UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

May 21, 2015

Date

of Report (Date of earliest event reported)

AGENUS INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| DELAWARE |

|

000-29089 |

|

06-1562417 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 3 Forbes Road

Lexington, MA |

|

02421 |

| (Address of principal executive offices) |

|

(Zip Code) |

781-674-4400

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

On May 21, 2015, Agenus Inc. (the “Company”)

entered into an Underwriting Agreement (the “Underwriting Agreement”) with Jefferies LLC and William Blair & Company, L.L.C., acting as representatives of the underwriters named therein (collectively, the

“Underwriters”), pursuant to which the Company agreed to offer and sell 11,000,000 shares of its common stock in an underwritten offering at a price to the public of $6.30 per share (the “Offering”). In addition,

the Company has granted the Underwriters an option exercisable for 30 days from the date of the Underwriting Agreement to purchase up to an additional 1,650,000 shares of the Company’s common stock. The Company expects to receive approximately

$69,300,000 million in gross proceeds from the Offering, or approximately $79,695,000 million if the Underwriters exercise in full their option to purchase additional shares, in each case before deducting underwriting discounts and commissions and

estimated offering expenses. Advent Life Sciences LLP, of which the Company’s director, Dr. Shahzad Malik, is a General Partner, agreed to purchase shares of the Company’s common stock from the Underwriters in the Offering.

The shares are being offered and sold in the Offering pursuant to the Company’s currently effective shelf registration statement on

Form S-3 (File No. 333-199255) (the “Registration Statement”), as supplemented by a preliminary prospectus supplement dated May 20, 2015. The shares are expected to be delivered to the Underwriters on or about

May 27, 2015, subject to the satisfaction of customary closing conditions.

On May 20, 2015, the Company issued a press release

announcing the Offering. On May 21, 2015, the Company issued a press release announcing the pricing of the Offering. Copies of the press releases are attached hereto as Exhibits 99.1 and 99.2, respectively, and are each incorporated herein by

reference.

| Item 9.01 |

Financial Statements and Exhibits. |

The following Exhibits are filed as part of this report:

|

|

|

| Exhibit

No. |

|

Description of Exhibit |

|

|

| 99.1 |

|

Press Release dated May 20, 2015 issued by Agenus Inc. |

|

|

| 99.2 |

|

Press Release dated May 21, 2015 issued by Agenus Inc. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

AGENUS INC. |

|

|

|

|

| Date: May 21, 2015 |

|

|

|

By: |

|

/s/ Garo H. Armen |

|

|

|

|

|

|

|

|

|

|

Garo H. Armen |

|

|

|

|

|

|

Chairman and CEO |

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description of Exhibit |

|

|

| 99.1 |

|

Press Release dated May 20, 2015 issued by Agenus Inc. |

|

|

| 99.2 |

|

Press Release dated May 21, 2015 issued by Agenus Inc. |

Exhibit 99.1

Agenus Announces Proposed Public Offering of Common Stock

LEXINGTON, Mass – May 20, 2015 – Agenus Inc. (NASDAQ: AGEN), an immunotherapy company developing immune-oncology checkpoint modulators

(CPMs), heat shock protein peptide-based vaccines and immune adjuvants, today announced that it intends to offer and sell, subject to market conditions, shares of its common stock in an underwritten public offering. Agenus intends to grant the

underwriters a 30-day option to purchase up to an additional 15 percent of the shares of its common stock offered in the public offering. All of the shares of common stock to be sold in the offering will be offered by Agenus. There can be no

assurance as to whether or when the offering may be completed, or as to the actual size or terms of the offering.

Jefferies LLC and William

Blair & Company, L.L.C. are acting as joint book-running managers for the proposed offering and Oppenheimer & Co. Inc. is acting as co-manager for the proposed offering.

