United

States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

---------------

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 9, 2015

CHINA GREEN AGRICULTURE, INC.

---------------------------------------

(Exact name of Registrant

as specified in charter)

| Nevada |

|

001-34260 |

|

36-3526027 |

| (State or other jurisdiction |

|

(Commission File No.) |

|

(IRS Employer |

| of Incorporation) |

|

|

|

Identification No.) |

| 300 Walnut Street Suite 245 |

| Des Moines, IA 50309 |

| (Address of principal executive offices) (Zip Code) |

Registrant's telephone number, including

area code: (515) 897-2421

Check the appropriate box below if the

Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17CFR230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule14a-12 under the Exchange Act (17CFR240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17CFR240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17CFR240.13e-4(c)) |

| Item 2.02 |

Results of Operations and Financial Condition. |

On February 9, 2015,

China Green Agriculture, Inc., a corporation incorporated in the State of Nevada (the “Company”), issued a press release

announcing (i) certain financial results for the fiscal quarter ended December 31, 2014; (ii) guidance for the third quarter of

fiscal year of 2015 and reaffirming the guidance for the fiscal year of 2015; and (iii) a conference call to be held by the Company

on Monday, February 9, 2015 at 8:30 a.m. Eastern Time to discuss the results of operations for the quarter ended December 31, 2014.

A copy of the press release is attached hereto as Exhibit 99.1.

| Item 9.01 |

Financial Statements and Exhibits. |

The following is filed as an exhibit to

this report:

| Exhibit No. |

Description |

| |

|

| 99.1 |

Press Release, dated February 9, 2015. |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: February 9, 2015

| |

CHINA GREEN AGRICULTURE, INC. |

| |

(Registrant) |

| |

|

|

| |

By: |

/s/ Tao Li |

| |

Name: Tao Li |

| |

Title: President and Chief Executive Officer |

Exhibit 99.1

China

Green Agriculture, Inc. Reports the Financial Results for the Second Quarter of Fiscal Year 2015

with Revenue Beating the Guidance

and Net Income Meeting the Guidance

Provides

Guidance of Revenue and Net Income for the Third Quarter of Fiscal Year 2015, and Reaffirms

Guidance of Revenue and Net Income

for Fiscal Year 2015

XI'AN, China, February

9, 2015 /PRNewswire-Asia-FirstCall/ --

- Second

Quarter of FY 2015 net sales increased 33.0% to $54.1million; net income increase 41.9% to $5.2million with EPS of $0.16.

- The

Company provided third quarter of fiscal year 2015 guidance range: Revenue, Net Income and EPS of between $75 million and $80 million,

$8 million and $10 million, and $0.23 and $ 0.28 based on 35.2 million fully diluted shares, respectively.

- The

Company Updated Guidance Range of Fiscal Year 2015 as the following: Revenue, Net Income and EPS of between $255 million and $269

million, $26 million and $ 35 million, and $0.74 and $0.99 based on 35.2 million fully diluted shares, respectively.

China

Green Agriculture, Inc. (NYSE: CGA; "China Green Agriculture" or the "Company"), a company mainly produces

and distributes humic acid-based compound fertilizers, other varieties of compound fertilizers and agricultural products through

its subsidiaries in China, today announced its financial results for the quarter ended December 31, 2014, i.e., the second

quarter of Fiscal Year 2015.

