UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (date of earliest event

reported): May 11, 2015

Alico, Inc.

(Exact name of registrant as specified in

its charter)

| |

|

|

|

|

| Florida |

|

0-261 |

|

59-0906081 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

10070 Daniels Interstate Court

Fort Myers, Florida, 33913

(Address of principal executive offices)

Registrant’s telephone number:

(239) 226-2000

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 C.F.R. 230.425) |

| ¨ |

Soliciting Material pursuant to Rule 14a-12 under the Exchange Act (17 C.F.R. 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14D-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 C.F.R. 240.13e-4(c)) |

| Section 2 |

|

Financial Information |

| Item 2.02 |

|

Results of Operations and Financial Condition. |

On May 11, 2015, Alico, Inc. issued a press

release announcing its financial results for the three and six months ended March 31, 2015. A copy of the press release is furnished

within this report as Exhibit 99.1.

| Section 9 |

|

Financial Statements and Exhibits |

| Item 9.01 |

|

Financial Statements and Exhibits. |

| (d) |

|

Exhibits. |

| |

|

|

| 99.1 |

|

Alico, Inc. Press Release dated May 11, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: May 11, 2015 |

ALICO, INC. |

| |

|

|

|

| |

By: |

|

/s/ W. Mark Humphrey |

| |

|

|

|

| |

|

|

W. Mark Humphrey |

| |

|

|

Senior Vice President and Chief Financial Officer

|

Exhibit 99.1

Alico, Inc. Announces Second Quarter and

Six Months of Fiscal Year 2015

Financial Results

Fort Myers, FL, May 11, 2015 — Alico,

Inc. (“Alico”) (NASDAQ:ALCO), an agribusiness and natural resources company, today announced financial results for

the second quarter and six months ended March 31, 2015. Net income applicable to common stock for the second quarter of fiscal

2015 was $2.8 million, or $0.34 per basic and diluted share, compared to net income of $4.7 million, or $0.64 per basic and diluted

share, in the second quarter of fiscal 2014. Adjusted EBITDA, excluding non-recurring income and expense items, was $15.7 million

for the second quarter of fiscal 2015 compared to $10.8 million for the second quarter of fiscal 2014.

Fiscal Year 2015 Second Quarter Results

For the second quarter of fiscal year 2015,

total operating revenue was $55.1 million as compared to $40.6 million for the second quarter of fiscal year 2014. The increase

in operating revenue was due primarily to acquisitions in our Citrus Groves segment offset by decreased sales in the Improved Farmland

segment as a result of the recent disposition of our sugarcane operations.

Second quarter fiscal year 2015 revenue included

Citrus Groves revenue of $50.4 million compared to $22.6 million from the same period of fiscal year 2014, an increase of approximately

$27.8 million. This increase was due primarily to our December 1, 2014 acquisition of certain citrus and other assets of Orange-Co,

LP (“Orange-Co”).

We sold approximately 3.1 million boxes of

Early and Mid-Season oranges in the second quarter of 2015 compared to approximately 1.4 million boxes in the same period of fiscal

year 2014. Production of Early and Mid-Season pound solids totaled 18.7 million in the second quarter of 2015 compared to pound

solids production of approximately 8.6 million in the second quarter of 2014. The market price per pound solid for Early and Mid-Season

varieties in the second quarter of fiscal year 2015 was approximately $1.93 compared to $2.07 in the same period of fiscal 2014,

a decrease of $0.14 per pound solid or 6.8%.

Improved Farmland revenue,

which previously included the results of our sugarcane operations, was $1.0 million for the second quarter of fiscal year 2015

as compared to $10.8 million for the same period of fiscal year 2014. On November 21, 2014, we completed the sale of approximately

36,000 acres of land in Hendry County, Florida that had been used for sugarcane production and land leasing.

Total operating expenses for the second quarter

of fiscal year 2015 were $45.0 million as compared to $30.7 million for the second quarter of fiscal year 2014, an increase of

$14.3 million. Operating expenses increased by approximately $25.7 million in the Citrus Groves segment primarily due to the acquisition

of Orange-Co. Operating expenses increased by $4.2 million as a result of purchase accounting related to the acquisition of Orange-Co.

