|

| | |

UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

| | |

FORM 8-K |

| | |

CURRENT REPORT |

| | |

PURSUANT TO SECTION 13 OR 15(d) OF |

THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

Date of Report (Date of earliest event reported): January 21, 2015 |

| | |

1st Source Corporation |

(Exact name of registrant as specified in its charter) |

| | |

Indiana | 0-6233 | 35-1068133 |

(State or other jurisdiction of incorporation) | (Commission File No.) | (I.R.S. Employer Identification No.) |

| | |

100 North Michigan Street, South Bend, Indiana 46601 |

(Address of principal executive offices) (Zip Code) |

| | |

574-235-2000 |

(Registrant's telephone number, including area code) |

| | |

Not Applicable |

(Former name or former address, if changed since last report) |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

|

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 2.02 Results of Operations and Financial Condition.

On January 21, 2015, 1st Source Corporation issued a press release that announced its fourth quarter earnings for 2014. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated by reference herein.

ITEM 9.01 Financial Statements and Exhibits.

Exhibit 99.1: Press release dated January 21, 2015, with respect to 1st Source Corporation’s financial results for the fourth quarter ended December 31, 2014.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | 1st SOURCE CORPORATION |

| | (Registrant) |

| | |

| | |

Date: January 21, 2015 | | /s/ CHRISTOPHER J. MURPHY III |

| | Christopher J. Murphy III |

| | Chairman of the Board and CEO |

| | |

| | |

Date: January 21, 2015 | | /s/ ANDREA G. SHORT |

| | Andrea G. Short |

| | Treasurer and Chief Financial Officer |

| | Principal Accounting Officer |

Exhibit 99.1

|

| | | |

For: | Immediate Release | Contact: | Andrea Short |

| January 21, 2015 | | 574-235-2000 |

1st Source Corporation Reports Another Year of Record Earnings,

History of Increased Dividends Continues

South Bend, IN - 1st Source Corporation (NASDAQ:SRCE), parent company of 1st Source Bank, today announced record net income of $58.07 million for the year of 2014, a 5.66% increase over the $54.96 million in 2013. The annual net income is the highest in company history. Fourth quarter net income was $15.00 million, up 9.33% compared to $13.72 million in the fourth quarter of 2013.

Diluted net income per common share for the year was $2.39, another all-time record and an increase of 7.17% over the $2.23 per common share a year earlier. Diluted net income per common share for the fourth quarter was $0.62, up 10.71% compared to $0.56 per common share reported in the fourth quarter of the previous year.

At its January 2015 meeting, the 1st Source Board of Directors approved a cash dividend of $0.18 per common share. The cash dividend is payable on February 13, 2015 to shareholders of record on February 3, 2015. Dividends for 2014 increased 4.41% over the previous year.

According to Christopher J. Murphy, III, Chairman, "I am pleased to report a steady fourth quarter and another solid year for 1st Source Corporation. We achieved record earnings yet again and continued our streak of 27 years of consecutive dividend growth. It was also a year of celebration, as we began our 151st year of helping clients achieve security, build wealth and realize their dreams. We increased our primary client relationships in all of our markets. We were also able to decrease our nonperforming assets and grow our loan and lease outstandings by almost $140 million during the year, while reducing our exposure to some more risk challenged markets."

"We ended the year having refurbished six banking centers and opening two new ones in Fort Wayne, Indiana. The grand openings marked the completion of an $8 million investment in that market, the second largest city in Indiana. This allows us to increase our market share in an attractive market and provide a level of convenience and service previously not available," Murphy concluded.

Total assets at the end of 2014 were $4.83 billion, up 2.27% from the same period last year. Total loans and leases at December 31, 2014 were $3.69 billion, up 3.92%, and total deposits at December 31, 2014 were $3.80 billion, up 4.08% from the same period last year. As of December 31, 2014, the common equity-to-assets ratio was 12.72%, compared to 12.39% at December 31, 2013 and the tangible common equity-to-tangible assets ratio was 11.15% at December 31, 2014 compared to 10.76% at December 31, 2013.

