UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

Current Report Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 22, 2015

ART’S-WAY MANUFACTURING CO., INC.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

(State or other jurisdiction of incorporation) |

|

|

|

|

|

000-05131 |

|

42-0920725 |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| |

|

5556 Highway 9

Armstrong, Iowa 50514 |

|

(Address of principal executive offices) (Zip Code) |

|

|

|

(712) 864-3131 |

|

(Registrant’s telephone number, including area code) |

|

|

|

Not Applicable |

|

(Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On January 22, 2015, Art’s-Way Manufacturing Co., Inc. (the “Company”) appointed Amber Murra, age 36, as the Company’s new Chief Financial Officer. The Company issued a press release in connection with the appointment on January 26, 2015, the full text of which is set forth in Exhibit 99.1 attached hereto.

Ms. Murra has served as the Company’s Director of Finance since May 27, 2014, and previously served as the Company’s Director of Finance from April 2007 until December 2010. During her absence from the Company, Ms. Murra worked for Winnebago Industries, Inc., a recreational vehicle manufacturer, as the Finance Manager. Over the years, Ms. Murra’s responsibilities have included developing accounting processes and procedures, staff development, budgeting, forecasting, cost analysis, financial statement preparation and presentation, capital planning, and cash management.

Ms. Murra was not appointed pursuant to any arrangement or understanding with any person, and Ms. Murra does not have any family relationships with any directors or executive officers of the Company. Neither Ms. Murra nor any “related person” (as that term is defined under Item 404(a) of Regulation S-K) has had a direct or indirect material interest in any transaction with the Company since the beginning of the Company’s last fiscal year, nor is any such transaction currently proposed, that would be reportable under Item 404(a) of Regulation S-K.

In connection with her promotion, Ms. Murra entered into a new employment agreement with the Company on January 27, 2015 (the “Agreement”), which supersedes her existing employment agreement dated May 1, 2014. The Agreement provides for at-will employment and an initial annual base salary of $115,500. Ms. Murra is also eligible to receive incentive compensation, including cash bonuses and equity awards, in the exclusive discretion of the Board of Directors (or a committee authorized by the Board of Directors), and to participate in any and all other employee benefit plans that are generally available to the Company’s employees.

As consideration for her agreement not to compete with the Company or solicit the Company’s employees or customers during the term of her employment with the Company or for one year thereafter, and as a retention incentive, on February 13, 2015, Ms. Murra will receive a restricted stock award for 2,000 shares of Company common stock, which will be issued under the Company’s 2011 Equity Incentive Plan (the “Plan”). The risks of forfeiture for the restricted stock award will lapse in equal annual installments of 500 shares beginning February 13, 2015, provided that Ms. Murra remains employed by the Company on those dates. The award will be governed by the Plan and the Company’s form of restricted stock award agreement.

The Agreement may be terminated at any time by either party. If the Agreement is terminated by the Company without cause (as defined in the Agreement), the Company may be required to pay up to six weeks of compensation and benefits to Ms. Murra, in exchange for her release of any and all claims against the Company and her compliance with the one-year non-competition and non-solicitation provisions of the Agreement. The Agreement also contains confidentiality and assignment of inventions provisions that survive the termination of the Agreement for an indefinite period.

This foregoing summary does not purport to be complete and is qualified in its entirety by reference to the text of the Agreement, a copy of which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 8.01 Other Events.

On January 26, 2015, Art’s-Way Manufacturing Co., Inc. issued a press release announcing its declaration of a cash dividend of $0.05 per share to stockholders of record as of February 12, 2015. The dividend will be paid on March 2, 2015. The full text of the press release is furnished as Exhibit 99.2 hereto.

Item 9.01 Financial Statements and Exhibits.

(a) Financial statements: None

(b) Pro forma financial information: None

(c) Shell Company Transactions: None

(d) Exhibits:

10.1 Amended employment agreement dated January 27, 2015.

99.1 Press Release announcing new Chief Financial Officer dated January 26, 2015.

99.2 Press Release announcing dividend dated January 26, 2015.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: January 28, 2015

|

|

ART’S-WAY MANUFACTURING CO., INC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Carrie L. Majeski |

|

|

|

Carrie L. Majeski |

|

|

|

President and Chief Executive Officer |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

ART’S-WAY MANUFACTURING CO., INC.

