UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): April 21, 2015

LOCKHEED

MARTIN CORPORATION

(Exact

name of registrant as specified in its charter)

| Maryland |

1-11437 |

52-1893632 |

| (State or other jurisdiction |

(Commission File Number) |

(IRS Employer |

| of incorporation) |

|

Identification No.) |

| |

|

|

| 6801 Rockledge Drive |

|

|

| Bethesda, Maryland |

|

20817 |

| (Address of principal executive offices) |

|

(Zip Code) |

| |

|

|

| |

(301) 897-6000 |

|

| (Registrant’s telephone

number, including area code) |

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item

2.02. Results of Operations and Financial Condition.

On

April 21, 2015, Lockheed Martin Corporation issued a news release reporting its financial results for the quarter ended March 29, 2015. A copy of the news release is furnished as Exhibit 99.1 to this Current Report on Form 8-K. Exhibit 99.1 shall not be

deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended.

Item

9.01. Financial Statements and Exhibits.

| Exhibit

No. |

|

Description |

| |

|

|

| 99.1 |

|

Lockheed Martin Corporation News Release dated April 21, 2015 (earnings

release reporting Lockheed Martin Corporation’s financial results for the quarter ended March 29, 2015). |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

| |

|

Lockheed Martin

Corporation |

| |

|

(Registrant) |

| |

|

|

| Date: April 21, 2015 |

By: |

/s/ Brian P. Colan |

| |

|

Brian P. Colan |

| |

|

Vice President and Controller |

EXHIBIT

INDEX

| Exhibit

No. |

|

Description |

| |

|

|

| 99.1 |

|

Lockheed Martin Corporation News Release dated April 21, 2015 (earnings

release reporting Lockheed Martin Corporation’s financial results for the quarter ended March 29, 2015). |

Exhibit 99.1

|

News Release |

Lockheed Martin Reports First Quarter 2015

Results

| · | Net sales of $10.1 billion |

| · | Net earnings of $878 million, or $2.74 per share |

| · | Cash from operations of $957 million |

| · | Repurchased 3.0 million shares for $604 million |

| · | Increases 2015 outlook for operating profit and earnings per share |

BETHESDA, Md., April 21, 2015 – Lockheed Martin Corporation

[NYSE: LMT] today reported first quarter 2015 net sales of $10.1 billion, compared to $10.7 billion in the first quarter

of 2014. Net earnings in the first quarter of 2015 were $878 million, or $2.74 per share, compared to $933 million,

or $2.87 per share, in the first quarter of 2014. Cash from operations in the first quarter of 2015 was $957 million, compared

to cash from operations of $2.1 billion in the first quarter of 2014.

“Our team continues to deliver solid performance

for our customers and strong results for our shareholders,” said Marillyn Hewson, Lockheed Martin Chairman, President and

CEO. “We remain focused on successfully competing in the global marketplace and delivering industry-leading affordable products

and technologies to our customers.”

Summary Financial Results

The following table presents the Corporation’s summary financial

results.

| |

(in millions, except per share data) | |

Quarters Ended | |

|

| |

| |

March 29, | | |

March 30, | |

|

| |

| |

2015 | | |

2014 | |

|

| |

Net sales | |

$ | 10,111 | | |

$ | 10,650 | |

|

| |

| |

| | | |

| | |

|

| |

Business segment operating profit | |

$ | 1,306 | | |

$ | 1,429 | |

|

| |

Unallocated items | |

| | | |

| | |

|

| |

FAS/CAS pension adjustment | |

| 119 | | |

| 86 | |

|

| |

Other, net | |

| (69 | ) | |

| (83 | ) |

|

| |

Total unallocated items | |

| 50 | | |

| 3 | |

|

| |

Consolidated operating profit | |

$ | 1,356 | | |

$ | 1,432 | |

|

| |

| |

| | | |

| | |

|

| |

Net earnings | |

$ | 878 | | |

$ | 933 | |

|

| |

| |

| | | |

| | |

|

| |

Diluted earnings per share | |

$ | 2.74 | | |

$ | 2.87 | |

|

| |

| |

| | | |

| | |

|

| |

Cash from operations | |

$ | 957 | | |

$ | 2,100 | |

|

| |

| |

| | | |

| | |

|

2015 Financial Outlook

The following table and other sections of this news release contain

forward-looking statements, which are based on the Corporation’s current expectations. Actual results may differ materially

from those projected. It is the Corporation’s practice not to incorporate adjustments into its financial outlook for proposed

acquisitions, divestitures, ventures, changes in law and restructuring activities (including special items) until such items have

been consummated or enacted. For additional factors that may impact the Corporation’s actual results, refer to the “Forward-Looking

Statements” section in this news release.

