawsuits alleging various claims that could cause us to incur substantial liabilities; (27) changes in immigration laws or enforcement

actions or investigations under such laws could significantly adversely affect our labor force, operations, and financial results;

(28) labor disputes could lead to loss of revenues or expense variations; (29) we participate in multiemployer pension plans that

under certain circumstances could result in material liabilities being incurred; and (30) disasters or acts of terrorism could

disrupt services.

Additional information regarding these

and other risks and uncertainties the Company faces is contained in the Company’s Annual Report on Form 10-K for the year

ended October 31, 2014, and in other reports the Company files from time to time with the Securities and Exchange Commission. The

Company urges readers to consider these risks and uncertainties in evaluating its forward-looking statements. The Company cautions

readers not to place undue reliance upon any such forward- looking statements, which speak only as of the date made. The Company

disclaims any obligation or undertaking to publicly release any updates or revisions to any forward-looking statements contained

herein (or elsewhere) to reflect any change in the Company’s expectations with regard thereto, or any change in events, conditions

or circumstances on which any such statement is made, whether as a result of new information, future events or otherwise.

Use of Non-GAAP Financial Information

To supplement ABM’s consolidated financial

information, the Company has presented net income and operating profit, as adjusted for items impacting comparability, for the

second quarter of fiscal years 2015 and 2014. These adjustments have been made with the intent of providing financial measures

that give management and investors a better understanding of the underlying operational results and trends as well as ABM’s

marketplace performance. In addition, the Company has presented earnings before interest, taxes, depreciation and amortization

and excluding items impacting comparability (adjusted EBITDA) for the second quarter of fiscal years 2015 and 2014. Adjusted EBITDA

is among the indicators management uses as a basis for planning and forecasting future periods. The presentation of these non-GAAP

financial measures is not meant to be considered in isolation or as a substitute for financial statements prepared in accordance

with accounting principles generally accepted in the United States of America. (See accompanying financial tables for supplemental

financial data and corresponding reconciliations to certain GAAP financial measures.)

# # #

| Contact: |

|

|

|

|

| Investors & Analysts: |

David Farwell |

|

Media: |

Chas Strong |

| |

(212) 297-9792 |

|

|

(770) 953-5072 |

| |

dfarwell@abm.com |

|

|

chas.strong@abm.com |

Financial Schedules

ABM INDUSTRIES INCORPORATED AND SUBSIDIARIES

CONSOLIDATED INCOME STATEMENT INFORMATION (UNAUDITED)

| | |

Three Months Ended April 30, | |

|

| ($ in millions, except per share amounts) | |

2015 | |

2014 | |

Increase /

(Decrease) |

| Revenues | |

$ | 1,270.1 | | |

$ | 1,231.3 | | |

| 3.2 | % |

| Expenses | |

| | | |

| | | |

| | |

| Operating | |

| 1,139.2 | | |

| 1,103.4 | | |

| 3.2 | % |

| Selling, general and administrative | |

| 94.1 | | |

| 93.3 | | |

| 0.9 | % |

| Amortization of intangible assets | |

| 6.0 | | |

| 6.7 | | |

| (10.4 | )% |

| Total expenses | |

| 1,239.3 | | |

| 1,203.4 | | |

| 3.0 | % |

| Operating profit | |

| 30.8 | | |

| 27.9 | | |

| 10.4 | % |

| Income from unconsolidated affiliates, net | |

| 2.2 | | |

| 1.2 | | |

| 83.3 | % |

| Interest expense | |

| (2.5 | ) | |

| (2.7 | ) | |

| 7.4 | % |

| Income before income taxes | |

| 30.5 | | |

| 26.4 | | |

| 15.5 | % |

| Provision for income taxes | |

| (12.2 | ) | |

| (11.2 | ) | |

| (8.9 | )% |

| Net income | |

$ | 18.3 | | |

$ | 15.2 | | |

| 20.4 | % |

| Net income per common share | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.32 | | |

