UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 17, 2015

KAR Auction Services, Inc.

(Exact name of Registrant as specified in its charter)

|

| | | | |

Delaware | | 001-34568 | | 20-8744739 |

(State or other jurisdiction

of incorporation) | | (Commission File

Number) | | (I.R.S. Employer

Identification No.) |

13085 Hamilton Crossing Boulevard

Carmel, Indiana 46032

(Address of principal executive offices)

(Zip Code)

(800) 923-3725

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition.

On February 17, 2015, KAR Auction Services, Inc. issued a press release announcing its financial results for the three and twelve months ended December 31, 2014. KAR Auction Services, Inc. will host an earnings conference call and webcast, Wednesday, February 18, 2015 at 11:00 a.m., Eastern Standard Time. The conference call may be accessed by calling 1-877-718-5101 and entering participant passcode 8517967 and the live webcast may be accessed at the investor relations section of www.karauctionservices.com. The call will be hosted by KAR Auction Services, Inc. Chief Executive Officer, Jim Hallett, and Executive Vice President and Chief Financial Officer, Eric Loughmiller. The call will feature a review of operating highlights and financial results for the three and twelve months ended December 31, 2014. The press release dated February 17, 2015 is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference in its entirety.

On February 17, 2015, KAR Auction Services, Inc. also posted supplemental financial information for the three and twelve months ended December 31, 2014, at the investor relations section of www.karauctionservices.com under the quarterly results page. The supplemental financial information posted on February 17, 2015 is attached to this Current Report on Form 8-K as Exhibit 99.2 and is incorporated herein by reference in its entirety.

Within the Company's fourth quarter 2014 press release, related attachments thereto and the supplemental financial information, the Company makes reference to certain non-GAAP financial measures. The non-GAAP financial measures include the following: EBITDA, Adjusted EBITDA, Adjusted Net Income and Adjusted Net Income Per Share. The Company has presented reconciling information along with the most directly comparable financial measure calculated and presented in accordance with Generally Accepted Accounting Principles in the United States (“GAAP”) for each of the above non-GAAP financial measures in the press release and supplemental financial information. In addition, the Company’s reasons for presenting these non-GAAP financial measures are discussed below.

The Company believes that these measures represent important internal measures of performance. Accordingly, where these non-GAAP measures are provided, it is done so that investors have the same financial data that management uses with the belief that it will assist the investment community in properly assessing the underlying performance of the Company on a year-over-year and quarter-sequential basis. Investors should consider these non-GAAP measures in addition to, not as a substitute for or superior to, measures of financial performance prepared in accordance with GAAP. The specific reasons, in addition to the reasons described above, why the Company's management believes that the presentation of the non-GAAP financial measures provides useful information to investors regarding the Company’s results of operations are as follows:

EBITDA and Adjusted EBITDA – The Company’s management believes that EBITDA is a useful supplement and meaningful indicator of earnings performance to be used by its investors, financial analysts and others to analyze the Company’s financial performance and results of operations over time. Management believes that the inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA is appropriate to provide additional information to investors about one of the principal measures of performance used by its creditors. In addition, management uses EBITDA and Adjusted EBITDA to evaluate the performance of the Company. The most directly comparable financial performance measure calculated and presented in accordance with GAAP is

net income (loss). A reconciliation of net income (loss) to EBITDA and Adjusted EBITDA for the three and twelve months ended December 31, 2014 and 2013 is contained in the attachments to the press release. In addition, a reconciliation of net income (loss) to EBITDA and Adjusted EBITDA for the three months ended December 31, 2014 and 2013, as well as each of the last four quarters and the twelve months ended December 31, 2014 is contained in the supplemental financial information.

Adjusted Net Income and Adjusted Net Income Per Share – The Company’s management believes that adjusted net income and adjusted net income per share are useful supplements and meaningful indicators of earnings performance to be used by its investors, financial analysts and others to analyze the Company’s financial performance and results of operations over time. The revaluation of certain assets of the company, and resultant increase in depreciation and amortization expense which resulted from the 2007 merger, as well as stock-based compensation expense tied to the 2007 merger, have had a continuing effect on our reported results. Non-GAAP financial measures of adjusted net income and adjusted net income per share, in the opinion of the company, provide comparability to other companies that may have not incurred these types of non-cash expenses. In addition, net income and net income per share have been adjusted for certain other charges. A reconciliation of net income (loss) and net income (loss) per share to adjusted net income and adjusted net income per share for the three and twelve months ended December 31, 2014 and 2013 is contained in the attachments to the press release.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

EXHIBIT NO. DESCRIPTION OF EXHIBIT

| |

99.1 | Press release dated February 17, 2015 – “KAR Auction Services, Inc. Reports Fourth Quarter and Full Year 2014 Results” |

| |

99.2 | KAR Auction Services, Inc. Q4 and YTD 2014 Supplemental Financial Information – February 17, 2015 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Dated: February 17, 2015 KAR Auction Services, Inc.

/s/ Eric M. Loughmiller

Eric M. Loughmiller

Executive Vice President and Chief Financial Officer

For Immediate Release

Analyst Inquiries: Media Inquiries:

Jonathan Peisner Darci Valentine

(317) 249-4390 (317) 249-4414

jonathan.peisner@karauctionservices.com darci.valentine@karauctionservices.com

KAR Auction Services, Inc. Reports

Fourth Quarter and Full Year 2014 Results

Board Announces Quarterly Dividend of $0.27 per Common Share

Carmel, IN, February 17, 2015 — KAR Auction Services, Inc. (NYSE: KAR), today reported its fourth quarter financial results for the period ended December 31, 2014. For the fourth quarter of 2014, the company reported revenue of $606.0 million as compared with revenue of $540.6 million for the fourth quarter of 2013, an increase of 12%. Adjusted EBITDA for the quarter ended December 31, 2014 increased 13% to $148.5 million, as compared with Adjusted EBITDA of $131.2 million for the quarter ended December 31, 2013. Net income for the fourth quarter of 2014 increased to $50.3 million, or $0.35 per diluted share, as compared with a net loss of $17.6 million, or $0.13 per diluted share, in the fourth quarter of 2013. Adjusted net income per diluted share for the quarter ended December 31, 2014 increased 54% to $0.40 versus adjusted net income per diluted share of $0.26 for the quarter ended December 31, 2013.

