UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 19, 2015

|

|

ACACIA RESEARCH CORPORATION |

(Exact name of registrant as specified in its charter) |

|

| | |

Delaware | 000-26068 | 95-4405754 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

|

| |

520 Newport Center Drive Newport Beach, California | 92660 |

(Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (949) 480-8300

|

|

Not applicable |

(Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

On February 19, 2015, Acacia Research Corporation issued a press release announcing its earnings for the three months and the year ended December 31, 2014. A copy of that release is furnished as Exhibit 99.1 to this report.

The information in this Current Report on Form 8-K and the exhibit attached hereto as Exhibit 99.1 are being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section. The information in this Current Report on Form 8-K and the exhibit attached hereto as Exhibit 99.1 shall not be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended, regardless of any general incorporation by reference language in such filings, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

|

| | |

| (c) | Exhibits. |

| | |

| | 99.1 Press Release dated February 19, 2015 of the Registrant. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | ACACIA RESEARCH CORPORATION |

| | |

Date: February 19, 2015 | By: | /s/ Matthew Vella |

| | Name: Matthew Vella |

| | Title: Chief Executive Officer |

| | |

Exhibit Index

|

| |

Exhibit Number | Description |

| |

99.1 | Press Release dated February 19, 2015 of the Registrant. |

FOR RELEASE

February 19, 2015

Contact: Rob Stewart Media Contact: Adam Handelsman

Investor Relations President & Founder

Tel (949) 480-8300 SpecOps Communications

Fax (949) 480-8301 (212) 518-7721

adam@specopscomm.com

ACACIA RESEARCH REPORTS

FOURTH QUARTER AND YEAR END FINANCIAL RESULTS

AND ANNOUNCES PAYMENT OF QUARTERLY DIVIDEND

Newport Beach, Calif. - (BUSINESS WIRE) - February 19, 2015 - Acacia Research Corporation(1) (Nasdaq: ACTG) today reported results for the three months and year ended December 31, 2014.

Fourth Quarter 2014 Results

| |

• | Revenues were $31,030,000, as compared to $15,065,000 in the comparable prior year quarter. |

| |

• | GAAP net loss was $16,244,000, or $0.34 per diluted share, as compared to a GAAP net loss of $33,333,000, or $0.69 per diluted share for the comparable prior year quarter. |

| |

• | Non-GAAP net income was $1,576,000, or $0.03 per diluted share, as compared to a non-GAAP net loss of $10,556,000, or $0.22 per diluted share for the comparable prior year quarter. See below for information regarding non-GAAP measures. |

| |

• | During the fourth quarter of 2014 we acquired control of 2 new patent portfolios. |

| |

• | Cash and cash equivalents and investments totaled $193,024,000 as of December 31, 2014. |

Fiscal Year 2014 Results

| |

• | Revenues were $130,876,000, as compared to revenues of $130,556,000 in the comparable prior year. |

| |

• | GAAP net loss was $66,029,000, or $1.37 per diluted share, as compared to a GAAP net loss of $56,434,000, or $1.18 per diluted share for the comparable prior year. |

| |

• | Non-GAAP net income was $9,328,000, or $0.18 per diluted share, as compared to a non-GAAP net loss of $1,424,000, or $0.04 per diluted share for the comparable prior year. See below for information regarding non-GAAP measures. |

| |

• | During fiscal year 2014 we acquired control of 6 new patent portfolios. |

Approval of Quarterly Dividend

Acacia Research Corporation also announced today that its Board of Directors has approved a quarterly cash dividend, payable in the amount of $0.125 per share, which will be paid on March 30, 2015, to shareholders of record at the close of business on March 2, 2015. Future cash dividends are expected to be paid on a quarterly basis and will be at the discretion of the Board of Directors.

Consolidated Financial Results - Overview

Financial results and operating activities during the periods presented included the following:

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2014 | | 2013 | | 2014 | | 2013 |

| | | | | | | |

Revenues (in thousands) | $ | 31,030 |

| | $ | 15,065 |

| | $ | 130,876 |

| | $ | 130,556 |

|

Net loss (in thousands) | $ | (16,244 | ) | | $ | (33,333 | ) | | $ | (66,029 | ) | | $ | (56,434 | ) |

Non-GAAP net income (loss) (in thousands) | $ | 1,576 |

| | $ | (10,556 | ) | | $ | 9,328 |

| | $ | (1,424 | ) |

Diluted loss per share | $ | (0.34 | ) | | $ | (0.69 | ) | | $ | (1.37 | ) | | $ | (1.18 | ) |

Pro forma non-GAAP net earnings (loss) per common share - diluted | $ | 0.03 |

| | $ | (0.22 | ) | | $ | 0.18 |

| | $ | (0.04 | ) |

New agreements executed | 33 |

| | 24 |

| | 88 |

| | 120 |

|

Licensing and enforcement programs generating revenues | 27 |

| | 23 |

| | 46 |

| | 53 |

|

Licensing and enforcement programs with initial revenues | 5 |

| | 4 |

| | 15 |

| | 23 |

|

New patent portfolios | 2 |

| | 3 |

| | 6 |

| | 25 |

|

Summary Financial Results

For the Three Months and Fiscal Years Ended December 31, 2014 and 2013

Revenues: |

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2014 | | 2013 | | 2014 | | 2013 |

