Current Report Filing (8-k)

March 17 2015 - 6:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): March 16, 2015

THE BRINK’S COMPANY

(Exact name of registrant as specified in its charter)

|

Virginia

|

001-09148

|

54-1317776

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

1801 Bayberry Court

P. O. Box 18100

Richmond, VA 23226-8100

(Address and zip code of

principal executive offices)

Registrant’s telephone number, including area code: (804) 289-9600

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

|

[ ]

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

|

[ ]

|

|

Soliciting materials pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

|

[ ]

|

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

|

[ ]

|

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 7.01

|

Regulation FD Disclosure

|

The Brink’s Company (the “Company”) officials expect to participate in meetings with investors and analysts on March 17, 2015 at the Bank of America Merrill Lynch Smid Cap Conference. The Company updated the slides that it uses for these meetings. A copy of the updated slides is furnished as Exhibit 99.1 hereto.

During these meetings, Company officials expect to reaffirm the estimate for 2015 revenue of approximately $3.4 billion, non-GAAP margin rate of 5.1% to 5.6% and non-GAAP earnings per share of $1.55 to $1.75. Company officials also expect to reaffirm non-GAAP financial targets for 2016, which include revenue of approximately $3.6 billion, margin rate of 6.7% and earnings per share of $2.00 to $2.40.

Investors are strongly encouraged to review the factors cited in the Forward-Looking Statements disclosure included in this report.

Forward-Looking Statements

This report contains forward-looking information. Words such as "anticipate," "assume," "estimate," "expect," “target” "project," "predict," "intend," "plan," "believe," "potential," "may," "should" and similar expressions may identify forward-looking information. Forward-looking information in this report includes, but is not limited to: estimated 2015 revenue and non-GAAP margin rate and earnings per share; and estimated 2016 revenue, non-GAAP margin rate, operating profit and earnings per share. Forward-looking information in this document is subject to known and unknown risks, uncertainties and contingencies, which are difficult to predict or quantify, and which could cause actual results, performance or achievements to differ materially from those that are anticipated.

These risks, uncertainties and contingencies, many of which are beyond our control, include, but are not limited to:

|

·

|

our ability to improve profitability in our largest five markets;

|

|

·

|

our ability to identify and execute further cost and operational improvements and efficiencies in our core businesses;

|

|

·

|

continuing market volatility and commodity price fluctuations and their impact on the demand for our services;

|

|

·

|

our ability to maintain or improve volumes at favorable pricing levels and increase cost and productivity efficiencies, particularly in the United States and Mexico;

|

|

·

|

investments in information technology and adjacent businesses and their impact on revenues and profit growth;

|

|

·

|

our ability to develop and implement solutions for our customers and gain market acceptance of those solutions;

|

|

·

|

our ability to maintain an effective IT infrastructure and safeguard confidential information;

|

|

·

|

risks customarily associated with operating in foreign countries including changing labor and economic conditions, currency restrictions and devaluations, safety and security

|

issues, political instability, restrictions on repatriation of earnings and capital, nationalization, expropriation and other forms of restrictive government actions;

|

·

|

the strength of the U.S. dollar relative to foreign currencies and foreign currency exchange rates;

|

|

·

|

the stability of the Venezuelan economy, changes in Venezuelan policy regarding foreign-owned businesses;

|

|

·

|

regulatory and labor issues in many of our global operations, including negotiations with organized labor and the possibility of work stoppages;

|

|

·

|

our ability to integrate successfully recently acquired companies and improve their operating profit margins;

|

|

·

|

costs related to dispositions and market exits;

|

|

·

|

our ability to identify evaluate and pursue acquisitions and other strategic opportunities;

|

|

·

|

the willingness of our customers to absorb fuel surcharges and other future price increases;

|

|

·

|

our ability to obtain necessary information technology and other services at favorable pricing levels from third party service providers;

|

|

·

|

variations in costs or expenses and performance delays of any public or private sector supplier, service provider or customer;

|

|

·

|

our ability to obtain appropriate insurance coverage, positions taken by insurers with respect to claims made and the financial condition of insurers, safety and security performance, our loss experience, and changes in insurance costs;

|

|

·

|

security threats worldwide and losses of customer valuables;

|

|

·

|

costs associated with the purchase and implementation of cash processing and security equipment;

|

|

·

|

employee and environmental liabilities in connection with our former coal operations, including black lung claims incidence;

|

|

·

|

the impact of the Patient Protection and Affordable Care Act on black lung liability and the Company's ongoing operations;

|

|

·

|

changes to estimated liabilities and assets in actuarial assumptions due to payments made, investment returns, interest rates and annual actuarial revaluations, the funding requirements, accounting treatment, investment performance and costs and expenses of our pension plans, the VEBA and other employee benefits, mandatory or voluntary pension plan contributions;

|

|

·

|

the nature of our hedging relationships;

|

|

·

|

changes in estimates and assumptions underlying our critical accounting policies;

|

|

·

|

our ability to realize deferred tax assets;

|

|

·

|

the outcome of pending and future claims, litigation, and administrative proceedings;

|

|

·

|

public perception of the Company's business and reputation;

|

|

·

|

access to the capital and credit markets;

|

|

·

|

seasonality, pricing and other competitive industry factors; and

|

|

·

|

the promulgation and adoption of new accounting standards and interpretations, new government regulations and interpretation of existing regulations.

