UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 29, 2015

ALBEMARLE CORPORATION

(Exact name of registrant as specified in charter)

| |

|

|

|

|

|

Virginia

|

|

001-12658

|

|

54-1692118

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

| |

|

|

|

451 Florida Street, Baton Rouge, Louisiana

|

|

70801

|

|

(Address of principal executive offices)

|

|

(Zip code)

|

Registrant’s telephone number, including area code: (225) 388-8011

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a- 12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 8.01 Other Events.

In connection with Albemarle Corporation’s (“Albemarle”) previously-described acquisition of Rockwood Holdings, Inc. (“Rockwood”), on January 14, 2015, Albemarle Holdings II Corporation, a Delaware corporation and indirect wholly-owned subsidiary of Albemarle, merged with and into Rockwood Specialties Group, Inc. (“RSGI”), a Delaware corporation and indirect wholly-owned subsidiary of Albemarle, with RSGI as the surviving corporation. As a result of the merger, RSGI became a guarantor of Albemarle’s 3.000% Senior Notes due 2019, 4.150% Senior Notes due 2024 and 5.450% Senior Notes due 2044.

|

|

(b)

|

Fourth Supplemental Indenture

|

On January 29, 2015, Albemarle entered into a Fourth Supplemental Indenture (the “Fourth Supplemental Indenture”), among Albemarle, Rockwood, RSGI, The Bank of New York Mellon Trust Company, N.A., (as successor to The Bank of New York, “The Bank of New York Mellon”) as resigning trustee, and U.S. Bank National Association (“U.S. Bank”), as successor trustee. The Fourth Supplemental Indenture supplements and amends the Indenture, dated as of January 20, 2005 (as amended and supplemented, the “Indenture”), which governs Albemarle’s outstanding series of senior notes. The Fourth Supplemental Indenture replaces The Bank of New York Mellon, as trustee, with U.S. Bank, as the successor trustee, with respect to Albemarle’s outstanding 4.50% Senior Notes due 2020 (the “Albemarle 2020 Notes”) and as Trustee under the Indenture. This change will become effective February 9, 2015. The Fourth Supplemental Indenture also adds Rockwood and RSGI as guarantors of the Albemarle 2020 Notes. A copy of the Fourth Supplemental Indenture is filed as Exhibit 4.1 to this Current Report on Form 8-K.

|

|

(c)

|

Third Supplemental Indenture

|

On January 29, 2015, Albemarle entered into a Third Supplemental Indenture (the “Third Supplemental Indenture”), among Albemarle, RSGI, and Wells Fargo Bank, National Association (“Wells Fargo”), as trustee. The Third Supplemental Indenture supplements and amends the Indenture, dated as of September 25, 2012, among Rockwood, RSGI and Wells Fargo (as amended and supplemented, the “RSGI Indenture”), which governs RSGI’s outstanding 4.625% Senior Notes due 2020 (the “RSGI Notes”). The Third Supplemental Indenture amends the reporting requirements of the RSGI Indenture by substituting Albemarle for Rockwood so that, so long as Albemarle is a guarantor of the RSGI Notes and complies with certain SEC requirements, the reports, information and other documents required to be filed and furnished to holders of the RSGI Notes pursuant to the RSGI Indenture may, at the option of RSGI, be filed by and be those of Albemarle rather than, as had been done previously, Rockwood. A copy of the Third Supplemental Indenture is filed as Exhibit 4.2 to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

|

|

|

|

4.1

|

|

Fourth Supplemental Indenture, dated as of January 29, 2015, among Albemarle Corporation, Rockwood Holdings, Inc. (as successor by merger to Albemarle Holdings Corporation), Rockwood Specialties Group, Inc. (as successor by merger to Albemarle Holdings II Corporation), The Bank of New York Mellon Trust Company, N.A., a national banking association, as successor to The Bank of New York, as resigning trustee, and U.S. Bank National Association, as successor trustee.

