UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 26, 2015

ALPHATEC HOLDINGS, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Delaware |

|

000-52024 |

|

20-2463898 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

| 5818 El Camino Real, Carlsbad, CA |

|

92008 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (760) 431-9286

(Former Name or Former Address, if Changed Since Last Report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 |

Results of Operations and Financial Condition. |

On February 26, 2015, Alphatec

Holdings, Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended December 31, 2014 and the 2014 full fiscal year. A copy of the press release is attached to this Current Report on Form 8-K

as Exhibit 99.1 and is incorporated herein by reference. In accordance with General Instruction B-2 of Form 8-K, the information set forth in this Item 2.02 and in Exhibit 99.1 shall not be deemed to be “filed” for purposes of

Section 18 of the Securities and Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the

Exchange Act, except as expressly set forth by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

|

|

| 99.1 |

|

Press Release dated February 26, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

ALPHATEC HOLDINGS, INC.

(Registrant) |

|

|

| Date: February 26, 2015 |

|

/s/ Ebun S. Garner, Esq. |

|

|

Ebun S. Garner, Esq. |

|

|

General Counsel and Senior Vice President |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Alphatec Holdings Announces Fourth Quarter and Full Year 2014 Revenue and Financial Results

Company posts record sales and adjusted EBITDA for both fourth quarter and full year 2014

CARLSBAD, CA, February 26, 2015 – Alphatec Holdings, Inc. (Nasdaq: ATEC), the parent company of Alphatec Spine, Inc., a global provider of spinal

fusion technologies, announced today financial results for the fourth quarter and full year ended December 31, 2014.

| |

• |

|

Fourth quarter revenue of $53.6 million; 1.1% growth over 2013. 4.5% growth on a constant currency basis. |

| |

• |

|

Fourth quarter adjusted EBITDA of $8.3 million, 15.4% of revenue; 10.3% growth over 2013. |

| |

• |

|

Annual total revenue of $207.0 million; 1.1% growth over 2013. 2.5% growth on a constant currency basis. |

| |

• |

|

Full year adjusted EBITDA of $30.8 million, 14.9% of revenue; 22.4% growth over 2013. |

Highlights of

Alphatec’s Fiscal Year 2014

Progressively strengthened the quality of our business:

| |

• |

|

U.S. revenue of $137.1 million, representing 1.6% growth over full year 2013. |

| |

• |

|

International revenue of $69.9 million, representing 4.4% growth in constant currency over full year 2013. |

| |

• |

|

Revenues from international operations represent 34% of global revenues. |

| |

• |

|

Consolidated full year revenues were impacted by $2.9 million due to the devaluation of the Japanese Yen and Euro against the U.S. dollar. |

| |

• |

|

Adjusted EBITDA of approximately $31 million, or 15% of revenue. |

| |

• |

|

Consolidated gross margin improved 860 basis points to 69.3% from 60.7% in 2013. |

| |

• |

|

Successfully completed phase two of the U.S. beta launch of the Arsenal Spinal Fixation System, the Company’s innovative solution to treat the most complex degenerative pathologies. Full commercial launch of

Arsenal is underway. |

| |

• |

|

Biologics growth in the U.S. of over 14% in the fourth quarter of 2014. |

“2014 marked a transition year

for Alphatec Spine,” said Jim Corbett, President and CEO of Alphatec Spine, who joined the Company in May last year. “During the year, we substantially completed the restructuring of our French operations, settled the Orthotec

litigation, strengthened our executive leadership team, and achieved record-level adjusted EBITDA.”

Mr. Corbett added, “We still have work

to do in order to compete more effectively in the marketplace and create greater shareholder value. We have refocused the Company on a clear strategy aligned across the organization and begun executing initiatives intended to improve the fundamental

quality of our business. With the support of the Company’s highly engaged team, Alphatec is committed to making strides to accelerate growth and continue to improve profitability.”

-more-

Quarter Ended December 31, 2014

Consolidated net revenues for the fourth quarter of 2014 were $53.6 million, representing growth of approximately 1.1% compared to $53.1 million

reported for the fourth quarter of 2013, up 4.5% on a constant currency basis due to the strengthening of the U.S. Dollar. Consolidated revenues were adversely impacted by $1.3 million in foreign currency changes against the U.S. Dollar in the

fourth quarter, when compared to our third quarter 2014 exchange rates. Steep declines in the valuation of the Japanese Yen and Euro against the U.S. dollar in the fourth quarter were the primary contributors. Sequentially, consolidated net revenue

for the fourth quarter was up 5.1% compared to the third quarter of 2014.

U.S. net revenues for the fourth quarter of 2014 were $35.7 million, or

flat when compared to $35.7 million reported for the fourth quarter of 2013. Sequentially, U.S. revenue for the fourth quarter was 2.5% higher than the third quarter of 2014.