|

This list of risks, uncertainties and contingencies is not intended to be exhaustive. Additional factors that could cause our results to differ materially from those described in the forward-looking statements can be found under "Risk Factors" in Item 1A of our Annual Report on Form 10-K for the period ended December 31, 2014, and in our other public filings with the Securities and Exchange Commission. The forward-looking information included in this document is representative only as of the date of this document and The Brink's Company undertakes no obligation to update any information contained in this document.

|

Item 9.01

|

Financial Statements and Exhibits

|

|

| |

|

|

|

(d)

|

Exhibits

|

|

| |

|

|

| |

99.1

|

The Brink’s Company Investor Overview, March 2015

|

| |

|

|

| |

|

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

THE BRINK’S COMPANY

(Registrant)

|

| |

|

| |

|

|

Date: March 16, 2015

|

By:

|

/s/ Joseph W. Dziedzic

|

| |

|

Joseph W. Dziedzic

|

| |

|

Executive Vice President

and Chief Financial Officer

|

EXHIBIT INDEX

|

EXHIBIT

|

DESCRIPTION

|

| |

|

|

99.1

|

The Brink’s Company Investor Overview, March 2015

|

The Brink’s Company NYSE: BCO March 17, 2015 Exhibit 99.1

Forward-Looking Statements and Non-GAAP Results These materials contain forward-looking statements. Actual results could differ materially from projected or estimated results. Information regarding factors that could cause such differences is available in today's release and in The Brink’s Company’s most recent SEC filings. Information discussed today is representative as of today only and Brink's assumes no obligation to update any forward-looking statements. These materials are copyrighted and may not be used without written permission from Brink's. Today’s presentation is focused primarily on non-GAAP results. Detailed reconciliations of non-GAAP to GAAP results are provided in the appendix beginning on page 24. *

The world’s premier provider of secure transportation and cash management services * 2014 Adjusted Non-GAAP Revenue $3.4B 2014 Adjusted Non-GAAP EPS $1.20 2014 Non-GAAP CFOA $208M Head Count ~64,000 Operations in 41 Countries Company Overview(a) Facilities ~1,100 Revenue ~80% International Vehicles ~12,300 Customers in ~100 Countries (a) See reconciliation to GAAP results and other information in Appendix. Adjusted non-GAAP results adjusted for Venezuelan results at 50 bolivars per U.S. dollar

What We Do 2014 Revenue = $3.4B Adjusted Non-GAAP Armored Transport Cash, coins, checks and other valuables; ATM services Global Infrastructure Supports Global Services and Cash Logistics Cash-in-Transit Global Services Secure long-distance transport of valuables Cash Logistics Money processing Vaulting CompuSafe® Service Adjacencies Payment Services Commercial Security Security Services Guarding in select countries Airports, embassies Lines of Business * High-Value Services

2014 Adjusted Non-GAAP Revenue and Operating Profit by Segment(a) * Largest Markets Payment Services Global Markets Corporate Items Total Brink’s Revenue Operating Profit OP% 5% 12% (5%) 4.1% ($ millions) (a) See reconciliation to GAAP results and other information in Appendix. Adjusted non-GAAP results adjusted for Venezuelan results at 50 bolivars per U.S. dollar

2014 Largest 5 Markets Revenue and Operating Profit * United States Mexico France Canada Total Largest Markets Revenue Operating Profit OP% 3% 8% 3% 9% 7% 5% ($ millions) Brazil

2014 Global Markets Adjusted Non-GAAP Revenue and Operating Profit (a) * EMEA Latin America Total Global Markets Revenue Operating Profit OP% 9% 13% 16% 12% ($ millions) Asia (a) See reconciliation to GAAP results and other information in Appendix. Adjusted non-GAAP results adjusted for Venezuelan results at 50 bolivars per U.S. dollar

Strategy * To Be the World’s Leading Cash and Valuables Secure Supply Chain Provider Expand Our Offerings Move from transactional to value-based secure supply chain management Create Culture of Continuous Improvement Implement LEAN processes and drive centralization of support functions Live Our Values Accountability, Customer Focus & Trust

Significant Actions Taken to Reshape Brink’s * Exited Underperforming CIT Businesses Australia (2014) Germany (2013) Hungary (2013) Sold Non-Strategic Assets Select guarding operations: Morocco (2012), France (2013), Germany (2013) Threshold Technologies (2013) ICD – China (2013) Peru – minority position (2014) The Netherlands (2014) Poland (2013) Puerto Rico (2014) Turkey (2013) Reorganization (Late 2014) 2 Primary business units Largest 5 Markets Global Markets Centrally managing support functions Restructuring (late 2014, 2015) Global workforce reductions (~1,700) Eliminated Europe and Latin America regional structure Reduced/mitigated legacy liabilities Lump sum pension plan buy-out Accelerated pension payments De-risked investment allocation Generated ~$100 million in cash Portfolio Transformation Structure Changes

