UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported):February 20, 2015

AGENUS

INC.

(Exact

name of registrant as specified in its charter)

|

DELAWARE

|

000-29089

|

06-1562417

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

|

3 Forbes Road

Lexington, MA

|

02421

|

|

(Address

of Principal Executive Offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code 781-674-4400

N/A

(Former

Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions (see General Instruction A.2. below):

⃞

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR

230.425)

⃞

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

⃞

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b))

⃞

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c))

Item 2.03 Creation of a Direct Financial Obligation or an Obligation

under an Off-Balance Sheet Arrangement of a Registrant.

As previously disclosed, Agenus Inc. (the “Company”) is party to a Note

Purchase Agreement dated April 15, 2013, pursuant to which the Company

issued to certain investors (the “Existing Investors”) (i) senior

subordinated promissory notes in the aggregate principal amount of $5.0

million that were scheduled to mature on April 14, 2015 (the “2013

Notes”) and (ii) warrants to purchase 500,000 shares of the Company’s

common stock.

On February 20, 2015, the Company, the Existing Investors and certain

additional investors entered into an Amended and Restated Note Purchase

Agreement (the “Purchase Agreement”), pursuant to which the Company (i)

cancelled the 2013 Notes in exchange for new senior subordinated

promissory notes (the “2015 Notes”) in the aggregate principal amount of

$5.0 million, (ii) issued additional 2015 Notes in the aggregate

principal amount of $9.0 million and (iii) issued warrants to purchase

1,400,000 shares of the Company’s common stock (the “Warrants”).

The 2015 Notes bear interest at a rate of 8% per annum, payable in cash

on the first day of each month in arrears. Among other default and

acceleration terms customary for indebtedness of this type, the 2015

Notes include default provisions which allow for the acceleration of the

principal payment of the 2015 Notes in the event the Company becomes

involved in certain bankruptcy proceedings, becomes insolvent, fails to

make a payment of principal or (after a grace period) interest on the

2015 Notes, defaults on other indebtedness with an aggregate principal

balance of $13.5 million or more if such default has the effect of

accelerating the maturity of such indebtedness, or becomes subject to a

legal judgment or similar order for the payment of money in an amount

greater than $13.5 million if such amount will not be covered by

third-party insurance. The 2015 Notes are not convertible and will

mature on February 20, 2018, at which point the Company must repay the

outstanding balance in cash. The Company may prepay the 2015 Notes at

any time, in part or in full, without premium or penalty.

The Warrants have a term of five years and an exercise price of $5.10

per share.

The securities issued in connection with the Purchase Agreement were

issued in reliance on the exemption from registration provided by

Section 4(2) of the Securities Act of 1933, as amended (the “Securities

Act”). Neither the Warrants nor the underlying shares of common stock

have been registered under the Securities Act. Neither the Warrants nor

such underlying shares of common stock may be offered or sold in the

United States absent registration or an applicable exemption from

registration requirements. No commission or other remuneration was paid

or given directly or indirectly for soliciting such issuance.

Item 2.02 Results of Operations and Financial Condition.

On February 26, 2015, the Company announced its financial results for

the quarter and year ended December 31, 2014. The full text of the press

release issued in connection with the announcement is being furnished as

Exhibit 99.1 to this Current Report on Form 8-K.

The information set forth under Item 2.02 and in Exhibit 99.1 attached

hereto is intended to be furnished and shall not be deemed “filed” for

purposes of Section 18 of the Securities Exchange Act of 1934 or

otherwise subject to the liabilities of that section, nor shall it be

deemed incorporated by reference in any filing under the Securities Act

of 1933, except as expressly set forth by specific reference in such

filing.

Item 3.02 Unregistered Sales of Equity Securities.

The information provided above under Item 2.03 of this Current Report on

Form 8-K is hereby incorporated by reference into this Item 3.02.

