Current Report Filing (8-k)

March 30 2015 - 3:13PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) March 27, 2015

NEOGEN CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| MICHIGAN |

|

0-17988 |

|

38-2367843 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

|

|

|

| 620 Lesher Place Lansing, Michigan |

|

48912 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code 517-372-9200

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01 Other Events

On March 27, 2015, Neogen Corporation issued a press release announcing Jerome Properties, LLC, has adopted a prearranged trading plan in accordance with

Securities and Exchange Commission rule 10b5-1. James Herbert, Chairman and CEO of Neogen Corporation is a minority owner of this entity that owns shares of Neogen Corporation common stock.

Herbert does not have control of this entity, but felt the disclosure was appropriate. The filing is only for a portion of the shares owned by that entity and

is a small portion of total shares of Neogen stock held by Herbert or for his benefit.

Rule 10b5-1 of the Securities Exchange Commission permits officers

of public companies to adopt predetermined written plans for trading specified amounts of company stock when they are not in possession of material non-public information in order to gradually diversify their investment portfolio and to minimize the

market effect of stock sales by spreading them over an extended period of time.

The 10b5-1 Plan adopted by Jerome Properties LLC involves a market order

to sell up to 10,000 shares per month of Neogen Corporation common stock each month for one year. The Plan will take effect on April 1, 2015 and expire on March 31, 2016.

The stock transactions under the Rule 10b5-1 Plan will be disclosed publicly through Form 4 filings with the Securities and Exchange Commission. Neogen

undertakes no obligation to report on Form 8-K any Rule 10b5-1 plans that may be adopted by any of its other officers and directors or to report on Form 8-K any modifications or termination of any publicly announced trading plans, except to the

extent required by law.

Item 9.01 Financial Statements and Exhibits

| |

99.1 |

Press Release dated March 27, 2015 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

NEOGEN CORPORATION |

|

|

|

|

|

|

(Registrant) |

|

|

|

|

| Date: March 30, 2015 |

|

|

|

|

|

/s/ Steven J. Quinlan |

|

|

|

|

|

|

Steven J. Quinlan |

|

|

|

|

|

|

Vice President & CFO |

Exhibit 99.1

Neogen CEO Adopts 10b5-1 Trading Plan

LANSING, Mich., March 27, 2015 — Neogen Corporation (NASDAQ: NEOG) announced today that Jerome Properties, LLC, has adopted a prearranged trading

plan in accordance with Securities and Exchange Commission rule 10b5-1. James Herbert, Chairman and CEO of Neogen Corporation is a minority owner of this entity that owns shares of Neogen Corporation common stock.

Herbert does not have control of this entity, but felt the disclosure was appropriate. The filing is only for a portion of the shares owned by that entity and

is a small portion of total shares of Neogen stock held by Herbert or for his benefit.

Rule 10b5-1 of the Securities Exchange Commission permits officers

of public companies to adopt predetermined written plans for trading specified amounts of company stock when they are not in possession of material non-public information in order to gradually diversify their investment portfolio and to minimize the

market effect of stock sales by spreading them over an extended period of time.

The 10b5-1 Plan adopted by Jerome Properties LLC involves a market order

to sell up to 10,000 shares per month of Neogen Corporation common stock each month for one year. The Plan will take effect on April 1, 2015 and expire on March 31, 2016.

Neogen Corporation develops and markets products dedicated to food and animal safety. The company’s Food Safety Division markets dehydrated culture media

and diagnostic test kits to detect foodborne bacteria, natural toxins, food allergens, drug residues, plant diseases and sanitation concerns. Neogen’s Animal Safety Division is a leader in the development of animal genomics along with the

manufacturing and distribution of a variety of animal healthcare products, including diagnostics, pharmaceuticals, veterinary instruments, wound care and disinfectants.

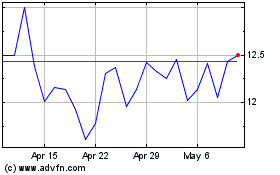

Neogen (NASDAQ:NEOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Neogen (NASDAQ:NEOG)

Historical Stock Chart

From Apr 2023 to Apr 2024