UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 27, 2015

AAON, INC.

(Exact name of Registrant as Specified in Charter)

|

| | |

Nevada | 0-18953 | 87-0448736 |

(State or Other Jurisdiction | (Commission File Number: ) | (IRS Employer Identification No.) |

of Incorporation) | | |

| | |

2425 South Yukon, Tulsa, Oklahoma | | 74107 |

(Address of Principal Executive Offices) | | (Zip Code) |

(Registrant's telephone number, including area code): (918) 583-2266

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Conditions.

On February 27, 2015, AAON, Inc. (the "Company") announced its financial and operating results for the quarter and year ended December 31, 2014. A copy of the Company's press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference. The Company plans to host a teleconference at 10:00 A.M. (Eastern Time) on February 27, 2015 to discuss these results. To access the call, please dial 1-888-241-0551 (code 88563885). A replay of the call will be available through March 6, 2015 by dialing 1-855-859-2056 (code 88563885).

In accordance with General Instruction B.2 of Form 8-K, the information in this Item shall not be deemed "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing.

Item 7.01 Regulation FD Disclosure.

On February 27, 2015, the Company issued the press release described above in Item 2.02 of this Current Report on Form 8-K. A copy of the press release is attached hereto as Exhibit 99.1.

All statements in the teleconference, other than historical financial information, may be deemed to be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in the forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

In accordance with General Instruction B.2 of Form 8-K, the information in this Item shall not be deemed "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

| | | | |

Exhibit Number | | Description |

| | | | |

99.1 | | Press release dated February 27, 2015 announcing financial and operating results. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| | AAON, INC. |

| |

|

|

Date: | February 27, 2015 | By: | /s/ John B. Johnson, Jr. |

| |

| John B. Johnson, Jr., Secretary |

Exhibit 99.1

|

| | | | |

NEWS BULLETIN | | AAON, Inc. |

| 2425 South Yukon Ave. Ÿ Tulsa, OK 74107-2728 |

| Ÿ Ph: (918) 583-2266 Ÿ Fax: (918) 583-6094 Ÿ |

| Ÿhttp://www.aaon.comŸ |

| | | | |

FOR IMMEDIATE RELEASE FEBRUARY 27, 2015 | | For Further Information: |

| Jerry R. Levine Ÿ Phone: (914) 244-0292 Ÿ Fax: (914) 244-0295 |

| Email: jrladvisor@yahoo.com |

AAON REPORTS RECORD SALES AND EARNINGS

FOR FOURTH QUARTER AND YEAR 2014

TULSA, OK, February 27, 2015 - AAON, INC. (NASDAQ-AAON), today announced its operating results for the fourth quarter and year 2014. Sales in the fourth quarter were a record $84.7 million, up 15.5% from $73.4 million in 2013. Net income was also a record $10.5 million, up 35.6% from $7.8 million in the same period a year ago. Sales for the year 2014 were, too, a record $356.3 million, up 11.0% compared to $321.1 million in 2013. Earnings for 2014 were also a record, $44.2 million, up 17.6% compared to $37.5 million in 2013.

Earnings for the fourth quarter of 2014 and 2013 were $0.19 and $0.14 per diluted share, based upon 54.8 million and 55.4 million diluted shares outstanding, respectively. Earnings per diluted share for the years 2014 and 2013 were $0.80 and $0.68, based upon 55.4 million and 55.6 million diluted shares outstanding, respectively. All per share earnings reflect the 3-for-2 stock split effective July 16, 2014.

Norman H. Asbjornson, President and CEO, stated, “The 2014 gains in sales and income from operations primarily reflect favorable reception of our products and efficiencies from our investment in equipment that caused gross profit as a percent of sales to increase from 28.0% to 30.4%; despite SG&A expense as a percent of sales having increased from 10.6% to 11.4%, the majority of which represents non-recurring charitable donations. Absent these donations, our diluted earnings per share would have been $0.04 higher."

