UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 9, 2015

ARMSTRONG WORLD INDUSTRIES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Pennsylvania |

|

1-2116 |

|

23-0366390 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| P.O. Box 3001, Lancaster, Pennsylvania |

|

17604 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (717) 397-0611

NA

(Former name or former address if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 5 – Corporate Governance and Management

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain

Officers.

(e) Adoption of Executive Retention and Severance Agreements; Amendment to Severance Provisions in CEO Employment Agreement.

On March 9, 2015, Armstrong World Industries, Inc. (the “Company”) entered into retention letter agreements (the “Retention

Agreements”) with Matthew J. Espe, the Company’s President and Chief Executive Officer, David S. Schulz, the Company’s Senior Vice President, Chief Financial Officer, and Mark A. Hershey, the Company’s Senior Vice President,

General Counsel and Chief Compliance Officer, and also entered into new severance agreements (the “Severance Agreements”) with Messrs. Schulz and Hershey and Victor D. Grizzle, Executive Vice President and Chief Executive Officer of the

Company’s Armstrong Building Products business. The Company also entered into an amendment (the “Employment Agreement Amendment”) to Mr. Espe’s employment agreement with the Company dated June 24, 2010, and amended on

December 31, 2012. The material terms of the Retention Agreements, Severance Agreements and Employment Agreement Amendment are described below.

Retention

Subject to the conditions set forth in the

Retention Agreement, each executive will be eligible to receive a cash retention award in an amount equal to one and one-half (1.5) times the executive’s base salary (two (2) times in the case of Messrs. Espe and Schulz) if his

employment with the Company continues through the closing of a spin-off, sale or similar transaction with respect to the flooring business of the Company prior to June 30, 2016 (unless such date is extended by the Board of Directors of the

Company). In the event that an executive’s employment is terminated by the Company without Cause or by the executive for Good Reason, or due to the executive’s death or Disability (as such terms are defined in the Retention Agreement),

prior to the closing of the transaction, the retention award will be paid within fifteen (15) business days of the date of termination. By executing the Retention Agreement, each executive acknowledged that the transaction does not constitute a

“change in control” for purposes of the executive’s existing Change in Control Agreement with the Company.

Severance

Pursuant to the Severance Agreements, each executive will be entitled to receive certain cash severance benefits if the executive’s employment is

terminated by the Company without Cause or by the executive for Good Reason (as such terms are defined in the Severance Agreement). The severance is equal to (i) one and one-half (1.5) times the executive’s then-current annual base

salary plus his target annual incentive under the Company’s MAP program (such target, the “MAP Component”), payable in lump sum, and (ii) a pro-rated annual incentive bonus based on actual performance for the year of termination,

payable at the time that bonuses are paid to employees of the Company generally. As a condition to receiving severance benefits, each executive must sign a release of claims.

2

The Employment Agreement Amendment provides Mr. Espe with comparable severance benefits by adding the MAP

Component to his existing severance formula of two (2) times base salary.

Pursuant to the Severance Agreements and, in the case of Mr. Espe,

the Employment Agreement Amendment, the executive acknowledges and agrees that (i) notwithstanding any provision of any equity incentive plan or award agreement to the contrary, a termination of employment under the Severance Agreement will not

result in accelerated vesting of the executive’s outstanding equity awards, and (ii) in the event that an executive’s employment is terminated prior to a Change in Control (as defined in the executive’s existing Change in Control

Agreement with the Company (the “Change in Control Agreement”)), the Change in Control Agreement will terminate as of the executive’s termination date. The Severance Agreement and, in the case of Mr. Espe, the Employment

Agreement Amendment, further provides that the restrictive covenants set forth in such executive’s Change in Control Agreement will survive his termination of employment and are incorporated by reference into the executive’s Severance

Agreement or Employment Agreement Amendment as the case may be.

The above description of the Retention Agreements, the Severance Agreements and

Employment Agreement Amendment does not purport to be complete and is qualified in its entirety by reference to the full text of the Employment Agreement Amendment and the forms of Retention Agreement and Severance Agreement, which are filed as

Exhibits 10.1 – 10.3 hereto and are incorporated herein by reference.

Section 9 – Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits.

|

|

|

Exhibit

No. |

|

Description |

|

|

| 10.1 |

|

Amendment to Employment Agreement between Matthew J. Espe and Armstrong World Industries, Inc., dated March 9, 2015 |

|

|

| 10.2 |

|

Form of Retention Agreement |

|

|

| 10.3 |

|

Form of Severance Agreement |

3

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

| ARMSTRONG WORLD INDUSTRIES, INC. |

|

|

| By: |

|

/s/ Mark A. Hershey |

|

|

Mark A. Hershey |

|

|

Senior Vice President, General Counsel and Chief Compliance Officer |

4

Exhibit 10.1

AMENDMENT

TO

EMPLOYMENT AGREEMENT

THIS

AMENDMENT TO EMPLOYMENT AGREEMENT (this “Amendment”), dated as of March 9, 2015, is made by and between ARMSTRONG WORLD INDUSTRIES, INC., a Pennsylvania corporation (the “Company”), and Matthew Espe (“Executive”).

Capitalized terms used herein without definition shall have the meanings ascribed thereto in the Employment Agreement (defined below).

