UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT TO SECTION 13 OR 15 (d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: January 20, 2015

(Date of earliest event reported)

INTERNATIONAL BUSINESS MACHINES CORPORATION

(Exact name of registrant as specified in its charter)

|

New York |

|

1-2360 |

|

13-0871985 |

|

(State of Incorporation) |

|

(Commission File Number) |

|

(IRS employer Identification No.) |

|

ARMONK, NEW YORK |

|

10504 |

|

(Address of principal executive offices) |

|

(Zip Code) |

914-499-1900

(Registrant’s telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition.

Attachment I of this Form 8-K contains the prepared remarks for IBM’s Chief Financial Officer Martin Schroeter’s fourth quarter earnings presentation to investors on January 20, 2015, as well as certain comments made by Mr. Schroeter during the question and answer period and at the conclusion of the presentation, edited for clarity. Certain reconciliation and other information (“Non-GAAP Supplemental Materials”) for this presentation was included in Attachment II to the Form 8-K that IBM submitted on January 20, 2015, which included IBM’s press release dated January 20, 2015. All of the information in Attachment I is hereby filed.

IBM’s web site (www.ibm.com) contains a significant amount of information about IBM, including financial and other information for investors (www.ibm.com/investor/). IBM encourages investors to visit its various web sites from time to time, as information is updated and new information is posted.

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

Date: January 21, 2015 |

|

|

|

|

|

|

By: |

/s/ Stanley J. Sutula III |

|

|

|

|

|

|

|

Stanley J. Sutula III |

|

|

|

Vice President and Controller |

3

ATTACHMENT I

Introduction

Thank you. This is Patricia Murphy, Vice President of Investor Relations for IBM. I’m here today with Martin Schroeter, IBM’s Senior Vice President and Chief Financial Officer. I want to welcome you to our fourth quarter earnings presentation.

The prepared remarks will be available in within a couple of hours, and a replay of the webcast will be posted by this time tomorrow.

I’ll remind you that certain comments made in this presentation may be characterized as forward looking under the Private Securities Litigation Reform Act of 1995. Those statements involve a number of factors that could cause actual results to differ materially. Additional information concerning these factors is contained in the company’s filings with the SEC. Copies are available from the SEC, from the IBM web site, or from us in Investor Relations.

Our presentation also includes certain non-GAAP financial measures, in an effort to provide additional information to investors. All non-GAAP measures have been reconciled to their related GAAP measures in accordance with SEC rules. You will find reconciliation charts at the end of the presentation, and in the Form 8-K submitted to the SEC.

Now, I’ll turn the call over to Martin Schroeter.

4Q and Full Year 2014 Overview

Thanks Patricia. Today I’ll start with a brief overview of our fourth quarter and full-year performance, review the details of the quarter, and wrap up with a discussion of 2014 and expectations for 2015.

Our strategy is focused on leading in the areas where we see the most value in enterprise IT, and in 2014 we made tremendous progress in repositioning the portfolio and making investments to shift into these areas. Our results reflect all of that.

In the fourth quarter, we delivered revenue of $24.1 billion, net income of $5.8 billion, free cash flow of $6.6 billion and operating earnings per share of $5.81. Our total revenue performance reflects the divestitures of System x and Customer Care which together had $1.6 billion of revenue in the fourth quarter of 2013, and we had about a $1.2 billion impact from currency movements. So combined, this represents about $2.8 billion of revenue, or a 10 point impact to the reported revenue growth rate. That currency impact was even greater than spot rates suggested 90 days ago. Excluding the impact of currency and divestitures, our total revenue was in line with our expectations.

We once again had strong performance in our strategic imperatives that address the market shifts in data, cloud, and engagement. Together, they posted double-digit growth, as they did in every quarter of 2014. We had solid improvement in gross and pre-tax margins, as we drive our overall business to higher value. That’ll certainly continue into this year, as we benefit from the recent portfolio actions. And we’re continuing to shift our investments and resources to our strategic imperatives and solutions that address our clients’ most critical issues.