|

| |

|

|

|

4.2

|

|

Third Supplemental Indenture, dated as of January 29, 2015, among Albemarle Corporation, Rockwood Specialties Group, Inc., and Wells Fargo Bank, National Association, as trustee.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

| |

|

ALBEMARLE CORPORATION

|

| |

|

|

|

Date: January 29, 2015

|

By:

|

|

| |

|

Karen G. Narwold

|

| |

|

Senior Vice President, General Counsel, Corporate and Government Affairs, Corporate Secretary

|

EXHIBITS

|

|

|

|

|

4.1

|

|

Fourth Supplemental Indenture, dated as of January 29, 2015, among Albemarle Corporation, Rockwood Holdings, Inc. (as successor by merger to Albemarle Holdings Corporation), Rockwood Specialties Group, Inc. (as successor by merger to Albemarle Holdings II Corporation), The Bank of New York Mellon Trust Company, N.A., a national banking association, as successor to The Bank of New York, as resigning trustee, and U.S. Bank National Association, as successor trustee.

|

| |

|

|

|

4.2

|

|

Third Supplemental Indenture, dated as of January 29, 2015, among Albemarle Corporation, Rockwood Specialties Group, Inc., and Wells Fargo Bank, National Association, as trustee.

|

Exhibit 4.1

FOURTH SUPPLEMENTAL INDENTURE

FOURTH SUPPLEMENTAL INDENTURE, dated as of January 29, 2015 (this “Fourth Supplemental Indenture”), among Albemarle Corporation, a Virginia corporation (the “Company”), whose principal office is located at 451 Florida Street, Baton Rouge, Louisiana 70801, Rockwood Holdings, Inc. (as successor by merger to Albemarle Holdings Corporation), a Delaware corporation (“Holdings”), whose principal office is located at 451 Florida Street, Baton Rouge, Louisiana 70801, Rockwood Specialties Group, Inc. (as successor by merger to Albemarle Holdings II Corporation), a Delaware corporation (“RSGI” and, together with Holdings, the “Guarantors” and each, a “Guarantor”), whose principal office is located at 451 Florida Street, Baton Rouge, Louisiana 70801, The Bank of New York Mellon Trust Company, N.A., a national banking association, as successor to The Bank of New York (the “Resigning Trustee”), and U.S. Bank National Association, as successor trustee (the “Successor Trustee”).

W I T N E S S E T H

WHEREAS, the Company and The Bank of New York have duly executed and delivered an Indenture, dated as of January 20, 2005 (as amended and supplemented, the “Indenture”), providing for the authentication, issuance, delivery and administration of unsecured notes, debentures or other evidences of indebtedness to be issued in one or more series by the Company; and

WHEREAS, the Company issued its 4.50% Senior Notes due 2020 (the “Notes”) on December 10, 2010, pursuant to the Indenture and the second supplemental indenture, dated as of December 10, 2010, between the Company and the Resigning Trustee; and

WHEREAS, each of the Guarantors desires to provide a Guarantee with respect to the Notes; and

WHEREAS, the Resigning Trustee intends to resign as Trustee of the Notes and the Company desires to appoint the Successor Trustee as Trustee with respect to the Notes; and

WHEREAS, the Resigning Trustee has not resigned as Trustee of the Company’s 5.10% Senior Notes due 2015 (the “2015 Notes”); and

WHEREAS, in the case of the appointment of a successor Trustee with respect to one or more (but not all) series of Securities under the Indenture, Section 6.11 of the Indenture provides for a retiring Trustee and any successor Trustee to enter into an indenture supplemental to the Indenture providing for such items as are set forth in such Section 6.11; and

WHEREAS, the Resigning Trustee intends to resign as Trustee under the Indenture, such resignation to be effective upon the maturity of the 2015 Notes and the payment by the Company of all sums payable by the Company under the Indenture with respect thereto and the Company desires to appoint the Successor Trustee as Trustee under the Indenture; and