Item 5.02 Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

(b) On February 23, 2015, Tom Dechaene, a member of the Company’s board

of directors (the “Board”), informed the Company of his intention to

resign from the Board effective as of December 31, 2015. Mr. Dechaene

will continue to serve as a director until such date. Mr. Dechaene’s

decision is required by his role as an executive director of the

National Bank of Belgium and is not due to any disagreement with the

Company on any matter relating to the Company’s operations, policies or

practices.

Item 9.01 Financial Statements and Exhibits.

(d)

Exhibits

The following exhibit is furnished herewith:

99.1 Press

Release dated February 26, 2015

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

AGENUS INC.

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

February 26, 2015

|

|

By:

|

/s/ Garo H. Armen

|

|

|

|

|

|

Garo H. Armen

|

|

|

|

|

Chairman and CEO

|

EXHIBIT INDEX

Exhibit No. Description

of Exhibit

99.1 Press Release dated

February 26, 2015

Exhibit 99.1

Agenus

Reports Fourth Quarter and Full Year 2014 Financial Results

Agenus

to host conference call at 11 a.m. ET today

LEXINGTON, Mass.--(BUSINESS WIRE)--February 26, 2015--Agenus Inc.

(NASDAQ:AGEN), an immunology company developing novel therapeutic

approaches based on checkpoint modulators (CPMs), heat shock

protein-based vaccines, and immune adjuvants, today announced its

financial results and business highlights for the fourth quarter and

year ended December 31, 2014.

“2014 was a transformative year for Agenus on many levels,” said Garo H.

Armen, Ph.D., Chairman and CEO of Agenus. “We started the year with the

acquisition of privately held 4-Antibody AG, which brought us into the

critically important field of checkpoint modulators. Through this

acquisition, Agenus acquired our Retrocyte DisplayTM

technology, for the generation of antibody therapeutics, as well as a

broad portfolio of checkpoint programs. In April, we announced a

collaboration and license agreement with Merck around two undisclosed

checkpoint targets, with Agenus eligible to receive up to $100 million

in milestone payments as well as royalties on product sales. In June, we

reported positive data from a Phase 2 study of our heat shock

protein-based synthetic vaccine (HerpV) for the treatment of genital

herpes, and shortly thereafter we announced positive results from a

Phase 2 study of our heat shock-protein-based autologous vaccine

(Prophage) in patients with newly diagnosed glioblastoma multiforme

(GBM). In addition, our partner GlaxoSmithKline’s application for

regulatory review of its malaria vaccine candidate, RTS,S, was accepted

by the European Medicines Agency. The application was based on positive

Phase 3 data for RTS,S, which contains Agenus’ proprietary QS-21 Stimulon®

adjuvant. In December, GlaxoSmithKline reported that its Phase 3 study

with shingles vaccine candidate HZ/su, which also contains Agenus’

proprietary QS-21 Stimulon® adjuvant, met its primary

endpoint and reduced the risk of shingles by an unprecedented 97.2% in

adults aged 50 years and older compared to placebo. Building on our

achievements in 2014, we started 2015 with a transformative global

oncology alliance with Incyte that includes, but is not limited to, four

of our checkpoint programs. We look forward to executing on our

alliances with Incyte and Merck, and expanding our portfolio of

antibody-based therapeutics as we pursue the development of novel single

agent and combination therapies for cancer patients.”

“Supporting these initiatives has required a growth in the breadth and

depth of our R&D capabilities, including the assembly of a world-class

translational biology team,” said Robert Stein, M.D., Ph.D., Chief

Scientific Officer of Agenus. “We believe our partnership with Incyte

leverages their track record of success in the discovery and development

of important new cancer therapies, with our therapeutic antibody

expertise, as well as our shared objectives in immuno-oncology. Our

alliance aims to accelerate the development of novel checkpoint

modulators in oncology, as single agent and combination therapies, while

also allowing Agenus the ability to independently advance other antibody

therapies and heat shock protein-based vaccines.”

