Current Report Filing (8-k)

January 27 2015 - 5:01PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

January 27, 2015

Date of Report (Date of earliest event reported)

ABBOTT LABORATORIES

(Exact name of registrant as specified in its charter)

|

Illinois |

|

1-2189 |

|

36-0698440 |

|

(State or other Jurisdiction |

|

(Commission File Number) |

|

(IRS Employer |

|

of Incorporation) |

|

|

|

Identification No.) |

100 Abbott Park Road

Abbott Park, Illinois 60064-6400

(Address of principal executive offices)(Zip Code)

Registrant’s telephone number, including area code: (224) 667-6100

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

In July, 2014, Abbott Laboratories (“Abbott”) announced it had entered into an agreement to sell its developed markets branded generics pharmaceuticals business to Mylan Inc. In November 2014, Abbott entered into an agreement to sell its animal health business to Zoetis. As a result of the planned disposition of these businesses, the results of these businesses are being reported as discontinued operations.

Furnished as Exhibit 99.1 is Abbott’s unaudited non-GAAP financial information for the first three quarters of 2014 reflecting the presentation of the developed markets branded generics pharmaceutical business and the animal health business as discontinued operations and other adjustments to provide a historical baseline of Abbott’s standalone operating results from continuing operations and excluding specified items. Abbott plans to evaluate its future results from continuing operations against this historical baseline. Exhibit 99.1 also provides a reconciliation of this non-GAAP information to Abbott’s historical consolidated results in accordance with U.S. GAAP.

Abbott uses various non-GAAP financial measures including, among others, net earnings excluding specified items. These non-GAAP financial measures adjust for factors that are unusual or unpredictable, such as cost reduction initiatives; integration and separation-related costs; transaction-related costs; a philanthropic contribution to the Abbott Fund; benefits of U.S. tax law changes; tax expense associated with a one-time repatriation of ex-U.S. earnings; and tax expense adjustments for resolution of various tax positions from previous years. These non-GAAP financial measures also exclude intangible amortization expense to provide greater visibility on the results of operations excluding these costs, similar to how Abbott’s management internally assesses performance. Abbott’s management believes the presentation of these non-GAAP financial measures provides useful information to investors regarding Abbott’s results of operations as these non-GAAP financial measures allow investors to better evaluate ongoing business performance. Abbott’s management also uses these non-GAAP financial measures internally to monitor performance of the businesses. Abbott, however, cautions investors to consider these non-GAAP financial measures in addition to, and not as a substitute for, financial measures prepared in accordance with GAAP.

The financial information is intended for informational purposes only and does not purport to project Abbott’s financial performance or cost structure for any future period. The financial information should be read in conjunction with the audited consolidated financial statements and accompanying notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in Abbott’s Form 10K for the year ended December 31, 2013.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

Exhibit

No. |

|

Exhibit |

|

99.1 |

|

Unaudited non-GAAP consolidated financial information for Abbott Laboratories |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

ABBOTT LABORATORIES |

|

|

|

|

|

|

|

Date: January 27, 2015 |

By: |

/s/ Thomas C. Freyman |

|

|

|

Thomas C. Freyman |

|

|

|

Executive Vice President, Finance and Chief Financial Officer |

|

|

|

|

3

EXHIBIT INDEX

|

Exhibit

No. |

|

Exhibit |

|

99.1 |

|

Unaudited non-GAAP consolidated financial information for Abbott Laboratories |

4

Exhibit 99.1

Abbott Laboratories and Subsidiaries

Reconciliation of Non-GAAP Financial Information to

Abbott’s 2014 Historical Information Adjusted for Discontinued Operations

Quarter Ended March 31, 2014

(dollars in millions, except per share data - unaudited)