The shares will be issued by Agenus pursuant to a shelf registration statement that was previously filed with the Securities and Exchange Commission (SEC) on

October 10, 2014 and declared effective by the SEC on October 23, 2014. The offering will be made only by means of a written prospectus and prospectus supplement that form a part of the registration statement. A preliminary prospectus

supplement and accompanying prospectus relating to the offering will be filed with the SEC and will be available on the SEC’s website at www.sec.gov. Copies of the preliminary prospectus supplement and the accompanying prospectus, when

available, may also be obtained by contacting Jefferies LLC, Attention: Equity Syndicate Prospectus Department, 520 Madison Avenue, 2nd Floor, New York, NY 10022, or by email at Prospectus_Department@Jefferies.com, or by phone at

(877) 547-6340; or William Blair & Company, L.L.C. at 222 West Adams Street, Chicago, IL 60606, Attention: Prospectus Department, by telephone at (800) 621-0687, or by email at prospectus@williamblair.com.

This press release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

About Agenus

Agenus is an immunology company developing

a series of Checkpoint Modulators for the treatment of patients with cancer, infectious diseases, and other immune disorders, heat shock protein (HSP)-based vaccines, and immune adjuvants. These programs are supported by three separate technology

platforms. Agenus’ internal and partnered checkpoint modulator programs target GITR, OX40, CTLA-4, LAG-3, TIM-3, PD-1 and other undisclosed programs. The company’s proprietary discovery engine Retrocyte DisplayTM is used to generate fully human and humanized therapeutic antibody drug candidates. The Retrocyte Display platform uses a high-throughput approach incorporating IgG format human antibody

libraries expressed in mammalian B-lineage cells. Agenus recently acquired a powerful yeast antibody display platform termed SECANT, developed by Celexion, LLC. SECANT allows rapid generation of soluble, full-length human antibodies. SECANT and

Agenus’ mammalian antibody display platform have complementary strengths and further bolster Agenus’ abilities to generate and optimize fully human monoclonal antibodies. Agenus’ heat shock protein-based vaccines have completed Phase

2 studies in newly diagnosed glioblastoma multiforme, and in the treatment of herpes simplex viral infection; the heat shock protein-based vaccine platform can generate personalized as well as off the shelf products. The company’s QS-21

Stimulon® adjuvant platform is extensively partnered with GlaxoSmithKline and with Janssen Sciences Ireland UC and includes several candidates in Phase 2 trials, as well as shingles and

malaria vaccines which have successfully completed Phase 3 clinical trials.

Forward-Looking Statement

This press release contains forward-looking statements, including statements regarding the Company’s proposed public offering. These forward-looking

statements are subject to risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties include, among others, the factors described under the Risk Factors section of our most recent Quarterly Report on

Form 10-Q, which was filed with the SEC on May 1, 2015. Agenus cautions investors not to place considerable reliance on the forward-looking statements contained in this release. These statements speak only as of the date of this press

release, and Agenus undertakes no obligation to update or revise the statements, other than to the extent required by law. All forward-looking statements are expressly qualified in their entirety by this cautionary statement.

Contact:

Media:

Brad Miles

BMC Communications

646-513-3125

bmiles@bmccommunications.com

Investors:

Andrea Rabney/Jamie Maarten

Argot Partners

212-600-1902

andrea@argotpartners.com

jamie@argotpartners.com

Exhibit 99.2

Agenus Announces Pricing of Its Public Offering of Common Stock

LEXINGTON, Mass – May 21, 2015 – Agenus Inc. (NASDAQ: AGEN), an immunology company developing innovative treatments for cancers and

other diseases, today announced the pricing of an underwritten public offering of 11,000,000 shares of its common stock at a price to the public of $6.30 per share. The gross proceeds from the offering to Agenus are expected to be $69,300,000,

before deducting underwriting discounts and commissions and estimated offering expenses payable by Agenus. Agenus has granted the underwriters a 30-day option to purchase up to an additional 1,650,000 shares of its common stock at the public

offering price, less the underwriting discount. All of the shares of common stock to be sold in the offering will be sold by Agenus.

Jefferies

LLC and William Blair & Company, L.L.C. are acting as joint book-running managers for the offering and Oppenheimer & Co. Inc. is acting as co-manager for the offering. The offering is expected to close on or about

May 27, 2015, subject to customary closing conditions.