Mr. Asbjornson continued, "The Company’s backlog increased from $45.3 million at December 31, 2013 to $48.8 million at December 31, 2014. In addition, the Company's balance sheet at year end was strong. The current ratio was 3.1:1 (including cash and investments of $49.3 million). It should be noted that the Company purchased a total of 1.0 million shares of AAON stock under its resumed open market buyback program for approximately $20.0 million during the year, for an average cost of $19.67 per share. We continued to remain debt-free and our return on average stockholder equity was 26.1% in 2014."

Mr. Asbjornson next said, "While we had another record year, we are starting to see an inflation in raw material, component and labor costs, and perceive a stagnation in non-residential construction growth. Still, we expect to have another good year in 2015."

The Company will host a conference call today at 10:00 A.M. (Eastern Time) to discuss the fourth quarter and year 2014 results. To participate, call 1-888-241-0551 (code 88563885); or, for rebroadcast, call 1-855-859-2056 (code 88563885).

AAON, Inc. is a manufacturer of air-conditioning and heating equipment consisting of rooftop units, chillers, air-handling units, condensing units, heat recovery units, commercial self-contained units and coils. Its products serve the new construction and replacement markets. The Company has successfully gained market share through its “semi-custom” product lines, which offer the customer value, quality, function, serviceability and efficiency.

Certain statements in this news release may be “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933. Statements regarding future prospects and developments are based upon current expectations and involve certain risks and uncertainties that could cause actual results and developments to differ materially from the forward-looking statements.