Financial

Summary

| Second Quarter 2015 Results (USD) |

| (Three months ended December 31, 2014) |

| | |

| |

| |

| |

| | |

Q2 FY2015 | |

Q2 FY2014 | |

CHANGE (%) | |

| Net Sales | |

$54.1 million | |

$40.6 million | |

| 33.0 | % |

| Gross Profit | |

$22.9 million | |

$18.9 million | |

| 21.5 | % |

| Net Income | |

$5.2 million | |

$3.7 million | |

| 41.9 | % |

| EPS (Diluted) | |

$0.16 | |

$0.12 | |

| 35.6 | % |

| Weighted Average Shares Outstanding (Diluted) | |

$33.3 million | |

$31.8 million | |

| 4.6 | % |

| (Six months ended December 31, 2014) |

| | |

| |

| |

| |

| | |

Q2 FY2015 | |

Q2 FY2014 | |

CHANGE (%) | |

| Net Sales | |

$105.4 million | |

$91.0 million | |

| 15.9 | % |

| Gross Profit | |

$47.6 million | |

$41.3 million | |

| 15.2 | % |

| Net Income | |

$13.3 million | |

$14.1 million | |

| (5.3 | )% |

| EPS (Diluted) | |

$0.41 | |

$0.45 | |

| (10.8 | )% |

| Weighted Average Shares Outstanding (Diluted) | |

$32.8 million | |

$30.9 million | |

| 6.3 | % |

“We

are very pleased with our performance of business operation, generating $5.2 million net income in the second quarter ended December

31, 2014," said Mr. Li Tao, Chairman and Chief Executive Officer of China Green Agriculture." Looking ahead to the third

quarter of fiscal year 2015, we expect net sales of $75 to $80 million, net income of $8 to $10 million, and EPS of $0.23

and $0.28 based on 35.2 million fully diluted weighted average shares outstanding for the third quarter ended March 31, 2015.

With our track-record history and incredible momentum in our fertilizer business, we are confident in achieving our target for

the third quarter of fiscal year 2015. "

Second

Quarter of FY2015 Results of Operations

Total net sales for the three months ended

December 31, 2014 were $54,051,174, an increase of $13,416,573, or 33.0%, from $40,634,601 for the three months ended December

31, 2013. This increase was principally due to an increase in Jinong’s and Gufeng’s net sales.

For the three months ended December 31,

2014, Jinong’s net sales increased $4,904,071, or 18.7%, to $31,192,693 from $26,288,622 for the three months ended December

31, 2013. This increase was mainly attributable to Jinong’s implementation of the sales strategy that focus on promoting

the sales of high-margin liquid fertilizer despite the decrease in its sales volume during the three months ended December 31,

2014.

For the three months ended December 31,

2014, Gufeng’s net sales were $21,778,807, an increase of $8,296,791 or 61.5% from $13,482,016 for the three months ended

December 31, 2013. The increase was mainly attributable to the fact that Gufeng had developed more large clients from northeast

area in mainland China and completed a large amount sale to China National Agricultural Means of Production Group Corporation (“Sino-agri

Group”) during the three months ended December 31, 2014 compared with the same period a year before.

For the three months ended December 31,

2014, Yuxing’s net sales were $1,079,674, an increase of $215,711 or 25.0%, from $863,963 during the three months ended

December 31, 2013. The increase was mainly attributable to the increase in sales demand on Yuxing’s top-grade flowers.

Total cost of goods sold for the three

months ended December 31, 2014 was $31,141,180, an increase of $9,358,094, or 43.0%, from $21,783,086 for the three months ended

December 31, 2013. This increase was mainly due to the 33.0% increase in net sales.

Cost of goods sold by Jinong for the three

months ended December 31, 2014 was $12,314,040, an increase of $1,444,778, or 13.3%, from $10,869,262 for the three months ended

December 31, 2013. Although Jinong lowered the product costs for the mix of products being sold, the increase in cost of goods

was primarily attributable to Jinong’s higher net sales.

Cost of goods sold by Gufeng for the three

months ended December 31, 2014 was $18,034,979, an increase of $7,743,867, or 75.2%, from $10,291,112 for the three months ended

December 31, 2013. This increase was primarily attributable to an increase in the cost of raw materials and an increase in the

sales of fertilizer products.

For the three months ended December 31,

2014, cost of goods sold by Yuxing was $792,161, an increase of $169,449, or 27.2%, from $622,712 for the three months ended December

31, 2013. This increase was mainly due to the 25.0% increase in Yuxing’s net sales.

Total gross profit for the three months

ended December 31, 2014 increased by $4,058,479 to $22,909,994, as compared to $18,851,515 for the three months ended December

31, 2013. Gross profit margin was 42.4% and 46.4% for the three months ended December 31, 2014 and 2013, respectively.