$ | 0.27 | | |

| 18.5 | % |

| Diluted | |

$ | 0.32 | | |

$ | 0.27 | | |

| 18.5 | % |

| Weighted-average common and common equivalent shares outstanding | |

| | | |

| | | |

| | |

| Basic | |

| 56.8 | | |

| 56.1 | | |

| | |

| Diluted | |

| 57.6 | | |

| 57.0 | | |

| | |

| Dividends declared per common share | |

$ | 0.160 | | |

$ | 0.155 | | |

| | |

| | |

Six Months Ended April 30, | |

|

| ($ in millions, except per share amounts) | |

2015 | |

2014 | |

Increase /

(Decrease) |

| Revenues | |

$ | 2,559.5 | | |

$ | 2,457.8 | | |

| 4.1 | % |

| Expenses | |

| | | |

| | | |

| | |

| Operating | |

| 2,300.4 | | |

| 2,211.9 | | |

| 4.0 | % |

| Selling, general and administrative | |

| 196.9 | | |

| 180.7 | | |

| 9.0 | % |

| Amortization of intangible assets | |

| 12.2 | | |

| 13.4 | | |

| (9.0 | )% |

| Total expenses | |

| 2,509.5 | | |

| 2,406.0 | | |

| 4.3 | % |

| Operating profit | |

| 50.0 | | |

| 51.8 | | |

| (3.5 | )% |

| Income from unconsolidated affiliates, net | |

| 3.7 | | |

| 2.7 | | |

| 37.0 | % |

| Interest expense | |

| (5.2 | ) | |

| (5.4 | ) | |

| 3.7 | % |

| Income before income taxes | |

| 48.5 | | |

| 49.1 | | |

| (1.2 | )% |

| Provision for income taxes | |

| (12.5 | ) | |

| (20.8 | ) | |

| 39.9 | % |

| Net income | |

$ | 36.0 | | |

$ | 28.3 | | |

| 27.2 | % |

| Net income per common share | |

| | | |

| | | |

| | |

| Basic | |

$ | 0.64 | | |

$ | 0.51 | | |

| 25.5 | % |

| Diluted | |

$ | 0.63 | | |

$ | 0.50 | | |

| 26.0 | % |

| Weighted-average common and common equivalent shares outstanding | |

| | | |

| | | |

| | |

| Basic | |

| 56.6 | | |

| 55.9 | | |

| | |

| Diluted | |

| 57.4 | | |

| 57.0 | | |

| | |

| Dividends declared per common share | |

$ | 0.320 | | |

$ | 0.310 | | |

| | |

ABM INDUSTRIES INCORPORATED AND SUBSIDIARIES

SELECTED CONSOLIDATED CASH FLOW INFORMATION (UNAUDITED)

| | |

Three Months Ended April 30, |

| (in millions) | |

2015 | |

2014 |

| Net cash provided by operating activities | |

$ | 71.4 | | |

$ | 76.6 | |

| Purchase of businesses, net of cash acquired | |

$ | (4.4 | ) | |

$ | (12.3 | ) |

| Other | |

| (5.9 | ) | |

| (9.1 | ) |

| Net cash used in investing activities | |

$ | (10.3 | ) | |

$ | (21.4 | ) |

| Proceeds from exercises of stock options | |

$ | 8.6 | | |

$ | 2.5 | |

| Incremental tax benefit from share-based compensation awards | |

| 0.9 | | |

| — | |

| Repurchases of common stock | |

| (7.9 | ) | |

| — | |

| Dividends paid | |

| (9.0 | ) | |

| (8.7 | ) |

| Borrowings from line of credit | |

| 230.6 | | |

| 245.0 | |

| Repayment of borrowings from line of credit | |

| (286.1 | ) | |

| (284.8 | ) |

| Changes in book cash overdrafts | |

| (5.9 | ) | |

| (4.8 | ) |

| Repayment of capital lease obligations | |

| (0.7 | ) | |

| (0.9 | ) |

| Net cash used in financing activities | |

$ | (69.5 | ) | |

$ | (51.7 | ) |

| | |

Six Months Ended April 30, |

| (in millions) | |

2015 | |

2014 |

| Net cash provided by operating activities | |

$ | 39.0 | | |

$ | 37.7 | |

| Purchase of businesses, net of cash acquired | |

$ | (4.2 | ) | |

$ | (12.1 | ) |

| Other | |

| (9.7 | ) | |

| (18.7 | ) |

| Net cash used in investing activities | |

$ | (13.9 | ) | |

$ | (30.8 | ) |

| Proceeds from exercises of stock options | |

$ | 13.5 | | |

$ | 4.8 | |

| Incremental tax benefit from share-based compensation awards | |

| 1.2 | | |

| — | |

| Repurchases of common stock | |

| (7.9 | ) | |

| — | |

| Dividends paid | |

| (17.9 | ) | |

| (17.3 | ) |

| Deferred financing costs paid | |

| (0.3 | ) | |

| (1.2 | ) |

| Borrowings from line of credit | |

| 457.3 | | |

| 534.1 | |

| Repayment of borrowings from line of credit | |

| (470.1 | ) | |

| (521.8 | ) |

| Changes in book cash overdrafts | |

| (5.9 | ) | |

| 1.5 | |

| Repayment of capital lease obligations | |

| (1.3 | ) | |

| (1.9 | ) |

| Net cash used in financing activities | |

$ | (31.4 | ) | |

$ | (1.8 | ) |

ABM INDUSTRIES INCORPORATED AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEET INFORMATION (UNAUDITED)

| (in millions) | |

April 30, 2015 | |

October 31, 2014 |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 30.4 | | |