International net revenues for the fourth quarter of 2014 were $17.9 million, up 3.3% compared to $17.4 million for the fourth quarter of 2013,

or up 13.7% on a constant currency basis.

Consolidated gross profit and gross margin for the fourth quarter of 2014 were $37.7 million and

70.3%, respectively, compared to $35.3 million and 66.4%, respectively, for the fourth quarter of 2013.

Gross margin improvement in the fourth quarter of

390 basis points over the prior year is primarily due to continued diligence at managing costs and operational efficiencies, a reduction in depreciation expense, the ending of the Cross Medical settlement amortization, as well as reductions in one

time charges during the prior period, including the Company’s French restructuring.

Gross profit in the fourth quarter of 2014 increased 6.9% over

prior year. This improvement is due to continued diligence around managing overall costs and a reduction associated with non-recurring charges mentioned previously.

Total operating expenses for the fourth quarter of 2014 were $34.7 million, reflecting a decrease of approximately 62%. This decrease is primarily

attributable to the expenses related to the Orthotec legal matter and the restructuring of the Company’s French operations incurred in the fourth quarter of 2013. When operating expenses are compared with non-GAAP adjustments for the fourth

quarter of 2013, total operating expenses for the fourth quarter 2014 were down by 4.8%, or $1.7 million, mainly due to expense reductions and cost savings across the organization.

GAAP net loss for the fourth quarter of 2014 was $273 thousand or ($0.00) per share basic and ($0.03) per share diluted, compared to a net loss of

$60.4 million, or ($0.62) per share (basic and diluted) for the fourth quarter of 2013. Please refer to the table, “Alphatec Holdings, Inc. Reconciliation of Non-GAAP Financial Measures” that follows for more detailed information.

Adjusted EBITDA in the fourth quarter of 2014 was $8.3 million, or 15.4% of revenues, compared to $7.5 million, or 14.1% of revenues reported in the

fourth quarter of 2013. Fourth quarter 2014 adjusted EBITDA represents net income excluding effects of interest and other expenses, taxes, depreciation, amortization and stock-based compensation. Please refer to the table, “Alphatec Holdings,

Inc. Reconciliation of Non-GAAP Financial Measures” that follows for more detailed information.

Unrestricted cash and cash equivalents were

$19.7 million at December 31, 2014, compared to $21.3 million reported at December 31, 2013. Additionally, the Company has reported $6.8 million of current and non-current restricted cash, which must be used for future payment obligations

associated with the Orthotec settlement.

-more-

Year Ended December 31, 2014

Consolidated net revenues for full year 2014 were $207.0 million, representing growth of 1.1%, compared to $204.7 million reported for full year 2013,

or up 2.5% on a constant currency basis. Consolidated revenues were adversely impacted by $2.9 million in foreign currency changes against the U.S. Dollar for the full year 2014, predominantly changes against the Japanese Yen and Euro.

U.S. net revenues for full year 2014 were $137.1 million, representing growth of 1.6%, compared to $135.0 million reported for full year 2013.

International net revenues for full year 2014 were $69.9 million, or relatively flat on an as reported basis compared to $69.8

million for full year 2013, or up 4.4% on a constant currency basis.

Consolidated gross profit and gross margin for full year 2014 were

$143.4 million and 69.3%, respectively, compared to $124.3 million and 60.7%, respectively, for full year 2013.

Gross margin for the full year 2014

increased 860 basis points over the prior year primarily due to continued diligence at managing costs and operational efficiencies, the ending of the Cross Medical settlement amortization, as well as a reduction in one time charges during the prior

period including the Company’s French restructuring and discontinuation of its Puregen product.

Gross profit in the fourth quarter of 2014 increased

15.4% over prior year. The continued improvement is due to the benefits of an overall increase in sales volume, continued diligence around managing overall costs and a reduction in the cost of revenues associated with non-recurring charges mentioned

previously.

Total operating expenses for full year 2014 were $141.6 million, reflecting a decrease of 28.4% compared to full year 2013. This

decrease is primarily attributable to the absence of expenses related to the Orthoec legal matter and the restructuring of the Company’s French operations versus the full year of 2013. When operating expenses are compared with non-GAAP

adjustments for the full year of 2013, total operating expense for the full year of 2014 were down by almost 2%, or $2.3 million, mainly due to savings in general and administrative expense driven primarily by the absence of the Orthotec litigation

expenses offset by increased spending in R&D in 2014 associated with development and pre-commercialization of the Arsenal Spinal Fixation System. Please refer to the tables titled, “Alphatec Holdings, Inc. Non-GAAP Condensed Consolidated

Statement of Operations” that follow for more detailed information.