Fourth Quarter 2014 and Full Year Financial Update

Cash, cash equivalents and short-term investments were $40.2 million as

of December 31, 2014. Subsequent to year-end, the company received an

additional $60 million from its global alliance with Incyte.

For the fourth quarter, Agenus reported a net loss attributable to

common stockholders of $26.0 million, including $14.3 million of

non-cash charges, or $0.41 per share, basic and diluted, compared with a

net loss attributable to common stockholders for the fourth quarter of

2013 of $5.8 million, or $0.16 per share, basic and diluted.

For the year ended December 31, 2014, the company incurred a net loss

attributable to common stockholders of $42.7 million, or $0.71 per

share, basic and diluted, compared with a net loss attributable to

common stockholders of $33.2 million, or $1.12 per share, basic and

diluted, for the comparable period in 2013.

The increase in net loss attributable to common stockholders for the

year ended December 31, 2014, compared to the net loss attributable to

common stockholders for the same period in 2013, was primarily due to

our acquisition of 4-Antibody AG in February 2014. In addition to

increased operating expenses, we recorded non-cash expense of $6.7

million due to the fair value adjustment of the contingent purchase

price consideration and non-cash income of $3.1 million related to the

results of various trials of QS-21 Stimulon containing vaccines at

GlaxoSmithKline.

During the same period of 2013, the company’s preferred stock

restructuring resulted in a non-cash deemed dividend of $2.9 million,

and the retirement of its then outstanding $39 million 8.0% senior

secured convertible notes due August 2014 resulted in a non-cash expense

of $3.3 million.

The increased net loss attributable to common stockholders for the

quarter ended December 31, 2014, compared to the net loss attributable

to common stockholders for the same period in 2013, was as well due to

increased expenses related to our acquisition of 4-Anitbody AG. We also

recorded non-cash expenses for the quarter ended December 31, 2014 of

$6.6 million, due to the fair value adjustment of the contingent

purchase price consideration, and $7.7 million related to the fair value

adjustment of our contingent royalty obligation.

2014 Highlights:

-

January: Agenus signed a definitive agreement to acquire

privately held 4-Antibody AG, with its proprietary Retrocyte DisplayTM

technology and a broad preclinical portfolio of checkpoint modulators

targeting GITR, OX40, TIM-3 and LAG-3, among others. The acquisition

closed in February 2014.

-

February: Agenus closed a public offering that resulted in net

proceeds of approximately $56 million.

-

April: Agenus entered into a collaboration and license

agreement with Merck, involving generation by Agenus of fully human

antibodies against two undisclosed checkpoint targets from Merck, in

exchange for up to $100 million in potential milestones, as well as

royalties on worldwide product sales.

-

June: Agenus announced positive data from a randomized double

blind Phase 2 study involving its heat shock protein-based vaccine

candidate, HerpV, for the treatment of adult genital herpes. The study

showed a statistically significant reduction in viral load in the more

than half of patients who generated a robust anti-HSV cytotoxic T-cell

immune response.

-

July: Agenus announced positive data from a single arm Phase 2

study involving its heat shock protein-based autologous vaccine,

Prophage, in the setting of GBM. The data showed patients treated with

Prophage achieved a median overall survival of 23.8 months, compared

with the historical expectation of about 16 months median survival

with the standard of care. Subsequently, an end of Phase 2 meeting was

held with the FDA.

-

July: The EMA accepted GlaxoSmithKline’s application for

regulatory review of its malaria vaccine candidate, RTS,S, based on

positive data from a large Phase 3 study involving over 16,000

children. The vaccine contains Agenus’ proprietary QS-21 Stimulon®

adjuvant, and Agenus is eligible to receive low single digit royalties

on any future product sales.

-

December: Agenus announced positive data from our partner

GlaxoSmithKline’s ZOE-50 Phase 3 trial involving its HZ/su vaccine

candidate for the prevention of shingles in adults aged 50 and over.