* Adjusted Non-GAAP Revenue Trend(a) Organic Growth Currency Organic Growth Currency Organic Growth ($ millions) (a) See reconciliation to GAAP results and other information in Appendix. Adjusted non-GAAP results adjusted for Venezuelan results at 50 bolivars per U.S. dollar

* 2015 & 2016 Margin Rate Targets Prior Reporting Format Segment Non-Segment Operating Profit Margin 5.9% (1.3) 4.7% 5.4% (1.4) 4.1% 6.5 – 7.0% (1.4) 5.1 – 5.6% 8.0% (1.3) 6.7% Adjusted Non-GAAP Margin %(a) (a) See reconciliation to GAAP results and other information in Appendix. Adjusted non-GAAP results adjusted for Venezuelan results at 50 bolivars per U.S. dollar

* Adjusted Non-GAAP EPS Outlook(a) Operations Currency Operations Operations ($ millions) Currency Operations 2014 2015 2016 Currency 2014 2015 2013 2014 2015 Target 2016 Target 2013 Sub-Total 2016 Target (a) See reconciliation to GAAP results and other information in Appendix. Adjusted non-GAAP results adjusted for Venezuelan results at 50 bolivars per U.S. dollar

How We Get to 2016 Targets * ($ millions, except EPS or as otherwise noted) (a) See information about reconciliation to GAAP results in Appendix. Adjusted non GAAP results adjusted for Venezuelan results at 50 bolivars per U.S. dollar. 2014 Adjusted Non-GAAP(a) $3,449 $140 4.1% U.S @ 6% 21 Mexico @ 10% 29 Rest of World 52 Organic Growth ~5% 401 28 2016 before currency 3,850 270 Currency impact (250) (30) 2016 Outlook ~$3,600 ~$240 ~6.7% 2016 Targets Operating Profit Revenue

New Organization Structure 4 geographic units replaced with 2 operating units Eliminated regional roles and structures * How We Achieve Our Profit Goals: $45 - $50 Million Cost Savings Expected in 2015 ($ millions) Global Headcount Reductions Global reductions SG&A and operations Majority of 2015 savings implemented in 1Q15 2014 Severance Costs 2015 Savings ~$15 $3 2014 Severance Costs 2015 Savings ~$30-$35 $19

* How We Achieve Our Profit Goals: Fix the U.S. U.S. Operating Profit Margin Field Force Automation (% implemented) Deposit Imaging (% implemented) Route Logistics (% implemented) Centralized Billing (% implemented) Key Projects/Actions Route logistics Field force automation Centralized billing Headcount/SG&A reductions Deposit imaging in money processing One-person vehicle Overtime management Target Target Target Target Target Target Target YE15 Target 1H15 Target 1H16 Target Target

Standard Branch Structure (% implemented) * How We Achieve Our Profit Goals: Fix Mexico Mexico Operating Profit Margin CIT & ATM Efficiencies (% implemented) Finance Centralization % implemented Key Projects/Actions “Standard” branch structure CIT & ATM efficiencies Finance centralization Money processing turnaround Global procurement IT infrastructure Money Processing “Turnaround” % implemented Target Target Target Target Target Target Target Target Target

CapEx and Legacy Liabilities

Reinvestment Ratio ($ millions, except ratio) * Capex Spend Depreciation & Amortization $131 $159 $141 $156 $160

Legacy Liabilities – Underfunding – at December 31, 2014 * ($ millions)

Prepaid 2015 and 2016 pension payments in 3Q14 Accelerates de-risking of invested asset allocation Reduces PBGC premiums (current borrowing costs are lower than PBGC premiums) No future cash payments expected based on current actuarial assumptions Lump-sum pension payments made to eligible former employees in 4Q14 $56 million non-cash GAAP settlement loss recognized in 4Q14 Reduced plan assets by $150 million & liability reduced slightly more No cash payments to UMWA expected until 2032 * Estimated Cash Payments: $0 to Primary U.S. Pension $0 to UMWA until 2032 Payments to Primary U.S. Pension Payments to UMWA through ($ millions) (and beyond)