WHEREAS, Section 9.01 of the Indenture expressly permits the Company and the Trustee, subject to certain conditions, to enter into one or more supplemental indentures for the purposes, inter alia, of adding to, changing or eliminating any of the provisions of the Indenture in respect of one or more series of Securities, and permits the execution of such supplemental indentures without the consent of the Holders of any Securities then outstanding; and

WHEREAS, for the purposes recited above, and pursuant to due corporate action, the Company and each of the Guarantors have duly determined to execute and deliver to the Resigning Trustee and the Successor Trustee this Fourth Supplemental Indenture; and

WHEREAS, all conditions and requirements necessary to make this Fourth Supplemental Indenture a valid instrument in accordance with its terms have been done and performed, and the execution and delivery hereof have been in all respects duly authorized.

NOW, THEREFORE, in consideration of the premises, the Company, the Guarantors, the Resigning Trustee and the Successor Trustee mutually covenant and agree as follows:

ARTICLE 1. DEFINITIONS.

1.1 All terms contained in this Fourth Supplemental Indenture shall, except as specifically provided herein or except as the context may otherwise require, have the meanings given to such terms in the Indenture.

ARTICLE 2. THE TRUSTEE.

2.1 Resignation of Trustee of the Notes. The Resigning Trustee hereby resigns as Trustee, Paying Agent and Security Registrar under the Indenture with respect to the Notes.

2.2 Appointment of Replacement Trustee. The Company hereby appoints U.S. Bank National Association to act as Trustee, Paying Agent and Security Registrar under the Indenture with respect to the Notes and U.S. Bank National Association hereby accepts such appointment, together with all rights, powers, privileges, benefits, duties, trusts and obligations associated with such appointment. With respect to the Notes, references in the Indenture to “Corporate Trust Office” mean the corporate trust office of the Successor Trustee, which, at the time of the execution of this Fourth Supplemental Indenture, is located at 333 Commerce Street, Suite 800, Nashville, Tennessee 37201; facsimile: (615) 251-0737.

2.3 Transfer of Interest. All rights, powers, trusts and duties of the Resigning Trustee with respect to the Notes are hereby transferred, confirmed to and vested in the Successor Trustee. The Resigning Trustee hereby confirms that it holds no property or money under the Indenture with respect to the Notes. Upon request of the Successor Trustee, the Company shall execute any and all instruments as the Successor Trustee may reasonably require so as to more fully and certainly vest and confirm in the Successor Trustee all the rights, powers and trusts hereby assigned, transferred, delivered and confirmed to the Successor Trustee as Trustee, Paying Agent and Security Registrar with respect to the Notes.

2.4 Confirmation with Respect to the 2015 Notes. The Company hereby confirms that all the rights, powers, trusts and duties of the Resigning Trustee as Trustee under the Indenture with respect to the 2015 Notes, as to which the Resigning Trustee is not retiring, shall continue to be vested in the Resigning Trustee.

2.5 No Co-Trustees. Nothing herein shall constitute the Resigning Trustee and the Successor Trustee co-trustees of the same trust and each of the Resigning Trustee and the Successor Trustee shall be trustee of a trust under the Indenture separate and apart from any trust administered by the other trustee.

2.6 Resignation as Trustee under the Indenture. The Resigning Trustee hereby resigns as Trustee, Paying Agent and Security Registrar under the Indenture, subject to those rights of the Trustee under the Indenture which by their terms survive the discharge of the Indenture and the resignation or removal of the Trustee. Such resignation shall be effective upon the maturity of the 2015 Notes and the payment by the Company of all sums payable under the Indenture with respect to the 2015 Notes, and upon such payment and at the request of the Company, the Resigning Trustee shall execute an instrument acknowledging payment of such sums with respect to the 2015 Notes.

