UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 19, 2015

AMN Healthcare Services, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

| Delaware |

| (State or other jurisdiction of incorporation) |

|

|

| 001-16753 |

|

06-1500476 |

| (Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

| 12400 High Bluff Drive; Suite 100, San Diego, California |

|

92130 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (866) 871-8519

Not Applicable

(Former

name or former address, if changed from last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Section 2 – Financial Information

| Item 2.02 |

Results of Operations and Financial Condition. |

On February 19, 2015, AMN Healthcare Services, Inc.

(the “Company”) reported its 2014 full year and fourth quarter results. The Company’s 2014 full year and fourth quarter results are discussed in detail in the press release, which is furnished as Exhibit 99.1 to this Current Report on

Form 8-K and incorporated herein by reference.

The information in this Item 2.02 and Exhibit 99.1 attached hereto shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, except to the extent as

shall be expressly set forth by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits

|

|

|

|

|

| 99.1 |

|

Press Release issued by the Company on February 19, 2015 furnished pursuant to Item 2.02 of this Current Report on Form 8-K. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

AMN Healthcare Services, Inc. |

|

|

|

| Date: February 19, 2015 |

|

By: |

|

/s/ Susan R. Salka |

|

|

|

|

Susan R. Salka |

|

|

|

|

President & Chief Executive Officer |

Exhibit 99.1

|

|

|

|

|

Contact: |

|

|

Amy C. Chang |

|

|

Vice President, Investor Relations |

|

|

866.861.3229 |

AMN HEALTHCARE ANNOUNCES FULL YEAR

AND FOURTH QUARTER 2014 RESULTS

Quarterly revenue of $280 million, above the high end of guidance, EPS of $0.20

SAN DIEGO – (February 19, 2015) – AMN Healthcare Services, Inc. (NYSE: AHS), healthcare’s innovator in workforce solutions and staffing

services, today announced full year and fourth quarter 2014 financial results exceeded the Company’s guidance for revenue and adjusted EBITDA. Fourth quarter and full year financial highlights are as follows:

Dollars in millions, except per share amounts.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Q4 2014 |

|

|

% Change

Q4 2013 |

|

|

Full Year 2014 |

|

|

% Change Full

Year 2013 |

|

| Revenue |

|

$ |

279.6 |

|

|

|

12 |

% |

|

$ |

1,036.0 |

|

|

|

2 |

% |

| Gross profit |

|

$ |

84.7 |

|

|

|

14 |

% |

|

$ |

316.1 |

|

|

|

6 |

% |

| Net income |

|

$ |

9.9 |

|

|

|

18 |

% |

|

$ |

33.2 |

|

|

|

1 |

% |

| Diluted EPS |

|

$ |

0.20 |

|

|

|

18 |

% |

|

$ |

0.69 |

|

|

|

0 |

% |

| Adjusted Diluted EPS* |

|

$ |

0.21 |

|

|

|

N/A |

|

|

$ |

0.74 |

|

|

|

7 |

% |

| Adjusted EBITDA* |

|

$ |

25.3 |

|

|

|

19 |

% |

|

$ |

91.5 |

|

|

|

7 |

% |

| * |

See “Non-GAAP Measures” below for a discussion of our use of non-GAAP items and the table entitled “Supplemental Financial and Operating Data” for a reconciliation of non-GAAP items.

|

| |

• |

|

All AMN’s business segments experienced year-over-year growth for the fourth quarter and full year. |

| |

• |

|

The Nurse and Allied Healthcare Staffing and Physician Permanent Placement Services segments led with fourth quarter year-over-year revenue growth of 17% and 14%, respectively. |

| |

• |

|

Full year gross margin of 30.5% represented an improvement of 110 basis points from the prior year. |

| |

• |

|

Full year adjusted EBITDA margin of 8.8% reflected a 40 basis point improvement from the prior year. |

| |

• |

|

The Company completed the acquisitions of Avantas in December 2014, and Onward Healthcare, Locum Leaders and Medefis in January 2015. |

“During 2014, AMN Healthcare delivered a total shareholder return of 33% through solid execution and our differentiated strategy as the

innovator in healthcare workforce solutions. The market environment accelerated mid-year as a stronger economy and millions of newly insured Americans released pent-up demand for both healthcare services and the underlying clinical labor that

delivers patient care. Market trends continued to strengthen as the fourth quarter progressed, resulting in better than anticipated revenue and earnings growth,” said Susan R. Salka, President and Chief Executive Officer of AMN Healthcare.