* Other Items Not Allocated to Segments FX devaluation in Venezuela The rate we use to remeasure operations in Venezuela declined 16% in February 2013 (from 5.3 to 6.3 bolivars to the U.S. dollar) and 88% in March 2014 (from 6.3 to 50 bolivars to the U.S. dollar). Expenses related to remeasured net monetary assets were $13.4 million in the first quarter of 2013 and $121.6 million in 2014. In addition, nonmonetary assets were not remeasured to a lower basis when the currency devalued. Instead, under highly inflationary accounting rules, these assets retained their higher historical bases, which excess is recognized in earnings as the asset is consumed resulting in incremental expense until the excess bases is depleted. Higher expenses related to nonmonetary assets were $0.5 million in the first quarter of 2013, $0.2 million in the second quarter of 2013, $0.2 million in the third quarter of 2013, $0.3 million in the fourth quarter of 2013, $1.4 million in the first quarter of 2014, $9.5 million in the second quarter of 2014, $5.4 million in the third quarter of 2014, and $4.8 million in the fourth quarter of 2014. Expenses related to these Venezuelan devaluations have not been allocated to segment results. 2014 Reorganization and Restructuring Brink’s reorganized and restructured its business in December 2014, eliminating management positions in its former Latin America and EMEA regions and is beginning to implement a plan to reduce the cost structure of various country operations by eliminating approximately 1,700 positions. Severance costs of $21.8 million associated with these actions were recognized in the fourth quarter of 2014. These amounts have not been allocated to segment results. 2013 2013 2013 2013 2013 2013 2013 2013 2013 2014 2014 2014 2014 2014 2014 2014 2014 2014 (In millions) (In millions) (In millions) (In millions) 1Q 2Q 3Q 4Q Full Year 1Q 2Q 3Q 4Q Full Year FX devaluation in Venezuela FX devaluation in Venezuela FX devaluation in Venezuela $ (13.9) (0.2) (0.2) (0.3) (14.6) $ (123.3) (9.8) (4.8) (4.8) (142.7) 2014 Reorganization and Restructuring 2014 Reorganization and Restructuring 2014 Reorganization and Restructuring - - - - - - - - (21.8) (21.8) Acquisitions and dispositions Acquisitions and dispositions Acquisitions and dispositions 2.7 1.3 2.4 (0.6) 5.8 1.2 1.3 46.9 - 49.4 Mexican settlement losses Mexican settlement losses Mexican settlement losses (0.2) (0.5) (0.8) (0.9) (2.4) (0.8) (0.9) (2.3) (1.9) (5.9) U.S. retirement plans U.S. retirement plans U.S. retirement plans (13.4) (13.1) (13.2) (13.2) (52.9) (6.0) (3.6) (3.7) (59.8) (73.1) Share-based compensation adj. Share-based compensation adj. Share-based compensation adj. - - - - - - (4.2) 1.8 - (2.4) Other items Other items $ (24.8) (12.5) (11.8) (15.0) (64.1) $ (128.9) (17.2) 37.9 (88.3) (196.5)

* Other Items Not Allocated to Segments Acquisitions and dispositions Gains and losses related to acquisitions and dispositions that have not been allocated to segment results are described below: Brink’s sold an equity investment in a CIT business in Peru and recognized a $44.3 million gain in the fourth quarter of 2014. Other divestiture gains were $0.6 million. Both the gains and the equity earnings related to our former investment in Peru recognized in prior periods are not allocated to segment results. Adjustments to the 2010 business acquisition gain for Mexico are not allocated to segment results ($1.1 million favorable adjustment in the first quarter of 2013, $2.2 million unfavorable adjustment in the fourth quarter of 2013 and $0.7 million favorable adjustment in the third quarter of 2014). Adjustments to the purchase price of the January 2013 acquisition of Rede Trel in Brazil are not allocated to segment results ($1.7 million of favorable adjustments in the third and fourth quarters of 2013). The $0.9 million fourth quarter 2013 impairment of an intangible asset acquired in the 2009 India acquisition is not allocated to segment results. A $2.6 million unfavorable tax adjustment in fourth quarter 2013 related to the 2010 Belgium disposition is not allocated to segment results. Mexican settlement losses Employee benefit settlement losses in Mexico have not been allocated to segment results. U.S. retirement plans Brink’s retirement plan benefits in the U.S. are frozen and the related expenses have not been allocated to segment results. Brink’s primary U.S. pension plan settled a portion of its obligation in the fourth quarter of 2014 under a lump sum buy-out offer. Approximately 4,300 terminated participants were paid about $150 million of plan assets under this offer in lieu of receiving their pension benefit. A $56 million settlement loss was recognized as a result of the settlement. Share-based compensation adjustment Accounting adjustments related to share-based compensation have not been allocated to segment results ($4.2 million expense in the second quarter of 2014 and a $1.8 million benefit in the third quarter of 2014). The accounting adjustments revise the accounting for share-based compensation from fixed to variable fair value accounting as defined in ASC Topic 718, Stock Compensation.