$ | 36.7 | |

| Trade accounts receivable, net of allowances | |

| 764.6 | | |

| 748.2 | |

| Prepaid expenses | |

| 75.7 | | |

| 65.5 | |

| Deferred income taxes, net | |

| 51.0 | | |

| 46.6 | |

| Other current assets | |

| 30.1 | | |

| 30.2 | |

| Total current assets | |

| 951.8 | | |

| 927.2 | |

| Other investments | |

| 31.9 | | |

| 32.9 | |

| Property, plant and equipment, net of accumulated depreciation | |

| 79.2 | | |

| 83.4 | |

| Other intangible assets, net of accumulated amortization | |

| 118.7 | | |

| 128.8 | |

| Goodwill | |

| 908.8 | | |

| 904.6 | |

| Other assets | |

| 115.2 | | |

| 116.0 | |

| Total assets | |

$ | 2,205.6 | | |

$ | 2,192.9 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Trade accounts payable | |

$ | 147.9 | | |

$ | 175.9 | |

| Accrued compensation | |

| 133.3 | | |

| 131.2 | |

| Accrued taxes—other than income | |

| 34.6 | | |

| 29.4 | |

| Insurance claims | |

| 80.1 | | |

| 80.0 | |

| Income taxes payable | |

| 0.1 | | |

| 2.0 | |

| Other accrued liabilities | |

| 115.5 | | |

| 107.9 | |

| Total current liabilities | |

| 511.5 | | |

| 526.4 | |

| Noncurrent income taxes payable | |

| 55.6 | | |

| 53.7 | |

| Line of credit | |

| 307.0 | | |

| 319.8 | |

| Deferred income tax liability, net | |

| 27.2 | | |

| 16.4 | |

| Noncurrent insurance claims | |

| 263.8 | | |

| 269.7 | |

| Other liabilities | |

| 40.3 | | |

| 38.1 | |

| Total liabilities | |

| 1,205.4 | | |

| 1,224.1 | |

| Total stockholders' equity | |

| 1,000.2 | | |

| 968.8 | |

| Total liabilities and stockholders’ equity | |

$ | 2,205.6 | | |

$ | 2,192.9 | |

ABM INDUSTRIES INCORPORATED AND SUBSIDIARIES

REVENUES AND OPERATING PROFIT BY SEGMENT (UNAUDITED)

| | |

Three Months Ended April 30, | |

Increase/ |

| ($ in millions) | |

2015 | |

2014 | |

(Decrease) |

| Revenues | |

| | | |

| | | |

| | |

| Janitorial | |

$ | 659.5 | | |

$ | 631.7 | | |

| 4.4 | % |

| Facility Services | |

| 145.8 | | |

| 149.5 | | |

| (2.5 | )% |

| Parking | |

| 153.5 | | |

| 152.6 | | |

| 0.6 | % |

| Security | |

| 93.7 | | |

| 93.8 | | |

| (0.1 | )% |

| Building & Energy Solutions | |

| 121.5 | | |

| 118.5 | | |

| 2.5 | % |

| Other | |

| 96.1 | | |

| 85.2 | | |

| 12.8 | % |

| Total revenues | |

$ | 1,270.1 | | |

$ | 1,231.3 | | |

| 3.2 | % |

| Operating profit | |

| | | |

| | | |

| | |

| Janitorial | |

$ | 39.9 | | |

$ | 37.2 | | |

| 7.3 | % |

| Facility Services | |

| 6.6 | | |

| 5.0 | | |

| 32.0 | % |

| Parking | |

| 6.7 | | |

| 6.0 | | |

| 11.7 | % |

| Security | |

| 2.6 | | |

| 2.0 | | |

| 30.0 | % |

| Building & Energy Solutions | |

| 3.2 | | |

| 3.5 | | |

| (8.6 | )% |

| Other | |

| 3.0 | | |

| 2.4 | | |

| 25.0 | % |

| Corporate | |

| (29.0 | ) | |

| (27.0 | ) | |

| (7.4 | )% |

| Adjustment for income from unconsolidated affiliates, net included in Building & Energy Solutions | |

