Current Report Filing (8-k)

February 12 2015 - 4:02PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 OR 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) February 12, 2015

Associated Banc-Corp

(Exact name of registrant as specified in its chapter)

|

|

|

|

|

| Wisconsin |

|

001-31343 |

|

39-1098068 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 433 Main Street, Green Bay, Wisconsin |

|

54301 |

| (Address of principal executive offices) |

|

(Zip code) |

Registrant’s telephone number, including area code 920-491-7500

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01. |

Regulation FD Disclosure |

Associated Banc-Corp is furnishing the investor presentation, included as

Exhibit 99.1 to this Report on Form 8-K, which will be used, in whole or in part, from time to time by executives of the Registrant in one or more meetings with investors and analysts.

The information furnished pursuant to this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of

the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Registrant under the Securities Act of 1933

or the Exchange Act.

| Item 9.01. |

Financial Statements and Exhibits. |

The following exhibit is furnished as part of this Report on Form

8-K.

(d) Exhibits

99.1 Associated Banc-Corp Investor

Presentation

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

Associated Banc-Corp |

|

|

(Registrant) |

|

|

|

| Date: February 12, 2015 |

|

By: |

|

/s/ Christopher J. Del Moral-Niles |

|

|

|

|

Christopher J. Del Moral-Niles |

|

|

|

|

Chief Financial Officer |

Exhibit Index

|

|

|

| Exhibit

Number |

|

|

|

|

| 99.1 |

|

Associated Banc-Corp Investor Presentation. |

|

|

| FIRST

QUARTER 2015 ASSOCIATED BANC-CORP

INVESTOR

PRESENTATION

LISTED

ASB

NYSE

Exhibit 99.1 |

|

|

|

FORWARD-LOOKING STATEMENTS AND

TRADEMARKS

Important

note

regarding

forward-looking

statements:

Statements made in this presentation which are not purely historical are

forward-looking statements, as defined in the Private Securities

Litigation Reform Act of 1995. This includes any statements regarding

management’s plans, objectives, or goals for future operations, products or

services,

and

forecasts

of

its

revenues,

earnings,

or

other

measures

of

performance.

Such

forward-looking

statements

may

be

identified

by

the

use

of

words

such

as

“believe”,

“expect”,

“anticipate”,

“plan”,

“estimate”,

“should”,

“will”,

“intend”,

“outlook”,

or

similar

expressions.

Forward-

looking statements are based on current management expectations and, by their

nature, are subject to risks and uncertainties. Actual results may differ

materially from those contained in the forward-looking statements.

Factors which may cause actual results to differ materially from those

contained in such forward-looking statements include those identified in the

Company’s most recent Form 10-K and subsequent SEC filings.

Such factors are incorporated herein by reference.

Trademarks:

All

trademarks,

service

marks

and

trade

names

referenced

in

this

material

are

the

property

of their

respective owners. Apple, the Apple logo, and iPhone are trademarks of Apple Inc.,

registered in the U.S. and other countries. Apple Pay and Touch ID are

trademarks of Apple Inc. : MasterPass, MasterCard and the MasterCard Brand

Mark are registered trademarks of MasterCard International

Incorporated. Popmoney is a registered trademark of Fiserv, Inc. or its affiliates.

1 |

|

|

| OUR

FOOTPRINT AND FRANCHISE Deposits

2

($ in billions)

Branches

WI

$12.7

161

IL

$4.6

43

MN

$1.5

22

Total

$18.8

226

1

FDIC market share data 6/30/14

2

As of 12/31/14 (Period End)

1861

1999

2006

1987

2011

2011

2012

>$1bn

deposits

1

>$500mm

deposits

1

2

Total Loan Distribution

($17.6 billion –

Dec 2014 –

Period End)

Wisconsin

Upper

Midwest

Other

Largest bank headquartered in

Wisconsin

$27 billion in assets (Top 50 bank

holding company in the U.S.)

