UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 16, 2015

APARTMENT INVESTMENT AND MANAGEMENT COMPANY

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Maryland |

|

1-13232 |

|

84-1259577 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

AIMCO PROPERTIES, L.P.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Delaware |

|

0-24497 |

|

84-1275621 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 4582 SOUTH ULSTER STREET

SUITE 1100, DENVER, CO |

|

80237 |

| (Address of Principal Executive Offices) |

|

(ZIP Code) |

Registrant’s Telephone Number, Including Area Code: (303) 757-8101

Not Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of

the Registrant under any of the following provisions:

| ¨ |

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencements communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Pursuant to the Underwriting Agreement, dated January 12, 2015, among

Apartment Investment and Management Company (the “Company”), AIMCO Properties, L.P., and Citigroup Global Markets Inc. and KeyBanc Capital Markets Inc. (together, the “Underwriters”) relating to an underwritten public offering by

the Company of 8,200,000 shares of Class A Common Stock, par value $.01 per share (the “Common Stock”), the Company granted the Underwriters an option to purchase up to 1,230,000 additional shares of Common Stock (“Option

Shares”), exercisable within 30 days of the date of the Underwriting Agreement. On January 16, 2015, the Underwriters exercised such option to purchase all of the Option Shares. The sale of the Option Shares is expected to close on or

about January 21, 2015, subject to customary conditions.

| Item 9.01 |

Financial Statements and Exhibits |

(d) Exhibits.

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 5.1 |

|

Opinion of DLA Piper LLP (US) |

|

|

| 23.1 |

|

Consent of DLA Piper LLP (US) (included in Exhibit 5.1) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

APARTMENT INVESTMENT AND |

|

|

|

|

MANAGEMENT COMPANY |

|

|

|

|

| Date: January 20, 2015 |

|

|

|

By: |

|

/s/ Ernest M. Freedman |

|

|

|

|

Name: |

|

Ernest M. Freedman |

|

|

|

|

Title: |

|

Executive Vice President and |

|

|

|

|

|

|

Chief Financial Officer |

|

|

|

| Date: January 20, 2015 |

|

|

|

AIMCO PROPERTIES, L.P. |

|

|

|

|

|

|

|

|

By: |

|

AIMCO-GP, Inc., |

|

|

|

|

|

|

Its General Partner |

|

|

|

|

|

|

|

|

|

|

|

By: |

|

/s/ Ernest M. Freedman |

|

|

|

|

|

|

Name: |

|

Ernest M. Freedman |

|

|

|

|

|

|

Title: |

|

Executive Vice President and |

|

|

|

|

|

|

|

|

Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 5.1 |

|

Opinion of DLA Piper LLP (US) |

|

|

| 23.1 |

|

Consent of DLA Piper LLP (US) (included in Exhibit 5.1) |

Exhibit 5.1

|

|

|

|

|

DLA Piper LLP (US) |

|

|

The Marbury Building 6225 Smith Avenue

Baltimore, Maryland 21209-3600 www.dlapiper.com |

|

|

|

|

T 410.580.3000 |

|

|

F 410.580.3001 |

January 20, 2015

Apartment Investment and Management Company

4582 South Ulster

Street, Suite 1100

Denver, Colorado 80237

| |

Re: |

Offering of Class A Common Stock |

Ladies and Gentlemen:

We have acted as special Maryland counsel to Apartment Investment and Management Company, a Maryland corporation (the “Company”),

and have been requested to render this opinion in connection with the registration under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to a Registration Statement on Form S-3 of the Company (Registration

No. 333-195133) and any amendments through the date hereof (the “Registration Statement”), prepared and filed with the Securities and Exchange Commission (the “Commission”) and effective on April 8, 2014, including a

base prospectus, dated April 8, 2014, included therein at the time the Registration Statement became effective (the “Base Prospectus”), the preliminary prospectus supplement, dated January 12, 2015 and filed by the Company with

the Commission on January 12, 2015 pursuant to Rule 424(b)(5) under the Securities Act (together with the Base Prospectus, the “Preliminary Prospectus”), and the prospectus supplement, dated January 12, 2015 and filed by the

Company with the Commission on January 14, 2015 pursuant to Rule 424(b)(5) under the Securities Act (the “Prospectus Supplement,” and together with the Base Prospectus, the “Prospectus”), for offering by the Company of

1,230,000 shares (the “Shares”) of Class A Common Stock, par value $.01 per share, of the Company, pursuant to the full exercise by Citigroup Global Markets Inc. and KeyBanc Capital Markets Inc. (together, the

“Underwriters”) of their over-allotment option pursuant to the terms of an Underwriting Agreement, dated January 12, 2015 (the “Underwriting Agreement”), among the Company and AIMCO Properties, L.P., a Delaware limited

partnership, on the one hand, and the Underwriters, on the other hand. This opinion is being provided at your request in connection with the filing of a Current Report on Form 8-K and supplements our opinion, dated April 8, 2014, previously

filed as Exhibit 5.1 to the Registration Statement.

