UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): January 27, 2015

3M COMPANY

(Exact Name of Registrant as Specified in Its Charter)

Delaware

(State or Other Jurisdiction of Incorporation)

|

File No. 1-3285 |

|

41-0417775 |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

3M Center, St. Paul, Minnesota |

|

55144-1000 |

|

(Address of Principal Executive Offices) |

|

(Zip Code) |

(651) 733-1110

(Registrant’s Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition

On January 27, 2015, 3M Company issued a press release reporting fourth-quarter and full-year 2014 results (attached hereunder as Exhibit 99 and incorporated herein by reference).

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

|

Exhibit Number |

|

Description |

|

|

|

|

|

99 |

|

Press Release, dated as of January 27, 2015, of 3M Company (furnished pursuant to Item 2.02 hereof) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

3M COMPANY |

|

|

|

|

|

|

By: |

/s/ Gregg M. Larson |

|

|

|

Gregg M. Larson, |

|

|

|

Deputy General Counsel and Secretary |

Dated: January 27, 2015

Exhibit 99

For Immediate Release

3M Announces Fourth-Quarter Results;

Company Posts Record Sales and Earnings per Share for Both Fourth Quarter and Full Year

Fourth-Quarter Highlights:

– Organic local-currency sales growth of 6.3 percent

– Earnings of $1.81 per share, up 11.7 percent

– Operating income margins of 21.5 percent, up 0.6 percentage points year-on-year

– Free cash flow conversion of 144 percent

– Returned $1.8 billion to shareholders via dividends and gross share repurchases

– Announced Q1 2015 dividend per share increase of 20 percent

ST. PAUL, Minn. – January 27, 2015 - 3M (NYSE: MMM) today reported fourth-quarter earnings of $1.81 per share, an increase of 11.7 percent versus the fourth quarter of 2013. Sales grew 2.0 percent year-on-year to $7.7 billion. Organic local-currency sales grew 6.3 percent with acquisitions adding 0.1 percent to sales. Foreign currency translation reduced sales by 4.4 percent year-on-year.

Operating income was $1.7 billion and operating income margins for the quarter were 21.5 percent. Fourth-quarter net income was $1.2 billion and the company converted 144 percent of net income to free cash flow.

3M paid $544 million in cash dividends to shareholders and repurchased $1.3 billion of its own shares during the quarter.

Organic local-currency sales growth was 9.2 percent in Safety and Graphics, 6.4 percent in Health Care, 6.2 percent in Electronics and Energy, 5.9 percent in Industrial, and 5.8 percent in Consumer. On a geographic basis, organic local-currency sales grew 9.0 percent in Latin America/Canada, 6.9 percent in Asia Pacific, 6.6 percent in the U.S., and 3.3 percent in EMEA (Europe, Middle East and Africa).

Full-year 2014 earnings were $7.49 per share, an increase of 11.5 percent. Sales increased 3.1 percent to a record $31.8 billion with organic local-currency growth of 4.9 percent. Foreign currency translation reduced sales by 1.9 percent. Full-year operating income margins were 22.4 percent, up 0.8 percentage points versus 2013. 3M converted 104 percent of net income to free cash flow for the year and generated 22 percent return on invested capital.

For the full year, 3M paid $2.2 billion in cash dividends to shareholders and repurchased $5.7 billion of its own shares.

“3M delivered strong results in the fourth quarter, which culminated a solid 2014 performance,” said Inge G. Thulin, 3M’s chairman, president and chief executive officer. “Organic growth was positive across all business groups and geographic areas, and operating margins rose by nearly a full point. We once again generated substantial free cash flow, which allowed for continued investment in our businesses and significant return of cash to our shareholders.”

3M affirmed its 2015 full-year performance expectations. The company expects 2015 earnings to be in the range of $8.00 to $8.30 per share with organic local-currency sales growth of 3 to 6 percent. 3M also expects free cash flow conversion to be in the range of 90 to 100 percent.

Fourth-Quarter Business Group Discussion

Industrial

· Sales of $2.6 billion, up 1.4 percent in U.S. dollars. Organic local-currency sales increased 5.9 percent and foreign currency translation reduced sales by 4.5 percent.

· On an organic local-currency basis:

· Sales growth was led by advanced materials, aerospace and commercial transportation, industrial adhesives and tapes, and automotive aftermarket.

· Sales grew in all major geographies, led by the U.S., Latin America/Canada and Asia Pacific.