Gross profit generated by Jinong increased

by $3,459,293, or 22.4%, to $18,878,653 for the three months ended December 31, 2014 from $15,419,360 for the three months ended

December 31, 2013. Gross profit margin from Jinong’s sales was approximately 60.5% and 58.7% for the three months ended December

31, 2014 and 2013, respectively. The increase in gross profit margin was mainly due to the increased weight for higher-margin products

sales in Jinong’s total sales due to Jinong’s sales strategy. Jinong has adjusted its production process to focus

on producing the high-margin liquid fertilizer during the three months ended December 31, 2014.

For the three months ended December 31,

2014, gross profit generated by Gufeng was $3,743,828, an increase of $552,924, or 17.3%, from $3,190,904 for the three months

ended December 31, 2013. Gross profit margin from Gufeng’s sales was approximately 17.2% and 23.7% for the three months ended

December 31, 2014 and 2013, respectively. The decrease in gross profit percentage was mainly due to the increased weight for lower-margin

products sales in Gufeng’s total sales answering to market demand.

For the three months ended December 31,

2014, gross profit generated by Yuxing was $287,513, an increase of $46,262, or 19.2% from $241,251 for the three months ended

December 31, 2013. The gross profit margin was approximately 26.6% and 27.9% for the three months ended December 31, 2014

and 2013, respectively.

This decrease in gross profit margin was

mainly due to an increase in the cost of raw materials for the three months ended December 31, 2014, compared to the same period

in 2013.

Our selling expenses consisted primarily of salaries of sales

personnel, advertising and promotion expenses, freight-out costs and related compensation. Selling expenses were $1,981,065, or

3.7%, of net sales for the three months ended December 31, 2014, as compared to $752,642 or 1.9% of net sales for the three months

ended December 31, 2013, an increase of $1,228,423, or 163.2%. The selling expenses of Yuxing were $13,935 or 1.3% of Yuxing’s

net sales for the three months ended December 31, 2014, as compared to $13,119, or 1.5% of Yuxing’s net sales for the three

months ended December 31, 2013. The selling expenses of Gufeng were $228,488 or 1.0% of Gufeng’s net sales for the three

months ended December 31, 2014, as compared to $314,138, or 2.3% of Gufeng’s net sales for the three months ended December

31, 2013. The selling expenses of Jinong for the three months ended December 31, 2014 were $1,738,642 or 5.6% of Jinong’s

net sales, as compared to selling expenses of $425,386, or 1.6% of Jinong’s net sales for the three months ended December

31, 2013. The increase in Jinong’s selling expenses was due to Jinong’s expanded marketing efforts and the increase

in shipping costs.

Our selling expenses - amortization of

our deferred assets were $10,651,432, or 19.7%, of net sales for the three months ended December 31, 2014, as compared to $8,054,453

or 19.8% of net sales for the three months ended December 31, 2013, an increase of $2,596,979, or 32.2%. This increase was due

to the increased amortization of the deferred tax assets for the three months ended December 31, 2014 related to our business strategy

implemented since the first quarter of fiscal year of 2014 that assists distributors in certain marketing efforts and develops

standard stores to expand our competitive advantages and market shares.

General and administrative expenses consisted

primarily of related salaries, rental expenses, business development, depreciation and travel expenses incurred by our general

and administrative departments and legal and professional expenses including expenses incurred and accrued for certain litigations.

General and administrative expenses were $3,193,979, or 5.9% of net sales for the three months ended December 31, 2014, as compared

to $4,565,932, or 11.2%, of net sales for the three months ended December 31, 2013, a decrease of $1,371,953, or 30.0%. The

decrease in general and administrative expenses was mainly due to the related expenses in the stock compensation awarded to

the employees which amounted to $1,786,225 for the three months ended December 31, 2014 as compared to $2,852,155 for the three

months ended December 31, 2013.

Net income for the three months ended December

31, 2014 was $5,215,437, an increase of $1,539,700, or 41.9%, compared to $3,675,737 for the three months ended December 31, 2013.

The increase was attributable to the significant increase in sales offset by an increase in selling expenses. Net income as a percentage

of total net sales was approximately 9.6% and 9.0% for the three months ended December 31, 2014 and 2013, respectively.