2.7 Appointment as Trustee under the Indenture. The Company hereby appoints U.S. Bank National Association to act as Trustee, Paying Agent and Security Registrar under the Indenture and U.S. Bank National Association hereby accepts such appointment, together with all rights, powers, privileges, benefits, duties, trusts and obligations associated with such appointment. Such appointment and acceptance shall be effective immediately upon the effectiveness of the resignation of the Resigning Trustee as set forth in Section 2.6, without further act, deed or conveyance.

ARTICLE 3. AMENDMENT OF TERMS OF THE INDENTURE WITH RESPECT TO THE NOTES.

The following amendments to the Indenture in this Article 3 shall apply to the Notes:

3.1 Definitions. Section 1.02 of the Indenture is hereby amended to add in its appropriate alphabetical sequence the following definitions:

““Guarantee” means any guarantee of a Guarantor endorsed on a Security authenticated and delivered pursuant to this Indenture and shall include the Guarantees by a Guarantor set forth in any supplemental indenture hereto or Officers’ Certificate in accordance with Section 3.01.”

““Guarantor” means the Person(s) named as a “Guarantor” in the applicable indenture supplemental to the Indenture or Officers’ Certificate pursuant to Section 3.01 of the Indenture until a successor Person shall have become such pursuant to the applicable provisions of this Indenture, and thereafter “Guarantor” shall mean such successor Person.”

ARTICLE 4. GUARANTEES

The provisions of this Article 4 shall apply to the Notes.

4.1 Guarantee. (a) Each Guarantor hereby fully and unconditionally guarantees to each Holder of the Notes and to the Trustee for itself and on behalf of each such Holder, the due and punctual payment of the principal of (and premium, if any, on) and interest (including, in case of default, interest on principal and, to the extent permitted by applicable law, on overdue interest and including any additional interest required to be paid according to the terms of the Notes), if any, on each such Note, when and as the same shall become due and payable, whether at Maturity of the Notes, upon redemption, upon acceleration, upon tender for repayment at the option of any Holder or otherwise, according to the terms thereof and of the Indenture (the “Guarantor Obligations”). In case of the failure of the Company or any successor thereto punctually to pay any such principal, premium or interest payment, each such Guarantor hereby agrees to cause any such payment to be made punctually when and as the same shall become due and payable, whether at Maturity of the Notes, upon redemption, upon declaration of acceleration, upon tender for repayment at the option of any Holder or otherwise, as if such payment were made by the Company.

(b) Each Guarantor hereby agrees that its Guarantor Obligations hereunder shall be as if it were principal debtor and not merely surety and shall be absolute and unconditional, irrespective of the identity of the Company, the validity, regularity or enforceability of the Notes or the Indenture, the absence of any action to enforce the same, any waiver or consent by the Holder of any Note with respect to any provisions thereof, the recovery of any judgment against the Company or any action to enforce the same, or any other circumstance which might otherwise constitute a legal or equitable discharge or defense of a Guarantor. Each Guarantor hereby waives diligence, presentment, demand of payment, filing of claims with a court in the event of insolvency or bankruptcy of the Company, any right to require a proceeding first against the Company, protest, notice and all demands whatsoever and covenants that its Guarantee with respect to the Notes will not be discharged except by complete performance of its obligations contained in the Notes and in this Guarantee.

(c) Each Guarantor hereby agrees that, in the event of a default in payment of principal or premium, if any, or interest on the Notes, whether at Maturity, by acceleration, purchase or otherwise, legal proceedings may be instituted by the Trustee on behalf of, or by, the Holder of any Note, subject to the terms and conditions set forth in this Supplemental Indenture, directly against each such Guarantor to enforce its Guarantee without first proceeding against the Company.

(d) If any Holder or the Trustee is required by any court or otherwise to return to the Company or any Guarantor, or any custodian, trustee, liquidator or other similar official acting in relation to either the Company or any Guarantor, any amount paid in respect of a Note by any of them to the Trustee or such Holder, this Guarantee, to the extent theretofore discharged, shall be reinstated in full force and effect.