GAAP net loss for full year 2014 was $12.9 million or ($0.13) per share

basic and ($0.16) per share diluted, compared to a net loss of $82.2 million, or ($0.85) per share (basic and diluted) for full year 2013. Net loss, when adjusted for expense items related to the Orthoec legal matter and the restructuring of the

Company’s French operations discussed previously, IPR&D, as well as warrants issued in connection with the Deerfield credit facility, was $9.4 million for full year 2014, or ($0.10) per share basic and diluted, compared to a non-GAAP EPS

for the full year of 2013 of ($0.14) per share (basic and diluted). Please refer to the tables titled, “Alphatec Holdings, Inc. Non-GAAP Condensed Consolidated Statement of Operations” that follow for more detailed information.

Adjusted EBITDA for full year 2014 was $30.8 million, or 14.9% of revenues, compared to $25.2 million, or 12.3% of revenues reported for full year

2013. Full year 2014 adjusted EBITDA represents net income excluding effects of interest and other expenses, taxes, depreciation, amortization, stock-based compensation, IPR&D and the following items: a non-recurring expense of $4.8 million

associated with the settlement of the Orthotec litigation and trial-related litigation expenses and $706 thousand of expenses related to restructuring of the Company’s French operations. Please refer to the table, “Alphatec Holdings, Inc.

Reconciliation of Non-GAAP Financial Measures” that follows for more detailed information.

-more-

2015 Financial Guidance

The Company anticipates full year 2015 constant currency revenue growth of approximately 4% to 7% over 2014, which represents a range of revenue in constant

currency of $215 million to $222 million. Additionally, the Company expects annual adjusted EBITDA of $34 million to $37 million in 2015, representing a range of approximately 10% to 20% growth over 2014.

Conference Call

Alphatec Spine will webcast its

Quarterly Update Call today at 5:00 p.m. EDT / 2:00 p.m. PDT. Jim Corbett, President and CEO of Alphatec Spine, will lead the call. During the call the Company plans to provide further details underlying its fourth quarter 2014 financial results.

To access the webcast, please log on to www.alphatecspine.com approximately fifteen minutes prior to the call to register, download and install

any necessary audio software. For those without access to the internet, the live call may be accessed by phone by calling toll-free (877) 556-5251 (U.S. / Canada) or (720) 545-0036 (international), participant passcode number 80756901. A

replay of the call will also be available on the investor relations section of Alphatec Spine’s website for at least 30 days.

Non-GAAP

Information

Alphatec Spine reports certain non-GAAP financial measures such as non-GAAP earnings and earnings per share, adjusted for effects of

amortization and other non-recurring or expense items, such as loss on extinguishment of debt, restructuring expenses and transaction-related expenses. Adjusted EBITDA included in this press release is a non-GAAP financial measure that represents

net income (loss) excluding the effects of interest, taxes, depreciation, amortization, stock-based compensation expenses, in process research and development (IPR&D) expenses and other non-recurring income or expense items, such as severance

expense, litigation expenses, damages associated with ongoing litigation and transaction-related expenses. The Company believes that non-GAAP adjusted EBITDA provides investors with an additional tool for evaluating the Company’s core

performance, which management uses in its own evaluation of continuing operating performance, and a base-line for assessing the future earnings potential of the Company. For completeness, management uses non-GAAP adjusted EBITDA in conjunction with

GAAP earnings and earnings per common share measures. These non-GAPP financial measures should be considered in addition to, and not as a substitute for, or superior to, financial measures calculated in accordance with GAAP. Included below are

reconciliations of the non-GAAP financial measures to the comparable GAAP financial measure.

About Alphatec Spine

Alphatec Spine, Inc., a wholly owned subsidiary of Alphatec Holdings, Inc., is a global medical device company that designs, develops, manufactures and markets

spinal fusion technology products and solutions for the treatment of spinal disorders associated with disease and degeneration, congenital deformities and trauma. The Company’s mission is to improve lives by delivering advancements in spinal

fusion technologies. The Company and its affiliates market products in the U.S. and internationally via a direct sales force and independent distributors.

-more-

Additional information can be found at www.alphatecspine.com.

Forward Looking Statements

This press release may

contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainty. Such statements are based on management’s current expectations and are subject to a

number of risks and uncertainties that could cause actual results to differ materially from those described in the forward looking statements. Alphatec Spine cautions investors that there can be no assurance that actual results or business

conditions will not differ materially from those projected or suggested in such forward-looking statements as a result of various factors. Forward looking statements include the references to Alphatec Spine’s 2015 revenue guidance and 2015

adjusted EBITDA guidance; the success of the Company’s initiatives to drive global sales growth, increase margins and increase operating efficiencies. The important factors that could cause actual operating results to differ significantly

from those expressed or implied by such forward-looking statements include, but are not limited to: the uncertainty of success in developing new products or products currently in Alphatec Spine’s pipeline; the uncertainties in the