“We were very pleased to add Avantas, Onward Healthcare, Locum Leaders and Medefis into the AMN family to bolster our workforce solutions and recruitment and supply capabilities. Our stronger portfolio of services and differentiated

capabilities, combined with the favorable market conditions, give us a very optimistic outlook for 2015.”

Fourth Quarter 2014 Results

For the fourth quarter of 2014, consolidated revenue was $280 million, an increase of 12% from the same quarter last year and 6%

sequentially. Fourth quarter revenue for the Nurse and Allied Healthcare Staffing segment was $192 million, up 17% from the same quarter last year and 10% sequentially. Locum Tenens Staffing segment revenue in the fourth quarter was $76 million, an

increase of 3% from the same quarter last year and down 3% sequentially. Fourth quarter Physician Permanent Placement Services segment revenue was $12 million, an increase of 14% from the same quarter last year and 4% sequentially.

Fourth quarter gross margin of 30.3% was higher by 50 basis points than the same quarter last year but lower by 10 basis points sequentially.

SG&A expenses for the fourth quarter were $62 million, representing 22.1% of revenue, compared to 21.9% in the same quarter last year

and 22.8% in the prior quarter. The year-over-year increase in SG&A expenses as a percentage of revenue was due primarily to the additional SG&A expenses from ShiftWise. The lower sequential SG&A expenses as a percentage of revenue were

driven by a favorable professional liability actuarial adjustment in the fourth quarter.

2

Fourth quarter net income was $10 million and net income per diluted share was $0.20. Excluding

acquisition related costs, adjusted net income per diluted share was $0.21. Fourth quarter adjusted EBITDA was $25 million, a year-over-year increase of 19% and sequential increase of 16%. Adjusted EBITDA margin of 9.0% represented a 50 basis point

increase over prior year.

Full Year 2014 Results

Full year 2014 consolidated revenue was $1,036 million, an increase of 2% from prior year. Nurse and Allied Healthcare Staffing segment revenue

was $695 million, a year-over-year increase of 2%. Locum Tenens Staffing segment revenue was $296 million, a year-over-year increase of 3%. Physician Permanent Placement Services segment revenue was $45 million, a year-over-year increase of 5%.

Full year gross margin was 30.5% as compared to 29.4% for prior year, with gross margin expansion across all three reportable segments.

Full year SG&A expenses were $232 million, representing 22.4% of revenue as compared to 21.6% for the prior year. The increase in

SG&A expenses was due primarily to the addition of a full year of our ShiftWise business in 2014 as well as higher employee, professional services and technology-related expenses to support business growth and strategic initiatives.

Full year net income was $33 million. Full year net income per diluted common share was $0.69. Excluding non-cash charges to interest expense

associated with the execution of a new credit agreement and acquisition related costs incurred during the year, adjusted net income per diluted share was $0.74. Full year adjusted EBITDA grew 7% to $91 million. Adjusted EBITDA margin of 8.8%

represented a 40 basis point increase over prior year.

At December 31, 2014, cash and cash equivalents totaled $13 million. Full year

cash flow from operations was $28 million and capital expenditures were $19 million. The Company ended the year with total debt outstanding of $162 million, with a leverage ratio of 1.9 to 1.

3

Business Trends and Outlook

The Company expects consolidated first quarter 2015 revenue of $310 million to $314 million. Gross margin is expected to be approximately

30.5%. SG&A expenses as a percentage of revenue are expected to be approximately 22.5%. Adjusted EBITDA margin is expected to be 8.5% to 9.0%. This guidance includes the expected results for Avantas for the entire quarter and the Onward

Healthcare, Locum Leaders and Medefis companies from the January 7th acquisition date.