BACKGROUND RECITALS

A. The

Company and Executive are party to that certain Employment Agreement dated as of June 24, 2010 (as amended, the “Employment Agreement”);

B. The Company and Executive desire to amend the Employment Agreement in accordance with the provisions set forth in Section 15(g)

thereof regarding the modification of any provision of such agreement.

NOW, THEREFORE, in consideration of the premises set forth above,

and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereby agree to the following terms.

| |

1. |

Section 8(d)(iii) of the Employment Agreement is amended and restated in its entirety to read as follows: “in lieu of any further Base Salary or other compensation or benefits not described in clauses (i),

(ii), (iv), or (v) for periods subsequent to the termination date, an amount in cash, which amount shall be payable in a lump sum payment within sixty (60) days following such termination, equal to two (2) times the sum of

(a) Executive’s Base Salary as in effect immediately prior to the termination date or, if higher, in effect immediately prior to the first occurrence of an event or circumstance constituting Good Reason, and (b) Executive’s

Target Bonus in respect of the fiscal year in which occurs the termination date or, if higher, the Target Bonus in effect immediately prior to the first occurrence of an event or circumstance constituting Good Reason; and” |

| |

2. |

A new Section 8(g) shall be added to the end of Section 8 of the Employment Agreement, which shall read as follows: “(g) Notwithstanding any provision of any equity incentive plan or award agreement to

the contrary, a termination of employment under Section 8(d) shall not result in accelerated vesting of Executive’s outstanding equity awards.” |

| |

3. |

Section 15(n) of the Employment Agreement is amended and restated in its entirety to read as follows: “This Agreement supersedes any other

agreements or representations, oral or otherwise, express or implied, with respect to the subject |

| |

matter hereof which have been made by either party; provided, however, that this Agreement shall supersede any agreement setting forth the terms and conditions of Executive’s employment with

the Company only in the event that Executive’s employment with the Company is terminated by the Company other than for Cause or by Executive for Good Reason. In the event that Executive’s employment is terminated hereunder during the

Employment Term and prior to a Change in Control (as defined in the Executive’s Change in Control Agreement dated as of June 24, 2010 (the “Change in Control Agreement”)), Executive acknowledges and agrees that the Change

in Control Agreement will terminate as of Executive’s termination date. Notwithstanding the preceding sentence, Executive acknowledges and agrees that the restrictive covenants set forth in Section 5 of the Change in Control Agreement

shall survive such termination and are incorporated in full herein.” |

Except to the extent modified by this Amendment, the Employment

Agreement shall remain unchanged and in full force and effect.

This Amendment may be executed in any number of counterparts and by different parties

hereto in separate counterparts, each of which when so executed and delivered shall be deemed to be an original and all of which when taken together shall constitute but one and the same instrument. Delivery of an executed counterpart of a signature

page to this Amendment by facsimile or other electronic means shall be effective as delivery of a manually executed counterpart of this Amendment.

The

validity, interpretation, construction and performance of this Amendment shall be governed by the laws of the Commonwealth of Pennsylvania.

[Remainder of Page Intentionally Left Blank]

2

IN WITNESS WHEREOF, the Company and Executive have executed this Amendment as of the date first

written above.

|

|

|

| ARMSTRONG WORLD INDUSTRIES, INC. |

|

|

| By: |

|

/s/ Mark A. Hershey |

| Name: |

|

Mark A. Hershey |

| Title: |

|

Senior Vice President, General Counsel and Chief Compliance Officer |

|

| MATTHEW ESPE |

|

| /s/ Matthew Espe |

3

Exhibit 10.2

Execution Version

[DATE], 2015

Private & Confidential

[NAME]

[ADDRESS]

| |

Re: |

Retention Award Agreement |

Dear [First Name of Recipient]:

Your services and loyalty to Armstrong World Industries, Inc. (“us” or “we” or the

“Company”) are very important to us. We are therefore pleased to inform you that, pursuant to the terms of this letter (the “Award Agreement”), you are eligible to receive a retention award in the form of a cash

payment pursuant to the terms herein (the “Retention Award”). This Retention Award is intended to incentivize you to continue to use your best efforts to ensure optimal corporate performance through the closing of a Transaction (as

defined in your severance agreement entered into with the Company) (the “Severance Agreement”) and to contribute towards the successful completion of the Transaction. Capitalised terms that are used but not defined herein will have

the meaning ascribed to such terms in the Severance Agreement.

1. Retention Award. You will be eligible to receive the Retention

Award equal to $[ ] in the aggregate (less applicable tax withholdings) if you continue to be employed with the Company on the closing date of the Transaction. To the extent earned, the Retention Award

will be payable in a lump sum no later than fifteen (15) business days following the closing date of the Transaction.

2.

Termination of Employment. Notwithstanding paragraph 1 of this Award Agreement, if your employment is terminated prior to the closing of the Transaction (i) by the Company without Cause, (ii) by you for Good Reason, (iii) due

to your Disability or (iv) due to your death, you, or your estate as the case may be, will be entitled to receive the Retention Award (less applicable tax withholdings), payable in a lump sum no later than fifteen (15) business days

following the date of termination.

3. Circumstances under which the Retention Award will not be Paid. If your employment with the

Company terminates for any reason other than as described in paragraph 2 above at any time prior to the closing date of the Transaction, you will not receive the Retention Award. In addition, this Award Agreement will terminate and be of no further

force and effect, and no Retention Award will be payable hereunder, if the closing of the Transaction does not occur before June 30, 2016 (the “Expiration Date”). The Expiration Date may be extended by the Board of Directors of

the Company as it deems appropriate to reflect changes in the timing or progress of the Transaction.