The valuation of fruit inventory acquired from Orange-Co was marked to fair value to account for the stage of the fruit development

at the time of acquisition. We expect approximately $3.0 million of incremental operating expenses related the purchase accounting

in the second half of fiscal year 2015. The impact of the purchase accounting on operating expenses is non-recurring beyond fiscal

year 2015.

Gross profit for the second quarter of fiscal

year 2015 was $10.1 million compared to $10.0 million for the second quarter of fiscal year 2014. Citrus Grove gross profit was

$10.0 million for the second quarter of fiscal year 2015 compared to $7.9 million in the second quarter of fiscal year 2014. The

2015 Citrus Groves gross profit was impacted by a $4.2 million increase in cost of sales due to the purchase accounting related

valuation of the inventory acquired from Orange-Co. Gross profit exclusive of the impact of the fair market valuation of inventory

increased by $4.3 million. Gross profit for Improved Farmland was ($.3) million for the second quarter of fiscal year 2015 compared

to $1.9 million for the second quarter of 2014 due to the sale of our sugarcane operations.

Adjusted EBITDA (defined as net income excluding

interest expense, income taxes, depreciation and amortization and non-recurring income and expense items) for the second quarter

of fiscal year 2015 was $15.7 million as compared to $10.8 million for the second quarter of fiscal year 2014. A reconciliation

of net income to Adjusted EBITDA is provided at the end of this release.

Adjusted Earnings per Common Share (defined

as net income excluding non-recurring income and expense items, net of related income taxes) were $0.76 for the second quarter

of fiscal year 2015 as compared to $0.66 for the second quarter of fiscal 2014. A reconciliation of net income to Adjusted Earnings

per Common Share is provided at the end of this release.

Fiscal Year 2015 Six Months Results

Net income for the six months ended March 31,

2015 was $10.5 million, or $1.35 per diluted share, compared to $4.0 million, or $0.54 per diluted share, for the same period of

fiscal 2014, an increase of $6.5 million. For the six months ended March 31, 2015, total operating revenue was $71.3 million, compared

to $55.6 million for the same period of fiscal year 2014, an increase of $15.7 million. Increased Citrus Groves revenues were offset

by decreases in Agricultural Supply Chain Management and Improved Farmland revenues resulting from a reduction in external boxes

handled and the sale of our sugarcane operations, respectively.

Adjusted EBITDA in the first six months of

fiscal year 2015 was $18.5 million as compared to $14.0 million in the first six months of fiscal year 2014. The increase

of $4.5 million in Adjusted EBITDA is driven by an increase in gross profit from the Citrus Groves segment of $7.0 million, partially

offset by a $2.9 million decrease in gross profit from Improved Farmland’s sugarcane operations. A reconciliation of net

income to Adjusted EBITDA is provided at the end of this release.

Adjusted Earnings per Common Share for the

first six months of fiscal year 2015 was $.084 compared to $0.71 for the first six months of fiscal year 2014. A reconciliation

of net income to Adjusted Earnings per Common Share is provided at the end of this release.

Balance Sheet and Liquidity

Cash used in operating activities was ($6.3)

million for the first six months of fiscal year 2015 as compared to cash provided by operating activities of $4.6 million during

the first six months of fiscal year 2014. Availability under our revolving lines of credit was $ 61.5 million at March 31, 2015

and $60.0 million at September 30, 2014. The Company paid down approximately $11.3 million of term debt in the second quarter of

fiscal year 2015. Debt net of cash and cash equivalents was $229.2 million at March 31, 2015 and $33.8 million at September 30,

2014.

About Alico

Alico is a holding company with assets and

related operations in agriculture and natural resources. In addition to its citrus operations, Alico is currently involved in cattle

ranching, water management, mining and other natural resources. Our mission is to create value for our customers, clients and shareholders

by managing existing lands to their optimal current income and total returns, opportunistically acquiring new agricultural assets

and producing high quality agricultural products while exercising responsible environmental stewardship. Learn more about Alico

(NASDAQ: ALCO) at www.alicoinc.com.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended. These forward-looking statements are based on Alico’s current expectations about future events and

can be identified by terms such as “plans,” “expect,” “may,” “anticipate,” “intend,”

“should be,” “will be,” “is likely to,” “believes,” and similar expressions referring

to future periods.