(e) This Guarantee shall remain in full force and effect and continue to be effective should any petition be filed by or against the Company for liquidation, reorganization, should the Company become insolvent or make an assignment for the benefit of creditors or should a receiver or trustee be appointed for all or any significant part of the Company’s assets, and shall, to the fullest extent permitted by law, continue to be effective or be reinstated, as the case may be, if at any time payment and performance of any Note are, pursuant to applicable law, rescinded or reduced in amount, or must otherwise be restored or returned by any obligee on any Note, whether as a “voidable preference”, “fraudulent transfer” or otherwise, all as though such payment or performance had not been made. In the event that any payment or any part thereof is rescinded, reduced, restored or returned, any Note shall, to the fullest extent permitted by law, be reinstated and deemed reduced only by such amount paid and not so rescinded, reduced, restored or returned.

4.2 Severability. In case any provision of this Guarantee shall be invalid, illegal or unenforceable, the validity, legality, and enforceability of the remaining provisions shall not in any way be affected or impaired thereby.

4.3 Priority of Guarantee. This Guarantee shall be an unsecured and unsubordinated obligation of each Guarantor, ranking pari passu with all other existing and future unsubordinated and unsecured indebtedness of the Company and each such Guarantor, respectively.

4.4 Limitation of Guarantors’ Liability. Each Guarantor and by its acceptance hereof each Holder confirms that it is the intention of all such parties that this Guarantee does not constitute a fraudulent transfer or conveyance for purposes of the Bankruptcy Law, the Uniform Fraudulent Conveyance Act, the Uniform Fraudulent Transfer Act or any similar federal or state law or the provisions of its local law relating to fraudulent transfer or conveyance. To effectuate the foregoing intention, the Holders and each Guarantor hereby irrevocably agree that the obligations of each such Guarantor under this Guarantee shall be limited to the maximum amount that will not, after giving effect to all other contingent and fixed liabilities of each such Guarantor, result in the obligations of such Guarantor under this Guarantee constituting such fraudulent transfer or conveyance.

4.5 Subrogation. Each Guarantor shall be subrogated to all rights of Holders of the Notes against the Company in respect of any amounts paid by any such Guarantor on account of such Notes or the Indenture; provided, however, that, if an Event of Default has occurred and is continuing, each Guarantor shall not be entitled to enforce or receive any payments arising out of, or based upon, such right of subrogation until all amounts then due and payable by the Company under the Indenture or the Notes shall have been paid in full.

4.6 Reinstatement. Each Guarantor hereby agrees that its Guarantee provided for in Section 4.1 shall continue to be effective or be reinstated, as the case may be, if at any time, payment, or any part thereof, of any obligations or interest thereon is rescinded or must otherwise be restored by a Holder to the Company upon the bankruptcy or insolvency of the Company or such Guarantor. Subject to the preceding sentence, once released in accordance with its terms and the Indenture, a Guarantee shall not be required to be reinstated for any reason.

4.7 Release of Guarantor. (a) Concurrently with the discharge of the Notes under Section 4.01 of the Indenture or the defeasance of the Notes under Sections 13.02 or 13.03 of the Indenture, each Guarantor shall be released from all its obligations under its Guarantee with respect to the Notes under the Indenture.

(b) So long as no Default exists or upon the occurrence of the following events, with notice or lapse of time or both, would exist, this Guarantee and any Liens securing this Guarantee shall be automatically and unconditionally released and discharged:

(i) upon any sale, exchange or transfer to any Person that is not an Affiliate of the Company of all of the Company’s Capital Stock in a Guarantor, which transaction is otherwise in compliance with the Indenture.

(ii) upon any consolidation or merger of a Guarantor with or into the Company or another Guarantor, which transaction is otherwise in compliance with the Indenture.

(iii) upon the redemption, defeasance, retirement or any other discharge in full of the 4.625% Senior Notes due 2020 issued by RSGI.

