UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: March 5, 2015

(Date of earliest event reported)

THE KROGER CO.

(Exact name of registrant as specified in its charter)

|

Ohio |

|

No. 1-303 |

|

31-0345740 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

1014 Vine Street

Cincinnati, OH 45202

(Address of principal executive offices, including zip code)

Registrant’s telephone number: (513) 762-4000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On March 5, 2015, The Kroger Co. issued a press release announcing its fourth quarter and full year 2014 results. Attached hereto as Exhibit 99.1, and filed herewith, is a copy of that release.

Item 7.01 Regulation FD Disclosure.

Fiscal 2015 Annual Guidance

|

Identical supermarket sales growth (excluding fuel sales) |

|

3.0% to 4.0% |

|

|

|

|

|

Net earnings per diluted share |

|

We expect net earnings to be $3.80 to $3.90 per diluted share, which is consistent with our long-term net earnings per diluted share growth rate of 8-11%, growing off of 2014 adjusted earnings of $3.52 per diluted share. |

|

|

|

|

|

Non-fuel FIFO operating margin |

|

We expect full-year FIFO operating margin in 2015, excluding fuel, to expand slightly compared to fiscal 2014 results. |

|

|

|

|

|

Capital investments |

|

We expect capital investments, excluding mergers, acquisitions and purchases of leased facilities, to be $3.0 to $3.3 billion. These capital investments include approximately 75 to 85 major projects covering new stores, expansions and relocations, 180 to 200 major remodels, and other investments including minor remodels and technology and infrastructure to support our Customer 1st business strategy. |

|

|

|

|

|

Supermarket square footage growth |

|

Approximately 2.0% to 2.5% before acquisitions and operational closings |

|

|

|

|

|

Expected tax rate |

|

We expect the 2015 tax rate to be approximately 35%, excluding the resolution of certain tax items and potential changes to tax regulations. |

|

|

|

|

|

Product Cost Inflation/LIFO |

|

In 2015, we anticipate product cost inflation of 1.0% to 2.0%, excluding fuel, and a LIFO charge of approximately $75 million. |

|

|

|

|

|

Pension Contributions/Expenses |

|

Company-sponsored pension plans

We expect 2015 expense to be approximately $90 million. We do not expect to make a cash contribution in 2015.

Multi-employer plans

In 2015, we expect to contribute approximately $250 million to multi-employer pension funds. |

|

|

|

|

|

Labor |

|

In 2015, we will negotiate agreements with UFCW for store associates in Columbus, Denver, Las Vegas, Louisville, Memphis and Portland, and agreements with the Teamsters covering several distribution and manufacturing facilities. Negotiations this year will be challenging as we must have competitive cost structures in each market while meeting our associates’ needs for solid wages and good quality, affordable health care and retirement benefits. Also, continued long-term financial viability of our current Taft-Hartley pension plan participation is important to address. |

2

Long-Term Guidance

Our long-term net earnings per diluted share growth rate guidance is 8-11%, plus a dividend that we expect to increase over time.

Forward Looking Statements

This Current Report contains certain statements that constitute “forward-looking statements” about the future performance of The Kroger Co. These statements are based on management’s assumptions and beliefs in light of the information currently available to it. Such statements are indicated by words such as “guidance,” “expect,” “anticipate,” “believe,” “will” and “continue.” Various uncertainties and other factors could cause actual results to differ materially from those contained in the forward-looking statements. These include the specific risk factors identified in “Risk Factors” and “Outlook” in our annual report on Form 10-K for our last fiscal year and any subsequent filings, as well as the following:

· The extent to which our sources of liquidity are sufficient to meet our requirements may be affected by the state of the financial markets and the effect that such condition has on our ability to issue commercial paper at acceptable rates. Our ability to borrow under our committed lines of credit, including our bank credit facilities, could be impaired if one or more of our lenders under those lines is unwilling or unable to honor its contractual obligation to lend to us, or in the event that natural disasters or weather conditions interfere with the ability of our lenders to lend to us. Our ability to refinance maturing debt may be affected by the state of the financial markets.

· Our ability to use cash flow to continue to maintain our investment grade debt rating and repurchase shares, fund dividends and increase capital investments, could be affected by unanticipated increases in net total debt, our inability to generate cash flow at the levels anticipated, and our failure to generate expected earnings.

· Our ability to achieve identical sales, earnings and cash flow goals may be affected by: labor negotiations or disputes; changes in the types and numbers of businesses that compete with us; pricing and promotional activities of existing and new competitors, including non-traditional competitors, and the aggressiveness of that competition; our response to these actions; the state of the economy, including interest rates, the inflationary and deflationary trends in certain commodities, and the unemployment rate; the effect that fuel costs have on consumer spending; volatility of fuel margins; changes in government-funded benefit programs; manufacturing commodity costs; diesel fuel costs related to our logistics operations; trends in consumer spending; the extent to which our customers exercise caution in their purchasing in response to economic conditions; the inconsistent pace of the economic recovery; changes in inflation or deflation in product and operating costs; stock repurchases; our ability to retain pharmacy sales from third party payors; consolidation in the healthcare industry, including pharmacy benefit managers; our ability to negotiate modifications to multi-employer pension plans; natural disasters or adverse weather conditions; the potential costs and risks associated with potential cyber-attacks or data security breaches; the success of our future growth plans; and the successful integration of Harris Teeter. Our ability to achieve sales and earnings goals may also be affected by our ability to manage the factors identified above.