The net interest margin was 3.61% for the fourth quarter of 2014 versus 3.59% for the same period in 2013. The net interest margin was 3.59% for the year ending December 31, 2014 versus 3.67% for the year ending December 31, 2013. Tax-equivalent net interest income was $41.29 million for the fourth quarter of 2014, up 4.53% compared

to $39.50 million for 2013’s fourth quarter. For the twelve months of 2014, tax-equivalent net interest income was $162.17 million, up 2.22% compared to $158.64 million for the twelve months of 2013.

Reserve for loan and lease losses as of December 31, 2014 was 2.31% of total loans and leases, compared to 2.35% as of December 31, 2013. Net charge-offs were $1.51 million for the fourth quarter 2014, compared to $0.14 million in the fourth quarter 2013. Net charge-offs for the full year were $2.17 million in 2014 compared to $0.58 million in 2013. There was a recovery of provision for loan and lease losses of $0.82 million in the fourth quarter of 2014, compared with $0.86 million for the same period in 2013. For the twelve months of 2014, the provision for loan and lease losses was $3.73 million compared with $0.77 million for the twelve months of 2013. The ratio of nonperforming assets to net loans and leases was 1.13% on December 31, 2014, compared to 1.29% on December 31, 2013.

Noninterest income for the fourth quarter of 2014 was $19.88 million, up 10.51% compared to $17.99 million for the fourth quarter of 2013. The fourth quarter increase was primarily a result of higher trust fees, increased equipment rental income and higher debit card income. For the year, noninterest income was $77.89 million, up slightly from $77.21 million in 2013.

Noninterest expense for the fourth quarter of 2014 was $41.99 million, up 8.81% compared to $38.59 million for the fourth quarter of 2013. The leading factors for the fourth quarter increase were higher salary and employee benefits expense, other expenses, depreciation on leased equipment, business development and marketing expenses, loan and lease collection and repossession expenses and professional fees. For the year ending December 31, 2014, noninterest expense was $150.04 million, up slightly from $149.31 million one year ago.

The provision for income taxes included a one-time benefit of $2.12 million and $3.30 million for the three and twelve months ended December 31, 2014, respectively, which resulted in a lower effective tax rate. These benefits were the result of a reduction in uncertain tax positions due to settlements with taxing authorities and the lapse of the applicable statute of limitations.

1st Source common stock is traded on the NASDAQ Global Select Market under “SRCE” and appears in the National Market System tables in many daily newspapers under the code name “1st Src.” Since 1863, 1st Source has been committed to the success of the communities it serves. For more information, visit www.1stsource.com.

1st Source serves the northern half of Indiana and southwest Michigan and is the largest locally controlled financial institution headquartered in the area. While delivering a comprehensive range of consumer and commercial banking services through its community bank offices, 1st Source has distinguished itself with highly personalized services. 1st Source Bank also competes for business nationally by offering specialized financing services for new and used private and cargo aircraft, automobiles for leasing and rental agencies, medium and heavy duty trucks, construction and environmental equipment. The Corporation includes 80 community banking centers in 17 counties, 9 trust and wealth management locations, 8 1st Source Insurance offices, as well as 21 specialty finance locations nationwide.

In addition to the results presented in accordance with generally accepted accounting principles in the United States of America, this press release contains certain non-GAAP financial measures. 1st Source Corporation believes that providing non-GAAP financial measures provides investors with information useful to understanding our financial performance. Additionally, these non-GAAP measures are used by management for planning and forecasting purposes, including measures based on “tangible equity” which is “common shareholders’ equity” excluding intangible assets.

Except for historical information contained herein, the matters discussed in this document express “forward-looking statements.” Generally, the words “believe,” “contemplate,” “seek,” “plan,” “possible,” “assume,” “expect,” “intend,” “targeted,” “continue,” “remain,” “estimate,” “anticipate,” “project,” “will,” “should,” “indicate,” “would,” “may” and similar expressions indicate forward-looking statements. Those statements, including statements, projections, estimates or assumptions concerning future events or performance, and other statements that are other than statements of historical fact, are subject to material risks and uncertainties. 1st Source cautions readers not to place undue reliance on any forward-looking statements, which speak only as of the date made.