| | | | | | | |

Revenues (in thousands) | $ | 31,030 |

| | $ | 15,065 |

| | $ | 130,876 |

| | $ | 130,556 |

|

| | | | | | | |

New agreements executed | 33 |

| | 24 |

| | 88 |

| | 120 |

|

Licensing and enforcement programs generating revenues | 27 |

| | 23 |

| | 46 |

| | 53 |

|

Licensing and enforcement programs with initial revenues | 5 |

| | 4 |

| | 15 |

| | 23 |

|

Fourth Quarter 2014 compared to Fourth Quarter 2013. Revenues in the fourth quarter of 2014 increased $15,965,000, or 106%, to $31,030,000, as compared to $15,065,000 in the comparable prior year quarter. In the fourth quarter of 2014, three licensees individually accounted for 35%, 19% and 10% of revenues recognized, as compared to two licensees individually accounting for 35% and 11% of revenues recognized during the fourth quarter of 2013.

Fiscal Year 2014 compared to Fiscal Year 2013. Fiscal year 2014 revenues were $130,876,000, relatively consistent with fiscal year 2013 revenues of $130,556,000. In fiscal year 2014, two licensees each individually accounted for 22% of revenues recognized, as compared to two licensees individually accounting for 38% and 16% of revenues recognized in fiscal year 2013.

Cost of Revenues (in thousands):

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2014 | | 2013 | | 2014 | | 2013 |

| |

Inventor royalties | $ | 4,358 |

| | $ | 3,280 |

| | $ | 20,670 |

| | $ | 29,724 |

|

Contingent legal fees | 7,296 |

| | 3,181 |

| | 23,563 |

| | 24,784 |

|

Fourth quarter 2014 revenues, less inventor royalties expense and contingent legal fees expense totaled $19,376,000, or 62% of related quarterly revenues, as compared to $8,604,000, or 57% of quarterly revenues, in the comparable prior year quarter.

Fiscal year 2014 revenues, less inventor royalties expense and contingent legal fees expense totaled $86,643,000, or 66% of related fiscal year 2014 revenues, as compared to $76,048,000, or 58% of related fiscal year 2013 revenues.

The increase in fourth quarter and fiscal year 2014 revenues, less related inventor royalties and contingent legal fees expense, as a percentage of related quarterly and annual revenues, respectively, was primarily due to, on average, a higher percentage of revenues generated in the fourth quarter and fiscal year 2014 having no inventor royalty obligations, and lower overall inventor royalty rates, primarily due to preferential returns on advances and cost recoveries, for the portfolios generating revenues during the 2014 periods, as compared to the revenues generated in the 2013 periods. Inventor royalties and contingent legal fees expenses fluctuate period to period, based on the amount of revenues recognized each period and the economic terms of the patent portfolio partnering arrangements and contingent legal fee arrangements, if any, associated with the specific patent portfolios generating revenues each period.

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2014 | | 2013 | | 2014 | | 2013 |

| | | | | |

Litigation and licensing expenses - patents | $ | 8,208 |

| | $ | 8,899 |

| | $ | 37,614 |

| | $ | 39,335 |

|

Fourth quarter 2014 and 2013 litigation and licensing expenses-patents were relatively flat quarter to quarter. Fiscal year 2014 litigation and licensing expenses-patents decreased due primarily to a net decrease in litigation support and third-party technical consulting expenses associated with ongoing and new licensing and enforcement programs commenced during fiscal year 2014. We expect litigation and licensing expenses to continue to fluctuate period to period in connection with our current and future patent partnering, prosecution, licensing and enforcement activities.

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2014 | | 2013 | | 2014 | | 2013 |

| | | | | |

Amortization of patents | $ | 13,727 |

| | $ | 16,735 |

| | $ | 57,242 |

| | $ | 53,658 |

|

The change in patent amortization expense for the periods presented was due to the following:

|

| | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2014 vs. 2013 | | 2014 vs. 2013 |

| | | |

Patent portfolio investments since the end of the prior year period | $ | 920 |

| | $ | 2,534 |

|

Scheduled amortization related to patent portfolios acquired during the prior year | (301 | ) | | 562 |

|

Accelerated amortization related to recovery of upfront advances | 60 |

| | 655 |

|

Patent portfolio dispositions | — |

| | 955 |

|

Patent portfolio impairment charges | (3,687 | ) | | (1,122 | ) |

Total change in patent amortization expense | $ | (3,008 | ) | | $ | 3,584 |

|

Other Operating Expenses (in thousands):

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2014 | | 2013 | | 2014 | | 2013 |

| | | | | |

Marketing, general and administrative expenses | $ | 7,951 |

| | $ | 6,906 |

| | $ | 30,439 |

| | $ | 31,335 |

|

Non-cash stock compensation expense - MG&A | 4,093 |

| | 7,082 |

| | 18,115 |

| | 27,894 |

|

Total marketing, general and administrative expenses | $ | 12,044 |

| | $ | 13,988 |

| | $ | 48,554 |

| | $ | 59,229 |

|

Fourth quarter 2014 marketing, general and administrative expenses, excluding non-cash stock compensation expense, increased $1,045,000 or15%, due primarily to an increase in variable performance-based compensation costs, consistent with the increase in revenues quarter to quarter and an increase in non-recurring employee severance and corporate administrative costs. The increase was partially offset by an overall decrease in personnel costs resulting from net staff reductions occurring during the year.