226 banking offices serving

approximately one million customers

2 |

|

|

|

STRATEGIC FUNDAMENTALS

3

FOCUS ON

CUSTOMER

EXPERIENCE

GEOGRAPHIC

ANCHOR IN THE

UPPER MIDWEST

DIVERSIFIED

PORTFOLIO OF

BUSINESSES

EVOLUTION OF

CUSTOMER NEEDS

AND CHANNELS

Becoming a strong competitor or market

leader in attractive Midwest markets

Meeting customer needs to build

deep and lasting customer relationships

Evolving our overall delivery model

to meet changing preferences of

our customers

Delivering strong, well-balanced earnings

from all of our core businesses through a

diversified loan portfolio |

|

|

|

ATTRACTIVE MIDWEST MARKETS

Serve a Large Market Place:

(Footprint

is

~

20%

of

USA)

1

Manufacturing

Concentrated

:

Top 3 states (Indiana, Wisconsin,

and Iowa) for concentration of

manufacturing jobs and two other

states in the top 10

Favorable Employment

Dynamics:

Wisconsin,

Minnesota, Iowa, Missouri and

Ohio all have unemployment rates

that

are

under

5.5%

3

Positive

Economic

Trends:

Continuing job growth

Best

Consumer

Credit:

Top

4

and 8 of top 10 cities within

footprint

1

Based on Population -

US Census Bureau 2012 ;

2

Area Development Online –

Author: Mark Crawford (Winter 2013);

3

December 2014

US Bureau of Labor Statistics;

4

Experian.com –

State of Credit 2014 –

VantageScore registered trademark.

4

Dec

13

to

Dec

14

3

Total

Employment

up 363k

Manufacturing

Employment

up 74k

Top

Ten

US

Cities

by

Credit

Score

4

1 –

Mankato, MN (706)

6 –

Wausau, WI (699)

2 –

Rochester, MN (703)

7 –

Green Bay, WI (698)

3 –

Minneapolis, MN (702)

8 –

Sioux Falls, SD (697)

4 –

Duluth, MN (699)

9 –

Cedar Rapids, IA (697)

5 –

Fargo, ND (699)

10 –

La Crosse, WI (696)

*National Average: 666

2 |

|

|

|

Strong lending base in high-quality, low-volatility

diversified assets to provide foundation for

selective and prudent risk taking in higher risk

asset classes. (Meaningful allocations to

Mortgage, Multi-family and Manufacturing)

Core lending markets in Midwest with primary

emphasis placed on Wisconsin, Minnesota,

Illinois, Missouri, Iowa, Indiana, Ohio and

Michigan. (85% of Q4 2014 Loans)

Retail –

30-40%

C&I –

30-40%

CRE –

25-35%

DIVERSIFIED LOAN PORTFOLIO

5

Asset Mix

Geographic Mix

Industry Mix

Internal Portfolio Management Goals

We are building a diversified loan portfolio that we believe will perform well

through the next downturn in the credit cycle.

Current (Q4-2014)

Retail –

37%

C&I –

40%

CRE –

23%

Goal Range |

|

|

|

RESHAPING & REBUILDING THE LOAN

PORTFOLIO

1

1

Based on Average Balances, $ in Billions

$13.2

$14.7

$15.7

$16.8

$13.3

6

Cumulative

2010-2014

Change

+$0.5 bn

+$2.1 bn

+$2.2 bn |

|

|

| LOAN

PORTFOLIO GROWTH 2014 AVERAGE LOAN GROWTH OF $1.2 BILLION OR 8% FROM 2013

$ IN MILLIONS

7

Home Equity & Installment

Commercial Real Estate

Residential Mortgage

Power & Utilities

Oil & Gas

Mortgage Warehouse

General Commercial Loans

+13%

% Change

+8%

+71%

+5%

+34%

Total

Commercial

& Business

Lending

+12%

($686 mln)

+2%

(12%) |

|

|

| STABLE

DEPOSIT AND LIQUIDITY PROFILE Loans / Deposits –

Year End

Bank holding company cash and liquid

investments of $599 mm (12/31/2014)

Deposits and Customer Funding Mix

$19.1 billion at 12/31/2014

~987k deposit accounts with over

$10.9 billion of granular deposits

(under $250k)

8

Strong Holding Company Liquidity

Deposit & Customer Funding Trend (Period End -

$ in Billions)

$15.8

$16.5

$17.6

$17.7

$19.1

Time Deposits

Savings

Other Funding

Money Market

Demand Deposits

Cumulative

2010-2014

Change

+ $2.9 bn

+ $2.0 bn |

|

|

|

GROWING NET INTEREST INCOME

($ IN MILLIONS)