1st Source may make other written or oral forward-looking statements from time to time. Readers are advised that various important factors could cause 1st Source’s actual results or circumstances for future periods to differ materially from those anticipated or projected in such forward-looking statements. Such factors, among others, include changes in laws, regulations or accounting principles generally accepted in the United States; 1st Source’s competitive position within its markets served; increasing consolidation within the banking industry; unforeseen changes in interest rates; unforeseen downturns in the local, regional or national economies or in the industries in which 1st Source has credit concentrations; and other risks discussed in 1st Source’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K, which filings are available from the SEC. 1st Source undertakes no obligation to publicly update or revise any forward-looking statements.

# # #

(charts attached)

|

| | | | | | | | | | | | | | | | | | |

1st SOURCE CORPORATION | | | | | | | | | | |

4th QUARTER 2014 FINANCIAL HIGHLIGHTS | | | | | | | | | |

(Unaudited - Dollars in thousands, except per share amounts) | | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| | 2014 | 2013 | | 2014 | 2013 |

END OF PERIOD BALANCES | | | | | | | | | | |

Assets | | | | | | | $ | 4,829,958 |

| | $ | 4,722,826 |

| |

Loans and leases | | | | | | | 3,688,574 |

| | 3,549,324 |

| |

Deposits | | | | | | | 3,802,860 |

| | 3,653,650 |

| |

Reserve for loan and lease losses | | | | | | | 85,068 |

| | 83,505 |

| |

Intangible assets | | | | | | | 85,371 |

| | 86,343 |

| |

Common shareholders' equity | | | | | | | 614,473 |

| | 585,378 |

| |

| | | | | | | | | | |

AVERAGE BALANCES | | | | | | | | | | |

Assets | | $ | 4,839,479 |

| | $ | 4,649,245 |

| | | $ | 4,806,805 |

| | $ | 4,607,949 |

| |

Earning assets | | 4,536,441 |

| | 4,362,005 |

| | | 4,513,631 |

| | 4,325,907 |

| |

Investments | | 812,497 |

| | 837,180 |

| | | 822,021 |

| | 840,798 |

| |

Loans and leases | | 3,651,994 |

| | 3,487,900 |

| | | 3,639,985 |

| | 3,433,938 |

| |

Deposits | | 3,844,239 |

| | 3,720,299 |

| | | 3,777,743 |

| | 3,700,509 |

| |

Interest bearing liabilities | | 3,361,111 |

| | 3,281,486 |

| | | 3,395,591 |

| | 3,286,558 |

| |

Common shareholders' equity | | 611,960 |

| | 587,442 |

| | | 601,892 |

| | 575,662 |

| |

| | | | | | | | | | |

INCOME STATEMENT DATA | | | | | | | | | | |

Net interest income | | $ | 40,839 |

| | $ | 39,034 |

| | | $ | 160,329 |

| | $ | 156,817 |

| |

Net interest income - FTE | | 41,285 |

| | 39,495 |

| | | 162,168 |

| | 158,643 |

| |

(Recovery of) provision for loan and lease losses | | (820 | ) | | (859 | ) | | | 3,733 |