Fiscal year 2014 marketing, general and administrative expenses, excluding non-cash stock compensation expense, decreased $896,000 or 3%, due primarily to a net decrease in personnel costs resulting from net staff reductions occurring during fiscal 2014.

Fourth quarter and fiscal year 2014 non-cash stock compensation expense decreased due to a decrease in the average grant date fair value for the shares expensed in the respective periods, and a decrease in the number of shares expensed during the periods resulting from a net reduction in employee headcount and a decrease in the number of shares vesting for current employees. Fiscal year 2013 non-cash stock compensation expense included CEO retirement package related non-recurring non-cash charges totaling $1,823,000.

Other Operating Expenses:

Fiscal year 2014 operating expenses included an expense accrual for court ordered attorney fees related to separate matters initiated in 2010 and 2011 totaling $1,548,000. The respective operating subsidiaries have filed notices of appeal. Fiscal year 2013 operating expenses included a one-time, non-recurring charge related to the resolution of a dispute concerning legal fees associated with a prior matter totaling $3,506,000.

Income Taxes:

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2014 | | 2013 | | 2014 | | 2013 |

| | | | | |

(Provision for) benefit from income taxes (in thousands) | $ | (450 | ) | | $ | (3,390 | ) | | $ | (3,912 | ) | | $ | 21,958 |

|

Effective tax rate | 3 | % | | 11 | % | | 6 | % | | (27 | )% |

Tax expense for the fourth quarter and fiscal year 2014 reflects the impact of a full valuation allowance recorded for net operating loss and foreign tax credit related tax assets generated during the periods. As such, no tax benefit was recognized for net operating loss and foreign tax credit related tax benefits generated during the 2014 periods. Tax expense for the fourth quarter and fiscal year 2014 primarily reflects foreign taxes withheld on revenue agreements with licensees in foreign jurisdictions and other state taxes.

The tax benefit recognized for fiscal 2013 reflects the application of an annual effective tax rate to the GAAP pre-tax net loss reported for fiscal 2013. The fiscal year 2013 effective tax rate was lower than the U.S. federal statutory rate primarily due to a partial increase in the valuation allowance related to certain foreign tax credits generated in 2013 and certain nondeductible expenses.

Financial Condition (in thousands)

Summary Balance Sheet Information:

|

| | | | | | | | |

| | December 31, 2014 | | December 31, 2013 |

| | |

Cash and cash equivalents and investments | | $ | 193,024 |

| | $ | 256,702 |

|

Accounts receivable | | 20,168 |

| | 6,341 |

|

Total assets | | 536,348 |

| | 593,393 |

|

Accounts payable and accrued expenses | | 14,860 |

| | 11,555 |

|

Accrued patent portfolio investment costs | | 16,700 |

| | 4,000 |

|

Royalties and contingent legal fees payable | | 14,351 |

| | 10,447 |

|

Total liabilities | | 47,300 |

| | 31,195 |

|

Summary Cash Flow Information:

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2014 | | 2013 | | 2014 | | 2013 |

| | | | | | | |

Net cash provided by (used in): | | | | | | | |

Operating activities | $ | (9,706 | ) | | $ | 1,310 |

| | $ | 4,184 |

| | $ | (3,509 | ) |

Investing activities | (3,827 | ) | | 22,076 |

| | 29,297 |

| | (66,059 | ) |

Financing activities | (6,258 | ) | | (15,004 | ) | | (25,700 | ) | | (25,551 | ) |

Patent Portfolio Investment Costs. Patent related upfront advances and scheduled milestone payments paid in the fourth quarter of 2014 totaled $18,228,000, as compared to $14,645,000 during the comparable prior year quarter.

Patent related upfront advances and scheduled milestone payments paid in fiscal year 2014 totaled $42,746,000, as compared to $25,061,000 in fiscal year 2013. Accrued patent portfolio investment costs totaled $16,700,000 at December 31, 2014.

Quarterly Dividends Paid. Cash outflows from financing activities included cash dividends to shareholders totaling $6,266,000 and $25,039,000 for the fourth quarter and fiscal year ended December 31, 2014, respectively. Refer to our website for IRS Form 8937 information related to the distribution announced herein and any previous distributions.

See “Business Highlights and Recent Developments” below for a summary of patent portfolio investments during the current quarter.

Refer to the section below entitled “Summary Financial Information” for additional summary consolidated balance sheet, statements of operations and cash flow information as of and for the applicable periods presented.

INFORMATION ABOUT NON-GAAP FINANCIAL MEASURES

As used herein, “GAAP” refers to accounting principles generally accepted in the United States of America. To supplement our consolidated financial statements prepared and presented in accordance with GAAP, this earnings release includes financial measures, including (1) non-GAAP net income and (2) non-GAAP Earnings Per Share (“EPS”), that are considered non-GAAP financial measures as defined in Rule 101 of Regulation G promulgated by the Securities and Exchange Commission. Generally, a non-GAAP financial measure is a numerical measure of a company’s historical or future performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated

and presented in accordance with GAAP. The presentation of this non-GAAP financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

We use these non-GAAP, or pro forma, financial measures for internal financial and operational decision making purposes and as a means to evaluate period-to-period comparisons of the performance and results of operations of our core business. Our management believes that these non-GAAP financial measures provide meaningful supplemental information regarding the performance of our core business by excluding non-cash stock compensation charges, non-cash patent amortization charges, excess benefit related non-cash tax expense and certain non-cash tax benefits, that may not be indicative of our recurring core business operating results. These non-GAAP financial measures also facilitate management’s internal planning and comparisons to our historical performance and liquidity. We believe these non-GAAP financial measures are useful to investors as they allow for greater transparency with respect to key metrics used by management in its financial and operational decision making and are used by our institutional investors and the analyst community to help them analyze the performance and operational results of our core business.

