_______________________________________________________________________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________________________________________________________________________________________

FORM 8-K

_______________________________________________________________________________________________________________________________________

CURRENT REPORT

Pursuant To Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 19, 2015

_______________________________________________________________________________________________________________________________________

eBay Inc.

(Exact name of registrant as specified in its Charter)

|

|

|

|

|

|

|

Delaware

|

|

000-24821

|

|

77-0430924

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

2065 Hamilton Avenue,

San Jose, CA 95125

|

|

(Address of Principal Executive Offices)

|

Registrant's telephone number, including area code: (408) 376-7400

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

_______________________________________________________________________________________________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 21, 2015, eBay Inc. (the "Company") announced that Perry Traquina and Frank Yeary had been appointed new members of the Company's Board of Directors (the "Company Board"), with such appointment to be effective immediately. A copy of the Company's press release announcing the appointment of Mr. Traquina and Mr. Yeary, which also announced certain matters relating to the Icahn Group described below, is attached as Exhibit 99.1 to this current report.

Mr. Traquina's and Mr. Yeary's terms on the Company Board will begin immediately. They fill two vacancies created by an increase in the size of the Company Board from 12 to 14, and their term of office will expire at the Company's 2015 annual meeting of stockholders (the "2015 Meeting") or until their successors have been elected and qualified.

As non-employee directors, each of Mr. Traquina and Mr. Yeary is entitled to receive: (i) an annual cash retainer of $80,000, pro-rated for the remaining portion of 2015, and (ii) $220,000 in deferred stock units ("DSUs"), representing an unfunded, unsecured right to receive shares of eBay common stock at the time the director ceases to be a member of the Board, which DSUs will be granted at the time of each annual meeting of stockholders, with such annual equity grants vesting as to 100% of the DSUs on the first anniversary of the date of grant.

Item 8.01. Other Events

On January 21, 2015, the Company also announced that it had entered into a nomination and standstill agreement (the "Agreement") with Carl C. Icahn, High River Limited Partnership, Icahn Partners Master Fund LP, Icahn Partners LP and certain of their affiliates party thereto (collectively, the "Icahn Group"). Pursuant to the Agreement, the Company agreed that no later than the first regularly scheduled meeting of the Company Board immediately following the date of the Agreement, the Company Board would expand the Company Board and appoint Jonathan Christodoro (the "Nominee") to fill the resulting vacancy. In connection with the Company's determination of the composition of the Company Board and the board of directors of PayPal (the "PayPal Board") following the separation of PayPal into a separate, publicly traded company (the "Spin-Off"), the Nominee may elect to remain on the Company Board or resign from the Company Board and become a member of the PayPal Board, with such resignation and appointment to be effective as of the effective time of the Spin-Off. As noted above, a copy of the press release announcing the Agreement is attached as Exhibit 99.1 to this current report.

The Company also agreed to include the Nominee in the Company's slate of directors for the 2015 Meeting and to use reasonable best efforts to cause the Nominee to be elected. The Icahn Group has agreed not to conduct a proxy contest regarding any matter, including the election of directors, with respect to the 2015 Meeting.

The Icahn Group also agreed to a standstill that applies to either the Company or PayPal depending on whether the Nominee remains on the Company Board or elects to become a member of the PayPal Board. The standstill begins on the date the Nominee is appointed to the Company Board and continues until the later of: (i) the last day of the advance notice deadline set forth in the Company's bylaws or PayPal's bylaws following the

Spin-Off with respect to the 2016 Annual Meeting of the stockholders of the Company or PayPal, as applicable, and (ii) twenty-five days after the date that the Nominee or his replacement no longer serves on the Board of the Company or the PayPal Board, as applicable. Under the standstill, the Icahn Group has agreed, among other things, not to: (1) solicit proxies or consents or influence others with respect to the same; (2) present stockholder proposals for consideration of action at an annual or special meeting; (3) acquire or otherwise beneficially own more than 20% of the Company's outstanding voting securities, subject to certain exceptions in response to a unsolicited tender or exchange offers by a third party; or (4) propose or participate in certain extraordinary transactions, subject to certain exceptions for an unsolicited tender or exchange offer by a third party.

In addition, from the date of the Agreement until the end of the standstill period, the Icahn Group and the Company have agreed that they will not (subject to certain exceptions) directly or indirectly make any public statement or announcement (including social media) disparaging each other or any of their officers or directors with respect to matters relating to the Company or PayPal, as applicable. The Icahn Group has also agreed until the end of the standstill period to vote all of its securities: (1) for all of the directors nominated by the Company Board or the PayPal Board, as applicable; (2) against any directors that are not nominated by the Company Board or the PayPal Board, as applicable; and (3) against any proposals not recommended by the Company Board or the PayPal Board, as applicable, relating to the removal of directors of the Board or otherwise changing the composition of the applicable boards.

Finally, the Company has agreed that until the conclusion of the standstill period to provide that, among other things: (1) the PayPal Board is annually elected; (2) the provisions of PayPal's governing documents enable a special meeting of PayPal stockholders to be called by holders of 20% of the outstanding shares of PayPal common stock who meet certain requirements with respect to advance notice, required disclosures and permitted matters and other matters (except that business at such stockholder-called meeting shall generally not include the removal or election of directors); (3) except as required by law or pursuant to item (6) below, PayPal's governing documents will not impose minimum voting requirements greater than a majority of the outstanding shares of PayPal common stock; (4) PayPal will schedule its annual meeting within the twelve-month anniversary of the effective time of the Spin-Off; (5) any "stockholder rights plan" adopted by PayPal shall not have triggering "Acquiring Person" ownership thresholds below 19.9% of the then-outstanding PayPal shares and, if not ratified by stockholders within one hundred thirty-five days of the plan taking effect, shall automatically expire; (6) PayPal shall opt-out of application of Section 203 of the Delaware General Corporation Law ("DGCL"), provided that PayPal may include comparable provisions in its certificate of incorporation that use a 20% threshold instead of the 15% provided for in the DGCL; (7) PayPal shall not adopt or approve change-of-control provisions in material agreements such as debt, equity compensation and severance agreements with ownership triggers below 20%; and (8) if PayPal rejects an acquisition proposal in favor of a proposal its board considers superior, and the rejected party then makes a binding superior "topping" bid, PayPal will in certain circumstances enter into a confidentiality agreement with the party making the "topping" bid.

A copy of the Agreement is attached as Exhibit 99.2 to this current report and incorporated by reference herein. The foregoing description of the Agreement is qualified in its entirety by reference to the full text of the Agreement.

Item 9.01. Financial Statements and Exhibits

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

Press release dated January 21, 2015

|

|

99.2

|

|

Nomination and Standstill Agreement, dated as of January 21, 2015, by and among the persons and entities listed on Schedule A thereto and the Company

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Date: January 23, 2015

|

|

|

|

eBay Inc.

