Current Report Filing (8-k)

May 07 2015 - 6:04AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 5, 2015

ALBEMARLE CORPORATION

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Virginia |

|

001-12658 |

|

54-1692118 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification Number) |

451 Florida Street, Baton Rouge, Louisiana 70801

(Address of Principal Executive Offices, including Zip Code)

Registrant’s Telephone Number, including Area Code: (225) 388-8011

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.07 Submission of Matters to a Vote of Security Holders.

On May 5, 2015, Albemarle Corporation (the “Company”) held its annual meeting of shareholders (the “Annual Meeting”). During the

Annual Meeting, shareholders of the Company were asked to consider and vote upon four proposals: (1) election of the eleven nominees to the Board of Directors set forth in the 2015 Proxy Statement; (2) ratification of the appointment of

PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015; (3) re-approval of the performance measures under the Albemarle Corporation 2008 Incentive Plan, as

amended and restated April 20, 2010; and (4) approval of a non-binding advisory resolution approving the compensation of the Company’s named executive officers.

As of the record date for the Annual Meeting, March 10, 2015, there were 112,179,867 shares of common stock outstanding and entitled to vote, of which

the holders of 102,069,644 shares of common stock were represented in person or by proxy at the Annual Meeting. For each proposal, the results of the shareholder voting were as follows:

1. Election of directors. All of the director nominees were elected to serve for a term which expires at the annual meeting of shareholders in 2016, by

the votes set forth in the table below.

|

|

|

|

|

|

|

|

|

| Nominee |

|

Voted For |

|

|

Withheld |

|

| Jim W. Nokes |

|

|

94,479,585 |

|

|

|

1,314,412 |

|

| William H. Hernandez |

|

|

94,457,095 |

|

|

|

1,336,902 |

|

| Luther C. Kissam, IV |

|

|

91,833,997 |

|

|

|

3,960,000 |

|

| Douglas L. Maine |

|

|

94,484,235 |

|

|

|

1,309,762 |

|

| J. Kent Masters |

|

|

94,312,107 |

|

|

|

1,481,890 |

|

| James J. O’Brien |

|

|

94,427,975 |

|

|

|

1,366,022 |

|

| Barry W. Perry |

|

|

94,181,646 |

|

|

|

1,612,351 |

|

| John Sherman, Jr. |

|

|

93,764,523 |

|

|

|

2,029,474 |

|

| Gerald A. Steiner |

|

|

94,478,730 |

|

|

|

1,315,267 |

|

| Harriett Tee Taggart |

|

|

93,946,762 |

|

|

|

1,847,235 |

|

| Alejandro Wolff |

|

|

94,445,605 |

|

|

|

1,348,392 |

|

There were 6,275,647 broker non-votes received for each nominee.

2. Ratification of appointment of independent registered public accounting firm. The appointment of PricewaterhouseCoopers LLC as the Company’s

independent registered public accounting firm for the fiscal year ending December 31, 2015, was ratified by the shareholders by the votes set forth in the table below.

|

|

|

|

|

| Voted For |

|

Voted Against |

|

Abstain |

| 101,223,678 |

|

799,823 |

|

46,143 |

The proposal to ratify the appointment of PricewaterhouseCoopers LLC was a routine matter and, therefore, there were no broker

non-votes relating to this matter.

3. Re-approval of performance measures. The re-approval of the performance measures under the Albemarle

Corporation 2008 Incentive Plan, as amended and restated April 20, 2010, were approved by the shareholders by the votes set forth in the table below.

|

|

|

|

|

|

|

| Voted For |

|

Voted Against |

|

Abstain |

|

Broker Non-Votes |

| 92,531,269 |

|

3,152,499 |

|

110,229 |

|

6,275,647 |

4. Advisory vote on executive compensation. The shareholders approved on a non-binding advisory basis the compensation

of the Company’s named executive officers by the votes set forth in the table below.

|

|

|

|

|

|

|

| Voted For |

|

Voted Against |

|

Abstain |

|

Broker Non-Votes |

| 63,139,332 |

|

32,194,329 |

|

460,336 |

|

6,275,647 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the

undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALBEMARLE CORPORATION |

|

|

|

|

|

| Date: May 6, 2015 |

|

|

|

|

|

By: |

|

/s/ Karen G. Narwold |

|

|

|

|

|

|

|

|

Senior Vice President, General Counsel, Corporate

& Government Affairs, and Corporate Secretary |

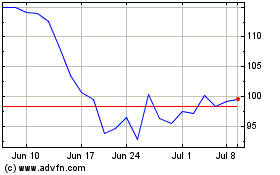

Albemarle (NYSE:ALB)

Historical Stock Chart

From Mar 2024 to Apr 2024

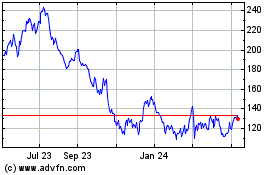

Albemarle (NYSE:ALB)

Historical Stock Chart

From Apr 2023 to Apr 2024