For the year ended December 31, 2014, the company reported revenue of $2,364.5 million as compared with revenue of $2,173.3 million for the year ended December 31, 2013, an increase of 9%. Adjusted EBITDA for the year ended December 31, 2014 increased 11% to $598.8 million, as compared with Adjusted EBITDA of $538.2 million for the year ended December 31, 2013. Net income increased 150% to $169.3 million, or $1.19 per diluted share, as compared with net income of $67.7 million, or $0.48 per diluted share for the year ended December 31, 2013. Adjusted net income per diluted share for the year ended December 31, 2014 increased 36% to $1.62 versus adjusted net income per diluted share of $1.19 for the year ended December 31, 2013.

The company also announced a cash dividend today of $0.27 per share on the company’s common stock. The dividend is payable on April 2, 2015, to stockholders of record as of the close of business on March 25, 2015.

2015 Outlook

The company expects 2015 Adjusted EBITDA of $630 million - $660 million. The company also expects net income per share of $1.40 - $1.55 and adjusted net income per share of $1.60 - $1.75, assuming a 2015 effective tax rate of approximately 38%. Adjusted net income per share for 2015 represents GAAP net income per diluted share excluding excess depreciation and amortization resulting from the 2007 merger, net of taxes. Additionally, the company expects 2015 cash taxes of approximately $130 million - $135 million, cash interest on corporate debt of approximately $60 million and capital expenditures of approximately $115 million. This would result in free cash flow before dividend payments of approximately $325 million - $350 million or $2.27 - $2.45 per share.

Earnings Conference Call Information

KAR Auction Services, Inc. will be hosting an earnings conference call and webcast on Wednesday, February 18, 2015 at 11:00 a.m. EST (10:00 a.m. CST). The call will be hosted by KAR Auction Services, Inc.’s Chief Executive Officer, Jim Hallett, and Executive Vice President and Chief Financial Officer, Eric Loughmiller. The conference call may be accessed by calling 1-877-718-5101 and entering participant passcode 8517967 while the live web cast will be available at the investor relations section of www.karauctionservices.com. Supplemental financial information for KAR Auction Services’ fourth quarter and full year 2014 results is available at the investor relations section of www.karauctionservices.com under the quarterly results page.

A replay of the call will be available for two weeks via telephone starting approximately 30 minutes after the completion of the call. The replay may be accessed by calling 1-888-203-1112 and entering pass code 8517967. The archive of the web cast will also be available following the call and will be available at the investor relations section of www.karauctionservices.com for a limited time.

About KAR Auction Services, Inc.

KAR Auction Services, Inc. (NYSE: KAR), a FORTUNE® 1000 company, operates used vehicle auction services for North American sellers and buyers worldwide. Based in Carmel, Ind., the KAR group of companies is comprised of ADESA, Inc. (ADESA), Insurance Auto Auctions, Inc. (IAA), Automotive Finance Corporation (AFC), and additional business units, with nearly 12,000 employees across the globe.

ADESA operates 65 wholesale used vehicle auctions and IAA has 168 salvage vehicle auctions. Both companies offer leading online auction platforms to provide greater access for customers. AFC provides inventory financing and comprehensive business services primarily to independent used vehicle dealers from its 111 locations. Together, KAR’s complementary businesses provide support, technology and logistics for the used vehicle industry. For more information, visit karauctionservices.com.

Forward Looking Statements

Certain statements contained in this release include "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 and which are subject to certain risks, trends and uncertainties. In particular, statements made that are not historical facts may be forward-looking statements. Words such as “should,” “may,” “will,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates,” and similar expressions identify forward-looking statements. Such statements are not guarantees of future performance and are subject to risks and uncertainties that could cause actual results to differ materially from the results projected, expressed or implied by these forward-looking statements. Factors that could cause or contribute to such differences include those matters disclosed in the Company’s Securities and Exchange Commission filings. The Company does not undertake any obligation to update any forward-looking statements.

KAR Auction Services, Inc.

Condensed Consolidated Statements of Income

(In millions) (Unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2014 | | 2013 | | 2014 | | 2013 |

Operating revenues | | | | | | | |

ADESA Auction Services |

| $310.5 |

| |

| $274.3 |

| |

| $1,218.5 |

| |

| $1,118.6 |

|

IAA Salvage Services | 229.6 |

| | 206.8 |

| | 895.9 |

| | 830.0 |

|

AFC | 65.9 |

| | 59.5 |

| | 250.1 |

| | 224.7 |

|

Total operating revenues | 606.0 |

| | 540.6 |

| | 2,364.5 |

| | 2,173.3 |

|

| | | | | | | |

Operating expenses | | | | | | | |

Cost of services (exclusive of depreciation and amortization) | 344.2 |

| | 305.7 |

| | 1,318.8 |

| | 1,232.2 |

|

Selling, general and administrative | 113.8 |

| | 156.7 |

| | 471.4 |

| | 490.0 |

|

Depreciation and amortization | 51.3 |

| | 48.5 |

| | 196.6 |

| | 194.4 |

|

Total operating expenses | 509.3 |

| | 510.9 |

| | 1,986.8 |

| | 1,916.6 |

|

| | | | | | | |

Operating profit | 96.7 |

| | 29.7 |

| | 377.7 |

| | 256.7 |

|

| | | | | | | |

Interest expense | 20.9 |

| | 25.4 |

| | 86.2 |

| | 104.7 |

|

Other income, net | (1.9) |

| | (0.1) |

| | (3.8) |

| | (2.6) |

|

Loss on extinguishment/modification of debt | -- |

| | -- |

| | 30.3 |

| | 5.4 |

|

| | | | | | | |

Income before income taxes | 77.7 |

| | 4.4 |

| | 265.0 |

| | 149.2 |

|

| | | | | | | |

Income taxes | 27.4 |

| | 22.0 |

| | 95.7 |

| | 81.5 |

|

| | | | | | | |

Net income (loss) |

| $50.3 |

| | $(17.6) | |

| $169.3 |

| |

| $67.7 |

|

| | | | | | | |

Net income (loss) per share | | | | | | | |

Basic |

| $0.36 |

| | $(0.13) | |

| $1.21 |

| |

| $0.49 |

|

Diluted |

| $0.35 |

| | $(0.13) | |

| $1.19 |

| |

| $0.48 |

|

| | | | | | | |

Dividends declared per common share |

| $0.27 |

| |

| $0.25 |

| |

| $1.02 |

| |

| $0.82 |

|

KAR Auction Services, Inc.