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Michael R. Jacobson

|

|

|

|

|

|

|

|

Name:

|

|

Michael R. Jacobson

|

|

|

|

|

|

|

|

Title:

|

|

Senior Vice President, Legal Affairs, General Counsel and Secretary

|

EXHIBIT INDEX

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

Press release dated January 21, 2015

|

|

99.2

|

|

Nomination and Standstill Agreement, dated as of January 21, 2015, by and among the persons and entities listed on Schedule A thereto and the Company

|

eBay Inc. Expands Board of Directors

Perry Traquina, Former Chairman & CEO of Wellington Management, and

Frank Yeary, Executive Chairman of CamberView Partners, to Join Board

New Independent Directors Add Investor Perspective and

Significant Financial and Governance Expertise

Company Reaches Standstill Agreement with Carl Icahn;

Jonathan Christodoro to Join Board as Part of Agreement

SAN JOSE, Calif. (January 21, 2015) — eBay Inc. (Nasdaq: EBAY) today announced the appointment of Perry Traquina and Frank Yeary to its board of directors. Separately, the company also announced it has entered into a standstill agreement with Carl Icahn, the company's largest active shareholder.

"We are delighted to add Perry and Frank, two outstanding and independent directors, to our board," said John Donahoe, President and CEO of eBay Inc. "Their appointments are the result of significant effort by the nominating committee over the last several months to find talented new directors who will contribute valuable expertise to eBay and PayPal as we create two best in class boards. Both of them have a deep understanding of the investment community and our shareholders, along with expertise in executive leadership, financial advising and governance. We look forward to the contributions as we progress toward the separation of eBay and PayPal and set each business on independent paths toward sustained growth and profitability."

Mr. Traquina brings a valuable market-oriented investor perspective to eBay Inc.'s board, having served as CEO and Chairman of Wellington Management, one of the world's largest investment management companies with over $900 billion of assets under management ("AUM"). Under Mr. Traquina's leadership from 2004 until his retirement at the end of 2014, Wellington more than doubled its AUM, while expanding its investment team and product line and improving its risk management function. Mr. Traquina also fostered a culture of diversity and inclusion at Wellington.

Mr. Yeary brings extensive experience in corporate governance, M&A strategy and audit committee membership to the board. In 2012, he co-founded CamberView Partners, a financial advisory firm dedicated to bringing independent, investor-led advice into corporate boardrooms, and currently serves as its Executive Chairman. He has deep knowledge of financial markets and advisory services gained from his more than two decades of industry experience, including serving as Global Head of Mergers & Acquisitions for Citigroup Global Markets and Chairman of Salomon Smith Barney's Global Technology, Media and Telecommunications (TMT) Investment Banking Group. Mr. Yeary also serves as a member of Intel's board of directors.

"I'm thrilled to join the board of such an innovative company as it embarks on a path to capitalize on eBay and PayPal's respective growth prospects," said Mr. Traquina. "The separation is an excellent opportunity to create sustainable and lasting value – providing shareholders more targeted investment opportunities while preserving the benefits of the current relationships."

"This is an exciting time in eBay's history and I am delighted to join the board of the company that revolutionized the online shopping and payments experience for millions of consumers worldwide," said Mr. Yeary. "eBay has a tremendous leadership team and board, and I look forward to working with them to complete the separation and launch eBay and PayPal as standalone businesses with best-in-class governance structures."

The company also announced today that it has entered into a standstill agreement with investor Carl Icahn. In addition to certain corporate governance provisions to be adopted by PayPal as an independent company at the time of its spin-off from eBay Inc., the agreement appoints Icahn Capital executive Jonathan Christodoro to eBay Inc.'s current board of directors. The agreement with Mr. Icahn allows him to determine which board Mr. Christodoro will serve on at the time of separation.

Mr. Donahoe continued, "We are pleased to reach an agreement with Carl Icahn and to add Jonathan to the board. This agreement reflects our alignment on separation and our shared belief in the benefits of avoiding distractions. We look forward to contributions of all of our

directors as we work to set up eBay and PayPal for success and create strong boards for each of the new companies."

With the appointments of Traquina, Yeary and Christodoro, eBay Inc.'s board is comprised of 15 directors, 13 of whom are independent.

On September 30, 2014, eBay Inc. announced that its board of directors had approved a plan to separate the company's eBay and PayPal businesses into two independent publicly traded companies in 2015, subject to customary conditions.

About Perry Traquina

Mr. Traquina had a successful 34-year career at Wellington Management, retiring in 2014. He held a series of positions of increasing responsibility, including Assistant Vice President, Director of Global Research, Partner and President. From 2004-2014, he served as Chairman, CEO and Managing Partner. Mr. Traquina graduated from Brandeis University, received an MBA from Harvard Business School and is a Chartered Financial Analyst.

About Frank Yeary

Mr. Yeary currently is Executive Chairman of CamberView Partners and also serves a member of Intel's board of directors. He previously was Co-founder and Chairman of Level Money and, from 2008-2012, was Vice Chancellor of the University of California, Berkeley, where he designed and implemented multiple financial and operating reforms. Prior to 2008, he held a number of leadership positions at Citigroup Global Markets, including Global Head of Mergers & Acquisitions, a member of the Investment Banking Management Committee and Chairman of Salomon Smith Barney's Global Technology, Media and Telecommunications (TMT) group. Mr. Yeary graduated from University of California, Berkeley.

About Jonathan Christodoro

Jonathan Christodoro has served as a Managing Director of Icahn Capital LP, the entity through which Carl C. Icahn manages investment funds, since July 2012. Mr. Christodoro is responsible for identifying, analyzing and monitoring investment opportunities and portfolio companies for Icahn Capital. Prior to joining Icahn Capital LP, Mr. Christodoro held positions at P2 Capital

Partners, LLC, Prentice Capital Management, LP and S.A.C Capital Advisors, LP. He began his investment banking career at Morgan Stanley. He earned an MBA from the University of Pennsylvania's Wharton School of Business with Distinction, and his BS in Applied Economics and Management Magna Cum Laude with Honors Distinction in Research from Cornell University.

About eBay Inc.

eBay Inc. (NASDAQ: EBAY) is a global commerce and payments leader, providing a robust platform where merchants of all sizes can compete and win. Founded in 1995 in San Jose, Calif., eBay Inc. connects millions of buyers and sellers and enabled $205 billion* of commerce volume in 2013. We do so through eBay, one of the world's largest online marketplaces, which allows users to buy and sell in nearly every country on earth; through PayPal, which enables individuals and businesses to securely, easily and quickly send and receive digital payments; and through eBay Enterprise, which enables omnichannel commerce, multichannel retailing and digital marketing for global enterprises in the U.S. and internationally. We also reach millions through specialized marketplaces such as StubHub, the world's largest ticket marketplace, and eBay classifieds sites, which together have a presence in more than 1,000 cities around the world. For more information about the company and its global portfolio of online brands, visit www.ebayinc.com.

* This adjusted number reflects decision to remove vehicles and real estate GMV from ongoing total GMV and ECV metrics (previously stated ECV for 2013 was $212 billion, incorporating vehicles and real estate GMV).

