UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

April 22, 2015

Date of Report

(Date of earliest event reported)

AIR LEASE CORPORATION

(Exact name of registrant as specified in its charter)

|

Delaware |

|

001-35121 |

|

27-1840403 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

2000 Avenue of the Stars, Suite 1000N

Los Angeles, California |

|

90067 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (310) 553-0555

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 1.01 Entry into a Material Definitive Agreement.

On April 22, 2015, Air Lease Corporation (the “Company”) and certain executive officers and employees of the Company entered into a settlement agreement and release (the “Settlement Agreement”) with American International Group, Inc. (“AIG”), International Lease Finance Corporation (“ILFC”), and ILFC’s parent, AerCap Holdings N.V., to settle all ongoing litigation as set forth in Note 13: Litigation, in the Notes to Consolidated Financial Statements of the Company’s Form 10-K for the fiscal year ended December 31, 2014, filed on February 26, 2015 (“Note 13”).

Pursuant to the terms of the Settlement Agreement, (i) all claims and counterclaims asserted in the litigation will be dismissed with prejudice, (ii) each of the parties to the litigation will receive full releases of all claims and counterclaims asserted in the litigation, and (iii) the Company will pay AIG the sum of $36 million no later than June 30, 2015, and an additional sum of $36 million no later than September 30, 2015, which will be reflected in the Company’s March 31, 2015 financial statements. The parties to the Settlement Agreement agreed that the settlement was intended solely as a compromise of disputed claims, and that no party admits any wrongdoing or liability with respect to any matter alleged in the litigation.

The foregoing description of the material terms of the Settlement Agreement is qualified in its entirety by reference to the complete text of the agreement, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and which is incorporated herein by reference.

Further information regarding the litigation between the parties that was resolved pursuant to the Settlement Agreement is set forth in Note 13.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

Exhibit 10.1 |

|

Settlement Agreement and Release dated April 22, 2015 by and among Air Lease Corporation, American International Group, Inc., International Lease Finance Corporation and AerCap Holdings N.V. and the other parties named therein. |

|

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

AIR LEASE CORPORATION |

|

|

|

|

|

|

|

Date: April 23, 2015 |

/s/ Carol H. Forsyte |

|

|

Carol H. Forsyte |

|

|

Executive Vice President, General Counsel, Corporate Secretary and Chief Compliance Officer |

3

Exhibit 10.1

SETTLEMENT AGREEMENT AND RELEASE

It is hereby agreed by and among the parties herein as follows:

1. Parties and Effective Date

1.1. “AIG” shall mean American International Group, Inc.

1.2. “Plaintiffs” shall mean (i) AIG and International Lease Finance Corporation (“ILFC”), on behalf of and including themselves and all their present or former parents, direct and indirect subsidiaries, divisions, and affiliates, (ii) current and former employees, directors, officers, shareholders, partners, managers, investors, principals, attorneys, accountants, auditors, insurers, representatives, independent contractors, vendors, suppliers, servants and agents of the entities described in the foregoing clause (i) (for the avoidance of doubt, such employees, directors, officers, shareholders, partners, managers, investors, principals, attorneys, accountants, auditors, insurers, representatives, independent contractors, vendors, suppliers, servants and agents only constitute “Plaintiffs” in their capacity as such of (and for) an entity identified in clause (i) and not otherwise), and (iii) the predecessors, successors, heirs, and assigns of each of the Persons described in the foregoing clauses (i) and (ii).

1.3. “ALC” shall mean (i) Air Lease Corporation on behalf of and including itself and all its present or former parents, direct and indirect subsidiaries, divisions, and affiliates, (ii) current and former employees, directors, officers, shareholders, partners, managers, investors, principals, attorneys, accountants, auditors, insurers, representatives, independent contractors, vendors, suppliers, servants and agents of the entities described in the foregoing clause (i) (for the avoidance of doubt, such employees, directors, officers, shareholders, partners, managers, investors, principals, attorneys, accountants, auditors, insurers, representatives, independent contractors, vendors, suppliers, servants and agents only constitute “ALC” in their capacity as such of (and for) an entity identified in clause (i) and not otherwise), and (iii) the predecessors, successors, heirs, and assigns of each of the Persons described in the foregoing clauses (i) and (ii).