9

Interest Income

Interest Expense

Net Interest Income

-9%

-67%

+7% |

|

|

|

DIVERSIFIED PORTFOLIO OF VALUE-ADDED

BUSINESSES

10

Corporate and

Specialized Lending

Consumer

and

Business

Banking

Private

Client and

Institutional

Services

Commercial Real

Estate Lending

Private

Banking

Personal

Trust

Asset

Management

Retirement

Plan Services

Associated

Financial

Group

Community

Markets

Branch

Banking

Commercial

Banking

Residential

Lending

Payments

and Direct

Channels

AIS

(Brokerage)

Corporate

Commercial and

Specialized Lending

Commercial

Deposits and

Treasury

Management

Global Markets

(FX swaps)

Community, Consumer, and Business

Corporate and Commercial Specialty

Rochester, MN

Eau Claire, WI

La Crosse, WI

Central

Wisconsin

Rockford, IL

Peoria, IL

Southern

Illinois

CRE lending

Real Estate

Investment Trusts

Developers |

|

|

|

COMMERCIAL & BUSINESS LENDING

11

$7 billion portfolio; 40% of total loans

–

Predominantly LIBOR-based commercial lines

of credit

–

86% reset, re-price, or mature within a year

More than 280 colleagues serving businesses,

municipal governments, and entrepreneurs:

–

Includes Middle Market, Corporate, and

Commercial, and Specialized Lending efforts

–

Offers unsecured and customized commercial

finance lending solutions secured by accounts

receivable, inventory, machinery, and

equipment

–

Capital Markets revenue of $10 million in 2014

More than 40 Commercial Deposit and Treasury

Management colleagues

–

$4.9

billion

of

Commercial

average

deposits

–

Streamlined cash management solutions via

our Associated Connect platform for

businesses, municipalities, and correspondent

banks

1

Includes Missouri, Indiana, Ohio, Michigan, & Iowa

2

2014 Average Deposits for Corporate and Commercial Specialty (Segment

Reporting) C&BL Loans by Industry

($7.0 billion –

Dec 2014 –

Period End)

C&BL Loans by State

($7.0 billion –

Dec 2014 –

Period End)

2 |

|

|

| OIL

AND GAS LENDING 12

~

$750

million

portfolio;

~4%

of

total

loans

and

~11%

of

overall

CB&L

activity

–

Outstanding balance is driven by respective borrowing bases.

Exclusively

focused

on

the

upstream

sector

(‘Exploration

and

Production’

or

‘E&P’

sector).

–

Focused on the small to mid-size independent segment, both public and private

companies. –

Asset-based loans collateralized by a lien on oil and gas reserves.

–

Generally, we are a participant in a syndicated loan.

Price redeterminations are formally performed on a semi-annual basis.

–

Commodity prices are continuously monitored.

Recent

stress

test

indicates

adequate

specific

reserves

for

this

portfolio.

–

Reserves ascribed to Oil & Gas portfolio provide coverage of 135% versus

identified potential problem loans.

Please

Note:

For

more

information

on

Associated

Banc-Corp’s

oil

and

gas

lending,

please

refer

to

the

appendix

2014 Fourth

Quarter Loan

Composition

All other loans

Oil and Gas book

48 clients

Over $1 billion in aggregate commitments

Average commitment of $23 million |

|

|

|

COMMERCIAL REAL ESTATE LENDING

13

$4.1 billion portfolio; ~23% of total loans

More than 90 CRE colleagues:

–

Offices in Chicago, Cincinnati, Columbus, Detroit,

Green Bay, Madison, Milwaukee, Minneapolis,

and St. Louis

Recognized as:

–

#4 in US Syndicated CRE facilities under $50MM

transaction

size

1

–

Top

20

US

Syndicated

CRE

facilities

Overall

1

1

Thomson Reuters LPC-

December, 2014 (based on # of transactions)

2

Includes Missouri, Indiana, Ohio, Michigan, & Iowa

Current CRE offices

CRE Loans by Industry

($4.1 billion –

Dec 2014 –

Period End)