###

NOMINATION AND STANDSTILL AGREEMENT

This Nomination and Standstill Agreement, dated January 21, 2015 (this "Agreement"), is by and among the persons and entities listed on Schedule A hereto (collectively, the "Icahn Group", and individually a "member" of the Icahn Group) and eBay Inc. (the "Company").

In consideration of and reliance upon the mutual covenants and agreements contained herein, and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto agree as follows:

|

(a)

|

No later than the first regularly scheduled meeting of the Board of Directors of the Company (the "Board") immediately following the date hereof (which is expected to be on or around April 1, 2015), the Board shall take action to increase the size of the Board by one member and to appoint Jonathan Christodoro (the "Icahn Nominee") to fill the vacancy so created (the date of such appointment, the "Board Appointment Date"); provided that as a condition to the Icahn Nominee's appointment to the Board and inclusion in the Company's director slate for the 2015 Annual Meeting, the Icahn Group, including the Icahn Nominee, agrees to provide to the Company, prior to nomination and appointment and on an on-going basis while he is serving as a member of the Board, such information and materials as the Company routinely receives from other members of the Board or as is required to be disclosed in proxy statements under applicable law or as is otherwise reasonably requested by the Company from time-to-time from members of the Board in connection with the Company's legal, regulatory, auditor or stock exchange requirements, a completed D&O Questionnaire in the form separately provided to the Icahn Group and, as contemplated by Section 9 of this Agreement, an executed irrevocable resignation as director in the form attached hereto as Exhibit B (the "Nomination Documents").

|

|

(b)

|

Upon becoming a member of the Board, the Icahn Nominee shall have the same rights (including for the avoidance of doubt with respect to consideration for committee appointments) and duties as any other Board member. From and after the Board Appointment Date, so long as the Icahn Nominee is a member of the Board, (1) the Board shall not form an Executive Committee or any other committee with functions similar to those customarily granted to an Executive Committee unless the Icahn Nominee is offered membership on such committee, (2) the Icahn Nominee shall be offered membership on the Compensation Committee or the Corporate Governance and Nominating Committee, and (3) with respect to any Board consideration of appointment and employment of the CEO and CFO, mergers, acquisitions of material assets, dispositions of material assets, or other Extraordinary Transactions (as hereafter defined), such consideration, and voting with respect thereto, shall take place only at the full Board level or in committees of which the Icahn Nominee is a member (subject to recusal of the Icahn Nominee from such portions of Board or committee meetings, if any, involving actual conflicts between the Company and the Icahn Group). At all times

|

|

|

from the date of this Agreement through his termination of service as a member of the Board, the Icahn Nominee shall comply with all written policies, procedures, processes, codes, rules, standards and guidelines applicable to Board members (and of which the Icahn Nominee has been provided written copies in advance (or which have been filed with the Securities and Exchange Commission (the "SEC") or posted on the Company's website)), including but not limited to the Company's code of business conduct and ethics, standards of business conduct, securities trading policies, insider trading policy, directors confidentiality policy, directors' code of conduct, and corporate governance guidelines, and preserve the confidentiality of Company business and information, including discussions or matters considered in meetings of the Board or Board committees, subject to the Confidentiality Agreement (as defined in Section 4). For the avoidance of doubt, without limiting the applicability of relevant laws, the Company agrees that such policies, procedures, processes, codes, rules, standards and guidelines shall not be applicable to, or deemed to apply or extend to, the members of the Icahn Group (other than their application to the Icahn Nominee). For the avoidance of doubt, if the SpinCo Board Election (as defined in Section 2) is made, then the provisions of this paragraph (including with respect to committee membership) shall be applicable to SpinCo (as defined in Section 2) rather than the Company from and after the Separation Effective Time.

|

|

(c)

|

The Company and the Icahn Group agree to include the Icahn Nominee in the Company's slate of directors for the 2015 Annual Meeting, and the Company shall use reasonable best efforts to cause the Icahn Nominee to be elected (including recommending that the Company's stockholders vote in favor of the election of the Icahn Nominee, including the Icahn Nominee in the Company's proxy statement and proxy card for such annual meeting and otherwise supporting the Icahn Nominee for election in a manner no less rigorous and favorable than the manner in which the Company supports its other nominees in the aggregate) (collectively, the "Election Support Efforts"), and the Icahn Group agrees not to conduct a proxy contest regarding any matter, including the election of directors, with respect to the 2015 Annual Meeting.

|

|

(d)

|

For any annual meeting of stockholders subsequent to the 2015 Annual Meeting (each a "Subsequent Meeting"), the Company shall notify the Icahn Group in writing no less than forty-five (45) calendar days before the last day of the advance notice deadline set forth in the Company's bylaws if the Icahn Nominee will be nominated by the Company for election as a director at such annual meeting and, if the Icahn Nominee is to be so nominated, shall use reasonable best efforts to cause the election of the Icahn Nominee so nominated by the Company (including the Election Support Efforts). For the avoidance of doubt, if the SpinCo Board Election is made, then the provisions of this paragraph (including the obligation to notify the Icahn Group with respect to including the Icahn Nominee on the slate of directors for annual meetings subsequent to the 2015 Annual Meeting and to provide the Election Support Efforts) shall be applicable to SpinCo rather than the Company from and after the Separation Effective Time (it being understood that SpinCo is not expected to have a 2015 annual meeting as a publicly traded company).

|

|

(e)

|

Should the Icahn Nominee resign from the Board or be rendered unable to, or refuse to, be appointed to, or for any other reason fail to serve or is not serving, on, the Board (other than as a result of not being nominated by the Company for an annual meeting of stockholders subsequent to the 2015 Annual Meeting or the Icahn Nominee ceasing to be a member of the Board in connection with a SpinCo Board Election), as long as the Icahn Group has not materially breached this Agreement and failed to cure such breach within five business days of written notice from the Company specifying any such breach, the Icahn Group shall be entitled to designate privately, and the Company shall cause to be added as a member of the Board, a replacement approved by the Company (such approval not to be unreasonably withheld or delayed) and who qualifies as an independent director (an "Acceptable Person") (and if such proposed designee is not an Acceptable Person, the Icahn Group shall be entitled to continue designating a recommended replacement until such proposed designee is an Acceptable Person) (a "Replacement"). Any such Replacement who becomes a Board member in replacement of any Icahn Nominee shall be deemed to be an Icahn Nominee for all purposes under this Agreement, and prior to his or her appointment to the Board, shall be required to provide to the Company the Nomination Documents, including an irrevocable resignation as director in the form attached hereto as Exhibit B.

|

|

(f)

|

To the extent permitted by law and the Company's existing insurance coverage (or the insurance coverage of SpinCo, as applicable), from and after the Board Appointment Date, the Icahn Nominee shall be covered by the same indemnification and insurance provisions and coverage as are applicable to the individuals that are currently directors of the Company (or, if the SpinCo Board Election has been made, as are applicable to the individuals that are directors of SpinCo).