Non-GAAP Net income and EPS. We define non-GAAP net income as net income calculated in accordance with GAAP, plus non-cash stock compensation charges, non-cash patent amortization charges and excess benefit related non-cash tax expense, less certain non-cash tax benefits included in tax expense. Non-GAAP EPS is defined as non-GAAP net income divided by the weighted average outstanding shares, on a fully-diluted basis, calculated in accordance with GAAP, for the respective reporting period.

Due to the inherent volatility in stock prices, the use of estimates and assumptions in connection with the valuation and expensing of share-based awards and the variety of award types that companies can issue under FASB ASC Topic 718, management believes that providing a non-GAAP financial measure that excludes non-cash stock compensation allows investors to make meaningful comparisons between our recurring core business operating results and those of other companies period to period, as well as providing our management with a critical tool for financial and operational decision making and for evaluating our own period-to-period recurring core business operating results. Similarly, due to the variability associated with the timing and amount of patent portfolio investment payments and estimates inherent in the capitalization and amortization of patent costs, management believes that providing a non-GAAP financial measure that excludes non-cash patent amortization charges allows investors to make meaningful comparisons between our recurring core business operating results and those of other companies, and also provides our management with a useful tool for financial and operational decision making and for evaluating our own period-to-period recurring core business operating results. Management also believes that providing a non-GAAP financial measure that excludes the impact of excess benefit related non-cash tax expense and certain non-cash tax benefits included in tax expense allows investors to asses our net results and the economic impact of income taxes based largely on cash tax obligations, make more meaningful comparisons between our recurring core business net results and those of other companies period to period, and also provides our management with a useful tool for financial and operational decision making and for evaluating our own period-to-period recurring core business net results.

There are a number of limitations related to the use of non-GAAP net income and EPS versus net income and EPS calculated in accordance with GAAP. For example, non-GAAP net income excludes the impact of significant non-cash stock compensation charges, non-cash patent amortization charges, excess benefit related non-cash tax expense and certain non-cash tax benefits included in tax expense that are or may be recurring, and that may or will continue to be recurring for the foreseeable future. In addition, non-cash stock compensation is a critical component of our employee compensation programs and non-cash patent amortization reflects the cost of certain patent portfolio investments, amortized on a straight-line basis over the estimated economic useful life of the respective patent portfolio, and may reflect the acceleration of amortization related to recoupable up-front patent portfolio costs. Management compensates for these limitations by providing specific information regarding the GAAP amounts excluded from non-GAAP net income and EPS and evaluating non-GAAP net income and EPS in conjunction with net income and EPS calculated in accordance with GAAP.

The accompanying table below provides a reconciliation of the non-GAAP financial measures presented to the most directly comparable financial measures prepared in accordance with GAAP.

_____________________________________________

A conference call is scheduled for today. The Acacia Research presentation and Q&A will start at 1:30 p.m. Pacific Time (4:30 p.m. Eastern).

To listen to the presentation by phone, dial (888) 299-7205 for domestic callers and (719) 325-2301 for international callers, both of whom will need to enter the conference ID 7520198 when prompted. A replay of the audio presentation will be available for 30 days at (888) 203-1112 for domestic callers and (719) 457-0820 for international callers, both of whom will need to enter the Conference ID 7520198 when prompted.

The call is being webcast by CCBN and can be accessed at Acacia’s website at www.acaciaresearch.com.

ABOUT ACACIA RESEARCH CORPORATION

Founded in 1993, Acacia Research Corporation (NASDAQ: ACTG) is the industry leader in patent licensing. An intermediary in the patent marketplace, Acacia partners with inventors and patent owners to unlock the financial value in their patented inventions. Acacia bridges the gap between invention and application, facilitating efficiency and delivering monetary rewards to the patent owner.

Information about Acacia Research Corporation and its subsidiaries is available at www.acaciaresearch.com.

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

This news release contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These statements are based upon our current expectations and speak only as of the date hereof. Our actual results may differ materially and adversely from those expressed in any forward-looking statements as a result of various factors and uncertainties, including the effect of the global economic downturn on technology companies, the ability to successfully develop licensing programs and attract new business, rapid technological change in relevant markets, changes in demand for current and future intellectual property rights, legislative, regulatory and competitive developments addressing licensing and enforcement of patents and/or intellectual property in general and general economic conditions. Our Annual Report on Form 10-K, recent and forthcoming Quarterly Reports on Form 10-Q, recent Current Reports on Forms 8-K and 8-K/A, and other SEC filings discuss some of the important risk factors that may affect our business, results of operations and financial condition. We undertake no obligation to revise or update publicly any forward-looking statements for any reason.

The results achieved in the most recent quarter are not necessarily indicative of the results to be achieved by us in any subsequent quarters, as it is currently anticipated that Acacia Research Corporation’s financial results will vary, and may vary significantly, from quarter to quarter. This variance is expected to result from a number of factors, including risk factors affecting our results of operations and financial condition referenced above, and the particular structure of our licensing transactions, which may impact the amount of inventor royalties and contingent legal fees expenses we incur period to period.