Alico believes the expectations

reflected in the forward-looking statements are reasonable but cannot guarantee future results, level of activity,

performance or achievements. Actual results may differ materially from those expressed or implied in the forward-looking

statements. Therefore, Alico cautions you against relying on any of these forward-looking statements. Factors which may cause

future outcomes to differ materially from those foreseen in forward-looking statements include, but are not limited to:

changes in laws, regulation and rules; weather conditions that affect production, transportation, storage, demand, import and

export of fresh product and its by-products, increased pressure from disease, insects and other pests; disruption of water

supplies or changes in water allocations; pricing and supply of raw materials and products; market responses to industry

volume pressures; pricing and supply of energy; changes in interest rates; availability of financing for land development

activities and other growth opportunities; onetime events; acquisitions and divestitures; seasonality; labor disruptions;

inability to pay debt obligations; inability to engage in certain transactions due to restrictive covenants in debt

instruments; government restrictions on land use; changes in agricultural land values; and market and pricing risks due to

concentrated ownership of stock. Other risks and uncertainties include those that are described in Alico’s SEC filings,

which are available on the SEC’s website at http://www.sec.gov. Alico undertakes no obligation to subsequently update

or revise the forward-looking statements made in this press release, except as required by law.

Non-GAAP Financial Measures

Due to significant depreciable assets associated

with the nature of our operations and, to a lesser extent, interest costs associated with our capital structure, management believes

that Adjusted EBITDA and Adjusted Earnings per Common Share are important measures to evaluate our results of operations between

periods on a more comparable basis. Such measurements are not prepared in accordance with accounting principles generally accepted

in the United States (“GAAP”) and should not be construed as an alternative to reported results determined in accordance

with GAAP. The non-GAAP information provided is unique to Alico and may not be consistent with methodologies used by other companies.

Net income which management considers being the most directly comparable financial measure calculated and presented in accordance

with GAAP is reconciled to Adjusted EBITDA and Adjusted Earnings per Common Share, as follows:

Adjusted EBITDA

| (in thousands) | |

Three Months Ended March 31, | |

Six Months Ended March 31, |

| | |

2015 | |

2014 | |

2015 | |

2014 |

| Net income | |

| 2,794 | | |

| 4,697 | | |

$ | 10,525 | | |

$ | 3,992 | |

| Interest expense, net | |

| 2,285 | | |

| 395 | | |

| 3,586 | | |

| 638 | |

| Loss on extinguishment of debt | |

| 17 | | |

| - | | |

| 964 | | |

| - | |

| Income taxes | |

| 950 | | |

| 2,992 | | |

| 4,713 | | |

| 2,445 | |

| Depreciation and amortization | |

| 4,020 | | |

| 2,427 | | |

| 6,068 | | |

| 4,929 | |

| EBITDA | |

| 10,066 | | |

| 10,511 | | |

| 25,856 | | |

| 12,004 | |

| Asset impairment | |

| 541 | | |

| - | | |

| 541 | | |

| - | |

| Transaction costs | |

| 774 | | |

| 260 | | |

| 4,353 | | |

| 2,005 | |

| Acquired citrus inventory fair value adjustments | |

| 4,202 | | |

| - | | |

| 4,202 | | |

| - | |

| Losses (Gains) on sale of real estate | |

| 116 | | |

| - | | |

| (16,424 | ) | |

| 1 | |

|

| Adjusted EBITDA | |

$ | 15,699 | | |

$ | 10,771 | | |

$ | 18,528 | | |

$ | 14,010 | |

Adjusted Earnings per Common Share

| (in thousands) | |

Three Months Ended March 31, | |

Six Months Ended March 31, |

| | |

2015 | |

2014 | |

2015 | |

2014 |

| Net income | |

$ | 2,794 | | |

$ | 4,697 | | |

$ | 10,525 | | |

$ | 3,992 | |

| Loss on extinguishment of debt | |

| 17 | | |

| - | | |

| 964 | | |

| - | |

| Asset impairment | |

| 541 | | |

| - | | |

| 541 | | |

| - | |

| Transaction costs | |

| 774 | | |

| 260 | | |

| 4,353 | | |

| 2,005 | |

| Acquired citrus inventory fair value adjustments | |

| 4,202 | | |

| - | | |

| 4,202 | | |

| - | |

| Losses (Gains) on sales of real estate | |

| 116 | | |

| - | | |

| (16,424 | ) | |

| 1 | |

| Tax impact | |

| (2,147 | ) | |

| (99 | ) | |

| 2,418 | | |

| (762 | ) |

| Adjusted net income | |

$ | 6,297 | | |

$ | 4,858 | | |

$ | 6,579 | | |

$ | 5,236 | |

| Diluted shares | |

| 8,272 | | |

| 7,349 | | |

| 7,815 | | |

| 7,349 | |

| Adjusted Earnings per Common Share | |

$ | 0.76 | | |

$ | 0.66 | | |

$ | 0.84 | | |

$ | 0.71 | |

ALICO, INC. AND SUBSIDIARIES

CONDENSED COMBINED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (UNAUDITED)