CRE Loans by State

($4.1 billion –

Dec 2014 –

Period End) |

|

|

|

PRIVATE CLIENT & INSTITUTIONAL

SERVICES

14

Over 170 colleagues serving our Private Client &

Institutional Customers:

–

Private banking, personal trust, and portfolio

management services for individuals ($500k

to $10 million in investible assets)

–

Corporate trust, asset management and

retirement plan services

–

$8.0 billion of AUM

Associated

Financial

Group

:

370

1,2

colleagues

supporting our insurance brokerage

–

Leading benefits consultant in our markets

–

Providing Risk Management, HR, and

Benefits solutions for over 40 years

–

Acquisition of Ahmann & Martin Co. adds to

Commercial Property and Casualty

expertise.

2

–

Insurance Revenue of over $44 million in

2014; Expected to be over $70 million in

2015

1,2

Assets Under Management ($ in billions)

Insurance Commissions ($ in millions)

$6.5

$7.4

CAGR = 10%

$8.0

1

Includes Ahmann & Martin Co.

2

The acquisition of Ahmann & Martin Co. is expected to be completed in February

2015. |

|

|

|

CONSUMER AND BUSINESS BANKING

15

Over 1,700 colleagues servicing individuals and

small business owners through five business units:

–

Consumer Banking, Business Banking,

Residential Lending, Retail Payments, and

Retail Brokerage

#1 mortgage originator in Wisconsin (in units)

A leading SBA lender in our markets

Official bank of the Green Bay Packers

Residential Mortgage Loans by State

($4.5

billion

–

Dec

2014)

1

Includes Missouri, Indiana, Ohio, Michigan, & Iowa

2

Approximately 40% is in first-lien position

Home

Equity

Loans

2

by

State

($1.6

billion

–

Dec

2014)

Note: All trademarks, service marks and trade names referenced in this

material are the property of their respective owners. Wisconsin

41%

Illinois

37%

Minnesota

14%

In-

Footprint

1

7%

Other

1%

Wisconsin

71%

Illinois

16%

Minnesota

11%

Other

2% |

|

|

|

EVOLVING MODEL WITH CUSTOMER TRENDS

16

Since 2011:

Branch transactions -15%

Mobile banking adoption +250%

Since 2013:

Rationalize Branch Network

Since 2007:

28%

branches closed or sold

36%

reduction in branch FTE

Focused on smaller, lower

construction cost, and more

visibility

Enhance Digital Banking:

Current Offerings:

Note: All trademarks, service marks and trade names referenced in this

material are the property of their respective owners. Online Deposit and

Lending Sales Platforms

ATM Deposit Automation &

Remote Deposit

Technology Kiosks

Apple Pay & MasterPass

Evolve Selling Tools:

Coming Soon:

Redesigned website

that features:

–

Responsive design

across devices

–

Enhanced eCommerce

capabilities including

guided selling and

product comparison tools

Piloting video teller

Digital Deposits +78%

Associated

Bank

Customer

Trends |

|

|

|

Areas of Focus

PURSUING EFFICIENCY GAINS

($ IN MILLIONS)

Efficiency Ratio

1

at 2014 =

69%

Goal =

Peer Average

or Better

1

–

Efficiency

ratio

=

Noninterest

expense,

excluding

other

intangible

amortization,

divided

by

sum

of

taxable

equivalent

net

interest

income

plus

noninterest

income, excluding investment securities gains/losses, net, and asset gains/losses,

net. This is a non-GAAP financial measure. Please refer to the appendix for a

reconciliation of this measure.

2

–

FTE

= Average Full Time Equivalent Employees

3

–

Technology

Spend

=

Technology

and

Equipment

expenses

Back Office Initiatives:

Implementing technology

solutions in labor intensive

processes

Real Estate Initiatives:

Actions to optimize our real

estate holdings and capacity

Distribution Initiatives:

Optimize the ways that we

interact with our customers

17

Efficiency

Ratio

1

2

3

$48

$52

$67

$75

$80

4,809

4,985

4,968

4,728

4,406

2010

2011

2012

2013

2014

Technology Spend

Avg FTE

62.5%

70.4%

69.3%

69.5%

69.0% |

|

|

|

CAPITAL MANAGEMENT PRIORITIES

Funding

Organic Growth

Paying a

Competitive

Dividend

Non-organic

Growth

Opportunities

Share Buybacks

and

Redemptions

2013

2014

Fund Loan Growth and other Capital Investments

Repurchased

$120 mm of

Common Stock

Retired $26 mm

in Sub-Debt

Increased

quarterly dividend

in Q4 2013

Paid $0.33/

common share

Focused on Cost Take-out Driven Depository M&A

Maintaining Discipline in Pricing of any Transaction

2015

Repurchased $259

mm of Common

Stock

Retired $155 mm in

Senior Notes in Q1

2014

Increased

quarterly dividend

in Q4 2014

Paid $0.37/

common share

18

ASB

Basel

III

Tier

1

Common

Ratio

Goal

=

8

–

9.5%

Repurchased $30

mm of Common

Stock in Q1 2015

Declared quarterly

common dividend

of $0.10/ share in

Q1 2015 |

|

|

| WHY

ASSOCIATED 1

–

Return on Tier 1 Common Equity (ROT1CE)

= Management uses Tier 1 common equity, along with other

capital measures, to assess and monitor our capital position. This is a

non-GAAP financial measure. Please refer to the appendix for a

definition of this and other non-GAAP items. EPS and

Dividends

Paid

&

ROT1CE

¹

Return on Tier 1

Common Equity

$0.23

$0.26

$0.28

$0.31

Diluted

Earnings

per

Common

Share

Dividends per Common Share

19

•

Leading Midwest Bank Operating in

Attractive Markets

•

Well Diversified Lending Portfolio

•

Stable Deposits and Liquidity

•

Committed to Expense Containment

•

Strong Credit Quality and Capital Profile

•

Disciplined Capital Deployment

•

Improving Earnings Outlook

Management Team Focused on Creating

Long-Term Value

Reasons to Invest

9.0%

9.6%

9.8%

10.4%

$0.01

$0.08

$0.09

$0.10

4Q 2011

4Q 2012

4Q 2013

4Q 2014 |

|

|

|

•

MISCELLANEOUS EXHIBITS

•

ASSOCIATED OIL AND GAS LENDING DETAIL

APPENDIX |

|

|

|

SEGMENT PROFITABILITY

FULL YEAR 2014

ASB –

Consolidated Total

Earning Assets* = $22.8 bn

Total Revenue = $971.3 mm

Net Income = $190.5 mm

ROT1CE: 9.9%

* Average Earning Assets

21

Earning Assets*

Total Revenue

Net Income

Community, Consumer, & Business Banking

Risk Management & Shared Services

Corporate and Commercial Specialty Banking

ROT1CE

5.3%

10.4%

13.2%

36%

26%

38%

56%

10%

34%

16%

33%

51% |

|

|

|

CREDIT QUALITY INDICATORS

($ IN MILLIONS)

22

Potential Problems Loans & PPLs to Total Loans

Nonaccruals & NA / Total Loans

ALL to Nonaccruals and Total Loans

Net Charge Offs & NCOs to Avg Loans

$185

$178

$179

$184

$177

1.17%

1.08%

1.05%

1.07%

1.01%

4Q 2013

1Q 2014

2Q 2014

3Q 2014

4Q 2014

Nonaccruals

Nonaccruals / Total Loans

$5

$5

$3

$3

$4

0.14%

0.14%

0.06%

0.06%

0.10%

4Q 2013

1Q 2014

2Q 2014

3Q 2014

4Q 2014

Net Charge Offs

NCOs / Avg Loans

145%

151%

152%

145%

150%

1.69%

1.63%

1.59%

1.55%

1.51%

4Q 2013

1Q 2014

2Q 2014

3Q 2014

4Q 2014

ALLL/ Nonaccruals

ALLL/ Total Loans

$235

$220

$288

$220

$190

1.48%

1.34%

1.69%

1.28%

1.08%

4Q 2013

1Q 2014

2Q 2014

3Q 2014

4Q 2014

Potential Problem Loans

PPLs / Total Loans |

|

|

|

NONINTEREST INCOME TREND

($ IN MILLIONS)