1.4. “The Leonard Green Defendants” shall mean (i) Leonard Green & Partners, L.P., Green Equity Investors V, L.P., and Green Equity Investors Side V, L.P. on behalf of and including themselves and all their present or former parents, direct and indirect subsidiaries, general partners, limited partners, divisions, and affiliates, (ii) current and former employees, directors, officers, shareholders, partners, managers, investors, principals, attorneys, accountants, auditors, insurers, representatives, independent contractors, vendors, suppliers, servants and agents of the entities described in the foregoing clause (i) (for the avoidance of doubt, such employees, directors, officers, shareholders, partners, managers, investors, principals, attorneys, accountants, auditors, insurers, representatives, independent contractors, vendors, suppliers, servants and agents only constitute “Leonard Green” in their capacity as such of (and for) an entity identified in clause (i) and not otherwise), and (iii) the predecessors, successors, heirs, and assigns of each of the Persons described in the foregoing clauses (i) and (ii).

1

1.5. “The Individual Defendants” shall mean (i) Steven Udvar-Házy, John Plueger, Marc Baer, Grant Levy, Michael Bai, Housni Chraibi, Chi Yan, Robert McNitt, Jenny Van Le, Lance Pekala, and William MacCary, and (ii) attorneys, accountants, auditors, insurers, representatives, and agents of each of the Persons described in the foregoing clauses (i) (for the avoidance of doubt, such employees, attorneys, accountants, auditors, insurers, representatives and agents only constitute “Individual Defendants” in their capacity as such of (and for) an entity identified in clause (i) and not otherwise), and (iii) the predecessors, successors, heirs, and assigns of each of the Persons described in the foregoing clauses (i) and (ii).

1.6. “Defendants” shall mean ALC, the Leonard Green Defendants, and the Individual Defendants.

1.7. This Settlement Agreement and Release (this “Agreement”) is made and entered into as of the 22nd day of April 2015 (the “Effective Date”), by and between AIG, ILFC, AerCap Holdings N.V. (“AerCap”), ALC, the Leonard Green Defendants, and the Individual Defendants. The above parties are sometimes referred to in this Agreement individually as “Party” or collectively as “the Parties.”

2. Background Facts

This Agreement is made in light of the following facts:

2.1. On April 24, 2012, AIG and ILFC filed a lawsuit against ALC, Steven Udvar-Házy, John Plueger, Grant Levy, Marc Baer, Robert McNitt, William MacCary, Jenny Van Le, Chi Yan, Michael Bai, Lance Pekala, and Housni Chraibi in Los Angeles Superior Court. That lawsuit was captioned American International Group and International Lease Finance Corporation v. Air Lease Corporation, Steven Udvar-Hazy, John Plueger, Marc Baer, Grant Levy, Michael Bai, Housni Chraibi, Lance Pekala, Chi Yan, Robert McNitt, Jenny Van Le, William MacCary and Does 1-20, Los Angeles Superior Court Case No. BC483370. The lawsuit alleged the following causes of action: Breach of Fiduciary Duty, Aiding and Abetting Breach of Fiduciary Duty, Breach of Duty of Loyalty, Aiding and Abetting Breach of Duty of Loyalty, Misappropriation of Trade Secrets, and Violations of Penal Code Section 502, Labor Code Section 2834, Labor Code Section 2856, Labor Code Section 2863, Labor Code Section 2857, and California Business & Professions Code 17200. Not all Defendants were named in all causes of action.

2.2. On August 15, 2013, ALC filed cross claims against AIG and ILFC (“Cross-Complaint”). ALC alleged the following causes of action: Breach of Contract for the Sale of Goods, California Business and Professions Code Section 17200, Breach of Written Contract, Intentional Interference with Contractual Relations, Intentional Interference with Prospective Economic Relations, and Declaratory Judgment. On November 14, 2013, ALC filed its Second Amended Cross-Complaint that alleged Breach of Contract for the Sale of Goods. The above-referenced lawsuit, including as amended, together with the Cross-Complaint, including as amended, shall be referred to as “the Litigation” throughout this Agreement.

2.3. In response to the Complaints as amended in this Litigation, Defendants answered, denied the causes of action, and asserted affirmative defenses. In response to the Cross-Complaint as amended in this Litigation, Plaintiffs answered, denied the causes of action, and asserted affirmative defenses.

2

2.4. On August 1, 2014, AIG and ILFC dismissed Lance Pekala without prejudice from the Litigation.

2.5. On April 23, 2014, AIG and ILFC filed their Fifth Amended Complaint adding Leonard Green & Partners, L. P. as a defendant in the Litigation. By the Seventh Amended Complaint, filed on January 2, 2015, Green Equity Investors V, L.P. and Green Equity Investors Side V, L.P. were added as defendants in the Litigation. The causes of action against ALC, the Individual Defendants, and the Leonard Green Defendants were as follows: Breach of Fiduciary Duty, Aiding and Abetting Breach of Fiduciary Duty, Conspiracy to Breach Fiduciary Duty, Breach of the Duty of Loyalty, Aiding and Abetting Breach of the Duty of Loyalty, Conspiracy to Breach the Duty of Loyalty, Intentional Interference with Prospective Economic Relations, Aiding and Abetting Intentional Interference with Prospective Economic Relations, Conspiracy to Intentionally Interfere with Prospective Economic Relations, Negligent Interference with Prospective Economic Relations, Misappropriation of Trade Secrets, Violation of Penal Code Section 502, Conversion, Conspiracy to Commit Conversion, Breach of Contract, and Violation of Business and Professions Code Section 17200. Not all Defendants were named in all causes of action.