· Operating income was $538 million, down 2.9 percent year-on-year; operating margin of 20.5 percent.

Health Care

· Sales of $1.4 billion, up 2.4 percent in U.S. dollars. Organic local-currency sales increased 6.4 percent, acquisitions increased sales by 0.6 percent and foreign currency translation reduced sales by 4.6 percent.

· On an organic local-currency basis:

· Sales growth was led by health information systems, food safety, infection prevention, and critical and chronic care.

· Sales increased in all major geographies, with the strongest growth in Latin America/Canada, Asia Pacific and the U.S.

· Operating income was $431 million, an increase of 1.6 percent; operating margin of 31.0 percent.

Electronics and Energy

· Sales of $1.4 billion, up 3.3 percent in U.S. dollars. Organic local-currency sales increased 6.2 percent and foreign currency translation reduced sales by 2.9 percent.

· On an organic local-currency basis:

· Electronics-related sales increased 9 percent with strong growth in both electronics materials solutions and display materials and systems; energy-related sales increased 2 percent year-on-year with solid growth in electrical markets partially offset by declines in telecom and renewable energy businesses.

· Positive sales growth in Latin America/Canada, Asia Pacific and EMEA; U.S. was flat year-on-year.

· Operating income was $257 million, up 16.1 percent year-on-year; operating margin of 18.7 percent.

Safety and Graphics

· Sales of $1.4 billion, up 3.4 percent in U.S. dollars. Organic local-currency sales increased 9.2 percent and foreign currency translation reduced sales by 5.8 percent.

· On an organic local-currency basis:

· Sales growth was led by the personal safety and commercial solutions businesses; sales in traffic safety and security systems were down slightly year-on-year.

· Sales grew across all areas, led by Asia Pacific, Latin America/Canada and EMEA.

· Operating income was $285 million, an increase of 12.3 percent year-on-year; operating margin of 20.8 percent.

Consumer

· Sales of $1.1 billion, up 2.2 percent in U.S. dollars. Organic local-currency sales increased 5.8 percent and foreign currency translation reduced sales by 3.6 percent.

· On an organic local-currency basis:

· Sales growth was led by DIY, consumer health care, and home care.

· Sales increased in Latin America/Canada, the U.S. and Asia Pacific; EMEA sales declined year-on-year.

· Operating income was $254 million, up 12.4 percent year-on-year; operating margin of 22.5 percent.

3M will conduct an investor teleconference at 9:00 a.m. EST (8:00 a.m. CST) today. Investors can access this conference via the following:

· Live webcast at http://investor.3M.com.

· Live telephone:

Call 800-762-2596 within the U.S. or +1 212-231-2916 outside the U.S. Please join the call at least 10 minutes before the start time.

· Webcast replay:

Go to 3M’s Investor Relations website at http://investor.3M.com and click on “Quarterly Earnings.”

· Telephone replay:

· Call 800-633-8284 within the U.S. or +1 402-977-9140 outside the U.S. (for both U.S. and outside the U.S. access code is 21728433). The telephone replay will be available until 10:30 a.m. CST on February 1, 2015.

Forward-Looking Statements

This news release contains forward-looking information about 3M’s financial results and estimates and business prospects that involve substantial risks and uncertainties. You can identify these statements by the use of words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “will,” “target,” “forecast” and other words and terms of similar meaning in connection with any discussion of future operating or financial performance or business plans or prospects. Among the factors that could cause actual results to differ materially are the following: (1) worldwide economic and capital markets conditions and other factors beyond the Company’s control, including natural and other disasters affecting the operations of the Company or its customers and suppliers; (2) the Company’s credit ratings and its cost of capital; (3) competitive conditions and customer preferences; (4) foreign currency exchange rates and fluctuations in those rates; (5) the timing and market acceptance of new product offerings; (6) the availability and cost of purchased components, compounds, raw materials and energy (including oil and natural gas and their derivatives) due to shortages, increased demand or supply interruptions (including those caused by natural and other disasters and other events); (7) the impact of acquisitions, strategic alliances, divestitures, and other unusual events resulting from portfolio management actions and other evolving business strategies, and possible organizational restructuring; (8) generating fewer productivity improvements than estimated; (9) unanticipated problems or delays with the phased implementation of a global enterprise resource planning (ERP) system, or security breaches and other disruptions to the Company’s information technology infrastructure; and (10) legal proceedings, including significant developments that could occur in the legal and regulatory proceedings described in the Company’s Annual Report on Form 10-K for the year ended December

31, 2013, and its subsequent quarterly reports on Form 10-Q (the “Reports”). Changes in such assumptions or factors could produce significantly different results. A further description of these factors is located in the Reports under “Cautionary Note Concerning Factors That May Affect Future Results” and “Risk Factors” in Part I, Items 1 and 1A (Annual Report) and in Part I, Item 2 and Part II, Item 1A (Quarterly Report). The information contained in this news release is as of the date indicated. The Company assumes no obligation to update any forward-looking statements contained in this news release as a result of new information or future events or developments.