(c) Upon written instruction from the Company, the Trustee shall execute and deliver any documents, instructions or instruments evidencing any release of a Guarantee.

4.8 Benefits Acknowledged. Each Guarantor acknowledges that it will receive direct and indirect benefits from the financing arrangements contemplated by the Indenture and that its guarantee and waivers pursuant to the Guarantee are knowingly made in contemplation of such benefits.

ARTICLE 5. MISCELLANEOUS.

5.1 Ratification of Indenture. The Indenture, as supplemented by this Fourth Supplemental Indenture, is in all respects ratified and confirmed, and this Fourth Supplemental Indenture shall be deemed a part of the Indenture in the manner and to the extent herein and therein provided.

5.2 Governing Law. This Fourth Supplemental Indenture and each Guarantee shall be governed by, and construed in accordance with, the laws of the State of New York.

5.3 Counterparts. This Fourth Supplemental Indenture may be executed in several counterparts, each of which shall be an original, and all collectively but one and the same instrument.

5.4 Effective Date. Except as indicated in the following sentence, this Fourth Supplemental Indenture shall be effective as of the date hereof. Notwithstanding the preceding sentence, the appointment and acceptance of the Successor Trustee with respect to the Notes effected hereby shall be effective as of the opening of business on February 9, 2015.

5.5 The Resigning Trustee and the Successor Trustee. Neither the Resigning Trustee nor the Successor Trustee shall be responsible in any manner whatsoever for or in respect of the validity or sufficiency of this Fourth Supplemental Indenture or for or in respect of the recitals contained herein, all of which are made solely by the Company and the Guarantors (other than with respect to the intention of the Resigning Trustee to resign as set forth in the fourth and seventh recitals hereof, which are made by the Resigning Trustee). All rights, privileges, protections, indemnities and benefits granted or afforded to the Resigning Trustee and the Successor Trustee, each as Trustee under the Indenture, shall be deemed incorporated herein by this reference and shall be applicable to all actions taken, suffered or omitted by the Resigning Trustee and the Successor Trustee under this Fourth Supplemental Indenture.

[Signature page follows]

IN WITNESS WHEREOF, the parties hereto have caused this Fourth Supplemental Indenture to be executed as of the date first above written.

| |

ALBEMARLE CORPORATION, as Issuer |

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Karen G. Narwold |

|

| |

Name: |

Karen G. Narwold |

|

| |

Title: |

Senior Vice President, General Counsel, |

|

| |

|

Corporate & Governmental Affairs,

|

|

| |

|

Corporate Secretary |

|

| |

ROCKWOOD HOLDINGS, INC.,

|

|

| |

as Guarantor

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Karen G. Narwold |

|

| |

Name: |

Karen G. Narwold |

|

| |

Title: |

President, Treasurer and Secretary |

|

| |

ROCKWOOD SPECIALTIES GROUP, INC.,

|

|

| |

as Guarantor

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Karen G. Narwold |

|

| |

Name: |

Karen G. Narwold |

|

| |

Title: |

President, Treasurer and Secretary |

|

| |

THE BANK OF NEW YORK MELLON TRUST COMPANY, N.A.,

|

|

| |

as Resigning Trustee

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Michael Countryman |

|

| |

Name: |

Michael Countryman |

|

| |

Title: |

Vice President |

|

| |

U.S. BANK NATIONAL ASSOCIATION,

|

|

| |

as Successor Trustee

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Connie Jaco |

|

| |

Name: |

Connie Jaco |

|

| |

Title: |

Assistant Vice President |

|

Exhibit 4.2

THIRD SUPPLEMENTAL INDENTURE

THIRD SUPPLEMENTAL INDENTURE, dated as of January 29, 2015 (this “Third Supplemental Indenture”), among Albemarle Corporation, a Virginia corporation (the “Parent”), whose principal office is located at 451 Florida Street, Baton Rouge, Louisiana 70801, Rockwood Specialties Group, Inc., a Delaware corporation (the “Issuer” and, together with the Parent, the “Companies”), whose principal office is located at 451 Florida Street, Baton Rouge, Louisiana 70801, and Wells Fargo Bank, National Association, as trustee (the “Trustee”).