| |

(in millions, except per share data) | |

Current Update | |

January 2015 |

|

| |

| |

| |

|

|

| |

Orders | |

No Change | |

$43,500 – $45,000 |

|

| |

| |

| |

|

|

| |

Net sales | |

No Change | |

$43,500 – $45,000 |

|

| |

| |

| |

|

|

| |

Business segment operating profit | |

$5,150 – $5,300 | |

$5,100 – $5,250 |

|

| |

FAS/CAS pension adjustment | |

No Change | |

~475 |

|

| |

Other, net | |

No Change | |

~(275) |

|

| |

Consolidated operating profit | |

$5,350 – $5,500 | |

$5,300 – $5,450 |

|

| |

| |

| |

|

|

| |

Diluted earnings per share | |

$10.85 – $11.15 | |

$10.80 – $11.10 |

|

| |

| |

| |

|

|

| |

Cash from operations | |

No Change | |

≥ $5,000 |

|

| |

| |

| |

|

|

Cash Activities

The Corporation’s cash deployment activities in the first quarter

of 2015 consisted of the following:

| · | repurchasing 3.0 million shares for $604 million, compared to 7.0 million shares for $1.1 billion in the first quarter

of 2014; |

| · | paying cash dividends of $498 million, compared to $444 million in the first quarter of 2014; and |

| · | making capital expenditures of $118 million, compared to $103 million in the first quarter of 2014. |

On Feb. 20, 2015, the Corporation issued $2.25 billion of notes in

a registered public offering consisting of $750 million maturing in 2025 with a fixed interest rate of 2.90%, $500 million maturing

in 2035 with a fixed interest rate of 3.60% and $1.0 billion maturing in 2045 with a fixed interest rate of 3.80%.

Segment Results

The Corporation operates in five business segments: Aeronautics,

Information Systems & Global Solutions (IS&GS), Missiles and Fire Control (MFC), Mission Systems and Training (MST) and

Space Systems. The Corporation organizes its business segments based on the nature of the products and services offered.

Operating profit of the business segments includes the Corporation’s

share of earnings or losses from equity method investees as the operating activities of the equity method investees are closely

aligned with the operations of the Corporation’s business segments. United Launch Alliance (ULA), which is part of the Space

Systems business segment, is the Corporation’s primary equity method investee. Operating profit of the Corporation’s

business segments excludes the FAS/CAS pension adjustment, which represents the difference between total pension expense recorded

in accordance with GAAP (FAS) and pension costs recoverable on U.S. Government contracts as determined in accordance with U.S.

Government Cost Accounting Standards (CAS); expense for stock-based compensation; the effects of items not considered part of management’s

evaluation of segment operating performance, such as charges related to significant severance actions and goodwill impairments;

gains or losses from divestitures; the effects of certain legal settlements; corporate costs not allocated to the Corporation’s

business segments; and other miscellaneous corporate activities.

Changes in net sales and operating profit generally are expressed

in terms of volume. Changes in volume refer to increases or decreases in sales or operating profit resulting from varying production

activity levels, deliveries or service levels on individual contracts. Changes in volume also include the effect of fluctuations

in contract profit booking rates that have occurred in reporting periods other than those presented in the comparative segment

results. Volume changes in segment operating profit are typically based on the current profit booking rate for a particular contract.

In addition, comparability of the Corporation’s segment sales,

operating profit and operating margins may be impacted favorably or unfavorably by changes in profit booking rates on the Corporation’s

contracts accounted for using the percentage-of-completion method of accounting. Increases in the profit booking rates, typically

referred to as risk retirements, usually relate to revisions in the estimated total costs that reflect improved conditions on a

particular contract. Conversely, conditions on a particular contract may deteriorate resulting in an increase in the estimated

total costs to complete and a reduction in the profit booking rate. Increases or decreases in profit booking rates are recognized

in the current period and reflect the inception-to-date effect of such changes. Segment operating profit and margins may also be

impacted favorably or unfavorably by other items. Favorable items may include the positive resolution of contractual matters, cost

recoveries on restructuring charges, insurance recoveries and gains on sales of assets. Unfavorable items may include the adverse

resolution of contractual matters; restructuring charges, except for significant severance actions which are excluded from segment

operating results; reserves for disputes; asset impairments; and losses on sales of assets. Segment operating profit and items

such as risk retirements, reductions of profit booking rates or other matters are presented net of state income taxes.

