UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): March 27, 2015

OraSure Technologies, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

001-16537 |

|

36-4370966 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 220 East First Street

Bethlehem, Pennsylvania |

|

18015-1360 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: 610-882-1820

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the

following provisions:

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02 – Departure of Directors or Certain Officers; Election of Directors; Appointment of

Certain Officers; Compensatory Arrangements of Certain Officers.

On March 27, 2015, the employment agreements between OraSure

Technologies, Inc. (the “Company”) and each of the following executive officers were amended as described below (the “Amendments”):

|

|

|

| Name |

|

Title |

|

|

| • Douglas A. Michels |

|

President and Chief Executive Officer |

|

|

| • Ronald H. Spair |

|

Chief Financial Officer and Chief Operating Officer |

|

|

| • Jack E. Jerrett |

|

Senior Vice President, General Counsel and Secretary |

|

|

| • Mark L. Kuna |

|

Senior Vice President, Finance, Controller and Assistant Secretary |

Pursuant to the Amendments, the employment agreements for each of the foregoing executives were amended to

remove a provision requiring the Company to provide a gross-up to the executive for certain excise tax liability under Section 280G of the Internal Revenue Code. In addition, Mr. Michels’ employment agreement was amended to change a

“single trigger” change of control severance provision to a “double trigger” severance provision. Copies of the Amendments are attached to this Report as Exhibits 99.1 through 99.4 and are incorporated by reference herein.

Item 9.01 – Financial Statements and Exhibits.

(d) Exhibits

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Amendment No. 3 to Employment Agreement, dated as of March 27, 2015, between Douglas A. Michels and OraSure Technologies, Inc. |

|

|

| 99.2 |

|

Amendment No. 3 to Employment Agreement, dated as of March 27, 2015, between Ronald H. Spair and OraSure Technologies, Inc. |

|

|

| 99.3 |

|

Amendment No. 3 to Employment Agreement, dated as of March 27, 2015, between Jack E. Jerrett and OraSure Technologies, Inc. |

|

|

| 99.4 |

|

Amendment No. 3 to Employment Agreement, dated as of March 27, 2015, between Mark L. Kuna and OraSure Technologies, Inc. |

Signatures

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned, hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

ORASURE TECHNOLOGIES, INC. |

|

|

|

|

| Date: March 31, 2015 |

|

|

|

By: |

|

/s/ Jack E. Jerrett |

|

|

|

|

|

|

Jack E. Jerrett |

|

|

|

|

|

|

Senior Vice President, General Counsel and

Secretary |

Index to Exhibits

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Amendment No. 3 to Employment Agreement, dated as of March 27, 2015, between Douglas A. Michels and OraSure Technologies, Inc. |

|

|

| 99.2 |

|

Amendment No. 3 to Employment Agreement, dated as of March 27, 2015, between Ronald H. Spair and OraSure Technologies, Inc. |

|

|

| 99.3 |

|

Amendment No. 3 to Employment Agreement, dated as of March 27, 2015, between Jack E. Jerrett and OraSure Technologies, Inc. |

|

|

| 99.4 |

|

Amendment No. 3 to Employment Agreement, dated as of March 27, 2015, between Mark L. Kuna and OraSure Technologies, Inc. |

Exhibit 99.1

AMENDMENT NO. 3 TO EMPLOYMENT AGREEMENT

This Amendment No. 3 to Employment Agreement entered into as of March 27, 2015 (this “Amendment”), between Douglas A.

Michels (“Employee”) and OraSure Technologies, Inc., a Delaware corporation (the “Company”).

WHEREAS, the parties

have previously entered into an Employment Agreement, dated as of June 22, 2004 as amended (the “Original Agreement”), and desire to amend the Original Agreement as more fully set forth herein.

NOW, THEREFORE, intending to be legally bound, the parties hereby agree as follows:

| |

1.1. |

Termination by Employee With Good Reason. Section 6.4 of the Original Agreement is hereby amended and restated as follows: |

“6.4 Termination by Employee With Good Reason. Employee may terminate his employment under this Agreement for Good Reason; provided

that (i) Employee gives written notice to the Board of Directors within 90 days of the event constituting Good Reason; (ii) the Company has not cured the event giving rise to such notice within 30 days of receipt of Employee’s notice;

and (iii) such termination of employment occurs not less than two years after the occurrence of the event constituting Good Reason. The term “Good Reason” shall mean any of the following: (a) a material breach of this Agreement

by the Company (or its successor); (b) a material diminution in Employee’s base compensation or authority, duties or responsibilities, it being understood that, following a Change of Control, such a material diminution shall be deemed to

have occurred if Employee no longer is appointed or ceases to function as the sole chief executive officer of the successor organization; (c) a material diminution in the authority, duties or responsibilities of the person to whom Employee

reports, including a change in Employee’s reporting obligation from the Board of Directors to another employee of the Company, it being understood that, following a Change of Control, such a material diminution shall be deemed to have occurred

if Employee no longer reports to a board of directors of a public company; (d) a material diminution of the budget over which Employee exercises control; or (e) a material change in Employee’s job location.”