2.6. Since the filing of the lawsuit, a subsidiary of AerCap, on or about May 15, 2014, purchased ILFC from AIG. For purposes of this Agreement, AerCap and each of its direct and indirect subsidiaries and affiliates is therefore a parent and/or affiliate of ILFC as those terms are used in paragraph 1.2 above and is therefore providing and receiving the releases and covenants not to sue in paragraphs 5.1, 5.2, 5.3 and 5.4 below. Notwithstanding AerCap’s purchase of ILFC from AIG, AIG represents that AIG, pursuant to the terms of a Joint Litigation Agreement between AIG and ILFC amended and restated as of May 14, 2014, retained control of the Litigation and any decision or consent to a settlement, compromise or discharge of the Litigation and is entitled to all amounts received by AIG and/or ILFC in a settlement or compromise of the Litigation.

3. Purpose of this Agreement

3.1. The Parties now desire to fully and finally settle the Litigation and all related claims on the terms and conditions set forth in this Agreement. It is the intent of the Parties that there be a complete and global resolution of all potential and actual claims related to the facts and allegations in the Litigation, including claims not yet asserted against other parties. By way of example, this would include but not be limited to claims against former ILFC employees, related to the facts and allegations in the Litigation, who left ILFC to join ALC and other investors, banks, real estate agents, and consultants who worked with ALC and its founders, but who have not yet been named as a defendant in the Litigation. This would also include any claims against any current or former AIG or ILFC employees, related to the facts and allegations in the Litigation, who did not leave ILFC to join ALC.

3

3.2. The Parties acknowledge and agree that the execution of this Agreement by the Parties is for settlement purposes only and is intended solely as a compromise of claims, cross-claims, and defenses that the Parties recognize they would have contested had the Litigation not settled, and that no Party admits any wrongdoing or liability with respect to any matter alleged in the Litigation. This settlement of claims in the Litigation among the Parties is voluntary and does not and shall not constitute an admission or other basis for liability by any of the Parties or an admission of the existence of any facts upon which liability could be based.

4. Agreements and Undertakings

In light of the foregoing and in consideration for the releases, agreements, representations, warranties and undertakings set forth in this Agreement, the Parties agree as follows:

4.1. Within three (3) business days of the Effective Date, the Parties shall file in Los Angeles Superior Court a joint stipulation of dismissal with prejudice of all claims and cross-claims set forth in the Litigation, in the form attached hereto as Exhibit A. In addition, within three (3) business days of the Effective Date, AIG and ILFC shall file in the California Court of Appeal a notice of dismissal of the pending petition for writ of mandamus, Case No. B258943, related to this Litigation, in the form attached hereto as Exhibit B.

4.2. In full and final settlement of all of AIG and ILFC’s claims in and related to the Litigation, ALC covenants and agrees to pay AIG the sum of $72 million, to be paid in two equal installments as follows:

(a) By no later than June 30, 2015, ALC will cause to be delivered to AIG the sum of $36 million. Such payment shall have been made by ALC by wire transfer to the account set forth in Exhibit C (the “Account”).

(b) By no later than September 30, 2015, ALC will cause to be delivered to AIG the additional sum of $36 million by wire transfer to the Account.

4.3. Subject to the provisions of section 5.5 (ii) below, the monetary consideration set forth in paragraph 4.2 hereby constitutes the sole and entire payment to be made in settlement of the released claims, and AIG, ILFC, and AerCap, on the one hand, and Defendants, on the other hand, will not attempt to collect from each other their attorney’s fees and expenses in connection with any matters related to this dispute and/or this settlement.

4.4. No Party shall make any disclosure, or comment publicly or privately with third parties, about this Agreement or the settlement, except (a) as provided in paragraph 4.5 below, (b) on a need-to-know basis to the Parties’ respective accountants, financial advisors, attorneys, auditors, insurers and their claims representatives and reinsurers, officers, directors, partners, general partners, limited partners, and employees provided such persons are subject to confidentiality obligations; (c) as necessary to comply or enforce the terms of the Agreement; (d) as required by a discovery request, subpoena, question during testimonial proceedings, or similar procedure; (e) public securities filings summarizing the terms of this Agreement (without additional comment), including a copy of this Settlement Agreement; (f) as any Party deems necessary under any law, rule, accounting rule, tax rule or regulation, including, but not limited to, federal or state securities laws; (g) in response to a request made by a Governmental

4

Authority having jurisdiction over any Party; (h) to any agency or auditor that supervises, regulates, or audits any Party; (i) as otherwise required by law; (j) to the extent necessary or advisable for the purpose of financial reporting, including SEC and regulatory filings; or (k) as mutually agreed upon in a writing signed by all of the Parties.