Looking at the full year, from a financial perspective, we delivered $21 billion of pre-tax income and operating earnings per share of $16.53. We generated about $12½ billion of free cash flow, paid out over $4 billion in dividends, and reduced our average share count by over 8 percent, while reducing our core debt by half a billion dollars.

Our strategic imperatives continue to drive strong growth, up 16 percent in 2014, and that includes an impact from currency. Together cloud, analytics, mobile, social and security generated $25 billion in revenue, which is 27 percent of IBM. Analytics was up 7 percent on a large base. And with 60 percent revenue growth, our cloud business is substantial. It’s now $7 billion in revenue, and we exited the year with an annual as-a-Service run rate of $3.5 billion. That’s up from $2.2 billion a year ago.

During the year we once again spent 6% of our revenue in research and development and invested about $4B on capital — supporting actions in a number of areas that will yield financial benefits in future years. Let me mention a few. We introduced our cloud platform-as-a service Bluemix, and are shifting capital to globally-expand our SoftLayer cloud data centers. We are bringing Watson’s capabilities to the enterprise and building a partner ecosystem, effectively creating a market for cognitive computing. We introduced cloud application innovations around Watson Analytics and Verse. We launched Power8, and are building the OpenPOWER consortium. We formed a partnership with Apple for enterprise mobility, with Twitter for big data, and with SAP and Tencent for cloud. Clearly we are the go-to platform for the enterprise.

In 2014, we divested large businesses that no longer fit our strategic profile, System x and Customer Care BPO, and announced the divestiture of our semiconductor manufacturing business. These 3 businesses drove $7 billion of revenue in 2013, but lost about half a billion dollars of pre-tax profit.

So while we certainly have a smaller business in terms of revenue, and of course the divestitures reduced the number of employees, it is a higher value, higher margin business. Within that, we are continuing to remix our skills. As an example, we had over 45k hires in 2014, adding to our capabilities in our strategic areas.

So we got a lot done in 2014 that positions us for the longer term. I’ll talk more about the full year, and what it means for 2015 after going through the details of the quarter.

Key Financial Metrics

So now let me get into the fourth quarter results. These are all operating results, which are based on continuing operations.

We delivered $5.8 billion of operating net income on revenue of $24.1 billion. Revenue was down 12 percent, but as I just said that includes about 10 points of impact from currency and divestitures. So we were down 2 percent at constant currency excluding the divested businesses.

On that basis, Services revenue was flat, our Software segment declined 3 percent, and Systems and Technology revenue was down 12 percent. We’ve seen significant strengthening of the dollar since September. Currency impacted our revenue performance by about 4½ points, or $1.2 billion. This is a point and a half of growth, or $400 million more than anticipated based on spot rates 90 days ago.

Our gross margin was up 60 basis points, driven by improvements in GBS, and a mix away from the low margin System x business. Pre-tax margin was up 3 points this quarter. PTI includes the gain from the sale of System x, which net of related transaction and performance based costs was $1.1 billion, as well as nearly $600 million of workforce rebalancing charges. We had a substantial tax headwind in the fourth quarter. Last year our rate included the benefit associated with the settlement of a US tax audit and as a result our tax rate is up nearly 10 points over last year. On the bottom line, we reported Operating EPS of $5.81.

Looking at our free cash flow, we generated $6.6 billion in the quarter, which is more than half of the full year. We ended the year with $8.5 billion of cash on hand.

Revenue by Geography

Now turning to the revenue by geography, because of the geography mix of the System x business, the divestiture impacted major markets growth by 4 points, and growth markets by 9 points. So I’ll focus on year-to-year performance at constant currency and adjusting for the divested businesses in all periods. On this basis, both major markets and growth markets were down 2 percent.

Within major markets, we had growth in Japan, while North America and Europe declined. Europe’s performance improved from last quarter, with improvements in the UK and Italy, and continued growth in Spain. Our North America revenue was down, driven by declines in Global Business Services, though signings grew for the second consecutive quarter.

Our growth markets year-to-year performance improved nearly 2 points from last quarter. This was driven by China, which was down 1 percent this quarter. The improvement in the year-to-year trajectory was driven by strong software performance, and several large mainframe transactions. In fact, 4 of our 5 largest banking clients in China added substantial new mainframe capacity.