The study showed an unprecedented 97.2% efficacy rate in the

prevention of shingles compared to placebo. Full study results will be

submitted for publication this year and presented at a forthcoming

medical conference. The vaccine candidate contains Agenus’ proprietary

QS-21 Stimulon® adjuvant, and Agenus is eligible to receive low single

digit royalties on any future product sales.

Target Milestones for 2015 include:

-

Publication of the Phase 2 data for Prophage in newly diagnosed GBM in

a peer reviewed journal. Explore options for the advancement of

Prophage for newly diagnosed GBM to a Phase 3 trial.

-

Full Phase 3 data for partner GlaxoSmithKline’s HZ/su shingles vaccine

are expected to be presented at a scientific conference and submitted

for publication in a peer-reviewed journal. The vaccine contains

Agenus’ proprietary QS-21 Stimulon® adjuvant.

-

EMA regulatory decision on GlaxoSmithKline’s malaria vaccine candidate

RTS,S, which contains Agenus’s QS-21 Stimulon® adjuvant.

-

File Investigational New Drug (IND) applications for two checkpoint

modulator antibody programs as part of our global oncology alliance

with Incyte.

Conference Call and Web Cast Information

Agenus executives will host a conference call at 11:00 a.m. Eastern Time

today. To access the live call, dial 866-233-4585 (U.S.) or 416-640-5946

(international). The live and archived webcast of the presentation will

be accessible from the Company’s website at www.agenusbio.com/webcast.

Please log in approximately 5-10 minutes before the call to ensure a

timely connection. The archived replay will be available on the Agenus

website for 60 days. The replay number is 866-245-6755 (U.S.) or

416-915-1035 (international), and the access code is 55109. The replay

will also be available on the Company’s website approximately two hours

after the live call.

About Agenus

Agenus is an immunology company developing a series of immuno-oncology

CPMs, heat shock protein peptide-based vaccines and immune adjuvants.

These programs are supported by three separate technology platforms.

Agenus’ checkpoint modulator programs target GITR, OX40, CTLA-4, LAG-3,

TIM-3 and PD-1. The Company’s proprietary discovery engine Retrocyte

DisplayTM is used to generate fully human and humanized

therapeutic antibody drug candidates. The Retrocyte DisplayTM

platform uses a high-throughput approach incorporating IgG format human

antibody libraries expressed in mammalian B-lineage cells. Agenus’ heat

shock protein vaccines have completed Phase 2 studies in newly diagnosed

glioblastoma multiforme, and in the treatment of herpes simplex viral

infection; the heat shock protein platform can generate personalized as

well as off the shelf products. The Company’s QS-21 Stimulon® adjuvant

platform is extensively partnered with GlaxoSmithKline and Janssen

Sciences Ireland UC and includes several candidates in Phase 2, as well

as shingles and malaria vaccines which have successfully completed Phase

3 clinical trials. For more information, please visit www.agenusbio.com,

or connect with the company on Facebook, LinkedIn, Twitter and Google+.

Forward-Looking Statement

This press release contains forward-looking statements that are made

pursuant to the safe harbor provisions of the federal securities laws,

including statements regarding the Company’s research and development

and clinical trial activities, potential revenue streams, potential

regulatory approvals, the potential application of the Company’s

technologies and product candidates in the prevention and treatment of

diseases, plans to execute on the Company’s alliances with Incyte and

Merck, the expected timing for filing IND applications for CPM antibody

candidates, the submission and publication of data in peer-reviewed

journals and presentations of data at scientific conferences. These

forward-looking statements are subject to risks and uncertainties that

could cause actual results to differ materially. These risks and

uncertainties include, among others, the factors described under the

Risk Factors section of our most recent Quarterly Report on Form 10-Q or

annual report on Form 10-K filed with the Securities and Exchange

Commission. Agenus cautions investors not to place considerable reliance

on the forward-looking statements contained in this release. These

statements speak only as of the date of this press release, and Agenus

undertakes no obligation to update or revise the statements, other than

to the extent required by law. All forward-looking statements are

expressly qualified in their entirety by this cautionary statement.