4.5. Any public comments from the Parties regarding the resolution of this matter will be limited to a statement that the matter has been resolved and the Litigation has concluded.

4.6. The Parties agree that they will make no direct or indirect publication of any statements intended to be derogatory of the other Party’s claims and defenses asserted in the Litigation.

5. Releases

5.1. In consideration for the payment set forth above, Plaintiffs hereby release and forever discharge all persons, including but not limited to ALC, the Individual Defendants, and the Leonard Green Defendants (collectively, the “Defendant Releasees”), of and from any and all claims, losses, debts, charges, damages, demands, obligations, indemnities, causes of action, lawsuits, liabilities, breaches of duty, misfeasance, malfeasance, promises, controversies, contracts, judgments, awards, penalties, costs, and expenses, of whatever nature, type, kind, description or character, whether known or unknown, suspected and unsuspected, including malicious prosecution and abuse of process and including but not limited to any claims that Plaintiffs could assert at common law or by any statute, rule, regulation, ordinance or law, whether federal, state or local, or on any other grounds whatsoever, which Plaintiffs do, did, or might have, own, or hold, from the beginning of time through the Effective Date, that arise out of or relate to the allegations in the Complaint and Cross-Complaint in the Litigation, including any amendments, to any fact revealed in the course of discovery in the Litigation that relates to the Litigation, or to any act or omission in the conduct of the Litigation or this settlement.

5.2. In consideration for the covenants set forth above, Plaintiffs hereby covenant not to sue any Defendant Releasee, or otherwise assert against any Defendant Releasee any claims, damages, demands, or causes of action, lawsuits, judgments, awards, penalties, costs, and expenses, of whatever nature, whether known or unknown, from the beginning of time through the Effective Date, that arise out of or relate to the allegations in the Complaint and Cross-Complaint in the Litigation, including any amendments, to any fact revealed in the course of discovery in the Litigation that relates to the Litigation, or to any act or omission in the conduct of the Litigation or this settlement.

5.3. In consideration for the releases and covenants set forth above, Defendants hereby release and forever discharge all persons, including but not limited to Plaintiffs (collectively, the “AIG Releasees”), of and from any and all claims, losses, debts, charges, damages, demands, obligations, indemnities, causes of action, lawsuits, liabilities, breaches of duty, misfeasance, malfeasance, promises, controversies, contracts, judgments, awards, penalties, costs, and expenses, of whatever nature, type, kind, description or character, whether known or unknown, suspected and unsuspected, including malicious prosecution and abuse of process and including but not limited to any claims that Defendants could assert at common law or by any statute, rule, regulation, ordinance or law, whether federal, state or local, or on any other grounds whatsoever,

5

which Defendants do, did, or might have, own, or hold, from the beginning of time through the Effective Date, that arise out of or relate to the allegations in the Complaint and Cross-Complaint in the Litigation, including any amendments, to any fact revealed in the course of discovery in the Litigation that relates to the Litigation, or to any act or omission in the conduct of the Litigation or this settlement.

5.4. In consideration for the covenants set forth above, Defendants hereby covenant not to sue any AIG Releasee, or otherwise assert against any AIG Releasee any claims, damages, demands, or causes of action, lawsuits, judgments, awards, penalties, costs, and expenses, of whatever nature, whether known or unknown, from the beginning of time through the Effective Date, that arise out of or relate to the allegations in the Complaint and Cross-Complaint in the Litigation, including any amendments, to any fact revealed in the course of discovery in the Litigation that relates to the Litigation, or to any act or omission in the conduct of the Litigation or this settlement.

5.5. Notwithstanding any other provision of this Agreement, nothing herein shall restrict in any way Defendants’ right to pursue any insurance claims they may have relating to this settlement or to the Litigation, except that (i) Defendants may not pursue any insurance coverage claim against any insurer with which ALC has an insurance policy that is currently an AIG-affiliated insurer relating to this settlement or the Litigation, and (ii) AIG and ALC represent to each other that, based on their respective reasonable due diligence, each is unaware of any reinsurance contract issued by any AIG-affiliated entity that would require AIG to reimburse any of ALC’s insurers for any insurance claim paid to any Defendant relating to this settlement or the Litigation.