The following table presents summary operating results of the Corporation’s

five business segments and reconciles these amounts to the Corporation’s consolidated financial results.

| |

(in millions) | |

Quarters Ended | |

|

| |

| |

March 29, | | |

March 30, | |

|

| |

| |

2015 | | |

2014 | |

|

| |

Net sales | |

| | | |

| | |

|

| |

Aeronautics | |

$ | 3,134 | | |

$ | 3,386 | |

|

| |

Information Systems & Global Solutions | |

| 1,869 | | |

| 1,910 | |

|

| |

Missiles and Fire Control | |

| 1,503 | | |

| 1,867 | |

|

| |

Mission Systems and Training | |

| 1,651 | | |

| 1,628 | |

|

| |

Space Systems | |

| 1,954 | | |

| 1,859 | |

|

| |

Total net sales | |

$ | 10,111 | | |

$ | 10,650 | |

|

| |

| |

| | | |

| | |

|

| |

Operating profit | |

| | | |

| | |

|

| |

Aeronautics | |

$ | 371 | | |

$ | 393 | |

|

| |

Information Systems & Global Solutions | |

| 136 | | |

| 174 | |

|

| |

Missiles and Fire Control | |

| 292 | | |

| 358 | |

|

| |

Mission Systems and Training | |

| 219 | | |

| 250 | |

|

| |

Space Systems | |

| 288 | | |

| 254 | |

|

| |

Total business segment operating profit | |

| 1,306 | | |

| 1,429 | |

|

| |

Unallocated items | |

| | | |

| | |

|

| |

FAS/CAS pension adjustment | |

| 119 | | |

| 86 | |

|

| |

Other, net | |

| (69 | ) | |

| (83 | ) |

|

| |

Total unallocated items | |

| 50 | | |

| 3 | |

|

| |

Total consolidated operating profit | |

$ | 1,356 | | |

$ | 1,432 | |

|

| |

| |

| | | |

| | |

|

The Corporation’s consolidated net adjustments not related

to volume, including net profit booking rate adjustments and other matters, represented approximately 38 percent of total segment

operating profit for the first quarter of 2015, compared to approximately 37 percent in the first quarter of 2014.

Aeronautics

| |

(in millions) | |

Quarters Ended | |

|

| |

| |

March 29, | | |

March 30, | |

|

| |

| |

2015 | | |

2014 | |

|

| |

Net sales | |

$ | 3,134 | | |

$ | 3,386 | |

|

| |

Operating profit | |

$ | 371 | | |

$ | 393 | |

|

| |

Operating margins | |

| 11.8 | % | |

| 11.6 | % |

|

Aeronautics’ net sales for the first quarter of 2015 decreased

$252 million, or 7 percent, compared to the same period in 2014. The decrease was attributable to lower net sales of approximately

$135 million for the C-130 program due to fewer aircraft deliveries (four aircraft delivered in the first quarter of 2015, compared

to five delivered in the same period in 2014) and lower sustainment activities; about $95 million for the C-5 program due to fewer

aircraft deliveries (one aircraft delivered in the first quarter of 2015, compared to two delivered in the same period in 2014);

approximately $70 million for the F-16 program due to decreased sustainment activities and fewer aircraft deliveries (three aircraft

delivered in the first quarter of 2015, compared to four delivered in the same period in 2014); about $50 million for the F-22

program due to decreased sustainment activities; and approximately $50 million due to lower volume on various other sustainment

activities. The decreases were partially offset by higher net sales of approximately $175 million for F-35 production contracts

due to increased volume and sustainment activities. Net sales for F-35 development contracts were comparable.

Aeronautics’ operating profit for the first quarter of 2015

decreased $22 million, or 6 percent, compared to the same period in 2014. The decrease was primarily attributable to lower operating

profit of approximately $30 million for the C-130 program due to fewer aircraft deliveries and lower risk retirements; and about

$20 million for the F-16 program due to decreased sustainment activities, lower risk retirements, and fewer aircraft deliveries.

The decreases were partially offset by higher operating profit of approximately $25 million for F-35 production contracts due to

increased volume and risk retirements. Operating profit for F-35 development contracts was comparable. Adjustments not related

to volume, including net profit booking rate adjustments, for the first quarter of 2015 were comparable to the same period in 2014.

Information Systems & Global Solutions

| |

(in millions) | |

Quarters Ended | |

|

| |

| |

March 29, | | |

March 30, | |

|

| |

| |

2015 | | |

2014 | |

|

| |

Net sales | |

$ | 1,869 | | |

$ | 1,910 | |

|

| |

Operating profit | |

$ | 136 | | |

$ | 174 | |

|

| |

Operating margins | |

| 7.3 | % | |

| 9.1 | % |

|

IS&GS’ net sales decreased $41 million, or 2

percent, for the first quarter of 2015 compared to the same period in 2014. The decrease was attributable to lower net sales

of approximately $160 million due to decreased volume as a result of the wind-down or completion of certain programs

(including Persistent Threat Detection System program) affected by in-theater force reductions, lower customer funding levels

(primarily command and control programs), and the impacts of increased re-competition of existing contracts coupled with the

fragmentation of large contracts into multiple smaller contracts that are awarded primarily on the basis of price

(CMS-CITIC). The decreases were partially offset by higher net sales of approximately $80 million for businesses acquired in

2014; and about $40 million due to increased volume on recently awarded programs.