EXHIBIT INDEX TO FORM 8-K

|

Date of Report: |

Commission File No.: |

|

January 22, 2015 |

000-05131 |

|

Exhibit No. |

ITEM |

|

|

|

|

10.1 |

Amended employment agreement dated January 27, 2015. |

|

99.1 |

Press Release announcing new Chief Financial Officer dated January 26, 2015. |

|

99.2 |

Press Release announcing dividend dated January 26, 2015. |

Exhibit 10.1

EMPLOYMENT AGREEMENT

(Amber Murra/ Chief Financial Officer)

This Employment Agreement (“Agreement”) is entered into as of January 27th, 2015 and effective as of the 27th day of January 2015 by and between Art’s-Way Manufacturing Co., Inc. (the “Company”), and Amber Murra (“Employee”).

RECITALS

| |

A. |

Employee was employed by the Company as its Director of Finance until January 22, 2015, pursuant to an employment agreement dated May 1, 2014. |

| |

|

|

| |

B. |

The Company promoted Employee to the position of Chief Financial Officer, effective January 22, 2015 and the parties desire to enter into an amended and restated employment agreement to reflect the promotion and the terms and conditions of employment in such position. This Agreement supersedes the employment agreement dated May 1, 2014. |

| |

C. |

Employee recognizes, agrees and understands that execution of this Agreement is an express condition of employment with the Company as its Chief Financial Officer under the terms of this Agreement. |

NOW, THEREFORE, in consideration of the Company employing Employee as its Chief Financial Officer under this Agreement and/or other benefits now or hereafter paid or made available to Employee by the Company, Employee and the Company agree as follows:

ARTICLE 1

EMPLOYMENT AND TERMS OF AGREEMENT

1.1 Employment. The Company hereby employs Employee and Employee hereby accepts employment as the Chief Financial Officer of the Company. This is a full-time position.

1.2 Term. This Agreement is effective, and Employee’s employment hereunder shall commence, as of the effective date set forth above. Employee’s employment with the Company shall be “at will,” meaning either Employee or the Company may terminate this Agreement and the employment relationship at any time, with or without cause, and with or without advance notice. The circumstances under which this Agreement may be terminated are set forth in more detail in Section 3.1 of this Agreement.

1.3 Duties.

| |

(a) |

Employee agrees, during her employment with the Company, to devote her full business and professional time and best efforts to the business of the Company, including, without limitation, the performance of those duties and responsibilities reasonably and customarily associated with her position; provided, however, that Employee’s duties and responsibilities shall be subject to determination by the Board of Directors of the Company. |

| |

(b) |

Employee shall report to, and at all times shall be subject to the direction of the Company’s Chief Executive Officer and the Board of Directors or either of their designee. |

| |

(c) |

Employee shall, at all times during her employment with the Company, comply with the Company’s reasonable standards, regulations and policies as determined or set forth by the Company from time to time. |

1.4 Outside Activities. During her employment with the Company, Employee shall not engage in any other business activity that would conflict or interfere with her ability to perform her duties under this Agreement.

ARTICLE 2

COMPENSATION AND BENEFITS

2.1 Base Salary. Employee’s initial annual base salary under this Agreement shall be $115,500, subject to required and authorized deductions and withholdings. This base salary is subject to upward or downward adjustment by the recommendations of the CEO, Chairman of the Board and Vice Chairman of the Board, the Compensation Committee and the final approval of the Board. This Compensation shall be reviewed at least annually. The Company shall pay the base salary to Employee in accordance with its standard payroll practices. Employee’s base salary may be subject to review and adjustment by the Company from time to time.

2.2 Incentive Pay. Employee shall be eligible to receive incentive pay, including cash bonuses and equity awards under an equity incentive plan of the Company, from time to time in the exclusive discretion of the Company. The form, amount, and other terms of any such incentive pay shall be determined by the Board of Directors (or a committee authorized by the Board).