| | 772 |

| |

Noninterest income | | 19,876 |

| | 17,985 |

| | | 77,887 |

| | 77,212 |

| |

Noninterest expense | | 41,991 |

| | 38,590 |

| | | 150,040 |

| | 149,314 |

| |

Net income | | 14,996 |

| | 13,716 |

| | | 58,069 |

| | 54,958 |

| |

| | | | | | | | | | |

PER SHARE DATA | | | | | | | | | | |

Basic net income per common share | | $ | 0.62 |

| | $ | 0.56 |

| | | $ | 2.39 |

| | $ | 2.23 |

| |

Diluted net income per common share | | 0.62 |

| | 0.56 |

| | | 2.39 |

| | 2.23 |

| |

Common cash dividends declared | | 0.18 |

| | 0.17 |

| | | 0.71 |

| | 0.68 |

| |

Book value per common share | | 25.75 |

| | 24.07 |

| | | 25.75 |

| | 24.07 |

| |

Tangible book value per common share | | 22.17 |

| | 20.52 |

| | | 22.17 |

| | 20.52 |

| |

Market value - High | | 35.22 |

| | 32.92 |

| | | 35.22 |

| | 32.92 |

| |

Market value - Low | | 28.00 |

| | 25.64 |

| | | 27.56 |

| | 21.88 |

| |

Basic weighted average common shares outstanding | | 23,862,382 |

| | 24,322,516 |

| | | 24,031,608 |

| | 24,344,623 |

| |

Diluted weighted average common shares outstanding | | 23,862,382 |

| | 24,323,158 |

| | | 24,031,608 |

| | 24,345,209 |

| |

| | | | | | | | | | |

KEY RATIOS | | | | | | | | | | |

Return on average assets | | 1.23 |

| % | 1.17 |

| % | | 1.21 |

| % | 1.19 |

| % |

Return on average common shareholders' equity | | 9.72 |

| | 9.26 |

| | | 9.65 |

| | 9.55 |

| |

Average common shareholders' equity to average assets | | 12.65 |

| | 12.64 |

| | | 12.52 |

| | 12.49 |

| |

End of period tangible common equity to tangible assets | | 11.15 |

| | 10.76 |

| | | 11.15 |

| | 10.76 |

| |

Risk-based capital - Tier 1 | | 14.57 |

| | 14.54 |

| | | 14.57 |

| | 14.54 |

| |

Risk-based capital - Total | | 15.89 |

| | 15.86 |

| | | 15.89 |

| | 15.86 |

| |

Net interest margin | | 3.61 |

| | 3.59 |

| | | 3.59 |

| | 3.67 |

| |

Efficiency: expense to revenue | | 67.56 |

| | 66.25 |

| | | 60.62 |

| | 62.44 |

| |

Net charge offs to average loans and leases | | 0.16 |

| | 0.02 |

| | | 0.06 |

| | 0.02 |

| |

Loan and lease loss reserve to loans and leases | | 2.31 |

| | 2.35 |

| | | 2.31 |

| | 2.35 |

| |

Nonperforming assets to loans and leases | | 1.13 |

| | 1.29 |

| | | 1.13 |

| | 1.29 |

| |

| | | | | | | | | | |

ASSET QUALITY | | | | | | | | | | |

Loans and leases past due 90 days or more | | | | | | | $ | 981 |

| | $ | 287 |

| |

Nonaccrual loans and leases | | | | | | | 34,602 |

| | 36,707 |

| |

Other real estate | | | | | | | 1,109 |

| | 4,539 |

| |

Former bank premises held for sale | | | | | | | 626 |

| | 951 |

| |

Repossessions | | | | | | | 5,156 |

| | 4,262 |

| |

Equipment owned under operating leases | | | | | | | 6 |

| | — |

| |

Total nonperforming assets | | | | | | | $ | 42,480 |

| | $ | 46,746 |

| |

|

| | | | | | | | |

1st SOURCE CORPORATION | | | | |

CONSOLIDATED STATEMENTS OF FINANCIAL CONDITION | | | | |

(Unaudited - Dollars in thousands) | | | | |

| | December 31, 2014 | | December 31, 2013 |

ASSETS | | | | |

Cash and due from banks | | $ | 64,834 |

| | $ | 77,568 |

|

Federal funds sold and interest bearing deposits with other banks | | 1,356 |

| | 2,484 |

|

Investment securities available-for-sale (amortized cost of $776,057 and $822,163 at December 31, 2014 and 2013, respectively) | | 791,118 |