* Adjusted Non-GAAP and Non-GAAP Reconciled to GAAP Amounts may not add due to rounding. See slide 29 for footnote explanations. 2013 2013 2013 2013 2013 2013 2013 2013 2013 2014 2014 2014 2014 2014 2014 2014 2014 2014 (In millions) (In millions) (In millions) (In millions) 1Q 2Q 3Q 4Q Full Year 1Q 2Q 3Q 4Q Full Year Revenues: Revenues: Revenues: Revenues: Adjusted non-GAAP Adjusted non-GAAP Adjusted non-GAAP Adjusted non-GAAP $ 825.8 845.1 842.0 874.2 3,387.1 $ 836.5 859.0 872.5 881.2 3,449.2 Effect of Ven. at 50 VEF/USD(b) Effect of Ven. at 50 VEF/USD(b) Effect of Ven. at 50 VEF/USD(b) 84.5 83.9 100.1 123.0 391.5 113.1 - - - 113.1 Non-GAAP and GAAP Non-GAAP and GAAP Non-GAAP and GAAP Non-GAAP and GAAP $ 910.3 929.0 942.1 997.2 3,778.6 $ 949.6 859.0 872.5 881.2 3,562.3 Operating profit (loss): Operating profit (loss): Operating profit (loss): Operating profit (loss): Adjusted non-GAAP Adjusted non-GAAP Adjusted non-GAAP Adjusted non-GAAP $ 22.0 35.6 48.0 52.8 158.4 $ 26.3 25.9 23.3 64.6 140.1 Effect of Ven. at 50 VEF/USD(b) Effect of Ven. at 50 VEF/USD(b) Effect of Ven. at 50 VEF/USD(b) 18.0 8.6 20.7 21.6 68.9 28.9 - - - 28.9 Non-GAAP Non-GAAP Non-GAAP Non-GAAP 40.0 44.2 68.7 74.4 227.3 55.2 25.9 23.3 64.6 169.0 Other items not allocated to segments(c) Other items not allocated to segments(c) Other items not allocated to segments(c) (24.8) (12.5) (11.8) (15.0) (64.1) (128.9) (17.2) 37.9 (88.3) (196.5) GAAP GAAP GAAP GAAP $ 15.2 31.7 56.9 59.4 163.2 $ (73.7) 8.7 61.2 (23.7) (27.5) Taxes: Taxes: Taxes: Taxes: Adjusted non-GAAP Adjusted non-GAAP Adjusted non-GAAP Adjusted non-GAAP $ 7.0 12.6 17.6 19.6 56.8 $ 8.6 8.7 7.2 25.4 49.9 Effect of Ven. at 50 VEF/USD(b) Effect of Ven. at 50 VEF/USD(b) Effect of Ven. at 50 VEF/USD(b) 4.8 0.6 3.8 3.7 12.7 10.4 (0.8) (0.6) (2.2) 6.8 Non-GAAP Non-GAAP Non-GAAP Non-GAAP 11.8 13.2 21.4 23.3 69.7 19.0 7.9 6.6 23.2 56.7 Other items not allocated to segments(c) Other items not allocated to segments(c) Other items not allocated to segments(c) (5.6) (5.5) (5.7) (3.6) (20.4) (10.2) (2.0) 20.7 (28.5) (20.0) Income tax rate adjustment(d) Income tax rate adjustment(d) Income tax rate adjustment(d) (1.7) 2.9 (1.4) 0.2 - (0.1) (1.8) (0.5) 2.4 - GAAP GAAP GAAP GAAP $ 4.5 10.6 14.3 19.9 49.3 $ 8.7 4.1 26.8 (2.9) 36.7 Noncontrolling interests: Noncontrolling interests: Noncontrolling interests: Noncontrolling interests: Adjusted non-GAAP Adjusted non-GAAP Adjusted non-GAAP Adjusted non-GAAP $ 2.3 2.6 3.5 1.8 10.2 $ 2.1 2.2 2.5 3.2 10.0 Effect of Ven. at 50 VEF/USD(b) Effect of Ven. at 50 VEF/USD(b) Effect of Ven. at 50 VEF/USD(b) 4.5 1.9 5.3 7.6 19.3 7.6 - - - 7.6 Non-GAAP Non-GAAP Non-GAAP Non-GAAP Non-GAAP 6.8 4.5 8.8 9.4 29.5 9.7 2.2 2.5 3.2 17.6 Other items not allocated to segments(c) Other items not allocated to segments(c) Other items not allocated to segments(c) (4.9) (0.1) (0.1) (0.1) (5.2) (40.2) (3.8) (1.9) (2.6) (48.5) Income tax rate adjustment(d) Income tax rate adjustment(d) Income tax rate adjustment(d) 1.8 (1.1) (0.5) (0.2) - 1.3 - (1.2) (0.1) . - GAAP GAAP GAAP GAAP $ 3.7 3.3 8.2 9.1 24.3 $ (29.2) (1.6) (0.6) 0.5 (30.9)