2.3 Promotion Bonus. As consideration for Employee’s acceptance of the terms and conditions of this Agreement, including the covenants in Article 5, on February 13, 2015, the Company shall grant to the Employee a restricted stock grant for two thousand (2,000) shares of Company common stock, issued under the Company’s 2011 Equity Incentive Plan as of the close of the market on February 13, 2015; provided, however, said restricted stock shall be held by the Company subject to a risk of forfeiture. The risk of forfeiture shall lapse as to 500 shares upon the date of grant and shall lapse as to 500 shares on the first, second, and third anniversaries of the issue date, provided the Employee is still employed by the Company on such dates. The Company shall hold the shares until so issued. A separate equity award agreement, entered into by Employee and Company, shall govern the terms of the grant.

2.4 Other Benefit Plans. Employee shall be eligible to participate in any and all other employee benefit plans, health plans, or arrangements, if any, made available from time to time by the Company to its employees to the extent Employee meets the eligibility requirements to receive such benefits. Nothing in this Agreement is intended to or shall in any way restrict the Company’s right to, or not to, offer, amend, modify or terminate any of its benefits or benefit plans during the terms of Employee’s employment.

2.5 Vacation & Sick Days. Employee shall be eligible to accrue vacation in an amount to be determined by the Company in accordance with and subject to the Company’s employee policies as they may exist from time to time. Currently the Employee is eligible to accrue vacation for up to three (3) weeks (15 work days) per year, accruing equally during the year as of each pay period. In accordance with current policies, Employee may accrue and carry forward up to 160 hours of vacation time, which upon termination from the Company would be paid for pro rata for the then-current annual salary. In addition, in accordance with current policies, the Employee may take up to five (5) days of sick leave. Company reserves the right to modify and alter its vacation and sick day policies, and Employee’s benefits thereunder, in its sole discretion, provided, however, the Employee shall have the right to use then-existing accrued and carried vacation time up to the current maximum of 160 hours.

2.6 Expense Reimbursement. During the term of this Agreement, Employee shall be entitled to reimbursement of all ordinary and necessary expenses incurred by Employee for the Company, in accordance with the Company’s policies and practices with regard to documentation and payment of such expenses. Employee may be provided with one cell phone, which may be used incidentally for personal use, but which phone number, phone and related data shall be solely owned by the Company. The type of phone and phone plan shall be determined in the sole discretion of the Company.

ARTICLE 3

TERMINATION OF EMPLOYMENT

3.1 Termination. Employee’s employment with the Company may be terminated at any time upon occurrence of any of the following:

| |

(a) |

By mutual written agreement of the Company and Employee. |

| |

(b) |

Immediately upon the death of Employee. |

| |

(c) |

Immediately by the Company for Cause, which shall mean the following: |

| |

(i) |

Failure of Employee to (A) faithfully, diligently or competently perform the material duties, requirements and responsibilities of her employment as contemplated by this Agreement or as reasonably assigned by the Company’s Board of Directors; or (B) Employee’s material breach of any provision of this Agreement or of the policies, regulations and directives of the Company as in effect from time to time; |

| |

(ii) |

Any negligent or intentional act or omission on the part of Employee that is materially injurious (or would be reasonably likely to be materially injurious) to the reputation or business of the Company, including, but not limited to, professional or personal conduct of Employee which is dishonest, disloyal, or inconsistent with federal and state laws respecting harassment of, or discrimination against, one or more of the Company’s employees; or |

| |

(iii) |

Commission by or conviction of Employee of, or a guilty or nolo contendere plea by Employee with respect to, any crime punishable as a felony. |

| |

(d) |

Upon written notice by Employee for any reason, effective immediately, unless the Company, in its sole discretion, elects that Employee continue to provide services hereunder for up to six weeks from the date of such written notice, in which case the effective date shall be the date through which Employee provides services hereunder. Employee will use best efforts to provide six weeks’ written notice of Employee’s intent to terminate employment under this subsection 3.1(d) and agrees to provide services for up to six weeks from the date of such notice if requested by the Company. |

| |

(e) |

Upon written notice by the Company for any reason, effective upon the date specified therein, which may, at the Company’s sole discretion, be a date that is up to six (6) weeks from the date of such written notice. |

