Current Report Filing (8-k)

February 17 2015 - 4:17PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 10, 2015

KAR Auction Services, Inc.

(Exact name of registrant as specified in its charter)

|

| | | | | |

Delaware (State or other jurisdiction of incorporation) | 001-34568 (Commission File Number)

| 20-8744739 (I.R.S. Employer Identification No.) |

| 13085 Hamilton Crossing Boulevard Carmel, Indiana 46032 (Address of principal executive offices) (Zip Code) |

|

| (800) 923-3725 (Registrant’s telephone number, including area code) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

| |

Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On February 10, 2015, the Compensation Committee of the Board of Directors of KAR Auction Services, Inc. (the “Company”) approved the 2015 long-term incentive awards for the Company’s named executive officers to be granted on February 20, 2015 with the following aggregate grant date award values: James Hallett, Chief Executive Officer and Chairman of the Board - $2,700,000; Eric Loughmiller, Executive Vice President and Chief Financial Officer - $1,250,000; Rebecca Polak, Executive Vice President, General Counsel and Secretary - $400,000; and Thomas Caruso, Chief Client Officer - $212,500.

The aggregate target award value for each named executive officer is allocated such that 75% of the value is in the form of performance-based restricted stock units (PRSUs) and 25% of the value is in the form of time-vested restricted stock units (RSUs). The PRSUs may be earned (from 0% to 200% of the target award value) based on the Company’s cumulative adjusted net income per share performance during the three-year period ending December 31, 2017 and are on substantially the same terms utilized by the Company for a portion of its PRSUs awards in 2014. The RSUs generally vest and convert into shares of common stock of the Company on a 1-for-1 basis on each of the first three anniversaries of the grant date during the named executive officer’s continued employment with the Company.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | | |

| KAR AUCTION SERVICES, INC. |

| | |

| | |

Dated: February 17, 2015 | By: | /s/ | Rebecca C. Polak |

| Name: | Rebecca C. Polak |

| Title: | Executive Vice President, General Counsel and Secretary |

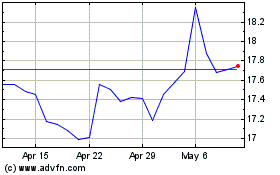

OPENLANE (NYSE:KAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

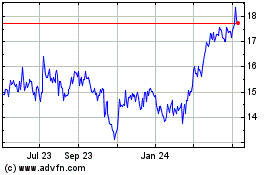

OPENLANE (NYSE:KAR)

Historical Stock Chart

From Apr 2023 to Apr 2024