|

| | | | | | | | | | | | | | | |

AAON, Inc. and Subsidiaries |

Unaudited Consolidated Statements of Income |

| Three Months Ended

December 31, | | Years Ending December 31, |

| 2014 | | 2013 | | 2014 | | 2013 |

| (in thousands, except share and per share data) |

Net sales | $ | 84,728 |

| | $ | 73,376 |

| | $ | 356,322 |

| | $ | 321,140 |

|

Cost of sales | 59,537 |

| | 53,188 |

| | 248,059 |

| | 231,348 |

|

Gross profit | 25,191 |

| | 20,188 |

| | 108,263 |

| | 89,792 |

|

Selling, general and administrative expenses | 8,519 |

| | 8,246 |

| | 40,562 |

| | 33,989 |

|

(Gain) loss on disposal of assets | (281 | ) | | 30 |

| | (305 | ) | | (22 | ) |

Income from operations | 16,953 |

| | 11,912 |

| | 68,006 |

| | 55,825 |

|

Interest income, net | 81 |

| | 70 |

| | 276 |

| | 221 |

|

Other (expense) income, net | (6 | ) | | (4 | ) | | (36 | ) | | 248 |

|

Income before taxes | 17,028 |

| | 11,978 |

| | 68,246 |

| | 56,294 |

|

Income tax provision | 6,495 |

| | 4,212 |

| | 24,088 |

| | 18,747 |

|

Net income | $ | 10,533 |

| | $ | 7,766 |

| | $ | 44,158 |

| | $ | 37,547 |

|

Earnings per share: | |

| | |

| | |

| | |

|

Basic* | $ | 0.19 |

| | $ | 0.14 |

| | $ | 0.81 |

| | $ | 0.68 |

|

Diluted* | $ | 0.19 |

| | $ | 0.14 |

| | $ | 0.80 |

| | $ | 0.68 |

|

Cash dividends declared per common share*: | $ | 0.09 |

| | $ | 0.07 |

| | $ | 0.18 |

| | $ | 0.13 |

|

Weighted average shares outstanding: | | | | | |

| | |

|

Basic* | 54,291,317 |

| | 55,181,840 |

| | 54,809,319 |

| | 55,119,150 |

|

Diluted* | 54,815,954 |

| | 55,416,734 |

| | 55,369,016 |

| | 55,587,381 |

|

*Reflects three-for-two stock split effective July 16, 2014

|

| | | | | | | |

AAON, Inc. and Subsidiaries |

Unaudited Consolidated Balance Sheets |

| December 31, |

| 2014 | | 2013 |

Assets | (in thousands, except share and per share data) |

Current assets: | | | |

Cash and cash equivalents | $ | 21,952 |

| | $ | 12,085 |

|

Certificates of deposit | 6,098 |

| | 8,110 |

|

Investments held to maturity at amortized cost | 11,972 |

| | 16,040 |

|

Accounts receivable, net | 44,092 |

| | 39,063 |

|

Income tax receivable | 2,569 |

| | 1,073 |

|

Note receivable | 30 |

| | 29 |

|

Inventories, net | 37,618 |

| | 32,140 |

|

Prepaid expenses and other | 609 |

| | 304 |

|

Deferred tax assets | 6,143 |

| | 4,779 |

|

Total current assets | 131,083 |

| | 113,623 |

|

Property, plant and equipment: | |

| | |

|

Land | 2,233 |

| | 1,417 |

|

Buildings | 64,938 |

| | 61,821 |

|

Machinery and equipment | 127,968 |

| | 119,439 |

|

Furniture and fixtures | 10,388 |

| | 9,748 |

|

Total property, plant and equipment | 205,527 |

| | 192,425 |

|

Less: Accumulated depreciation | 113,605 |

| | 105,142 |

|

Property, plant and equipment, net | 91,922 |

| | 87,283 |

|

Certificates of deposit | 5,280 |

| | 2,638 |

|

Investments held to maturity at amortized cost | 4,015 |

| | 10,981 |

|

Note receivable | 817 |

| | 919 |

|

Total assets | $ | 233,117 |

| | $ | 215,444 |

|

| | | |

Liabilities and Stockholders' Equity | |

| | |

|

Current liabilities: | |

| | |

|

Revolving credit facility | $ | — |

| | $ | — |

|

Accounts payable | 11,370 |

| | 7,779 |

|

Accrued liabilities | 31,343 |

| | 28,550 |

|

Total current liabilities | 42,713 |

| | 36,329 |

|

Deferred revenue | 1,006 |

| | 585 |

|

Deferred tax liabilities | 13,677 |

| | 14,424 |

|

Donations | 1,662 |

| | — |

|

Commitments and contingencies | | | |

Stockholders' equity: | |

| | |

|

Preferred stock, $.001 par value, 5,000,000 shares authorized, no shares issued | | | |

Common stock, $.004 par value, 100,000,000 shares authorized, 54,041,829 and 55,067,031 issued and outstanding at December 31, 2014 and 2013, respectively* | 216 |

| | 221 |

|

Additional paid-in capital | — |

| | — |

|

Retained earnings | 173,843 |

| | 163,885 |

|

Total stockholders' equity | 174,059 |

| | 164,106 |

|

Total liabilities and stockholders' equity | $ | 233,117 |

| | $ | 215,444 |

|

*Reflects three-for-two stock split effective July 16, 2014

|

| | | | | | | | | | | |

AAON, Inc. and Subsidiaries |

Unaudited Consolidated Statements of Cash Flows |

| Years Ending December 31, |

| 2014 | | 2013 | | 2012 |

Operating Activities | (in thousands) |

Net income | $ | 44,158 |

| | $ | 37,547 |

| | $ | 27,449 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | |

| | |

| | |

|

Depreciation | 11,553 |

| | 12,312 |

| | 13,407 |

|

Amortization of bond premiums | 688 |

| | 790 |

| | 155 |

|

Provision for losses on accounts receivable, net of adjustments | (22 | ) | | 141 |

| | (83 | ) |

Provision for excess and obsolete inventories | 135 |

| | 243 |

| | 63 |

|

Share-based compensation | 2,178 |

| | 1,763 |

| | 1,294 |

|

Excess tax benefits from stock options exercised and restricted stock awards vested | (1,239 | ) | | (843 | ) | | (393 | ) |