3M Company and Subsidiaries

CONSOLIDATED STATEMENT OF INCOME

(Millions, except per-share amounts)

(Unaudited)

|

|

|

Three-months ended |

|

Twelve-months ended |

|

|

|

|

December 31, |

|

December 31, |

|

|

|

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

7,719 |

|

$ |

7,569 |

|

$ |

31,821 |

|

$ |

30,871 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

Cost of sales |

|

4,027 |

|

3,976 |

|

16,447 |

|

16,106 |

|

|

Selling, general and administrative expenses |

|

1,594 |

|

1,576 |

|

6,469 |

|

6,384 |

|

|

Research, development and related expenses |

|

436 |

|

438 |

|

1,770 |

|

1,715 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses |

|

6,057 |

|

5,990 |

|

24,686 |

|

24,205 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating income |

|

1,662 |

|

1,579 |

|

7,135 |

|

6,666 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense and income |

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

32 |

|

32 |

|

142 |

|

145 |

|

|

Interest income |

|

(8 |

) |

(11 |

) |

(33 |

) |

(41 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Total interest expense – net |

|

24 |

|

21 |

|

109 |

|

104 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income before income taxes |

|

1,638 |

|

1,558 |

|

7,026 |

|

6,562 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

459 |

|

442 |

|

2,028 |

|

1,841 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income including noncontrolling interest |

|

$ |

1,179 |

|

$ |

1,116 |

|

$ |

4,998 |

|

$ |

4,721 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: Net income attributable to noncontrolling interest |

|

— |

|

13 |

|

42 |

|

62 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to 3M |

|

$ |

1,179 |

|

$ |

1,103 |

|

$ |

4,956 |

|

$ |

4,659 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average 3M common shares outstanding – basic |

|

637.9 |

|

668.5 |

|

649.2 |

|

681.9 |

|

|

Earnings per share attributable to 3M common shareholders – basic |

|

$ |

1.85 |

|

$ |

1.65 |

|

$ |

7.63 |

|

$ |

6.83 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average 3M common shares outstanding – diluted |

|

650.9 |

|

681.3 |

|

662.0 |

|

693.6 |

|

|

Earnings per share attributable to 3M common shareholders – diluted |

|

$ |

1.81 |

|

$ |

1.62 |

|

$ |

7.49 |

|

$ |

6.72 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash dividends paid per 3M common share |

|

$ |

0.855 |

|

$ |

0.635 |

|

$ |

3.42 |

|

$ |

2.54 |

|

3M Company and Subsidiaries

CONDENSED CONSOLIDATED BALANCE SHEET

(Dollars in millions)

(Unaudited)

|

|

|

Dec. 31, |

|

Dec. 31, |

|

|

|

|

2014 |

|

2013 |

|

|

ASSETS |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,897 |

|

$ |

2,581 |

|

|

Marketable securities – current |

|

626 |

|

756 |

|

|

Accounts receivable – net |

|

4,238 |

|

4,253 |

|

|

Inventories |

|

3,706 |

|

3,864 |

|

|

Other current assets |

|

1,298 |

|

1,279 |

|

|

Total current assets |

|

11,765 |

|

12,733 |

|

|

Marketable securities – non-current |

|

828 |

|

1,453 |

|

|

Investments |

|

102 |

|

122 |

|

|

Property, plant and equipment – net |

|

8,489 |

|

8,652 |

|

|

Goodwill and intangible assets – net |

|

8,485 |

|

9,033 |

|

|

Prepaid pension benefits (a) |

|

46 |

|

577 |

|

|

Other assets (a) |

|

1,554 |

|

980 |

|

|

Total assets |

|

$ |

31,269 |

|

$ |

33,550 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Short-term borrowings and current portion of long-term debt |