· Our capital investments could differ from our estimate if we are unsuccessful in acquiring suitable sites for new stores, if development costs vary from those budgeted, if our logistics and technology or store projects are not completed on budget or within the time frame projected, or if economic conditions fail to improve, or worsen.

· During the first three quarters of each fiscal year, our LIFO charge and the recognition of LIFO expense is affected primarily by estimated year-end changes in product costs. Our fiscal year LIFO charge is affected primarily by changes in product costs at year-end.

· If actual results differ significantly from anticipated future results for certain reporting units including variable interest entities, an impairment loss for any excess of the carrying value of the reporting units’ goodwill over the implied fair value would have to be recognized.

· Our effective tax rate may differ from the expected rate due to changes in laws, the status of pending items with various taxing authorities, and the deductibility of certain expenses.

3

· Changes in our product mix may negatively affect certain financial indicators. For example, we continue to add supermarket fuel centers to our store base. Since gasoline generates low profit margins, we expect to see our FIFO gross margins decline as gasoline sales increase.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Press Release dated March 5, 2015 |

4

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

THE KROGER CO. |

|

|

|

|

|

|

|

March 5, 2015 |

By: |

/s/ Christine S. Wheatley |

|

|

|

Christine S. Wheatley |

|

|

|

Group Vice President, Secretary and General Counsel |

5

EXHIBIT INDEX

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Press Release dated March 5, 2015 |

6

Exhibit 99.1

Kroger Reports Fourth Quarter and Full Year 2014 Results

Q4 EPS of $1.04 and Adjusted Full Year 2014 EPS of $3.52(1)

Q4 ID Sales Up 6.0% Without Fuel

Initial 2015 Net Earnings Growth Guidance of $3.80 to $3.90 Per Diluted Share

Fiscal 2014 Highlights

· Achieved 45th consecutive quarter of positive identical supermarket sales growth, excluding fuel

· Exceeded commitment to slightly expand FIFO operating margin, excluding fuel, on a rolling four quarters basis(2)

· Achieved 10th consecutive year of market share growth

· Reduced operating expenses as a rate of sales for 10th consecutive year(2)

· Improved return on invested capital and increased capital investment

· Achieved 2.00 — 2.20 net total debt to adjusted EBITDA ratio earlier than anticipated

· Created nearly 25,000 new jobs

· Continued successful integration with Harris Teeter

· Completed merger with Vitacost.com

· Invested in The Kroger Co. Foundation to support future community investments

CINCINNATI, March 5, 2015 — The Kroger Co. (NYSE: KR) today reported fourth quarter net earnings of $1.04 per diluted share and identical supermarket sales growth, without fuel, of 6.0%. Fiscal 2014 GAAP net earnings were $3.44 per diluted share(1), and identical supermarket sales growth, without fuel, was 5.2%.

(1) See Table 6 for a reconciliation of non-GAAP to GAAP results

(2) Excludes FY 2013 and 2014 adjustments and certain contributions as described in this press release

1

In addition to strong core operating results, an increase in fuel margin per gallon and a lower-than-estimated LIFO charge contributed to the company’s net earnings per diluted share results in the fourth quarter.

Comments from Chairman and CEO Rodney McMullen

“2014 was an outstanding year by all measures. Kroger captured more share of the massive food market, delivered on our commitments and invested to grow our business.

“While improved fuel margins contributed to our results in the second half of the year, our core operating performance without fuel shows that our associates are improving our relationship with customers in ways that grow loyalty and generate strong shareholder returns.

“Kroger’s consistent Customer 1st performance is expanding our business, creating opportunity for associates and generating value for our shareholders. We created nearly 25,000 new jobs last year, and I am especially proud that our commitment to hiring veterans resulted in more than 6,000 veterans joining our company last year.”

Items Affecting 2014 Results

Kroger’s 2014 net earnings results are adjusted for two items:

· Charges incurred in the first quarter related to the restructuring of certain pension obligations to help stabilize associates’ future benefits.

· Certain tax items that benefited the third quarter.

Adjusted 2014 results include the effect of the following items:

· Low retail fuel prices and unusually-high fuel margins.

· A LIFO charge that was significantly higher in 2014 than in 2013.

· A $55 million contribution to the UFCW Consolidated Pension Plan in the fourth quarter.

· An $85 million contribution to The Kroger Co. Foundation in 2014, $60 million of which was in the fourth quarter. This will allow Kroger to continue to support causes such as

2

hunger relief, breast cancer awareness, the military and their families, and local community organizations.

Details of Fourth Quarter 2014 Results

Kroger’s operating results include Harris Teeter in fourth quarter and fiscal 2014 but not fourth quarter and fiscal 2013, which affects year-over-year comparisons.

Kroger reported total sales of $25.2 billion in the fourth quarter, which ended January 31, 2015. Total sales increased by 8.5%. Total sales excluding fuel increased by 14.2%.

Net earnings for the fourth quarter totaled $518 million, or $1.04 per diluted share.

The company recorded a LIFO charge of $9 million, compared to a $10 million LIFO charge in the same quarter last year.