ACACIA RESEARCH CORPORATION

SUMMARY FINANCIAL INFORMATION

(In thousands, except share and per share information)

(Unaudited)

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2014 | | 2013 | | 2014 | | 2013 |

| | | | | | | |

Revenues | $ | 31,030 |

| | $ | 15,065 |

| | $ | 130,876 |

| | $ | 130,556 |

|

Operating costs and expenses: | |

| | |

| | |

| | |

|

Cost of revenues: | |

| | |

| | |

| | |

|

Inventor royalties | 4,358 |

| | 3,280 |

| | 20,670 |

| | 29,724 |

|

Contingent legal fees | 7,296 |

| | 3,181 |

| | 23,563 |

| | 24,784 |

|

Litigation and licensing expenses - patents | 8,208 |

| | 8,899 |

| | 37,614 |

| | 39,335 |

|

Amortization of patents | 13,727 |

| | 16,735 |

| | 57,242 |

| | 53,658 |

|

Marketing, general and administrative expenses (including non-cash stock compensation expense of $4,093 and $18,115 for the three months and year ended December 31, 2014, respectively, and $7,082 and $27,894 for the three months and year ended December 31, 2013, respectively) | 12,044 |

| | 13,988 |

| | 48,554 |

| | 59,229 |

|

Research, consulting and other expenses - business development | 637 |

| | 742 |

| | 3,840 |

| | 3,251 |

|

Other | — |

| | — |

| | 1,548 |

| | 3,506 |

|

Total operating costs and expenses | 46,270 |

| | 46,825 |

| | 193,031 |

| | 213,487 |

|

Operating loss | (15,240 | ) | | (31,760 | ) | | (62,155 | ) | | (82,931 | ) |

| |

| | |

| | |

| | |

|

Total other income (expense) | (451 | ) | | 161 |

| | (595 | ) | | 2,131 |

|

Loss from operations before (provision for) benefit from income taxes | (15,691 | ) | | (31,599 | ) | | (62,750 | ) | | (80,800 | ) |

(Provision for) benefit from income taxes | (450 | ) | | (3,390 | ) | | (3,912 | ) | | 21,958 |

|

Net loss including noncontrolling interests in operating subsidiaries | (16,141 | ) | | (34,989 | ) | | (66,662 | ) | | (58,842 | ) |

Net (income) loss attributable to noncontrolling interests in operating subsidiaries | (103 | ) | | 1,656 |

| | 633 |

| | 2,408 |

|

Net loss attributable to Acacia Research Corporation | $ | (16,244 | ) | | $ | (33,333 | ) | | $ | (66,029 | ) | | $ | (56,434 | ) |

| | | | | | | |

Net loss attributable to common stockholders - diluted | $ | (16,399 | ) | | $ | (33,517 | ) | | $ | (66,755 | ) | | $ | (56,945 | ) |

| |

| | |

| | |

| | |

|

Diluted loss per common share | $ | (0.34 | ) | | $ | (0.69 | ) | | $ | (1.37 | ) | | $ | (1.18 | ) |

| | | | | | | |

Weighted average number of shares outstanding, diluted | 48,944,914 |

| | 48,415,684 |

| | 48,658,088 |

| | 48,155,832 |

|

Reconciliation of GAAP Net Loss and EPS to Non-GAAP Net Income (Loss) and EPS

(In thousands, except share and per share data)

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2014 | | 2013 | | 2014 | | 2013 |

| | | | | | | |

GAAP net loss | $ | (16,244 | ) | | $ | (33,333 | ) | | $ | (66,029 | ) | | $ | (56,434 | ) |

| | | | | | | |

Non-cash stock compensation | 4,093 |

| | 7,082 |

| | 18,115 |

| | 27,894 |

|

Non-cash patent amortization | 13,727 |

| | 16,735 |

| | 57,242 |

| | 53,658 |

|

Non-cash tax benefits | — |

| | (1,040 | ) | | — |

| | (26,542 | ) |

| | | | | | | |

Pro forma non-GAAP net income (loss) | $ | 1,576 |

| | $ | (10,556 | ) | | $ | 9,328 |

| | $ | (1,424 | ) |

Pro forma non-GAAP net income (loss) attributable to common stockholders - diluted | $ | 1,530 |

| | $ | (10,740 | ) | | $ | 9,020 |

| | $ | (1,935 | ) |

Pro forma non-GAAP net earnings (loss) per common share — diluted | $ | 0.03 |

| | $ | (0.22 | ) | | $ | 0.18 |

| | $ | (0.04 | ) |

GAAP weighted-average shares — diluted | 49,079,030 |

| | 48,415,684 |

| | 48,785,441 |

| | 48,155,832 |

|

ACACIA RESEARCH CORPORATION

SUMMARY FINANCIAL INFORMATION, (CONTINUED)

(In thousands)

(Unaudited)