IS&GS’ operating profit for the first quarter of 2015 decreased

$38 million, or 22 percent, compared to the same period in 2014. The decrease was primarily attributable to lower operating profit

of approximately $70 million for performance matters on an international program during the first quarter of 2015 and about $10

million for the amortization of intangible assets associated with recently acquired businesses. The decreases were partially offset

by higher operating profit of approximately $35 million due to risk retirements on various programs and increased volume on recently

awarded programs. Adjustments not related to volume, including net profit booking rate adjustments, were $25 million lower for

the first quarter of 2015 compared to the same period in 2014.

Missiles and Fire Control

| |

(in millions) | |

Quarters Ended | |

|

| |

| |

March 29, | | |

March 30, | |

|

| |

| |

2015 | | |

2014 | |

|

| |

Net sales | |

$ | 1,503 | | |

$ | 1,867 | |

|

| |

Operating profit | |

$ | 292 | | |

$ | 358 | |

|

| |

Operating margins | |

| 19.4 | % | |

| 19.2 | % |

|

MFC’s net sales for the first quarter of 2015 decreased $364

million, or 19 percent, compared to the same period in 2014. The decrease was attributable to lower net sales of approximately

$160 million for tactical missile programs due to fewer deliveries (primarily Hellfire, Joint Air-to-Surface Standoff Missile and

Guided Multiple Launch Rocket System); about $115 million for air and missile defense programs due to decreased deliveries (primarily

Patriot Advanced Capability-3); and approximately $85 million for fire control programs due to decreased deliveries (primarily

LANTIRN® and Sniper®).

MFC’s operating profit for the first quarter of 2015 decreased

$66 million, or 18 percent, compared to the same period in 2014. The decrease was attributable to lower operating profit of approximately

$50 million for tactical missile programs due to fewer deliveries and lower risk retirements (primarily Hellfire); and about $25

million for fire control programs due to lower risk retirements and fewer deliveries (primarily LANTIRN® and Sniper®).

Adjustments not related to volume, including net profit booking rate adjustments, were approximately $25 million lower for the

first quarter of 2015 compared to the same period in 2014.

Mission Systems and Training

| |

(in millions) | |

Quarters Ended | |

|

| |

| |

March 29, | | |

March 30, | |

|

| |

| |

2015 | | |

2014 | |

|

| |

Net sales | |

$ | 1,651 | | |

$ | 1,628 | |

|

| |

Operating profit | |

$ | 219 | | |

$ | 250 | |

|

| |

Operating margins | |

| 13.3 | % | |

| 15.4 | % |

|

MST’s net sales for the first quarter of 2015 increased $23

million, or 1 percent, compared to the same period in 2014. Net sales increased by approximately $110 million for integrated warfare

systems and sensors programs due to the start of new programs (primarily Space Fence) and volume (including Aegis and radar surveillance

programs); and $35 million for undersea systems due to an increase in volume on various programs. The increases were mostly offset

by lower net sales of approximately $120 million for ship and aviation systems programs due to fewer deliveries (including MH-60)

and lower volume (including Merlin Capability Sustainment Program).

MST’s operating profit for the first quarter of 2015 decreased

$31 million, or 12 percent, compared to the same period in 2014. The decrease was primarily attributable to lower operating profit

of approximately $25 million for ship and aviation systems due to decreased risk retirements (primarily naval launchers programs)

and lower volume. Adjustments not related to volume, including net profit booking rate adjustments and other matters, were approximately

$40 million lower for the first quarter of 2015 compared to the same period in 2014.

Space Systems

| |

(in millions) | |

Quarters Ended | |

|

| |

| |

March 29, | | |

March 30, | |

|

| |

| |

2015 | | |

2014 | |

|

| |

Net sales | |

$ | 1,954 | | |

$ | 1,859 | |

|

| |

Operating profit | |

$ | 288 | | |

$ | 254 | |

|

| |

Operating margins | |

| 14.7 | % | |

| 13.7 | % |

|

Space Systems’ net sales for the first quarter of 2015 increased

$95 million, or 5 percent, compared to the same period in 2014. The increase was attributable to higher net sales of approximately

$105 million for the Orion program due to increased volume; and about $90 million for businesses acquired in 2014. These increases

were partially offset by lower net sales of approximately $75 million for government satellite programs due to decreased volume.

Space Systems’ operating profit for the first quarter of 2015

increased $34 million, or 13 percent, compared to the same period in 2014. The increase was attributable to higher operating profit

of about $20 million for government satellite programs due to increased risk retirements; and approximately $15 million for the

Orion program due to increased risk retirements and volume. Adjustments not related to volume, including net profit booking rate

adjustments and other matters, were approximately $50 million higher for the first quarter of 2015 compared to the same period

in 2014.