(Gain) loss on disposition of assets | (305 | ) | | (22 | ) | | 4 |

|

Foreign currency transaction loss (gain) | 74 |

| | 67 |

| | (27 | ) |

Interest income on note receivable | (36 | ) | | (40 | ) | | (42 | ) |

Deferred income taxes | (2,111 | ) | | (1,594 | ) | | (2,028 | ) |

Write-off of note receivable | — |

| | 75 |

| | — |

|

Changes in assets and liabilities: | |

| | |

| | |

Accounts receivable | (5,007 | ) | | 4,662 |

| | (9,646 | ) |

Income tax receivable | (257 | ) | | 464 |

| | 9,715 |

|

Inventories | (5,613 | ) | | 231 |

| | 2,271 |

|

Prepaid expenses and other | (305 | ) | | 436 |

| | (17 | ) |

Accounts payable | 3,512 |

| | (5,197 | ) | | 2,461 |

|

Deferred revenue | 782 |

| | 615 |

| | — |

|

Accrued liabilities | 4,094 |

| | 1,942 |

| | 6,584 |

|

Net cash provided by operating activities | 52,279 |

| | 53,592 |

| | 51,167 |

|

Investing Activities | |

| | |

| | |

Capital expenditures | (16,127 | ) | | (9,041 | ) | | (14,147 | ) |

Proceeds from sale of property, plant and equipment | 319 |

| | 92 |

| | 11 |

|

Investment in certificates of deposits | (9,940 | ) | | (9,108 | ) | | (6,540 | ) |

Maturities of certificates of deposits | 9,310 |

| | 3,600 |

| | 1,300 |

|

Purchases of investments held to maturity | (6,880 | ) | | (22,275 | ) | | (11,654 | ) |

Maturities of investments | 14,197 |

| | 2,005 |

| | — |

|

Proceeds from called investments | 3,029 |

| | 3,332 |

| | 626 |

|

Principal payments from note receivable | 63 |

| | 69 |

| | 69 |

|

Net cash used in investing activities | (6,029 | ) | | (31,326 | ) | | (30,335 | ) |

Financing Activities | |

| | |

| | |

Borrowings under revolving credit facility | — |

| | 8,325 |

| | 34,847 |

|

Payments under revolving credit facility | — |

| | (8,325 | ) | | (39,422 | ) |

Stock options exercised | 1,318 |

| | 1,467 |

| | 1,996 |

|

Excess tax benefits from stock options exercised and restricted stock awards vested | 1,239 |

| | 843 |

| | 393 |

|

Repurchase of stock | (29,284 | ) | | (8,222 | ) | | (6,660 | ) |

Cash dividends paid to stockholders | (9,656 | ) | | (7,428 | ) | | (8,840 | ) |

Net cash used in financing activities | (36,383 | ) | | (13,340 | ) | | (17,686 | ) |

Net increase in cash and cash equivalents | 9,867 |

| | 8,926 |

| | 3,146 |

|

Cash and cash equivalents, beginning of period | 12,085 |

| | 3,159 |

| | 13 |

|

Cash and cash equivalents, end of period | $ | 21,952 |

| | $ | 12,085 |

| | $ | 3,159 |

|

Use of Non-GAAP Financial Measures

To supplement the Company’s consolidated financial statements presented in accordance with generally accepted accounting principles (“GAAP”), additional non-GAAP financial measures are provided and reconciled in the following tables. The Company believes that these non-GAAP financial measures, when considered together with the GAAP financial measures, provide information that is useful to investors in understanding period-over-period operating results. The Company believes that these non-GAAP financial measures enhance the ability of investors to analyze the Company’s business trends and operating performance.

EBITDAX

EBITDAX (as defined below) is presented herein and reconciled from the GAAP measure of net income because of its wide acceptance by the investment community as a financial indicator of a company's ability to internally fund operations.

The Company defines EBITDAX as net income, plus (1) depreciation, (2) amortization of bond premiums, (3) share-based compensation, (4) interest (income) expense and (5) income tax expense. EBITDAX is not a measure of net income or cash flows as determined by GAAP.