Overall BRIC performance was consistent with last quarter, with the improvement in China offset by weaker performance in Brazil.

Revenue and Gross Profit Margin by Segment

Turning to the segment perspective, our total services revenue was flat at constant currency adjusting for the divested businesses.

On that base, GTS was up 2 percent and we had growth across all business lines - Outsourcing, Integrated Technology Services, and Maintenance. Global Business Services revenue was down, with significant growth in the strategic imperatives offset by weakness in some of the more traditional application areas. In Software, we had good growth in key areas like security, cloud, and mobile, but our software customers continue to utilize the flexibility we have provided, impacting transaction revenue growth, and weakness in operating systems. Systems performance reflects the end of the product cycle in our System z mainframe, and declines in Power and storage, though both had modest sequential improvement in year-to-year performance.

Our gross profit margin was nearly 54 percent; that’s up 60 basis points from last year. We had solid improvements in GBS, as we mix toward the higher margin strategic imperatives. The GTS margin is relatively flat, even with an impact from the divestiture of System x maintenance. Software continued to have a very strong margin at 90 percent. And we had significant margin improvement in Systems, driven by the divestiture of the lower margin System x business. So our focus on moving to higher value spaces is showing up in our gross margin.

Expense Summary

The reported Total Operating Expense and Other Income reflects not only the ongoing run rate of the business, but also the impact of the System x divestiture, and a charge for workforce rebalancing. In total, the reported level of expense is down 20 percent, though the entire decline is driven by the combination of the System x gain, and the fact that we no longer have the expense for the System x business in our run rate. Normalizing for the System x divestiture, our expense and other income would have been up about 2 percent, or about 6 percent adjusted for currency and acquisitions.

You’ll recall last October I told you that we expected to take a charge for workforce rebalancing in the fourth quarter. SG&A includes a workforce rebalancing charge of about $580 million, nearly all of which is a year-to-year increase. Within our base expense, we’re continuing to shift resources and spending to areas where we see the most opportunity, including Watson, SoftLayer, Bluemix, and in support of our Apple partnership.

Finally, I want to spend a minute on the impact of currency. The dramatic dollar strengthening started in September, and has continued at a rapid pace. In addition, the currencies have nearly all moved in an unfavorable direction for our business profile. The result is an impact to our revenue and our earnings. We hedge a portion of our cross-border cash flows, which defers the impact of the currency movement, but it doesn’t eliminate it. Our hedges are designed to provide stability around the receipt of cash, but there is no year-to-year benefit in the income statement when a currency’s direction is sustained over a longer period. And that’s what we’ve been dealing with.

Looking at the fourth quarter, we estimate the impact to our profit growth was nearly $300 million. At current spot rates, we would expect a significant impact to revenue and profit in 2015. The chart in the back of our presentation sizes the revenue impact at current spot rates.

Now let’s turn to the segments, and we’ll start with Services.

Services Segments

Our total services backlog was $128 billion. When adjusted for currency, and the Customer Care and System x divestitures, it was flat year-to-year. This is an improvement from the 2 percent decline we reported in the third quarter on that same basis. The sequential backlog improvement was driven by several significant new Outsourcing contracts closed in the period. As a result, Outsourcing backlog returned to growth and was up 1 percent at constant currency adjusted for the Customer Care divestiture. The combined Services revenue was $13½ billion, which is flat year to year at constant currency adjusting for the divestitures.

Revenue for Global Technology Services was $9.2 billion, up 2 percent at constant currency adjusted for the divestitures.

GTS Outsourcing was up 1 percent at constant currency for the quarter and for the year, adjusted for the Customer Care divestiture. Clients are continuing to sign large outsourcing engagements that leverage our cloud, business analytics, and mobile solutions. Clients are using these outsourcing engagements as ways to optimize their IT infrastructure while at the same time enabling new services to their customers. Lufthansa and ABN AMRO, both of which were over $1 billion in contract value, are great recent examples of this.