|

|

2.

|

SpinCo Matters. Within ten days of written request by the Company in connection with the Company's determination of the constitution of the boards of directors of the Company and PayPal ("SpinCo") after the effective time of the consummation of the Company's separation of its PayPal business into a separate, publicly traded company (the "Separation," and such effective time, the "Separation Effective Time"), the Icahn Nominee shall notify the Company in writing whether he intends to remain on the Board or instead irrevocably elects to resign from the Board and become a member of the Board of Directors of SpinCo (such board, the "SpinCo Board" and such election to resign from the Board and become a member of the SpinCo Board instead, the "SpinCo Board Election"). If the Icahn Nominee does not provide a SpinCo Board Election within such ten day period, he will be deemed to have chosen to remain on the Board and not become a member of the SpinCo Board. In the event that the SpinCo Board Election is made, the Icahn Nominee shall be deemed to have resigned from the Board (and any Board committees) and shall become a member of the SpinCo Board, in each case effective as of the Separation Effective Time.

|

|

3.

|

Certain Other Matters. If immediately prior to the Separation Effective Time, the Icahn Group has, together with the Icahn Affiliates, at least the same Beneficial Ownership of Common Stock (as defined below) as it has as of the date hereof and the Icahn Group has

|

|

|

not materially breached this Agreement or the Confidentiality Agreement and failed to cure such breach within five business days of written notice from the Company specifying any such breach, the Company will take such action (if it has not previously so acted) as permitted by law and necessary and appropriate to provide that, as of the Separation Effective Time and until the conclusion of the Standstill Period (such period, the "Specified Period," provided that if the SpinCo Board Election has been made and SpinCo has elected pursuant to Section 1(d) not to nominate the Icahn Nominee as a director for election at a Subsequent Meeting and the Icahn Nominee ceases to serve on the SpinCo Board prior to the conclusion of such Subsequent Meeting, then the Specified Period shall expire at the conclusion of such Subsequent Meeting), except as may be approved by the stockholders of the Company or the stockholders of SpinCo, as applicable: (i) the SpinCo Board is annually elected (i.e., not a "staggered" board); (ii) the provisions of SpinCo's certificate of incorporation and/or bylaws (but if only in the bylaws, then the provision granting stockholders such right to call special meetings may not be amended without a stockholder vote or restricted in the certificate of incorporation) enable a special meeting of stockholders to be requested by stockholders who meet reasonable requirements specified therein (including but not limited to advance notice, required disclosures, permitted matters and other terms which shall not in the aggregate be more restrictive than the stockholder special meeting rights provided for under the Company's bylaws as in effect as of the date hereof, provided that (X) the ownership threshold shall be at 20% of the outstanding shares of common stock of SpinCo (the "SpinCo Shares") as opposed to the 25% ownership threshold in the Company's current bylaws and (Y) until such time after the Separation Effective Time that a single person or entity (or "group" of persons or entities who have filed as a "group" as defined under Section 13(d) of the Exchange Act with respect to their ownership in SpinCo) owns at least a majority of the outstanding stock of SpinCo, business at stockholder-called special meetings shall not be authorized to include the removal of directors or the election of directors, which matters shall only be taken by the stockholders at an annual meeting) and (Z) following such time after the Separation Effective Time that a single person or entity (or "group" of persons or entities who have filed as a "group" as defined under Section 13(d) of the Exchange Act with respect to their ownership in SpinCo) owns at least a majority of the outstanding stock of SpinCo, the removal and replacement of directors at a special meeting shall not require a vote of more than a majority of shares present and voted at such meeting; (iii) the provisions of neither SpinCo's certificate of incorporation nor its bylaws do not, except as required by law (or with respect to the DGCL 203-equivalent provisions referred to in clause (vi) below), impose minimum voting requirements for which matters subject to a stockholder vote are deemed approved greater than requiring approval from a majority of the outstanding SpinCo Shares; (iv) SpinCo will schedule its first annual meeting of stockholders following the Separation Effective Time no later than the twelve-month anniversary of the Separation Effective Time; (v) "stockholder rights plans" adopted by the SpinCo Board shall not have triggering "Acquiring Person" ownership thresholds below 19.9% of the then-outstanding SpinCo Shares and, if not ratified by stockholders within one hundred thirty-five days of their taking effect, shall automatically expire; (vi) SpinCo shall have elected to opt-out of application of DGCL 203 (it being understood that comparable provisions may be included in SpinCo's certificate of incorporation and/or bylaws but with a 20% ownership threshold instead of the 15% provided for in DGCL 203,

|

|

|

amendment of which may be subject to the equivalent vote as would be required in DGCL 203), (vii) SpinCo shall not adopt or approve change-of-control provisions in material agreements (such as debt, equity compensation or severance arrangements) with ownership triggers below 20%, and (viii) if SpinCo receives a bona fide, binding premium offer from a third party (the "Initial Party") to acquire all of the outstanding shares of SpinCo and rejects that offer in favor of an offer from another party (the "Other Party") that the SpinCo Board deems superior, and if SpinCo engages in substantive negotiations with such Other Party and provides material non-public information to it and the Initial Party then makes a "topping" bona fide, binding premium bid that is superior to the Other Party's offer and requests non-public information from SpinCo, SpinCo will, subject to fiduciary duties and compliance with contractual arrangements, enter into a confidentiality agreement with the Initial Party that would enable non-competitively sensitive non-public information to be shared with such party.

|

|

4.

|

Information. It is understood that the Icahn Group may receive certain non-public information concerning the Company. If the Icahn Group receives any such information, it agrees to hold such information subject to and in accordance with the terms of the Confidentiality Agreement dated April 10, 2014, which shall remain in place in accordance with its terms (provided that the term "New Nominee" as used therein shall include the Icahn Nominee, and that, from and after the Separation Effective Time, the term "Company" as used therein shall refer also to SpinCo) (the "Confidentiality Agreement"). As long as the Icahn Nominee is on the Board and the Icahn Group has not materially breached this Agreement and failed to cure such breach within five business days of written notice from the Company specifying any such breach, the Board shall not adopt a policy precluding members of the Board, including the Icahn Nominee, from speaking to Mr. Icahn, and the Company confirms that it will advise members of the board, including the Icahn Nominee, that they may, but are not obligated to, speak to Mr. Icahn (but subject to the Confidentiality Agreement), if they are willing to do so. For the avoidance of doubt, if the SpinCo Board Election is made, then the provisions of this paragraph (including with respect to committee membership) shall be applicable to SpinCo rather than the Company from and after the Separation Effective Time.

|

|

5.