|

$ |

106 |

|

$ |

1,683 |

|

|

Accounts payable |

|

1,807 |

|

1,799 |

|

|

Accrued payroll |

|

732 |

|

708 |

|

|

Accrued income taxes |

|

435 |

|

417 |

|

|

Other current liabilities |

|

2,918 |

|

2,891 |

|

|

Total current liabilities |

|

5,998 |

|

7,498 |

|

|

Long-term debt |

|

6,731 |

|

4,326 |

|

|

Pension and postretirement benefits (a) |

|

3,843 |

|

1,794 |

|

|

Other liabilities |

|

1,555 |

|

1,984 |

|

|

Total liabilities |

|

$ |

18,127 |

|

$ |

15,602 |

|

|

|

|

|

|

|

|

|

Total equity (a) |

|

$ |

13,142 |

|

$ |

17,948 |

|

|

Shares outstanding |

|

|

|

|

|

|

December 31, 2014: 635,134,594 shares |

|

|

|

|

|

|

December 31, 2013: 663,296,239 shares |

|

|

|

|

|

|

Total liabilities and equity |

|

$ |

31,269 |

|

$ |

33,550 |

|

(a) The changes in 3M’s defined benefit pension and postretirement plans’ funded status, which is required to be measured as of each year-end, significantly impacted several balance sheet amounts. In the fourth quarter of 2014, these required annual measurements decreased prepaid pension benefits by $0.7 billion, increased deferred taxes within other assets by $0.8 billion, increased pension and postretirement benefits’ long-term liabilities by $1.9 billion, and decreased stockholders’ equity by $1.8 billion. Other pension and postretirement changes during the year, such as contributions and amortization, also impacted these balance sheet amounts.

3M Company and Subsidiaries

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

(Dollars in millions)

(Unaudited)

|

|

|

Twelve-months ended |

|

|

|

|

December 31, |

|

|

|

|

2014 |

|

2013 |

|

|

NET CASH PROVIDED BY OPERATING ACTIVITIES |

|

$ |

6,626 |

|

$ |

5,817 |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

Purchases of property, plant and equipment |

|

(1,493 |

) |

(1,665 |

) |

|

Acquisitions, net of cash acquired |

|

(94 |

) |

— |

|

|

Purchases and proceeds from sale or maturities of marketable securities and investments – net |

|

754 |

|

627 |

|

|

Other investing activities |

|

237 |

|

182 |

|

|

|

|

|

|

|

|

|

NET CASH USED IN INVESTING ACTIVITIES |

|

(596 |

) |

(856 |

) |

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

Change in debt |

|

1,010 |

|

(37 |

) |

|

Purchases of treasury stock |

|

(5,652 |

) |

(5,212 |

) |

|

Proceeds from issuances of treasury stock pursuant to stock option and benefit plans |

|

968 |

|

1,609 |

|

|

Dividends paid to shareholders |

|

(2,216 |

) |

(1,730 |

) |

|

Purchase of noncontrolling interest (b) |

|

(861 |

) |

— |

|

|

Other financing activities |

|

148 |

|

124 |

|

|

|

|

|

|

|

|

|

NET CASH USED IN FINANCING ACTIVITIES |

|

(6,603 |

) |

(5,246 |

) |

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash and cash equivalents |

|

(111 |

) |

(17 |

) |

|

|

|

|

|

|

|

|

Net increase (decrease) in cash and cash equivalents |

|

(684 |

) |

(302 |

) |

|

Cash and cash equivalents at beginning of year |

|

2,581 |

|

2,883 |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at end of period |

|

$ |

1,897 |

|

$ |

2,581 |

|

(b) This primarily related to the purchase of the remaining noncontrolling interest of Sumitomo 3M Limited from Sumitomo Electric Industries, Ltd. for 90 billion Japanese Yen. The transaction closed on September 1, 2014.