4. Acknowledgement. By

executing this Award Agreement, you hereby acknowledge that the Transaction does not constitute a “change in control” for purposes of the Change in Control Agreement.

5. No Right of Employment. Neither this Award Agreement nor the Severance Agreement, nor any modification thereof, nor the creation of

any fund, trust or account, nor

the payment of any benefits shall be construed as giving you, or any person whomsoever, the right to be retained in the service of the Company or its subsidiaries. Except to the extent provided

under an employment contract with the Company, your employment with the Company is “at-will,” meaning that either you or the Company may terminate your employment at any time and for any reason.

6. Counterparts. This Reward Agreement may be signed in counterparts, each of which will be deemed to be an original but all of which

together will constitute one and the same instrument.

We are pleased to be able to provide you with this incentive and look forward to

your active participation during this important time for the Company. If you accept the terms and conditions of this Award Agreement, please sign one of the two enclosed copies and return it to the undersigned.

|

|

|

| Yours sincerely, |

|

| |

| Name: |

|

| Title: |

|

|

|

|

|

|

|

|

|

| ACKNOWLEDGED AND AGREED: |

|

|

|

|

|

| Signature: |

|

|

|

|

|

Date: |

|

|

2

Exhibit 10.3

Execution Version

SEVERANCE AGREEMENT

THIS

AGREEMENT, dated , 2015, is made by and between Armstrong World Industries, Inc., a Pennsylvania corporation (the “Company”), and (the

“Executive”).

WHEREAS, the Company considers it essential to the best interests of its stockholders to foster the continued

employment of key management personnel; and

WHEREAS, the Board has determined that appropriate steps should be taken to reinforce and

encourage the continued attention and dedication of members of the Company’s management, including the Executive, to their assigned duties;

NOW, THEREFORE, in consideration of the premises and the mutual covenants herein contained, the Company and the Executive hereby agree as

follows:

1. Defined Terms. The definitions of capitalized terms used in this Agreement are provided in the last Section hereof.

2. Term of Agreement. The Term of this Agreement shall commence on the date hereof and shall continue in effect through

December 31, 2016; provided, however, that commencing on January 1, 2017 and each January 1 thereafter, the Term shall automatically be extended for one additional year unless, not later than September 30 of the

preceding year, the Company or the Executive shall have given notice not to extend the Term.

3. Company’s Covenants

Summarized. In order to induce the Executive to remain in the employ of the Company, the Company agrees, under the conditions described herein, to pay the Executive the Severance Payments and the other payments and benefits described herein. No

Severance Payments shall be payable under this Agreement unless there shall have been a termination of the Executive’s employment with the Company during the Term; provided, however, that the Executive shall not receive Severance

Payments pursuant to this Agreement if the Executive is entitled to any payments or benefits under the Executive’s Change in Control Severance Agreement entered into with the Company on [DATE] (the “Change in Control Agreement”). This

Agreement shall not be construed as creating an express or implied contract of employment and, except as otherwise agreed in writing between the Executive and the Company, the Executive shall not have any right to be retained in the employ of the

Company.

4. Compensation Other Than Severance Payments.

4.1 If the Executive’s employment shall be terminated for any reason during the Term, the Company shall pay the Executive’s full

salary to the Executive

through the Date of Termination at the rate in effect immediately prior to the Date of Termination or, if higher, the rate in effect immediately prior to the first occurrence of an event or

circumstance constituting Good Reason, together with all compensation and benefits accrued and payable to the Executive through the Date of Termination under the terms of the Company’s compensation and benefit plans, programs or arrangements as

in effect immediately prior to the Date of Termination or, if more favorable to the Executive, as in effect immediately prior to the first occurrence of an event or circumstance constituting Good Reason.

4.2 If the Executive’s employment shall be terminated for any reason during the Term, the Company shall pay to the Executive the

Executive’s normal, accrued post-termination compensation and benefits as such payments become due. Such post-termination compensation and benefits shall be

determined under, and paid in accordance with, the Company’s retirement, insurance and other compensation or benefit plans, programs and arrangements as in effect immediately prior to the Date of Termination or, if more favorable to the

Executive, as in effect immediately prior to the occurrence of the first event or circumstance constituting Good Reason.

5. Severance

Entitlements.

5.1 Subject to Sections 5.2 and 5.3 hereof, if (i) the Executive’s employment is terminated during the Term,

other than (A) by the Company for Cause, (B) by reason of death or Disability, or (C) by the Executive without Good Reason, then the Company shall pay the Executive the amounts, and provide the Executive the benefits, described in

this Section 5.1 (“Severance Payments”), in addition to any payments and benefits to which the Executive is entitled under Section 4 hereof; provided, however, that, in the case of clauses (A) and

(B) below, Executive shall have executed a release of claims substantially in the form attached as Exhibit A hereto and such release shall become effective within sixty (60) days following the Date of Termination.