5.6. WAIVER OF CIVIL CODE SECTION 1542: The Parties specifically understand, acknowledge and agree that this is a full and final release, applying to any and all of the claims released in paragraphs 5.1 and 5.3 above. The Parties, having been fully advised by counsel, hereby expressly waive any right or benefit of the provisions of Section 1542 of the California Civil Code, which provides as follows, and under all federal, state and common-law statutes or principles of similar effect:

A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS WHICH THE CREDITOR DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE, WHICH IF KNOWN BY HIM OR HER MUST HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR.

5.7. Each of the Parties acknowledges the inclusion of unknown claims in the releases was separately bargained for and was an essential element of the settlement.

5.8. Nothing in the Settlement Agreement will release or serve as a bar to (i) any claims based on any actions by the Parties that occur after the Effective Date or (ii) any claims alleging breach of the Settlement Agreement.

6

6. Warranties of Authority and Nonassignment

6.1. Each of the Parties to this Agreement warrants that said Party has full authority to enter into this Agreement, to make the releases and covenants set forth in paragraphs 5.1 to 5.6, and to enter into the obligations set forth in this Agreement. The Parties hereby warrant that they have not assigned or transferred any claim to any other party or person, and that no other consents, approvals, authorizations, releases or settlements are necessary from any other person or entity to release and discharge completely the other Parties from the claims specified above.

7. Further Representations and Warranties

7.1. In entering into this Agreement, the Parties represent and warrant that they have fully discussed and reviewed all aspects of this Agreement with their counsel; that they have carefully reviewed and understand all of the provisions of this Agreement; and that they are freely, knowingly, and voluntarily entering into this Agreement without any form of duress.

7.2. In entering into this Agreement, all Parties represent and warrant that they have made such investigation of the facts pertaining to this settlement and this Agreement as they deem necessary and that they are not relying on and have not relied upon any representation or statement made by any other Party or by any person affiliated with or representing any of the other Parties with respect to any of the facts involved in the disputes compromised or with regard to the claims or asserted claims of either.

8. Alternative Dispute Resolution

8.1. In the event any dispute, claim or controversy arising out of or relating to this Agreement or the breach, termination, enforcement, interpretation or validity thereof, should arise between the Parties, the Parties shall make a good faith effort to resolve the dispute, claim or controversy informally through direct communication between the Parties before resorting to the Alternative Dispute Resolution procedure specified in paragraphs 8.2 to 8.5.

8.2. The Parties agree that any and all disputes, claims or controversies arising out of or relating to this Agreement or the breach, termination, enforcement, interpretation or validity thereof, that cannot, within 7 calendar days of being raised, be resolved informally through direct communication between the Parties, shall be submitted to Robert Meyer at Loeb & Loeb, for a confidential mediation in Los Angeles, California, and if the matter is not resolved through a good faith and expedited mediation effort, then it shall be submitted to an arbitrator for final and binding arbitration pursuant to the arbitration provisions set forth in paragraphs 8.3-8.4 below. If Mr. Meyer is not available for a mediation, the Parties will jointly petition Mr. Meyer to select a neutral mediator. Any Party may commence mediation by providing to Mr. Meyer and the other Party a written request for mediation, setting forth the subject of the dispute and the relief requested. All offers, promises, conduct and statements, whether oral or written, made in the course of the mediation by any of the Parties, their agents, employees, experts and attorneys, and by the mediator or his employees, are confidential, privileged and inadmissible for any purpose to the full extent provided by California law.

7

8.3. Any Party may initiate arbitration with respect to the matters submitted to mediation by filing a written demand for arbitration at any time following fourteen (14) days after the initial mediation session or forty-five (45) days after the date of filing the written request for mediation, whichever occurs first. The mediation may continue after the commencement of arbitration if the Parties so desire. The provisions of this section 8 may be enforced by any court of competent jurisdiction, and if a Party refuses to mediate or arbitrate, the Party seeking enforcement shall be entitled to an award of all costs, fees and expenses, including attorneys’ fees, to be paid by the party against whom enforcement is ordered.