| |

1.2. |

Elimination of Single Trigger. Section 6.6 of the Original Agreement is hereby deleted in its entirety and all subsequent Sections and cross references are renumbered accordingly. |

| |

1.3. |

Double Trigger Severance. Section 6.8.2 is hereby amended and restated as Section 6.7.2 to read as follows: |

“6.7.2 Termination Without Cause or Upon Good Reason. In the event of a termination of Employee’s employment with the Company

pursuant to Section 6.4 or 6.5, Employee: (i) shall be paid all salary pursuant to Section 3.1 through the date of termination and any bonus that has been approved by the Board of Directors or Compensation Committee prior to the date

of termination but not yet paid; (ii) shall (A) if such termination is for Good Reason pursuant to Section 6.4 or without Cause pursuant to Section 6.5 and does not occur during a Change of Control Period, be paid a lump sum

equivalent to 12 months of Employee’s annual salary, or (B) if such termination is for Good Reason pursuant to Section 6.4 or without Cause pursuant to Section 6.5 and occurs during a Change of Control Period, be paid a

lump sum equivalent to 36 months of the Employee’s annual salary; (iii) shall receive a cash bonus for the calendar year in which termination occurs equal to Employee’s target bonus for such year established pursuant to

Section 3.2; and (iv) for a period of one year after the date of termination, shall receive benefits for Employee and/or Employee’s family at levels substantially equal to those which would have been provided to them in accordance

with the plans described in Section 3.4 of this Agreement if Employee’s employment had not been terminated, including health, disability and life insurance, in accordance with the most favorable plans of the Company in effect during the

90-day period immediately preceding the date of termination (amounts payable under clauses (ii), (iii) and (iv) are collectively referred to as “severance”). Subject to Section 6.9, all payments will be made (or commence)

under this Section 6.7 on the 90th day after termination of employment hereunder.

As a condition to receipt of severance under this

Section 6.7.2, within 30 days following termination of Employee’s employment, Employee shall sign and deliver a release agreement, in form and substance substantially as set forth in Exhibit C hereto, releasing all claims related to

Employee’s employment. The severance shall be in lieu of and not in addition to any other severance arrangement maintained by the Company, and shall be offset by any monies Employee may owe to the Company. The Company’s obligation to pay

the amounts stated in clauses (ii), (iii) and (iv) of this Section 6.7.2 shall terminate if, during the period commencing on termination of employment and continuing until all severance payments have been made by the Company, Employee

fails to comply with the Confidentiality Agreement and such failure would constitute a material breach of this Agreement under Section 5 hereof.”

| |

1.4. |

Golden Parachute Excise Tax. Section 10 of the Original Agreement is hereby deleted in its entirety and all subsequent Sections and cross references are renumbered accordingly. |

| 2. |

Effect of Amendment. Except as amended hereby, the Original Agreement shall remain in full force and effect. All references to the “Agreement” shall hereafter be deemed to mean the Original Agreement as

amended by this Amendment. |

| 3. |

Counterparts and Facsimiles. This Amendment may be executed, including execution by facsimile signature, in one or more counterparts, each of which shall be deemed an original, and all of which together shall be

deemed to be one and the same instrument. |

| 4. |

Governing Law. This Amendment shall be governed by, and enforced in accordance with, the laws of the Commonwealth of Pennsylvania without regards to the application of the principles of conflicts of laws.

|

The parties have executed this Amendment as of the date indicated above.

|

|

|

|

|

|

|

|

|

|

|

ORASURE TECHNOLOGIES, INC. |

|

|

|

|

| /s/ Douglas A. Michels |

|

|

|

By: |

|

/s/ Ronald H. Spair |

| Douglas A. Michels |

|

|

|

|

|

|

|

|

|

|

Title: |

|

Chief Financial Officer and |

|

|

|

|

|

|

Chief Operating Officer |

|

|

|

|

|

|

|

|

Name: |

|

Ronald H. Spair |

Exhibit 99.2

AMENDMENT NO. 3 TO EMPLOYMENT AGREEMENT

This Amendment No. 3 to Employment Agreement entered into as of March 27, 2015 (this “Amendment”), between Ronald H. Spair

(“Employee”) and OraSure Technologies, Inc., a Delaware corporation (the “Company”).

WHEREAS, the parties have

previously entered into an Employment Agreement, dated as of July 1, 2004, as amended (the “Original Agreement”), and desire to amend the Original Agreement as more fully set forth herein.