About AMN Healthcare

AMN Healthcare is the innovator in healthcare workforce solutions and staffing services to healthcare facilities across the nation. AMN

Healthcare’s workforce solutions - including managed services programs, vendor management systems, and recruitment process outsourcing - enable providers to successfully reduce complexity, increase efficiency and improve patient outcomes within

the rapidly evolving healthcare environment. The Company provides unparalleled access to the most comprehensive network of quality healthcare professionals through its innovative recruitment strategies and breadth of career opportunities. Clients

include acute-care hospitals, community health centers and clinics, physician practice groups, retail and urgent care centers, home health facilities, and many other healthcare settings. AMN Healthcare disseminates news and information about the

Company through its website, which can be found at www.amnhealthcare.com.

Conference Call on February 19, 2015

AMN Healthcare Services, Inc.’s fourth quarter 2014 conference call will be held on Thursday, February 19, 2015, at 5:00 p.m. Eastern

Time. A live webcast of the call can be accessed through AMN Healthcare’s website at http://amnhealthcare.investorroom.com/presentations. Please log in at least 10 minutes prior to the conference call in order to download the applicable audio

software. Interested parties may participate live via telephone by dialing (800) 230-1059 in the U.S. or (612) 234-9960 internationally. Following the conclusion of the call, a replay of the webcast will be available at the Company’s

website. A telephonic replay of the call will be available at 7:30 p.m. Eastern

4

Time on February 19, 2015, and can be accessed until 11:59 p.m. Eastern Time on March 5, 2015, by calling (800) 475-6701 in the U.S. or (320) 365-3844

internationally, with access code 351234.

Non-GAAP Measures

This earnings release contains certain non-GAAP financial information, which the Company provides as additional information, and not as an alternative, to the

Company’s condensed consolidated financial statements presented in accordance with GAAP. These non-GAAP financial measures include (1) adjusted EBITDA, (2) adjusted EBITDA margin, and (3) adjusted diluted EPS. The Company

provides such non-GAAP financial measures because management believes that they are useful both to management and investors as a supplement, and not as a substitute, when evaluating the Company’s operating performance. Additionally, management

believes that adjusted EBITDA and adjusted EBITDA margin serve as industry-wide financial measures, and it uses adjusted EBITDA for making financial decisions and allocating resources. The non-GAAP measures in this release are not in accordance

with, or an alternative to, GAAP, and may be different from non-GAAP measures, or may be calculated differently than other similarly title-captioned non-GAAP measures, reported by other companies. They should not be used in isolation to evaluate the

Company’s performance. A reconciliation of non-GAAP measures identified in this release, along with further detail about the use and limitations of certain of these non-GAAP measures, may be found below in the table entitled Supplemental

Financial and Operating Data under the caption entitled “Reconciliation of Non-GAAP Items” or on the Company’s website at http://amnhealthcare.investorroom.com/financialreports. Additionally, from time to time, additional

information regarding non-GAAP financial measures, including pro forma measures, may be made available on the Company’s website.

Forward-Looking Statements

This press release

contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements include expectations regarding

the 2015 outlook and first quarter revenue, gross margin, SG&A expenses and adjusted EBITDA margin. The Company based these forward-looking statements on its current expectations, estimates and projections about future events and the industry in

which it operates using information currently available to it. Actual results could differ materially from those discussed in, or implied by, these forward-looking statements. Forward-looking statements are identified by words such as

“believe,” “anticipate,” “expect,” “intend,” “plan,” “will,” “may,” “estimates,” variations of such words and other similar expressions. In addition, any statements that

refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. Factors that could cause actual results to differ from those implied by the forward-looking statements contained in this

press release are set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013 and its other periodic reports as well as the Company’s current and other reports filed from time to time with the Securities

and Exchange Commission. Be advised that developments subsequent to this press release are likely to cause these statements to become outdated with the passage of time.

Contact:

Amy C. Chang

Vice President, Investor Relations

866.861.3229

5

AMN Healthcare Services, Inc.