FIFO gross margin was comparable to the same period last year, excluding retail fuel operations.

Total operating expenses — excluding retail fuel operations, the contributions to the pension and foundation described above, and the 2013 adjustment items — decreased 15 basis points as a percent of sales compared to the same period last year.

Fiscal Year 2014 Results

Kroger reported total sales of $108.5 billion in 2014, an increase of 10.3%. Total sales excluding fuel increased 12.9% over the prior year.

Net earnings for 2014 totaled $1.73 billion, or $3.44 per diluted share. Excluding the 2014 adjustment items, adjusted net earnings for fiscal 2014 totaled $1.77 billion, or $3.52 per diluted share.

Kroger’s LIFO charge for 2014 was $147 million, significantly higher than 2013 due to higher product costs.

FIFO gross margin for 2014, excluding retail fuel operations, declined 3 basis points.

3

Total operating expenses for 2014 — excluding retail fuel operations, the contributions to the pension and foundation described above, and the 2013 adjustment items — decreased 13 basis points as a percent of sales compared to the prior year.

FIFO operating margin for 2014 — excluding retail fuel operations, the contributions to the pension and foundation described above, and the 2013 adjustment items —increased 10 basis points compared to the prior year.

Fiscal Year 2014 Job Creation

Kroger’s total active workforce grew by nearly 25,000 during 2014. More than 90 percent of the new jobs are in the company’s supermarket divisions, ranging from full-time department heads and assistant store managers to part-time courtesy clerks and cashiers.

“Kroger is a great place to start and build a career. We continue to have thousands of openings for friendly, hard-working associates who are passionate about making a difference for our customers,” said Mr. McMullen, whose career began as a part-time stock clerk at a Kroger store in Lexington, KY, noting that many store and executive managers started with entry level jobs in the company’s family of stores.

Over the last seven years, Kroger has created more than 65,000 new jobs. This figure does not include increases due to the company’s mergers. Kroger and its subsidiaries today employ nearly 400,000 associates.

The company hired more than 6,000 veterans in 2014, and has hired more than 29,000 veterans since 2009.

Financial Strategy

Kroger’s long-term financial strategy continues to be to use cash flow from operations to maintain its current investment grade debt rating, repurchase shares, fund its dividend, and increase capital investments.

4

Kroger achieved its 2.00 — 2.20 net total debt to adjusted EBITDA ratio objective earlier than anticipated due to strong fiscal 2014 operating results. As of the close of the fourth quarter, net total debt to adjusted EBITDA ratio decreased to 2.15, compared to 2.43 during the same period last year (see Table 5).

Kroger’s strong financial position allowed the company to return more than $1.6 billion to shareholders through share buybacks and dividends in 2014. During the fiscal year, Kroger repurchased 28.4 million common shares for a total investment of $1.3 billion.

Capital investments, excluding mergers, acquisitions and purchases of leased facilities, totaled $2.8 billion for the year, compared to $2.3 billion in 2013.

Kroger’s strong EBITDA performance resulted in a return on invested capital for 2014 of 13.74%, compared to 13.43% for 2013.

Fiscal 2015 Annual Guidance

Kroger anticipates identical supermarket sales growth, excluding fuel, of approximately 3.0% to 4.0% for 2015. This range takes into account the expectation of lower inflation during the year.

Full-year net earnings for 2015 are expected to range from $3.80 to $3.90 per diluted share. This is consistent with the company’s long-term net earnings per diluted share growth rate of 8 — 11%, growing off of 2014 adjusted earnings of $3.52 per diluted share. Shareholder return will be further enhanced by a dividend which is expected to increase over time.

For 2015, Kroger expects fuel margins to return to historical averages, a lower LIFO charge, and no comparable contributions to the pension and foundation; as a result, the company expects to achieve near the middle of the guidance range.

The company expects capital investments, excluding mergers, acquisitions and purchases of leased facilities, to be in the $3.0 to $3.3 billion range for 2015.

5

Kroger, one of the world’s largest retailers, employs nearly 400,000 associates who serve customers in 2,625 supermarkets and multi-department stores in 34 states and the District of Columbia under two dozen local banner names including Kroger, City Market, Dillons, Food 4 Less, Fred Meyer, Fry’s, Harris Teeter, Jay C, King Soopers, QFC, Ralphs and Smith’s. The company also operates 782 convenience stores, 326 fine jewelry stores, 1,330 supermarket fuel centers and 37 food processing plants in the U.S. Recognized by Forbes as the most generous company in America, Kroger supports hunger relief, breast cancer awareness, the military and their families, and more than 30,000 schools and community organizations. Kroger contributes food and funds equal to 200 million meals a year through more than 80 Feeding America food bank partners. A leader in supplier diversity, Kroger is a proud member of the Billion Dollar Roundtable and the U.S. Hispanic Chamber’s Million Dollar Club.

Note: Fuel sales have historically had a low FIFO gross margin rate and operating expense rate as compared to corresponding rates on non-fuel sales. As a result Kroger discusses the changes in these rates excluding the effect of retail fuel operations.

Please refer to the supplemental information presented in the tables for reconciliations of the non-GAAP financial measures used in this press release to the most comparable GAAP financial measure and related disclosure.