Condensed Consolidated Balance Sheets

(In millions) (Unaudited)

|

| | | | | | | |

| December 31, 2014 | | December 31, 2013 |

Cash and cash equivalents |

| $152.9 |

| |

| $191.6 |

|

Restricted cash | 17.0 |

| | 18.8 |

|

Trade receivables, net of allowances | 401.2 |

| | 354.3 |

|

Finance receivables, net of allowances | 1,363.1 |

| | 1,099.6 |

|

Other current assets | 140.7 |

| | 127.2 |

|

Total current assets | 2,074.9 |

| | 1,791.5 |

|

| | | |

Goodwill | 1,705.2 |

| | 1,705.1 |

|

Customer relationships, net of accumulated amortization | 484.4 |

| | 569.9 |

|

Intangible and other assets | 359.1 |

| | 356.9 |

|

Property and equipment, net of accumulated depreciation | 727.9 |

| | 703.8 |

|

Total assets |

| $5,351.5 |

| |

| $5,127.2 |

|

| | | |

Current liabilities, excluding obligations collateralized by finance receivables and current maturities of debt |

| $707.7 |

| |

| $629.7 |

|

Obligations collateralized by finance receivables | 865.2 |

| | 772.4 |

|

Current maturities of debt | 17.7 |

| | 32.5 |

|

Total current liabilities | 1,590.6 |

| | 1,434.6 |

|

| | | |

Long-term debt | 1,736.6 |

| | 1,734.7 |

|

Other non-current liabilities | 477.2 |

| | 476.1 |

|

Stockholders’ equity | 1,547.1 |

| | 1,481.8 |

|

Total liabilities and stockholders’ equity |

| $5,351.5 |

| |

| $5,127.2 |

|

KAR Auction Services, Inc.

EBITDA and Adjusted EBITDA Measures

EBITDA and Adjusted EBITDA Measures

EBITDA and Adjusted EBITDA as presented herein are supplemental measures of our performance that are not required by, or presented in accordance with, generally accepted accounting principles in the United States (“GAAP”). They are not measurements of our financial performance under GAAP and should not be considered as substitutes for net income (loss) or any other performance measures derived in accordance with GAAP.

EBITDA is defined as net income (loss), plus interest expense net of interest income, income tax provision (benefit), depreciation and amortization. Adjusted EBITDA is EBITDA adjusted for the items of income and expense and expected incremental revenue and cost savings as described in our senior secured credit agreement covenant calculations. Management believes that the inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA is appropriate to provide additional information to investors about one of the principal measures of performance used by our creditors. In addition, management uses EBITDA and Adjusted EBITDA to evaluate our performance. EBITDA and Adjusted EBITDA have limitations as analytical tools, and should not be considered in isolation or as a substitute for analysis of the results as reported under GAAP. These measures may not be comparable to similarly titled measures reported by other companies.

The following table reconciles EBITDA and Adjusted EBITDA to net income for the periods presented:

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

(Dollars in millions), (Unaudited) | 2014 | | 2013 | | 2014 | | 2013 |

| | | | | | | |

Net income |

| $50.3 |

| | $(17.6) | |

| $169.3 |

| |

| $67.7 |

|

Add back: | | | | | | | |

Income taxes | 27.4 |

| | 22.0 |

| | 95.7 |

| | 81.5 |

|

Interest expense, net of interest income | 20.8 |

| | 25.3 |

| | 85.9 |

| | 104.3 |

|

Depreciation and amortization | 51.3 |

| | 48.5 |

| | 196.6 |

| | 194.4 |

|

EBITDA | 149.8 |

| | 78.2 |

| | 547.5 |

| | 447.9 |

|

Adjustments per the Credit Agreement | (1.3) |

| | 53.0 |

| | 51.3 |

| | 76.8 |

|

Superstorm Sandy | -- |

| | -- |

| | -- |

| | 13.5 |

|

Adjusted EBITDA |

| $148.5 |

| |

| $131.2 |

| |

| $598.8 |

| |

| $538.2 |

|

KAR Auction Services, Inc.

Adjusted Net Income and Adjusted Net Income Per Share

Adjusted Net Income and Adjusted Net Income Per Share

The revaluation of certain assets of the company, and resultant increase in depreciation and amortization expense which resulted from the 2007 merger, as well as stock-based compensation expense tied to the 2007 merger, have had a continuing effect on our reported results. Non-GAAP financial measures of adjusted net income and adjusted net income per share, in the opinion of the company, provide comparability to other companies that may have not incurred these types of non-cash expenses. In addition, net income and net income per share have been adjusted for certain other charges, as seen in the following reconciliation.

The following table reconciles adjusted net income and adjusted net income per share to net income and net income per share for the periods presented:

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

(In millions, except per share amounts) | 2014 | | 2013 | | 2014 | | 2013 |

| | | | | | | |

Net income |

| $50.3 |

| | $(17.6) | |

| $169.3 |

| |

| $67.7 |

|

Loss on extinguishment/modification of debt, net of tax (1) | -- |

| | -- |

| | 19.3 |

| | 3.2 |

|

Stepped up depreciation and amortization expense, net of tax (2) | 7.2 |

| | 7.1 |

| | 28.6 |

| | 28.7 |

|

Stock-based compensation, net of tax (3) | (0.3) |

| | 46.2 |

| | 13.2 |

| | 60.2 |

|

Superstorm Sandy, net of tax (4) | -- |

| | -- |

| | -- |

| | 8.0 |

|

Adjusted net income |

| $57.2 |

| |

| $35.7 |

| |

| $230.4 |

| |

| $167.8 |

|

| | | | | | | |

Net income per share – diluted |

| $0.35 |

| | $(0.13) | |

| $1.19 |

| |

| $0.48 |

|

Loss on extinguishment/modification of debt, net of tax | -- |

| | -- |

| | 0.14 |

| | 0.02 |

|

Stepped up depreciation and amortization expense, net of tax | 0.05 |

| | 0.05 |

| | 0.20 |

| | 0.20 |

|

Stock-based compensation, net of tax | -- |

| | 0.34 |

| | 0.09 |

| | 0.43 |

|

Superstorm Sandy, net of tax | -- |

| | -- |

| | -- |

| | 0.06 |

|

Adjusted net income per share - diluted |

| $0.40 |

| |

| $0.26 |

| |

| $1.62 |

| |

| $1.19 |

|

| | | | | | | |

Weighted average diluted shares | 142.8 |

| | 138.9 |

| | 141.8 |

| | 140.8 |

|

| |

(1) | We incurred a loss on the extinguishment/modification of debt totaling $30.3 million ($19.3 million net of tax) and $5.4 million ($3.2 million net of tax) for the year ended December 31, 2014 and 2013, respectively. |

| |

(2) | Increased depreciation and amortization expense was $11.1 million ($7.2 million net of tax) and $11.3 million ($7.1 million net of tax) for the three months ended December 31, 2014 and 2013, respectively. For the year ended December 31, 2014 and 2013, increased depreciation and amortization expense was $44.8 million ($28.6 million net of tax) and $45.8 million ($28.7 million net of tax), respectively. |

| |

(3) | For the three months ended December 31, 2014, there was a reduction in stock-based compensation resulting from the 2007 merger of $0.5 million ($0.3 million benefit net of tax). Stock-based compensation resulting from the 2007 merger was $49.7 million ($46.2 million net of tax) for the three months ended December 31, 2013. For the year ended December 31, 2014 and 2013, such stock-based compensation was $20.6 million ($13.2 million net of tax) and $64.5 million ($60.2 million net of tax), respectively. |

| |

(4) | We incurred a loss resulting from Superstorm Sandy of approximately $13.5 million ($8.0 million net of tax) for the year ended December 31, 2013. |

Non-GAAP Financial Measures

The company provides historical and forward-looking non-GAAP measures called EBITDA, Adjusted EBITDA, free cash flow, adjusted net income and adjusted net income per share. Management believes that these measures provide investors additional meaningful methods to evaluate certain aspects of the company’s results period over period and for the other reasons set forth previously.

Earnings guidance also does not contemplate future items such as business development activities, strategic developments (such as restructurings or dispositions of assets or investments), significant expenses related to litigation and changes in applicable laws and regulations (including significant accounting and tax matters). The timing and amounts of these items are highly variable, difficult to predict, and of a potential size that could have a substantial impact on the company’s reported results for any given period. Prospective quantification of these items is generally not practicable. Forward-looking non-GAAP guidance excludes increased depreciation and amortization expense that resulted from the 2007 revaluation of the company’s assets, as well as one-time charges, net of taxes.

KAR Auction Services, Inc.

Q4 and YTD 2014 Supplemental Financial Information

February 17, 2015

KAR Auction Services, Inc.

EBITDA and Adjusted EBITDA Measures

EBITDA and Adjusted EBITDA Measures

EBITDA and Adjusted EBITDA as presented herein are supplemental measures of our performance that are not required by, or presented in accordance with, generally accepted accounting principles in the United States (“GAAP”). They are not measurements of our financial performance under GAAP and should not be considered as substitutes for net income (loss) or any other performance measures derived in accordance with GAAP.

EBITDA is defined as net income (loss), plus interest expense net of interest income, income tax provision (benefit), depreciation and amortization. Adjusted EBITDA is EBITDA adjusted for the items of income and expense and expected incremental revenue and cost savings as described in our senior secured credit agreement covenant calculations. Management believes that the inclusion of supplementary adjustments to EBITDA applied in presenting Adjusted EBITDA is appropriate to provide additional information to investors about one of the principal measures of performance used by our creditors. In addition, management uses EBITDA and Adjusted EBITDA to evaluate our performance. EBITDA and Adjusted EBITDA have limitations as analytical tools, and should not be considered in isolation or as a substitute for analysis of the results as reported under GAAP. These measures may not be comparable to similarly titled measures reported by other companies.

The following tables reconcile EBITDA and Adjusted EBITDA to net income (loss) for the periods presented:

|

| | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2014 |

(Dollars in millions), (Unaudited) | ADESA | | IAA | | AFC | | Corporate | | Consolidated |

| | | | | | | | | |

Net income (loss) |

| $23.9 |

| |

| $18.5 |

| |

| $19.9 |

| | $(12.0) | |

| $50.3 |

|

Add back: | | | | | | | | | |

Income taxes | 7.5 |

| | 12.4 |

| | 13.9 |

| | (6.4) | | 27.4 |

|

Interest expense, net of interest income | 0.1 |

| | -- |

| | 4.9 |

| | 15.8 | | 20.8 |

|

Depreciation and amortization | 21.2 |

| | 19.6 |

| | 7.7 |

| | 2.8 | | 51.3 |

|

Intercompany interest | 13.0 |

| | 9.4 |

| | (5.1) |

| | (17.3) | | -- |

|

EBITDA | 65.7 |

| | 59.9 |

| | 41.3 |

| | (17.1) | | 149.8 |

|

Adjustments per the Credit Agreement | 3.2 |

| | 0.1 |

| | (2.7) |

| | (1.9) | | (1.3) |

|

Adjusted EBITDA |

| $68.9 |

| |

| $60.0 |

| |

| $38.6 |

| | $(19.0) | |

| $148.5 |

|

|

| | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2013 |

(Dollars in millions), (Unaudited) | ADESA | | IAA | | AFC | | Corporate | | Consolidated |