| (2.2 | ) | |

| (1.2 | ) | |

| (83.3 | )% |

| Total operating profit | |

| 30.8 | | |

| 27.9 | | |

| 10.4 | % |

| Income from unconsolidated affiliates, net | |

| 2.2 | | |

| 1.2 | | |

| 83.3 | % |

| Interest expense | |

| (2.5 | ) | |

| (2.7 | ) | |

| 7.4 | % |

| Income before income taxes | |

| 30.5 | | |

| 26.4 | | |

| 15.5 | % |

| Provision for income taxes | |

| (12.2 | ) | |

| (11.2 | ) | |

| (8.9 | )% |

| Net income | |

$ | 18.3 | | |

$ | 15.2 | | |

| 20.4 | % |

| | |

Six Months Ended April 30, | |

Increase/ |

| ($ in millions) | |

2015 | |

2014 | |

(Decrease) |

| Revenues | |

| | | |

| | | |

| | |

| Janitorial | |

$ | 1,325.5 | | |

$ | 1,268.8 | | |

| 4.5 | % |

| Facility Services | |

| 302.0 | | |

| 301.2 | | |

| 0.3 | % |

| Parking | |

| 309.2 | | |

| 302.9 | | |

| 2.1 | % |

| Security | |

| 188.6 | | |

| 193.5 | | |

| (2.5 | )% |

| Building & Energy Solutions | |

| 240.9 | | |

| 220.6 | | |

| 9.2 | % |

| Other | |

| 193.3 | | |

| 170.8 | | |

| 13.2 | % |

| Total revenues | |

$ | 2,559.5 | | |

$ | 2,457.8 | | |

| 4.1 | % |

| Operating profit | |

| | | |

| | | |

| | |

| Janitorial | |

$ | 74.8 | | |

$ | 67.5 | | |

| 10.8 | % |

| Facility Services | |

| 12.5 | | |

| 10.1 | | |

| 23.8 | % |

| Parking | |

| 13.2 | | |

| 11.2 | | |

| 17.9 | % |

| Security | |

| 4.5 | | |

| 4.3 | | |

| 4.7 | % |

| Building & Energy Solutions | |

| 4.4 | | |

| 6.2 | | |

| (29.0 | )% |

| Other | |

| 5.6 | | |

| 4.3 | | |

| 30.2 | % |

| Corporate | |

| (61.3 | ) | |

| (49.1 | ) | |

| (24.8 | )% |

| Adjustment for income from unconsolidated affiliates, net included in Building & Energy Solutions | |

| (3.7 | ) | |

| (2.7 | ) | |

| (37.0 | )% |

| Total operating profit | |

| 50.0 | | |

| 51.8 | | |

| (3.5 | )% |

| Income from unconsolidated affiliates, net | |

| 3.7 | | |

| 2.7 | | |

| 37.0 | % |

| Interest expense | |

| (5.2 | ) | |

| (5.4 | ) | |

| 3.7 | % |

| Income before income taxes | |

| 48.5 | | |

| 49.1 | | |

| (1.2 | )% |

| Provision for income taxes | |

| (12.5 | ) | |

| (20.8 | ) | |

| 39.9 | % |

| Net income | |

$ | 36.0 | | |

$ | 28.3 | | |

| 27.2 | % |

ABM INDUSTRIES INCORPORATED AND SUBSIDIARIES

RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES (UNAUDITED)