The

First Six Months of FY2015 Results of Operations

Total net sales for the six months ended

December 31, 2014 were $105,352,964, an increase of $14,415,016, or 15.9%, from $90,937,948 for the six months ended December 31,

2013. This increase was principally due to an increase in Jinong’s and Gufeng’s net sales.

For the six months ended December 31, 2014,

Jinong’s net sales increased $7,606,234, or 13.1%, to $65,656,858 from $58,050,624 for the six months ended December 31,

2013. This increase was mainly attributable to Jinong’s implementation of the sales strategy that focus on promoting the

sales of high-margin liquid fertilizer despite the decrease in its sales volume during the last six months.

For the six months ended December 31, 2014,

Gufeng’s net sales were $37,764,881, an increase of $6,526,783 or 20.9% from $31,238,098 for the six months ended December

31, 2013. The increase was mainly attributable to Gufeng had more large clients from northeast area in mainland China and one large

amount sale to Sino-agri Group during the six months ended December 31, 2014 compared with the same period a year before.

For the six months ended December 31, 2014,

Yuxing’s net sales were $1,931,225, an increase of $281,999 or 17.1%, from $1,649,226 during the six months ended December

31, 2013. The increase was mainly attributable to the increase in sales demand on Yuxing’s top-grade flowers.

Total cost of goods sold for the six months

ended December 31, 2014 was $57,769,536, an increase of $8,152,791, or 16.4%, from $49,616,745 for the six months ended December

31, 2013. This increase was mainly due to the 15.9% increase in net sales.

Cost of goods sold by Jinong for the six

months ended December 31, 2014 was $25,694,663, an increase of $855,570, or 3.4%, from $24,839,093 for the six months ended December

31, 2013. Although Jinong lowered the product costs for the mix of products being sold, the increase was primarily attributable

to its higher net sales.

Cost of goods sold by Gufeng for the six

months ended December 31, 2014 was $30,634,164, an increase of $7,133,420, or 30.4%, from $23,500,744 for the six months ended

December 31, 2013. This increase was primarily attributable to an increase in the cost of raw materials and an increase in the

sales of fertilizer products.

For the six months ended December 31, 2014,

cost of goods sold by Yuxing was $1,440,709, an increase of $163,801, or 12.8%, from $1,276,908 for the six months ended December

31, 2013. This increase was mainly due to the 17.1% increase in Yuxing’s net sales.

Net income for the six months ended December

31, 2014 was $13,314,519, a decrease of $739,675, or 5.3%, compared to $14,054,194 for the six months ended December 31, 2013.

The decrease was attributable to the increase in selling expenses offset by an increase in our gross margin. Net income as a percentage

of total net sales was approximately 12.6% and 15.5% for the six months ended December 31, 2014 and 2013, respectively.

Financial

Condition

As of December 31, 2014, cash and cash

equivalents were $59,364,446, an increase of $32,474,125, or 120.8%, from $26,890,321 as of June 30, 2014. Net cash provided in

operating activities was $38,908,479 for the six months ended December 31, 2014, an increase of $38,491,193 compared to $417,286

for the six months ended December 31, 2013. The increase was mainly attributable to the decrease in accounts receivable and

advances to suppliers, increase in customer deposits and tax payable and an increase in depreciation and amortization, offset by

an increase in inventories during the six months ended December 31, 2014 as compared to the same period in 2013. We had accounts

receivable of $71,065,640 as of December 31, 2014, as compared to $88,781,608 as of June 30, 2014, a decrease of $17,715,968 or

20.0%.

Third

Quarter Fiscal Year 2015 and Fiscal Year 2015 Guidance

“For

the third quarter ending March 31, 2015, management expects net sales of $75 to $80million, net income of $8 to $10 million, and

EPS of $0.23 to $0.28 based on 35.2million fully diluted shares. For the fiscal year ended June 30, 2015, management expects

net sales of $255 million to $269 million, net income of $26 million to $35 million, and an EPS of $0.74 to $0.99 based

on 35.2 million fully diluted shares.