| | | | | | | | | |

Net income (loss) |

| $2.7 |

| |

| $17.3 |

| |

| $21.7 |

| | $(59.3) | | $(17.6) |

Add back: | | | | | | | | | |

Income taxes | 11.9 |

| | 9.2 |

| | 6.0 |

| | (5.1) | | 22.0 |

|

Interest expense, net of interest income | 0.2 |

| | 0.1 |

| | 4.4 |

| | 20.6 | | 25.3 |

|

Depreciation and amortization | 21.1 |

| | 18.4 |

| | 7.3 |

| | 1.7 | | 48.5 |

|

Intercompany interest | 12.7 |

| | 9.4 |

| | (4.7) |

| | (17.4) | | -- |

|

EBITDA | 48.6 |

| | 54.4 |

| | 34.7 |

| | (59.5) | | 78.2 |

|

Adjustments per the Credit Agreement | 9.5 |

| | 3.2 |

| | -- |

| | 40.3 | | 53.0 |

|

Adjusted EBITDA |

| $58.1 |

| |

| $57.6 |

| |

| $34.7 |

| | $(19.2) | |

| $131.2 |

|

Certain of our loan covenant calculations utilize financial results for the most recent four consecutive fiscal quarters. The following table reconciles EBITDA and Adjusted EBITDA to net income for the periods presented:

|

| | | | | | | | | | | | | | | | | | | |

|

Three Months Ended | | Twelve Months Ended |

(Dollars in millions), (Unaudited) | March 31, 2014 | | June 30, 2014 | | September 30, 2014 | | December 31, 2014 | | December 31, 2014 |

| | | | | | | | | |

Net income (loss) |

| $20.7 |

| |

| $50.8 |

| |

| $47.5 |

| |

| $50.3 |

| |

| $169.3 |

|

Add back: | | | | | | | | | |

Income taxes | 9.8 |

| | 30.1 |

| | 28.4 |

| | 27.4 |

| | 95.7 |

|

Interest expense, net of interest income | 24.1 |

| | 20.8 |

| | 20.2 |

| | 20.8 |

| | 85.9 |

|

Depreciation and amortization | 48.1 |

| | 48.3 |

| | 48.9 |

| | 51.3 |

| | 196.6 |

|

EBITDA | 102.7 |

| | 150.0 |

| | 145.0 |

| | 149.8 |

| | 547.5 |

|

Other adjustments per the Credit Agreement | 1.3 |

| | 0.9 |

| | 1.0 |

| | 0.6 |

| | 3.8 |

|

Non-cash charges | 46.4 |

| | 6.7 |

| | 6.8 |

| | 2.0 |

| | 61.9 |

|

AFC interest expense | (3.3) |

| | (3.5) |

| | (3.7) |

| | (3.9) |

| | (14.4) |

|

Adjusted EBITDA |

| $147.1 |

| |

| $154.1 |

| |

| $149.1 |

| |

| $148.5 |

| |

| $598.8 |

|

Segment Results

ADESA Results

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

(Dollars in millions) | 2014 | | 2013 | | 2014 | | 2013 |

ADESA revenue |

| $310.5 |

| |

| $274.3 |

| |

| $1,218.5 |

| |

| $1,118.6 |

|

Cost of services* | 180.9 |

| | 160.1 |

| | 693.4 |

| | 629.9 |

|

Gross profit* | 129.6 |

| | 114.2 |

| | 525.1 |

| | 488.7 |

|

Selling, general and administrative | 63.2 |

| | 64.6 |

| | 259.9 |

| | 252.3 |

|

Depreciation and amortization | 21.2 |

| | 21.1 |

| | 80.2 |

| | 87.9 |

|

Operating profit |

| $45.2 |

| |

| $28.5 |

| |

| $185.0 |

| |

| $148.5 |

|

EBITDA |

| $65.7 |

| |

| $48.6 |

| |

| $261.0 |

| |

| $231.3 |

|

Adjustments per the Credit Agreement | 3.2 |

| | 9.5 |

| | 24.0 |

| | 24.7 |

|

Adjusted EBITDA |

| $68.9 |

| |

| $58.1 |

| |

| $285.0 |

| |

| $256.0 |

|

* Exclusive of depreciation and amortization

Overview of ADESA Results for the Three Months Ended December 31, 2014 and 2013

Revenue

Revenue from ADESA increased $36.2 million, or 13%, to $310.5 million for the three months ended December 31, 2014, compared with $274.3 million for the three months ended December 31, 2013. The increase in revenue was primarily a result of a 9% increase in the number of vehicles sold, as well as a 4% increase in revenue per vehicle sold, offset by the impact of a decrease in revenues of $4.3 million due to fluctuations in the Canadian exchange rate.

The increase in volume sold was primarily attributable to an increase in institutional volume, including vehicles sold on our online only platform, as well as a 3% increase in dealer consignment units sold for the three months ended December 31, 2014 compared with the three months ended December 31, 2013. Online sales volumes for ADESA represented approximately 37% of the total vehicles sold in the fourth quarter of 2014, compared with approximately 35% in the fourth quarter of 2013. "Online sales" includes the following: (i) selling vehicles directly from a dealership or other interim storage location (upstream selling); (ii) online solutions that offer vehicles for sale while in transit to auction locations (midstream selling); (iii) simultaneously broadcasting video and audio of the physical auctions to online bidders (LiveBlock®); and (iv) bulletin-board or real-time online auctions (DealerBlock®). Both the upstream and midstream selling represent online only sales, which represent over half of ADESA's online sales volume. ADESA sold approximately 115,000 and 98,000 vehicles through its online only offerings in the fourth quarter of 2014 and 2013, respectively. For the three months ended December 31, 2014, dealer consignment vehicles represented approximately 47% of used vehicles sold at ADESA physical auction locations, compared with approximately 49% for the three months ended December 31, 2013. Vehicles sold at physical auction locations increased 7% in the fourth quarter of 2014, compared with the fourth quarter of 2013. The used vehicle conversion percentage at physical auction locations, calculated as the number of vehicles sold as a percentage of the number of vehicles entered for sale at our ADESA auctions, increased to 56.8% for the three months ended December 31, 2014, compared with 55.5% for the three months ended December 31, 2013.