|

|

|

Summary Consolidated Financial Information

|

|

|

|

Condensed Consolidated Statements of Operations Data

|

|

(in thousands, except per share data)

|

|

(Unaudited)

|

|

|

|

|

|

|

Three months ended December 31,

|

|

Year ended December 31,

|

|

|

|

|

|

2014

|

|

|

|

|

2013

|

|

|

|

2014

|

|

|

|

|

2013

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

|

$

|

1,619

|

|

|

|

$

|

393

|

|

|

$

|

6,977

|

|

|

|

$

|

3,045

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue

|

|

|

|

-

|

|

|

|

|

7

|

|

|

|

-

|

|

|

|

|

536

|

|

|

Research and development

|

|

|

|

7,369

|

|

|

|

|

3,241

|

|

|

|

22,349

|

|

|

|

|

13,005

|

|

|

General and administrative

|

|

|

|

5,374

|

|

|

|

|

3,372

|

|

|

|

21,250

|

|

|

|

|

14,484

|

|

|

Non-cash contingent consideration fair value adjustment

|

|

|

|

6,535

|

|

|

|

|

-

|

|

|

|

6,699

|

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss

|

|

|

|

(17,659

|

)

|

|

|

|

(6,227

|

)

|

|

|

(43,321

|

)

|

|

|

|

(24,980

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense), net

|

|

|

|

(8,319

|

)

|

|

|

|

450

|

|

|

|

835

|

|

|

|

|

(5,093

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

|

|

(25,978

|

)

|

|

|

|

(5,777

|

)

|

|

|

(42,486

|

)

|

|

|

|

(30,073

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends on Series A convertible preferred stock

|

|

|

|

(51

|

)

|

|

|

|

(50

|

)

|

|

|

(204

|

)

|

|

|

|

(3,159

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to common stockholders

|

|

|

$

|

(26,029

|

)

|

|

|

$

|

(5,827

|

)

|

|

$

|

(42,690

|

)

|

|

|

$

|

(33,232

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per common share data, basic and diluted:

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to common stockholders

|

|

|

$

|

(0.41

|

)

|

|

|

$

|

(0.16

|

)

|

|

$

|

(0.71

|

)

|

|

|

$

|

(1.12

|

)

|

|

Weighted average number of common shares outstanding, basic and

diluted

|

|

|

|

62,849

|

|

|

|

|

35,676

|

|

|

|

59,754

|

|

|

|

|

29,766

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CONDENSED CONSOLIDATED BALANCE SHEET DATA

|

|

(in thousands)

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

2014

|

|

|

December

31, 2013

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash, cash equivalents and short-term investments

|

|

|

$

|

40,224

|

|

|

|

$

|

27,352

|

|

|

|

|

|

|

|

Total assets

|

|

|

|

74,527

|

|

|

|

|

34,835

|

|

|

|

|

|

|

|

Total stockholders' equity (deficit)

|

|

|

|

23,018

|

|

|

|

|

(4,481

|

)

|

|

|

|

|

|

CONTACT:

Agenus Inc.

Media:

BMC Communications

Brad

Miles, 646-513-3125

bmiles@bmccommunications.com

or

Investors:

Argot

Partners

Andrea Rabney/ Jamie Maarten

212-600-1902

andrea@argotpartners.com

jamie@argotpartners.com

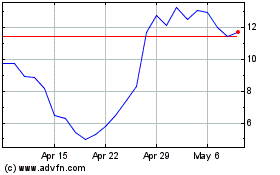

Agenus (NASDAQ:AGEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

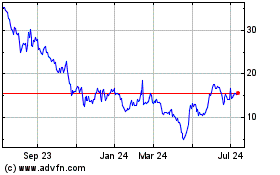

Agenus (NASDAQ:AGEN)

Historical Stock Chart

From Apr 2023 to Apr 2024