8.4. Any dispute, claim or controversy arising out of or relating to this Agreement or the breach, termination, enforcement, interpretation or validity thereof, that cannot be resolved through the meet and confer and mediation methods specified in paragraphs 8.1 to 8.3, including the determination of the scope or applicability of this Agreement to arbitrate, shall be determined by final and binding arbitration in Los Angeles, California, before an agreed upon arbitrator. If the Parties cannot agree upon an arbitrator, the JAMS rules for arbitrator selection shall apply. The arbitration shall be governed by the JAMS Streamlined Arbitration Rules & Procedures. The arbitration proceedings between the Parties shall be kept confidential. Notwithstanding the foregoing, the fact of the arbitration between the Parties and the arbitrator’s decision (i.e., the final award) shall not be confidential. The arbitrator shall be empowered to award, without limitation, any interim or permanent injunctive or equitable relief that would be available in a court of competent jurisdiction. The arbitrator may, in the award, allocate all or part of the costs of the arbitration, including the fees of the arbitrator and the reasonable attorneys’ fees of the prevailing party. Judgment on the award may be entered under seal in any court having jurisdiction. This clause shall not preclude the Parties from seeking provisional remedies in aid of arbitration from a court of appropriate jurisdiction. The provisions of this clause may be enforced by any court of competent jurisdiction, and the Party seeking enforcement shall be entitled to an award of all costs, fees and expenses, including attorneys’ fees, to be paid by the Party against whom enforcement is ordered. Notwithstanding Section 12 below, this Section 8 shall be governed by the Federal Arbitration Act, 9 U.S.C. § 1 et seq.

8.5. Notwithstanding the foregoing, with respect only to any breaches of the confidentiality terms set forth in paragraphs 4.4-4.6 above, the parties agree that Robert Meyer at Loeb & Loeb acting as an arbitrator shall make a final and binding determination of any disputes. Mr. Meyer shall have the authority to order the Parties to provide any discovery or information he deems appropriate to determine the fact and scope of any alleged breach of those terms. Mr. Meyer shall also have the authority to order any remedy he deems appropriate to address any such breach, including issuing a public statement to correct any misimpression of the facts and circumstances relating to the settlement created by such breach, or the disclosure of information necessary to reasonably respond to the breach.

9. Performance of Agreement

9.1. The Parties each agree to perform all acts and execute, deliver and file all documents necessary to carry out the provisions, purposes and intent of this Agreement.

8

10. Successors In Interest

10.1. This Agreement shall be binding upon and shall inure to the benefit of each of the Parties hereto and each of their respective successors in interest and assigns.

11. Mutually Drafted Settlement Agreement

11.1. Each of the Parties hereto has been fully and competently represented by counsel of its own choosing in the negotiation and preparation of this Agreement. Accordingly, the Parties agree that the rule of construction of contracts resolving any ambiguities against the drafting party shall be inapplicable to this Agreement. Each of the Parties hereto further acknowledges that it has read this entire Agreement and fully understands its terms, conditions and effects.

12. California Law

12.1. All questions with respect to the construction of this Agreement, and the rights and liabilities of the Parties hereto, shall be governed by and construed in accordance with the laws of the State of California without reference to conflicts of law principles or rules.

13. Entire Agreement

13.1. This Agreement, including Exhibits, contains the entire agreement of the Parties relating to the subject matters addressed herein and may not be modified or amended except by a further document in writing signed by the Parties. In executing this Agreement and making the settlement contained herein, none of the Parties is relying upon any promise, representation or statement not contained within this Agreement.

14. Headings

14.1. Paragraph headings are for convenience only and are not part of the Agreement.

15. Counterparts

15.1. The Parties may execute this Agreement in counterparts, each of which shall be deemed an original or the equivalent thereof. Signatures by facsimile or in electronic form (including in PDF form) are binding, and the Parties will exchange duplicate original signatures promptly after execution of this Agreement.

16. Notice

16.1. All notices under this Agreement shall be sent by email and U.S. mail to the following:

9

To AIG:

Michael Leahy

Deputy General Counsel

AIG

80 Pine Street

New York, New York 10005

Copies to:

Michael Carlinsky

Quinn Emanuel Urquhart & Sullivan

51 Madison Avenue

New York, New York 10010

michaelcarlinsky@quinnemanuel.com

To ILFC:

Scot Kennedy

Vice President

International Lease Finance Corporation

10250 Constellation Boulevard

31st Floor

Los Angeles, CA 90067

(310) 788-1999

skennedy@aercap.com

Copies to:

Keith Hallam

Cravath, Swaine & Moore LLP

825 Eighth Avenue

New York, New York 10019-7475

(212) 474-1000

khallam@cravath.com

To AerCap:

AerCap House

Stationsplein 965

1117 CE Schipol

The Netherlands

Attention: Scot Kennedy, Vice President Legal

+31 20 655 9655

skennedy@aercap.com

Copies to:

Keith Hallam

Cravath, Swaine & Moore LLP

10

825 Eighth Avenue

New York, New York 10019-7475

(212) 474-1000

khallam@cravath.com

To ALC:

Carol Forsyte

General Counsel, Air Lease Corporation

2000 Avenue of the Stars, Suite 1000N

Los Angeles, CA 90067

(310) 553-0555

cforsyte@airleasecorp.com

Copies to:

Carolyn Hoecker Luedtke

Munger, Tolles & Olson LLP

560 Mission Street, 27th Floor

San Francisco, CA 94105

(415) 512-4027

Carolyn.Luedtke@mto.com

To the Leonard Green Defendants:

Adrian Maizey

Chief Operating Officer

Leonard Green & Partners, L.P.