Total revenue per vehicle sold increased 4% to approximately $574 for the three months ended December 31, 2014, compared with approximately $554 for the three months ended December 31, 2013. Physical auction revenue per vehicle sold increased $38 or 6%, to $700 for the three months ended December 31, 2014, compared with $662 for the three months ended December 31, 2013. Physical auction revenue per vehicle sold includes revenue from seller and buyer auction fees and ancillary and other related services, which includes non-auction services. The increase in physical auction revenue per vehicle sold was primarily attributable to an increase in ancillary and other related services revenue. Online only auction revenue per vehicle sold decreased $9 to $106 for the three months ended December 31, 2014, compared with $115 for the three months ended December 31, 2013. The decrease in online only auction revenue per

vehicle sold was attributable to a decline in fees per car sold, primarily due to an increase in the number of cars sold in closed private label sales, which includes sales to grounding dealers. The revenue per vehicle sold in a closed private label sale is lower than the revenue per vehicle sold in an open online only auction.

Gross Profit

For the three months ended December 31, 2014, gross profit for ADESA increased $15.4 million, or 13%, to $129.6 million, compared with $114.2 million for the three months ended December 31, 2013. Gross profit for ADESA was 41.7% of revenue for the three months ended December 31, 2014, compared with 41.6% of revenue for the three months ended December 31, 2013. The increase in gross profit percentage for the three months ended December 31, 2014, compared with the three months ended December 31, 2013, was primarily the result of the 13% increase in revenue.

Selling, General and Administrative

Selling, general and administrative expenses for the ADESA segment decreased $1.4 million, or 2%, to $63.2 million for the three months ended December 31, 2014, compared with $64.6 million for the three months ended December 31, 2013, primarily due to a decrease in stock-based compensation expense of $4.3 million and fluctuations in the Canadian exchange rate of $0.8 million, partially offset by an increase in incentive-based compensation expense of $1.2 million, selling, general and administrative expenses associated with High Tech Locksmiths of $1.0 million and an increase in professional fees of $0.7 million.

Overview of ADESA Results for the Year Ended December 31, 2014 and 2013

Revenue

Revenue from ADESA increased $99.9 million, or 9%, to $1,218.5 million for the year ended December 31, 2014, compared with $1,118.6 million for the year ended December 31, 2013. The increase in revenue was primarily a result of a 7% increase in the number of vehicles sold, as well as a 2% increase in revenue per vehicle sold, partially offset by the impact of a decrease in revenues of $15.7 million due to fluctuations in the Canadian exchange rate.

The increase in volume sold was primarily attributable to an increase in institutional volume, including vehicles sold on our online only platform, as well as a 3% increase in dealer consignment units sold for the year ended December 31, 2014 compared with the year ended December 31, 2013. Online sales volumes for ADESA represented approximately 38% of the total vehicles sold in 2014, compared with approximately 35% in 2013. "Online sales" includes the following: (i) selling vehicles directly from a dealership or other interim storage location (upstream selling); (ii) online solutions that offer vehicles for sale while in transit to auction locations (midstream selling); (iii) simultaneously broadcasting video and audio of the physical auctions to online bidders (LiveBlock®); and (iv) bulletin-board or real-time online auctions (DealerBlock®). Both the upstream and midstream selling represent online only sales, which represent over half of ADESA's online sales volume. ADESA sold approximately 495,000 and 407,000 vehicles through its online only offerings in 2014 and 2013, respectively. For the year ended December 31, 2014 and 2013, dealer consignment vehicles represented approximately 51% of used vehicles sold at ADESA physical auction locations. Vehicles sold at physical auction locations increased 3% in 2014, compared with 2013. The used vehicle conversion percentage at physical auction locations, calculated as the number of vehicles sold as a percentage of the number of vehicles entered for sale at our ADESA auctions, increased to 58.2% for the year ended December 31, 2014, compared with 56.9% for the year ended December 31, 2013.

Total revenue per vehicle sold increased 2% to approximately $554 for the year ended December 31, 2014, compared with approximately $544 for the year ended December 31, 2013. Physical auction revenue per vehicle sold increased $36 or 6%, to $685 for the year ended December 31, 2014, compared with $649 for the year ended December 31, 2013. Physical auction revenue per vehicle sold includes revenue from seller and buyer auction fees and ancillary and other related services, which includes non-auction services. The increase in physical auction revenue per vehicle sold was primarily attributable to an increase in ancillary and other related services revenue. Online only auction revenue per vehicle sold decreased $15 to $104 for the year ended December 31, 2014, compared with $119 for the year ended December 31, 2013. The decrease in online only auction revenue per vehicle sold was attributable to a decline in fees per car sold, primarily due to an increase in the number of cars sold in closed private label sales, which includes sales to grounding dealers. The revenue per vehicle sold in a closed private label sale is lower than the revenue per vehicle sold in an open online only auction.

Gross Profit

For the year ended December 31, 2014, gross profit for ADESA increased $36.4 million, or 7%, to $525.1 million, compared with $488.7 million for the year ended December 31, 2013. Gross profit for ADESA was 43.1% of revenue for the year ended December 31, 2014, compared with 43.7% of revenue for the year ended December 31, 2013. The decrease in gross profit percentage for the year ended December 31, 2014, compared with the year ended December 31, 2013, was primarily the result of the 10% increase in cost of services. The increase in cost of services was primarily attributable to an increase in lower margin ancillary and non-auction services, increased utilities and maintenance, partially offset by fluctuations in the Canadian exchange rate.

Selling, General and Administrative

Selling, general and administrative expenses for the ADESA segment increased $7.6 million, or 3%, to $259.9 million for the year ended December 31, 2014, compared with $252.3 million for the year ended December 31, 2013, primarily due to increases in stock-based compensation expense of $4.7 million, incentive-based compensation expense of $3.3 million, selling, general and administrative expenses associated with High Tech Locksmiths of $2.9 million, an increase in bad debt expense of $1.2 million and an increase in professional fees of $1.0 million, partially offset by fluctuations in the Canadian exchange rate of $3.1 million and decreases in marketing and compensation expenses of $2.2 million and $1.3 million, respectively.