(A) In lieu of any further salary payments to the Executive for periods subsequent to the Date of Termination and in lieu of

any severance benefit otherwise payable to the Executive, the Company shall pay to the Executive a lump sum severance payment, in cash, equal to one and a half (1.5) times the sum of (i) the Executive’s base salary as in effect

immediately prior to the Date of Termination or, if higher, in effect immediately prior to the first occurrence of an event or circumstance constituting Good Reason, and (ii) the Executive’s target annual bonus under the Management

Achievement Plan (the “MAP”) or any other annual incentive compensation plan adopted by the Company in which the Executive participates in respect of the fiscal year in which occurs the Date of Termination or, if higher, such target

annual bonus in effect immediately prior to the first occurrence of an event or circumstance constituting Good Reason.

2

(B) Notwithstanding any provision of any annual incentive plan to the contrary,

the Company shall pay to the Executive a pro rata portion to the Date of Termination of the bonus amount the Executive would have earned with respect to the year in which the Date of Termination occurs, calculated by multiplying the award that the

Executive would have earned for such year, based upon the actual level of achievement of the performance goals established with respect to such award, by the fraction obtained by dividing the number of full months and any fractional portion of a

month during such year through the Date of Termination by twelve (12). Such prorated bonus, if any, shall be payable at such time that annual incentives are paid to employees of the Company who have not experienced a termination of employment.

(C) The Company shall pay the Executive, no later than thirty (30) days following the Date of Termination, at a daily

salary rate based upon the Executive’s annual base salary in effect immediately prior to the Date of Termination (or immediately prior to any reduction resulting in a termination for Good Reason, if applicable), a lump sum amount equal to all

earned but unused vacation days through the Date of Termination.

5.2 (A) Anything in this Agreement to the contrary notwithstanding, in

the event it shall be determined that any payment (including any acceleration of vesting of stock based benefits) or distribution by the Company to or for the benefit of the Executive (whether paid or payable or distributed or distributable pursuant

to the terms of this Agreement or otherwise) (a “Payment”) would be subject to the excise tax imposed by Section 4999 of the Code (the “Excise Tax”), the amounts and benefits payable under this Agreement shall be reduced by

an amount that would result in no Excise Tax being imposed; provided that the amounts and benefits payable under this Agreement shall not be reduced unless the amounts and benefits the Executive would receive after such reduction would be greater

than the amounts and benefits the Executive would receive if there were no reduction and the Excise Tax were paid by the Executive (such reduction, the “Cut Back”). For purposes of determining whether any Payments should be subject to the

Cut-Back, (i) the Executive shall be deemed to pay federal income tax at the highest marginal rate of federal income taxation in the calendar year in which the Date of Termination occurs and state and local income taxes at the highest marginal

rate of taxation in the state and locality of the Executive’s residence on the Date of Termination, net of the maximum reduction in federal income taxes which could be obtained from deduction of such state and local taxes, (ii) no portion

of the Payments the receipt or enjoyment of which the Executive shall have waived at such time and in such manner as not to constitute a “payment” within the meaning of section 280G(b) of the Code shall be taken into account, (iii) no

portion of the Payments shall be taken into account which, in the opinion of the Accounting Firm, does not constitute a “parachute payment” within the meaning of section 280G(b)(2) of the Code, including by reason of section 280G(b)(4)(A)

of the Code, (iv) the Severance Payments shall be reduced only to the extent necessary so that the Payments in their entirety constitute reasonable compensation for services actually rendered within the meaning of section 280G(b)(4)(B) of the

Code or are otherwise not subject to disallowance as deductions by reason of

3

section 280G of the Code, in the opinion of the Accounting Firm, and (v) the value of any noncash benefit or any deferred payment or benefit included in the Payments shall be determined by

the Accounting Firm in accordance with the principles of sections 280G(d)(3) and (4) of the Code. Unless the Executive shall have given prior written notice to the Company specifying a different order of payments and benefits to be reduced to

achieve the Cut-Back, any payments and benefits to be reduced hereunder shall be determined in a manner that has the least economic cost to the Executive, on an after-tax basis, and to the extent the economic cost is equivalent, such payments and

benefits shall be reduced in the inverse order of when the payments and benefits would have been made or provided to the Executive until the reduction specified herein is achieved. The Executive may specify the order of reduction of the payments and

benefits only to the extent that doing so does not directly or indirectly alter the time or method of payment of any amount that is deferred compensation subject to (and not exempt from) Section 409A of the Code.

(B) All determinations required to be made under this Section 5.2 shall be made by a nationally recognized accounting firm designated by

the Company (the “Accounting Firm”) which shall provide detailed supporting calculations both to the Company and the Executive within fifteen (15) business days after there has been a Cut-Back, or such earlier time as requested by the

Company. In the event that the Accounting Firm is serving as accountant or auditor for the individual, entity or group effecting the Change in Control, the Company shall appoint another nationally recognized accounting firm to make the

determinations required hereunder (which accounting firm instead shall be the Accounting Firm hereunder). All fees and expenses of the Accounting Firm shall be borne solely by the Company. Any determination by the Accounting Firm shall be binding

upon the Company and the Executive.

5.3 Subject to the provisions of Section 16 hereof, the payments provided for in subsection

(A) of Section 5.1 hereof shall be made on the sixtieth (60th) day following the Date of Termination.

5.4 Notwithstanding

any provision of any equity incentive plan or award agreement to the contrary, a termination of employment under Section 5.1 shall not result in accelerated vesting of the Executive’s outstanding equity awards.