Company’s ability to execute upon is strategic operating plan; the uncertainties regarding the ability to successfully license or acquire new products, and the commercial success of such products; failure to achieve acceptance of Alphatec

Spine’s products by the surgeon community, including the Arsenal Spinal Fixation System and the Company’s biologics products; failure to successfully implement streamlining and lean activities to create anticipated savings; failure to

obtain FDA clearance or approval or international regulatory approvals for new products, including the products discussed in this press release, or unexpected or prolonged delays in the process; continuation of favorable third party payor

reimbursement for procedures performed using the Company’s products; unanticipated expenses or liabilities or other adverse events affecting cash flow or the Company’s ability to successfully control its costs or achieve profitability;

uncertainty of additional funding; the Company’s ability to compete with other competing products and with emerging new technologies; product liability exposure; an unsuccessful outcome in any material litigation in which the Company is a

defendant; patent infringement claims; claims related to the Company’s intellectual property and the Company’s ability to meet its financial obligations under its credit agreements and the Orthotec settlement agreement. The words

“believe,” “will,” “should,” “expect,” “intend,” “estimate” and “anticipate,” variations of such words and similar expressions identify forward-looking statements, but their

absence does not mean that a statement is not a forward-looking statement. Please refer to the risks detailed from time to time in Alphatec Spine’s SEC reports, including its Annual Report Form 10-K for the year ended December 31,

2013, filed on March 20, 2014 with the Securities and Exchange Commission, as well as other filings on Form 10-Q and periodic filings on Form 8-K. Alphatec Spine disclaims any intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events, or otherwise, unless required by law.

CONTACT: Investor/Media Contact:

Christine Zedelmayer

Investor Relations

Alphatec Spine, Inc.

(760) 494-6610

czedelmayer@alphatecspine.com

-more-

ALPHATEC HOLDINGS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts - unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Year Ended |

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Revenues |

|

$ |

53,627 |

|

|

$ |

53,065 |

|

|

$ |

206,980 |

|

|

$ |

204,724 |

|

| Cost of revenues |

|

|

15,529 |

|

|

|

17,366 |

|

|

|

61,834 |

|

|

|

78,669 |

|

| Amortization of acquired intangible assets |

|

|

408 |

|

|

|

444 |

|

|

|

1,736 |

|

|

|

1,733 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total cost of revenues |

|

|

15,937 |

|

|

|

17,810 |

|

|

|

63,570 |

|

|

|

80,402 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

37,690 |

|

|

|

35,255 |

|

|

|

143,410 |

|

|

|

124,322 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

3,661 |

|

|

|

3,814 |

|

|

|

16,799 |

|

|

|

14,190 |

|

| In-process research and development |

|

|

— |

|

|

|

— |

|

|

|

527 |

|

|

|

— |

|

| Sales and marketing |

|

|

20,634 |

|

|

|

21,156 |

|

|

|

77,179 |

|

|

|

76,960 |

|

| General and administrative |

|

|

9,705 |

|

|

|

13,931 |

|

|

|

43,381 |

|

|

|

47,949 |

|

| Amortization of acquired intangible assets |

|

|

717 |

|

|

|

754 |

|

|

|

2,974 |

|

|

|

3,009 |

|

| Litigation settlement |

|

|

— |

|

|

|

45,982 |

|

|

|

— |

|

|

|

45,982 |

|

| Restructuring expenses |

|

|

— |

|

|

|

5,620 |

|

|

|

706 |

|

|

|

9,665 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

34,717 |

|

|

|

91,257 |

|

|

|

141,566 |

|

|

|

197,755 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating loss |

|

|

2,973 |

|

|

|

(56,002 |

) |

|

|

1,844 |

|

|

|

(73,433 |

) |

| Interest and other income (expense), net |

|

|

(3,107 |

) |

|

|

(2,109 |

) |

|

|

(13,639 |

) |

|

|

(5,615 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from continuing operations before taxes |

|

|

(134 |

) |

|

|

(58,111 |

) |

|

|

(11,795 |

) |

|

|

(79,048 |

) |

| Income tax provision |

|

|

139 |

|

|

|

2,296 |

|

|

|

1,087 |

|

|

|

3,179 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(273 |

) |

|

$ |

(60,407 |

) |

|

$ |

(12,882 |

) |

|

$ |

(82,227 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic net loss per share |

|

$ |

(0.00 |

) |

|

$ |

(0.62 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.85 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted net loss per share |

|

$ |

(0.03 |

) |

|

$ |

(0.62 |

) |

|

$ |

(0.16 |

) |

|

$ |

(0.85 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

98,261 |

|

|

|

96,793 |

|

|

|

97,347 |

|

|

|

96,235 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

98,477 |

|

|

|

96,793 |

|

|

|

97,735 |

|

|

|

96,235 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-tables to follow -

ALPHATEC HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands - unaudited)