|

|

|

|

|

|

|

|

|

|

|

Adjusted for |

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued |

|

|

|

|

|

|

|

|

Historical |

|

|

|

Operations |

|

|

|

|

|

|

Discontinued |

|

Adjusted for |

|

Specified |

|

and Excluding |

|

|

|

|

Historical |

|

Operations |

|

Discontinued |

|

Items |

|

Specified |

|

|

|

|

(Note 1) |

|

(Note 2) |

|

Operations |

|

(Note 3) |

|

Items |

|

|

Net Sales |

|

$ |

5,244 |

|

$ |

489 |

|

$ |

4,755 |

|

$ |

— |

|

$ |

4,755 |

|

|

Cost of products sold, excluding amortization expense |

|

2,470 |

|

196 |

|

2,274 |

|

(55 |

) |

2,219 |

|

|

Amortization of intangible assets |

|

174 |

|

47 |

|

127 |

|

(127 |

) |

— |

|

|

Research & development |

|

387 |

|

18 |

|

369 |

|

(50 |

) |

319 |

|

|

Selling, general and administrative |

|

1,762 |

|

142 |

|

1,620 |

|

(85 |

) |

1,535 |

|

|

Total Operating Cost and Expenses |

|

4,793 |

|

403 |

|

4,390 |

|

(317 |

) |

4,073 |

|

|

Operating Earnings |

|

451 |

|

86 |

|

365 |

|

317 |

|

682 |

|

|

Net Interest expense |

|

23 |

|

3 |

|

20 |

|

— |

|

20 |

|

|

Net foreign exchange loss (gain) |

|

2 |

|

1 |

|

1 |

|

— |

|

1 |

|

|

Other (income) expense, net |

|

3 |

|

— |

|

3 |

|

(2 |

) |

1 |

|

|

Earnings from Continuing Operations Before Taxes |

|

423 |

|

82 |

|

341 |

|

319 |

|

660 |

|

|

Taxes on Earnings |

|

84 |

|

(33 |

) |

117 |

|

8 |

|

125 |

|

|

Earnings from Continuing Operations |

|

339 |

|

115 |

|

224 |

|

311 |

|

535 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings Per Common Share |

|

$ |

0.22 |

|

$ |

0.08 |

|

$ |

0.14 |

|

$ |

0.20 |

|

$ |

0.34 |

|

Notes:

1. Reflects the historical consolidated financial results for Abbott Laboratories in accordance with U.S. GAAP as previously reported in Abbott’s earnings release dated April 16, 2014.

2. Reflects the discontinued operations of the developed markets branded generics pharmaceuticals business and the animal health business. This column includes an allocation of interest assuming a uniform ratio of consolidated debt to equity for all of Abbott’s historical operations in accordance with Accounting Standards Codification 205-20-45.

3. This column includes the specified items that were previously identified in Abbott’s earnings release dated April 16, 2014 and that relate to Abbott’s continuing operations.

Abbott Laboratories and Subsidiaries

Reconciliation of Non-GAAP Financial Information to

Abbott’s 2014 Historical Information Adjusted for Discontinued Operations

Quarter Ended June 30, 2014

(dollars in millions, except per share data - unaudited)

|

|

|

|

|

|

|

|

|

|

|

Adjusted for |

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued |

|

|

|

|

|

|

|

|

Historical |

|

|

|

Operations |

|

|

|

|

|

|

Discontinued |

|

Adjusted for |

|

Specified |

|

and Excluding |

|

|

|

|

Historical |

|

Operations |

|

Discontinued |

|

Items |

|

Specified |

|

|

|

|

(Note 1) |

|

(Note 2) |

|

Operations |

|

(Note 3) |

|

Items |

|

|

Net Sales |

|

$ |

5,551 |

|

$ |

494 |

|

$ |

5,057 |

|

$ |

— |

|

$ |

5,057 |

|

|

Cost of products sold, excluding amortization expense |

|

2,506 |

|

218 |

|

2,288 |

|

(27 |

) |

2,261 |

|

|

Amortization of intangible assets |

|

161 |

|

28 |

|

133 |

|

(133 |

) |

— |

|

|

Research & development |

|

335 |

|

25 |

|

310 |

|

(1 |

) |

309 |

|

|

Selling, general and administrative |

|

1,788 |

|

139 |

|

1,649 |

|

(95 |

) |

1,554 |

|

|

Total Operating Cost and Expenses |

|

4,790 |

|

410 |

|

4,380 |

|

(256 |

) |

4,124 |

|

|

Operating Earnings |

|

761 |

|

84 |

|

677 |

|

256 |

|

933 |

|

|

Net Interest expense |

|

20 |

|

3 |

|

17 |

|

— |

|

17 |

|

|

Net foreign exchange loss (gain) |

|

1 |

|

1 |

|

— |

|

— |

|

— |

|

|

Other (income) expense, net |

|

3 |

|

1 |

|

2 |

|

(2 |

) |

— |

|

|

Earnings from Continuing Operations Before Taxes |

|

737 |

|

79 |

|

658 |

|

258 |

|

916 |

|

|

Taxes on Earnings |

|

277 |

|

44 |

|

233 |

|

(58 |

) |

175 |

|

|

Earnings from Continuing Operations |

|

460 |

|

35 |

|

425 |

|

316 |

|

741 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings Per Common Share |

|

$ |

0.30 |

|

$ |

0.02 |

|

$ |

0.28 |

|

$ |

0.21 |

|

$ |

0.49 |

|

Notes:

1. Reflects the historical consolidated financial results for Abbott Laboratories in accordance with U.S. GAAP as previously reported in Abbott’s earnings release dated July 16, 2014.