This press release contains certain statements that constitute “forward-looking statements” about the future performance of the company. These statements are based on management’s assumptions and beliefs in light of the information currently available to it. These statements are indicated by words such as “expect,” “anticipate,” “believe,” “guidance,” “plans,” “committed,” “goal,” “will” and “continue.” Various uncertainties and other factors could cause actual results to differ materially from those contained in the forward-looking statements. These include the specific risk factors identified in “Risk Factors” and “Outlook” in Kroger’s annual report on Form 10-K for the last fiscal year and any subsequent filings, as well as the following:

6

· Our ability to achieve identical sales, earnings and cash flow goals may be affected by: labor negotiations or disputes; changes in the types and numbers of businesses that compete with us; pricing and promotional activities of existing and new competitors, including non-traditional competitors, and the aggressiveness of that competition; our response to these actions; the state of the economy, including interest rates, the inflationary and deflationary trends in certain commodities, and the unemployment rate; the effect that fuel costs have on consumer spending; volatility of fuel margins; changes in government-funded benefit programs; manufacturing commodity costs; diesel fuel costs related to our logistics operations; trends in consumer spending; the extent to which our customers exercise caution in their purchasing in response to economic conditions; the inconsistent pace of the economic recovery; changes in inflation or deflation in product and operating costs; stock repurchases; our ability to retain pharmacy sales from third party payors; consolidation in the healthcare industry, including pharmacy benefit managers; our ability to negotiate modifications to multi-employer pension plans; natural disasters or adverse weather conditions; the potential costs and risks associated with potential cyber-attacks or data security breaches; the success of our future growth plans; and the successful integration of Harris Teeter. Our ability to achieve sales and earnings goals may also be affected by our ability to manage the factors identified above.

· During the first three quarters of each fiscal year, the company’s LIFO charge and the recognition of LIFO expense is affected primarily by estimated year-end changes in product costs. The fiscal year LIFO charge is affected primarily by changes in product costs at year-end.

· Our ability to use cash flow to continue to maintain our investment grade debt rating and repurchase shares, fund dividends, and increase capital investments, could be affected by unanticipated increases in net total debt, our inability to generate cash flow at the levels anticipated, and our failure to generate expected earnings.

7

· Our capital investments could differ from our estimate if we are unsuccessful in acquiring suitable sites for new stores, if development costs vary from those budgeted, if our logistics and technology or store projects are not completed on budget or within the time frame projected, or if economic conditions fail to improve, or worsen.

Kroger assumes no obligation to update the information contained herein. Please refer to Kroger’s reports and filings with the Securities and Exchange Commission for a further discussion of these risks and uncertainties.

Note: Kroger’s quarterly conference call with investors will be broadcast live online at 10 a.m. (ET) on March 5, 2015 at ir.kroger.com. An on-demand replay of the webcast will be available from approximately 1 p.m. (ET) Thursday, March 5 through Thursday, March 19, 2015.

—30—

4th Quarter and Fiscal Year 2014 Tables Include:

1. Consolidated Statements of Operations

2. Consolidated Balance Sheets

3. Consolidated Statements of Cash Flows

4. Supplemental Sales Information

5. Reconciliation of Net Total Debt and Net Earnings Attributable to The Kroger Co. to Adjusted EBITDA

6. Net Earnings per Diluted Share Excluding Adjustment Items

7. Return on Invested Capital

Kroger Contacts:

Media: Keith Dailey (513) 762-1304

Investors: Cindy Holmes (513) 762-4969

8

Table 1.

THE KROGER CO.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except per share amounts)

(unaudited)

|

|

|

FOURTH QUARTER |

|

YEAR-TO-DATE |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SALES |

|

$ |

25,207 |

|

100.0 |

% |

$ |

23,222 |

|

100.0 |

% |

$ |

108,465 |

|

100.0 |

% |

$ |

98,375 |

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MERCHANDISE COSTS, INCLUDING ADVERTISING, WAREHOUSING AND TRANSPORTATION (a), AND LIFO CHARGE (b) |

|

19,547 |

|

77.6 |

|

18,397 |

|

79.2 |

|

85,512 |

|

78.8 |

|

78,138 |

|

79.4 |

|

|

OPERATING, GENERAL AND ADMINISTRATIVE (a) |

|

4,119 |

|

16.3 |

|

3,558 |

|

15.3 |

|

17,161 |

|

15.8 |

|

15,196 |

|

15.5 |

|

|

RENT |

|

162 |

|

0.6 |

|

147 |

|

0.6 |

|

707 |

|

0.7 |

|

613 |

|

0.6 |

|

|

DEPRECIATION AND AMORTIZATION |

|

467 |

|

1.9 |

|

402 |

|

1.7 |

|

1,948 |

|

1.8 |

|

1,703 |

|

1.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING PROFIT |

|

912 |

|

3.6 |

|

718 |

|

3.1 |

|

3,137 |

|

2.9 |

|

2,725 |

|

2.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INTEREST EXPENSE |

|

115 |

|

0.5 |

|

107 |

|

0.5 |

|

488 |

|

0.5 |

|

443 |

|

0.5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET EARNINGS BEFORE INCOME TAX EXPENSE |

