UNITED STATES SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event

Reported): March 30, 2015

Atossa Genetics Inc.

(Exact name of registrant as specified in

its charter)

| |

|

|

|

|

| Delaware |

|

001-35610 |

|

26-4753208 |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

|

2345 Eastlake Ave. East, Suite 201

Seattle, Washington |

|

98102 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (206) 325-6086

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02. Results of Operations and Financial Condition.

On March 30, 2015, Atossa Genetics Inc. (the “Company”)

issued a press release announcing fiscal year ended December 31, 2014 financial results and a company update. A copy of the press

release is attached as Exhibit 99.1 to this current report and is incorporated herein by reference.

The information in the report, including Exhibit 99.1 attached

hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended,

or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended.

The information contained herein and in the accompanying exhibit shall not be incorporated by reference into any filing with the

U.S. Securities and Exchange Commission made by the Company, whether made before or after the date hereof, regardless of any general

incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| |

|

|

| Exhibit No. |

|

Description |

| 99.1 |

|

Press Release, dated March 30, 2015 |

| |

|

|

* * *

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

|

| Date: March 30, 2015 |

Atossa Genetics Inc.

|

|

| |

By: |

/s/ Kyle Guse |

|

| |

|

Kyle Guse |

|

| |

|

Chief Financial Officer,

General Counsel and Secretary |

|

Exhibit Index

| |

|

|

| Exhibit No. |

|

Description |

| 99.1 |

|

Press Release, dated March 30, 2015 |

| |

|

|

Exhibit 99.1

Atossa Genetics Announces 2014 Financial

Results

and Provides Company Update

Conference Call to be Held Today at 4:30

pm Eastern Time

SEATTLE, March 30, 2015 -- Atossa Genetics, Inc. (NASDAQ:

ATOS) today announced 2014 financial results and provided an update on recent company developments.

Steve Quay, President and CEO, commented,

“2014 was a pivotal year for Atossa. We developed and began to execute on a new strategy to obtain a CE-mark for our ForeCYTE

Breast Aspirator and to launch the device in the EU and to commercialize the FullCYTE Breast Aspirator in the U.S. We launched

a new pharmacogenomics test in the last quarter of 2014 with the goal of developing a non-dilutive cash flow for our business.

Our achievements in 2014 positioned us well to accomplish our 2015 key objectives, which are:

| · | Launching and commercializing the FullCYTE Breast Aspirator in the

U.S. market. |

| · | Launching and commercializing the CE-marked ForeCYTE Breast Aspirator

in the EU. |

| · | Achieving top-line combined gross revenue of $8.0 million from medical

device sales and laboratory services, including our pharmacogenomics test offering. |

| · | Initiating pharmaceutical clinical trials in women for the treatment

of serious breast diseases via local delivery of pharmaceuticals, potentially reducing systemic adverse events. |

We have now made significant progress towards

accomplishing these objectives. We have launched the ForeCYTE Breast Aspirator in the EU, launched the FullCYTE Breast Aspirator

in the U.S. and we are on track to achieving or exceeding our $8 million gross revenue target in 2015,” Dr. Quay continued.

Recent Corporate Developments

Important recent corporate developments include the following:

| · | Launched the ForeCYTE Breast Aspirator in the EU. |

| · | Launched the FullCYTE Breast Aspirator in the U.S. |

| · | Atossa’s subsidiary, The National Reference Laboratory for Breast

Health, Received Accreditation from the College of American Pathologists. |

| · | Two Leading National Distributors now offer the FullCYTE Breast Aspirator

in the United States. |

| · | Received CE Mark for the ForeCYTE Breast Aspirator Device in the EU. |

| · | Received Quality Registration Certificates ISO 13485:2003; EN ISO

13485:2012 and AC:2012 (Canadian); and ISO 9001:2008. |

| · | The NRLBH Processed and Reported 527 Pharmacogenomics Tests in 2014. |

| · | Launched a Pharmacogenomic Test in October 2014 Which Generated $525,954

in Total Revenue in 2014. |

Fourth Quarter 2014 Financial Results

Revenue for the year ended December 31,

2014, totaled $525,954, mainly from pharmacogenomics testing. Total revenue for the year ended December 31, 2013 was $632,558,

primarily consisting of NAF cytology tests from January through September 2013. Cost of revenue was $340,658 for the year ended

December 31, 2014, compared to $345,519 in 2013.

For the year ended December 31, 2014,

gross profit totaled $185,296, compared to $137,093 in 2013.

