UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): February 19, 2015

Insperity, Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Delaware (State or other jurisdiction of incorporation) | 1-13998 (Commission File Number) | 76-0479645 (I.R.S. Employer Identification No.) |

19001 Crescent Springs Drive

Kingwood, Texas 77339

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (281) 358-8986

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

[] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[] Pre-commencement communications pursuant to Rule 14d-2(b) under The Exchange Act (17 CFR 240.14d-2(b))

[] Pre-commencement communications pursuant to Rule 13e-4(c) under The Exchange Act (17 CFR 240.13e-4(c))

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On February 19, 2015, the Board of Directors (the “Board”) of Insperity, Inc. approved the adoption of the Second Amendment (the “Amendment”) to the Insperity, Inc. 2012 Incentive Plan (the “Plan”). The Amendment amends the Plan to require a minimum three year vesting period for employee awards granted in the form of stock options, phantom stock, restricted stock, stock appreciation rights or stock awards that are not performance based, unless certain exceptions apply. The Amendment is filed as Exhibit 10.1 to this Form 8-K and is incorporated herein by reference.

Also on February 19, 2015, the Board approved the First Amendment and Appendix A (the “First Amendment”) to the Insperity, Inc. Directors Compensation Plan (the “Directors Compensation Plan”). The First Amendment amends the Directors Compensation Plan to eliminate meeting fees and to adjust the annual Board and committee retainers accordingly. The adjustment to the annual retainers was based on the average of the meeting fees paid over the prior three years and was intended to be cost neutral. The First Amendment also eliminates stock options as an optional form of payment directors could elect for the annual director award and clarifies that the retainer and committee chair fees for directors who are elected, appointed or resign during the year will be pro-rated. The First Amendment is filed as Exhibit 10.2 to this Form 8-K and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits

10.1 — Second Amendment to the Insperity Inc. 2012 Incentive Plan

10.2 — First Amendment and Appendix A to the Directors Compensation Plan

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

INSPERITY, INC.

By: /s/ Daniel D. Herink

Daniel D. Herink

Senior Vice President of Legal, General Counsel and Secretary

Date: February 25, 2015

EXHIBIT INDEX

Exhibit

No. Description

10.1* — Second Amendment to the Insperity Inc. 2012 Incentive Plan

10.2* — First Amendment and Appendix A to the Directors Compensation Plan

* Filed herewith.

Exhibit 10.1

|

|

SECOND AMENDMENT TO THE |

INSPERITY, INC. 2012 INCENTIVE PLAN |

The Insperity, Inc. 2012 Incentive Plan (the “Plan”), shall be, and hereby is, amended in the following respects, effective as of January 1, 2015, except as otherwise specified below:

I.

Section 7 is amended, by adding the following new subsection 7(i) thereto:

“(i) Minimum Vesting for Certain Types of Employee Awards.

Any Option, Phantom Stock Award, Restricted Stock, Stock Appreciation Right, or Stock Award, granted to an Employee, which is not a Performance Award, shall be granted with a minimum vesting period of three (3) years from the Grant Date, provided that:

| |

(i) | Vesting of the Employee Award may occur pro-rata over the vesting period, or in accordance with a vesting schedule that does not provide for vesting to occur quicker than pro-rata over the vesting period. |

| |

(ii) | The Committee may provide for earlier vesting for an Employee Award granted in conjunction with an Employee’s date of hire or upon a termination of employment by reason of death, disability or Change of Control. |

| |

(iii) | The three (3) year minimum vesting period shall not apply to an Employee Award that is granted in lieu of salary or bonus.” |

II.

Except as modified herein, the Plan shall remain in full force and effect.

IN WITNESS WHEREOF, this Amendment to the Plan is adopted this 19th day of February, 2015.

INSPERITY, INC.

Daniel D. Herink

Senior Vice President of Legal, General Counsel and Secretary

Exhibit 10.2

FIRST AMENDMENT TO THE

INSPERITY, INC. DIRECTORS COMPENSATION PLAN

The Insperity, Inc. Directors Compensation Plan (the “Plan”), shall be, and hereby is, amended in the following respects, effective as of January 1, 2015, except as otherwise specified below:

I.

Section 1.2 is amended, in its entirety, to be and to read as follows:

“1.2. Applicable Date means for the annual Board retainer, committee membership retainers and annual committee chair fees, the last day of the quarter.”

II.

Section 1.8 is amended, in its entirety, to be and to read as follows:

“1.8. Compensation means the Participant’s annual Board retainer, committee membership retainers and any retainers and fees earned by the Participant for chairing committees during the applicable Plan Year, as set forth in Appendix A, which may be amended from time to time by the Board.”

III.

Section 1.11 is amended, in its entirety, to be and to read as follows: “1.11. Reserved.”

IV.