11111 Santa Monica Blvd., Suite 2000

Los Angeles, CA 90025

(310) 954-0414

amaizey@leonardgreen.com

Copies to:

Michael Bruce Abelson

Susan P. Welch

Abelson Herron Halpern LLP

333 S. Grand Ave., #1550

Los Angeles, CA 90071

(213) 402-1900

mabelson@abelsonherron.com

swelch@abelsonherron.com

To Steven Udvar-Házy:

Air Lease Corporation

2000 Avenue of the Stars, Suite 1000N

Los Angeles, CA 90067

310-553-0555

11

Copies to:

Bert Deixler

Kendall Brill & Klieger LLP

10100 Santa Monica Blvd., Suite 1725

Los Angeles, California 90067

(310) 272-7910

bdeixler@kbkfirm.com

To John Plueger:

Air Lease Corporation

2000 Avenue of the Stars, Suite 1000N

Los Angeles, CA 90067

310-553-0555

Copies to:

Alexander Cote

Scheper Kim & Harris LLP

One Bunker Hill

601 West Fifth Street, 12th Floor

Los Angeles, CA 90071-2025

(213) 613-4660

acote@scheperkim.com

To Grant Levy:

Air Lease Corporation

2000 Avenue of the Stars, Suite 1000N

Los Angeles, CA 90067

310-553-0555

Copies To:

Alexander Cote

Scheper Kim & Harris LLP

One Bunker Hill

601 West Fifth Street, 12th Floor

Los Angeles, CA 90071-2025

(213) 613-4660

acote@scheperkim.com

To Marc Baer:

Air Lease Corporation

2000 Avenue of the Stars, Suite 1000N

Los Angeles, CA 90067

310-553-0555

Copies To:

Alexander Cote

Scheper Kim & Harris LLP

12

One Bunker Hill

601 West Fifth Street, 12th Floor

Los Angeles, CA 90071-2025

(213) 613-4660

acote@scheperkim.com

To Michael Bai:

Air Lease Corporation

2000 Avenue of the Stars, Suite 1000N

Los Angeles, CA 90067

310-553-0555

Copies to:

Daniel J. Woods

Musick, Peeler & Garrett LLP

One Wilshire Boulevard, Suite 2000

Los Angeles, CA 90017

(213) 629-7622

d.woods@mpglaw.com

To Chi Yan:

Air Lease Corporation

2000 Avenue of the Stars, Suite 1000N

Los Angeles, CA 90067

310-553-0555

Copies To:

Daniel J. Woods

Musick, Peeler & Garrett LLP

One Wilshire Boulevard, Suite 2000

Los Angeles, CA 90017

(213) 629-7622

d.woods@mpglaw.com

To Housni Chraibi:

Air Lease Corporation

2000 Avenue of the Stars, Suite 1000N

Los Angeles, CA 90067

310-553-0555

Copies To:

Daniel J. Woods

Musick, Peeler & Garrett LLP

One Wilshire Boulevard, Suite 2000

Los Angeles, CA 90017

(213) 629-7622

13

d.woods@mpglaw.com

To Robert McNitt:

Air Lease Corporation

2000 Avenue of the Stars, Suite 1000N

Los Angeles, CA 90067

310-553-0555

Copies To:

Daniel J. Woods

Musick, Peeler & Garrett LLP

One Wilshire Boulevard, Suite 2000

Los Angeles, CA 90017

(213) 629-7622

d.woods@mpglaw.com

To Jenny Van Le:

Air Lease Corporation

2000 Avenue of the Stars, Suite 1000N

Los Angeles, CA 90067

310-553-0555

Copies To:

Daniel J. Woods

Musick, Peeler & Garrett LLP

One Wilshire Boulevard, Suite 2000

Los Angeles, CA 90017

(213) 629-7622

d.woods@mpglaw.com

To William MacCary:

Air Lease Corporation

2000 Avenue of the Stars, Suite 1000N

Los Angeles, CA 90067

310-553-0555

Copies To:

Daniel J. Woods

Musick, Peeler & Garrett LLP

One Wilshire Boulevard, Suite 2000

Los Angeles, CA 90017

(213) 629-7622

d.woods@mpglaw.com

14

16.2. Changes in the names or addresses of the representatives set forth above may be made by a written notification to the other party at its address set forth above (or such other addresses subsequently designated by any Party).