(in thousands, except per share amounts)

| | |

Three Months Ended March 31, | |

Six Months Ended March 31, |

| | |

2015 | |

2014 | |

2015 | |

2014 |

| Operating revenues: | |

| | | |

| | | |

| | | |

| | |

| Citrus Groves | |

$ | 50,371 | | |

$ | 22,590 | | |

$ | 63,289 | | |

$ | 28,223 | |

| Agricultural Supply Chain Management | |

| 3,296 | | |

| 6,135 | | |

| 4,479 | | |

| 8,241 | |

| Improved Farmland | |

| 982 | | |

| 10,750 | | |

| 2,074 | | |

| 17,282 | |

| Ranch and Conservation | |

| 309 | | |

| 910 | | |

| 1,145 | | |

| 1,441 | |

| Other Operations | |

| 164 | | |

| 257 | | |

| 313 | | |

| 444 | |

| Total operating revenue | |

| 55,122 | | |

| 40,642 | | |

| 71,300 | | |

| 55,631 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Citrus Groves | |

| 40,349 | | |

| 14,699 | | |

| 50,476 | | |

| 18,243 | |

| Agricultural Supply Chain Management | |

| 2,740 | | |

| 5,844 | | |

| 4,111 | | |

| 8,169 | |

| Improved Farmland | |

| 1,286 | | |

| 8,865 | | |

| 2,077 | | |

| 14,395 | |

| Ranch and Conservation | |

| 623 | | |

| 1,171 | | |

| 1,368 | | |

| 1,547 | |

| Other Operations | |

| 45 | | |

| 90 | | |

| 93 | | |

| 507 | |

| Total operating expenses | |

| 45,043 | | |

| 30,669 | | |

| 58,125 | | |

| 42,861 | |

| Gross profit | |

| 10,079 | | |

| 9,973 | | |

| 13,175 | | |

| 12,770 | |

| Corporate general and administrative | |

| 3,381 | | |

| 1,834 | | |

| 9,294 | | |

| 5,622 | |

| Income from operations | |

| 6,698 | | |

| 8,139 | | |

| 3,881 | | |

| 7,148 | |

| Other income (expense), net: | |

| | | |

| | | |

| | | |

| | |

| Interest and investment income, net | |

| - | | |

| (9 | ) | |

| 2 | | |

| 27 | |

| Interest expense | |

| (2,285 | ) | |

| (396 | ) | |

| (3,588 | ) | |

| (665 | ) |

| Loss on extinguishment of debt | |

| (17 | ) | |

| - | | |

| (964 | ) | |

| - | |

| Gain (loss) on sale of real estate | |

| (116 | ) | |

| (1 | ) | |

| 16,424 | | |

| (1 | ) |

| Asset impairment | |

| (541 | ) | |

| - | | |

| (541 | ) | |

| - | |

| Other income (loss), net | |

| 5 | | |

| (44 | ) | |

| 24 | | |

| (72 | ) |

| Total other income (expense), net | |

| (2,954 | ) | |

| (450 | ) | |

| 11,357 | | |

| (711 | ) |

| Income before income taxes | |

| 3,744 | | |

| 7,689 | | |

| 15,238 | | |

| 6,437 | |

| Income taxes | |

| 950 | | |

| 2,992 | | |

| 4,713 | | |

| 2,445 | |

| Net income attributable to common shareholders | |

| 2,794 | | |

| 4,697 | | |

| 10,525 | | |

| 3,992 | |

| Comprehensive income, net of tax effect | |

| - | | |

| - | | |

| - | | |

| - | |

| Comprehensive income attributable to common shareholders | |

$ | 2,794 | | |

$ | 4,697 | | |

$ | 10,525 | | |

$ | 3,992 | |

ALICO, INC. AND SUBSIDIARIES

CONDENSED COMBINED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

(dollars in thousands, except share and per share amounts)