6. Termination Procedures.

6.1 Notice of Termination. During the Term, any purported termination of the Executive’s employment (other than by reason of

death) shall be communicated by written Notice of Termination from one party hereto to the other party hereto in accordance with Section 10 hereof. For purposes of this Agreement, a “Notice of Termination” shall mean a notice which

shall indicate the specific termination provision in this Agreement relied upon and shall set forth in reasonable detail the facts and circumstances claimed to provide a basis for termination of the Executive’s employment under the provision so

indicated.

4

6.2 Date of Termination. “Date of Termination,” with respect to any purported

termination of the Executive’s employment during the Term, shall mean (i) if the Executive’s employment is terminated for Disability, thirty (30) days after Notice of Termination is given (provided that the Executive shall not

have returned to the full-time performance of the Executive’s duties during such thirty (30) day period), and (ii) if the Executive’s employment is terminated for any other reason, the date

specified in the Notice of Termination (which, in the case of a termination by the Executive, shall not be less than fifteen (15) days nor more than sixty (60) days, respectively, from the date such Notice of Termination is given).

7. Requirement of Release. Notwithstanding anything in this Agreement to the contrary, the Executive’s entitlement to any payments

other than the Executive’s accrued but unpaid base compensation and any accrued but unpaid or otherwise vested benefits under any benefit or incentive plan determined at the time of the Executive’s termination of employment shall be

contingent upon the Executive having executed a release substantially in the form attached as Exhibit A hereto and such release becoming effective within sixty (60) days after the Date of Termination. If such release does not become effective

within the time period prescribed above, the Company’s obligations under Section 5.1 (other than Section 5.1(C)) shall cease immediately.

8. No Mitigation. The Company agrees that the Executive is not required to seek other employment or to attempt in any way to reduce any

amounts payable to the Executive by the Company pursuant to Section 5 hereof. Further, no payment or benefit provided for in this Agreement shall be reduced by any compensation earned by the Executive as the result of employment by another

employer, by retirement benefits, by offset against any amount claimed to be owed by the Executive to the Company, or otherwise.

9.

Successors; Binding Agreement.

9.1 In addition to any obligations imposed by law upon any successor to the Company, the Company

will require any successor (whether direct or indirect, by purchase, merger, consolidation or otherwise) to all or substantially all of the business and/or assets of the Company to expressly assume and agree to perform this Agreement in the same

manner and to the same extent that the Company would be required to perform it if no such succession had taken place.

9.2 This Agreement

shall inure to the benefit of and be enforceable by the Executive’s personal or legal representatives, executors, administrators, successors, heirs, distributees, devisees and legatees. If the Executive shall die while any amount would still be

payable to the Executive hereunder (other than amounts which, by their terms, terminate upon the death of the Executive) if the Executive had continued to live, all such amounts, unless otherwise provided herein, shall be paid in accordance with the

terms of this Agreement to the executors, personal representatives or administrators of the Executive’s estate.

5

10. Notices. For the purpose of this Agreement, notices and all other communications

provided for in the Agreement shall be in writing and shall be deemed to have been duly given when delivered or mailed by United States registered mail, return receipt requested, postage prepaid, addressed, if to the Executive, to the most recent

address shown in the personnel records of the Company and, if to the Company, to the address set forth below, or to such other address as either party may have furnished to the other in writing in accordance herewith, except that notice of change of

address shall be effective only upon actual receipt:

|

|

|

|

|

| To the Company: |

|

Armstrong World Industries, Inc. |

|

|

P.O. Box 3001 |

|

|

Lancaster, Pennsylvania 17604 |

|

|

Attention: |

|

General Counsel |

11. Entire Agreement Clause. This Agreement supersedes any other agreements or representations, oral or

otherwise, express or implied, with respect to the subject matter hereof which have been made by either party; provided, however, that this Agreement shall supersede any agreement setting forth the terms and conditions of the

Executive’s employment with the Company only in the event that the Executive’s employment with the Company is terminated by the Company other than for Cause or by the Executive for Good Reason. In the event that the Executive’s

employment is terminated hereunder during the Term and prior to a Change in Control (as defined in the Change in Control Agreement), the Executive acknowledges and agrees that the Change in Control Agreement will terminate as of the Date of

Termination. Notwithstanding the preceding sentence, the executive acknowledges and agrees that the restrictive covenants set forth in Section [5] of the Change in Control Agreement shall survive such termination and are incorporated in full herein.

12. Miscellaneous. No provision of this Agreement may be modified, waived or discharged unless such waiver, modification or

discharge is agreed to in writing and signed by the Executive and such officer as may be specifically designated by the Board. No waiver by either party hereto at any time of any breach by the other party hereto of, or of any lack of compliance

with, any condition or provision of this Agreement to be performed by such other party shall be deemed a waiver of similar or dissimilar provisions or conditions at the same or at any prior or subsequent time. The validity, interpretation,

construction and performance of this Agreement shall be governed by the laws of the Commonwealth of Pennsylvania. All references to sections of the Exchange Act or the Code shall be deemed also to refer to any successor provisions to such sections.

Any payments provided for hereunder shall be paid net of any applicable withholding required under federal, state or local law and any additional withholding to which the Executive has agreed. The obligations of the Company and the Executive under

this Agreement which by their nature may require either partial or total performance after the expiration of the Term (including, without limitation, those under Sections 5 hereof) shall survive such expiration.

6

13. Validity. The invalidity or unenforceability of any provision of this Agreement shall

not affect the validity or enforceability of any other provision of this Agreement, which shall remain in full force and effect.