* Adjusted Non-GAAP and Non-GAAP Reconciled to GAAP 2013 2013 2013 2013 2013 2013 2013 2013 2013 2014 2014 2014 2014 2014 2014 2014 2014 2014 2014 (In millions, except for percentages and per share amounts) (In millions, except for percentages and per share amounts) (In millions, except for percentages and per share amounts) (In millions, except for percentages and per share amounts) 1Q 2Q 3Q 4Q Full Year 1Q 2Q 3Q 4Q Full Year Full Year Income from continuing operations attributable to Brink's: Income from continuing operations attributable to Brink's: Income from continuing operations attributable to Brink's: Income from continuing operations attributable to Brink's: Income from continuing operations attributable to Brink's: Income from continuing operations attributable to Brink's: Income from continuing operations attributable to Brink's: Income from continuing operations attributable to Brink's: Income from continuing operations attributable to Brink's: Adjusted non-GAAP Adjusted non-GAAP Adjusted non-GAAP Adjusted non-GAAP $ 7.3 14.9 20.8 25.3 68.3 $ 9.8 9.7 7.4 31.8 58.7 Effect of Ven. at 50 VEF/USD(b) Effect of Ven. at 50 VEF/USD(b) Effect of Ven. at 50 VEF/USD(b) 8.7 5.9 11.7 9.9 36.2 10.9 0.8 0.6 2.2 14.5 Non-GAAP Non-GAAP Non-GAAP Non-GAAP 16.0 20.8 32.5 35.2 104.5 20.7 10.5 8.0 34.0 73.2 Other items not allocated to segments(c) Other items not allocated to segments(c) Other items not allocated to segments(c) (14.3) (6.9) (6.0) (11.3) (38.5) (78.5) (11.4) 19.1 (57.2) (128.0) Income tax rate adjustment(d) Income tax rate adjustment(d) Income tax rate adjustment(d) (0.1) (1.8) 1.9 - - (1.2) 1.8 1.7 (2.3) - GAAP GAAP GAAP GAAP $ 1.6 12.1 28.4 23.9 66.0 $ (59.0) 0.9 28.8 (25.5) (54.8) EPS: EPS: EPS: EPS: Adjusted non-GAAP Adjusted non-GAAP Adjusted non-GAAP Adjusted non-GAAP $ 0.15 0.30 0.43 0.52 1.40 $ 0.20 0.20 0.15 0.65 1.20 Effect of Ven. at 50 VEF/USD(b) Effect of Ven. at 50 VEF/USD(b) Effect of Ven. at 50 VEF/USD(b) 0.18 0.12 0.24 0.20 0.74 0.22 0.02 0.01 0.04 0.30 Non-GAAP Non-GAAP Non-GAAP Non-GAAP 0.33 0.42 0.66 0.72 2.13 0.42 0.21 0.16 0.69 1.49 Other items not allocated to segments(c) Other items not allocated to segments(c) Other items not allocated to segments(c) (0.30) (0.14) (0.12) (0.23) (0.78) (1.61) (0.23) 0.38 (1.17) (2.61) Income tax rate adjustment(d) Income tax rate adjustment(d) Income tax rate adjustment(d) - (0.04) 0.04 - - (0.02) 0.04 0.03 (0.05) - GAAP GAAP GAAP GAAP $ 0.03 0.25 0.58 0.49 1.35 $ (1.21) 0.02 0.58 (0.52) (1.12) Adjusted non-GAAP margin Adjusted non-GAAP margin Adjusted non-GAAP margin Adjusted non-GAAP margin 2.7% 4.2% 5.7% 6.0% 4.7% 3.1% 3.0% 2.7% 7.3% 4.1% Amounts may not add due to rounding. See slide 29 for footnote explanations. (a) See reconciliation to GAAP results and other information in Appendix. Adjusted non-GAAP results adjusted for Venezuelan results at 50 bolivars per U.S. dollar

* Adjusted Non-GAAP and Non-GAAP Reconciled to GAAP Amounts may not add due to rounding. From continuing operations. Effective March 24, 2014, Brink’s began remeasuring its Venezuelan operating results using currency exchange rates reported under a newly established currency exchange process in Venezuela (the “SICAD II process”). The rate published for this process has averaged approximately 50 since opening. For non-GAAP operating profit, non-GAAP income from continuing operations and for non-GAAP EPS, we include an adjustment to reflect lower revenues and operating profit as a result of a hypothetical remeasurement of Brink’s Venezuela’s 2013 and first quarter 2014 revenue and operating results using a rate of 50 bolivars to the U.S. dollar, which approximates the rate observed in the SICAD II process in March 2014. See “Other Items Not Allocated To Segments” on slides 25-26 for pre-tax amounts and details. Other Items Not Allocated To Segments for noncontrolling interests, income from continuing operations attributable to Brink's and EPS are the effects of the same items at their respective line items of the consolidated statements of income (loss). Non-GAAP income from continuing operations and non-GAAP EPS have been adjusted to reflect an effective income tax rate in each interim period equal to the full-year non-GAAP effective income tax rate. The full-year non-GAAP effective tax rate was 38.5% for 2014 and 34.2% for 2013. 2013 2013 2013 2013 2013 2014 2014 2014 2014 2014 Pre-tax Tax Effective tax rate Pre-tax Tax Effective tax rate Effective Income Tax Rate(a) Effective Income Tax Rate(a) Effective Income Tax Rate(a) Adjusted Non-GAAP Adjusted Non-GAAP Adjusted Non-GAAP $ 135.3 56.8 42.0% $ 118.6 49.9 42.1% Effect of Ven. at 50 VEF/USD(b) Effect of Ven. at 50 VEF/USD(b) 68.4 12.9 (7.8%) 28.9 6.8 (3.6%) Non-GAAP Non-GAAP Non-GAAP 203.7 69.7 34.2% 147.5 56.7 38.5% Other items not allocated to segments(c) Other items not allocated to segments(c) (64.1) (20.4) 1.1% (196.5) (20.0) (113.4%) GAAP GAAP GAAP $ 139.6 49.3 35.3% $ (49.0) 36.7 (74.9%)

