Current Report Filing (8-k)

May 08 2015 - 6:02AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 7, 2015

| |

ADAMS RESOURCES & ENERGY, INC.

|

|

|

|

|

|

| |

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

Delaware

|

|

|

1-7908

|

|

|

74-1753147

|

|

|

| |

|

|

|

|

|

(State or other jurisdiction of incorporation)

|

|

|

(Commission file

number)

|

|

|

(IRS employer

identification no.)

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

17 S. Briar Hollow Lane, Houston, Texas

|

|

|

|

77027

|

|

|

|

| |

|

|

|

|

|

(Address of principal executive offices)

|

|

|

(Zip code)

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

(713) 881-3600

|

|

|

|

|

|

| |

|

|

|

(Registrant’s telephone number, including area code)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2 (b) under the Exchange Act

|

(17 CFR 240.14d-2(b))

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4 (c) under the Exchange Act

|

(17 CFR 240.13e-4c))

|

Item 2.02.

|

Results of Operations and Financal Condition.

|

On May 7, 2015, Adams Resources & Energy, Inc., a Delaware corporation, issued a press release announcing a dividend and financial results for the first quarter ended March 31, 2015. A copy of the news release is furnished as Exhibit 99.1 to this report and is incorporated herein by reference. The information in the Current Report on Form 8-K, including the exhibit, shall not be deemed ‟filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, (the ‟Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ADAMS RESOURCES & ENERGY. INC.

|

| |

|

| |

|

| |

|

|

May 7, 2015

|

BY: /s/ Richard B. Abshire

|

| |

Richard B. Abshire

|

| |

Chief Financial Officer

|

EXHIBIT 99.1

Rick Abshire

(713) 881-3609

FOR IMMEDIATE RELEASE

ADAMS RESOURCES ANNOUNCES FIRST QUARTER 2015

EARNINGS AND DIVIDEND

Houston (May 7, 2015) -- Adams Resources & Energy, Inc., (NYSE MKT - AE), announced first quarter 2015 unaudited net earnings of $3,097,000 or $.73 per common share on revenues of $555,573,000. This compares to first quarter 2014 unaudited net earnings of $5,363,000 or $1.27 per common share. Net cash provided by operating activities totaled $12,131,000 for the three-month period ended March 31, 2015.

Thomas S. Smith, President and Chief Executive Officer, attributed the earnings reduction to a sharp drop in crude oil prices for the comparative first quarter of 2015. In the first quarter 2014, crude oil prices were increasing and the Company recognized a $2,629,000 pre-tax inventory liquidation gain. Such item did not recur during 2015. Mr. Smith added that in contradiction to current industry trends, the Company’s crude oil marketing operation experienced a fourteen percent volume increase relative to the 2014 period. It was noted that this trend may not continue as the Company’s suppliers curtail new well drilling activity.

A summary of operating results follows:

| |

|

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Operating Earnings (Expense)

|

|

|

|

|

|

|

|

Crude oil marketing

|

|

$ |

8,848,000 |

|

|

$ |

9,370,000 |

|

|

Transportation

|

|

|

1,125,000 |

|

|

|

1,175,000 |

|

|

Oil and gas

|

|

|

(1,725,000 |

) |

|

|

121,000 |

|

|

Administrative expenses

|

|

|

(3,331,000 |

) |

|

|

(2,254,000 |

) |

| |

|

|

4,917,000 |

|

|

|

8,412,000 |

|

|

Interest income (expense), net

|

|

|

74,000 |

|

|

|

42,000 |

|

|

Income tax (provision) benefit

|

|

|

(1,894,000 |

) |

|

|

(3,091,000 |

) |

|

Net earnings

|

|

$ |

3,097,000 |

|

|

$ |

5,363,000 |

|

The Company also announced that its Board of Directors declared a quarterly cash dividend in the amount of $.22 (twenty-two cents) per common share, payable on June 17, 2015 to shareholders of record as of June 3, 2015.