CONDENSED CONSOLIDATED BALANCE SHEET INFORMATION

|

| | | | | | | |

| December 31,

2014 | | December 31,

2013 |

ASSETS | | | |

Current assets: | | | |

Cash and cash equivalents | $ | 134,466 |

| | $ | 126,685 |

|

Short-term investments | 58,558 |

| | 130,017 |

|

Accounts receivable | 20,168 |

| | 6,341 |

|

Deferred income tax | 1,161 |

| | 3,139 |

|

Prepaid expenses and other current assets | 4,355 |

| | 7,546 |

|

Total current assets | 218,708 |

| | 273,728 |

|

| |

| | |

|

Property and equipment, net of accumulated depreciation and amortization | 500 |

| | 766 |

|

Patents, net of accumulated amortization | 286,636 |

| | 288,432 |

|

Goodwill | 30,149 |

| | 30,149 |

|

Other assets | 355 |

| | 318 |

|

| $ | 536,348 |

| | $ | 593,393 |

|

| |

| | |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | |

|

Current liabilities: | |

| | |

|

Accounts payable and accrued expenses | $ | 14,860 |

| | $ | 11,555 |

|

Accrued patent investment costs | 16,700 |

| | 4,000 |

|

Royalties and contingent legal fees payable | 14,351 |

| | 10,447 |

|

Total current liabilities | 45,911 |

| | 26,002 |

|

| | | |

Deferred income taxes | 1,161 |

| | 4,874 |

|

Other liabilities | 228 |

| | 319 |

|

Total liabilities | 47,300 |

| | 31,195 |

|

Total stockholders’ equity | 489,048 |

| | 562,198 |

|

| $ | 536,348 |

| | $ | 593,393 |

|

ACACIA RESEARCH CORPORATION

SUMMARY FINANCIAL INFORMATION, (CONTINUED)

(In thousands)

(Unaudited)

CONSOLIDATED STATEMENTS OF CASH FLOWS

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2014 | | 2013 | | 2014 | | 2013 |

Cash flows from operating activities: | | | | | | | |

Net loss including noncontrolling interests in operating subsidiaries | $ | (16,141 | ) | | $ | (34,989 | ) | | $ | (66,662 | ) | | $ | (58,842 | ) |

Adjustments to reconcile net loss including noncontrolling interests in operating subsidiaries to net cash provided by (used in) operating activities: | | | | | |

| | |

|

Depreciation and amortization | 13,793 |

| | 16,809 |

| | 57,546 |

| | 53,894 |

|

Non-cash stock compensation | 4,093 |

| | 7,082 |

| | 18,115 |

| | 27,894 |

|

Excess tax benefits from stock-based compensation | — |

| | 1,040 |

| | — |

| | 1,398 |

|

Change in valuation allowance on net deferred tax assets | — |

| | 2,189 |

| | — |

| | 2,189 |

|

Other | (4 | ) | | 34 |

| | (28 | ) | | 12 |

|

Changes in assets and liabilities: | | | | | | | |

Accounts receivable | (7,466 | ) | | 10,471 |

| | (13,827 | ) | | 3,502 |

|

Prepaid expenses and other assets | 1,435 |

| | 566 |

| | 3,154 |

| | (5,300 | ) |

Accounts payable and accrued expenses | (1,786 | ) | | (5,798 | ) | | 3,717 |

| | 1,076 |

|

Royalties and contingent legal fees payable | (3,426 | ) | | 2,134 |

| | 3,904 |

| | (2,061 | ) |

Deferred taxes, net | (204 | ) | | 1,772 |

| | (1,735 | ) | | (27,271 | ) |

| | | | | | | |

Net cash provided by (used in) operating activities | (9,706 | ) | | 1,310 |

| | 4,184 |

| | (3,509 | ) |

| | | | | |

| | |

|

Cash flows from investing activities: | | | | | |

| | |

|

Purchases of property and equipment | (3 | ) | | (96 | ) | | (109 | ) | | (675 | ) |

Purchase of available-for-sale investments | (33,833 | ) | | (46,884 | ) | | (109,963 | ) | | (279,693 | ) |

Maturities and sales of available-for-sale investments | 48,237 |

| | 83,701 |

| | 182,115 |

| | 239,370 |

|

Investments in patents / patent rights | (18,228 | ) | | (14,645 | ) | | (42,746 | ) | | (25,061 | ) |

| | | | | | | |

Net cash provided by (used in) investing activities | (3,827 | ) | | 22,076 |

| | 29,297 |

| | (66,059 | ) |

| | | | | |

| | |

|

Cash flows from financing activities: | | | | | |

| | |

|

Repurchases of common stock | — |

| | (7,908 | ) | | — |

| | (7,926 | ) |

Dividends paid to shareholders | (6,266 | ) | | (6,241 | ) | | (25,039 | ) | | (18,633 | ) |

Distributions to noncontrolling interests in operating subsidiary | — |

| | — |

| | (867 | ) | | — |

|

Contributions from noncontrolling interests in operating subsidiary | — |

| | — |

| | — |

| | 1,920 |

|

Excess tax benefits from stock-based compensation | — |

| | (1,040 | ) | | — |

| | (1,398 | ) |

Proceeds from exercises of stock options | 8 |

| | 185 |

| | 206 |

| | 486 |

|

| | | | | | | |

Net cash used in financing activities | (6,258 | ) | | (15,004 | ) | | (25,700 | ) | | (25,551 | ) |

| | | | | |

| | |

|

Increase (decrease) in cash and cash equivalents | (19,791 | ) | | 8,382 |

| | 7,781 |

| | (95,119 | ) |

| | | | | |

| | |

|

Cash and cash equivalents, beginning | 154,257 |

| | 118,303 |

| | 126,685 |

| | 221,804 |

|

| | | | | |

| | |

|

Cash and cash equivalents, ending | $ | 134,466 |

| | $ | 126,685 |

| | $ | 134,466 |

| | $ | 126,685 |

|

Business Highlights and Recent Developments(2)