|

Standstill. From and including the Board Appointment Date until the later of (i) the last day of the advance notice deadline set forth in the Company's bylaws or SpinCo's bylaws, as applicable (it being understood and agreed that the provisions of this Section 5 shall during the Standstill Period only restrict the activities of the Icahn Group with respect to the Company unless the SpinCo Board Election is made, in which case these provisions shall restrict the activities of the Icahn Group with respect to SpinCo, but not the Company, from and after the Separation Effective Time, and, for the avoidance of doubt, only the beneficiary of these restrictions, the Company or SpinCo, as the case may be, shall be subject to the provisions of this Section 5), with respect to the 2016 Annual Meeting of Stockholders of the Company or of SpinCo, as applicable, and (ii) twenty-five days after the date that no Icahn Nominee (including for the avoidance of doubt any Replacement) serves on either the Board or the SpinCo Board (it being understood that if the Icahn Nominee gives the Company or SpinCo, as applicable, at least twenty-five days advance written notice of his or her intent to resign as a director prior to resigning, then the foregoing clause (ii) shall refer to the date that no Icahn Nominee (including for the

|

|

|

avoidance of doubt any Replacement) serves on either the Board or the SpinCo Board rather than thirty days after such date; it being further understood that if the Icahn Nominee is no longer a member of the Board or of the SpinCo Board due to circumstances in which the Icahn Group would be entitled to appoint a Replacement, an Icahn Nominee shall be deemed to continue to be a member of the Board and the SpinCo Board, as applicable, for all purposes of this Agreement until such time as the Icahn Group irrevocably waives in writing any right to either designate such a Replacement or appoint such a Replacement) (such waiver, the "Replacement Waiver") (such period, the "Standstill Period," provided that if the Board or the SpinCo Board, as applicable, has elected pursuant to Section 1(d) not to nominate the Icahn Nominee as a director for election at a Subsequent Meeting and the Icahn Nominee resigns from the Board prior to such Subsequent Meeting, then the Standstill Period shall expire on the effective date of the Icahn Nominee's resignation from the Board or the SpinCo Board, as applicable), no member of the Icahn Group shall, directly or indirectly, and each member of the Icahn Group shall cause each of the Icahn Affiliates not to, directly or indirectly, with respect to the Company and its controlled affiliates which are not publicly traded entities, provided that if the SpinCo Board Election has been made, then the restrictions below shall apply, from and after the Separation Effective Time until the end of the Standstill Period, with respect to SpinCo and its controlled affiliates which are not publicly traded entities instead of with respect to the Company (it being understood that the foregoing shall not restrict the Icahn Nominee from discussing such matters addressed below privately with other members of the Board solely in their capacities as a directors in a manner consistent with the Icahn Nominee's fiduciary duties to the Company):

|

|

(i)

|

solicit proxies or written consents of stockholders or conduct any other type of referendum (binding or non-binding) with respect to, or from the holders of, the voting securities of the Company or SpinCo, as applicable ("Voting Securities"), or become a "participant" (as such term is defined in Instruction 3 to Item 4 of Schedule 14A promulgated under the Exchange Act) in or assist any third party in any "solicitation" of any proxy, consent or other authority (as such terms are defined under the Exchange Act) to vote or withhold from voting any Voting Securities (other than such encouragement, advice or influence that is consistent with Company management's recommendation in connection with such matter);

|

|

(ii)

|

encourage, advise or influence any other person or assist any third party in so encouraging, assisting or influencing any person with respect to the giving or withholding of any proxy, consent or other authority to vote or in conducting any type of referendum (other than such encouragement, advice or influence that is consistent with Company management's recommendation in connection with such matter);

|

|

(iii)

|

form or join in a partnership, limited partnership, syndicate or a "group" as defined under Section 13(d) of the Exchange Act, with respect to the Voting Securities, or otherwise support or participate in any effort by a third party with respect to the matters set forth in this Section 5;

|

|

(iv)

|

present (or request to present) at any annual meeting or any special meeting of the Company's stockholders, any proposal for consideration for action by stockholders or propose (or request to propose) any nominee for election to the Board or seek representation on the Board or the removal of any member of the Board (or in each case the SpinCo Board, as applicable);

|

|

(v)

|

grant any proxy, consent or other authority to vote with respect to any matters (other than to the named proxies included in the Company's proxy card for any annual meeting or special meeting of stockholders) or deposit any Voting Securities in a voting trust or subject them to a voting agreement or other arrangement of similar effect (excluding customary brokerage accounts, margin accounts, prime brokerage accounts and the like), in each case, except as provided in Section 6 below;

|

|

(vi)

|

make any request under Section 220 of the Delaware General Corporation Law ("DGCL") or other applicable legal provisions regarding inspection of books and records or other materials (including stocklist materials);

|

|

(vii)

|

institute, solicit, assist or join, as a party, any litigation, arbitration or other proceeding against or involving the Company or any of its current or former directors or officers (including derivative actions) other than to enforce the provisions of this Agreement;

|

|

(viii)

|

until such time as a third party (not a party to this Agreement or an affiliate of a party) commences an unsolicited tender offer or exchange offer for all of the outstanding Voting Securities that is not recommended by the Board (or the SpinCo Board, as applicable) in its Recommendation Statement on Schedule 14D-9, acquire Beneficial Ownership of Voting Securities in an amount that would result in the Beneficial Ownership of the Icahn Group, together with all Icahn Affiliates, exceeding (in the aggregate with all other members of the Icahn Group and all Icahn Affiliates) 20% of the outstanding Voting Securities;

|

|

(ix)

|

without the prior approval of the Board (or the SpinCo Board, as applicable), separately or in conjunction with any other person or entity in which it is or proposes to be either a principal, partner or financing source or is acting or proposes to act as broker or agent for compensation, propose (publicly or to the Company) or participate in, effect or seek to effect, any tender offer or exchange offer, merger, acquisition, business combination, reorganization, restructuring, recapitalization, sale or acquisition of material assets, liquidation, or dissolution involving the Company or any of its subsidiaries or its or their securities or a material amount of the assets or businesses of the Company or any of its subsidiaries (collectively, an "Extraordinary Transaction"); provided that the members of the Icahn Group shall be permitted to sell or tender their Voting Securities, and otherwise receive consideration, pursuant to any Extraordinary Transaction and provided further that if a third party (not a party to this Agreement or an

|

|

|

affiliate of a party) commences an unsolicited tender offer or exchange offer for all of the outstanding Voting Securities that is not recommended by the Board (or the SpinCo Board, as applicable) in its Recommendation Statement on Schedule 14D-9, then the Icahn Group shall similarly be permitted to commence a tender offer or exchange offer for all of the outstanding Voting Securities at the same or higher consideration per share; or

|

|

(x)

|

request, directly or indirectly, any amendment or waiver of the foregoing in a manner that would reasonably likely require public disclosure by the Icahn Group or the Company.

|

From the date of this Agreement until the end of the Standstill Period, (1) the Icahn Group shall not directly or indirectly make, or cause to be made, by press release or similar public statement to the press or media (including social media), or in an SEC or other public filing, any statement or announcement that disparages (as distinct from objective statements reflecting business criticism of the Company or SpinCo but not of individual directors or officers) the Company, SpinCo or any of their respective officers or directors with respect to matters relating to their service at the Company or SpinCo (including any former officers or directors); and (2) neither the Company or SpinCo nor any of their respective officers or directors shall directly or indirectly make, or cause to be made, by press release or similar public statement to the press or media (including social media), or in an SEC or other public filing, any statement or announcement that disparages (as distinct from objective statements reflecting business criticism) any member of the Icahn Group or any of its officers or directors with respect to matters relating to the Company or SpinCo. For the avoidance of doubt, the foregoing restrictions shall not be deemed to apply to advisors of the Icahn Group or of the Company or SpinCo who are not acting at the behest of such party.