3M Company and Subsidiaries

SUPPLEMENTAL FINANCIAL INFORMATION

NON-GAAP MEASURES

(Dollars in millions)

(Unaudited)

|

|

|

Three-months ended |

|

Twelve-months ended |

|

|

|

|

December 31, |

|

December 31, |

|

|

Free Cash Flow |

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by operating activities |

|

$ |

2,183 |

|

$ |

1,993 |

|

$ |

6,626 |

|

$ |

5,817 |

|

|

Purchases of property, plant and equipment |

|

(490 |

) |

(543 |

) |

(1,493 |

) |

(1,665 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Free Cash Flow (c) |

|

$ |

1,693 |

|

$ |

1,450 |

|

$ |

5,133 |

|

$ |

4,152 |

|

(c) Free cash flow and free cash flow conversion are not defined under U.S. generally accepted accounting principles (GAAP). Therefore, they should not be considered a substitute for income or cash flow data prepared in accordance with U.S. GAAP and may not be comparable to similarly titled measures used by other companies. The Company defines free cash flow as net cash provided by operating activities less purchases of property, plant and equipment. It should not be inferred that the entire free cash flow amount is available for discretionary expenditures. The Company defines free cash flow conversion as free cash flow divided by net income attributable to 3M. The Company believes free cash flow and free cash flow conversion are useful measures of performance and uses these measures as an indication of the strength of the company and its ability to generate cash.

|

|

|

December 31, |

|

|

Net Debt |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

Total Debt |

|

$ |

6,837 |

|

$ |

6,009 |

|

|

Less: Cash and Cash Equivalents and Marketable Securities |

|

3,351 |

|

4,790 |

|

|

|

|

|

|

|

|

|

Net Debt (d) |

|

$ |

3,486 |

|

$ |

1,219 |

|

(d) The Company defines net debt as total debt less the total of cash, cash equivalents and current and long-term marketable securities. 3M considers net debt and its components to be an important indicator of liquidity and a guiding measure of capital structure strategy. Net debt is not defined under U.S. GAAP and may not be computed the same as similarly titled measures used by other companies.

|

|

|

December 31, |

|

|

Working Capital Index |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

Net Working Capital Turns (e) |

|

5.0 |

|

4.8 |

|

(e) The Company uses various working capital measures that place emphasis and focus on certain working capital assets and liabilities. 3M’s net working capital index is defined as quarterly net sales multiplied by four, divided by ending net accounts receivable plus inventory less accounts payable. This measure is not recognized under U.S. GAAP and may not be comparable to similarly titled measures used by other companies.

|

|

|

Twelve-months ended |

|

|

|

|

December 31, |

|

|

Return on Invested Capital |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

Return on Invested Capital (f) |

|

22.0 |

% |

20.0 |

% |

(f) The Company uses non-GAAP measures to focus on shareholder value creation. 3M uses Return on Invested Capital (ROIC), defined as annualized after-tax operating income (including interest income) divided by average operating capital. Operating capital is defined as net assets (total assets less total liabilities) excluding debt. This measure is not recognized under U.S. GAAP and may not be comparable to similarly titled measures used by other companies.

3M Company and Subsidiaries

SALES CHANGE ANALYSIS

(Unaudited)