Business highlights of the fourth quarter of 2014 and recent developments include the following:

Revenues for the three months ended December 31, 2014 included fees from the following technology licensing and enforcement programs:

|

| | | | |

• | 3G & 4G Cellular Air Interface and Infrastructure technology

| | • | Mobile Computer Synchronization technology |

• | 4G Wireless technology | | • | Oil and Gas Production technology(1) |

• | Audio Communications Fraud Detection technology | | • | Online Auction Guarantee technology |

• | Automotive Safety, Navigation and Diagnostics technology | | • | Online newsletters with links technology |

• | Broadband Communications technology | | • | Optical Networking technology |

• | Cardiology and Vascular Device technology(1) | | • | Optimized Microprocessor Operation technology(1) |

• | Distributed Data Management & Synchronization technology(1) | | • | Reflective and Radiant Barrier Insulation technology |

• | Enhanced Mobile Communications technology | | • | Super Resolutions Microscopy technology |

• | Gas Modulation Control Systems technology | | • | Suture Anchors technology |

• | High Speed Circuit Interconnect and Display Control technology(1) | | • | Telematics technology |

• | Innovative Display technology | | • | Voice-Over-IP technology |

• | Intercarrier SMS technology | | • | Wireless Infrastructure and User Equipment technology |

• | Interstitial and Pop-Up Internet Advertising technology | | • | Wireless Monitoring technology |

• | Messaging technology | | | |

_______________________

(*) Initial license fees were recorded for these licensing programs in the fourth quarter of 2014.

| |

• | Acacia Research Corporation resolved the dispute initiated by Microsoft Corporation in the United States District Court for the Southern District of New York, Civil Action No. 1:13-cv-08275. |

The following actions brought by Acacia subsidiaries were also resolved as they relate to Microsoft: Intercarrier Communications LLC v. Microsoft Corp., et al., Case No. 1:13-cv-01639-GMS (D. Del.); Optimum Content Protection LLC v. Microsoft Corp., Case No. 6:13-cv-00741-KNM (E.D. Tex.); Internet Communications Solutions LLC v. Microsoft Corp., Skype Inc, and Skype Communications SARL, Case No. 2:14-cv-00189-JRG (E.D. Tex.); Cell and Network Selection LLC v. BlackBerry Corp. et al, Case No. 6:13-cv-00563-KNM (E.D. Tex.); Mobile Enhancement Solutions LLC v. Microsoft Mobile Oy & Nokia Inc, Case No. 3:13-cv-03977-MGL (N.D. Tex.); Super Interconnect Technologies v. Microsoft Mobile Oy & Nokia Inc, Case No. 6:13-cv-00739-KNM (E.D. Tex.), Case No. 3:14-cv-2293-H-BGS (S.D. Cal.).

In addition, the action entitled Cellular Communications Equipment LLC v. HTC Corp., et al., Case No. 6:13-cv-00738-LED/ 6:13-cv-00507-LED (E.D. Tex.) was dismissed with respect to Microsoft without prejudice.

| |

• | ADAPTIX, Inc. entered into a settlement and patent license agreement with Huawei Technologies Co., Ltd. for limited rights on user equipment. The agreement resolved litigation that was pending in the United States District Court for the Eastern District of Texas and litigation that was pending in Tokyo District Court asserting patent infringement by certain Huawei user equipment. |

| |

• | Adaptix, Inc. entered into a settlement and patent license agreement with NEC Corporation and its subsidiaries for certain limited rights to the Adaptix patent portfolio. This agreement resolved litigation that was pending in the United States District Court for the Eastern District of Texas. |

| |

• | Auto-Dimensions LLC and Dassault Systems SolidWorks Corporation resolved the dispute between the parties that was pending in the United States District Court for the District of Massachusetts, Civil Action No. 1:13-cv-12747. |

| |

• | Body Science LLC entered into a settlement agreement with A&D Engineering, Inc. regarding wireless medical diagnostic and monitoring systems. The agreement resolved litigation that was pending in the United States District Court for the District of Massachusetts. |

| |

• | Bonutti Skeletal Innovations LLC entered into a settlement and patent license agreement with DePuy Mitek LLC. The agreement resolved litigation that was pending in the United States District Court for the District of Massachusetts. |

| |

• | Bonutti Skeletal Innovations LLC entered into a settlement and patent license agreement with ConforMIS, Inc. The agreement resolved all aspects of the litigation for the United States District Court for the District of Delaware and the United States District Court for the District of Massachusetts. |

| |

• | Brandywine Communications Technologies LLC entered into a royalty-bearing patent license agreement with Gutierrez-Palmenberg, Inc. dba Phoenix Internet. |

| |

• | Brandywine Communications Technologies LLC entered into a settlement and patent license agreement with MegaPath Corporation. The agreement resolved litigation that was pending in the United States District Court for the District of Delaware. |

| |

• | Cell and Network Selection LLC and SOTA Semiconductor LLC entered into an agreement with RPX Corporation. |

| |

• | Cell and Network Selection LLC entered into a limited rights patent license agreement with NEC Corporation and its subsidiaries. |

| |

• | Cell and Network Selection LLC and AT&T Mobility LLC reached a settlement that resolved the dispute between the parties currently pending in the United States District Court for the Eastern District of Texas, Civil Action No. 6:13-cv-00403. |