3.2 Compensation Upon Termination of Employee’s Employment.

| |

(a) |

In the event that Employee’s employment with the Company terminates, the following provisions shall govern as applicable: |

| |

(i) |

If termination occurs pursuant to subsection 3.1(a), the agreement of the parties shall control. |

| |

(ii) |

If termination occurs pursuant to subsection 3.1(b), all benefits and compensation shall terminate as of the date of Employee’s death. |

| |

(iii) |

If termination occurs pursuant to subsection 3.1(c ), all benefits and compensation shall terminate as of the termination date. |

| |

(iv) |

If termination occurs pursuant to subsection 3.1(d), all benefits and compensation shall terminate as of the date the Employee ceases to provide services. |

| |

(v) |

If termination occurs pursuant to subsection 3.1(e), all benefits and compensation shall terminate as of the later of: (A) the date the Employee ceases to provide services; or (B) the date that is 6 weeks from the date of the written notice provided by the Company, provided that any payments under this subsection 3.2(a)(v)(B) shall be contingent upon Employee’s compliance through this period with her obligations under Section 3.3 and Articles IV, V and VI of this Agreement and Employee’s execution, delivery, compliance with, and non-rescission of a full and final release of any and all claims in favor of the Company and any related entities, and all such entities’ officers, directors, shareholders, and employees, which release shall also affirm Employee’s compliance with her obligations under Sections 3.3 and Articles IV, V and VI of this Agreement. If payments are made to Employee under this subsection 3.2(a)(v)(B), the first such payment shall be made on the next regularly scheduled payroll date which is not less than ten (10) calendar days after expiration of any applicable rescission periods set forth in the required release agreement executed and not rescinded by Employee. |

| |

(b) |

In addition to the consideration set forth in Section 2.3 of this Agreement, the parties acknowledge that the Company’s agreement to provide Separation Payments in accordance with the terms of this paragraph constitutes consideration for Employee’s acceptance of the terms and conditions of this Agreement, including the covenants in Article 5. |

| |

(c) |

Notwithstanding anything in this Agreement to the contrary, if any of the payments described in this subsection 3.2 are subject to the requirements of Section 409A of the Internal Revenue Code of 1986, as amended (“Code Section 409A”) and the Company determines that Employee is a “specified employee” as defined in Code Section 409A as of the date of Employee’s termination of employment, such payments shall not be paid or commence earlier than the first day of the seventh month following the date of Employee’s termination of employment. |

3.3 Return of Property. Immediately upon termination (or at such earlier time as requested by the Company or its designees), Employee shall deliver to the Company all of its property, including but not limited to all work in progress, research data, equipment, originals and copies of documents and software, client information and lists, financial information, and all other material in her possession or control that belongs to the Company or its clients or contains Confidential Information, as defined in Article 4.

ARTICLE 4

PROTECTION OF CONFIDENTIAL INFORMATION

4.1 Confidential Information. “Confidential Information” shall mean any information not generally known or readily ascertainable by the Company’s competitors or the general public. Confidential Information includes, but is not limited to, use of or customization to computer, software, and/or internet applications; data of any type that is created by Employee, which is provided, or to which access is provided, in the course of Employee’s employment by the Company; data or conclusions or opinions formed by Employee in the course of employment; manuals; trade secrets; methods, procedures or techniques pertaining to the business of the Company; specifications; systems; price lists; marketing plans; sales or service analyses; financial information; client names, contact information, requirements, purchase history or other information; supplier names or other information; employee names or other information; research and development data; diagrams; drawings; videotapes, audiotapes, or computerized media used as training regimens; and notes, memoranda, notebooks, and records or documents that are created, handled, seen, or used by Employee in the course of employment. Confidential Information does not include information that Employee can demonstrate by reliable, corroborated documentary evidence (1) is generally available to the public or (2) became generally available to the public through no act or failure to act by Employee.

