UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (date of earliest event reported):

March 20, 2015

ALICO, INC.

(Exact name of registrant as specified in

its charter)

| Florida |

0-261 |

59-0906081 |

(State or Other Jurisdiction of

Incorporation) |

(Commission File Number) |

(IRS Employer Identification

Number) |

|

10070 Daniels Interstate Court

Fort Myers, Florida, 33913

(Address of principal executive offices) |

Registrant’s telephone number, including

area code: (239) 226-2000

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrants under any of the following provisions (see General Instruction

A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 5.02. Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On March 26, 2015, Alico, Inc. (the “Company”)

announced that Kenneth Smith resigned as the Company’s Executive Vice President and Chief Operating Officer effective as

of March 20, 2015. A copy of the press release announcing Mr. Smith’s resignation is attached as Exhibit 99.1 to this

current report. The Company has entered into a separation and consulting agreement with Mr. Smith, dated as of March 20, 2015

(the “Separation and Consulting Agreement”), to govern certain compensation and post-employment matters and to provide

for Mr. Smith’s service to the Company as a consultant for a three-year period following his resignation. Under the Separation

and Consulting Agreement, Mr. Smith will be entitled, subject to his execution, delivery, and non-revocation of a general release

of claims in favor of the Company, to the following benefits: (a) $525,000 in cash in a lump sum, (b) an annual consulting

fee of $200,000 during the period commencing on his resignation date and ending on second anniversary of his resignation date,

subject to his continuing to provide services to the Company (the amounts described in clauses (a) and (b), the “Consulting

Fees”), and (c) if, as of the third anniversary of his resignation date, annualized revenues in respect of certain Company

water projects equal or exceed certain thresholds, then an amount up to $300,000 in cash in a lump sum (depending on such revenues),

subject to his continuing to provide services to the Company (the amount in clause (c), the “Third Year Payment”).

The Separation and Consulting Agreement also provides that, if Mr. Smith’s consulting services are terminated by the Company

without cause during the consulting period, he will be paid the amount of any unpaid Consulting Fees under the Separation and Consulting

Agreement and continue to be eligible to receive the Third Year Payment.

The Separation and Consulting Agreement also

contains customary restrictive covenants, including confidentiality, noncompetition, nonsolicitation, and nondisparagement covenants.

Item 9.01. Financial Statements and Exhibits

(d)

Exhibits.

| Exhibit No. |

Description |

| 99.1 |

Press Release, dated March 26, 2015 |

| |

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ALICO, INC. |

| |

|

| Date: March 26, 2015 |

By: |

|

| |

Name: |

W. Mark Humphrey |

| |

Title: |

Senior Vice President and Chief Financial Officer |

Exhibit 99.1

ALICO, INC. ANNOUNCES CHIEF OPERATING OFFICER

CHANGE

March 26, 2015 – Fort Myers, Florida – Alico, Inc. (NASDAQ:

ALCO, “Alico” or “the company”), an agriculture and natural resources company, today announced that Kenneth

Smith, its Executive Vice President and Chief Operating Officer, has stepped down to pursue other personal and professional opportunities.

Mr. Smith has agreed to provide consulting services to the company following his departure for a period of up to 36 months.

Alico’s business operations previously managed by Mr. Smith

will now be managed by Clay Wilson, Chief Executive Officer of Alico. The company does not expect to appoint an interim or ongoing

Chief Operating Officer.

Mr. Wilson said, “On behalf of the Board and the entire Alico

team, I want to thank Ken for his contributions to the growth of Alico, particularly in the identification and execution of opportunities

for the company’s cattle business. We are grateful for his willingness to serve in a consulting capacity following his resignation,

and wish him great success in his future endeavors.”

About Alico, Inc.

Alico is a holding company with assets and related operations in

agriculture and natural resources. In addition to its citrus operations, Alico is currently involved in cattle ranching, water

management, mining and other natural resources, including approximately 121,000 acres of land in twelve Florida counties (Alachua,

Charlotte, Collier, Desoto, Glades, Hardee, Hendry, Highlands, Lee, Martin, Osceola and Polk) and 90,000 acres of mineral

rights. Our mission is to create value for our customers, clients and shareholders by managing existing lands to their optimal

current income and total returns, opportunistically acquiring new agricultural assets and producing high quality agricultural products

while exercising responsible environmental stewardship.

Forward-Looking Statements

We provide forward-looking information in this release pursuant

to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933

and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Any statements in this release

that are not historical facts are forward-looking statements. Forward-looking statements include, but are not limited to, statements

that express our intentions, beliefs, expectations, strategies, predictions or any other statements relating to our future activities

or other future events or conditions. These statements are based on our current expectations, estimates and projections about our

business based, in part, on assumptions made by our management. These assumptions are not guarantees of future performance and

involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may differ materially

from what is expressed or forecasted in the forward-looking statements due to numerous factors, including those risks factors described

in our Annual Report on Form 10-K for the year ended September 30, 2014 and our Quarterly Reports on Form 10-Q filed with the Securities

and Exchange Commission. Alico undertakes no obligation to subsequently update or revise the forward-looking statements made in

this press release, except as required by law.

Press Contact

Vu Chung

Prosek Partners

212-279-3115 ext. 205

vchung@prosek.com

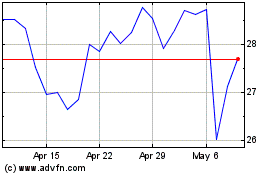

Alico (NASDAQ:ALCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

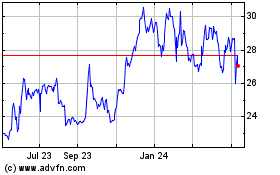

Alico (NASDAQ:ALCO)

Historical Stock Chart

From Apr 2023 to Apr 2024