Condensed Consolidated Statements of Comprehensive Income

(in thousands, except per share amounts)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

December 31, |

|

|

September 30, |

|

|

December 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2014 |

|

|

2013 |

|

| Revenue |

|

$ |

279,649 |

|

|

$ |

248,658 |

|

|

$ |

264,584 |

|

|

$ |

1,036,027 |

|

|

$ |

1,011,816 |

|

| Cost of revenue |

|

|

194,953 |

|

|

|

174,465 |

|

|

|

184,278 |

|

|

|

719,910 |

|

|

|

714,536 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

84,696 |

|

|

|

74,193 |

|

|

|

80,306 |

|

|

|

316,117 |

|

|

|

297,280 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30.3 |

% |

|

|

29.8 |

% |

|

|

30.4 |

% |

|

|

30.5 |

% |

|

|

29.4 |

% |

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and administrative |

|

|

61,668 |

|

|

|

54,470 |

|

|

|

60,319 |

|

|

|

232,221 |

|

|

|

218,233 |

|

|

|

|

22.1 |

% |

|

|

21.9 |

% |

|

|

22.8 |

% |

|

|

22.4 |

% |

|

|

21.6 |

% |

| Depreciation and amortization |

|

|

4,077 |

|

|

|

3,698 |

|

|

|

4,086 |

|

|

|

15,993 |

|

|

|

13,545 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating expenses |

|

|

65,745 |

|

|

|

58,168 |

|

|

|

64,405 |

|

|

|

248,214 |

|

|

|

231,778 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from operations |

|

|

18,951 |

|

|

|

16,025 |

|

|

|

15,901 |

|

|

|

67,903 |

|

|

|

65,502 |

|

| Interest expense, net, and other |

|

|

1,329 |

|

|

|

1,836 |

|

|

|

1,433 |

|

|

|

9,237 |

|

|

|

9,665 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

17,622 |

|

|

|

14,189 |

|

|

|

14,468 |

|

|

|

58,666 |

|

|

|

55,837 |

|

| Income tax expense |

|

|

7,727 |

|

|

|

5,833 |

|

|

|

5,969 |

|

|

|

25,449 |

|

|

|

22,904 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

9,895 |

|

|

$ |

8,356 |

|

|

$ |

8,499 |

|

|

$ |

33,217 |

|

|

$ |

32,933 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income (loss) |

|

|

113 |

|

|

|

(36 |

) |

|

|

75 |

|

|

|

142 |

|

|

|

(55 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive income |

|

$ |

10,008 |

|

|

$ |

8,320 |

|

|

$ |

8,574 |

|

|

$ |

33,359 |

|

|

$ |

32,878 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income per common share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.21 |

|

|

$ |

0.18 |

|

|

$ |

0.18 |

|

|

$ |

0.71 |

|

|

$ |

0.72 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.20 |

|

|

$ |

0.17 |

|

|

$ |

0.18 |

|

|

$ |

0.69 |

|

|

$ |

0.69 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

46,634 |

|

|

|

46,010 |

|

|

|

46,546 |

|

|

|

46,504 |

|

|

|

45,963 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

48,462 |

|

|

|

47,818 |

|

|

|

48,122 |

|

|

|

48,086 |

|

|

|

47,787 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

AMN Healthcare Services, Inc.

Supplemental Financial and Operating Data

(dollars in thousands, except per share data)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

December 31, |

|

|

September 30, |

|

|

December 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2014 |

|

|

2013 |

|

| Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nurse and allied healthcare staffing |

|

$ |

191,570 |

|

|

$ |

164,121 |

|

|

$ |

174,292 |

|

|

$ |

695,206 |

|

|

$ |

681,979 |

|

| Locum tenens staffing |

|

|

76,170 |

|

|

|

74,067 |

|

|

|

78,816 |

|

|

|

296,166 |

|

|

|

287,484 |

|

| Physician permanent placement services |

|

|

11,909 |

|

|

|

10,470 |

|

|

|

11,476 |

|

|

|

44,655 |

|

|

|

42,353 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

279,649 |

|

|

$ |

248,658 |

|

|

$ |

264,584 |

|

|

$ |

1,036,027 |

|

|

$ |

1,011,816 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of Non-GAAP Items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment operating income (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Nurse and allied healthcare staffing |