4.2 Confidentiality Restrictions. Employee agrees at all times to use all reasonable means to keep Confidential Information secret and confidential. Employee shall not at any time (including during and after termination of her employment with the Company) use, disclose, duplicate, record, or in any other manner reproduce in whole or in part any Confidential Information, except as necessary for the performance of Employee’s duties on behalf of the Company. Employee shall not at any time provide services to any person or entity if providing such services would require or likely result in her using or disclosing Confidential Information. Upon termination of Employee’s employment with the Company, or upon Company’s earlier request, Employee shall immediately return to the Company all originals and copies of Confidential Information and other Company materials and property in Employee’s possession. Employee acknowledges that use or disclosure of any of the Company’s confidential or proprietary information in violation of this Agreement would have a materially detrimental effect upon the Company, the monetary loss from which would be difficult, if not impossible, to measure.

ARTICLE 5

COVENANT NOT TO COMPETE

5.1 Noncompetition. During Employee’s employment with the Company and for a period of one year following the termination of her employment for any reason, whether voluntary or involuntary, Employee agrees that she will not, anywhere in the United States (which Employee acknowledges to be Employer’s trade area), directly or indirectly, on behalf of herself or another individual or entity, own, manage, operate, control, be employed by, consult for, participate in, or provide services to any business, entity or person that is in competition with Employer or sells or provides products or services that are the same as or similar to, or compete with, products or services offered by Employer at the time.

5.2 Nonsolicitation of Employees. During Employee’s employment with the Company and for a period of one year following the termination of her employment for any reason, whether voluntary or involuntary, Employee agrees that she will not, directly or indirectly, on behalf of herself or another individual or entity, solicit or hire for employment or any other arrangement for compensation to perform services, any employee of the Company. For purposes of this Section 5.2, an “employee” means any individual who is then employed by the Company or has been employed by the Company at any time within the six-month period prior to Employee’s separation from employment.

5.3 Nonsolicitation of Clients. During Employee’s employment with the Company and for a period of one year following the termination of her employment for any reason, whether voluntary or involuntary, Employee agrees that she will not, directly or indirectly, on behalf of herself or another individual or entity, solicit or provide products or services that compete with the Company to any of the Company’s clients. For purposes of this Section 5.3, a “client” means any individual or entity that is then a client of the Company or has been a client of the Company at any time within the twelve-month period prior to Employee’s separation from employment.

5.4 Understandings. Employee hereby acknowledges and agrees that the Company informed her that the restrictions contained in this Article 5 would be required as part of the terms and conditions of her employment under this Agreement; that she signed and returned this Agreement to the Company prior to commencing employment under the terms of this Agreement; that she has carefully considered the restrictions contained in this Agreement and that they are reasonable; and that the restrictions in this Agreement will not unduly restrict her in securing other employment in the event of a termination from the Company; and that the Promotion Bonus in Section 2.3 amount to valuable consideration, to which Employee would not otherwise be entitled, to support enforcement of the restrictions contained in this Article 5.

ARTICLE 6

INVENTIONS

6.1 Invention. For purposes of this Agreement, the term “Invention” means ideas, discoveries, and improvements, whether or not shown or described in writing or reduced to practice, and whether patentable or not, relating to any of the Company’s present or future sales, research, or other business activities, or reasonably foreseeable business interests of the Company.

6.2 Disclosure. Employee shall promptly and fully disclose to the Company, and will hold in trust for the Company’s sole right and benefit, any Invention which Employee, during the period of her employment, makes, conceives, or reduces to practice, or causes to be made, conceived, or reduced to practice, either alone or in conjunction with others, that:

| |

(a) |

Relates to any subject matter pertaining to Employee’s employment; |

| |

(b) |

Relates to or is directly or indirectly connected with the business, products, projects, or Confidential Information of the Company; or |

| |

(c) |

Involves the use of any time, material, or facility of the Company. |

6.3 Assignment of Ownership. Employee hereby assigns to the Company all of the Employee’s right, title, and interest in and to all such Inventions described in Section 6.2 and, upon request by the Company, Employee shall execute, verify, and deliver to the Company such documents, including, without limitation, assignments and applications for Letters Patent, and shall perform such other acts, including, without limitation, appearing as a witness in any action brought in connection with this Agreement that is necessary to enable the Company to obtain the sole right, title, and benefit to all such Inventions.

6.4 Excluded Inventions. It is further agreed, and Employee is hereby so notified, that Section 6.3 does not apply to any invention for which no equipment, supplies, facility, or Confidential Information of the Company was used; which was developed entirely on Employee’s own time; and (a) which does not relate either to the Company’s businesses or actual or demonstrably anticipated research or development, or (b) which does not result from any work performed by Employee for the Company.