14.

Counterparts. This Agreement may be executed in several counterparts, each of which shall be deemed to be an original but all of which together will constitute one and the same instrument.

15. Settlement of Disputes; Arbitration.

15.1 All claims by the Executive for benefits under this Agreement shall be directed to and determined by the Board and shall be in writing.

Any denial by the Board of a claim for benefits under this Agreement shall be delivered to the Executive in writing and shall set forth the specific reasons for the denial and the specific provisions of this Agreement relied upon. The Board shall

afford a reasonable opportunity to the Executive for a review of the decision denying a claim and shall further allow the Executive to appeal to the Board a decision of the Board within sixty (60) days after notification by the Board that the

Executive’s claim has been denied. Notwithstanding the above, in the event of any dispute, any decision by the Board hereunder shall be subject to a de novo review by the arbitrator.

15.2 Any further dispute or controversy arising under or in connection with this Agreement shall be settled exclusively by arbitration in

Lancaster County, Pennsylvania in accordance with the rules of the American Arbitration Association then in effect; provided, however, that the evidentiary standards set forth in this Agreement shall apply. Judgment may be entered on

the arbitrator’s award in any court having jurisdiction.

16. Section 409A. The intent of the parties is that payments

and benefits under this Agreement comply with section 409A of the Code to the extent subject thereto or be exempt therefrom, and, accordingly, to the maximum extent permitted, this Agreement shall be interpreted and administered to be in compliance

therewith. Notwithstanding anything contained herein to the contrary, to the extent required to avoid the application of an accelerated or additional tax under section 409A of the Code, the Executive shall not be considered to have terminated

employment with the Company for purposes of this Agreement until such time as the Executive is considered to have incurred a “separation from service” from the Company within the meaning of section 409A of the Code. Each amount to be paid

or benefit to be provided under this Agreement shall be construed as a separately identified payment for purposes of section 409A of the Code, and any payments that are due within the “short term deferral period” as defined in section 409A

of the Code shall not be treated as deferred compensation unless applicable law requires otherwise. To the extent required to avoid the application of an accelerated or additional tax under section 409A of the Code, amounts that would otherwise be

payable and benefits that would otherwise be provided pursuant to this Agreement during the six-month period immediately following the Executive’s termination of employment shall instead be paid on the first business day after the date

7

that is six months following the Executive’s termination of employment (or upon the Executive’s death, if earlier). The Company is entitled to determine whether any amounts under this

Agreement are to be suspended or delayed pursuant to the foregoing sentence, and the Company shall have no liability to the Executive for any such determination or any errors made by the Company in identifying the Executive as a specified employee.

Any amounts so suspended shall earn interest thereon, if applicable, calculated based upon the then prevailing monthly short-term applicable federal rate. Notwithstanding the foregoing, to the extent that the foregoing applies to the provision of

any ongoing welfare benefits to the Executive that would not be required to be delayed if the premiums therefor were paid by the Executive, the Executive shall pay the full cost of premiums for such welfare benefits during the six-month period and

the Company shall pay the Executive an amount equal to the amount of such premiums paid by the Executive during such six-month period on the first business day of the month following the expiration of the six-month period referred to above. To the

extent required to avoid an accelerated or additional tax under section 409A of the Code, amounts reimbursable to Executive under this Agreement shall be paid to Executive on or before the last day of the year following the year in which the expense

was incurred and the amount of expenses eligible for reimbursement (and in-kind benefits provided to Executive) during any one year may not effect amounts reimbursable or provided in any subsequent year.

17. Definitions. For purposes of this Agreement, the following terms shall have the meanings indicated below:

(A) “Accounting Firm” shall have the meaning set forth in Section 5.2 hereof.

(B) “Board” shall mean the Board of Directors of the Company.

(C) “Cause” for termination by the Company of the Executive’s employment shall mean (i) the deliberate and continued

failure by the Executive to devote substantially all the Executive’s business time and best efforts to the performance of the Executive’s duties (other than any such failure resulting from the Executive’s incapacity due to physical or

mental illness or any such actual or anticipated failure after the issuance of a Notice of Termination for Good Reason by the Executive pursuant to Section 6.1 hereof) after a written demand for substantial performance is delivered to the

Executive by the Board which demand specifically identifies the manner in which the Board believes the Executive has not substantially performed such duties; (ii) the deliberate engaging by the Executive in gross misconduct which is

demonstrably and materially injurious to the Company, monetarily or otherwise; or (iii) the Executive’s conviction of, or plea of guilty or nolo contendere to, a felony or any criminal charge involving moral turpitude. For the

purposes of this Agreement, no act, or failure to act, on the part of the Executive shall be considered “deliberate” unless done, or omitted to be done, by the Executive not in good faith and without reasonable belief that such action or

omission was in the best interests of the Company.

8

(D) A “Change in Control” shall have the meaning set forth in the Executive’s

Change in Control Agreement.

(E) “Code” shall mean the Internal Revenue Code of 1986, as amended from time to time.

(F) “Company” shall mean Armstrong World Industries, Inc. and shall include any successor to its business and/or assets which

assumes and agrees to perform this Agreement by operation of law, or otherwise.

(G) “Cut Back” shall have the meaning set forth

in Section 5.2 hereof.

(H) “Date of Termination” shall have the meaning set forth in Section 6.2 hereof.