The Company’s quarterly report on Form 10-Q for the period ended March 31, 2015 will be filed with the Securities and Exchange Commission on May 8, 2015 and will be available on the Company’s website at “adamsresources.com”.

……………………………………………….

The information in this release includes certain forward-looking statements that are based on assumptions that in the future may prove not to have been accurate. A number of factors could cause actual results or events to differ materially from those anticipated. Such factors include, among others, (a) general economic conditions and potential adverse world economic conditions, (b) fluctuations in hydrocarbon commodity prices and margins, (c) variations between commodity contract volumes and actual delivery volumes, (d) unanticipated environmental liabilities or regulatory changes, (e) counterparty credit default, (f) inability to obtain bank and/or trade credit support, (g) availability and cost of insurance, (h) changes in tax laws, (i) the availability and cost of capital, (j) results of current items of litigation, (k) uninsured items of litigation or losses, (l) uncertainty in reserve estimates and cash flows, (n) successful drilling activity and the ability to replace oil and gas reserves, (m) security issues related to drivers and terminal facilities, (o) demand for chemical based trucking operations, (p) financial soundness of customers and suppliers. These and other risks are described in the Company’s reports that are on file with the Securities and Exchange Commission.

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENT OF EARNINGS

|

|

|

(In thousands, except per share data)

|

|

| |

|

|

|

| |

|

March 31,

|

|

|

March 31,

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Revenues

|

|

$ |

555,573 |

|

|

$ |

949,189 |

|

| |

|

|

|

|

|

|

|

|

|

Costs, expenses and other

|

|

|

(550,582 |

) |

|

|

(940,735 |

) |

|

Income tax (provision)

|

|

|

(1,894 |

) |

|

|

(3,091 |

) |

| |

|

|

|

|

|

|

|

|

|

Net earnings

|

|

$ |

3,097 |

|

|

$ |

5,363 |

|

| |

|

|

|

|

|

|

|

|

|

Earnings per share:

|

|

|

|

|

|

|

|

|

|

Basic and diluted net earnings per common share

|

|

$ |

.73 |

|

|

|

1.27 |

|

| |

|

|

|

|

|

|

|

|

|

Dividends per common share

|

|

$ |

.22 |

|

|

$ |

.22 |

|

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEET

|

|

|

(In thousands)

|

|

| |

|

March 31,

|

|

|

December 31,

|

|

| |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

Cash and marketable securities

|

|

$ |

88,132 |

|

|

$ |

80,184 |

|

|

Other current assets

|

|

|

144,629 |

|

|

|

170,761 |

|

|

Total current assets

|

|

|

232,761 |

|

|

|

250,945 |

|

| |

|

|

|

|

|

|

|

|

|

Net property & equipment

|

|

|

81,635 |

|

|

|

84,871 |

|

|

Deposits and other assets

|

|

|

5,128 |

|

|

|

4,998 |

|

| |

|

$ |

319,524 |

|

|

$ |

340,814 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

$ |

146,054 |

|

|

$ |

168,603 |

|

|

Deferred tax and other liabilities

|

|

|

13,803 |

|

|

|

14,714 |

|

|

Shareholders’ equity

|

|

|

159,667 |

|

|

|

157,497 |

|

| |

|

$ |

319,524 |

|

|

$ |

340,814 |

|

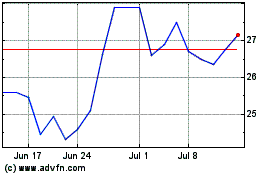

Adams Resources and Energy (AMEX:AE)

Historical Stock Chart

From Mar 2024 to Apr 2024

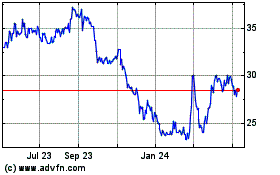

Adams Resources and Energy (AMEX:AE)

Historical Stock Chart

From Apr 2023 to Apr 2024