Total Noninterest Income

23

2014 Noninterest Income Composition

Mortgage Banking (net) Income

$335

$273

$313

$313

$290

$33

$13

$64

$49

$21

2010

2011

2012

2013

2014

Mortgage

Banking

7%

Svc Chg on

Deposits

24%

Card & Other

Non Deposit

17%

Trust Service

Fees

17%

Insurance

15%

Capital Market

Fees

3%

Brokerage &

Annuity

5%

BOLI

5%

Asset gains +

Investment

securities gains

4%

Other

3% |

|

|

|

Technology

2

Spend

NONINTEREST EXPENSE ANNUAL TRENDS

($ IN MILLIONS)

Total Noninterest Expense

Other Non-Personnel Spend

3

FTE

1

Trend

1

–

FTE

=

Average

Full

Time

Equivalent

Employees

2

–

Technology

Spend

=

Technology

and

Equipment

expenses

3

–

Other

Non-Personnel

Spend

=

Total

Noninterest

Expense

less

Personnel

and

Technology

spend

24

Personnel Expense

$617

$653

$675

$681

$679

$325

$360

$381

$397

$390

2010

2011

2012

2013

2014

$244

$241

$227

$209

$209

2010

2011

2012

2013

2014

$48

$52

$67

$75

$80

2010

2011

2012

2013

2014

4,809

4,985

4,968

4,728

4,406

2010

2011

2012

2013

2014

Avg FTE |

|

|

|

Amortized

Cost

Composition

–

December

31,

2014

Investment Portfolio –

December 31, 2014

Credit Rating

($ in thousands)

Fair Value

(000’s)

% of Total

Govt & Agency

$4,805,680

82.8

AAA

99,531

1.7

AA

761,979

13.1

A

134,966

2.3

BAA1, BAA2 & BAA3

-

-

BA1 & Lower

1,772

0.0

Non-rated

5,951

0.1

TOTAL Market Value

$5,809,879

100.0%

Type

Amortized

Cost

(000’s)

Fair Value

(000’s)

TEY

(%)

Duration

(Yrs)

Govt & Agencies

$999

$998

0.67

2.11

Agency MBS

2,762,222

2,792,479

2.57

2.83

CMOs

940,178

940,604

2.28

2.85

GNMA CMBS

1,097,913

1,073,893

2.09

4.23

Municipals

965,294

995,746

4.99

5.30

Corporates

6,090

6,109

1.35

1.52

Other

18

50

TOTAL HTM &

AFS

$5,772,714

$5,809,879

2.84

3.51

INVESTMENT SECURITIES PORTFOLIO

25

Portfolio

Ratings

Composition

–

December

31,

2014

Fair Value

(000’s)

% of Total

0% RWA

$1,264,776

21.8

20% RWA

4,486,698

77.2

50% RWA

17,819

0.3

=>100% RWA

3,435

0.1

Not subject to RW

37,151

0.6

TOTAL Market Value

$5,809,879

100.0%

Risk Weighting Profile –

December 31, 2014

Agency MBS

Hybrid

32%

Agency

MBS

16%

CMOs

16%

GNMA

CMBS

19%

Municipals

17%

Type |

|

|

|

RECONCILIATION AND DEFINITIONS OF

NON-GAAP ITEMS

4Q 2013

1Q 2014

2Q 2014

3Q 2014

4Q 2014

Efficiency Ratio Reconciliation:

Efficiency ratio (1)

73.70%

70.41%

69.70%

69.44%

70.33%

Taxable equivalent adjustment

(1.49)

(1.35)

(1.32)

(1.36)

(1.40)

Asset gains, net

0.80

0.22

0.26

1.36

1.05

Other intangible amortization

(0.42)

(0.42)

(0.41)

(0.40)

(0.32)

Efficiency ratio, fully taxable equivalent (1)

72.59%

68.86%

68.23%

69.04%

69.66%

(1) Efficiency

ratio

is

defined

by

the

Federal

Reserve

guidance

as

noninterest

expense

divided

by

the

sum

of

net

interest

income

plus

noninterest

income, excluding investment securities gains / losses, net. Efficiency

ratio, fully taxable equivalent, is noninterest expense, excluding other

intangible amortization, divided by the sum of taxable equivalent net interest

income plus noninterest income, excluding investment securities gains /

losses, net and asset gains / losses, net. This efficiency ratio is presented on a taxable equivalent basis, which adjusts net interest

income for the tax-favored status of certain loans and investment

securities. Management believes this measure to be the preferred industry

measurement of net interest income as it enhances the comparability of net interest

income arising from taxable and tax-exempt sources and it excludes

certain specific revenue items (such as investment securities gains / losses, net and asset gains / losses, net).