17. Gender and Number

17.1. Wherever the context so requires, the singular shall include the plural; the plural shall include the singular; the masculine gender shall include the feminine and neuter genders; the feminine gender shall include the masculine and neuter genders; and the neuter gender shall include the masculine and feminine genders.

15

IN WITNESS WHEREOF, the Parties hereto have agreed to and executed this Agreement.

|

April 22, 2015 |

|

|

|

|

By: |

/s/ Michael W. Leahy |

|

|

|

|

|

|

Print Name: |

Michael W. Leahy, VP & Deputy GC |

|

|

|

American International Group, Inc. |

|

|

|

|

|

April 23, 2015 |

|

|

|

|

By: |

/s/ W.M. Den Dikken |

|

|

|

|

|

|

Print Name: |

W.M. Den Dikken CEO |

|

|

|

International Lease Finance Corporation |

|

|

|

|

|

April 23, 2015 |

|

|

|

|

By: |

/s/ Keith Helming |

/s/ Marnix Den Heijer |

|

|

|

|

|

|

Print Name: |

Keith Helming

Authorised Signatory |

Marnix Den Heijer

Authorised Signatory |

|

|

|

AerCap Holdings N.V. |

|

|

April 22, 2015 |

|

|

|

|

|

|

|

|

By: |

/s/ Carol Forsyte |

|

|

|

|

|

|

Print Name: |

Carol Forsyte Executive Vice President and General Counsel |

|

|

|

Air Lease Corporation |

|

April 22, 2015 |

|

|

|

|

|

|

|

|

By: |

/s/ Cody Franklin |

|

|

|

|

|

|

Print Name: |

Cody Franklin |

|

|

|

Cody Franklin, Chief Financial Officer of GEI Capital V, LLC, the General Partner of Green Equity Investors V, L.P. and Green Equity Investors Side V, L.P. |

|

April 22, 2015 |

|

|

|

|

|

|

|

|

By: |

/s/ Cody Franklin |

|

|

|

|

|

|

Print Name: |

Cody Franklin |

|

|

|

Cody Franklin, Chief Financial Officer, Leonard Green & Partners, L.P. |

16

|

April 22, 2015 |

|

|

|

|

By: |

/s/ Steven F. Udvar-Házy |

|

|

|

|

|

|

Print Name: |

Steven F. Udvar-Házy |

|

|

|

Steven Udvar-Házy |

|

|

|

|

|

April 22, 2015 |

|

|

|

|

By: |

/s/ John Plueger |

|

|

|

|

|

|

Print Name: |

John Plueger |

|

|

|

John Plueger |

|

|

|

|

|

April 22, 2015 |

|

|

|

|

By: |

/s/ Grant Levy |

|

|

|

|

|

|

Print Name: |

Grant Levy |

|

|

|

Grant Levy |

|

|

|

|

|

April 22, 2015 |

|

|

|

|

By: |

/s/ Marc Baer |

|

|

|

|

|

|

Print Name: |

Marc Baer |

|

|

|

Marc Baer |

|

|

|

|

|

April 22, 2015 |

|

|

|

|

By: |

/s/ Michael Bai |

|

|

|

|

|

|

Print Name: |

Michael Bai |

|

|

|

Michael Bai |

|

|

|

|

|

April 22, 2015 |

|

|

|

|

By: |

/s/ Chi Yan |

|

|

|

|

|

|

Print Name: |

Chi Yan |

|

|

|

Chi Yan |

|

|

|

|

|

April 22, 2015 |

|

|

|

|

By: |

/s/ Housni Chraibi |

|

|

|

|

|

|

Print Name: |

Housni Chraibi |

|

|

|

Housni Chraibi |

17

|

April 22, 2015 |

|

|

|

|

By: |

/s/ Robert McNitt |

|

|

|

|

|

|

Print Name: |

Robert McNitt |

|

|

|

Robert McNitt |

|

|

|

|

|

April 22, 2015 |

|

|

|

|

By: |

/s/ Jenny Van Le |

|

|

|

|

|

|

Print Name: |

Jenny Van Le |

|

|

|

Jenny Van Le |

|

|

|

|

|

|

|

|

|

April 22, 2015 |

By: |

/s/ William MacCary |

|

|

|

|

|

|

Print Name: |

William MacCary |

|

|

|

William MacCary |

18

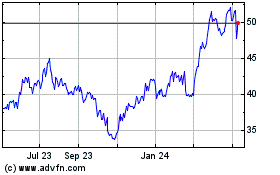

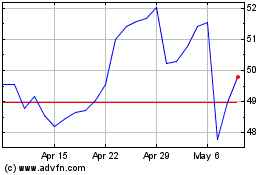

Air Lease (NYSE:AL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Air Lease (NYSE:AL)

Historical Stock Chart

From Apr 2023 to Apr 2024