6.5 Prior Inventions. Attached to this Agreement and initialed by both parties is a list of all of the Inventions, if any, in which Employee possesses any right, title, or interest prior to commencement of her employment with the Company, which are not subject to the terms of this Agreement.

ARTICLE 7

MISCELLANEOUS PROVISIONS

7.1 Survival and Remedies. The parties agree that the restrictions contained in Articles 4 - 6 shall survive the termination of this Agreement and Employee’s employment with the Company and shall apply no matter how Employee’s employment terminates and regardless of whether her termination is voluntary or involuntary. The parties further acknowledge and agree that, if Employee breaches or threatens to breach the terms of Articles 4 - 6, the Company shall be entitled as a matter of right to injunctive relief, in addition to any other remedies available at law or equity. In the event any litigation, mediation or arbitration or other process that is instituted by any party in order to interpret or enforce any term or condition of this Agreement, including the payment of money, injunctive relief, and the matter is addressed or the money is collected, and the services of an attorney or attorneys are utilized for the same, the prevailing party will be entitled to recover from the losing party all attorney fees and costs, including court costs and fees and costs incurred through any appeal, collection or enforcement, incurred by the prevailing party.

7.2 Notification. Employee authorizes the Company to notify third parties (including, but not limited to, Employee’s actual or potential future employers and the Company’s clients and employees) of the provisions of Articles 4 - 6, those provisions necessary for the enforcement of such articles, and Employee’s obligations hereunder.

7.3 Governing Law and Jurisdiction. This agreement shall be governed by and construed in accordance with the laws of the State of Iowa, without reference to its conflict of law provisions. Each of the parties agrees that any dispute between the parties will be resolved only in the courts of the State of Iowa or the United States District Court for the Northern District of Iowa and the appellate courts having jurisdiction of appeals in such courts.

7.4 Entire Agreement. This Agreement constitutes the entire understanding of the Company and Employee and supersedes all prior agreements, understandings, and negotiations between the parties, whether oral or written. No modification, supplement, or amendment of any provision hereof shall be valid unless made in writing and signed by the parties.

7.5 Successors and Assigns. This Agreement may be assigned by Company to its successors and assigns. The services to be performed by Employee are personal and are not assignable.

7.6 No Conflicting Obligations. Employee represents and warrants to the Company that she is not under, or bound to be under in the future, any obligation to any person or entity that is or would be inconsistent or in conflict with this Agreement or would prevent, limit, or impair in any way the performance by her of her obligations hereunder, including but not limited to any duties owed to any former employers not to compete or use or disclose confidential information. Employee represents and agrees that she will not disclose to Company or use on behalf of Company any confidential information belonging to a third party.

7.7 Waivers. The failure of a party to require the performance or satisfaction of any term or obligation of this Agreement, or the waiver by a party of any breach of this Agreement, shall not prevent subsequent enforcement of such term or obligation or be deemed a waiver of any subsequent breach.

7.8 Severability. In the event that any provision hereof is held invalid or unenforceable by a court of competent jurisdiction, the Company and Employee agree that that part should be modified by the court to make it enforceable to the maximum extent possible. If the part cannot be modified, then that part may be severed and the other parts of this Agreement shall remain enforceable.

7.9 Counterparts. More than one counterpart of this Agreement may be executed by the parties hereto, and each fully executed counterpart shall be deemed an original.

[Signature Page Follows]

With the intention of being bound hereby, the parties have executed this Agreement as of the date set forth above.

|

|

EMPLOYEE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Amber Murra |

|

|

|

|

Amber Murra |

|

|

|

|

Chief Financial Officer |

|

|

|

ART’S-WAY MANUFACTURING CO., INC. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Carrie Majeski |

|

|

|

|

Carrie Majeski |

|

|

|

|

President andChief Executive Officer |

|

[Signature Page to Amber Murra Agreement]