| (in millions,

except per share amounts) | |

Three Months Ended April 30, | |

Six Months Ended April 30, |

| | |

2015 | |

2014 | |

2015 | |

2014 |

| Reconciliation of Adjusted Net Income to Net Income | |

| | | |

| | | |

| | | |

| | |

| Adjusted net income | |

$ | 21.3 | | |

$ | 18.8 | | |

$ | 42.8 | | |

$ | 32.9 | |

| Items impacting comparability: | |

| | | |

| | | |

| | | |

| | |

| CEO/CFO Change (a) | |

| (1.4 | ) | |

| — | | |

| (4.6 | ) | |

| — | |

| Litigation and other settlements | |

| — | | |

| (3.4 | ) | |

| (2.3 | ) | |

| (3.4 | ) |

| Restructuring (b) | |

| (0.1 | ) | |

| (1.0 | ) | |

| (0.8 | ) | |

| (1.6 | ) |

| Acquisition costs | |

| (0.5 | ) | |

| (0.2 | ) | |

| (0.7 | ) | |

| (0.3 | ) |

| Rebranding (c) | |

| — | | |

| (1.4 | ) | |

| (0.1 | ) | |

| (1.8 | ) |

| U.S. Foreign Corrupt Practices Act investigation (d) | |

| (0.1 | ) | |

| (0.3 | ) | |

| (0.2 | ) | |

| (0.9 | ) |

| Insurance adjustment | |

| (3.0 | ) | |

| — | | |

| (3.0 | ) | |

| — | |

| Total items impacting comparability | |

| (5.1 | ) | |

| (6.3 | ) | |

| (11.7 | ) | |

| (8.0 | ) |

| Benefit from income taxes | |

| 2.1 | | |

| 2.7 | | |

| 4.9 | | |

| 3.4 | |

| Items impacting comparability, net of taxes | |

| (3.0 | ) | |

| (3.6 | ) | |

| (6.8 | ) | |

| (4.6 | ) |

| Net income | |

$ | 18.3 | | |

$ | 15.2 | | |

$ | 36.0 | | |

$ | 28.3 | |

| | |

Three Months Ended April 30, | |

Six Months Ended April 30, |

| | |

2015 | |

2014 | |

2015 | |

2014 |

| Reconciliation of Adjusted Operating Profit to Operating Profit | |

| | | |

| | | |

| | | |

| | |

| Adjusted operating profit | |

$ | 35.9 | | |

$ | 34.2 | | |

$ | 61.7 | | |

$ | 59.8 | |

| Total items impacting comparability | |

| (5.1 | ) | |

| (6.3 | ) | |

| (11.7 | ) | |

| (8.0 | ) |

| Operating profit | |

$ | 30.8 | | |

$ | 27.9 | | |

$ | 50.0 | | |

$ | 51.8 | |

| | |

| | | |

| | | |

| | | |

| | |

| Reconciliation of Adjusted EBITDA to Net Income | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA | |

$ | 52.5 | | |

$ | 49.4 | | |

$ | 93.8 | | |

$ | 90.9 | |

| Items impacting comparability | |

| (5.1 | ) | |

| (6.3 | ) | |

| (11.7 | ) | |

| (8.0 | ) |

| Provision for income taxes | |

| (12.2 | ) | |

| (11.2 | ) | |

| (12.5 | ) | |

| (20.8 | ) |

| Interest expense | |

| (2.5 | ) | |

| (2.7 | ) | |

| (5.2 | ) | |

| (5.4 | ) |

| Depreciation and amortization | |

| (14.4 | ) | |

| (14.0 | ) | |

| (28.4 | ) | |

| (28.4 | ) |

| Net income | |

$ | 18.3 | | |

$ | 15.2 | | |

$ | 36.0 | | |

$ | 28.3 | |

| | |

Three Months Ended April 30, | |

Six Months Ended April 30, |

| | |

2015 | |

2014 | |

2015 | |

2014 |

| Reconciliation of Adjusted Net Income per Diluted Share to Net Income per Diluted Share | |

| | | |

| | | |

| | | |

| | |

| Adjusted net income per diluted share | |

$ | 0.37 | | |

$ | 0.33 | | |

$ | 0.75 | | |

$ | 0.58 | |

| Items impacting comparability, net of taxes | |

| (0.05 | ) | |

| (0.06 | ) | |

| (0.12 | ) | |

| (0.08 | ) |

| Net income per diluted share | |

$ | 0.32 | | |

$ | 0.27 | | |

$ | 0.63 | | |

$ | 0.50 | |

| Diluted shares | |

| 57.6 | | |

| 57.0 | | |

| 57.4 | | |

| 57.0 | |

(a) Represents severance and other costs related to the departure

of our former CEO and CFO.

(b) Restructuring costs associated with realignment of our operational

structure.

(c) Represents costs related to the Company's branding initiative.

(d) Includes legal and other cost incurred in connection with

an internal investigation into a foreign entity affiliated with a former joint venture partner.

ABM INDUSTRIES INCORPORATED AND SUBSIDIARIES

RECONCILIATION OF ESTIMATED ADJUSTED NET INCOME PER DILUTED

SHARE TO

ESTIMATED NET INCOME PER DILUTED SHARE FOR THE YEAR ENDING

OCTOBER 31, 2015

| | |

Year Ended October 31, 2015 |

Estimated net income per diluted share (a) | |

Low Estimate | |

High Estimate |

| | |

(per diluted share) |

| Adjusted net income per diluted share | |

$ | 1.75 | | |

$ | 1.85 | |

| Adjustments (b) | |

$ | (0.20 | ) | |

$ | (0.20 | ) |

| Net income per diluted share | |

$ | 1.55 | | |

$ | 1.65 | |

(a) This guidance excludes potential benefit

associated with the Work Opportunity Tax Credit for calendar 2015. If Congress were to extend the WOTC for calendar 2015 prior

to October 31, 2015, the Company could have a further benefit of $0.08 per diluted share.