ITS revenue was up 4 percent at constant currency, driven largely by our high value security, mobility, and resiliency offerings. SoftLayer continues to attract new workloads to the platform, and in October we announced IBM was selected by SAP to be their global cloud provider for their enterprise cloud solution. IBM’s ability to integrate public and private workloads within our hybrid cloud was a critical differentiator for SAP. We’ve continued to expand our datacenter footprint and in the fourth quarter we opened cloud centers in Melbourne, Paris, Mexico City, Tokyo, and Frankfurt.

Maintenance was up 1 percent when adjusted for currency and the impact from the System x divestiture. GTS pre-tax profit was down significantly in the quarter. Year-to-year performance was driven by several key factors. First, we have the loss of year-to-year profit resulting from the Customer Care and System x divestitures. Second, we took a workforce rebalancing charge in the quarter, which impacts profit.

Finally, we’re continuing to invest in both offerings and operational capabilities. That includes targeted investments in mobility, security and cloud, which complement our clients’ systems-of-record, as well as operational improvements such as the savings yield from the rebalancing action we took earlier this year and more broadly deployed automation in the delivery centers. Overall, the profit performance in GTS reflects the actions we’ve taken to transform the business this year. We’ve invested in our Strategic Imperatives to accelerate growth, we’ve continued to optimize our delivery platform through the workforce rebalancing and broader use of automation, and we’ve divested businesses, impacting our year-to-year results. While those actions all have near-term impacts to profit, they better position us going forward, and enable us to deliver more value to clients.

Global Business Services revenue was $4.3 billion, down 3 percent at constant currency.

Consulting & Systems Integration declined 3 percent at constant currency. Revenue was down in our traditional back-office implementations, particularly in North America. We again had strong double-digit growth in our practices that address cloud, analytics, mobile, and social. Through our Apple partnership, we released the first 10 MobileFirst for iOS solutions in fourth quarter, with more to come by the end of this quarter focused in Healthcare, Energy, and Utilities. We’ve seen strong customer interest, and this partnership is another example of how we are helping enterprise clients transform their business models and sources of value.

Application Outsourcing was down 2 percent at constant currency, reflecting sequential year-to-year improvement, but we still see a challenging pricing environment.

GBS gross margin expanded roughly a point and a half year to year, which is a good indicator of the value our offerings deliver. Pre-tax profit declined, including a 15-point impact from the workforce rebalancing charge, which will pay back in 2015.We continued to see a slowdown in back office implementations in the traditional parts of the portfolio. We are investing in strategic partnerships, and those will pay off in 2015 as well.

To wrap up GBS, we have integrated Global Process Services, our BPO business, with GBS to create a seamless end-to-end business transformation capability for our clients. Starting in the first quarter, our reporting will reflect this shift of GPS from our Global Technology Services segment, to GBS.

Software Segment

Software revenue of $7.6 billion was down 3 percent at constant currency.

After the third quarter, we said we didn’t expect a change in trajectory in the fourth; and our fourth quarter performance was fairly similar to the third.

Total software growth reflects a headwind from operating systems, driven by the divestiture of System x, and our Power results. It also reflects business model changes, which impacted our transaction revenue growth as our customers continue to use the flexibility we have provided in the deployment of software purchased through enterprise licensing agreements. The flexibility enables clients to optimize their capacity on our platform for the long term.

We had solid growth in many of our solution areas, including security, mobile, and cloud. Our security software once again grew at a double-digit rate. In fact this was the ninth consecutive quarter of double-digit growth. Cybersecurity threats are one of the key issues that all our customers are facing. We have brought our analytics, big data, research IP, mobile and cloud capabilities to create security offerings to address this market opportunity. Our software mobile offerings more than doubled in the quarter, as we leveraged our integrated MobileFirst portfolio, and our Software-as-a-Service offerings are up nearly 50 percent.

Across software, we continue to drive innovation and capture growth areas. We’re integrating analytics and security capabilities that are needed to operate seamlessly in a hybrid environment. For example, we’re introducing several new offerings that further enable our analytics portfolio in a cloud environment, and we recently announced IBM Verse, a cloud-based email and collaboration offering that integrates Watson capabilities. This type of continued innovation in our offerings, together with expanding services on our Bluemix platform-as-a-service, will allow our customers to move to a hybrid environment.