Section 2.1 is amended, in its entirety, to be and to read as follows:

“2.1. Administration. The Plan shall be administered by the Board. The Board shall have the complete authority and power to interpret the Plan, prescribe, amend and rescind rules relating to its administration, determine a Participant’s right to a payment and the amount of such payment, and to take all other actions necessary or desirable for the administration of the Plan. In the event the Board determines that the number of actual meetings for the Board or a committee exceeds three (3) times the number of regularly scheduled meetings during a calendar year, the Board may provide for an adjustment to the Compensation paid for the corresponding retainer to compensate Directors for the additional attended meetings. All actions and decisions of the Board shall be final and binding upon all persons.”

V.

Section 4.1 is amended, in its entirety, to be and to read as follows:

“4.1. Retainer and Committee Chair Fees. The Compensation of Directors is set forth in Appendix A. The Compensation for annual retainers and annual committee chair fees, if any, shall be paid to each Director on a quarterly basis, with each installment being equal to one-fourth of the annualized amount set forth in Appendix A and being paid as soon as administratively feasible following the end of the quarter. Annually, each Director may elect, prior to the date that the Compensation would otherwise be paid to such Director in cash, to receive all such Compensation in shares of Company Stock. The number of shares of Company Stock to be paid to an electing Director shall be determined by dividing the Director’s Compensation to be paid on such date by the Fair Market Value of the Company Stock on the Applicable Date, with any fractional share paid in cash. Notwithstanding the foregoing, however, payment in shares of Company Stock may only be made by the Company with shares of Treasury Stock. In the event the number of shares of Treasury Stock is insufficient on any date to make all such payments provided for in this Section 4.1 in full, then all Directors who are entitled to receive shares of Company Stock on such date shall share ratably in the number of shares available and the balance of each such Director’s Compensation shall be paid in cash. An individual Director’s ratable share shall be calculated by dividing such Director’s eligible Compensation applicable to such payment by the total of all electing Directors’ eligible Compensation applicable to such payment. An election to receive payment of Compensation in Company Stock rather than in cash shall be made in such manner as the Committee may from time to time prescribe.”

VI.

Section 4.4 is amended, in its entirety, to be and to read as follows:

“4.4. Annual Director Award. On the Annual Director Award Date, each Director who is in office immediately after the annual meeting on such date and who was not elected or appointed to the Board for the first time on such date shall be granted a Stock Award of a number of shares of Common Stock with an aggregate Fair Market Value as set forth in Appendix A, determined as of the date prior to the Grant Date. The Annual Director Awards shall be 100% vested and exercisable and shall be rounded up to the next higher whole share amount in the case of a fractional share amount. No Annual Director Award will be made to an individual Director if such Director gives advance written notice to the Board that he or she does not wish to receive such award.”

VII.

Section 4 is amended, by adding the following new section 4.8, to be and to read as follows:

“4.8. Pro-Ration of Compensation. In the event a Director is elected or appointed to the Board at any time during the year other than at the annual meeting of the stockholders, or if a Director becomes a committee member or committee chair during the calendar year, the annual Board and committee retainer and annual committee chair fee shall be paid pro-rata based on service for the quarter, rounded to the nearest month based on the date of election or appointment. In the event a Director resigns from the Board, a committee or as committee chair, compensation for the respective retainer or fee will be similarly paid pro-rata based on service for the quarter.”

VIII.

Except as modified herein, the Plan shall remain in full force and effect.

IN WITNESS WHEREOF, this Amendment to the Plan is adopted this 19th day of February, 2015.

INSPERITY, INC.

Daniel D. Herink

Senior Vice President of Legal, General Counsel and Secretary

APPENDIX A

Insperity, Inc. Directors Compensation Plan

(Amended and Restated as of August 15, 2012)

Directors' Compensation & Equity Awards Effective January 1, 2015

|

| | | | |

| Board | Compensation Committee | FRMA Committee |

N&CG Committee |

| | | | |

Annual Retainer | $61,000 | $10,000 | $15,000 | None |

| | | | |

Annual Committee Chair Fees | N/A | $12,000 | $21,000 | $15,000 |

| | | | |

Initial Director Award | $75,000 | N/A | N/A | N/A |

| | | | |

Annual Director Award | $90,000 | N/A | N/A | N/A |

Appendix A to Dir Comp Plan_Feb 2015_final

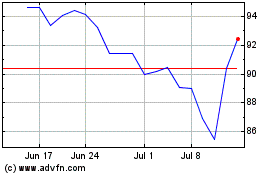

Insperity (NYSE:NSP)

Historical Stock Chart

From Mar 2024 to Apr 2024

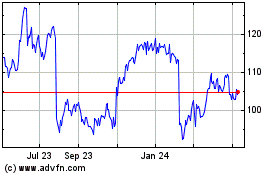

Insperity (NYSE:NSP)

Historical Stock Chart

From Apr 2023 to Apr 2024