(b) Adjustments include certain rebranding

costs and legal settlements, adjustments to self-insurance reserves pertaining to prior year's claims and other unique items impacting

comparability.

Exhibit 99.2

Cover Slide Title (20pt. Bold) Second Quarter 2015 Teleconference June 3, 2015 1

Agenda 2 1 2 3 4 Introduction, Overview & Highlights Second Quarter 2015 Operational Results Capital Structure Fiscal 2015 Outlook 5 Questions & Answers Forward - Looking Statements and Non - GAAP Financial Information: Our discussions during this conference call will include forward - looking statements. Actual results could differ materially fro m those projected in the forward - looking statements. The factors that could cause actual results to differ are discussed in the Company’s 2014 Annual Report on Form 10 - K and in our 2015 reports on Form 10 - Q and Form 8 - K that will be filed Wednesday, June 3rd. These reports are available on our website at http://investor.abm.com/ under “SEC Filings”. A description of factors that could cause actual results to differ is also set forth at the end of this presentation. Also, the discussion during this conference call will include certain financial measures that were not prepared in accordance wi th U.S. generally accepted accounting principles (“U.S. GAAP”). Reconciliations of those non - GAAP financial measures to the most directly comparable U.S. GAAP financ ial measures can be found on the Investor Relations portion of our website at http://investor.abm.com and at the end of this presentation.

Second Quarter Highlights • Revenues of $1,270.1m, up 3.2% y - o - y, organic growth of 1.3% • Adjusted EPS of $0.37, an increase of 12% compared to prior year • ABM executed ~$10m in share repurchases of ~313k shares • ABM funded its wholly owned Insurance Captive, IFM Assurance Company • Boston Consulting Group selected to assist in long - term strategic plan • Announced 197 th consecutive quarterly dividend 3

Second Quarter 2015 Review of Operational Results

Onsite Operational Results 5 Janitorial Services • Revenues of $659.5m, increase of 4.4% y - o - y − Includes revenues of $17.8m from the acquisition of GBM − Organic revenue growth of 1.6% ▪ 3.9%, excluding the termination of a large multi - regional contract • Operating profit of $39.9m, increase of 7.3% y - o - y − Operating profit margins increased to 6.1% Facility Services • Revenues of $145.8m, decrease of 2.5% y - o - y • Operating profit of $6.6m, increase of 32.0% y - o - y − Operating profit margins increased to 4.5% Parking • Revenues of $153.5m, increase of 0.6% y - o - y − Excluding management reimbursement Parking was up $2.9m, increase of 3.8% y - o - y • Operating profit of $6.7m, increase of 11.7% y - o - y − Operating profit margins increased to 4.4% Security • Revenues of $93.7m, decrease of 0.1% y - o - y • Operating profit of $2.6m, increase of 30.0% y - o - y − Operating profit margins increased to 2.8%

Operational Results 6 BESG Other ( AirServ ) • Revenues of $121.5m, increase of 2.5% y - o - y − Includes incremental revenues of $5.1m from recent acquisitions − ABES delivered 1.4% revenue growth − Healthcare Support Services delivered 12% revenue growth − Government saw a decline - 3.7% • Operating profit of $3.2m, decrease of 8.6% y - o - y − Operating profit margins decreased to 2.6% • Revenues of $96.1m, increase of 12.8% y - o - y • Operating profit of $3.0m, increase of 25.0% y - o - y − Operating profit margins increased to 3.1%

7 Capital Structure

Select Cash Flow & Balance Sheet Items Cash Flow from Operating Activities 8 • DSO unchanged on a y - o - y basis and down 3 days sequentially • Days sales outstanding (DSO) for the second quarter were 53 days

Select Cash Flow & Balance Sheet Items Leverage 9 Q2 FY15 Leverage of 1.93x Note: Acquisitions shown represent purchase above $15m

Select Cash Flow & Balance Sheet Items Shareholder Return 10 *Accelerated Q2 FY13 dividend payment in Q1 FY13

The Captive Vision • The Company formed a wholly - owned captive insurance entity (“IFM Assurance Company”) as a vehicle for change and continuous improvement as part of a multi - year risk and safety strategy • There will be multiple elements of the Captive strategy that will help us gain efficiencies over the long - term. Several of the initial areas we plan to look at include : − “True Cost” Analytics. More precisely assess where our risks lie which will allow us to make more informed risk tolerance and pricing decisions within the operating units − Allocation Practices. Continue to d evelop and deploy accountability - based risk allocation strategies with the goal of driving the right behaviors to minimize our risk exposure − Investments. Consider the implementation of new technology - based tools to document our work practices and expand our safety training curriculum − Retention. Evaluate whether or not our current retained limits and per - claim deductibles are at the optimal levels when considering the current legislative and legal climates 11