|

$ |

23,963 |

|

|

$ |

19,464 |

|

|

$ |

21,279 |

|

|

$ |

87,246 |

|

|

$ |

82,458 |

|

| Locum tenens staffing |

|

|

8,155 |

|

|

|

7,365 |

|

|

|

8,139 |

|

|

|

30,985 |

|

|

|

24,712 |

|

| Physician permanent placement services |

|

|

2,744 |

|

|

|

2,194 |

|

|

|

2,756 |

|

|

|

9,818 |

|

|

|

8,929 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34,862 |

|

|

|

29,023 |

|

|

|

32,174 |

|

|

|

128,049 |

|

|

|

116,099 |

|

| Unallocated corporate overhead |

|

|

9,601 |

|

|

|

7,842 |

|

|

|

10,396 |

|

|

|

36,559 |

|

|

|

30,927 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA (2) |

|

|

25,261 |

|

|

|

21,181 |

|

|

|

21,778 |

|

|

|

91,490 |

|

|

|

85,172 |

|

| Adjusted EBITDA margin (3) |

|

|

9.0 |

% |

|

|

8.5 |

% |

|

|

8.2 |

% |

|

|

8.8 |

% |

|

|

8.4 |

% |

| Depreciation and amortization |

|

|

4,077 |

|

|

|

3,698 |

|

|

|

4,086 |

|

|

|

15,993 |

|

|

|

13,545 |

|

| Share-based compensation |

|

|

1,796 |

|

|

|

1,458 |

|

|

|

1,791 |

|

|

|

7,157 |

|

|

|

6,125 |

|

| Acquisition transaction costs |

|

|

437 |

|

|

|

0 |

|

|

|

0 |

|

|

|

437 |

|

|

|

|

|

| Interest expense, net, and other |

|

|

1,329 |

|

|

|

1,836 |

|

|

|

1,433 |

|

|

|

9,237 |

|

|

|

9,665 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes |

|

|

17,622 |

|

|

|

14,189 |

|

|

|

14,468 |

|

|

|

58,666 |

|

|

|

55,837 |

|

| Income tax expense |

|

|

7,727 |

|

|

|

5,833 |

|

|

|

5,969 |

|

|

|

25,449 |

|

|

|

22,904 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

9,895 |

|

|

$ |

8,356 |

|

|

$ |

8,499 |

|

|

$ |

33,217 |

|

|

$ |

32,933 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP based diluted net income per share (EPS) |

|

$ |

0.20 |

|

|

$ |

0.17 |

|

|

$ |

0.18 |

|

|

$ |

0.69 |

|

|

$ |

0.69 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss on debt extinguishment |

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.04 |

|

|

|

0.00 |

|

| Acquistion transaction costs |

|

|

0.01 |

|

|

|

0.00 |

|

|

|

0.00 |

|

|

|

0.01 |

|

|

|

0.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted diluted EPS (4) |

|

$ |

0.21 |

|

|

|

N/A |

|

|

$ |

N/A |

|

|

$ |

0.74 |

|

|

$ |

0.69 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

December 31, |

|

|

September 30, |

|

|

December 31, |

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

2014 |

|

|

2013 |

|

| Gross Margin |

|

|

|

|

|

|

|

|

|

|

|

|

| Nurse and allied healthcare staffing |

|

|

28.6 |

% |

|

|

27.7 |

% |

|

|

28.7 |

% |

|

|

28.8 |

% |

|

|

27.4 |

% |

| Locum tenens staffing |

|

|

28.8 |

% |

|

|

29.9 |

% |

|

|

29.0 |

% |

|

|

29.3 |

% |

|

|

29.1 |

% |

| Physician permanent placement services |

|

|

66.1 |

% |

|

|

63.0 |

% |

|

|

64.9 |

% |

|

|

64.4 |

% |

|

|

62.7 |

% |

| Operating Data: |

|

|

|

|

|

|

|

|

|

|

|

|

| Nurse and allied healthcare staffing |

|

|

|

|

|

|

|

|

|

|

|

|

| Average clinicians on assignment (5) |

|

|

6,030 |

|

|

|

5,609 |

|

|

|

5,632 |

|

|

|

5,715 |

|

|

|

5,880 |

|

| Locum tenens staffing |

|

|

|

|

|

|

|

|

|

|

|

|

| Days filled (6) |

|

|

48,391 |

|

|

|

50,529 |

|

|

|

49,982 |

|

|

|

192,171 |

|

|

|

197,006 |

|

|

|

|

|

|

| |

|

As of December 31, |

|

|

As of September 30, |

|

|

|

|

|

|

|

| |

|

2014 |

|

|

2013 |

|

|

2014 |

|

|

|

|

|

|

|

| Leverage Ratio (7) |

|

|

1.9 |

|

|

|

2.0 |

|

|

|

1.7 |

|

|

|

|

|

|

|

|

|

8

AMN Healthcare Services, Inc.

