UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

CURRENT REPORT PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT: January 14, 2015

DATE OF EARLIEST EVENT REPORTED: January 8, 2015

001-35922

(Commission file number)

PEDEVCO CORP.

(Exact name of registrant as specified in its charter)

|

Texas

|

22-3755993

|

|

(State or other jurisdiction of

incorporation or organization)

|

(IRS Employer Identification

No.)

|

4125 Blackhawk Plaza Circle, Suite 201

Danville, California 94506

(Address of principal executive offices)

(855) 733 2685

(Issuer’s telephone number)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

ITEM 3.01 NOTICE OF DELISTING OF FAILURE TO SATISFY A CONTINUED LISTING RULE OR STANDARD; TRANSFER OF LISTING.

On January 8, 2015, PEDEVCO Corp. (the “Company”) received notice from the NYSE MKT LLC (the “Exchange”) that the Company is not in compliance with Section 1003(a)(iii) of the NYSE MKT Company Guide (“Company Guide”) since it reported stockholders’ equity (less non-controlling interest which the Company was informed by the Exchange could not be used in its compliance calculation) of less than $6,000,000 at September 30, 2014 and has incurred net losses in its five most recent fiscal years ended December 31, 2013.

Receipt of the letter does not have any immediate effect upon the listing of the Company’s common stock, provided that in order to maintain its listing on the Exchange, the Exchange has requested that the Company submit a plan of compliance (the “Plan”) by February 9, 2015 addressing how the Company intends to regain compliance with Section 1003(a)(iii) of the Company Guide by July 8, 2016.

As of the date hereof, the Company’s management has determined to submit a Plan to the Exchange by the February 9, 2015 deadline. If the Exchange accepts the Company’s Plan, the Company will be able to continue its listing during the plan period and will be subject to continued periodic review by the Exchange staff. If the Plan is not accepted, the Company is unable to regain compliance with the continued listing standards by July 8, 2016, or the Plan is accepted but the Company does not make progress consistent with the Plan during the plan period, the Company will be subject to delisting procedures as set forth in the Company Guide. The Company may then appeal such a determination by the staff of the Exchange in accordance with the provisions of the Company Guide. There can be no assurance that the Company will be able to achieve compliance with the Exchange’s continued listing standards within the required time frame. Until the Company regains compliance with the Exchange’s listing standards, a “.BC” indicator will be affixed to the Company’s trading symbol to denote non-compliance with the Exchange’s continued listing standards.

ITEM 7.01 REGULATION FD DISCLOSURE.

The Company issued a press release on January 14, 2015, announcing the initial production rate of 576 barrels of oil per day (bopd) and 630 thousand cubic feet of gas (mcfgd) (681 barrels of oil equivalent per day (boepd)) from its Loomis 2-1H well, which is the second of three new horizontal wells drilled and completed by the Company from a single pad in Weld County, Colorado, and that it had received notice from the Exchange indicating that it does not satisfy the continued listing standards of the Exchange. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated by reference herein.

In accordance with General Instruction B.2 of Form 8-K, the information presented herein under Item 7.01 and set forth in the attached Exhibit 99.1 is deemed to be “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall such information and Exhibit be deemed incorporated by reference into any filing under the Securities Act of 1933 or the Securities Exchange Act of 1934, each as amended.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

|

Exhibit No.

|

Description

|

| |

|

|

|

Press Release dated January 14, 2015

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

|

|

| |

PEDEVCO CORP.

|

| |

|

|

| |

By:

|

/s/ Frank C. Ingriselli

|

| |

|

Frank C. Ingriselli

|

| |

|

Chairman and

Chief Executive Officer

|

| |

|

|

| |

|

|

| |

|

|

Date: January 14, 2015

EXHIBIT INDEX

|

Exhibit No.

|

Description

|

| |

|

|

|

Press Release dated January 14, 2015

|

EXHIBIT 99.1

Pacific Energy Development Announces Production Rate from Second of Three Loomis Wells

These Two Wells Quadruple Net Production Rate of Company

Receives Noncompliance Notice

From NYSE MKT

January 14, 2015 – PEDEVCO Corp. d/b/a Pacific Energy Development (NYSE MKT: PED) (the “Company”), announced today that its Loomis 2-1H horizontal well recently completed in Weld County, Colorado has tested at an initial production rate of 576 barrels of oil per day (bopd) and 630 thousand cubic feet of gas (mcfgd) (681 barrels of oil equivalent per day (boepd)), from the Niobrara “B” Bench target zone. The Loomis 2-1H well is the second of three new horizontal wells recently completed by the Company from a single pad. The Company has an approximately 49.7% net working interest in this well, which came in under budget (below $4 million), reaching a total measured depth of 11,365 feet, with a 6,334 foot total vertical depth and 4,851 foot lateral length, and with 18 frac stages through the Niobrara “B” Bench target zone. On January 13th the Company announced that its first reported well (the Loomis 2-6H) had an initial production rate of 590 boepd.