|

|

|

|

|

|

|

|

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2014 |

|

|

2013 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

19,735 |

|

|

$ |

21,345 |

|

| Restricted cash |

|

|

4,400 |

|

|

|

— |

|

| Accounts receivable, net |

|

|

40,440 |

|

|

|

41,395 |

|

| Inventories, net |

|

|

41,747 |

|

|

|

41,939 |

|

| Prepaid expenses and other current assets |

|

|

5,466 |

|

|

|

7,694 |

|

| Deferred income tax assets |

|

|

1,324 |

|

|

|

1,372 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

113,112 |

|

|

|

113,745 |

|

| Property and equipment, net |

|

|

26,040 |

|

|

|

28,030 |

|

| Goodwill |

|

|

171,333 |

|

|

|

183,004 |

|

| Intangibles, net |

|

|

30,259 |

|

|

|

39,064 |

|

| Other assets |

|

|

4,179 |

|

|

|

1,787 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

344,923 |

|

|

$ |

365,630 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

10,130 |

|

|

$ |

10,790 |

|

| Accrued expenses |

|

|

35,393 |

|

|

|

62,996 |

|

| Deferred revenue |

|

|

1,300 |

|

|

|

1,009 |

|

| Common stock warrant liabilities |

|

|

8,702 |

|

|

|

— |

|

| Current portion of long-term debt |

|

|

8,076 |

|

|

|

4,924 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

63,601 |

|

|

|

79,719 |

|

| Total long term liabilities |

|

|

108,765 |

|

|

|

90,632 |

|

| Redeemable preferred stock |

|

|

23,603 |

|

|

|

23,603 |

|

| Stockholders’ equity |

|

|

148,954 |

|

|

|

171,676 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

344,923 |

|

|

$ |

365,630 |

|

|

|

|

|

|

|

|

|

|

-tables to follow -

ALPHATEC HOLDINGS, INC.

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

(in thousands, except per share amounts - unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Year Ended |

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2013 |

|

| Operating loss, as reported |

|

$ |

2,973 |

|

|

$ |

(56,002 |

) |

|

$ |

1,844 |

|

|

$ |

(73,433 |

) |

| Add back: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation |

|

|

2,913 |

|

|

|

3,786 |

|

|

|

12,160 |

|

|

|

14,638 |

|

| Amortization of intangible assets |

|

|

341 |

|

|

|

1,330 |

|

|

|

1,515 |

|

|

|

6,898 |

|

| Amortization of acquired intangible assets |

|

|

1,125 |

|

|

|

1,197 |

|

|

|

4,710 |

|

|

|

4,741 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total EBITDA |

|

|

7,352 |

|

|

|

(49,689 |

) |

|

|

20,229 |

|

|

|

(47,156 |

) |

| Add back significant items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

913 |

|

|

|

1,246 |

|

|

|

4,554 |

|

|

|

4,078 |

|

| In-process research and development |

|

|

— |

|

|

|

— |

|

|

|

527 |

|

|

|

— |

|

| Litigation settlement and trial costs |

|

|

— |

|

|

|

49,657 |

|

|

|

4,779 |

|

|

|

49,657 |

|

| Restructuring and other charges |

|

|

— |

|

|

|

6,282 |

|

|

|

742 |

|

|

|

18,603 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA, as adjusted for significant items |

|

$ |

8,265 |

|

|

$ |

7,496 |

|

|

$ |

30,831 |

|

|

$ |

25,182 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss, as reported |

|

$ |

(273 |

) |

|

$ |

(60,407 |

) |

|

$ |

(12,882 |

) |

|

$ |

(82,227 |

) |

| Add back: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| In-process research and development |

|

|

— |

|

|

|

— |

|

|

|

527 |

|

|

|

— |

|

| Amortization of acquired intangible assets |

|

|

1,125 |

|

|

|

1,197 |

|

|

|

4,710 |

|

|

|

4,741 |

|

| Amortization of intangible assets |

|

|

341 |

|

|

|

1,330 |

|

|

|

1,515 |

|

|

|

6,898 |

|

| Warrant fair value adjustment |

|

|

(2,870 |

) |

|

|

— |

|

|

|

(2,578 |

) |

|

|

— |

|

| Litigation settlement and trial costs |

|

|

— |

|

|

|

49,657 |

|

|

|

4,779 |

|

|

|

49,657 |

|

| Restructuring and other charges |

|

|

— |

|

|

|

6,282 |

|

|

|

742 |

|

|

|

18,603 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss, as adjusted for significant items |

|

$ |

(1,677 |

) |

|

$ |

(1,941 |

) |

|

$ |

(3,187 |

) |

|

$ |

(2,328 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per common share - basic and diluted |