Systems & Technology Segment

Systems and Technology revenue of $2.4 billion was down 12 percent at constant currency adjusting for the divestiture of our System x business.

Last January, our Systems and Technology business had just reported a $1.7 billion year-to-year profit decline for 2013, and we said we’d stabilize the profit on a go-forward basis. I’m pleased to say that after a lot of work to reposition the business, we have stabilized the profit.

Looking at our fourth quarter results, System z revenue was down 23 percent at constant currency, reflecting the fact that we are in the tenth and final quarter of this product cycle. Our last 10-quarter cycle was z10. Comparing the current cycle to that of z10, program-to-date System z revenue and gross profit is right on top of that cycle.

We continue to innovate on the platform and last week, we announced z13, the new generation of the IBM Mainframe. The z13 system culminates a billion dollar investment, five years of development, exploits the innovation of more than 500 new patents and represents a collaboration with more than 60 clients. The result of this innovation is a mainframe that has the world’s fastest processor that can execute two-and-a-half billion transactions a day.

With this generation of mainframe, we have dramatically enhanced the capabilities around analytics, mobile, security and cloud to address the needs our clients see in their businesses. These capabilities span from real-time insights to real-time fraud detection in a system that can consistently run at 100 percent utilization with 100 percent uptime. IBM continues to innovate on the platform to address client needs and extend its leadership in high-end systems, a core franchise that has nearly doubled in installed capacity over the last 5 years.

Power revenue declined 11 percent at constant currency, which is a modest sequential improvement in year-to-year performance. We have repositioned Power, which is now a systems business, as well as an open chip processor and an IP opportunity through the OpenPOWER foundation.

We saw double-digit growth in the low end, driven by entry-level POWER8-based systems, and in the fourth quarter we introduced our high-end Power 8 enterprise systems. OpenPOWER foundation membership continues to expand, which started in 2014 with 5 members and now stands at over 80, 14 of which are in greater China. Since the establishment of the consortium a year ago, several products have been introduced. For example, on the scale-out systems, Tyan launched the first OpenPOWER customer reference system, and on the high-end, the U.S department of energy recently awarded IBM a $350 million contract to create future super-computers based on OpenPOWER technology. In addition, we have initiated a strategic partnership with Suzhou PowerCore, which intends to use POWER architecture to develop and market processors for servers in China.

Our Storage hardware revenue was down 5 percent at constant currency, a modest sequential improvement from the rate in the prior quarter. We again saw strong growth in our FlashSystems and Storwize portfolio. This growth was offset by the wind down of our legacy OEM business and continued weakness in high-end disk. Recently IDC reported that IBM was the leader in all-flash systems shipped capacity during first-half of 2014, outpacing the #2 and #3 competitors combined.

Over the course of the year, we took significant actions to reposition our Systems and Technology business for higher value, and reinforced our commitment to driving innovation in our high-end systems and storage. We repositioned Power through creation of our Power 8 systems which are built for cloud and big data, and made available the POWER8 architecture through the OpenPOWER consortium to build an open ecosystem and an IP play. We are divesting our microelectronics manufacturing, with future chip supply coming from an at-scale provider. And we committed $3 billion of investment in the next era of chip technology as we strengthen our semiconductor research and development and systems innovation. We also divested System x, our low-end server business. And as I mentioned, just last week we announced z13, the new generation of the mainframe. Our Systems and Technology segment grew profit in the fourth quarter, and was profitable for the year. With our portfolio repositioned and introduction of the new mainframe we should now see profit leverage.

Cash Flow Analysis

Moving on to cash flow in the quarter, we generated $7.6 billion of cash from operations, excluding our Global Financing receivables. We invested a billion dollars in capital expenditures, and we generated $6.6 billion in free cash flow, which was up 4.4 billion quarter to quarter, but down 1.8 billion year to year.

As I said earlier, we generated more than half of our annual cash flow in the fourth quarter, in line with our average over the last 5 years.

For the full year, our cash from operations excluding GF receivables was $16.2 billion. We invested almost $4 billion in capital expenditures, with consistent spend throughout the year. And within that we shifted significant spend to strategic areas such as SoftLayer and Watson.