Conference

Call

The

Company will hold a conference call at 8:30 AM Eastern Time on Monday, February 9, 2015. Any interested participants

are welcome to join in the call by following the dial-in details as set out below. When prompted by the operator, please indicate

"China Green Agriculture's Second Quarter Fiscal Year 2015 Financial Results" to join the call.

| Event: |

CGA Second Quarter Fiscal Year 2015Conference Call |

|

| Date: |

February 9, 2015 |

|

| Time: |

8:30a.m. ET |

|

| |

|

|

To participate in the

conference call, please dial any of the following numbers:

| Participate dial in (Toll free): |

1-877-870-4263 |

| Participate international dial in: |

1-412-317-0790 |

| Hong Kong-Local Toll |

852-301-84992 |

| Beijing-Local Toll |

86-10-535-73132 |

| China Toll Free |

86-4001-201203 |

| Canada Toll Free |

1-855-669-9657 |

| Hong Kong Toll Free |

852-800-905945 |

To access the replay,

please dial any of the following numbers:

| US Toll Free: |

1-877-344-7529 |

| International Toll: |

1-412-317-0088 |

| Canada Toll Free: |

1-855-669-9658 |

| Replay Access Code: |

10060450 |

The replay will be

available 1 hour after the end of the conference.

Teleconference Replay

Available Until: Feb 16, 2015

About

China Green Agriculture, Inc.

The Company produces and

distributes humic acid-based compound fertilizers, other varieties of compound fertilizers and agricultural products through its

wholly-owned subsidiaries, i.e.: Shaanxi TechTeam Jinong Humic Acid Product Co., Ltd. ("Jinong"), Beijing Gufeng Chemical

Products Co., Ltd. ("Gufeng") and a variable interest entity, Xi'an Hu County Yuxing Agriculture Technology Development

Co., Ltd. ("Yuxing"). Jinong produced and sold 120 different kinds of fertilizer products as of December 31, 2014, all

of which are certified by the government of the People's Republic of China (the "PRC") as Green Food Production Materials,

as stated by the China Green Food Development Center. Jinong currently markets its fertilizer products to private wholesalers and

retailers of agricultural farm products in 27 provinces, four autonomous regions, and three central-government-controlled municipalities

in the PRC. Jinong had 972 distributors in the PRC as of December 31, 2014. Gufeng, and its wholly-owned subsidiary, Beijing Tianjuyuan

Fertilizer Co., Ltd., are Beijing-based producers of compound fertilizers, blended fertilizers, organic compound fertilizers, and

mixed organic-inorganic compound fertilizers. As of December 31, 2014, Gufeng produced and sold 332 different kinds of fertilizer

products, and had 271 distributors in the PRC. For more information, visit http://www.cgagri.com. The Company routinely posts important

information on its website.

Safe Harbor Statement

This press release contains

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 concerning the Company's

business, products and financial results. The Company's actual results may differ materially from those anticipated in the forward-looking

statements depending on a number of risk factors including, but not limited to, the following: general economic, business and environment

conditions, development, shipment, market acceptance, additional competition from existing and new competitors, changes in technology,

the execution of its ten-year growth plan, a satisfactory conclusion of the pending securities class action litigation and various

other factors beyond the Company's control. All forward-looking statements are expressly qualified in their entirety by this Safe

Harbor Statement and the risk factors detailed in the Company's reports filed with the SEC. China Green Agriculture undertakes

no duty to revise or update any forward-looking statements to reflect events or circumstances after the date of this release, except

as required by applicable law or regulations.

For more information, please

contact:

China Green Agriculture,

Inc.

Ms. Ran Liu (English and

Chinese)

Tel: +86-29-88266500

Email: liuran@cgagri.com

SOURCE China Green Agriculture,

Inc.

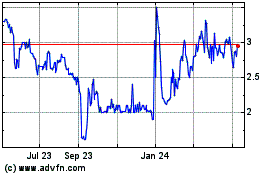

China Green Agriculture (NYSE:CGA)

Historical Stock Chart

From Mar 2024 to Apr 2024

China Green Agriculture (NYSE:CGA)

Historical Stock Chart

From Apr 2023 to Apr 2024