* 2014 Non-GAAP Results Reconciled to GAAP under Previous Segmentation Additional explanations provided on slides 25-26. Latin North Asia Total Segment Non-Segment Total Operating (In millions) America EMEA America Pacific Profit (Loss) Non-Segment Profit (Loss) Fourth Quarter 2014 Fourth Quarter 2014 GAAP GAAP $ 16.6 18.4 (15.2) 5.4 25.2 (48.9) (23.7) FX devaluation in Venezuela 4.8 - - - 4.8 - 4.8 2014 Reorganization and Restructuring 13.2 4.5 4.1 - 21.8 - 21.8 Mexican settlement losses 1.9 - - - 1.9 - 1.9 U.S. retirement plans - - 22.4 - 22.4 37.4 59.8 Non-GAAP Non-GAAP $ 36.5 22.9 11.3 5.4 76.1 (11.5) 64.6 Full Year 2014 Full Year 2014 GAAP GAAP $ (59.7) 72.1 (7.3) 19.2 24.3 (51.8) (27.5) FX devaluation in Venezuela 142.7 - - - 142.7 - 142.7 2014 Reorganization and Restructuring 13.2 4.5 4.1 - 21.8 - 21.8 Acquisitions and dispositions (4.5) - - - (4.5) (44.9) (49.4) Mexican settlement losses 5.9 - - - 5.9 - 5.9 U.S. retirement plans - - 25.2 - 25.2 47.9 73.1 Share-based compensation adj. 0.3 0.3 0.2 0.1 0.9 1.5 2.4 Non-GAAP Non-GAAP 97.9 76.9 22.2 19.3 216.3 (47.3) 169.0 Less effect of Venezuela at 50 VEF/USD (28.9) - - - (28.9) - (28.9) Adjusted Non-GAAP Adjusted Non-GAAP $ 69.0 76.9 22.2 19.3 187.4 (47.3) 140.1 Amounts may not add due to rounding.

* Additional explanations provided on slides 25-26. Amounts may not add due to rounding. Latin North Asia Total Segment Non-Segment Total Operating (In millions) America EMEA America Pacific Profit (Loss) Non-Segment Profit (Loss) Fourth Quarter 2013 Fourth Quarter 2013 GAAP GAAP $ 59.7 19.0 - 2.5 81.2 (21.8) 59.4 FX devaluation in Venezuela 0.3 - - - 0.3 - 0.3 Acquisitions and dispositions 0.5 - - 0.9 1.4 (0.8) 0.6 Mexican settlement losses 0.9 - - - 0.9 - 0.9 U.S. retirement plans - - 2.9 - 2.9 10.3 13.2 Non-GAAP Non-GAAP 61.4 19.0 2.9 3.4 86.7 (12.3) 74.4 Less effect of Venezuela at 50 VEF/USD (21.6) - - - (21.6) - (21.6) Adjusted Non-GAAP Adjusted Non-GAAP $ 39.8 19.0 2.9 3.4 65.1 (12.3) 52.8 Full Year 2013 Full Year 2013 GAAP GAAP $ 153.5 70.4 4.0 16.4 244.3 (81.1) 163.2 FX devaluation in Venezuela 14.6 - - - 14.6 - 14.6 Acquisitions and dispositions (3.9) - - 0.9 (3.0) (2.8) (5.8) Mexican settlement losses 2.4 - - - 2.4 - 2.4 U.S. retirement plans - - 11.6 - 11.6 41.3 52.9 Non-GAAP Non-GAAP 166.6 70.4 15.6 17.3 269.9 (42.6) 227.3 Less effect of Venezuela at 50 VEF/USD (68.9) - - - (68.9) - (68.9) Adjusted Non-GAAP Adjusted Non-GAAP $ 97.7 70.4 15.6 17.3 201.0 (42.6) 158.4 2013 Non-GAAP Results Reconciled to GAAP under Previous Segmentation