(I) “Disability” shall be deemed the reason for the termination by the Company of the Executive’s employment, if, as a result

of the Executive’s incapacity due to physical or mental illness, the Executive shall have been absent from the full-time performance of the Executive’s duties with the Company for a period of six

(6) consecutive months, the Company shall have given the Executive a Notice of Termination for Disability, and, within thirty (30) days after such Notice of Termination is given, the Executive shall not have returned to the full-time performance of the Executive’s duties.

(J) “Exchange Act” shall mean the

Securities Exchange Act of 1934, as amended from time to time.

(K) “Excise Tax” shall have the meaning set forth in

Section 5.2 hereof.

(L) “Executive” shall mean the individual named in the first paragraph of this Agreement.

(M) “Good Reason” for termination by the Executive of the Executive’s employment shall mean the occurrence (without the

Executive’s express written consent which specifically references this Agreement) of any one of the following acts by the Company, or failures by the Company to act, unless, in the case of any act or failure to act described below, such act or

failure to act is corrected prior to the Date of Termination specified in the Notice of Termination given in respect thereof:

(I) a material diminution in the Executive’s authority, duties, or responsibilities or the assignment to the Executive of

duties or responsibilities that are materially inconsistent with those in effect on the date hereof; provided, however, that Good Reason shall not exist under this clause (I) if, following the closing of the Transaction, the

Executive retains the same position with respect to either the floor or ceiling business unit as the position held by the Executive with the Company prior to such closing;

9

(II) a reduction of ten percent (10%) or more by the Company in the

Executive’s annual base salary as in effect on the date hereof or as the same may be increased from time to time except for across-the-board salary reductions similarly affecting all senior executive officers of the Company;

(III) the relocation of the Executive’s principal place of employment to a location more than fifty (50) miles from

the Executive’s principal place of employment as of the date hereof or the Company’s requiring the Executive to be based anywhere other than such principal place of employment (or permitted relocation thereof) except for required travel on

the Company’s business to an extent substantially consistent with the Executive’s present business travel obligations;

(IV) a material breach by the Company of its obligations under this Agreement; or

(V) failure of the Company to obtain assumption and agreement by a successor of the Company to perform this Agreement as

provided in Section 9.1.

The consummation of a Transaction, without the occurrence of one of the foregoing acts or failures to act,

shall not give rise to “Good Reason.” The Executive’s right to terminate the Executive’s employment for Good Reason shall not be affected by the Executive’s incapacity due to physical or mental illness. The Executive’s

continued employment shall not constitute consent to, or a waiver of rights with respect to, any act or failure to act constituting Good Reason hereunder. In no event will the Executive have Good Reason to terminate employment unless such act or

failure to act results in a material negative change to the Executive’s employment that has not been cured within 30 days after a Notice of Termination is delivered by the Executive to the Company. The Executive must also provide notice to the

Company of the Good Reason condition within ninety (90) days of the initial existence of such condition.

(N) “Notice of

Termination” shall have the meaning set forth in Section 6.1 hereof.

(O) “Payments” shall mean those payments so

described in Section 5.2 hereof.

(P) “Severance Payments” shall have the meaning set forth in Section 5.1 hereof.

(Q) “Tax Counsel” shall have the meaning set forth in Section 5.2 hereof.

10

(R) “Term” shall mean the period of time described in Section 2 hereof (including

any extension or continuation agreed in writing between the parties, or earlier termination by either party contemplated herein).

(S)

“Transaction” shall mean a spin-off of the Company’s flooring business or a sale of all or substantially all of the assets that comprise the Company’s flooring business or a similar transaction.

11

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

|

|

|

| ARMSTRONG WORLD INDUSTRIES, INC. |

|

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

|

| |

| [EXECUTIVE] |

12

EXHIBIT A

FORM OF RELEASE AGREEMENT

THIS RELEASE

AGREEMENT (the “Release”) is made as of this day of , , by and between

(“Executive”) and Armstrong World Industries, Inc. (the “Company”).

| 1. |

FOR AND IN CONSIDERATION of the payments and benefits provided in the Severance Agreement between Executive and the Company dated as of

, 20 , (the “Severance Agreement”), Executive, for himself or herself, his or her successors and assigns, executors and administrators, now and

forever hereby releases and discharges the Company, together with all of its past and present parents, subsidiaries, and affiliates, together with each of their officers, directors, stockholders, partners, employees, agents, representatives and

attorneys, and each of their subsidiaries, affiliates, estates, predecessors, successors, and assigns (hereinafter collectively referred to as the “Releasees”) from any and all rights, claims, charges, actions, causes of action,

complaints, sums of money, suits, debts, covenants, contracts, agreements, promises, obligations, damages, demands or liabilities of every kind whatsoever, in law or in equity, whether known or unknown, suspected or unsuspected, which Executive or

Executive’s executors, administrators, successors or assigns ever had, now has or may hereafter claim to have by reason of any matter, cause or thing whatsoever; arising from the beginning of time up to the date of the Release:

(i) relating in any way to Executive’s employment relationship with the Company or any of the Releasees, or the termination of Executive’s employment relationship with the Company or any of the Releasees; (ii) arising under or

relating to the Severance Agreement; (iii) arising under any federal, local or state statute or regulation, including, without limitation, the Age Discrimination in Employment Act of 1967, as amended by the Older Workers Benefit Protection Act,