Condensed Consolidated Balance Sheets

(dollars in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

December 31, |

|

|

September 30, |

|

|

December 31, |

|

| |

|

2014 |

|

|

2014 (8) |

|

|

2013 (8) |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

13,073 |

|

|

$ |

9,663 |

|

|

$ |

15,580 |

|

| Accounts receivable, net |

|

|

186,274 |

|

|

|

164,078 |

|

|

|

147,477 |

|

| Accounts receivable, subcontractor |

|

|

28,443 |

|

|

|

21,569 |

|

|

|

18,271 |

|

| Deferred income taxes, net |

|

|

27,330 |

|

|

|

24,970 |

|

|

|

24,938 |

|

| Prepaid and other current assets |

|

|

27,550 |

|

|

|

28,844 |

|

|

|

26,631 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

282,670 |

|

|

|

249,124 |

|

|

|

232,897 |

|

| Restricted cash, cash equivalents and investments |

|

|

19,567 |

|

|

|

21,012 |

|

|

|

23,115 |

|

| Fixed assets, net |

|

|

32,880 |

|

|

|

29,202 |

|

|

|

21,158 |

|

| Other assets |

|

|

39,895 |

|

|

|

40,045 |

|

|

|

32,279 |

|

| Goodwill |

|

|

154,387 |

|

|

|

144,937 |

|

|

|

144,642 |

|

| Intangible assets, net |

|

|

152,517 |

|

|

|

144,498 |

|

|

|

150,197 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

681,916 |

|

|

$ |

628,818 |

|

|

$ |

604,288 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and stockholders’ equity |

|

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable and accrued expenses |

|

$ |

78,993 |

|

|

$ |

67,036 |

|

|

$ |

71,314 |

|

| Accrued compensation and benefits |

|

|

67,995 |

|

|

|

64,574 |

|

|

|

55,949 |

|

| Revolving credit facility |

|

|

18,000 |

|

|

|

0 |

|

|

|

10,000 |

|

| Current portion of notes payable |

|

|

7,500 |

|

|

|

7,500 |

|

|

|

0 |

|

| Deferred revenue |

|

|

3,177 |

|

|

|

1,336 |

|

|

|

1,373 |

|

| Other current liabilities |

|

|

2,630 |

|

|

|

7,323 |

|

|

|

4,454 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

178,295 |

|

|

|

147,769 |

|

|

|

143,090 |

|

| Notes payable, net of discount |

|

|

136,875 |

|

|

|

138,750 |

|

|

|

148,672 |

|

| Deferred income tax benefits, net |

|

|

32,491 |

|

|

|

18,357 |

|

|

|

17,764 |

|

| Other long-term liabilities |

|

|

77,674 |

|

|

|

78,524 |

|

|

|

77,020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

425,335 |

|

|

|

383,400 |

|

|

|

386,546 |

|

| Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’ equity |

|

|

256,581 |

|

|

|

245,418 |

|

|

|

217,742 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

681,916 |

|

|

$ |

628,818 |

|

|

$ |

604,288 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9

AMN Healthcare Services, Inc.