Operating expenses for the year ended December

31, 2014 were $14,827,713 consisting of general and administrative (G&A) expenses of $8,625,917, research and development (R&D)

expenses of $2,577,465, selling expenses of $1,271,705, and $2,352,626 in impairment of intangibles, representing an increase of

$3,905,977, or 36% from $10,921,736 in the same period in 2013, which consisted of G&A expenses of $8,558,835, R&D expenses

of $1,105,110, and selling expenses of $1,257,791.

G&A expenses increased primarily

as a result of lower capital raising commissions, lower recall expenses, lower consulting fees, lower advertising and marketing

fees and lower bad debt expenses, offset by higher legal and regulatory and higher salaries, director fees and employees benefits.

R&D increased primarily as a result of increased expenditures on the development of our new products and tests in the pipeline,

including the NextCYTE Test and FullCYTE microcatheters.

We evaluated and reprioritized our R&D

pipeline based on recent business strategies, and as a result we have delayed plans to develop and invest further in patents and

technologies we acquired in 2012 from Acueity for at least the next year. Because of these changed business plans, we concluded

that these assets are partially impaired and recorded $2,352,626 in impairment.

We expect that our G&A and selling

expenses will increase in future periods as we hire additional administrative and sales personnel to commercialize the ForeCYTE

Breast Aspirator and FullCYTE Breast Aspirator and our pharmacogenomics test, and our other products and services under development.

We also expect that our R&D expenses will continue to increase as we add additional full time employees and incur additional

costs to continue the development of our products and services, including our planned clinical trials involving a pharmaceutical

for the potential local treatment of serious breast health diseases.

Conference Call Information

Management will host a conference call

today, March 30, 2015, at 4:30 pm Eastern Time to review the financial results and recent corporate developments. To listen to

the call by phone, interested parties within the U.S. may dial 866-652-5200 or 412-317-6060 for international callers. All callers

should ask for the Atossa Genetics conference call. The conference call will also be available through a live webcast at www.atossagenetics.com.

Details for the webcast may be found on the Company’s IR events page at http://ir.atossagenetics.com/ir-calendar.

A replay of the call will be available

one hour after the end of the call through April 30, 2015, and can be accessed via Atossa’s website or by dialing 877-344-7529

(domestic) or 412-317-0088 (international). The replay conference ID number is 10062963.

About Atossa Genetics

Atossa Genetics Inc. is focused on improving

breast health through the development of laboratory services, medical devices and therapeutics. The laboratory services are being

developed by its subsidiary, The National Reference Laboratory for Breast Health, Inc. The laboratory services and the Company's

medical devices are being developed so they can be used as companions to therapeutics to treat various breast health conditions.

For more information, please visit www.atossagenetics.com.

Forward-Looking Statements

Forward-looking statements in this press

release are subject to risks and uncertainties that may cause actual results to differ materially from the anticipated or estimated

future results, including the risks and uncertainties associated with actions by the FDA, the outcome or timing of regulatory approvals

needed by Atossa to sell its products, responses to regulatory matters, Atossa's ability to achieve its objectives, continue to

manufacture and sell its products, recalls of products, the safety and efficacy of Atossa's products and services, performance

of distributors, whether Atossa can launch and commercialize in the United States and foreign markets the additional tests, devices

and therapeutics in its pipeline in a timely and cost effective manner, and other risks detailed from time to time in Atossa's

filings with the Securities and Exchange Commission, including without limitation its periodic reports on Form 10-K and 10-Q, each

as amended and supplemented from time to time. Atossa does not undertake any obligation to update any forward looking statement.

Contact:

Atossa Genetics, Inc.

Kyle Guse

CFO and General Counsel

(O) 800-351-3902

Kyle.Guse@atossagenetics.com

Investor Relations:

CorProminence LLC

Scott Gordon

President

516-222-2560

scottg@corprominence.com

ATOSSA GENETICS, INC.