NOW, THEREFORE, intending to be legally bound, the parties hereby agree as follows:

| 1. |

Golden Parachute Excise Tax. Section 10 of the Original Agreement is hereby deleted in its entirety and all subsequent Sections and cross references are renumbered accordingly. |

| 2. |

Effect of Amendment. Except as amended hereby, the Original Agreement shall remain in full force and effect. All references to the “Agreement” shall hereafter be deemed to mean the Original Agreement as

amended by this Amendment. |

| 3. |

Counterparts and Facsimiles. This Amendment may be executed, including execution by facsimile signature, in one or more counterparts, each of which shall be deemed an original, and all of which together shall be

deemed to be one and the same instrument. |

| 4. |

Governing Law. This Amendment shall be governed by, and enforced in accordance with, the laws of the Commonwealth of Pennsylvania without regards to the application of the principles of conflicts of laws.

|

The parties have executed this Amendment as of the date indicated above.

|

|

|

|

|

|

|

|

|

|

|

ORASURE TECHNOLOGIES, INC. |

|

|

|

|

| /s/ Ronald H. Spair |

|

|

|

By: |

|

/s/ Douglas A. Michels |

| Ronald H. Spair |

|

|

|

|

|

|

|

|

|

|

Title: |

|

President and Chief Executive Officer |

|

|

|

|

|

|

|

|

Name: |

|

Douglas A. Michels |

Exhibit 99.3

AMENDMENT NO. 3 TO EMPLOYMENT AGREEMENT

This Amendment No. 3 to Employment Agreement entered into as of March 27, 2015 (this “Amendment”), between Jack E. Jerrett

(“Employee”) and OraSure Technologies, Inc., a Delaware corporation (the “Company”).

WHEREAS, the parties have

previously entered into an Employment Agreement, dated as of July 1, 2004, as amended (the “Original Agreement”), and desire to amend the Original Agreement as more fully set forth herein.

NOW, THEREFORE, intending to be legally bound, the parties hereby agree as follows:

| 5. |

Golden Parachute Excise Tax. Section 10 of the Original Agreement is hereby deleted in its entirety and all subsequent Sections and cross references are renumbered accordingly. |

| 6. |

Effect of Amendment. Except as amended hereby, the Original Agreement shall remain in full force and effect. All references to the “Agreement” shall hereafter be deemed to mean the Original Agreement as

amended by this Amendment. |

| 7. |

Counterparts and Facsimiles. This Amendment may be executed, including execution by facsimile signature, in one or more counterparts, each of which shall be deemed an original, and all of which together shall be

deemed to be one and the same instrument. |

| 8. |

Governing Law. This Amendment shall be governed by, and enforced in accordance with, the laws of the Commonwealth of Pennsylvania without regards to the application of the principles of conflicts of laws.

|

The parties have executed this Amendment as of the date indicated above.

|

|

|

|

|

|

|

|

|

|

|

ORASURE TECHNOLOGIES, INC. |

|

|

|

|

| /s/ Jack E. Jerrett |

|

|

|

By: |

|

/s/ Douglas A. Michels |

| Jack E. Jerrett |

|

|

|

|

|

|

|

|

|

|

Title: |

|

President and Chief Executive Officer |

|

|

|

|

|

|

|

|

Name: |

|

Douglas A. Michels |

Exhibit 99.4

AMENDMENT NO. 3 TO EMPLOYMENT AGREEMENT

This Amendment No. 3 to Employment Agreement entered into as of March 27, 2015 (this “Amendment”), between Mark L. Kuna

(“Employee”) and OraSure Technologies, Inc., a Delaware corporation (the “Company”).

WHEREAS, the parties have

previously entered into an Employment Agreement, dated as of October 2, 2006, as amended (the “Original Agreement”), and desire to amend the Original Agreement as more fully set forth herein.

NOW, THEREFORE, intending to be legally bound, the parties hereby agree as follows:

| 9. |

Golden Parachute Excise Tax. Section 10 of the Original Agreement is hereby deleted in its entirety and all subsequent Sections and cross references are renumbered accordingly. |

| 10. |

Effect of Amendment. Except as amended hereby, the Original Agreement shall remain in full force and effect. All references to the “Agreement” shall hereafter be deemed to mean the Original Agreement as

amended by this Amendment. |

| 11. |

Counterparts and Facsimiles. This Amendment may be executed, including execution by facsimile signature, in one or more counterparts, each of which shall be deemed an original, and all of which together shall be

deemed to be one and the same instrument. |

| 12. |

Governing Law. This Amendment shall be governed by, and enforced in accordance with, the laws of the Commonwealth of Pennsylvania without regards to the application of the principles of conflicts of laws.

|

The parties have executed this Amendment as of the date indicated above.

|

|

|

|

|

|

|

|

|

|

|

ORASURE TECHNOLOGIES, INC. |

|

|

|

|

| /s/ Mark L. Kuna |

|

|

|

By: |

|

/s/ Douglas A. Michels |

| Mark L. Kuna |

|

|

|

|

|

|

|

|

|

|

Title: |

|

President and Chief Executive Officer |

|

|

|

|

|

|

|

|

Name: |

|

Douglas A. Michels |

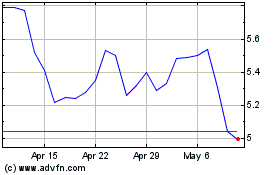

OraSure Technologies (NASDAQ:OSUR)

Historical Stock Chart

From Mar 2024 to Apr 2024

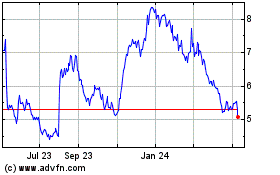

OraSure Technologies (NASDAQ:OSUR)

Historical Stock Chart

From Apr 2023 to Apr 2024