|

797 |

|

3.2 |

|

611 |

|

2.6 |

|

2,649 |

|

2.4 |

|

2,282 |

|

2.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME TAX EXPENSE |

|

274 |

|

1.1 |

|

184 |

|

0.8 |

|

902 |

|

0.8 |

|

751 |

|

0.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET EARNINGS INCLUDING NONCONTROLLING INTERESTS |

|

523 |

|

2.1 |

|

427 |

|

1.8 |

|

1,747 |

|

1.6 |

|

1,531 |

|

1.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET EARNINGS ATTRIBUTABLE TO NONCONTROLLING INTERESTS |

|

5 |

|

0.0 |

|

5 |

|

0.0 |

|

19 |

|

0.0 |

|

12 |

|

0.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET EARNINGS ATTRIBUTABLE TO THE KROGER CO. |

|

$ |

518 |

|

2.1 |

% |

$ |

422 |

|

1.8 |

% |

$ |

1,728 |

|

1.6 |

% |

$ |

1,519 |

|

1.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET EARNINGS ATTRIBUTABLE TO THE KROGER CO. PER BASIC COMMON SHARE |

|

$ |

1.06 |

|

|

|

$ |

0.82 |

|

|

|

$ |

3.49 |

|

|

|

$ |

2.93 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AVERAGE NUMBER OF COMMON SHARES USED IN BASIC CALCULATION |

|

486 |

|

|

|

511 |

|

|

|

490 |

|

|

|

514 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET EARNINGS ATTRIBUTABLE TO THE KROGER CO. PER DILUTED COMMON SHARE |

|

$ |

1.04 |

|

|

|

$ |

0.81 |

|

|

|

$ |

3.44 |

|

|

|

$ |

2.90 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AVERAGE NUMBER OF COMMON SHARES USED IN DILUTED CALCULATION |

|

493 |

|

|

|

517 |

|

|

|

497 |

|

|

|

520 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DIVIDENDS DECLARED PER COMMON SHARE |

|

$ |

0.185 |

|

|

|

$ |

0.165 |

|

|

|

$ |

0.700 |

|

|

|

$ |

0.630 |

|

|

|

Note: Certain per share amounts and percentages may not sum due to rounding.

Note: The Company defines First-In First-Out (FIFO) gross profit as sales minus merchandise costs, including advertising, warehousing and transportation, but excluding the Last-In First-Out (LIFO) charge.

The Company defines FIFO gross margin, as described in the earnings release, as FIFO gross profit divided by sales.

The Company defines FIFO operating profit as operating profit excluding the LIFO charge.

The Company defines FIFO operating margin, as described in the earnings release, as FIFO operating profit divided by sales.

The above FIFO financial metrics are important measures used by management to evaluate operational effectiveness. Management believes these FIFO financial metrics are useful to investors and analysts because they measure our day-to-day operational effectiveness.

(a) Merchandise costs and operating, general and administrative expenses exclude depreciation and amortization expense and rent expense which are included in separate expense lines.

(b) LIFO charges of $9 and $10 were recorded in the fourth quarter of 2014 and 2013, respectively. For the year to date period, LIFO charges of $147 and $52 were recorded for 2014 and 2013, respectively.

Table 2.

THE KROGER CO.

CONSOLIDATED BALANCE SHEETS

(in millions)

(unaudited)

|

|

|

January 31, |

|

Februrary 1, |

|

|

|

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

Current Assets |

|

|

|

|

|

|

Cash |

|

$ |

268 |

|

$ |

260 |

|

|

Temporary cash investments |

|

— |

|

141 |

|

|

Store deposits in-transit |

|

988 |

|

958 |

|

|

Receivables |

|

1,266 |

|

1,116 |

|

|

Inventories |

|

5,688 |

|

5,651 |

|

|

Prepaid and other current assets |

|

701 |

|

704 |

|

|

|

|

|

|

|

|

|

Total current assets |

|

8,911 |

|

8,830 |

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

17,912 |

|

16,893 |

|

|

Intangibles, net |

|

757 |

|

702 |

|

|

Goodwill |

|

2,304 |

|

2,135 |

|

|

Other assets |

|

672 |

|

721 |

|

|

|

|

|

|

|

|

|

Total Assets |

|

$ |

30,556 |

|

$ |

29,281 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREOWNERS’ EQUITY |

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

Current portion of long-term debt including obligations under capital leases and financing obligations |

|

$ |

1,885 |

|

$ |

1,657 |

|

|

Trade accounts payable |

|

5,052 |

|

4,881 |

|

|

Accrued salaries and wages |

|

1,291 |

|

1,150 |

|

|

Deferred income taxes |

|

287 |

|

248 |

|

|

Other current liabilities |

|

2,888 |

|

2,769 |

|

|

|

|

|

|

|

|

|

Total current liabilities |

|

11,403 |

|

10,705 |

|

|

|

|

|

|

|

|

|

Long-term debt including obligations under capital leases and financing obligations |

|

|

|

|

|

|

Face-value of long-term debt including obligations under capital leases and financing obligations |

|

9,771 |

|

9,654 |

|

|

Adjustment to reflect fair-value interest rate hedges |

|

— |

|

(1 |

) |

|

Long-term debt including obligations under capital leases and financing obligations |

|

9,771 |

|

9,653 |

|

|

|

|

|

|

|

|

|

Deferred income taxes |

|

1,209 |

|

1,381 |

|

|

Pension and postretirement benefit obligations |

|

1,463 |

|

901 |

|

|

Other long-term liabilities |

|

1,268 |

|

1,246 |

|

|

|

|

|

|

|

|

|

Total Liabilities |

|

25,114 |

|

23,886 |

|

|

|

|

|

|

|

|

|

Shareowners’ equity |

|

5,442 |

|

5,395 |

|

|

|

|

|

|

|

|

|

Total Liabilities and Shareowners’ Equity |

|

$ |

30,556 |

|

$ |

29,281 |

|

|

|

|

|

|

|

|

|

Total common shares outstanding at end of period |

|

486 |

|

508 |

|

|

Total diluted shares year-to-date |

|

497 |

|

520 |

|

Table 3.