IAA Results

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

(Dollars in millions) | 2014 | | 2013 | | 2014 | | 2013 |

IAA revenue |

| $229.6 |

| |

| $206.8 |

| |

| $895.9 |

| |

| $830.0 |

|

Cost of services* | 145.4 |

| | 129.5 |

| | 555.7 |

| | 545.9 |

|

Gross profit* | 84.2 |

| | 77.3 |

| | 340.2 |

| | 284.1 |

|

Selling, general and administrative | 25.2 |

| | 22.9 |

| | 98.8 |

| | 82.4 |

|

Depreciation and amortization | 19.6 |

| | 18.4 |

| | 76.2 |

| | 73.8 |

|

Operating profit |

| $39.4 |

| |

| $36.0 |

| |

| $165.2 |

| |

| $127.9 |

|

EBITDA |

| $59.9 |

| |

| $54.4 |

| |

| $242.2 |

| |

| $201.8 |

|

Adjustments per the Credit Agreement | 0.1 |

| | 3.2 |

| | 5.2 |

| | 3.9 |

|

Superstorm Sandy | -- |

| | -- |

| | -- |

| | 13.5 |

|

Adjusted EBITDA |

| $60.0 |

| |

| $57.6 |

| |

| $247.4 |

| |

| $219.2 |

|

* Exclusive of depreciation and amortization

Overview of IAA Results for the Three Months Ended December 31, 2014 and 2013

Revenue

Revenue from IAA increased $22.8 million, or 11%, to $229.6 million for the three months ended December 31, 2014, compared with $206.8 million for the three months ended December 31, 2013. The increase in revenue was a result of an increase in vehicles sold of approximately 10% for the three months ended December 31, 2014. IAA's total loss vehicle inventory has increased over 15% at December 31, 2014, as compared to December 31, 2013. Vehicles sold under purchase agreements were approximately 7% of total salvage vehicles sold for the three months ended December 31, 2014 and 2013. Online sales volumes for IAA for the three months ended December 31, 2014 and 2013 represented over half of the total vehicles sold by IAA.

Gross Profit

For the three months ended December 31, 2014, gross profit at IAA increased to $84.2 million, or 36.7% of revenue, compared with $77.3 million, or 37.4% of revenue, for the three months ended December 31, 2013. The gross profit increase was primarily the result of the 11% increase in revenue, partially offset by a 12% increase in cost of services. The increase in cost of services was primarily attributable to variable cost increases related to the increase in volume.

Selling, General and Administrative

Selling, general and administrative expenses at IAA increased $2.3 million, or 10%, to $25.2 million for the three months ended December 31, 2014, compared with $22.9 million for the three months ended December 31, 2013. The increase in selling, general and administrative expenses was primarily attributable to increases in information technology costs of $1.3 million, legal expenses and professional fees.

Overview of IAA Results for the Year Ended December 31, 2014 and 2013

Revenue

Revenue from IAA increased $65.9 million, or 8%, to $895.9 million for the year ended December 31, 2014, compared with $830.0 million for the year ended December 31, 2013. The increase in revenue was a result of an increase in vehicles sold of approximately 7% for the year ended December 31, 2014. Volumes and revenue for 2013 included the impact of Superstorm Sandy as discussed below. Excluding the impact of Superstorm Sandy, IAA's revenue and volumes increased 12% and 10%, respectively. IAA's total loss vehicle inventory has increased over 15% at December 31, 2014, as compared to December 31, 2013. Vehicles sold under purchase agreements were approximately 6% of total salvage vehicles sold for the year ended December 31, 2014, compared with approximately 7% for the year ended December 31, 2013. Online sales volumes for IAA for the years ended December 31, 2014 and 2013 represented over half of the total vehicles sold by IAA.

Gross Profit

For the year ended December 31, 2014, gross profit at IAA increased to $340.2 million, or 38.0% of revenue, compared with $284.1 million, or 34.2% of revenue, for the year ended December 31, 2013. The increase in gross profit and gross profit as a percentage of revenue was mainly attributable to expenses associated with processing total loss vehicles related to Superstorm Sandy for the year ended December 31, 2013, as well as the 8% increase in revenue for the year ended December 31, 2014.

For the year ended December 31, 2013, IAA sold over 45,000 Superstorm Sandy vehicles resulting in revenue of approximately $30.1 million and cost of services of approximately $43.6 million. Overall IAA incurred a pretax net loss of $13.5 million related to the processing of Superstorm Sandy vehicles for the year ended December 31, 2013. Excluding the impact of revenues and expenses associated with Superstorm Sandy, the gross profit as a percentage of revenue for the year ended December 31, 2013 would have been approximately 37.2%.

Selling, General and Administrative

Selling, general and administrative expenses at IAA increased $16.4 million, or 20%, to $98.8 million for the year ended December 31, 2014, compared with $82.4 million for the year ended December 31, 2013. The increase in selling, general and administrative expenses was primarily attributable to increases in information technology costs of $4.5 million, stock-based compensation expense of $2.6 million, incentive-based compensation expense of $1.8 million, professional fees of $1.5 million, sales and marketing expenses of $1.2 million and non-income based taxes of $1.1 million.

AFC Results

|

| | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

(Dollars in millions except volumes and per loan amounts) | 2014 | | 2013 | | 2014 | | 2013 |

AFC revenue |

| $65.9 |

| |

| $59.5 |

| |

| $250.1 |

| |

| $224.7 |

|

Cost of services* | 17.9 |

| | 16.1 |

| | 69.7 |

| | 56.4 |

|

Gross profit* | 48.0 |

| | 43.4 |

| | 180.4 |

| | 168.3 |

|

Selling, general and administrative | 6.7 |

| | 8.0 |

| | 28.8 |

| | 26.2 |

|

Depreciation and amortization | 7.7 |

| | 7.3 |

| | 30.4 |

| | 27.6 |

|

Operating profit |

| $33.6 |

| |

| $28.1 |

| |

| $121.2 |

| |

| $114.5 |

|

EBITDA |

| $41.3 |

| |

| $34.7 |

| |

| $151.6 |

| |

| $140.7 |

|

Adjustments per the Credit Agreement | (2.7) |

| | -- |

| | (8.1) |

| | (7.1) |

|

Adjusted EBITDA |

| $38.6 |

| |

| $34.7 |

| |

| $143.5 |

| |

| $133.6 |

|

| | | | | | | |

Loan transactions | 373,916 |

| | 340,918 |

| | 1,445,077 |

| | 1,354,955 |

|

Revenue per loan transaction, excluding “Other service revenue” |

| $158 |

| |

| $159 |

| |

| $155 |

| |

| $157 |

|

* Exclusive of depreciation and amortization

Overview of AFC Results for the Three Months Ended December 31, 2014 and 2013

Revenue

For the three months ended December 31, 2014, AFC revenue increased $6.4 million, or 11%, to $65.9 million, compared with $59.5 million for the three months ended December 31, 2013. The increase in revenue was the result of a 10% increase in loan transactions and an increase of $1.3 million of "Other service revenue" generated by PWI, for the three months ended December 31, 2014, compared with the same period in 2013.