|

|

|

Three-months ended December 31, 2014 |

|

|

Sales Change Analysis |

|

United |

|

Asia- |

|

Europe,

Middle

East and |

|

Latin

America/ |

|

World- |

|

|

By Geographic Area |

|

States |

|

Pacific |

|

Africa |

|

Canada |

|

Wide |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Volume – organic |

|

6.3 |

% |

7.2 |

% |

1.9 |

% |

6.0 |

% |

5.6 |

% |

|

Price |

|

0.3 |

|

(0.3 |

) |

1.4 |

|

3.0 |

|

0.7 |

|

|

Organic local-currency sales |

|

6.6 |

|

6.9 |

|

3.3 |

|

9.0 |

|

6.3 |

|

|

Acquisitions |

|

0.3 |

|

— |

|

— |

|

— |

|

0.1 |

|

|

Translation |

|

— |

|

(3.8 |

) |

(9.7 |

) |

(9.0 |

) |

(4.4 |

) |

|

Total sales change |

|

6.9 |

% |

3.1 |

% |

(6.4 |

)% |

— |

% |

2.0 |

% |

|

|

|

Three-months ended December 31, 2014 |

|

|

Worldwide |

|

Organic

local- |

|

|

|

|

|

|

|

Total |

|

|

Sales Change Analysis |

|

currency |

|

|

|

|

|

|

|

sales |

|

|

By Business Segment |

|

sales |

|

Acquisitions |

|

Divestitures |

|

Translation |

|

change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Industrial |

|

5.9 |

% |

— |

% |

— |

% |

(4.5 |

)% |

1.4 |

% |

|

Safety and Graphics |

|

9.2 |

% |

— |

% |

— |

% |

(5.8 |

)% |

3.4 |

% |

|

Electronics and Energy |

|

6.2 |

% |

— |

% |

— |

% |

(2.9 |

)% |

3.3 |

% |

|

Health Care |

|

6.4 |

% |

0.6 |

% |

— |

% |

(4.6 |

)% |

2.4 |

% |

|

Consumer |

|

5.8 |

% |

— |

% |

— |

% |

(3.6 |

)% |

2.2 |

% |

|

|

|

Twelve-months ended December 31, 2014 |

|

|

|

|

|

|

|

|

Europe,

Middle |

|

Latin |

|

|

|

|

Sales Change Analysis |

|

United |

|

Asia- |

|

East and |

|

America/ |

|

World- |

|

|

By Geographic Area |

|

States |

|

Pacific |

|

Africa |

|

Canada |

|

Wide |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Volume – organic |

|

4.4 |

% |

6.2 |

% |

2.1 |

% |

0.2 |

% |

3.9 |

% |

|

Price |

|

0.5 |

|

0.1 |

|

1.1 |

|

4.3 |

|

1.0 |

|

|

Organic local-currency sales |

|

4.9 |

|

6.3 |

|

3.2 |

|

4.5 |

|

4.9 |

|

|

Acquisitions |

|

0.2 |

|

— |

|

— |

|

— |

|

0.1 |

|

|

Divestitures |

|

(0.1 |

) |

— |

|

— |

|

— |

|

— |

|

|

Translation |

|

— |

|

(2.2 |

) |

(1.6 |

) |

(7.5 |

) |

(1.9 |

) |

|

Total sales change |

|

5.0 |

% |

4.1 |

% |

1.6 |

% |

(3.0 |

)% |

3.1 |

% |

|

|

|

Twelve-months ended December 31, 2014 |

|

|

|

|

Organic |

|

|

|

|

|

|

|

|

|

|

Worldwide |

|

local- |

|

|

|

|

|

|

|

Total |

|

|

Sales Change Analysis |

|

currency |

|

|

|

|

|

|

|

sales |

|

|

By Business Segment |

|

sales |

|

Acquisitions |

|

Divestitures |

|

Translation |

|

change |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Industrial |

|

4.9 |

% |

— |

% |

— |

% |

(1.8 |

)% |

3.1 |

% |

|

Safety and Graphics |

|

5.4 |

% |

— |

% |

— |

% |

(2.7 |

)% |

2.7 |

% |

|

Electronics and Energy |

|

5.2 |

% |

— |

% |

— |

% |

(1.3 |

)% |

3.9 |

% |

|

Health Care |

|

5.8 |

% |

0.4 |

% |

— |

% |

(1.7 |

)% |

4.5 |

% |

|

Consumer |

|

3.9 |

% |

— |

% |

(0.1 |

)% |

(1.8 |

)% |

2.0 |

% |

BUSINESS SEGMENTS

(Dollars in millions)

(Unaudited)

Effective in the first quarter of 2014, 3M transferred a product line between divisions within different business segments and made other changes within business segments in its continuing effort to improve the alignment of its businesses around markets and customers.

The product move between business segments was as follows:

· The movement of the Fire Protection product line from the Building and Commercial Services Division (Safety and Graphics business segment) to the Industrial Adhesives and Tapes Division (Industrial business segment). This product move resulted in an increase in net sales for total year 2013 of $73 million in the Industrial business segment offset by a corresponding decrease in the Safety and Graphics business segment.

In addition, other changes within business segments were as follows:

· The combination of certain existing divisions/departments into new divisions. Within the Electronics and Energy business segment, the new divisions include the Electrical Markets Division (which includes the former Infrastructure Protection Division), and the Electronic Solutions Division (which includes the former 3M Touch Systems, Inc.). Within the Safety and Graphics business segment, the new Commercial Solutions Division was created from the combination of the former Architectural Markets Department, the former Building and Commercial Services Division and the former Commercial Graphics Division. None of these combinations crossed business segments.

· The renaming of the former Aerospace and Aircraft Maintenance Division within the Industrial business segment to the Aerospace and Commercial Transportation Division.

· The movement of certain product lines between various divisions within the same business segment.

Effective in the second quarter of 2014, within the Electronics and Energy business segment, 3M combined three existing divisions into two new divisions. A large portion of both the Electronics Markets Materials Division and the Electronic Solutions Division were combined to form the Electronics Materials Solutions Division, which focuses on semiconductor and electronics materials and assembly solutions. The Optical Systems Division, the remaining portion of the Electronic Solutions Division and a portion of the Electronics Markets Materials Division were combined to form the Display Materials and Systems Division, which focuses on delivering light, color and user interface solutions.