So, our free cash flow was $12.4 billion, down $2.6 billion year to year. The bulk of that was driven by an increase in cash tax payments, and working capital impacts associated with the System x divestiture. While not in free cash flow, we received proceeds of $2.4 billion from divestitures, including the System x and Customer Care businesses.

As for the uses of free cash flow for the year, we acquired six companies, we paid $4.3 billion in dividends, and bought back almost 72 million shares, reducing our average share count by 8 percent.

Let me comment on our share repurchase activity over time. Since the beginning of our share repurchase program in 1995, we have taken our share count from roughly 2.35 billion shares, to fewer than 1 billion shares; that’s a reduction of 58 percent program to date, at an average purchase price of less than $100 per share. At the end of the year, we had $6.3 billion remaining in our buyback authorization.

Balance Sheet Summary

Turning to the balance sheet, we ended the year with a cash balance of $8.5 billion. Our total assets reflect a year-to-year reduction associated with the semiconductor transaction, as well as a reduction in our pension assets. We had strong returns on our pension assets, above the long term expected return assumption. The asset decline was driven by a year-end re-measurement of the liability. I’ll address that in a minute.

Total debt was $40.8 billion, of which 29.1 billion was in support of our financing business. The global financing leverage at year end was 7.2 to 1, consistent with last December. Our total debt was down almost $5 billion since September, and up $1.1 billion in the last year. Our non-financing debt drove the quarter-to-quarter decline. At $11.7 billion, it was down $5.4 billion since September, and down half a billion dollars year to year.

Let me put our current non-financing, or our core debt level in perspective. In May of 2007, we re-introduced debt to our core capital structure and in June of that year we had $11.8 billion of core debt. So while our debt level has varied over time, it’s at the same level as when we introduced debt to our structure.

Looking at debt-to-cap, we improved our ratio since September, though not as much as expected. We reduced debt levels, and profit performance increase equity, both as we expected. However, our debt-to-cap ratio was impacted by a $7 billion reduction in equity since September due to currency and pension. A billion dollars of the equity hit was due to currency translation, and over $6 billion for pension re-measurement driven by a reduction in the discount rates, and taking into account the recently released US mortality tables. Our pension funding levels remain solid despite the impacts from rates and mortality. The US and worldwide tax-qualified plans were 102 percent and 97 percent respectively. Our balance sheet continues to have the financial flexibility to support our business over the longer term.

2014 Portfolio Summary

So now let me wrap up 2014, and I want to put our revenue and profit performance in the context of the framework we provided at our investor day back in May.

The strategic imperatives are focused on the market shifts of data, cloud, and engagement. The model for these combined strategic imperatives is to deliver double-digit growth, with high contribution from Software, which obviously drives a more profitable business mix.

In 2014, revenue from our cloud, analytics, mobile, social, and security solutions together, was up 16 percent. And that includes the impact of currency, as well as the divested System x business. In total, the strategic imperatives generated $25 billion in revenue, which is about 27 percent of IBM’s total. And our software content is well above the level for overall IBM.

Business analytics revenue for the year was $17 billion, up 7 percent over last year. Growth was led by our consulting business, as we help our clients extract value from their data. Our cloud revenue in 2014 was up 60 percent to $7 billion, as we see growing client demands for higher-value cloud solutions across public, private, and hybrid. Revenue from our as-a-Service offerings increased about 75 percent to $3 billion for the year, and we exited 2014 with an annual run rate for our as-a-Service business of $3½ billion. The $7 billion also includes revenue from our foundational offerings, where we provide software, hardware and services to clients to build private clouds.

Turning to engagement, our mobile business more than tripled. We had strong growth in MobileFirst driven by an integrated portfolio of offerings, and a great start to our partnership with Apple. Social was up 3 percent and Security was up 19 percent. So very good growth in these businesses, in line with the double-digit objective. These are also the areas where we are launching initiatives and targeting investment. Earlier I mentioned investments to build out Bluemix, SoftLayer, Watson and the partnerships with Apple, Twitter, SAP and Tencent. These investments and actions support growth into the future.