W I T N E S S E T H

WHEREAS, the Issuer issued its 4.625% Senior Notes due 2020 (the “Notes”) on September 25, 2012, pursuant to an Indenture, dated as of September 25, 2012 (as amended and supplemented, the “Indenture”), among the Issuer, Rockwood Holdings, Inc. (“Rockwood”) and the Trustee, as amended and supplemented by the first supplemental indenture, dated as of September 25, 2012 (the “First Supplemental Indenture”), among the Issuer, the Guarantors party thereto and the Trustee, as further amended and supplemented by the second supplemental indenture, dated as of January 12, 2015, among the Issuer, the Parent and the Trustee; and

WHEREAS, pursuant to Section 10.2(a) of the First Supplemental Indenture, the Issuer and the Trustee may, with the consent of the Holders of at least a majority in principal amount of the Notes then outstanding issued under the Indenture (the “Majority Holders”), enter into a supplement to the Indenture to amend the provisions of the Indenture;

WHEREAS, the Majority Holders on or prior to the date hereof have given (and not revoked) their consents to the amendments to the provisions of the Indenture (the “Amendments”) as described in the consent solicitation statement, dated January 20, 2015 (the “Statement”), setting forth the terms and conditions of the consent solicitation (the “Consent Solicitation”) made by the Companies;

WHEREAS, for the purposes recited above, and pursuant to due corporate action, the Parent and the Issuer have duly determined to execute and deliver to the Trustee this Third Supplemental Indenture; and

WHEREAS, all conditions and requirements necessary to make this Third Supplemental Indenture a valid instrument in accordance with its terms have been done and performed, and the execution and delivery hereof have been in all respects duly authorized.

NOW, THEREFORE, in consideration of the premises, the Parent, the Issuer and the Trustee mutually covenant and agree as follows:

ARTICLE 1. DEFINITIONS.

1.1 All terms contained in this Third Supplemental Indenture shall, except as specifically provided herein or except as the context may otherwise require, have the meanings given to such terms in the Indenture.

ARTICLE 2. PARENT GUARANTEE.

2.1 For the avoidance of doubt, notwithstanding Sections 4.11 and 9.1 of the First Supplemental Indenture, the Parent’s Guarantee of the Notes shall not be released upon any Covenant Termination Event, whether prior to, at the time of or after the date of this Third Supplemental Indenture.

ARTICLE 3. REPORTS.

3.1 Section 4.7 of the First Supplemental Indenture is hereby amended and restated as follows:

“(a) Whether or not required by the Commission, so long as any Notes are outstanding, the Issuer will electronically file with the Commission by the respective dates specified in the Commission’s rules and regulations, including any extension pursuant to Rule 12b-25 under the Exchange Act (the “Required Filing Date”), unless, in any such case, such filings are not then permitted by the Commission:

(1) all quarterly and annual financial information that would be required to be contained in a filing with the Commission on Forms 10-Q and 10-K if the Issuer were required to file such Forms, including a “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and, with respect to the annual information only, a report on the annual financial statements by the Issuer’s certified independent accountants; and

(2) all current reports that would be required to be filed with the Commission on Form 8-K if the Issuer were required to file such reports.

If such filings with the Commission are not then permitted by the Commission, or such filings are not generally available on the Internet free of charge, the Issuer will, within 15 days of each Required Filing Date, transmit by mail or electronically deliver to Holders, as their names and addresses appear in the note register, without cost to such Holders, and file with the Trustee copies of the information or reports that the Issuer would be required to file with the Commission pursuant to the first paragraph if such filing were then permitted.