Effective in the fourth quarter of 2014, within the Industrial business segment, the Personal Care Division, which focuses on tapes and attachment systems for infant and adult hygiene, was combined with the Industrial Adhesives and Tapes Division.

The financial information presented herein reflects, for all periods presented, the impact of these realignments. Refer to 3M’s Current Report on Form 8-K furnished on March 5, 2014, and 3M’s Current Report on Form 8-K filed on May 15, 2014, for additional information concerning the business segment realignments effective in the first quarter of 2014.

|

BUSINESS SEGMENT INFORMATION |

|

Three-months ended |

|

Twelve-months ended |

|

|

NET SALES |

|

December 31, |

|

December 31, |

|

|

(Millions) |

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Industrial |

|

$ |

2,627 |

|

$ |

2,589 |

|

$ |

10,990 |

|

$ |

10,657 |

|

|

Safety and Graphics |

|

1,367 |

|

1,322 |

|

5,732 |

|

5,584 |

|

|

Electronics and Energy |

|

1,371 |

|

1,327 |

|

5,604 |

|

5,393 |

|

|

Health Care |

|

1,392 |

|

1,359 |

|

5,572 |

|

5,334 |

|

|

Consumer |

|

1,128 |

|

1,103 |

|

4,523 |

|

4,435 |

|

|

Corporate and Unallocated |

|

(1 |

) |

2 |

|

4 |

|

8 |

|

|

Elimination of Dual Credit |

|

(165 |

) |

(133 |

) |

(604 |

) |

(540 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Total Company |

|

$ |

7,719 |

|

$ |

7,569 |

|

$ |

31,821 |

|

$ |

30,871 |

|

|

BUSINESS SEGMENT INFORMATION |

|

Three-months ended |

|

Twelve-months ended |

|

|

OPERATING INCOME |

|

December 31, |

|

December 31, |

|

|

(Millions) |

|

2014 |

|

2013 |

|

2014 |

|

2013 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Industrial |

|

$ |

538 |

|

$ |

554 |

|

$ |

2,389 |

|

$ |

2,307 |

|

|

Safety and Graphics |

|

285 |

|

254 |

|

1,296 |

|

1,227 |

|

|

Electronics and Energy |

|

257 |

|

221 |

|

1,115 |

|

954 |

|

|

Health Care |

|

431 |

|

425 |

|

1,724 |

|

1,672 |

|

|

Consumer |

|

254 |

|

226 |

|

995 |

|

945 |

|

|

Corporate and Unallocated |

|

(67 |

) |

(72 |

) |

(251 |

) |

(321 |

) |

|

Elimination of Dual Credit |

|

(36 |

) |

(29 |

) |

(133 |

) |

(118 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Total Company |

|

$ |

1,662 |

|

$ |

1,579 |

|

$ |

7,135 |

|

$ |

6,666 |

|

About 3M

3M captures the spark of new ideas and transforms them into thousands of ingenious products. Our culture of creative collaboration inspires a never-ending stream of powerful technologies that make life better. 3M is the innovation company that never stops inventing. With $32 billion in sales, 3M employs 90,000 people worldwide and has operations in more than 70 countries.

|

Investor Contacts: |

Matt Ginter |

Media Contact: |

Fanna Haile-Selassie |

|

|

3M |

|

3M |

|

|

(651) 733-8206 |

|

(651) 736-0876 |

|

|

|

|

|

|

|

Bruce Jermeland |

|

|

|

|

3M |

|

|

|

|

(651) 733-1807 |

|

|

From:

3M Public Relations and Corporate Communications

3M Center, Building 225-1S-15

St. Paul, MN 55144-1000

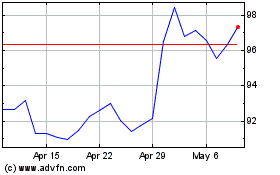

3M (NYSE:MMM)

Historical Stock Chart

From Mar 2024 to Apr 2024

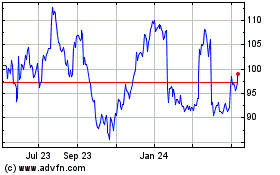

3M (NYSE:MMM)

Historical Stock Chart

From Apr 2023 to Apr 2024