|

$ |

(0.00 |

) |

|

$ |

(0.62 |

) |

|

$ |

(0.13 |

) |

|

$ |

(0.85 |

) |

| Add back: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| In-process research and development |

|

|

— |

|

|

|

— |

|

|

|

0.01 |

|

|

|

— |

|

| Amortization of acquired intangible assets |

|

|

0.01 |

|

|

|

0.01 |

|

|

|

0.05 |

|

|

|

0.05 |

|

| Amortization of intangible assets |

|

|

0.00 |

|

|

|

0.01 |

|

|

|

0.02 |

|

|

|

0.07 |

|

| Warrant fair value adjustment |

|

|

(0.03 |

) |

|

|

— |

|

|

|

(0.03 |

) |

|

|

— |

|

| Litigation settlement and trial costs |

|

|

— |

|

|

|

0.51 |

|

|

|

0.05 |

|

|

|

0.52 |

|

| Restructuring and other charges |

|

|

— |

|

|

|

0.06 |

|

|

|

0.01 |

|

|

|

0.19 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per common share - basic and diluted, as adjusted for significant items |

|

$ |

(0.02 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.02 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average shares - basic and diluted |

|

|

98,261 |

|

|

|

96,793 |

|

|

|

97,347 |

|

|

|

96,235 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALPHATEC HOLDINGS, INC.

RECONCILIATION OF GEOGRAPHIC SEGMENT REVENUES AND GROSS PROFIT

(in thousands, except percentages - unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

|

|

|

|

|

|

% Change |

|

| |

|

December 31, |

|

|

% Change |

|

|

% Change |

|

|

Foreign |

|

| |

|

2014 |

|

|

2013 |

|

|

As Reported |

|

|

Operations |

|

|

Currency |

|

| Revenues by geographic segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. |

|

$ |

35,683 |

|

|

$ |

35,702 |

|

|

|

-0.1 |

% |

|

|

-0.1 |

% |

|

|

0.0 |

% |

| International |

|

|

17,944 |

|

|

|

17,363 |

|

|

|

3.3 |

% |

|

|

13.7 |

% |

|

|

-10.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

$ |

53,627 |

|

|

$ |

53,065 |

|

|

|

1.1 |

% |

|

|

4.5 |

% |

|

|

-3.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit by geographic segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. |

|

$ |

26,358 |

|

|

$ |

26,058 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| International |

|

|

11,332 |

|

|

|

9,197 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total gross profit |

|

$ |

37,690 |

|

|

$ |

35,255 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit margin by geographic segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. |

|

|

73.9 |

% |

|

|

73.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| International |

|

|

63.2 |

% |

|

|

53.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total gross profit margin |

|

|

70.3 |

% |

|

|

66.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year Ended |

|

|

|

|

|

|

|

|

% Change |

|

| |

|

December 31, |

|

|

% Change |

|

|

% Change |

|

|

Foreign |

|

| |

|

2014 |

|

|

2013 |

|

|

As Reported |

|

|

Operations |

|

|

Currency |

|

| Revenues by geographic segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. |

|

$ |

137,060 |

|

|

$ |

134,951 |

|

|

|

1.6 |

% |

|

|

1.6 |

% |

|

|

0.0 |

% |

| International |

|

|

69,920 |

|

|

|

69,773 |

|

|

|

0.2 |

% |

|

|

4.4 |

% |

|

|

-4.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenues |

|

$ |

206,980 |

|

|

$ |

204,724 |

|

|

|

1.1 |

% |

|

|

2.5 |

% |

|

|

-1.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit by geographic segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. |

|

$ |

100,568 |

|

|

$ |

88,900 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| International |

|

|

42,842 |

|

|

|

35,422 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total gross profit |

|

$ |

143,410 |

|

|

$ |

124,322 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit margin by geographic segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| U.S. |

|

|

73.4 |

% |

|

|

65.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| International |

|

|

61.3 |

% |

|

|

50.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total gross profit margin |

|

|

69.3 |

% |

|

|

60.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Footnotes:

| 1) |

The impact from foreign currency represents the percentage change in 2014 revenues due to the change in foreign exchange rates for the periods presented. |

ALPHATEC HOLDINGS, INC.