Total equity earnings recognized by Space Systems (primarily

ULA) represented approximately $75 million, or 26 percent, of this business segment’s operating profit for the first

quarter of 2015, compared to approximately $70 million, or 28 percent, in the first quarter of 2014.

Income Taxes

The Corporation’s effective income tax rate was 30.6 percent

for the first quarter of 2015, compared to 30.8 percent for the first quarter of 2014. The rates for both periods benefited from

tax deductions for U.S. manufacturing activities and for dividends paid to the Corporation’s defined contribution plans with

an employee stock ownership plan feature. The rates included no benefit from the research and development tax credit because the

credit was not part of the law and had not been reenacted during either period.

About Lockheed Martin

Headquartered in Bethesda, Maryland, Lockheed Martin is a global

security and aerospace company that employs approximately 112,000 people worldwide and is principally engaged in the research,

design, development, manufacture, integration and sustainment of advanced technology systems, products and services. The Corporation’s

net sales for 2014 were $45.6 billion.

###

| MEDIA RELATIONS CONTACT: |

Dan Nelson, 301-897-6357, dan.nelson@lmco.com |

| INVESTOR RELATIONS CONTACT: |

Jerry Kircher, 301-897-6584 |

Website: www.lockheedmartin.com

Conference Call Information

Lockheed Martin will webcast the earnings conference call (listen-only

mode) at 11:00 a.m. ET on April 21, 2015. A live audio broadcast, including relevant charts, will be available on the Investor

Relations page of the Corporation’s website at: www.lockheedmartin.com/investor.

Forward-Looking Statements

This news release contains statements that, to the extent they are

not recitations of historical fact, constitute forward-looking statements within the meaning of the federal securities laws, and

are based on Lockheed Martin’s current expectations and assumptions. The words “believe,” “estimate,”

“anticipate,” “project,” “intend,” “expect,” “plan,” “outlook,”

“scheduled,” “forecast” and similar expressions are intended to identify forward-looking statements. These

statements are not guarantees of future performance and are subject to risks and uncertainties. Actual results may differ materially

due to factors such as:

| · | the Corporation’s reliance on contracts with the U.S. Government, all of which are conditioned upon the availability

of funding; |

| · | declining budgets; affordability initiatives; the implementation of automatic sequestration under the Budget Control Act of

2011; U.S. Government operations under a continuing resolution or the failure to adopt a budget which may cause contracts to be

delayed, canceled or funded at lower levels or which may cause the Corporation to put its funds at risk; |

| · | risks related to the development, performance, schedule, cost and requirements of complex and technologically advanced programs

including the Corporation’s largest, the F-35 program; |

| · | economic, industry, business and political conditions (domestic and international) including their effects on governmental

policy; |

| · | the Corporation’s success in growing international sales and expanding into adjacent markets and risks associated with

doing business in new markets and internationally; |

| · | the competitive environment for the Corporation’s products and services, including increased market pressures in the

Corporation’s services businesses, competition from outside the aerospace and defense industry, and increased bid protests; |

| · | planned production rates for significant programs and compliance with stringent performance and reliability standards; |

| · | the performance of key suppliers, teammates, venture partners, subcontractors and customers; |

| · | the timing and customer acceptance of product deliveries; |

| · | the Corporation’s ability to attract and retain key personnel and transfer knowledge to new personnel; the impact of

work stoppages or other labor disruptions; |

| · | the impact of cyber or other security threats or other disruptions to the Corporation’s businesses; |

| · | the Corporation’s ability to implement, pace and effect capitalization changes such as share repurchase activity and

pension funding or debt levels; |

| · | the Corporation’s ability to recover certain costs under U.S. Government contracts and changes in contract mix; |

| · | the accuracy of the Corporation’s estimates and projections; |

| · | risk of a future impairment of goodwill or other long-term assets; |

| · | movements in interest rates and other changes that may affect pension plan assumptions and actual returns on pension plan assets; |

| · | realizing the anticipated benefits of acquisitions or divestitures, ventures, teaming arrangements or internal reorganizations,

and the Corporation’s efforts to increase the efficiency of its operations and improve the affordability of its products

and services; |

| · | the adequacy of the Corporation’s insurance and indemnities; |

| · | the

effect of changes in (or the interpretation of): legislation, regulation or policy, including those applicable to procurement,

cost allowability or recovery, accounting, taxation, or export; and

|

| · | the outcome of legal proceedings, bid protests, environmental remediation efforts, government allegations that we have failed

to comply with law, other contingencies and U.S. Government identification of deficiencies in the Corporation’s

business systems. |

These are only some of the factors that may affect the forward-looking

statements contained in this news release. For a discussion identifying additional important factors that could cause actual results

to vary materially from those anticipated in the forward-looking statements, see the Corporation’s filings with the SEC including,

but not limited to, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and

“Risk Factors” in the Corporation’s Annual Report on Form 10-K for the year ended Dec. 31, 2014. The Corporation’s

filings may be accessed through the Investor Relations page of its website, www.lockheedmartin.com/investor, or through

the website maintained by the SEC at www.sec.gov.