Now, our Recurring Core Franchises includes our annuity businesses, and highly recurring portions of our transactions business, such as mainframe revenue from our largest clients. Most have annuity characteristics, and in many cases, these support mission critical processes for our clients. The model, or signpost, is for these combined businesses to have stable revenue, with improving margin. This year, revenue was down about 3 percent, with a modest decline in margin. The decline was driven by mainframe cycle, and by currency.

We also have high value transactional businesses, which include project-based work in services, transactional software, and Power and Storage, in areas other than our strategic imperatives. The objective here is to optimize our business model, and maintain margins. We’ve been clear that some parts of our hardware business have had secular challenges. I talked earlier about all of the actions we’ve taken to reposition our hardware business for high value. While revenue is down as we work through these transitions, our gross margin remains attractive at over 40 percent. And, of course we’ve divested businesses that don’t fit our strategic profile - Customer Care, System x, and microelectronics manufacturing. Together these businesses were about $7 billion of revenue in 2013, but lost $500 million of profit. So the divestitures reduce our revenue, but improve our profit profile, clearly in line with our shift to higher value.

Summary

Our strategic direction is clear and compelling, and we have made a lot of progress. We have been successful in shifting to the higher value areas of enterprise IT. The strong revenue growth in our strategic imperatives confirms that, as does the overall profitability of our business. We expect the industry to continue to shift, and I want to spend a minute on what we see over the longer term - not in terms of an absolute end point or multi-year objective, but rather in terms of a long term growth trajectory.

We have $25 billion of revenue in our strategic imperatives, and we continue to expect to grow this revenue at a double-digit rate. Keep in mind these areas are as high value as other parts of our business, which continue to manage our clients’ most critical business processes. As we get our cloud business to scale, and drive ongoing productivity improvements across our business, we see opportunity to continue to expand margin. And we’ll continue to allocate capital to investments, and to return value to shareholders through a combination of dividends and share repurchases. So over the longer term, when we look at the opportunities we will continue to develop, we see the ability to generate low-single digit revenue growth, and with a higher value mix, high-single digit Operating earnings per share growth, with free cash flow realization in the 90’s. Of course we’ll spend more time on the rate and pace of achieving that trajectory at our investor meeting next month.

Now, in the near term, there are a few dynamics that are inconsistent with that long term trajectory. For 2015 specifically, we are dealing with some transitions in our business. For example, while we are fully participating in the shift to cloud, margins are impacted by the level of investment we are making, and the fact that the business is not yet at scale. We will see some year-to-year benefit to margins in 2015 as the business ramps, but we won’t yet be at scale. And I talked about the impact to our software transaction revenue growth as customers utilize the flexibility we’ve provided, as they commit to our platform for the longer term.

And then there are cyclical considerations. Given the geographic breadth of our business, we have seen challenges in some markets — most notably many of the growth markets. We firmly believe these are important markets over time, and we’ve been investing to capture the opportunity, but we’re not counting on a robust

demand environment in many geographies in 2015. And then of course there is the impact from currency. The impact to our revenue growth is obvious as we translate results back to US dollars. But as with all companies with a similar business profile, with the dollar strengthening, currency will have a significant translation impact on our profit growth.

Now, we do have some cyclical benefits, like a tailwind from the new mainframe cycle, and we’ll have a full year of Power 8.

Now when you step back and look at the business, and take into account everything I have just told you about 2015, we’ll continue to grow in a lot of areas. We’ll continue to deliver strong growth in our strategic imperatives, we’ll continue to expand margins, and we’ll continue a high level of investment and hiring, shifting to areas where we see the best opportunity.

Now, in this currency environment, and with the divestitures we’ve completed, our total revenue as reported will not grow in 2015. I would expect less spending in workforce rebalancing, and while we always have gains, we won’t replicate the $1.6 billion of gains we had in 2014, so that will be a net impact to our profit. When we put it all together for 2015, we expect Operating EPS in the range of $15.75 to $16.50, and at that level of profit, we expect free cash flow to be relatively flat. More importantly, we will exit 2015 with a higher value, higher margin business.

Now Patricia and I will take your questions.

Closing

Thank you, Martin. Before we begin the Q&A I’d like to mention a few items.