NON-GAAP CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts - unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, 2014 |

|

| |

|

|

|

|

Non-GAAP |

|

|

|

|

| |

|

GAAP |

|

|

Adjustments |

|

|

Non-GAAP |

|

| Revenues |

|

$ |

53,627 |

|

|

$ |

— |

|

|

$ |

53,627 |

|

| Cost of revenues |

|

|

15,529 |

|

|

|

— |

|

|

|

15,529 |

|

| Amortization of acquired intangible assets |

|

|

408 |

|

|

|

— |

|

|

|

408 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total cost of revenues |

|

|

15,937 |

|

|

|

— |

|

|

|

15,937 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

37,690 |

|

|

|

— |

|

|

|

37,690 |

|

|

|

|

70.3 |

% |

|

|

|

|

|

|

70.3 |

% |

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

3,661 |

|

|

|

— |

|

|

|

3,661 |

|

| In-process research and development |

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Sales and marketing |

|

|

20,634 |

|

|

|

— |

|

|

|

20,634 |

|

| General and administrative |

|

|

9,705 |

|

|

|

— |

|

|

|

9,705 |

|

| Amortization of acquired intangible assets |

|

|

717 |

|

|

|

— |

|

|

|

717 |

|

| Transaction related costs |

|

|

— |

|

|

|

|

|

|

|

— |

|

| Litigation settlement |

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Restructuring expenses |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

34,717 |

|

|

|

— |

|

|

|

34,717 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating loss |

|

|

2,973 |

|

|

|

— |

|

|

|

2,973 |

|

| Interest and other income (expense), net |

|

|

(3,107 |

) |

|

|

(2,870 |

) (a) |

|

|

(5,977 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from continuing operations before taxes |

|

|

(134 |

) |

|

|

(2,870 |

) |

|

|

(3,003 |

) |

| Income tax provision |

|

|

139 |

|

|

|

— |

|

|

|

139 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(273 |

) |

|

$ |

(2,870 |

) |

|

$ |

(3,142 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year Ended December 31, 2014 |

|

| |

|

|

|

|

Non-GAAP |

|

|

|

|

| |

|

GAAP |

|

|

Adjustments |

|

|

Non-GAAP |

|

| Revenues |

|

$ |

206,980 |

|

|

$ |

— |

|

|

$ |

206,980 |

|

| Cost of revenues |

|

|

61,834 |

|

|

|

— |

|

|

|

61,834 |

|

| Amortization of acquired intangible assets |

|

|

1,736 |

|

|

|

— |

|

|

|

1,736 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total cost of revenues |

|

|

63,570 |

|

|

|

— |

|

|

|

63,570 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

143,410 |

|

|

|

— |

|

|

|

143,410 |

|

|

|

|

69.3 |

% |

|

|

|

|

|

|

69.3 |

% |

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

16,799 |

|

|

|

— |

|

|

|

16,799 |

|

| In-process research and development |

|

|

527 |

|

|

|

(527 |

) (b) |

|

|

— |

|

| Sales and marketing |

|

|

77,179 |

|

|

|

— |

|

|

|

77,179 |

|

| General and administrative |

|

|

43,381 |

|

|

|

(4,779 |

) (c) |

|

|

38,602 |

|

| Amortization of acquired intangible assets |

|

|

2,974 |

|

|

|

— |

|

|

|

2,974 |

|

| Litigation settlement |

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Restructuring expenses |

|

|

706 |

|

|

|

(776 |

) (d) |

|

|

(70.00 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

141,566 |

|

|

|

(6,082 |

) |

|

|

135,484 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating loss |

|

|

1,844 |

|

|

|

6,082 |

|

|

|

7,926 |

|

| Interest and other income (expense), net |

|

|

(13,639 |

) |

|

|

(2,578 |

) (a) |

|

|

(16,217 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from continuing operations before taxes |

|

|

(11,795 |

) |

|

|

3,504 |

|

|

|

(8,290 |

) |

| Income tax provision |

|

|

1,087 |

|

|

|

— |

|

|

|

1,087 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(12,882 |

) |

|

$ |

3,504 |

|

|

$ |

(9,377 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes:

| (a) |

Consists of warrant fair value adjustment. |

| (b) |

Represents initial payments for products that are not considered technologically feasible upon acquisition. |

| (c) |

Consists of Orthotec litigation trial related costs. |

| (d) |

Employee severance and facility closing costs accrued for the restructuring of the Company’s French operations. |

ALPHATEC HOLDINGS, INC.

NON-GAAP CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts - unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, 2013 |

|

| |

|

|

|

|

Non-GAAP |

|

|

|

|

| |

|

GAAP |

|

|

Adjustments |

|

|

Non-GAAP |

|

| Revenues |

|

$ |

53,065 |

|

|

$ |

— |

|

|

$ |

53,065 |

|

| Cost of revenues |

|

|

17,366 |

|

|

|

(1,131 |

) (a) |

|

|

16,235 |

|

| Amortization of acquired intangible assets |

|

|

444 |

|

|

|

— |

|

|

|

444 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total cost of revenues |