From the date of this Agreement until the end of the Standstill Period, (1) the Icahn Group shall not permit any of its controlled Affiliates to do any of the items in this Section 5 that the Icahn Group is restricted from doing and shall not publicly encourage or support any other person to take any of the actions described in this Section 5 that the Icahn Group is restricted from doing and (2) the Company or SpinCo, as applicable, shall not permit any of its controlled Affiliates to do any of the items in this Section 5 that the Company or SpinCo, as applicable, is restricted from doing and shall not publicly encourage or support any other person to take any of the actions described in this Section 5 that the Company or SpincCo is restricted from doing .

|

6.

|

Voting Commitment. Unless the Company or SpinCo, as applicable, has materially breached this Agreement and failed to cure within five business days following receipt of written notice from the Icahn Group, during the Standstill Period, each member of the Icahn Group shall (1) cause, in the case of all Voting Securities owned of record, and (2) instruct the record owner, in the case of all shares of Voting Securities Beneficially Owned but not owned of record, directly or indirectly, by it, or by any Icahn Affiliate, in each case as of the record date for any annual meeting of stockholders or any special meeting of stockholders of the Company or SpinCo within the Standstill Period, in each case that are

|

|

|

entitled to vote at any such annual or special meeting, to be present for quorum purposes and to be voted, at all such annual or special meetings or at any adjournments or postponements thereof (in each case with respect to the Company unless the SpinCo Board Election is made, in which case these provisions shall apply to SpinCo, but not the Company, from and after the Separation Effective Time) through the 2015 Annual Meeting and for so long thereafter as the Icahn Nominee is either appointed by the applicable board or will otherwise continue to be on the applicable board after any such meeting, (i) for all directors nominated by the Board or the SpinCo Board, as applicable, for election at such annual or special meeting, and (ii) against any directors proposed that are not nominated by the Board or the SpinCo Board, as applicable, for election at such annual or special meeting and against any proposals not recommended by the Board or the SpinCo Board, as applicable, relating to removing any directors of the Board or otherwise changing the composition of the Board. Except as provided in the foregoing sentence, the Icahn Group shall not be restricted from voting "For", "Against" or "Abstaining" from any other proposals at any annual or special meeting of the Company or SpinCo.

|

|

7.

|

Public Announcement. No earlier than 8:00 a.m., New York City time, on the date hereof, the Company and the Icahn Group shall announce this Agreement and the material terms hereof by means of a press release in the form attached hereto as Exhibit A (the "Press Release"). Neither the Company nor the Icahn Group shall make any public announcement or statement that contradicts or disagrees with the statements made in the Press Release, except as required by law or the rules of any stock exchange or with the prior written consent of the other party.

|

|

8.

|

Representations and Warranties of All Parties; Representations and Warranties of the Icahn Group.

|

|

(a)

|

Each of the parties represents and warrants to the other party that: (a) such party has all requisite company power and authority to execute and deliver this Agreement and to perform its obligations hereunder; (b) this Agreement has been duly and validly authorized, executed and delivered by it and is a valid and binding obligation of such party, enforceable against such party in accordance with its terms; (c) this Agreement will not result in a violation of any terms or conditions of any agreements to which such person is a party or by which such party may otherwise be bound or of any law, rule, license, regulation, judgment, order or decree governing or affecting such party; and (d) there is currently no pending or outstanding litigation between the Icahn Group and the Company or affiliates thereof.

|

|

(b)

|

Each member of the Icahn Group jointly represents and warrants that, as of the date of this Agreement, (i) the Icahn Group collectively Beneficially Own, an aggregate of 46,271,370 shares of Common Stock, par value $0.001, of the Company ("Common Stock"); (ii) except for such ownership, no member of the Icahn Group, individually or in the aggregate with all other members of the Icahn Group and Icahn Affiliates, has any other Beneficial Ownership of, and/or economic exposure to, any Voting Securities, including through any derivative transaction described in the definition of "Beneficial Ownership" above; and (iii) the Icahn Group, collectively with the Icahn Affiliates, have a Net Long Position of 46,271,370 shares of Common Stock. As used in this Agreement, the term

|

|

|

"Beneficial Ownership" of "Voting Securities" means ownership of: (i) Voting Securities, (ii) rights or options to own or acquire any Voting Securities (whether such right or option is exercisable immediately or only after the passage of time or upon the satisfaction of one or more conditions (whether or not within the control of such person), compliance with regulatory requirements or otherwise) and (iii) any other economic exposure to Voting Securities, including through any derivative transaction that gives any such person or any of such person's controlled Affiliates the economic equivalent of ownership of an amount of Voting Securities due to the fact that the value of the derivative is explicitly determined by reference to the price or value of Voting Securities, or which provides such person or any of such person's controlled Affiliates an opportunity, directly or indirectly, to profit, or to share in any profit, derived from any increase in the value of Voting Securities, in any case without regard to whether (x) such derivative conveys any voting rights in Voting Securities to such person or any of such person's Affiliates, (y) the derivative is required to be, or capable of being, settled through delivery of Voting Securities, or (z) such person or any of such person's Affiliates may have entered into other transactions that hedge the economic effect of such Beneficial Ownership of Voting Securities. For purposes of this Section, no Person shall be, or be deemed to be, the "Beneficial Owner" of, or to "beneficially own," any securities beneficially owned by any director of the Company to the extent such securities were acquired directly from the Company by such director as or pursuant to director compensation for serving as a director of the Company.

|

|

9.

|

Resignation. Any provision in this Agreement to the contrary notwithstanding, if at any time after the date of this Agreement, the Icahn Group, together with all controlled Affiliates of the members of the Icahn Group (such controlled Affiliates, collectively and individually, the "Icahn Affiliates"), ceases collectively to beneficially own (as defined in Rule 13d-3 promulgated by the SEC under the Securities Exchange Act of 1934, as amended (the "Exchange Act")), an aggregate Net Long Position in at least fifty percent (50%) of the number of Voting Securities set forth in Section 8(b) (as adjusted for any stock dividends, combinations, splits, recapitalizations and the like) of the shares of Common Stock of the Company or SpinCo outstanding as of such time or the Icahn Group materially breaches this Agreement or the Confidentiality Agreement and fails to cure such breach within five business days of written notice from the Company specifying any such breach, (1) the Icahn Group shall cause the Icahn Nominee to promptly tender his resignation from the Board and/or the SpinCo Board and any committee of the Board and/or the SpinCo Board on which he then sits and (2) the Company (and SpinCo) shall have no further obligations under this Agreement. In furtherance of the immediately preceding sentence, the Icahn Nominee shall, prior to his appointment to the Board and, if the SpinCo Board Election is made, the SpinCo Board, and each member of the Icahn Group shall cause the Icahn Nominee to, execute an irrevocable resignation as director in the form attached hereto as Exhibit B and deliver it to the Company and, as applicable, SpinCo. The Icahn Group shall keep the Company regularly apprised of the Net Long Position of the Icahn Group and the Icahn Affiliates. For purposes of this Agreement: the term "Affiliate" shall have the meaning set forth in Rule 12b-2 promulgated by the SEC under the Exchange Act and the term "Net Long Position" shall mean: such shares of Common Stock beneficially owned, directly or indirectly, that constitute such person's net long position as defined in Rule 14e-4 under the Exchange Act mutatis mutandis, provided that "Net Long Position" shall not include any shares as to which such person does not