Revenue per loan transaction, which includes both loans paid off and loans curtailed, was consistent with the prior year. Revenue per loan transaction excludes "Other service revenue."

Gross Profit

For the three months ended December 31, 2014, gross profit for the AFC segment increased $4.6 million, or 11%, to $48.0 million, or 72.8% of revenue, compared with $43.4 million, or 72.9% of revenue, for the three months ended December 31, 2013, primarily as a result of an 11% increase in revenue, partially offset by an 11% increase in cost of services. The increase in cost of services was primarily the result of an increase in compensation expense as well as the inclusion of expenses associated with PWI.

Selling, General and Administrative

Selling, general and administrative expenses at AFC decreased $1.3 million, or 16%, to $6.7 million for the three months ended December 31, 2014, compared with $8.0 million for the three months ended December 31, 2013. The decrease was primarily attributable to a decrease in stock-based compensation expense of $1.2 million.

Overview of AFC Results for the Year Ended December 31, 2014 and 2013

Revenue

For the year ended December 31, 2014, AFC revenue increased $25.4 million, or 11%, to $250.1 million, compared with $224.7 million for the year ended December 31, 2013. The increase in revenue was the result of a 7% increase in loan transactions and an increase of $13.0 million of "Other service revenue" generated by PWI, for the year ended December 31, 2014, compared with the same period in 2013, partially offset by a 1% decrease in revenue per loan transaction for the year ended December 31, 2014. PWI, a

service contract business, was acquired in June 2013. In addition, managed receivables increased to $1,371.1 million at December 31, 2014 from $1,107.6 million at December 31, 2013.

Revenue per loan transaction, which includes both loans paid off and loans curtailed, decreased $2, or 1%, primarily as a result of a decrease in floorplan and other fee income and an increase in the provision for credit losses as well as fluctuations in the Canadian exchange rate, partially offset by an increase in average loan values. Revenue per loan transaction excludes "Other service revenue."

Gross Profit

For the year ended December 31, 2014, gross profit for the AFC segment increased $12.1 million, or 7%, to $180.4 million, or 72.1% of revenue, compared with $168.3 million, or 74.9% of revenue, for the year ended December 31, 2013, primarily as a result of an 11% increase in revenue, partially offset by a 24% increase in cost of services. The increase in cost of services was primarily the result of the inclusion of expenses associated with PWI for the full year 2014, as well as an increase in compensation expense. The decrease in gross margin percentage is the result of the inclusion of PWI results for year ended December 31, 2014, as compared with a partial year for 2013.

Selling, General and Administrative

Selling, general and administrative expenses at AFC increased $2.6 million, or 10%, to $28.8 million for the year ended December 31, 2014, compared with $26.2 million for the year ended December 31, 2013. The increase was primarily attributable to the inclusion of a full year of expenses associated with PWI of $1.7 million and an increase in stock-based compensation of $1.6 million, as well as an increase in compensation, partially offset by a decrease in professional fees.

LIQUIDITY AND CAPITAL RESOURCES

The company believes that the significant indicators of liquidity for its business are cash on hand, cash flow from operations, working capital and amounts available under its credit facility. The company’s principal sources of liquidity consist of cash generated by operations and borrowings under its revolving credit facility.

|

| | | | | | | |

(Dollars in millions) | December 31, 2014 | | December 31, 2013 |

Cash and cash equivalents |

| $152.9 |

| |

| $191.6 |

|

Restricted cash | 17.0 |

| | 18.8 |

|

Working capital | 484.3 |

| | 356.9 |

|

Amounts available under credit facility* | 250.0 |

| | 250.0 |

|

Cash flow from operations | 431.3 |

| | 434.0 |

|

*KAR Auction Services, Inc. has a $250 million revolving line of credit as part of the company’s Credit Agreement, which was undrawn as of December 31, 2014. There were related outstanding letters of credit totaling approximately $25.1 million and $26.3 million at December 31, 2014 and December 31, 2013, respectively, which reduced the amount available for borrowings under the credit facility.

We regularly evaluate alternatives for our capital structure and liquidity given our expected cash flows, growth and operating capital requirements as well as capital market conditions. For the year ended December 31, 2014, the Company used cash of $101.0 million to purchase property, plant, equipment and computer software.

Non-GAAP Financial Measures

The company provides historical and forward-looking non-GAAP measures called EBITDA, Adjusted EBITDA, free cash flow, adjusted net income and adjusted net income per share. Management believes that these measures provide investors additional meaningful methods to evaluate certain aspects of the company’s results period over period and for the other reasons set forth previously.

Earnings guidance also does not contemplate future items such as business development activities, strategic developments (such as restructurings or dispositions of assets or investments), significant expenses related to litigation and changes in applicable laws and regulations (including significant accounting and tax matters). The timing and amounts of these items are highly variable, difficult to predict, and of a potential size that could have a substantial impact on the company’s reported results for any given period. Prospective quantification of these items is generally not practicable. Forward-looking non-GAAP guidance excludes increased depreciation and amortization expense that resulted from the 2007 revaluation of the company’s assets, as well as one-time charges, net of taxes.

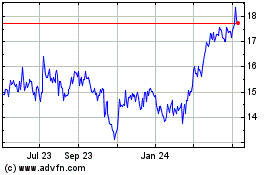

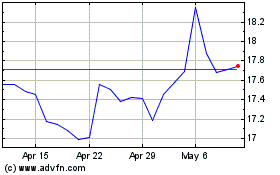

OPENLANE (NYSE:KAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

OPENLANE (NYSE:KAR)

Historical Stock Chart

From Apr 2023 to Apr 2024