The Corporation’s actual financial results likely will be different

from those projected due to the inherent nature of projections. Given these uncertainties, forward-looking statements should not

be relied on in making investment decisions. The forward-looking statements contained in this news release speak only as of the

date of its filing. Except where required by applicable law, the Corporation expressly disclaims a duty to provide updates to forward-looking

statements after the date of this news release to reflect subsequent

events, changed circumstances, changes in expectations, or the estimates

and assumptions associated with them. The forward-looking statements in this news release are intended to be subject to the safe

harbor protection provided by the federal securities laws.

Lockheed

Martin Corporation

Consolidated

Statements of Earnings1

(unaudited;

in millions, except per share data)

| | |

Quarters Ended | |

| | |

March 29,

2015 | | |

March 30,

2014 | |

| Net sales | |

$ | 10,111 | | |

$ | 10,650 | |

| Cost of sales | |

| (8,848 | ) | |

| (9,279 | ) |

| Gross profit | |

| 1,263 | | |

| 1,371 | |

| Other income, net | |

| 93 | | |

| 61 | |

| Operating profit | |

| 1,356 | | |

| 1,432 | |

| Interest expense | |

| (93 | ) | |

| (86 | ) |

| Other non-operating income, net | |

| 3 | | |

| 2 | |

| Earnings before income taxes | |

| 1,266 | | |

| 1,348 | |

| Income tax expense | |

| (388 | ) | |

| (415 | ) |

| Net earnings | |

$ | 878 | | |

$ | 933 | |

| Effective tax rate | |

| 30.6 | % | |

| 30.8 | % |

| | |

| | | |

| | |

| Earnings per common share | |

| | | |

| | |

| Basic | |

$ | 2.78 | | |

$ | 2.92 | |

| Diluted | |

$ | 2.74 | | |

$ | 2.87 | |

| | |

| | | |

| | |

| Weighted average shares outstanding | |

| | | |

| | |

| Basic | |

| 315.4 | | |

| 319.1 | |

| Diluted | |

| 320.2 | | |

| 325.1 | |

| | |

| | | |

| | |

| Common shares reported in stockholders' equity at end of period | |

| 313 | | |

| 315 | |

| 1 | The

Corporation closes its books and records on the last Sunday of the calendar quarter to

align its financial closing with its business processes, which was on March 29 for the

first quarter of 2015 and March 30 for the first quarter of 2014. The consolidated financial

statements and tables of financial information included herein are labeled based on that

convention. This practice only affects interim periods, as the Corporation's fiscal year

ends on Dec. 31. |

Lockheed

Martin Corporation

Business

Segment Summary Operating Results

(unaudited;

in millions)