THE KROGER CO.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in millions)

(unaudited)

|

|

|

YEAR-TO-DATE |

|

|

|

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

Net earnings including noncontrolling interests |

|

$ |

1,747 |

|

$ |

1,531 |

|

|

Adjustments to reconcile net earnings including noncontrolling interests to net cash provided by operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

1,948 |

|

1,703 |

|

|

LIFO charge |

|

147 |

|

52 |

|

|

Stock-based employee compensation |

|

155 |

|

107 |

|

|

Expense for Company-sponsored pension plans |

|

54 |

|

74 |

|

|

Deferred income taxes |

|

73 |

|

72 |

|

|

Other |

|

110 |

|

86 |

|

|

Changes in operating assets and liabilities, net of effects from acquisitions of businesses: |

|

|

|

|

|

|

Store deposits in-transit |

|

(27 |

) |

25 |

|

|

Receivables |

|

(141 |

) |

(8 |

) |

|

Inventories |

|

(147 |

) |

(131 |

) |

|

Prepaid and other current assets |

|

2 |

|

(49 |

) |

|

Trade accounts payable |

|

146 |

|

3 |

|

|

Accrued expenses |

|

208 |

|

77 |

|

|

Income taxes receivable and payable |

|

(68 |

) |

(47 |

) |

|

Other |

|

(22 |

) |

(115 |

) |

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

4,185 |

|

3,380 |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

Payments for property and equipment, including payments for lease buyouts |

|

(2,831 |

) |

(2,330 |

) |

|

Proceeds from sale of assets |

|

37 |

|

24 |

|

|

Payments for acquisitions |

|

(252 |

) |

(2,344 |

) |

|

Other |

|

(14 |

) |

(121 |

) |

|

|

|

|

|

|

|

|

Net cash used by investing activities |

|

(3,060 |

) |

(4,771 |

) |

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

Proceeds from issuance of long-term debt |

|

576 |

|

3,548 |

|

|

Payments on long-term debt |

|

(375 |

) |

(1,060 |

) |

|

Net borrowings (payments) on commercial paper |

|

25 |

|

(395 |

) |

|

Dividends paid |

|

(338 |

) |

(319 |

) |

|

Excess tax benefits on stock-based awards |

|

52 |

|

32 |

|

|

Proceeds from issuance of capital stock |

|

110 |

|

196 |

|

|

Treasury stock purchases |

|

(1,283 |

) |

(609 |

) |

|

Net increase (decrease) in book overdrafts |

|

(22 |

) |

193 |

|

|

Other |

|

(3 |

) |

(32 |

) |

|

|

|

|

|

|

|

|

Net cash used by financing activities |

|

(1,258 |

) |

1,554 |

|

|

|

|

|

|

|

|

|

NET INCREASE (DECREASE) IN CASH AND TEMPORARY CASH INVESTMENTS |

|

(133 |

) |

163 |

|

|

|

|

|

|

|

|

|

CASH AND TEMPORARY CASH INVESTMENTS: |

|

|

|

|

|

|

BEGINNING OF YEAR |

|

401 |

|

238 |

|

|

END OF YEAR |

|

$ |

268 |

|

$ |

401 |

|

|

|

|

|

|

|

|

|

Reconciliation of capital investments: |

|

|

|

|

|

|

Payments for property and equipment, including payments for lease buyouts |

|

$ |

(2,831 |

) |

$ |

(2,330 |

) |

|

Payments for lease buyouts |

|

135 |

|

108 |

|

|

Changes in construction-in-progress payables |

|

(56 |

) |

(83 |

) |

|

Total capital investments, excluding lease buyouts |

|

$ |

(2,752 |

) |

$ |

(2,305 |

) |

|

|

|

|

|

|

|

|

Disclosure of cash flow information: |

|

|

|

|

|

|

Cash paid during the year for interest |

|

$ |

477 |

|

$ |

401 |

|

|

Cash paid during the year for income taxes |

|

$ |

941 |

|

$ |

679 |

|

Table 4. Supplemental Sales Information

(in millions, except percentages)

(unaudited)

Items identified below should not be considered as alternatives to sales or any other GAAP measure of performance. Identical supermarket sales is an industry-specific measure and it is important to review it in conjunction with Kroger’s financial results reported in accordance with GAAP. Other companies in our industry may calculate identical supermarket sales differently than Kroger does, limiting the comparability of the measure. These results include Harris Teeter sales for stores that are identical as if they were part of Kroger in the prior year.