Commenting on these results, Mr. Frank C. Ingriselli, the Company’s Chairman and Chief Executive Officer, stated: “We are very pleased with the initial production rate from our first two of three Loomis wells, as it not only validates our improved completion techniques and value of this acreage, but also more than quadruples our current daily net production. We look forward to announcing initial production rates from the third Loomis well within the next several days, which results we anticipate will be consistent with these wells, further significantly increasing our net production.”

The Company also announced today that on January 8, 2015, the Company was notified by the NYSE MKT LLC (the “Exchange”) that the Company is not in compliance with certain of the Exchange’s continued listing standards as set forth in Part 10 of the NYSE MKT Company Guide (the “Company Guide”). Specifically, the Company is not in compliance with Section 1003(a)(iii) of the NYSE MKT Company Guide since it reported stockholders’ equity (less non-controlling interest) of less than $6,000,000 at September 30, 2014 and has incurred net losses in its five most recent fiscal years ended December 31, 2013.

In order to maintain its listing on the Exchange, the Exchange has requested that the Company submit a plan of compliance (the “Plan”) by February 9, 2015 addressing how it intends to regain compliance with Section 1003(a)(iii) of the Company Guide by July 8, 2016. If the Plan is accepted, the Company may be able to continue its listing, but will be subject to periodic reviews by the Exchange. Receipt of the letter does not have any immediate effect on the listing of the Company’s shares on the Exchange, except that until the Company regains compliance with the Exchange’s listing standards, a “.BC” indicator will be affixed to the Company’s trading symbol. The Company’s business operations, SEC reporting requirements and debt instruments are unaffected by the notification, provided that if the Plan is not acceptable, or if it is accepted, but the Company is not in compliance with the continued listing standards by July 8, 2016, or if the Company does not make progress consistent with the Plan, then the Company will be subject to the Exchange’s delisting procedures. The Company may then appeal a staff determination to initiate such proceedings in accordance with the Exchange’s Company Guide.

Mr. Ingriselli commented, “Although the recent trends in the market for oil and gas have negatively impacted our revenues and cash flow, and caused our stockholders’ equity (net of non-controlling interest) to dip below the $6 million NYSE MKT threshold, we plan to take action in the first quarter of 2015 which we believe will enable us to meet the stockholders’ equity requirement before the deadline set forth by the Exchange and further plan to prepare and file the Plan with the NYSE MKT which we anticipate will be satisfactory and accepted.”

About Pacific Energy Development (PEDEVCO Corp.)

PEDEVCO Corp, d/b/a Pacific Energy Development (NYSE MKT: PED), is a publicly-traded energy company engaged in the acquisition and development of strategic, high growth energy projects, including shale oil and gas assets, in the United States. The Company’s principal asset is its D-J Basin Asset located in the DJ Basin in Colorado. The Company has also previously announced its entry into an agreement to acquire an indirect 5% interest in a company which will hold a 380,000 acre producing asset located in the Pre-Caspian Basin, one of the largest producing basins in Kazakhstan. Pacific Energy Development is headquartered in Danville, California, with an operations office in Houston, Texas.

Forward-Looking Statements

All statements in this press release that are not based on historical fact are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and the provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. While management has based any forward-looking statements contained herein on its current expectations, the information on which such expectations were based may change. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of risks, uncertainties, and other factors, many of which are outside of the Company’s control, that could cause actual results to materially differ from such statements. Such risks, uncertainties, and other factors include, but are not necessarily limited to, those set forth under Item 1A “Risk Factors” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2013 and its subsequent Quarterly Reports on Form 10-Q. The Company operates in a highly competitive and rapidly changing environment, thus new or unforeseen risks may arise. Accordingly, investors should not place any reliance on forward-looking statements as a prediction of actual results. The Company disclaims any intention to, and undertakes no obligation to, update or revise any forward-looking statements. Readers are also urged to carefully review and consider the other various disclosures in the Company’s public filings with the SEC.

Contacts

Pacific Energy Development

Bonnie Tang

1-855-733-3826 ext 21 (Media)

PR@pacificenergydevelopment.com

Investor Relations:

Stonegate, Inc.

Casey Stegman

1-214-987-4121

casey@stonegateinc.com

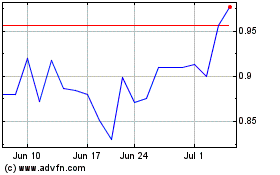

PEDEVCO (AMEX:PED)

Historical Stock Chart

From Mar 2024 to Apr 2024

PEDEVCO (AMEX:PED)

Historical Stock Chart

From Apr 2023 to Apr 2024