|

|

|

have the right to vote or direct the vote or as to which such person has entered into a derivative or other agreement, arrangement or understanding that hedges or transfers, in whole or in part, directly or indirectly, any of the economic consequences of ownership of such shares.

|

|

10.

|

Remedies; Forum and Governing Law. The parties hereto recognize and agree that if for any reason any of the provisions of this Agreement are not performed in accordance with their specific terms or are otherwise breached, immediate and irreparable harm or injury would be caused for which money damages would not be an adequate remedy. Accordingly, each party agrees that in addition to other remedies the other party shall be entitled to at law or equity, the other party shall be entitled to an injunction or injunctions to prevent breaches of this Agreement and to enforce specifically the terms and provisions of this Agreement exclusively in the Court of Chancery or other federal or state courts of the State of Delaware. In the event that any action shall be brought in equity to enforce the provisions of this Agreement, no party shall allege, and each party hereby waives the defense, that there is an adequate remedy at law. Furthermore, each of the parties hereto (a) consents to submit itself to the personal jurisdiction of the Court of Chancery or other federal or state courts of the State of Delaware in the event any dispute arises out of this Agreement or the transactions contemplated by this Agreement, (b) agrees that it shall not attempt to deny or defeat such personal jurisdiction by motion or other request for leave from any such court, (c) agrees that it shall not bring any action relating to this Agreement or the transactions contemplated by this Agreement in any court other than the Court of Chancery or other federal or state courts of the State of Delaware, and each of the parties irrevocably waives the right to trial by jury, (d) agrees to waive any bonding requirement under any applicable law, in the case any other party seeks to enforce the terms by way of equitable relief and (e) irrevocably consents to service of process by a reputable overnight mail delivery service, signature requested, to the address of such party's principal place of business or as otherwise provided by applicable law. THIS AGREEMENT SHALL BE GOVERNED IN ALL RESPECTS, INCLUDING VALIDITY, INTERPRETATION AND EFFECT, BY THE LAWS OF THE STATE OF DELAWARE APPLICABLE TO CONTRACTS EXECUTED AND TO BE PERFORMED WHOLLY WITHIN SUCH STATE WITHOUT GIVING EFFECT TO THE CHOICE OF LAW PRINCIPLES OF SUCH STATE.

|

|

11.

|

No Waiver. Any waiver by any party of a breach of any provision of this Agreement shall not operate as or be construed to be a waiver of any other breach of such provision or of any breach of any other provision of this Agreement. The failure of a party to insist upon strict adherence to any term of this Agreement on one or more occasions shall not be considered a waiver or deprive that party of the right thereafter to insist upon strict adherence to that term or any other term of this Agreement.

|

|

12.

|

Entire Agreement; Prior Agreement. This Agreement and the Confidentiality Agreement contain the entire understanding of the parties with respect to the subject matter hereof and may be amended only by an agreement in writing executed by the parties hereto. The parties hereby confirm and agree that each of the Agreement, dated April 10, 2014, by and among the Icahn Group and the Company and the Confidentiality Agreement shall remain in full force and effect in accordance with their respective terms.

|

|

13.

|

Notices. All notices, consents, requests, instructions, approvals and other communications provided for herein and all legal process in regard hereto shall be in writing and shall be deemed validly given, made or served, if (a) given by telecopy and email, when such telecopy and email is transmitted to the telecopy number set forth below and sent to the email address set forth below and the appropriate confirmation is received or (b) if given by any other means, when actually received during normal business hours at the address specified in this subsection:

|

|

|

eBay Inc.

|

|

|

|

2065 Hamilton Avenue

|

|

| |

San Jose, California 95125 |

|

|

|

Facsimile: 408-376-7514 |

|

|

|

Attention:

|

Michael R. Jacobson, Esq.

|

|

|

|

Senior Vice President, Legal Affairs, General

Counsel and Secretary

|

| |

Email: |

mikej@ebay.com |

|

|

|

|

|

|

With a copy to (which shall not constitute notice):

|

|

|

Wachtell, Lipton, Rosen & Katz

|

|

|

|

51 West 52nd Street

|

|

| |

New York, NY 10019 |

|

|

|

Facsimile: 212-403-2000 |

|

|

|

Attention:

|

Trevor S. Norwitz

|

|

|

|

Sabastian V. Niles |

| |

Email: |

TSNorwitz@wlrk.com |

|

|

|

SVNiles@wlrk.com |

|

|

Icahn Associates Corp.

|

|

|

|

767 Fifth Avenue, 47th Floor

|

|

| |

New York, New York 10153 |

|

|

|

Attention: Carl C. Icahn |

Keith Cozza

|

| |

Facsimile: (212) 750-5807 |

(212) 702-4323 |

| |

Email: sgordon@sfire.com |

kcozza@sfire.com |

|

|

With a copy to (which shall not constitute notice):

|

|

|

Icahn Associates Corp.

|

|

|

|

767 Fifth Avenue, 47th Floor

|

|

|

|

New York, New York 10153

|

|

|

|

Attention: Jesse Lynn |

|

|

|

Facsimile: (917) 591-3310

|

|

|

|

Email: jlynn@sfire.com |

|

|

14.

|

Severability. If at any time subsequent to the date hereof, any provision of this Agreement shall be held by any court of competent jurisdiction to be illegal, void or unenforceable, such provision shall be of no force and effect, but the illegality or unenforceability of such provision shall have no effect upon the legality or enforceability of any other provision of this Agreement.

|

|

15.

|

Counterparts. This Agreement may be executed in two or more counterparts (including by facsimile or PDF) which together shall constitute a single agreement.

|

|

16.

|

Successors and Assigns. This Agreement shall not be assignable or assigned, directly or indirectly, by operation of law or otherwise, by any of the parties to this Agreement.

|

|

17.

|

No Third Party Beneficiaries. This Agreement is solely for the benefit of the parties hereto and is not enforceable by any other persons; provided that from and after the Separation Effective Time, SpinCo shall be a beneficiary of this Agreement, both SpinCo and the Company shall be bound to this Agreement as applicable (and for the avoidance of doubt the Icahn Group shall remain bound), and for purposes of enforcement of this Agreement only, references herein to the "Company" shall also be deemed to refer to SpinCo.