10

Exhibit 99.1

FOR IMMEDIATE RELEASE

January 26, 2015

ART’S WAY MANUFACTURING NAMES AMBER

MURRA CHIEF FINANCIAL OFFICER

ARMSTRONG, IOWA, January 26, 2015 – Art’s Way Manufacturing Co., Inc. (NASDAQ: ARTW), a diversified, international manufacturer and distributor of equipment serving agricultural, research, water treatment and steel cutting needs, announces that Amber Murra has been promoted to Chief Financial Officer effective January 22, 2015. Prior to this position, Ms. Murra served as the Director of Finance for Art’s Way Manufacturing. Ms. Murra has 11 years of experience in various financial and accounting positions. Ms. Murra began her career in public accounting at KDV, and has also worked at J.L. Swanson, Chtd and Winnebago Industries. Ms. Murra graduated from Minnesota State University, Mankato in December 2003 with a Bachelor of Science degree in Accounting, and earned the CPA designation in June of 2007.

Chairman of the Art’s Way Board of Directors, J. Ward McConnell Jr., commented, “We are very pleased to announce Amber’s promotion to Chief Financial Officer. Amber’s dedication and growth have earned her this promotion. We believe her expertise will enable us to continue to move our business forward.”

About Art’s Way Manufacturing, Inc.

Art's Way manufactures and distributes farm machinery niche products including animal feed processing equipment, sugar beet defoliators and harvesters, land maintenance equipment, crop shredding equipment, round hay balers, plows, hay and forage equipment, manure spreaders, reels for combines and swathers, and top and bottom drive augers, as well as pressurized tanks and vessels, modular animal confinement buildings and laboratories and specialty tools and inserts. After-market service parts are also an important part of the Company's business. The Company has four reporting segments: agricultural products; pressurized tanks and vessels; modular buildings; and tools.

For more information, including an archived version of the conference call, contact: Carrie Majeski, Chief Executive Officer

712-864-3131

investorrelations@artsway-mfg.com

Or visit the Company's website at www.artsway-mfg.com/

-END-

Exhibit 99.2

FOR IMMEDIATE RELEASE

January 26, 2015

ART’S WAY MANUFACTURING ANNOUNCES CASH DIVIDEND ON THE COMPANY’S COMMON STOCK

ARMSTRONG, IOWA, January 26, 2015 – Art’s Way Manufacturing Co., Inc., (NASDAQ:ARTW) a diversified, international manufacturer and distributor of equipment serving agricultural, research, steel cutting and water treatment needs, announces the Board of Directors of the Company approved a cash dividend on the Company’s common stock. The dividend of $0.05 per share is payable on March 2, 2015 to shareholders of record on February 12, 2015.

J. Ward McConnell Jr., Chairman of the Board of Directors said, “Our Board of Directors has decided to review our dividends on a semi-annual basis due to the challenging beginning of our 2014 fiscal year. We had a strong second half of fiscal 2014, and we are very pleased to continue our legacy of dividend payouts to our shareholders at this time. We believe the Company is well positioned for a successful 2015 and will again review our dividend position in the third fiscal quarter of this year. We would like to thank our loyal shareholders for their continued support.”

About Art’s Way Manufacturing, Inc.

Art's Way manufactures and distributes farm machinery niche products including animal feed processing equipment, sugar beet defoliators and harvesters, land maintenance equipment, crop shredding equipment, round hay balers, plows, hay and forage equipment, manure spreaders, reels for combines and swathers, and top and bottom drive augers, as well as pressurized tanks and vessels, modular animal confinement buildings and laboratories and specialty tools and inserts. After-market service parts are also an important part of the Company's business. The Company has four reporting segments: agricultural products; pressurized tanks and vessels; modular buildings; and tools.

For more information, including an archived version of the conference call, contact: Carrie Majeski, Chief Executive Officer

712-864-3131

investorrelations@artsway-mfg.com

Or visit the Company's website at www.artsway-mfg.com/

-END-

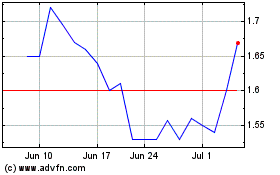

Arts Way Manufacturing (NASDAQ:ARTW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arts Way Manufacturing (NASDAQ:ARTW)

Historical Stock Chart

From Apr 2023 to Apr 2024