| |

• | Cellular Communications Equipment LLC entered into a settlement and limited rights patent license agreement with NEC Corporation and its subsidiaries. The agreement resolved litigation that was pending in the United States District Court for the Eastern District of Texas. |

| |

• | Credit Card Fraud Control Corporation entered into a settlement and patent license agreement with TCSP Inc. dba TrustCommerce. The agreement resolved litigation that was pending in the United States District Court for the Northern District of Texas. |

| |

• | Credit Card Fraud Control Corporation entered into a settlement and license agreement with Chase Paymentech Solutions, LLC. The agreement resolved patent litigation, Civil Action No. 3:14-cv-2671, pending in the United States District Court for the Northern District of Texas, Dallas Division. |

| |

• | Credit Card Fraud Control Corporation entered into a settlement and license agreement with First Data Corporation. This agreement resolved patent litigation, Civil Action No. 3:14-cv-2619, pending in the United States District Court for the Northern District of Texas, Dallas Division. |

| |

• | Database Sync Solutions LLC entered into a settlement and patent license agreement with International Business Machines Corporation. The agreement resolved litigation that was pending in the United States District Court for the Eastern District of Texas. |

| |

• | Innovative Display Technologies LLC and Delaware Display Group LLC entered into a settlement and patent license agreement with HTC Corporation and HTC America, Inc. The agreement resolved litigation that was pending in the United States District Court for the District of Delaware. |

| |

• | Labyrinth Optical Technologies LLC, Ciena Communications, Inc. and Ciena Corporation have reached a settlement that resolved the dispute between the parties currently pending in the United States District Court for the Central District of California, Civil Action No. 8:12-cv-02217. |

| |

• | LifeScreen Sciences LLC entered into a settlement and patent license agreement with Cordis Corporation. The agreement resolved litigation that was pending in the United States District Court for the Eastern District of Texas. |

| |

• | Online News Link LLC entered into a settlement with Epsilon Data Management, LLC. The agreement resolved litigation that was pending in the United States District Court for the Northern District of Texas, Dallas Division. |

| |

• | Parallel Separation Innovations LLC entered into a Settlement and Release Agreement with Axiom Process, LLC and Axiom Process Ltd. The agreement resolved litigation that was pending in the United States District Court for the Eastern District of Texas. |

| |

• | Smartphone Technologies LLC, ASUSTeK Computer Inc., and ASUS Computer International reached a settlement that resolved the dispute between the parties currently pending in the United States District Court for the Eastern District of Texas, Civil Action Nos. 6:13-cv-807 and 6:14-cv-803. |

| |

• | Super Resolution Technologies LLC and Carl Zeiss Microscopy, LLC and Carl Zeiss Microscopy, GmbH reached a resolution of their dispute over the Fluorescent Nanoscopy patents. The agreement resolved litigation that was pending in the United States District Court for the Southern District of Texas. |

| |

• | Unified Messaging Solutions LLC entered into a settlement and patent license agreement with Huntington Bancshares, Inc. The agreement resolved litigation that was pending in the United States District Court for the Northern District of Illinois. |

| |

• | Unified Messaging Solutions LLC entered into a settlement and patent license agreement with The Vanguard Group, Inc. and Vanguard Marketing Corporation. The agreement resolved litigation that was pending in the United States District Court for the Southern District of New York. |

| |

• | Acacia Research Group LLC and its affiliates continued their patent and patent rights investment activities, investing in a total of 2 new patent portfolios in the fourth quarter of 2014, including the following: |

| |

• | In December 2014, sourced rights in additional patent portfolios from Nokia Networks. With these new portfolios, Acacia’s subsidiary now controls marquee portfolios relating to 2G/3G/LTE and LTE-Advanced technologies. |

_______________________

(1) As used herein, “Acacia Research Corporation,” “we,” “us,” and “our” refer to Acacia Research Corporation and/or its wholly and majority-owned operating subsidiaries. All intellectual property investment, development, licensing and enforcement activities are conducted solely by certain of Acacia Research Corporation’s wholly and majority-owned operating subsidiaries.

(2) Acacia Research Group LLC, ADAPTIX, Inc., Auto-Dimensions LLC, Body Science LLC, Bonutti Skeletal Innovations LLC, Brandywine Communications Technologies LLC, Cell and Network Selection LLC, Cellular Communications Equipment LLC, Credit Card Fraud Control Corporation, Database Sync Solutions LLC, Delaware Display Group LLC,

Innovative Display Technologies LLC, Labyrinth Optical Technologies LLC, LifeScreen Sciences LLC, Online News Link LLC, Parallel Separation Innovations LLC, Smartphone Technologies LLC, SOTA Semiconductor LLC, Super Resolution Technologies LLC and Unified Messaging Solutions LLC are wholly and majority-owned operating subsidiaries of Acacia Research Corporation.

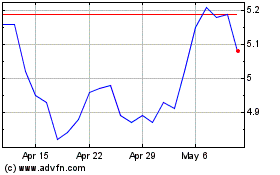

Acacia Research Technolo... (NASDAQ:ACTG)

Historical Stock Chart

From Mar 2024 to Apr 2024

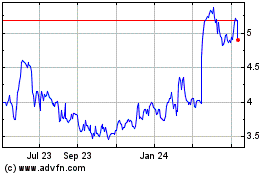

Acacia Research Technolo... (NASDAQ:ACTG)

Historical Stock Chart

From Apr 2023 to Apr 2024