|

|

18.

|

Fees and Expenses. Neither the Company (nor SpinCo), on the one hand, nor the Icahn Group, on the other hand, will be responsible for any fees or expenses of the other in connection with this Agreement.

|

|

19.

|

Interpretation and Construction. Each of the parties hereto acknowledges that it has been represented by counsel of its choice throughout all negotiations that have preceded the execution of this Agreement, and that it has executed the same with the advice of said independent counsel. Each party and its counsel cooperated and participated in the drafting and preparation of this Agreement and the documents referred to herein, and any and all drafts relating thereto exchanged among the parties shall be deemed the work product of all of the parties and may not be construed against any party by reason of its drafting or preparation. Accordingly, any rule of law or any legal decision that would require interpretation of any ambiguities in this Agreement against any party that drafted or prepared it is of no application and is hereby expressly waived by each of the parties hereto, and any controversy over interpretations of this Agreement shall be decided without regards to events of drafting or preparation. The section headings contained in this Agreement are for reference purposes only and shall not affect in any way the meaning or interpretation of this Agreement. The term "including" shall be deemed to mean "including without limitation" in all instances.

|

[Signature Pages Follow]

IN WITNESS WHEREOF, each of the parties hereto has executed this Agreement, or caused the same to be executed by its duly authorized representative as of the date first above written.

|

|

Very truly yours, |

| |

|

| |

EBAY INC. |

| |

|

|

|

By: _/s/ Michael R. Jacobson_____________

|

|

|

Name: Michael R. Jacobson

|

|

|

Title: Senior Vice President

|

[Signature Page to Agreement between the Icahn Group and eBay]

Accepted and agreed as of the date first written above:

| |

MR. CARL C. ICAHN |

| |

|

|

|

_/c/ Carl C. Icahn________________

|

|

|

Carl C. Icahn

|

| |

MR. JONATHAN CHRISTODORO |

| |

|

|

|

__/c/ Jonathan Christodoro ________

|

|

|

Jonathan Christodoro

|

| |

HIGH RIVER LIMITED PARTNERSHIP |

| |

|

|

|

By: __/c/ Keith Cozza________

|

|

|

Name: Keith Cozza

|

|

|

Title: Authorized Signatory

|

| |

HOPPER INVESTMENTS LLC |

| |

|

|

|

By: __/c/ Keith Cozza________

|

|

|

Name: Keith Cozza

|

|

|

Title: Authorized Signatory

|

| |

BARBERRY CORP. |

| |

|

|

|

By: __/c/ Keith Cozza________

|

|

|

Name: Keith Cozza

|

|

|

Title: Authorized Signatory

|

| |

ICAHN PARTNERS LP |

| |

|

|

|

By: __/c/ Keith Cozza________

|

|

|

Name: Keith Cozza

|

|

|

Title: Authorized Signatory

|

| |

ICAHN PARTNERS MASTER FUND LP |

| |

|

|

|

By: __/c/ Keith Cozza________

|

|

|

Name: Keith Cozza

|

|

|

Title: Authorized Signatory

|

[Signature Page to Agreement between the Icahn Group and eBay]

| |

ICAHN ENTERPRISES G.P. INC. |

| |

|

|

|

By: __/c/ Keith Cozza________

|

|

|

Name: Keith Cozza

|

|

|

Title: Authorized Signatory

|

| |

ICAHN ENTERPRISES HOLDINGS L.P. |

| |

|

|

|

By: __/c/ Keith Cozza________

|

|

|

Name: Keith Cozza

|

|

|

Title: Authorized Signatory

|

| |

IPH GP LLC |

| |

|

|

|

By: __/c/ Keith Cozza________

|

|

|

Name: Keith Cozza

|

|

|

Title: Authorized Signatory

|

| |

ICAHN CAPITAL LP |

| |

|

|

|

By: __/c/ Keith Cozza________

|

|

|

Name: Keith Cozza

|

|

|

Title: Authorized Signatory

|

| |

ICAHN ONSHORE LP |

| |

|

|

|

By: __/c/ Keith Cozza________

|

|

|

Name: Keith Cozza

|

|

|

Title: Authorized Signatory

|

| |

ICAHN OFFSHORE LP |

| |

|

|

|

By: __/c/ Keith Cozza________

|

|

|

Name: Keith Cozza

|

|

|

Title: Authorized Signatory

|

| |

BECKTON CORP |

| |

|

|

|

By: __/c/ Keith Cozza________

|

|

|

Name: Keith Cozza

|

|

|

Title: Authorized Signatory

|

[Signature Page to Agreement between the Icahn Group and eBay]

SCHEDULE A

------------------------------

MR. CARL C. ICAHN

HIGH RIVER LIMITED PARTNERSHIP

HOPPER INVESTMENTS LLC

BARBERRY CORP.

ICAHN PARTNERS LP

ICAHN PARTNERS MASTER FUND LP

ICAHN ENTERPRISES G.P. INC.

ICAHN ENTERPRISES HOLDINGS L.P.

IPH GP LLC

ICAHN CAPITAL LP

ICAHN ONSHORE LP

ICAHN OFFSHORE LP

BECKTON CORP.

Schedule A

EXHIBIT A

[PRESS RELEASE]

A-1

EXHIBIT B

IRREVOCABLE RESIGNATION RE: NOMINATION AND STANDSTILL AGREEMENT

Re: Resignation

Ladies and Gentlemen:

This irrevocable resignation is delivered pursuant to Sections 1 and 9 of that certain Nomination and Standstill Agreement, dated January __, 2015, between eBay Inc. and the members of the Icahn Group signatory thereto (the "Agreement"). Capitalized terms used herein but not defined shall have the meaning set forth in the Agreement. Effective only upon, and subject to, such time as (X) the Icahn Group, together with all of the Icahn Affiliates, ceases collectively to "beneficially own" (as defined in Rule 13d-3 under the Exchange Act) an aggregate Net Long Position of at least 23,135,685 shares of Common Stock (as adjusted for any stock dividends, combinations, splits, recapitalizations and the like) or (Y) the Icahn Group materially breaches the Agreement or the Confidentiality Agreement and fails to cure such breach within five business days of written notice from the Company specifying any such breach, I hereby resign from my position as a director of the Company and from any and all committees of the Board on which I serve.

[Signature Page Follows]

|

|

Sincerely,

|

|

|

|

|

|

_____________________________

|

|

|

Name:

|

B-1

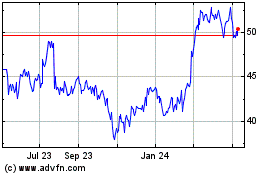

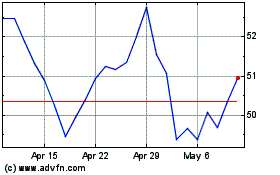

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

eBay (NASDAQ:EBAY)

Historical Stock Chart

From Apr 2023 to Apr 2024