2010

2011

2012

2013

2014

Efficiency Ratio Reconciliation:

Efficiency ratio (1)

65.35%

73.64%

72.16%

71.04%

69.97%

Taxable equivalent adjustment

(1.60)

(1.74)

(1.59)

(1.45)

(1.36)

Asset gains (losses), net

(0.77)

(0.92)

(0.86)

0.39

0.73

Other intangible amortization

(0.52)

(0.54)

(0.45)

(0.42)

(0.39)

Efficiency ratio, fully taxable equivalent (1)

62.46%

70.44%

69.26%

69.56%

68.95%

Tier

1

common

equity,

a

non-GAAP

financial

measure,

is

used

by

banking

regulators,

investors

and

analysts

to

assess

and

compare

the

quality

and composition of our capital with the capital of other financial services

companies. Management uses Tier 1 common equity, along with other capital

measures, to assess and monitor our capital position. Tier 1 common equity (period end and average) is Tier 1 capital excluding

qualifying perpetual preferred stock and qualifying trust preferred

securities. 26 |

|

|

| OUR

VISION ASSOCIATED

will be the most admired

Midwestern financial services company,

distinguished by sound, value-added financial

solutions with personal service for our customers,

built upon a strong commitment to our colleagues

and the communities we serve, resulting in

exceptional value for our shareholders.

27 |

|

|

|

•

MISCELLANEOUS EXHIBITS

•

ASSOCIATED OIL AND GAS LENDING DETAIL

APPENDIX |

|

|

| OIL

& GAS VALUE CHAIN 29

Supports

drilling for oil

and gas

(offshore and

onshore)

Upstream E&P

Midstream

Downstream

R&M

Field

Services

Involved in drilling for

oil and natural gas

and operating the

wells that bring the oil

and natural gas to the

surface. Also referred

to as the ‘Exploration

and Production or

E&P sector’.

Processes,

stores,

markets, and

transports

crude oil,

natural gas and

the various

natural gas

liquids like

ethane, butane

and propane.

Oil refineries and

petrochemical plants,

and petroleum product

distribution via affiliated

retail outlets and

natural gas distribution

companies.

Responsible for

marketing refined

products such as

gasoline, diesel, and jet

fuel

Field Services

(Not active

in this

sector)

(Our Oil & Gas

segment’s focus)

(Not active

in this

sector)

(Not active in this

sector)

From beneath the earth’s surface to the end-user:

|

|

|

|

PLAYERS IN THE UPSTREAM SECTOR

Integrated oil and gas companies

Derive revenue from all phases of the energy value chain (e.g., ExxonMobil, BP,

Shell) Independent oil and gas companies (Associated

Bank’s Oil & Gas segment’s focus)

Receive

substantially

all

revenue

from

the

production

of

oil

and

natural

gas.

They

are

public

and

private

companies

that

range

in

size

from

very

small

to

very

large

More than 6,000 independent oil & gas producers in the U.S.

Responsible for:

54% of domestic oil production

90% of domestic natural gas production

Drilling approximately 95% of wells in the U.S.

Direct and indirect impact of oil and natural gas industry to the U.S.

economy: $1.2 trillion contribution to U.S. GDP in 2011(8% of U.S.

total) 9.8 million jobs in 2011 (5.6% of U.S. total)

>$30 billion in federal, state, and local taxes

(Sources:

Independent

Producers

Association

of

America,

American

Petroleum

Institute,

and

PWC’s

July

2013

article

“Economic

Impacts of the Oil and Natural Gas Industry on the U.S. Economy in 2011)

30 |

|

|

|

RESERVE-BASED LENDING

Reserve-based lending is a form of Asset-based lending business

This is a standard lending model for borrowers engaged in the Upstream sector of

the oil and gas industry

Associated Bank’s emphasis is on the small to mid-size independent

segment, both public and private,

collateralized

by

oil

and

gas

reserves

(larger

companies

typically

borrow

on

an

unsecured basis)

Typical Borrowing Base Valuation:

Based on independent review by Associated Bank petroleum engineers of proven

reserves Overall market assessment of commodity prices is made based on

industry information sources and is continuously monitored to estimate

future cash flow from proven reserves Cash flows from proven reserves

are discounted to derive a present value Risk adjustments are made to present

value of non producing proven reserves A further significant advance rate

haircut is applied to derive a conforming borrowing base

Semi-annual

redetermination

of

borrowing

base

and

more

frequent

field

visits

during

periods

of high volatility or risk in O&G markets.