The Company’s EBITDAX measure provides additional information which may be used to better understand the Company’s operations. EBITDAX is one of several metrics that the Company uses as a supplemental financial measurement in the evaluation of its business and should not be considered as an alternative to, or more meaningful than, net income, as an indicator of operating performance. Certain items excluded from EBITDAX are significant components in understanding and assessing a company's financial performance. EBITDAX, as used by the Company, may not be comparable to similarly titled measures reported by other companies. The Company believes that EBITDAX is a widely followed measure of operating performance and is one of many metrics used by the Company’s management team, and by other users of the Company’s consolidated financial statements.

The following table provides a reconciliation of net income (GAAP) to EBITDAX (non-GAAP) for the periods indicated:

|

| | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Years Ending

December 31, |

| |

| 2014 | | 2013 | | 2014 | | 2013 |

| (in thousands) |

Net Income, a GAAP measure | $ | 10,533 |

| | $ | 7,766 |

| | $ | 44,158 |

| | $ | 37,547 |

|

Depreciation | 2,893 |

| | 2,963 |

| | 11,553 |

| | 12,312 |

|

Amortization of bond premiums | 127 |

| | 245 |

| | 688 |

| | 790 |

|

Share-based compensation | 600 |

| | 709 |

| | 2,178 |

| | 1,763 |

|

Interest (income) expense | (81 | ) | | (70 | ) | | (276 | ) | | (221 | ) |

Income tax expense | 6,495 |

| | 4,212 |

| | 24,088 |

| | 18,747 |

|

EBITDAX, a non-GAAP measure | $ | 20,567 |

| | $ | 15,825 |

| | $ | 82,389 |

| | $ | 70,938 |

|

Adjusted Net Income and Adjusted Earnings per Share

The Company defines Adjusted Net Income and the related per share amount as (1) net income, plus (2) non-recurring donations, less (3) the impact on profit sharing expense from the non-recurring donations and (4) the impact on income tax expense from the non-recurring donations. These measures provide additional information which may be used to better understand the Company’s operations.

The following tables provide a reconciliation of net income and earnings per share-diluted (GAAP) to adjusted net income and adjusted earnings per share-diluted (non-GAAP) for the periods indicated:

|

| | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Years Ending

December 31, |

| |

| 2014 | | 2013 | | 2014 | | 2013 |

| (in thousands except per share data) |

Net Income, a GAAP measure | $ | 10,533 |

| | $ | 7,766 |

| | $ | 44,158 |

| | $ | 37,547 |

|

Non-recurring donations | 18 |

| | — |

| | 3,862 |

| | — |

|

Profit-sharing | (2 | ) | | — |

| | (386 | ) | | — |

|

Income tax expense | (6 | ) | | — |

| | (1,227 | ) | | — |

|

Adjusted Net Income, a non-GAAP measure | $ | 10,543 |

| | $ | 7,766 |

| | $ | 46,407 |

| | $ | 37,547 |

|

| | | | | | | |

Earnings per share-diluted, a GAAP measure | $ | 0.19 |

| | $ | 0.14 |

| | $ | 0.80 |

| | $ | 0.68 |

|

Non-recurring donations | — |

| | — |

| | 0.07 |

| | — |

|

Profit-sharing | — |

| | — |

| | (0.01 | ) | | — |

|

Income tax expense | — |

| | — |

| | (0.02 | ) | | — |

|

Adjusted earnings per share-diluted, a non-GAAP measure | $ | 0.19 |

| | $ | 0.14 |

| | $ | 0.84 |

| | $ | 0.68 |

|

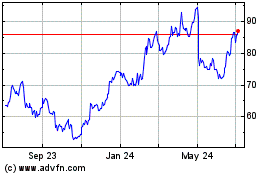

AAON (NASDAQ:AAON)

Historical Stock Chart

From Mar 2024 to Apr 2024

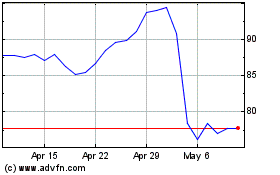

AAON (NASDAQ:AAON)

Historical Stock Chart

From Apr 2023 to Apr 2024