| | 832,700 |

|

Other investments | | 20,801 |

| | 22,400 |

|

Trading account securities | | 205 |

| | 192 |

|

Mortgages held for sale | | 13,604 |

| | 6,079 |

|

| | | | |

Loans and leases, net of unearned discount: | | | | |

Commercial and agricultural loans | | 710,758 |

| | 679,492 |

|

Auto and light truck | | 397,902 |

| | 391,649 |

|

Medium and heavy duty truck | | 247,153 |

| | 237,854 |

|

Aircraft financing | | 727,665 |

| | 738,133 |

|

Construction equipment financing | | 399,940 |

| | 333,088 |

|

Commercial real estate | | 616,587 |

| | 583,997 |

|

Residential real estate | | 445,759 |

| | 460,981 |

|

Consumer loans | | 142,810 |

| | 124,130 |

|

Total loans and leases | | 3,688,574 |

| | 3,549,324 |

|

Reserve for loan and lease losses | | (85,068 | ) | | (83,505 | ) |

Net loans and leases | | 3,603,506 |

| | 3,465,819 |

|

| | | | |

Equipment owned under operating leases, net | | 74,143 |

| | 60,967 |

|

Net premises and equipment | | 50,328 |

| | 46,630 |

|

Goodwill and intangible assets | | 85,371 |

| | 86,343 |

|

Accrued income and other assets | | 124,692 |

| | 121,644 |

|

| | | | |

Total assets | | $ | 4,829,958 |

| | $ | 4,722,826 |

|

| | | | |

LIABILITIES | | | | |

Deposits: | | | | |

Noninterest bearing | | $ | 796,241 |

| | $ | 735,212 |

|

Interest bearing | | 3,006,619 |

| | 2,918,438 |

|

Total deposits | | 3,802,860 |

| | 3,653,650 |

|

| | | | |

Short-term borrowings: | | | | |

Federal funds purchased and securities sold under agreements to repurchase | | 138,843 |

| | 181,120 |

|

Other short-term borrowings | | 106,979 |

| | 133,011 |

|

Total short-term borrowings | | 245,822 |

| | 314,131 |

|

Long-term debt and mandatorily redeemable securities | | 56,232 |

| | 58,335 |

|

Subordinated notes | | 58,764 |

| | 58,764 |

|

Accrued expenses and other liabilities | | 51,807 |

| | 52,568 |

|

Total liabilities | | 4,215,485 |

| | 4,137,448 |

|

| | | | |

SHAREHOLDERS' EQUITY | | | | |

Preferred stock; no par value | | — |

| | — |

|

Common stock; no par value | | 346,535 |

| | 346,535 |

|

Retained earnings | | 302,242 |

| | 261,626 |

|

Cost of common stock in treasury | | (43,711 | ) | | (29,364 | ) |

Accumulated other comprehensive income | | 9,407 |

| | 6,581 |

|

Total shareholders' equity | | 614,473 |

| | 585,378 |

|

| | | | |

Total liabilities and shareholders' equity | | $ | 4,829,958 |

| | $ | 4,722,826 |

|

|

| | | | | | | | | | | | | | | |

1st SOURCE CORPORATION | | | | | | | |

CONSOLIDATED STATEMENTS OF INCOME | | | | | | | |

(Unaudited - Dollars in thousands) | | | | | | | |

| Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| 2014 | | 2013 | | 2014 | | 2013 |

Interest income: | | | | | | | |

Loans and leases | $ | 40,781 |

| | $ | 39,463 |

| | $ | 161,215 |

| | $ | 161,137 |

|

Investment securities, taxable | 3,346 |

| | 3,640 |

| | 13,054 |

| | 14,414 |

|

Investment securities, tax-exempt | 803 |

| | 799 |

| | 3,269 |

| | 3,094 |

|

Other | 266 |

| | 228 |

| | 1,016 |

| | 940 |

|

Total interest income | 45,196 |

| | 44,130 |

| | 178,554 |

| | 179,585 |

|

| | | | | | | |

Interest expense: | | | | | | | |

Deposits | 2,626 |

| | 3,561 |

| | 11,356 |

| | 16,604 |

|

Short-term borrowings | 101 |

| | 62 |

| | 541 |

| | 211 |

|

Subordinated notes | 1,055 |

| | 1,055 |

| | 4,220 |

| | 4,220 |

|

Long-term debt and mandatorily redeemable securities | 575 |

| | 418 |

| | 2,108 |

| | 1,733 |

|

Total interest expense | 4,357 |

| | 5,096 |

| | 18,225 |

| | 22,768 |

|

| | | | | | | |

Net interest income | 40,839 |

| | 39,034 |

| | 160,329 |

| | 156,817 |

|

(Recovery of) provision for loan and lease losses | (820 | ) | | (859 | ) | | 3,733 |