O utlook

Fiscal 2015 Outlook • The Company is providing the following guidance: − A djusted net income to $1.75 to $1.85 per diluted share − Net income of $1.55 to $1.65 per diluted share − This guidance excludes potential benefits associated with the Work Opportunity Tax Credit, should Congress extend the WOTC for calendar 2015, prior to October 31, 2015,the Company could have a further benefit of $0.08 per diluted share in fiscal 2015 • Effective tax rate in the range of 32% to 36% • Fiscal 2015 has one less work day, which the Company anticipates will reduce labor expense by approximately $4.0 million on a pre - tax basis: − Work days for fiscal 2015 by quarter are as follows: Q1 65; Q2 64; Q3 66; and Q4 65. Year - over - year compared to fiscal 2014, Q1 has one less work day; Q2 has one more work day; Q3 works days are the same; and Q4 has one less work day • Interest expense of $11.0 million to $13.0 million • Depreciation and amortization expense of $56.0 million to $60.0 million • Capital expenditures are expected to be in the range of $31.0 million to $35.0 million 13

Forward - Looking Statement This presentation contains forward - looking statements that set forth management's anticipated results based on management's curr ent plans and assumptions. Any number of factors could cause the Company's actual results to differ materially from those anticipated. Thes e f actors include but are not limited to the following: (1) risks relating to our acquisition strategy may adversely impact our results of operatio ns; (2) our strategy of moving to an integrated facility solutions provider platform, which focuses on vertical markets, may not generate the organic gr owth in revenues or profitability that we expect; (3) we are subject to intense competition that can constrain our ability to gain business as we ll as our profitability; (4) our business success depends on our ability to preserve our long - term relationships with clients; (5) increases in costs that we cannot pass on to clients could affect our profitability; (6) we have high deductibles for certain insurable risks, and therefore we are subjec t t o volatility associated with those risks; (7) our restructuring initiatives may not achieve the expected cost reductions; (8) our business success depends on retaining senior management and attracting and retaining qualified personnel; (9) we are at risk of losses stemming from accidents or other in cid ents at facilities in which we operate, which could cause significant damage to our reputation and financial loss; (10) negative or unexpected tax con sequences could adversely affect our results of operations; (11) federal health care reform legislation may adversely affect our business and re sults of operations; (12) changes in energy prices and government regulations could adversely impact the results of operations of our Building & Energy So lutions business; (13) significant delays or reductions in appropriations for our government contracts may negatively affect our business and c oul d have an adverse effect on our financial position, results of operations, and cash flows; (14) we conduct some of our operations through joint ve ntures, and our ability to do business may be affected by the failure of our joint venture partners to perform their obligations; (15) our business m ay be negatively affected by adverse weather conditions; (16) we are subject to business continuity risks associated with centralization of certain adm ini strative functions; (17) our services in areas of military conflict expose us to additional risks; (18) we are subject to cyber - security risks arising ou t of breaches of security relating to sensitive company, client, and employee information and to the technology that manages our operations and other b usi ness processes; (19) a decline in commercial office building occupancy and rental rates could affect our revenues and profitability; (20) det eri oration in general economic conditions could reduce the demand for facility services and, as a result, reduce our earnings and adversely affect our financial condition; (21) financial difficulties or bankruptcy of one or more of our clients could adversely affect our results; (22) any future increase in the level of our debt or in interest rates could affect our results of operations; ( 23) our ability to operate and pay our debt obligations depends upon our access to cash; ( 24) goodwill impairment charges could have a material adverse effect on our financial condition and results of operations; ( 25) impairment of long - lived assets may adversely affect our operating results; ( 26) we are defendants in class and representative actions and other lawsuits alleging various claims that could cause us to incur substantial liabilities; ( 27) changes in immigration laws or enforcement actions or investigations under such laws could significantly adversely affect our labor force, operations, and financial results; ( 28) labor disputes could lead to loss of revenues or expense variations; (29) we participate in multiemployer pension plans that under certain circumstances could result in material liabilities being incurred; and ( 30) disasters or acts of terrorism could disrupt services. 14