The shares will be issued by Agenus pursuant to a shelf registration statement that was

previously filed with the Securities and Exchange Commission (SEC) on October 10, 2014 and declared effective by the SEC on October 23, 2014. The offering is being made only by means of a written prospectus and prospectus supplement that

form a part of the registration statement. A preliminary prospectus supplement and accompanying prospectus relating to the offering has been filed with the SEC and is available on the SEC’s website at www.sec.gov. A final prospectus supplement

related to the offering will be filed with the SEC. When available, copies of the final prospectus supplement and the accompanying prospectus may also be obtained by contacting Jefferies LLC, Attention: Equity Syndicate Prospectus Department, 520

Madison Avenue, 2nd Floor, New York, NY 10022, or by email at Prospectus_Department@Jefferies.com, or by phone at (877) 547-6340; or William Blair & Company, L.L.C. at 222 West Adams Street, Chicago, IL 60606, Attention: Prospectus

Department, by telephone at (800) 621-0687, or by email at prospectus@williamblair.com.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

state or jurisdiction.

About Agenus

Agenus is an

immunology company developing a series of Checkpoint Modulators for the treatment of patients with cancer, infectious diseases, and other immune disorders, heat shock protein (HSP)-based vaccines, and immune adjuvants. These programs are supported

by three separate technology platforms. Agenus’ internal and partnered checkpoint modulator programs target GITR, OX40, CTLA-4, LAG-3, TIM-3, PD-1 and other undisclosed programs. The company’s proprietary discovery engine Retrocyte DisplayTM is used to generate fully human and humanized therapeutic antibody drug candidates. The Retrocyte Display platform uses a high-throughput approach incorporating IgG format human antibody

libraries expressed in mammalian B-lineage cells. Agenus recently acquired a powerful yeast antibody display platform termed SECANT, developed by Celexion, LLC. SECANT allows rapid generation of soluble, full-length human antibodies. SECANT and

Agenus’ mammalian antibody display platform have complementary strengths and further bolster Agenus’ abilities to generate and optimize fully human monoclonal antibodies. Agenus’ heat shock protein-based vaccines have completed Phase

2 studies in newly diagnosed glioblastoma multiforme, and in the treatment of herpes simplex viral infection; the heat shock protein-based vaccine platform can generate personalized as well as off the shelf products. The company’s QS-21

Stimulon® adjuvant platform is extensively partnered with GlaxoSmithKline and with Janssen Sciences Ireland UC and includes several candidates in Phase 2 trials, as well as shingles and

malaria vaccines which have successfully completed Phase 3 clinical trials.

Forward-Looking Statement

This press release contains forward-looking statements, including statements regarding the company’s public offering. These forward-looking statements are

subject to risks and uncertainties that could cause actual results to differ materially. These risks and uncertainties include, among others, the uncertainties related to market conditions and the completion of the public offering on the anticipated

terms or at all and the factors described under the Risk Factors section of our most recent Quarterly Report on Form 10-Q, which was filed with the SEC on May 1, 2015, and the preliminary prospectus supplement filed with the SEC on May 20,

2015 under the heading “Risk Factors.” Agenus cautions investors not to place considerable reliance on the forward-looking statements contained in this release. These statements speak only as of the date of this press release, and Agenus

undertakes no obligation to update or revise the statements, other than to the extent required by law. All forward-looking statements are expressly qualified in their entirety by this cautionary statement.

Contact:

Media:

Brad Miles

BMC Communications

646-513-3125

bmiles@bmccommunications.com

Investors:

Andrea Rabney/Jamie Maarten

Argot Partners

212-600-1902

andrea@argotpartners.com

jamie@argotpartners.com

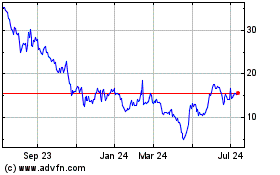

Agenus (NASDAQ:AGEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

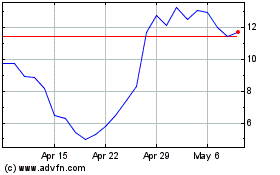

Agenus (NASDAQ:AGEN)

Historical Stock Chart

From Apr 2023 to Apr 2024