In rendering the opinion expressed herein, we have reviewed the following documents

(the “Documents”):

(a) the charter of the Company (the “Charter”), certified by the State

Department of Assessments and Taxation of the State of Maryland (the “SDAT”);

(b) the bylaws of the Company

(the “Bylaws”), as in effect on the date hereof, as certified by an officer of the Company;

(c) the

Underwriting Agreement;

(d) the Registration Statement;

Apartment Investment and Management Company

January 20, 2015

Page

2

(e) the Preliminary Prospectus;

(f) the Prospectus;

(g) resolutions of the Board of Directors of the Company or a committee thereof relating to the authorization and issuance

of the Shares and the authorization of the Underwriting Agreement and the transactions contemplated thereby, certified by an officer of the Company;

(h) a certificate of the SDAT as to the good standing of the Company, dated as of a recent date;

(i) a certificate executed by an officer of the Company (the “Certificate”), dated as of the date hereof, as to

certain factual matters; and

(j) such other documents as we have considered necessary to the rendering of the opinion

expressed below.

In examining the Documents, and in rendering the opinion set forth below, we have assumed the following: (a) each

of the parties to the Documents (other than the Company) has duly and validly executed and delivered each of the Documents and each instrument, agreement and other document executed in connection with the Documents to which such party is a

signatory, and each such party’s (other than the Company’s) obligations set forth in the Documents are its legal, valid and binding obligations, enforceable in accordance with their respective terms; (b) each person executing any such

instrument, agreement or other document on behalf of any such party (other than the Company) is duly authorized to do so; (c) each natural person executing any such instrument, agreement or other document is legally competent to do so;

(d) the Documents accurately describe and contain the mutual understandings of the parties, there are no oral or written modifications of or amendments or supplements to the Documents and there has been no waiver of any of the provisions of the

Documents by actions or conduct of the parties or otherwise; and (e) all documents submitted to us as originals are authentic, all documents submitted to us as certified or photostatic copies or telecopies or portable document file

(“.PDF”) copies conform to the original documents (and the authenticity of the originals of such copies), all signatures on all documents submitted to us for examination (and including signatures on photocopies, telecopies and .PDF copies)

are genuine and all public records reviewed are accurate and complete. As to certain factual matters, we have relied on the Certificate as to the factual matters set forth therein, which we assume to be accurate and complete.

Based upon and subject to the foregoing and having regard for such legal considerations we deem relevant, we are of the opinion that, as of

the date hereof, the Shares have been duly authorized and, upon issuance and delivery against payment therefor in accordance with the terms of the Underwriting Agreement, will be validly issued, fully paid and non-assessable.

The opinion set forth herein is subject to additional assumptions, qualifications and limitations as follows:

(a) We have made no investigation of, and we express no opinion as to, the laws of any jurisdiction other than the laws of

the State of Maryland. To the extent that any documents referred to herein are governed by the laws of a jurisdiction other than the State of Maryland, we have assumed that the laws of such jurisdiction are the same as the laws of the State of

Maryland.

Apartment Investment and Management Company

January 20, 2015

Page

3

(b) We further assume that the issuance and sale of the Shares will not cause

the Company to exceed the total limit of the authorized capital stock of the Company, as provided in the Charter.

(c) This opinion concerns only the effect of the laws (exclusive of the principles of conflict of laws) of the State of

Maryland as currently in effect. We assume no obligation to supplement this opinion if any applicable laws change after the date hereof or if any facts or circumstances come to our attention after the date hereof that might change this opinion.

(d) We express no opinion as to compliance with the securities (or “blue sky”) laws or the real estate

syndication laws of the State of Maryland.

(e) We assume that the issuance of the Shares by the Company will not

cause any person to violate any of the provisions of the Charter relating to the Initial Holder Limit, the Look-Through Ownership Limit or the Ownership Limit (as those terms are defined in the provisions in the Charter that are applicable to the

Shares), and that the Company will not issue any shares of capital stock other than the Shares.

(f) This opinion is

limited to the matters set forth herein, and no other opinion should be inferred beyond the matters expressly stated.

We hereby consent

to the filing of this opinion with the Commission as Exhibit 5.1 to the Current Report on Form 8-K and to the reference to our firm under the heading “Legal Matters” in the Preliminary Prospectus and the Prospectus Supplement. In giving

our consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission thereunder.

|

| Very truly yours, |

|

| /s/ DLA PIPER LLP (US) |

|

| DLA PIPER LLP (US) |

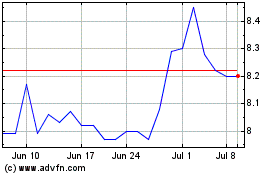

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

From Mar 2024 to Apr 2024

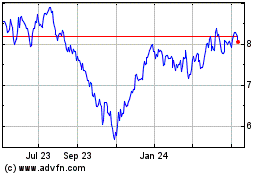

Apartment Investment and... (NYSE:AIV)

Historical Stock Chart

From Apr 2023 to Apr 2024