|

|

17,810 |

|

|

|

(1,131 |

) |

|

|

16,679 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

35,255 |

|

|

|

1,131 |

|

|

|

36,386 |

|

|

|

|

66.4 |

% |

|

|

|

|

|

|

68.6 |

% |

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

3,814 |

|

|

|

— |

|

|

|

3,814 |

|

| Sales and marketing |

|

|

21,156 |

|

|

|

— |

|

|

|

21,156 |

|

| General and administrative |

|

|

13,931 |

|

|

|

(3,206 |

) (b) |

|

|

10,725 |

|

| Amortization of acquired intangible assets |

|

|

754 |

|

|

|

— |

|

|

|

754 |

|

| Litigation settlement |

|

|

45,982 |

|

|

|

(45,982 |

) (c) |

|

|

— |

|

| Restructuring expenses |

|

|

5,620 |

|

|

|

(5,620 |

) (d) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

91,257 |

|

|

|

(54,808 |

) |

|

|

36,449 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating loss |

|

|

(56,002 |

) |

|

|

55,939 |

|

|

|

(63 |

) |

| Interest and other income (expense), net |

|

|

(2,109 |

) |

|

|

— |

|

|

|

(2,109 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from continuing operations before taxes |

|

|

(58,111 |

) |

|

|

55,939 |

|

|

|

(2,171 |

) |

| Income tax provision |

|

|

2,296 |

|

|

|

— |

|

|

|

2,296 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(60,407 |

) |

|

$ |

55,939 |

|

|

$ |

(4,468 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Year Ended December 31, 2013 |

|

| |

|

|

|

|

Non-GAAP |

|

|

|

|

| |

|

GAAP |

|

|

Adjustments |

|

|

Non-GAAP |

|

| Revenues |

|

$ |

204,724 |

|

|

$ |

— |

|

|

$ |

204,724 |

|

| Cost of revenues |

|

|

78,669 |

|

|

|

(9,176 |

) (a) (e) |

|

|

69,493 |

|

| Amortization of acquired intangible assets |

|

|

1,733 |

|

|

|

— |

|

|

|

1,733 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total cost of revenues |

|

|

80,402 |

|

|

|

(9,176 |

) |

|

|

71,226 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

124,322 |

|

|

|

9,176 |

|

|

|

133,498 |

|

|

|

|

60.7 |

% |

|

|

|

|

|

|

65.2 |

% |

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

|

14,190 |

|

|

|

(162 |

) (f) |

|

|

14,028 |

|

| Sales and marketing |

|

|

76,960 |

|

|

|

— |

|

|

|

76,960 |

|

| General and administrative |

|

|

47,949 |

|

|

|

(4,168 |

) (b) (g) |

|

|

43,781 |

|

| Amortization of acquired intangible assets |

|

|

3,009 |

|

|

|

— |

|

|

|

3,009 |

|

| Litigation settlement |

|

|

45,982 |

|

|

|

(45,982 |

) (c) |

|

|

— |

|

| Restructuring expenses |

|

|

9,665 |

|

|

|

(9,665 |

) (d) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

197,755 |

|

|

|

(59,977 |

) |

|

|

137,778 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating loss |

|

|

(73,433 |

) |

|

|

69,153 |

|

|

|

(4,280 |

) |

| Interest and other income (expense), net |

|

|

(5,615 |

) |

|

|

— |

|

|

|

(5,615 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from continuing operations before taxes |

|

|

(79,047 |

) |

|

|

69,153 |

|

|

|

(9,894 |

) |

| Income tax provision |

|

|

3,179 |

|

|

|

— |

|

|

|

3,179 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(82,227 |

) |

|

$ |

69,153 |

|

|

$ |

(13,074 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes:

| (a) |

Record inventory and instrument net book value adjustment and other costs of $1.1 million and $5.6 million for the three months and year ended December 31, 2013, respectively, related to the restructuring of the

Company’s French operations. |

| (b) |

Amount consists of Orthotec ltigation trial related costs of $3.7 million, partially offset by Phygen related escrow claim. |

| (c) |

Litigation settlement related to the Orthotec litigation. |

| (d) |

Employee severance and facility closing costs accrued for the restructuring of the Company’s French operations. |

| (e) |

Includes write-off of inventory and intangibles of $3.5 million related to the Company’s Puregen product. |

| (f) |

Expense related to research and development technology. |

| (g) |

Amount includes Phygen related acquisition costs of $0.4 million. |

# # #

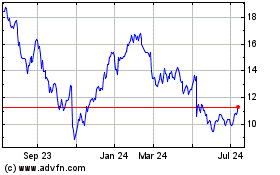

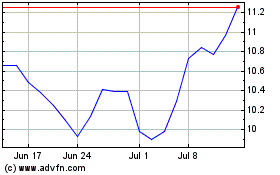

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alphatec (NASDAQ:ATEC)

Historical Stock Chart

From Apr 2023 to Apr 2024