CONSOLIDATED BALANCE SHEETS

| | |

As of December 31, | |

| | |

2014 | | |

2013 | |

| Assets | |

| | |

| |

| | |

| | |

| |

| Current assets | |

| | |

| |

| Cash and cash equivalents | |

$ | 8,500,718 | | |

$ | 6,342,161 | |

| Accounts receivable, net | |

| 297,958 | | |

| 139,072 | |

| Prepaid expenses | |

| 247,207 | | |

| 280,627 | |

| Inventory, net | |

| 39,788 | | |

| - | |

| Total current assets | |

| 9,085,671 | | |

| 6,761,860 | |

| | |

| | | |

| | |

| Furniture and equipment, net | |

| 357,532 | | |

| 163,147 | |

| Intangible assets, net | |

| 1,920,645 | | |

| 4,395,633 | |

| Deferred financing costs | |

| 351,961 | | |

| 651,961 | |

| Other assets | |

| 48,193 | | |

| 36,446 | |

| Total assets | |

$ | 11,764,002 | | |

$ | 12,009,047 | |

| | |

| | | |

| | |

| Liabilities and Stockholders' Equity | |

| | | |

| | |

| | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 594,357 | | |

$ | 248,142 | |

| Accrued expenses | |

| 444,861 | | |

| 295,310 | |

| Deferred rent | |

| - | | |

| 48,157 | |

| Payroll liabilities | |

| 1,056,705 | | |

| 580,645 | |

| Product recall liabilities | |

| - | | |

| 211,493 | |

| Short-term lease obligations | |

| 76,025 | | |

| 9,681 | |

| Other current liabilities | |

| 42,228 | | |

| 8,148 | |

| Total current liabilities | |

| 2,214,176 | | |

| 1,401,576 | |

| | |

| | | |

| | |

| Deferred rent, net of current portion | |

| 2,483 | | |

| - | |

| Long-term lease obligations | |

| 49,216 | | |

| 5,820 | |

| Total liabilities | |

| 2,265,875 | | |

| 1,407,396 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Stockholders' equity | |

| | | |

| | |

| Preferred stock - $.001 par value; 10,000,000 shares authorized, 0 shares issued and outstanding | |

| - | | |

| - | |

| Common stock - $.001 par value; 75,000,000 shares authorized, 24,564,058 and 18,574,334 shares issued and outstanding at December 31, 2014 and December 31, 2013, respectively | |

| 24,564 | | |

| 18,574 | |

| Additional paid-in capital | |

| 44,648,103 | | |

| 31,099,691 | |

| Accumulated deficit | |

| (35,174,540 | ) | |

| (20,516,614 | ) |

| Total stockholders' equity | |

| 9,498,127 | | |

| 10,601,651 | |

| | |

| | | |

| | |

| Total liabilities and stockholders' equity | |

$ | 11,764,002 | | |

$ | 12,009,047 | |

ATOSSA GENETICS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

| | |

For the Years Ended December 31, | |

| | |

2014 | | |

2013 | |

| Revenue | |

| | |

| |

| Diagnostic testing service | |

$ | 525,954 | | |

$ | 409,118 | |

| Product sales | |

| - | | |

| 223,440 | |

| Total revenue | |

| 525,954 | | |

| 632,558 | |

| | |

| | | |

| | |

| Cost of revenue | |

| | | |

| | |

| Diagnostic testing service | |

| 340,658 | | |

| 105,764 | |

| Product sales | |

| - | | |

| 239,755 | |

| Total cost of revenue | |

| 340,658 | | |

| 345,519 | |

| Loss on obsolete inventory | |

| - | | |

| 149,946 | |

| Gross profit | |

| 185,296 | | |

| 137,093 | |

| | |

| | | |

| | |

| Selling expenses | |

| 1,271,705 | | |

| 1,257,791 | |

| Research and development expenses | |

| 2,577,465 | | |

| 1,105,110 | |

| General and administrative expenses | |

| 8,625,917 | | |

| 8,558,835 | |

| Impairment of intangible assets | |

| 2,352,626 | | |

| - | |

| Total operating expenses | |

| 14,827,713 | | |

| 10,921,736 | |

| Operating loss | |

| (14,642,417 | ) | |

| (10,784,643 | ) |

| Interest income | |

| 260 | | |

| 295 | |

| Interest expense | |

| (15,769 | ) | |

| (360 | ) |

| Net loss before income taxes | |

| (14,657,926 | ) | |

| (10,784,708 | ) |

| Income taxes | |

| - | | |

| - | |

| Net loss | |

$ | (14,657,926 | ) | |

$ | (10,784,708 | ) |

| Loss per common share - basic and diluted | |

$ | (0.61 | ) | |

$ | (0.70 | ) |

| Weighted average shares outstanding, basic and diluted | |

| 24,038,578 | | |

| 15,484,414 | |

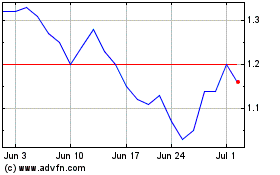

Atossa Therapeutics (NASDAQ:ATOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Atossa Therapeutics (NASDAQ:ATOS)

Historical Stock Chart

From Apr 2023 to Apr 2024