IDENTICAL SUPERMARKET SALES (a)

|

|

|

FOURTH QUARTER |

|

YEAR-TO-DATE |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

INCLUDING FUEL CENTERS |

|

$ |

22,728 |

|

$ |

22,181 |

|

$ |

97,323 |

|

$ |

93,435 |

|

|

EXCLUDING FUEL CENTERS |

|

$ |

20,234 |

|

$ |

19,086 |

|

$ |

82,987 |

|

$ |

78,878 |

|

|

|

|

|

|

|

|

|

|

|

|

|

INCLUDING FUEL CENTERS |

|

2.5% |

|

4.0% |

|

4.2% |

|

3.3% |

|

|

EXCLUDING FUEL CENTERS |

|

6.0% |

|

4.3% |

|

5.2% |

|

3.6% |

|

(a) Kroger defines a supermarket as identical when it has been open without expansion or relocation for five full quarters.

Table 5. Reconciliation of Net Total Debt and

Net Earnings Attributable to The Kroger Co. to Adjusted EBITDA

(in millions, except for ratio)

(unaudited)

The items identified below should not be considered an alternative to any GAAP measure of performance or access to liquidity. Net total debt to adjusted EBITDA is an important measure used by management to evaluate the Company’s access to liquidity. The items below should be reviewed in conjunction with Kroger’s financial results reported in accordance with GAAP.

The following table provides a reconciliation of net total debt.

|

|

|

January 31, |

|

Februrary 1, |

|

|

|

|

|

|

2015 |

|

2014 |

|

Change |

|

|

|

|

|

|

|

|

|

|

|

Current portion of long-term debt including obligations under capital leases and financing obligations |

|

$ |

1,885 |

|

$ |

1,657 |

|

$ |

228 |

|

|

Face-value of long-term debt including obligations under capital leases and financing obligations |

|

9,771 |

|

9,654 |

|

117 |

|

|

Adjustment to reflect fair-value interest rate hedges |

|

— |

|

(1 |

) |

1 |

|

|

|

|

|

|

|

|

|

|

|

Total debt |

|

$ |

11,656 |

|

$ |

11,310 |

|

$ |

346 |

|

|

|

|

|

|

|

|

|

|

|

Less: Temporary cash investments |

|

— |

|

141 |

|

(141 |

) |

|

Less: Prepaid benefit payments |

|

275 |

|

275 |

|

— |

|

|

|

|

|

|

|

|

|

|

|

Net total debt |

|

$ |

11,381 |

|

$ |

10,894 |

|

$ |

487 |

|

The following table provides a reconciliation from net earnings attributable to The Kroger Co. to adjusted EBITDA, as defined in the Company’s credit agreement. The table below only includes Harris Teeter in 2014.

|

|

|

YEAR-TO-DATE |

|

|

|

|

January 31, |

|

Februrary 1, |

|

|

|

|

2015 |

|

2014 |

|

|

|

|

|

|

|

|

|

Net earnings attributable to The Kroger Co. |

|

$ |

1,728 |

|

$ |

1,519 |

|

|

LIFO |

|

147 |

|

52 |

|

|

Depreciation and amortization |

|

1,948 |

|

1,703 |

|

|

Interest expense |

|

488 |

|

443 |

|

|

Income tax expense |

|

902 |

|

751 |

|

|

Adjustments for pension plan agreements |

|

87 |

|

— |

|

|

Other |

|

(7 |

) |

10 |

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

$ |

5,293 |

|

$ |

4,478 |

|

|

|

|

|

|

|

|

|

Net total debt to adjusted EBITDA ratio |

|

2.15 |

|

2.43 |

|

Table 6. Net Earnings Per Diluted Share Excluding the Adjustment Items

(in millions, except per share amounts)

(unaudited)

The purpose of this table is to better illustrate comparable operating results from our ongoing business, after removing the effects on net earnings per diluted common share for certain items described below. Items identified in this table should not be considered alternatives to net earnings attributable to The Kroger Co. or any other GAAP measure of performance. These items should not be reviewed in isolation or considered substitutes for the Company’s financial results as reported in accordance with GAAP. Due to the nature of these items, as further described below, it is important to identify these items and to review them in conjunction with the Company’s financial results reported in accordance with GAAP.

The following table summarizes items that affected the Company’s financial results during the periods presented. In 2014, these items include the benefit from certain tax items and charges related to the restructuring of certain pension obligations. In 2013, these items included the benefit from certain tax items and charges related to the merger with Harris Teeter.

|

|

|

FOURTH QUARTER |

|

YEAR-TO-DATE |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

NET EARNINGS ATTRIBUTABLE TO THE KROGER CO. |

|

$ |

518 |

|

$ |

422 |

|

$ |

1,728 |

|

$ |

1,519 |

|

|

|

|

|

|

|

|

|

|

|

|

|

BENEFIT FROM CERTAIN TAX ITEMS (a) |

|

— |

|

— |

|

(17 |

) |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTMENTS FOR PENSION PLAN AGREEMENTS (a)(b) |