| | |

March 31,

2015 | |

September 30,

2014 |

| | |

(unaudited) | |

(unaudited) |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 2,775 | | |

$ | 31,020 | |

| Investments | |

| 264 | | |

| 263 | |

| Accounts receivable, net | |

| 21,206 | | |

| 8,724 | |

| Inventories | |

| 58,539 | | |

| 25,469 | |

| Deferred tax asset | |

| 71 | | |

| - | |

| Assets held for sale | |

| 1,509 | | |

| 59,513 | |

| Other current assets | |

| 1,511 | | |

| 721 | |

| Total current assets | |

| 85,875 | | |

| 125,710 | |

| |

| Investment in Magnolia Fund | |

| 998 | | |

| 1,435 | |

| Investments, deposits and other non-current assets | |

| 6,269 | | |

| 2,905 | |

| Goodwill | |

| 1,146 | | |

| - | |

| Cash surrender value of life insurance | |

| 688 | | |

| 695 | |

| Property, buildings and equipment, net | |

| 383,446 | | |

| 126,833 | |

| Total assets | |

$ | 478,422 | | |

$ | 257,578 | |

| |

| LIABILITIES & STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 4,966 | | |

$ | 2,052 | |

| Long-term debt, current portion | |

| 4,511 | | |

| 3,196 | |

| Accrued expenses | |

| 8,685 | | |

| 1,934 | |

| Income taxes payable | |

| 4,085 | | |

| 4,572 | |

| Dividend payable | |

| 442 | | |

| 442 | |

| Accrued ad valorem taxes | |

| 930 | | |

| 1,850 | |

| Capital lease obligation | |

| 258 | | |

| 259 | |

| Other current liabilities | |

| 751 | | |

| 6,365 | |

| Total current liabilities | |

| 24,628 | | |

| 20,670 | |

| |

| Long-term debt, net of current portion | |

| 205,500 | | |

| 58,444 | |

| Line of credit | |

| 21,975 | | |

| 3,160 | |

| Other liability, noncurrent | |

| 3,633 | | |

| - | |

| Deferred gain on sale | |

| 29,140 | | |

| - | |

| Capital lease obligation, noncurrent | |

| 839 | | |

| 839 | |

| Deferred income taxes, net of current portion | |

| 11,966 | | |

| 5,738 | |

| Deferred retirement benefits, net of current portion | |

| 3,883 | | |

| 6,877 | |

| Total liabilities | |

| 301,564 | | |

| 95,728 | |

| |

| Commitments and contingencies | |

| | | |

| | |

| |

| Stockholders’ equity: | |

| | | |

| | |

| |

| Preferred stock, no par value. Authorized 1,000,000 shares; issued and outstanding, none | |

| - | | |

| - | |

| Common stock, $1 par value; 15,000,000 shares authorized; 8,300,363 shares issued and | |

| | | |

| | |

| 8,284,173 and 7,361,340 shares outstanding at March 31, 2015 and September 30, 2014, | |

| | | |

| | |

| respectively | |

| 8,300 | | |

| 7,377 | |

| Additional paid in capital | |

| 21,173 | | |

| 3,742 | |

| Treasury stock at cost 16,190 and 15,766 shares held at March 31, 2015 and September 30, | |

| | | |

| | |

| 2014, respectively | |

| (771 | ) | |

| (650 | ) |

| Member's equity | |

| - | | |

| 15,768 | |

| Retained earnings | |

| 143,222 | | |

| 135,613 | |

| Total Alico stockholders’ equity | |

| 171,924 | | |

| 161,850 | |

| |

| Noncontrolling interest | |

| 4,934 | | |

| - | |

| |

| Total liabilities and

stockholders’ equity | |

$ | 478,422 | | |

$ | 257,578 | |

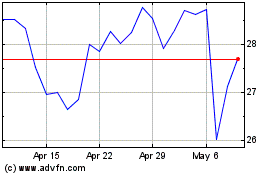

Alico (NASDAQ:ALCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

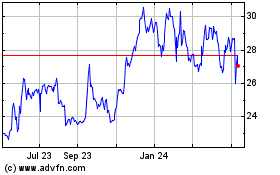

Alico (NASDAQ:ALCO)

Historical Stock Chart

From Apr 2023 to Apr 2024