* Non-GAAP Reconciliations – Cash Flows To eliminate the change in the balance of customer obligations related to cash received and processed in certain of our secure cash logistics operations. The title to this cash transfers to us for a short period of time. The cash is generally credited to customers’ accounts the following day and we do not consider it as available for general corporate purposes in the management of our liquidity and capital resources. Both measures of “Non-GAAP cash flows from operating activities” (before and after U.S. pension contributions) are supplemental financial measures that are not required by, or presented in accordance with GAAP. The purpose of the Non-GAAP measures is to report financial information excluding the impact of cash received and processed in certain of our Cash Management Service operations without cash flows from discontinued operations and with and without cash flows related to primary U.S pension plan. We believe these measures are helpful in assessing cash flows from operations, enable period-to-period comparability and are useful in predicting future operating cash flows. These Non-GAAP measures should not be considered as an alternative to cash flows from operating activities determined in accordance with GAAP and should be read in conjunction with our consolidated statements of cash flows. NON-GAAP CASH FLOWS FROM OPERATING ACTIVITIES – RECONCILED TO U.S. GAAP NON-GAAP CASH FLOWS FROM OPERATING ACTIVITIES – RECONCILED TO U.S. GAAP NON-GAAP CASH FLOWS FROM OPERATING ACTIVITIES – RECONCILED TO U.S. GAAP NON-GAAP CASH FLOWS FROM OPERATING ACTIVITIES – RECONCILED TO U.S. GAAP NON-GAAP CASH FLOWS FROM OPERATING ACTIVITIES – RECONCILED TO U.S. GAAP NON-GAAP CASH FLOWS FROM OPERATING ACTIVITIES – RECONCILED TO U.S. GAAP NON-GAAP CASH FLOWS FROM OPERATING ACTIVITIES – RECONCILED TO U.S. GAAP (In millions) 2014 2013 Cash flows from operating activities – GAAP Cash flows from operating activities – GAAP $ 141.3 $ 201.5 Decrease (increase) in certain customer obligations(a) Decrease (increase) in certain customer obligations(a) (15.4) 9.7 Cash outflows (inflows) related to discontinued operations Cash outflows (inflows) related to discontinued operations (5.5) (17.0) Cash flows from operating activities – Non-GAAP (reduced by pension contributions) 120.4 194.2 Contributions to primary U.S. pension plan Contributions to primary U.S. pension plan 87.2 13.0 Cash flows from operating activities – Non-GAAP (before pension contributions) $ 207.6 $ 207.2 ($ millions)

New Reporting Format Increases Transparency * ($ millions) Adjusted Revenue Adjusted Operating Profit(a) North America $ 908 $ 22 Latin America 1,328 69 EMEA 1,074 77 Asia 139 19 3,449 187 Non-Segment -- (47) Total $3,449 $140 Segment Margin(a) 5.4% Operating Profit Margin(a) Operating Profit Margin(a) 4.1% 2014 Old Reporting Format Adjusted Revenue Adjusted Operating Profit(a) United States $ 728 $ 23 France 517 39 Mexico 388 10 Brazil 364 34 Canada 180 13 Largest 5 Markets 2,177 119 Latin America 479 62 EMEA 556 53 Asia 140 23 Global Markets 1,175 137 Payment Services 97 (5) Corporate Items -- (111) Total $3,449 $ 140 Operating Profit Margin(a) Operating Profit Margin(a) 4.1% 2014 New Reporting Format (a) See reconciliation to GAAP results in this Appendix. Adjusted non-GAAP results adjusted for Venezuelan results at 50 bolivars per U.S. dollar

2014 Revenue % of Total Organic Growth vs. 2013 2014 Operating Profit(a) Margin %(a) United States $ 728 21 % - United States $ 23 3.1 % France 517 15 - France 39 7.6 Mexico 388 11 Mexico 10 2.5 Brazil 364 11 Brazil 34 9.4 Canada 180 5 - Canada 13 7.1 Latin America 479 14 Latin America 62 12.9 EMEA 556 16 EMEA 53 9.4 Asia 140 4 Asia 23 16.5 Payment Services 97 3 Payment Services (5) (5.1) Corporate Items Corporate Items (111) Total $ 3,449 100 % Total $ 140 4.1 % Fixing U.S. & Mexico To Drive Profit Growth * ($ millions) (a) See reconciliation to GAAP results in this Appendix

2015 Outlook and 2014 Adjusted Non-GAAP Results(a)(b) * Unfavorable currency in Europe, Brazil, Colombia, Argentina, and Mexico Operating margin improvement driven by global cost actions and Mexico, Brazil, Argentina & U.S. EPS Outlook $1.20 $(0.35) $0.74-$0.94 $(0.04) 2014 Currency Op Profit Growth Interest & Non-controlling Interest & Tax 2015 Outlook $1.55-$1.75 2015 Outlook 2014 2015 Outlook Revenue $3,449 $3,400 Op Profit 140 173 - 190 Interest/Other Income (22) (21) Taxes (50) (64 - 71) Noncontrolling interests (10) (11) Income from continuing ops (b) 59 77 - 87 EPS Range $1.20 $1.55 – 1.75 Key Metrics Revenue Change Organic $200 6% Currency (250) (7) Total $(50) (1)% Op Profit Margin 4.1% 5.1% - 5.6% Tax Rate 42% 42% ($ millions, except EPS) Operating Profit Outlook $(30) $63 - $80 _ $173 - $190 $140 (b) Attributable to Brink’s (a) See reconciliation to GAAP results in this Appendix. Adjusted non GAAP results adjusted for Venezuelan results at 50 bolivars per U.S. dollar.

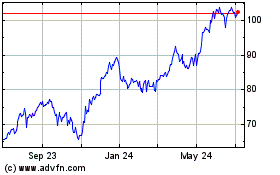

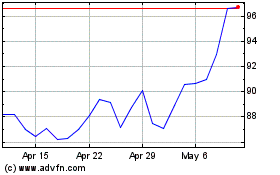

Brinks (NYSE:BCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Brinks (NYSE:BCO)

Historical Stock Chart

From Apr 2023 to Apr 2024