|

— |

|

— |

|

56 |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

BENEFIT FROM CERTAIN TAX ITEMS OFFSET BY HARRIS TEETER MERGER CHARGES (a) |

|

— |

|

(16 |

) |

— |

|

(23 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

NET EARNINGS ATTRIBUTABLE TO THE KROGER CO. EXCLUDING THE ADJUSTMENT ITEMS ABOVE |

|

$ |

518 |

|

$ |

406 |

|

$ |

1,767 |

|

$ |

1,496 |

|

|

|

|

|

|

|

|

|

|

|

|

|

NET EARNINGS ATTRIBUTABLE TO THE KROGER CO. PER DILUTED COMMON SHARE |

|

$ |

1.04 |

|

$ |

0.81 |

|

$ |

3.44 |

|

$ |

2.90 |

|

|

|

|

|

|

|

|

|

|

|

|

|

BENEFIT FROM CERTAIN TAX ITEMS (c) |

|

— |

|

— |

|

(0.03 |

) |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTMENTS FOR PENSION PLAN AGREEMENTS (c) |

|

— |

|

— |

|

0.11 |

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

BENEFIT FROM CERTAIN TAX ITEMS OFFSET BY HARRIS TEETER MERGER CHARGES (c) |

|

— |

|

(0.03 |

) |

— |

|

(0.05 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

NET EARNINGS ATTRIBUTABLE TO THE KROGER CO. PER DILUTED COMMON SHARE EXCLUDING THE ADJUSTMENT ITEMS ABOVE |

|

$ |

1.04 |

|

$ |

0.78 |

|

$ |

3.52 |

|

$ |

2.85 |

|

|

|

|

|

|

|

|

|

|

|

|

|

AVERAGE NUMBER OF COMMON SHARES USED IN DILUTED CALCULATION |

|

493 |

|

517 |

|

497 |

|

520 |

|

(a) The amounts presented represent the after-tax effect of each adjustment.

(b) The pre-tax adjustment for the pension plan agreements was $87.

(c) The amounts presented represent the net earnings per diluted common share effect of each adjustment.

Table 7. Return on Invested Capital

(in millions, except percentages)

(unaudited)

Return on invested capital should not be considered an alternative to any GAAP measure of performance. Return on invested capital is an important measure used by management to evaluate the Company’s investment returns on capital and its effectiveness in deploying assets. Return on invested capital should not be reviewed in isolation or considered as a substitute for the Company’s financial results as reported in accordance with GAAP. Other companies may calculate return on invested capital differently than Kroger, limiting the comparability of the measure.

The following table provides a calculation of return on invested capital for 2014 and 2013. The calculation of the numerator in the table below only includes Harris Teeter in 2014. The calculation of the denominator excludes the assets and liabilities recorded as of February 1, 2014 for Harris Teeter due to the merger being completed at the end of 2013.

|

|

|

YEAR-TO-DATE |

|

|

|

|

January 31, |

|

Februrary 1, |

|

|

|

|

2015 |

|

2014 |

|

|

Return on Invested Capital |

|

|

|

|

|

|

Numerator (a) |

|

|

|

|

|

|

Operating profit |

|

$ |

3,137 |

|

$ |

2,725 |

|

|

LIFO charge |

|

147 |

|

52 |

|

|

Depreciation and amortization |

|

1,948 |

|

1,703 |

|

|

Rent |

|

707 |

|

613 |

|

|

Adjustments for pension plan agreements |

|

87 |

|

— |

|

|

Other |

|

— |

|

16 |

|

|

|

|

|

|

|

|

|

Adjusted operating income |

|

$ |

6,026 |

|

$ |

5,109 |

|

|

|

|

|

|

|

|

|

Denominator (b) |

|

|

|

|

|

|

Average total assets |

|

$ |

29,919 |

|

$ |

26,958 |

|

|

Average taxes receivable (c) |

|

(19 |

) |

(10 |

) |

|

Average LIFO reserve (d) |

|

1,197 |

|

1,124 |

|

|

Average accumulated depreciation |

|

16,057 |

|

14,991 |

|

|

Average trade accounts payable |

|

(4,967 |

) |

(4,683 |

) |

|

Average accrued salaries and wages |

|

(1,221 |

) |

(1,084 |

) |

|

Average other current liabilities (e) |

|

(2,780 |

) |

(2,544 |

) |

|

Adjustment for Harris Teeter (f) |

|

— |

|

(1,618 |

) |

|

Rent * 8 (g) |

|

5,656 |

|

4,904 |

|

|

|

|

|

|

|

|

|

Average invested capital |

|

$ |

43,842 |

|

$ |

38,038 |

|

|

|

|

|

|

|

|

|

Return on Invested Capital |

|

13.74 |

% |

13.43 |

% |

(a) Represents year-to-date results for the periods noted.

(b) Represents the average of amounts at the beginning and end of year.

(c) Taxes receivable is recorded in the Consolidated Balance Sheet in receivables.

(d) LIFO reserve is recorded in the Consolidated Balance Sheet in inventories.

(e) The calculation of average other current liabilities excludes accrued income taxes.

(f) Adjustment to remove the assets and liabilities recorded at year end 2013 for Harris Teeter.

(g) The factor of eight estimates the hypothetical capitalization of our operating leases.

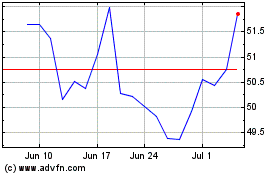

Kroger (NYSE:KR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kroger (NYSE:KR)

Historical Stock Chart

From Apr 2023 to Apr 2024