Appendix - Unaudited Reconciliation of non - GAAP Financial Measures

Unaudited Reconciliation of non - GAAP Financial Measures 16 ABM INDUSTRIES INCORPORATED AND SUBSIDIARIES RECONCILIATIONS OF NON-GAAP FINANCIAL MEASURES (UNAUDITED) (in millions, except per share amounts) 2015 2014 2015 2014 Reconciliation of Adjusted Net Income to Net Income Adjusted net income 21.3$ 18.8$ 42.8$ 32.9$ Items impacting comparability: CEO/CFO Change (a) (1.4) - (4.6) - Litigation and other settlements - (3.4) (2.3) (3.4) Restructuring (b) (0.1) (1.0) (0.8) (1.6) Acquisition costs (0.5) (0.2) (0.7) (0.3) Rebranding (c) - (1.4) (0.1) (1.8) U.S. Foreign Corrupt Practices Act investigation (d) (0.1) (0.3) (0.2) (0.9) Insurance adjustment (3.0) - (3.0) - Total items impacting comparability (5.1) (6.3) (11.7) (8.0) Benefit from income taxes 2.1 2.7 4.9 3.4 Items impacting comparability, net of taxes (3.0) (3.6) (6.8) (4.6) Net income 18.3$ 15.2$ 36.0$ 28.3$ (a) Represents severance and other costs related to the departure of our former CEO and CFO. (b) Restructuring costs associated with realignment of our operational structure. (c) Represents costs related to the Company's branding initiative. (d) Includes legal and other cost incurred in connection with an internal investigation into a foreign entity affiliated with a former joint venture partner. Three Months Ended April 30, Six Months Ended April 30,

Unaudited Reconciliation of non - GAAP Financial Measures 17 2015 2014 2015 2014 Reconciliation of Adjusted Operating Profit to Operating Profit Adjusted operating profit 35.9$ 34.2$ 61.7$ 59.8$ Total items impacting comparability (5.1) (6.3) (11.7) (8.0) Operating profit 30.8$ 27.9$ 50.0$ 51.8$ Reconciliation of Adjusted EBITDA to Net Income Adjusted EBITDA 52.5$ 49.4$ 93.8$ 90.9$ Items impacting comparability (5.1) (6.3) (11.7) (8.0) Provision for income taxes (12.2) (11.2) (12.5) (20.8) Interest expense (2.5) (2.7) (5.2) (5.4) Depreciation and amortization (14.4) (14.0) (28.4) (28.4) Net income 18.3$ 15.2$ 36.0$ 28.3$ 2015 2014 2015 2014 Adjusted net income per diluted share 0.37$ 0.33$ 0.75$ 0.58$ Items impacting comparability, net of taxes (0.05) (0.06) (0.12) (0.08) Net income per diluted share 0.32$ 0.27$ 0.63$ 0.50$ Diluted shares 57.6 57.0 57.4 57.0 Six Months Ended April 30, Six Months Ended April 30, Three Months Ended April 30, Three Months Ended April 30, Reconciliation of Adjusted Net Income per Diluted Share to Net Income per Diluted Share

Unaudited Reconciliation of non - GAAP Financial Measures 18 ABM INDUSTRIES INCORPORATED AND SUBSIDIARIES RECONCILIATION OF ESTIMATED ADJUSTED NET INCOME PER DILUTED SHARE TO ESTIMATED NET INCOME PER DILUTED SHARE FOR THE YEAR ENDING OCTOBER 31, 2015 Estimated net income per diluted share (a) Low Estimate High Estimate Adjusted net income per diluted share 1.75$ 1.85$ Adjustments (b) (0.20)$ (0.20)$ Net income per diluted share 1.55$ 1.65$ (b) Adjustments include certain rebranding costs and legal settlements, adjustments to self- insurance reserves pertaining to prior year's claims and other unique items impacting comparability. Year Ending October 31, 2015 (per diluted share) (a) This guidance excludes potential benefit associated with the Work Opportunity Tax Credit for calendar 2015. If Congress were to extend the WOTC for calendar 2015 prior to October 31, 2015, the Company could have a further benefit of $0.08 per diluted share.

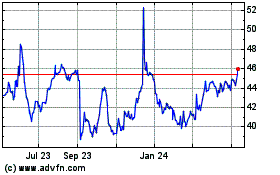

ABM Industries (NYSE:ABM)

Historical Stock Chart

From Mar 2024 to Apr 2024

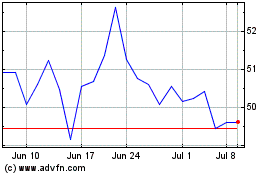

ABM Industries (NYSE:ABM)

Historical Stock Chart

From Apr 2023 to Apr 2024