| | 772 |

|

Net interest income after provision for loan and lease losses | 41,659 |

| | 39,893 |

| | 156,596 |

| | 156,045 |

|

| | | | | | | |

Noninterest income: | | | | | | | |

Trust fees | 4,581 |

| | 3,583 |

| | 18,511 |

| | 17,383 |

|

Service charges on deposit accounts | 2,186 |

| | 2,249 |

| | 8,684 |

| | 9,177 |

|

Debit card income | 2,508 |

| | 2,130 |

| | 9,585 |

| | 8,882 |

|

Mortgage banking income | 1,420 |

| | 1,277 |

| | 5,381 |

| | 5,944 |

|

Insurance commissions | 1,388 |

| | 1,361 |

| | 5,556 |

| | 5,492 |

|

Equipment rental income | 4,615 |

| | 4,131 |

| | 17,156 |

| | 16,229 |

|

Gains (losses) on investment securities available-for-sale | — |

| | (140 | ) | | 963 |

| | (168 | ) |

Other income | 3,178 |

| | 3,394 |

| | 12,051 |

| | 14,273 |

|

Total noninterest income | 19,876 |

| | 17,985 |

| | 77,887 |

| | 77,212 |

|

| | | | | | | |

Noninterest expense: | | | | | | | |

Salaries and employee benefits | 21,389 |

| | 20,230 |

| | 80,488 |

| | 79,783 |

|

Net occupancy expense | 2,387 |

| | 2,220 |

| | 9,311 |

| | 8,700 |

|

Furniture and equipment expense | 4,592 |

| | 4,610 |

| | 17,657 |

| | 16,895 |

|

Depreciation - leased equipment | 3,783 |

| | 3,310 |

| | 13,893 |

| | 13,055 |

|

Professional fees | 1,698 |

| | 1,478 |

| | 5,046 |

| | 5,321 |

|

Supplies and communication | 1,436 |

| | 1,325 |

| | 5,589 |

| | 5,690 |

|

FDIC and other insurance | 814 |

| | 783 |

| | 3,384 |

| | 3,462 |

|

Business development and marketing expense | 2,248 |

| | 1,927 |

| | 6,049 |

| | 4,938 |

|

Loan and lease collection and repossession expense | 962 |

| | 648 |

| | 1,102 |

| | 4,030 |

|

Other expense | 2,682 |

| | 2,059 |

| | 7,521 |

| | 7,440 |

|

Total noninterest expense | 41,991 |

| | 38,590 |

| | 150,040 |

| | 149,314 |

|

| | | | | | | |

Income before income taxes | 19,544 |

| | 19,288 |

| | 84,443 |

| | 83,943 |

|

Income tax expense | 4,548 |

| | 5,572 |

| | 26,374 |

| | 28,985 |

|

| | | | | | | |

Net income | $ | 14,996 |

| | $ | 13,716 |

| | $ | 58,069 |

| | $ | 54,958 |

|

| | | | | | | |

| | | | | | | |

The NASDAQ Stock Market National Market Symbol: "SRCE" (CUSIP #336901 10 3) | | | | | | |

Please contact us at shareholder@1stsource.com | | | | | | | |

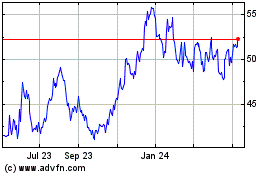

1st Source (NASDAQ:SRCE)

Historical Stock Chart

From Mar 2024 to Apr 2024

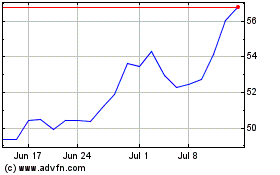

1st Source (NASDAQ:SRCE)

Historical Stock Chart

From Apr 2023 to Apr 2024