| | |

Quarters Ended | | |

| |

|

| | |

March 29,

2015 | | |

March 30,

2014 | | |

% Change |

|

| Net sales | |

| | | |

| | | |

| | |

|

| Aeronautics | |

$ | 3,134 | | |

$ | 3,386 | | |

| (7 | )% |

|

| Information Systems & Global Solutions | |

| 1,869 | | |

| 1,910 | | |

| (2 | )% |

|

| Missiles and Fire Control | |

| 1,503 | | |

| 1,867 | | |

| (19 | )% |

|

| Mission Systems and Training | |

| 1,651 | | |

| 1,628 | | |

| 1 | % |

|

| Space Systems | |

| 1,954 | | |

| 1,859 | | |

| 5 | % |

|

| Total net sales | |

$ | 10,111 | | |

$ | 10,650 | | |

| (5 | )% |

|

| | |

| | | |

| | | |

| | |

|

| Operating profit | |

| | | |

| | | |

| | |

|

| Aeronautics | |

$ | 371 | | |

$ | 393 | | |

| (6 | )% |

|

| Information Systems & Global Solutions | |

| 136 | | |

| 174 | | |

| (22 | )% |

|

| Missiles and Fire Control | |

| 292 | | |

| 358 | | |

| (18 | )% |

|

| Mission Systems and Training | |

| 219 | | |

| 250 | | |

| (12 | )% |

|

| Space Systems | |

| 288 | | |

| 254 | | |

| 13 | % |

|

| Total business segment operating profit | |

| 1,306 | | |

| 1,429 | | |

| (9 | )% |

|

| Unallocated items | |

| | | |

| | | |

| | |

|

| FAS/CAS pension adjustment | |

| 119 | | |

| 86 | | |

| | |

|

| Other, net | |

| (69 | ) | |

| (83 | ) | |

| | |

|

| Total unallocated items | |

| 50 | | |

| 3 | | |

| N/M | |

|

| Total consolidated operating profit | |

$ | 1,356 | | |

$ | 1,432 | | |

| (5 | )% |

|

| | |

| | | |

| | | |

| | |

|

| Operating margins | |

| | | |

| | | |

| | |

|

| Aeronautics | |

| 11.8 | % | |

| 11.6 | % | |

| | |

|

| Information Systems & Global Solutions | |

| 7.3 | % | |

| 9.1 | % | |

| | |

|

| Missiles and Fire Control | |

| 19.4 | % | |

| 19.2 | % | |

| | |

|

| Mission Systems and Training | |

| 13.3 | % | |

| 15.4 | % | |

| | |

|

| Space Systems | |

| 14.7 | % | |

| 13.7 | % | |

| | |

|

| Total business segment operating margins | |

| 12.9 | % | |

| 13.4 | % | |

| | |

|

| | |

| | | |

| | | |

| | |

|

| Total consolidated operating margins | |

| 13.4 | % | |

| 13.4 | % | |

| | |

|

Lockheed

Martin Corporation

Consolidated

Balance Sheets

(unaudited;

in millions, except par value)

| | |

March 29,

2015 | | |

Dec. 31,

2014 | |

| Assets | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 3,486 | | |

$ | 1,446 | |

| Receivables, net | |

| 6,545 | | |

| 5,884 | |

| Inventories, net | |

| 3,087 | | |

| 2,882 | |

| Deferred income taxes | |

| 1,468 | | |

| 1,451 | |

| Other current assets | |

| 632 | | |

| 666 | |

| Total current assets | |

| 15,218 | | |

| 12,329 | |

| | |

| | | |

| | |

| Property, plant and equipment, net | |

| 4,654 | | |

| 4,755 | |

| Goodwill | |

| 10,841 | | |

| 10,862 | |

| Deferred income taxes | |

| 4,024 | | |

| 4,013 | |

| Other noncurrent assets | |

| 5,015 | | |

| 5,114 | |

| Total assets | |

$ | 39,752 | | |

$ | 37,073 | |

| | |

| | | |

| | |

| Liabilities and stockholders' equity | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 1,945 | | |

$ | 1,570 | |

| Customer advances and amounts in excess of costs incurred | |

| 5,548 | | |

| 5,790 | |

| Salaries, benefits and payroll taxes | |

| 1,722 | | |

| 1,826 | |

| Other current liabilities | |

| 2,352 | | |

| 1,926 | |

| Total current liabilities | |

| 11,567 | | |

| 11,112 | |

| | |

| | | |

| | |

| Accrued pension liabilities | |

| 11,400 | | |

| 11,413 | |

| Other postretirement benefit liabilities | |

| 1,098 | | |

| 1,102 | |

| Long-term debt, net | |

| 8,404 | | |

| 6,169 | |

| Other noncurrent liabilities | |

| 3,763 | | |

| 3,877 | |

| Total liabilities | |

| 36,232 | | |

| 33,673 | |

| | |

| | | |

| | |

| Stockholders' equity | |

| | | |

| | |

| Common stock, $1 par value per share | |

| 313 | | |

| 314 | |

| Additional paid-in capital | |

| - | | |

| - | |

| Retained earnings | |

| 14,922 | | |

| 14,956 | |

| Accumulated other comprehensive loss | |

| (11,715 | ) | |

| (11,870 | ) |

| Total stockholders' equity | |

| 3,520 | | |

| 3,400 | |

| Total liabilities and stockholders' equity | |

$ | 39,752 | | |

$ | 37,073 | |

Lockheed

Martin Corporation

Consolidated

Statements of Cash Flows

(unaudited;

in millions)

| | |

Quarters Ended | |

| | |

March 29,

2015 | | |

March 30,

2014 | |

| | |

| | |

| |

| Operating activities | |

| | | |

| | |

| Net earnings | |

$ | 878 | | |

$ | 933 | |

| Adjustments to reconcile net earnings to net cash provided by operating activities | |