Summary Condensed Consolidated Statements of Cash Flows

(dollars in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

Twelve Months Ended |

|

| |

|

December 31, |

|

|

September 30, |

|

|

December 31, |

|

| |

|

2014 |

|

|

2013 (8) |

|

|

2014 |

|

|

2014 |

|

|

2013 (8) |

|

| Net cash provided by operating activities |

|

$ |

5,039 |

|

|

$ |

15,820 |

|

|

$ |

15,489 |

|

|

$ |

27,678 |

|

|

$ |

60,169 |

|

| Net cash used in investing activities |

|

|

(17,908 |

) |

|

|

(42,148 |

) |

|

|

(4,511 |

) |

|

|

(28,228 |

) |

|

|

(49,198 |

) |

| Net cash provided by (used in) financing activities |

|

|

16,166 |

|

|

|

10,291 |

|

|

|

(6,891 |

) |

|

|

(2,099 |

) |

|

|

(1,017 |

) |

| Effect of exchange rates on cash |

|

|

113 |

|

|

|

(36 |

) |

|

|

75 |

|

|

|

142 |

|

|

|

(55 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net increase (decrease) in cash and cash equivalents |

|

|

3,410 |

|

|

|

(16,073 |

) |

|

|

4,162 |

|

|

|

(2,507 |

) |

|

|

9,899 |

|

| Cash and cash equivalents at beginning of period |

|

|

9,663 |

|

|

|

31,653 |

|

|

|

5,501 |

|

|

|

15,580 |

|

|

|

5,681 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of period |

|

$ |

13,073 |

|

|

$ |

15,580 |

|

|

$ |

9,663 |

|

|

$ |

13,073 |

|

|

$ |

15,580 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) |

Segment operating income represents net income plus interest expense (net of interest income) and other, income taxes, depreciation and amortization, unallocated corporate overhead and share-based compensation expense.

|

| (2) |

Adjusted EBITDA represents net income plus interest expense (net of interest income) and other, income taxes, depreciation and amortization, acquisition transaction costs and share-based compensation expense. Management

believes that adjusted EBITDA provides an effective measure of the Company’s results, as it excludes certain items that management believes are not indicative of the Company’s operating performance and considers measures used in credit

facilities. Adjusted EBITDA is not intended to represent cash flows for the period, nor has it been presented as an alternative to income from operations or net income as an indicator of operating performance. Although management believes that some

of the items excluded from adjusted EBITDA are not indicative of the Company’s operating performance, these items do impact the statement of comprehensive income, and management therefore utilizes adjusted EBITDA as an operating performance

measure in conjunction with GAAP measures such as net income. |

| (3) |

Adjusted EBITDA margin represents adjusted EBITDA divided by revenue. |

| (4) |

Adjusted diluted EPS represents GAAP diluted EPS excluding the impact of 1) loss on debt extinguishment of $3,113 and $434 for the twelve months ended

December 31, 2014 and 2013, respectively; and 2) acquistion transaction costs of $437 for the three and twelve months ended December 31, 2014. Management believes such a measure provides a picture of the Company’s results that is more

comparable among periods since it excludes the impact of items that may recur occasionally, but tend to be irregular as to timing, thereby distorting |

10

| |

comparisons between periods. However, investors should note that this non-GAAP measure involves judgment by management (in particular, judgment as to what is classified as a special item to be

excluded from adjusted EPS). Although management believes the item excluded from adjusted EPS is not indicative of the Company’s operating performance, this item does impact the statement of comprehensive income, and management therefore

utilizes adjusted EPS as an operating performance measure in conjunction with GAAP measures such as GAAP EPS. |

| (5) |

Average clinicians on assignment represents the average number of nurse and allied healthcare professionals on assignment during the period presented. |

| (6) |

Days filled is calculated by dividing the locum tenens hours filled during the period by eight hours. |

| (7) |

Leverage ratio represents the ratio of the consolidated funded indebtedness (as calculated per the Company’s credit agreement) at the end of the period to the consolidated adjusted EBITDA (as calculated per the

Company’s credit agreement) for the last twelve months. |

| (8) |

Certain reclassifications have been made to the prior periods’ consolidated financial statements to conform to the current year presentation. |

11

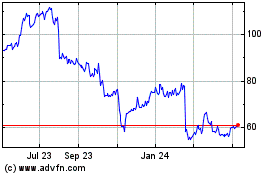

AMN Healthcare Services (NYSE:AMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

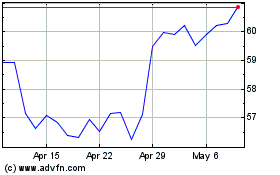

AMN Healthcare Services (NYSE:AMN)

Historical Stock Chart

From Apr 2023 to Apr 2024