First, we have supplemental charts at the end of the slide deck that provide additional information on the quarter and the year. We have also provided historical data on continuing operations.

And second, I’d ask you to refrain from multi-part questions.

Operator, can you please open it up for questions.

END OF PREPARED REMARKS.

Comments made by Mr. Schroeter during the question and answer period and at conclusion of the presentation, edited for clarity:

For 2015, we’re assuming a tax rate at 20 percent in the full year — so, a slight decline from where we finished 2014. Now, on the guidance in terms of what we saw coming out of the fourth quarter, there are a few things that I would mention relative to the trajectories in some of our businesses. We do expect that the launch of the mainframe along with the success in POWER8 that we’re seeing, that will generate some momentum. And so, we would expect to see growth in our systems in the mid single-digit range coming out of ’14 when we didn’t have the cycle. In services, we’ve not assumed a revenue trajectory that requires a lot of growth within our EPS. And then most important from a guidance perspective is software. So, we have a range in our EPS, and I think the way to characterize the bottom of the guidance and the top of the guidance is that at the bottom of the guidance, we are not assuming that we see an improvement in the trajectory of our software business. And I would characterize the top of the guidance as sort of a stabilization of the software business relative to 2014.

---------

Relative to share repurchase, we’ve only assumed about a two to three point impact from share repurchase, which is obviously less than what we were able to do in last year. So, a reduced level of share repurchases. The way to think about it is we entered 2015 with a bit over six billion of authorization remaining, and we’ve just assumed that we used the authorization. Now, timing will impact the impact on EPS, but think about our share repurchase in the year as consuming the bulk of that authorization. In terms of dividends, we have assumed that we would obviously continue to pay the dividend. We like to talk about how we might grow the dividend as well.

Our free cash flow guidance is essentially flat year to year, given the range of profit we provided. From a realization perspective, we printed a 79 percent realization in 2014, and we see that improving to the mid-eighties. Now, there are a few elements of our free cash flow relative to realization that I think are important to keep in mind. We’ll start at, call it 100 percent just for simplicity. We get a five to six-point impact just because we have a pension in terms of realization. Now, sometimes that is not as steep as that, and sometimes it can depend more on what the markets do to the pension. But right now, in 2014 we saw a five-point impact on realization. We also saw in 2014 a substantial impact in realization from our cash taxes. That was about a 10-point impact last year. So, pretty substantial impacts in realization. We do see that, as I mentioned, improving to the mid eighties in 2015 based on our guidance.

Now, there are some unique items within our guidance as well for 2015 that I think it’s important to realize. One, we are assuming a further increase in our capital expenditures of over half a billion dollars year to year as we continue to build out our cloud platform as we continue to invest in SoftLayer. We grew SoftLayer investment pretty aggressively in 2014, and we’ll continue to do that into 2015. We also have a year-to-year impact in cash flow in our guidance to recognize the timing of the payments for the restructuring actions we’ve taken. And then finally, as we had in 2014, we also have in 2015 a year-to-year impact from the System x business being out of our results, but because of the structure of that, there is a working capital impact. So, you know, overall guidance that we’ve provided has a profit decline embedded within it, and again, that combined with the year-to-year impacts we see in terms of capex, restructuring and System x being out delivers that essentially flat year-to-year free cash flow.

---------

For 2015, as we indicated, we see operating EPS in a range of $15.75 to $16.50. And within that, we’d see mid single digit EPS growth in the first quarter. Now, keep in mind we had a large charge last year. So, that growth in 1Q is off a low base, because it had the charge in it.

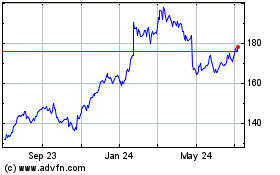

International Business M... (NYSE:IBM)

Historical Stock Chart

From Mar 2024 to Apr 2024

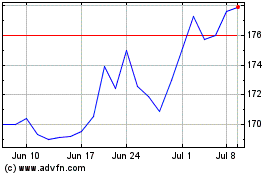

International Business M... (NYSE:IBM)

Historical Stock Chart

From Apr 2023 to Apr 2024