2. Reflects the discontinued operations of the developed markets branded generics pharmaceuticals business and the animal health business. This column includes an allocation of interest assuming a uniform ratio of consolidated debt to equity for all of Abbott’s historical operations in accordance with Accounting Standards Codification 205-20-45.

3. This column includes the specified items that were previously identified in Abbott’s earnings release dated July 16, 2014 and that relate to Abbott’s continuing operations.

Abbott Laboratories and Subsidiaries

Reconciliation of Non-GAAP Financial Information to

Abbott’s 2014 Historical Information Adjusted for Discontinued Operations

Quarter Ended September 30, 2014

(dollars in millions, except per share data - unaudited)

|

|

|

|

|

|

|

|

|

|

|

Adjusted for |

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued |

|

|

|

|

|

|

|

|

Historical |

|

|

|

Operations |

|

|

|

|

|

|

Discontinued |

|

Adjusted for |

|

Specified |

|

and Excluding |

|

|

|

|

Historical |

|

Operations |

|

Discontinued |

|

Items |

|

Specified |

|

|

|

|

(Note 1) |

|

(Note 2) |

|

Operations |

|

(Note 3) |

|

Items |

|

|

Net Sales |

|

$ |

5,104 |

|

$ |

25 |

|

$ |

5,079 |

|

$ |

— |

|

$ |

5,079 |

|

|

Cost of products sold, excluding amortization expense |

|

2,331 |

|

12 |

|

2,319 |

|

(56 |

) |

2,263 |

|

|

Amortization of intangible assets |

|

132 |

|

— |

|

132 |

|

(132 |

) |

— |

|

|

Research & development |

|

307 |

|

2 |

|

305 |

|

(2 |

) |

303 |

|

|

Selling, general and administrative |

|

1,603 |

|

8 |

|

1,595 |

|

(100 |

) |

1,495 |

|

|

Total Operating Cost and Expenses |

|

4,373 |

|

22 |

|

4,351 |

|

(290 |

) |

4,061 |

|

|

Operating Earnings |

|

731 |

|

3 |

|

728 |

|

290 |

|

1,018 |

|

|

Net Interest expense |

|

17 |

|

— |

|

17 |

|

— |

|

17 |

|

|

Net foreign exchange loss (gain) |

|

(1 |

) |

— |

|

(1 |

) |

— |

|

(1 |

) |

|

Other (income) expense, net |

|

(3 |

) |

— |

|

(3 |

) |

(4 |

) |

(7 |

) |

|

Earnings from Continuing Operations Before Taxes |

|

718 |

|

3 |

|

715 |

|

294 |

|

1,009 |

|

|

Taxes on Earnings |

|

278 |

|

1 |

|

277 |

|

(86 |

) |

191 |

|

|

Earnings from Continuing Operations |

|

440 |

|

2 |

|

438 |

|

380 |

|

818 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted Earnings Per Common Share |

|

$ |

0.29 |

|

$ |

— |

|

$ |

0.29 |

|

$ |

0.25 |

|

$ |

0.54 |

|

Notes:

1. Reflects the historical consolidated financial results for Abbott Laboratories in accordance with U.S. GAAP as previously reported in Abbott’s earnings release dated October 22, 2014. These results exclude the developed markets branded generics pharmaceuticals business from continuing operations as this business was reported as a discontinued operation beginning in the third quarter of 2014.

2. Reflects the discontinued operations of the Animal Health business as the developed markets branded generics pharmaceuticals business had previously been reported as discontinued operations beginning in the third quarter of 2014.

3. This column includes the specified items that were previously identified in Abbott’s earnings release dated October 22, 2014 and that relate to Abbott’s continuing operations.

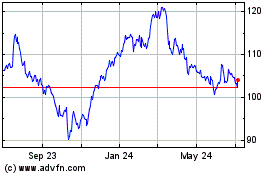

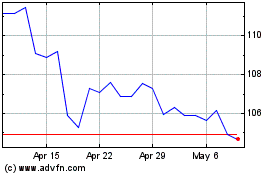

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Abbott Laboratories (NYSE:ABT)

Historical Stock Chart

From Apr 2023 to Apr 2024