So long as Albemarle Corporation (“Albemarle”) is a Guarantor and complies with the requirements of Rule 3-10 of Regulation S-X promulgated by the Commission (or any successor provision), the reports, information and other documents required to be filed and furnished to Holders pursuant to this Section 4.7 may, at the option of the Issuer, be filed by and be those of Albemarle rather than the Issuer.

The availability of the foregoing reports on the Commission’s EDGAR service (or successor thereto) shall be deemed to satisfy the Issuer’s delivery obligations to the Trustee and Holders, it being understood that the Trustee shall be under no obligation whatsoever to determine whether such reports have been posted. Any and all Defaults or Events of Default arising from a failure to furnish or file in a timely manner any information or report required by this Section 4.7 shall be deemed cured (and the Issuer shall be deemed to be in compliance with this Section 4.7) upon furnishing or filing such information or report as contemplated by this Section 4.7 (but without regard to the date on which such information or report is so furnished or filed); provided that such cure shall not otherwise affect the rights of the Holders under Article VI if the principal, premium, if any, and interest have been accelerated in accordance with the terms of this Indenture and such acceleration has not been rescinded or cancelled prior to such cure.

Delivery of such reports, information and documents to the Trustee is for informational purposes only, and the Trustee’s receipt of such shall not constitute constructive notice of any information contained therein or determinable from information contained therein, including the Issuer’s compliance with any of its covenants hereunder (as to which the Trustee is entitled to rely exclusively on Officers’ Certificates).”

ARTICLE 4. MISCELLANEOUS.

4.1 Ratification of Indenture. The Indenture, as amended and supplemented by this Third Supplemental Indenture, is in all respects ratified and confirmed, and this Third Supplemental Indenture shall be deemed a part of the Indenture in the manner and to the extent herein and therein provided.

4.2 Governing Law. This Third Supplemental Indenture shall be governed by, and construed in accordance with, the laws of the State of New York.

4.3 Counterparts. This Third Supplemental Indenture may be executed in several counterparts, each of which shall be an original, and all collectively but one and the same instrument.

4.4 The Trustee. The Trustee shall not be responsible in any manner whatsoever for or in respect of the validity or sufficiency of this Third Supplemental Indenture or for or in respect of the recitals contained herein, all of which are made solely by the Parent and the Issuer. All rights, privileges, protections, indemnities and benefits granted or afforded to the Trustee under the Indenture shall be deemed incorporated herein by this reference and shall be applicable to all actions taken, suffered or omitted by the Trustee under this Third Supplemental Indenture.

[Signature page follows]

IN WITNESS WHEREOF, the parties hereto have caused this Third Supplemental Indenture to be executed as of the date first above written.

| |

ALBEMARLE CORPORATION, as Issuer |

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Karen G. Narwold |

|

| |

Name: |

Karen G. Narwold |

|

| |

Title: |

Senior Vice President, General Counsel, |

|

| |

|

Corporate & Governmental Affairs,

|

|

| |

|

Corporate Secretary |

|

| |

ROCKWOOD SPECIALTIES GROUP, INC.,

|

|

| |

as Issuer

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Karen G. Narwold |

|

| |

Name: |

Karen G. Narwold |

|

| |

Title: |

President, Treasurer and Secretary |

|

| |

WELLS FARGO BANK, NATIONAL ASSOCIATION,

|

|

| |

as Trustee

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Stefan Victory |

|

| |

Name: |

Stefan Victory |

|

| |

Title: |

Vice President |

|

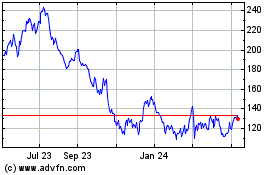

Albemarle (NYSE:ALB)

Historical Stock Chart

From Mar 2024 to Apr 2024

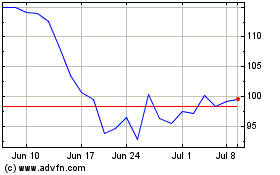

Albemarle (NYSE:ALB)

Historical Stock Chart

From Apr 2023 to Apr 2024