Title VII of the Civil Rights Act of 1964, the Americans with Disabilities Act of 1990, the Employee Retirement Income Security Act of 1974, and/or the applicable state law against discrimination, each as amended; (iv) relating to wrongful

employment termination or breach of contract; or (v) arising under or relating to any policy, agreement, understanding or promise, written or oral, formal or informal, between the Company and any of the Releasees and Executive; provided,

however, that notwithstanding the foregoing, nothing contained in the Release shall in any way diminish or impair: (i) any direct or indirect holdings of equity in Armstrong World Industries, Inc. or any vested awards (or awards which

may vest) which Executive has under any equity, equity-based, stock option or similar plan, agreement or program, which equity and awards shall be subject to all the terms and conditions of such documents; (ii) any claims for accrued and vested

benefits under any of the Company’s employee retirement and welfare benefit plans; and (iii) any rights or claims Executive may have that cannot be waived under applicable law (collectively, the “Excluded Claims”).

Executive further acknowledges and agrees that, except with respect to Excluded Claims, the Company and the Releasees have fully satisfied any and all obligations |

A-1

| |

whatsoever owed to Executive arising out of Executive’s employment with the Company or any of the Releasees, and that no further payments or benefits are owed to Executive by the Company or

any of the Releasees. |

| 2. |

Executive understands and agrees that, except for the Excluded Claims, Executive has knowingly relinquished, waived and forever released any and all rights to any personal recovery in any action or proceeding that may

be commenced on Executive’s behalf arising out of the aforesaid employment relationship or the termination thereof, including, without limitation, claims for back pay, front pay, liquidated damages, compensatory damages, general damages,

special damages, punitive damages, exemplary damages, costs, expenses and attorneys’ fees. |

| 3. |

Executive acknowledges and agrees that Executive has been advised to consult with an attorney of Executive’s choosing prior to signing the Release. Executive understands and agrees that Executive has the right and

has been given the opportunity to review the Release with an attorney of Executive’s choice should Executive so desire. Executive also agrees that Executive has entered into the Release freely and voluntarily. Executive further acknowledges and

agrees that Executive has had at least forty-five (45) calendar days to consider the Release, although Executive may sign it sooner if Executive wishes. In addition, once Executive has signed the Release, Executive shall have seven

(7) additional days from the date of execution to revoke Executive’s consent and may do so only by writing to: Armstrong World Industries, Inc., P.O. Box 3001, Lancaster, Pennsylvania 17604, Attention: General Counsel. The Release shall

not be effective until the eighth (8th) day after Executive shall have executed the Release and returned it to the Company, assuming that Executive had not revoked Executive’s consent to the Release prior to such date. No payments shall be

due under Section 5 of the Severance Agreement unless this Release has become effective, and no such amounts shall be paid until the times set forth therein. |

| 4. |

It is understood and agreed by Executive that the payment made to Executive is not to be construed as an admission of any liability whatsoever on the part of the Company or any of the other Releasees, by whom liability

is expressly denied. |

| 5. |

The Release is executed by Executive voluntarily and is not based upon any representations or statements of any kind made by the Company or any of the other Releasees as to the merits, legal liabilities or value of

Executive’s claims. Executive further acknowledges that Executive has had a full and reasonable opportunity to consider the Release and that Executive has not been pressured or in any way coerced into executing the Release. |

| 6. |

The exclusive venue for any disputes arising hereunder shall be the state or federal courts located in the Commonwealth of Pennsylvania, and each of

the parties hereto irrevocably waives, to the fullest extent permitted by law, any objection which it may now or hereafter have to the laying of the venue of any such proceeding brought in such a court and any claim that any such proceeding brought

in such a court has been brought in an inconvenient forum. Each of the |

A-2

| |

parties hereto also agrees that any final and unappealable judgment against a party hereto in connection with any action, suit or other proceeding may be enforced in any court of competent

jurisdiction, either within or outside of the United States. A certified or exemplified copy of such award or judgment shall be conclusive evidence of the fact and amount of such award or judgment. |

| 7. |

The Release and the rights and obligations of the parties hereto shall be governed and construed in accordance with the laws of the Commonwealth of Pennsylvania. If any provision hereof is unenforceable or is held to be

unenforceable, such provision shall be fully severable, and this document and its terms shall be construed and enforced as if such unenforceable provision had never comprised a part hereof, the remaining provisions hereof shall remain in full force

and effect, and the court construing the provisions shall add as a part hereof a provision as similar in terms and effect to such unenforceable provision as may be enforceable, in lieu of the unenforceable provision. |

| 8. |

The Release shall inure to the benefit of and be binding upon the Company and its successors and assigns. |

IN

WITNESS WHEREOF, Executive and the Company have executed the Release as of the date and year first written above.

|

|

|

| ARMSTRONG WORLD INDUSTRIES, INC. |

|

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

|

| |

| EXECUTIVE |

A-3

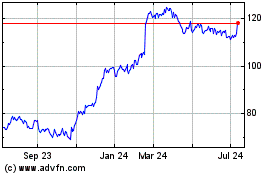

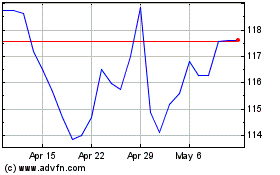

Armstrong World Industries (NYSE:AWI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Armstrong World Industries (NYSE:AWI)

Historical Stock Chart

From Apr 2023 to Apr 2024