| | | |

| | |

| Depreciation and amortization | |

| 244 | | |

| 237 | |

| Stock-based compensation | |

| 40 | | |

| 48 | |

| Changes in assets and liabilities | |

| | | |

| | |

| Receivables, net | |

| (661 | ) | |

| (423 | ) |

| Inventories, net | |

| (205 | ) | |

| 29 | |

| Accounts payable | |

| 375 | | |

| 545 | |

| Customer advances and amounts in excess of costs incurred | |

| (242 | ) | |

| (152 | ) |

| Postretirement benefit plans | |

| 292 | | |

| 320 | |

| Income taxes | |

| 395 | | |

| 584 | |

| Other, net | |

| (159 | ) | |

| (21 | ) |

| Net cash provided by operating activities | |

| 957 | | |

| 2,100 | |

| | |

| | | |

| | |

| Investing activities | |

| | | |

| | |

| Capital expenditures | |

| (118 | ) | |

| (103 | ) |

| Other, net | |

| 26 | | |

| (23 | ) |

| Net cash used for investing activities | |

| (92 | ) | |

| (126 | ) |

| | |

| | | |

| | |

| Financing activities | |

| | | |

| | |

| Issuance of long-term debt, net of related costs | |

| 2,213 | | |

| - | |

| Repurchases of common stock | |

| (604 | ) | |

| (1,106 | ) |

| Proceeds from stock option exercises | |

| 65 | | |

| 197 | |

| Dividends paid | |

| (498 | ) | |

| (444 | ) |

| Other, net | |

| (1 | ) | |

| 26 | |

| Net cash provided by (used for) financing activities | |

| 1,175 | | |

| (1,327 | ) |

| | |

| | | |

| | |

| Net change in cash and cash equivalents | |

| 2,040 | | |

| 647 | |

| Cash and cash equivalents at beginning of period | |

| 1,446 | | |

| 2,617 | |

| Cash and cash equivalents at end of period | |

$ | 3,486 | | |

$ | 3,264 | |

Lockheed

Martin Corporation

Consolidated

Statement of Stockholders' Equity

(unaudited;

in millions)

| | |

| | |

| | |

| | |

Accumulated | | |

| |

| | |

| | |

Additional | | |

| | |

Other | | |

Total | |

| | |

Common | | |

Paid-In | | |

Retained | | |

Comprehensive | | |

Stockholders' | |

| | |

Stock | | |

Capital | | |

Earnings | | |

Loss | | |

Equity | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance at Dec. 31, 2014 | |

$ | 314 | | |

$ | - | | |

$ | 14,956 | | |

$ | (11,870 | ) | |

$ | 3,400 | |

| Net earnings | |

| - | | |

| - | | |

| 878 | | |

| - | | |

| 878 | |

| Other comprehensive income, net of tax1 | |

| - | | |

| - | | |

| - | | |

| 155 | | |

| 155 | |

| Repurchases of common stock | |

| (3 | ) | |

| (166 | ) | |

| (435 | ) | |

| - | | |

| (604 | ) |

| Dividends declared2 | |

| - | | |

| - | | |

| (477 | ) | |

| - | | |

| (477 | ) |

| Stock-based awards and ESOP activity | |

| 2 | | |

| 166 | | |

| - | | |

| - | | |

| 168 | |

| Balance at March 29, 2015 | |

$ | 313 | | |

$ | - | | |

$ | 14,922 | | |

$ | (11,715 | ) | |

$ | 3,520 | |

| 1 | Primarily

represents the reclassification adjustment for recognition of prior period amounts related

to postretirement benefit plans. |

| 2 | Represents

dividends of $1.50 per share declared during the first quarter of 2015. |

Lockheed

Martin Corporation

Operating

Data

(unaudited;

in millions, except aircraft deliveries)

| Backlog | |

March 29,

2015 | | |

Dec. 31,

2014 | |

| Aeronautics | |

$ | 25,300 | | |

$ | 27,600 | |

| Information Systems & Global Solutions | |

| 8,100 | | |

| 8,700 | |

| Missiles and Fire Control | |

| 12,800 | | |

| 13,600 | |

| Mission Systems and Training | |

| 12,300 | | |

| 11,700 | |

| Space Systems | |

| 18,400 | | |

| 18,900 | |

| Total backlog | |

$ | 76,900 | | |

$ | 80,500 | |

| | |

Quarters Ended | |

| | |

March 29,

2015 | | |

March 30,

2014 | |

| Orders | |

$ | 6,500 | | |

$ | 7,700 | |

| | |

Quarters Ended | |

| Aircraft Deliveries | |

March 29,

2015 | | |

March 30,

2014 | |

| F-16 | |

| 3 | | |

| 4 | |

| F-35 | |

| 8 | | |

| 8 | |

| C-130J | |

| 4 | | |

| 5 | |

| C-5 | |

| 1 | | |

| 2 | |

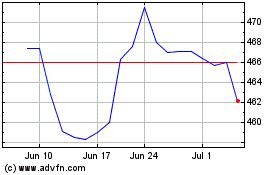

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Mar 2024 to Apr 2024

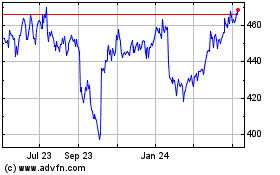

Lockheed Martin (NYSE:LMT)

Historical Stock Chart

From Apr 2023 to Apr 2024