If the borrowing base declines below the outstanding balance, there are

restructuring expectations.

Typically, this would mean reducing revolving lines to fully amortize inside a

conforming borrowing base within 3-6 months.

31 |

|

|

|

TYPICAL LOAN STRUCTURE

Secured by first priority lien on oil and gas reserves

These are syndicated deals with several banks participating in the credit

3 to 5 year working capital revolver with availability governed by a borrowing base

subject to semi-annual determinations

Proceeds used for acquisitions, development, working capital / letter of credit

issuance, and general corporate purposes

Financial covenants typically include cash flow leverage, interest coverage, and/or

current ratio measured quarterly

Sources of Repayment:

Primary Source of Repayment (“PSOR”) is cash flow.

Secondary Source of Repayment (“SSOR”) is sale of assets.

32 |

|

|

|

ASSOCIATED’S OIL & GAS PORTFOLIO

Established in January 2011 as a de novo lending vertical with zero loans

outstanding and zero clients, the Oil & Gas group has grown steadily to

its current book of forty-eight clients with aggregate commitments of

more than $1 billion ($687MM funded; ~66% utilization). –

Associated

has

Oil

and

Gas

average

loan

balances

of

$687

million

as

of

fourth

quarter

2014,

representing 4% of the total average loans outstanding ($17.4 Billion).

–

In addition, these balances are diversified between Oil and Gas operations.

January 2015 stress test indicates adequate specific reserves for this

portfolio. 33

Oil and Gas Average Loan Balances by Quarter ($ in Millions)

$87

$134

$165

$213

$295

$270

$281

$341

$387

$445

$539

$613

$652

$687

Q3

2011

Q4

2011

Q1

2012

Q2

2012

Q3

2012

Q4

2012

Q1

2013

Q2

2013

Q3

2013

Q4

2013

Q1

2014

Q2

2014

Q3

2014

Q4

2014 |

|

|

|

RISKS

Commodity price risk. Partially mitigated by:

Borrowers usually mitigate prices risk by entering into multi-year commodity

hedges with financial counterparties

Risk adjustments are made to proven reserves that are not producing

Commodity price environment is continuously monitored and changes in commodity

prices are considered in semi-annual redeterminations

Development risk. Partially mitigated by:

Borrowing Base is derived from existing Proven reserves (90% certainty of

recovery) Risk adjustments are made to non-proven, developed and

producing reserves At

least

70%

of

borrowing

base

is

required

to

be

attributable

to

proven,

developed

and

producing reserves

Reserve risk. Partially mitigated by:

Reserve report is required to be prepared by a qualified independent third party

engineering firm Associated Bank employs highly qualified staff petroleum

engineers to evaluate the assumptions utilized by the independent third

party firms that prepare the reserve reports. The engineering report

addresses four critical concerns: 1.

Pricing –

Future O&G prices must be realistic and fully supported

2.

Costs –

Exploration, development, and production costs

3.

Discount Rate –

Include the assumptions made

4.

Timing

–

Engineering

report

should

be

no

more

than

six

months

old,

never

over

a

year.

34 |

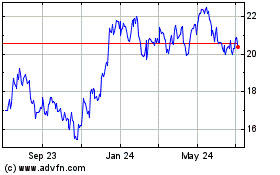

Associated Banc (NYSE:ASB)

Historical Stock Chart

From Mar 2024 to Apr 2024

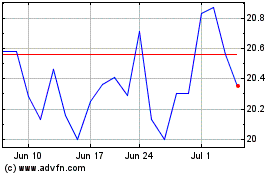

Associated Banc (NYSE:ASB)

Historical Stock Chart

From Apr 2023 to Apr 2024