UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 9, 2015

AGENUS INC.

(Exact name

of registrant as specified in its charter)

|

|

|

|

|

| DELAWARE |

|

000-29089 |

|

06-1562417 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

|

|

|

| 3 Forbes Road

Lexington, MA |

|

02421 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: 781-674-4400

N/A

(Former name or

former address, if changed since last report.)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On January 9, 2015, Agenus Inc. and

its wholly-owned subsidiary, 4-Antibody AG (together, “Agenus”), entered into a global license, development and commercialization agreement (the “Collaboration Agreement”) with Incyte Corporation and a wholly-owned subsidiary

thereof, pursuant to which the parties plan to develop and commercialize novel immuno-therapeutics using Agenus’ proprietary Retrocyte DisplayTM antibody discovery platform.

Pursuant to the terms of the Collaboration Agreement, Incyte is obligated to make upfront payments to Agenus totaling $25 million. The

collaboration will initially focus on four checkpoint modulator programs directed at GITR, OX40, LAG-3 and TIM-3. The parties will share all costs and profits for the GITR and OX40 antibody programs on a 50:50 basis, with Agenus eligible to receive

potential milestone payments. Incyte is obligated to reimburse Agenus for all development costs that it incurs in connection with the LAG-3 and TIM-3 antibody programs, and Agenus will be eligible to receive potential milestone payments and

royalties. Through the direction of a joint steering committee, the parties anticipate that, for each program, Agenus will lead preclinical development activities through IND filing, and Incyte will lead all clinical development activities. The

parties expect to initiate the first clinical trials of antibodies arising from these programs in 2016.

In addition to the initial four

antibody programs, the parties have an option to jointly nominate and pursue the development and commercialization of antibodies against additional targets during a five year discovery period. This discovery period may be extended by the parties for

an additional three years. For each antibody arising from a program that the parties elect to bring into the collaboration, Agenus will have the option to designate that program as one in which the parties will share costs and profits, or one in

which Incyte will fund development costs with Agenus to be eligible to receive milestones and royalties.

For each profit-share product,

Agenus will be eligible to receive up to $20 million in future contingent development milestones. For each royalty-bearing product, Agenus will be eligible to receive (i) up to $155 million in future contingent development, regulatory, and

commercialization milestone payments and (ii) tiered royalties on global net sales at rates ranging from the mid-single to low-double digits. For each royalty-bearing product, Agenus will also have the right to elect to co-fund 30% of

development costs incurred following initiation of pivotal clinical trials in return for an increase in royalty rates. Additionally, Agenus retains co-promotion participation rights in the United States on any profit-share product.

Pursuant to the terms of the Collaboration Agreement, the parties will collaborate to exclusively develop and commercialize antibodies

directed at GITR, OX40, TIM-3, LAG-3 and any other target that the parties jointly nominate and pursue (collectively, the “Named Targets”) in the oncology and hematology fields (the “Exclusive Fields”). The parties have agreed

not to exploit antibodies against the Named Targets within the Exclusive Fields outside of the collaboration. Additionally, the parties have agreed not to exploit the specific antibodies being developed under the Collaboration Agreement outside of

the Exclusive Fields without mutual consent. Agenus generally retains the right to pursue (i) antibodies against targets that are not Exclusive Targets, in all fields, and (ii) antibodies against Named Targets that are not being developed

or commercialized under the Collaboration Agreement outside of the Exclusive Fields.

The Collaboration Agreement will become effective on

the second business day after the parties receive clearance under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”) and will continue for so long as any product under the collaboration is being developed

or commercialized. After the first anniversary of the effective date of the Collaboration Agreement, Incyte may terminate the Collaboration Agreement or any individual program for convenience upon 12 months’ notice. The Collaboration Agreement

may also be terminated by either party upon the occurrence of an uncured material breach of the other party or by Agenus if Incyte challenges patent rights controlled by Agenus. In addition, either party may terminate the Collaboration Agreement as

to any program if the other party is acquired and the acquiring party controls a competing program.

Under the Collaboration Agreement,

Incyte has also agreed to certain standstill provisions that preclude it from acquiring more than 15% of Agenus’ outstanding voting stock, including shares acquired pursuant to the Stock Purchase Agreement described below, and requires that

such stock be held solely for investment purposes.

On January 9, 2015, Agenus Inc. and Incyte Corporation also entered into a Stock

Purchase Agreement (the “Stock Purchase Agreement” and together with the Collaboration Agreement, the “Agreements”), pursuant to which Incyte agreed to purchase approximately 7.76 million shares of Agenus common stock (the

“Shares”) for an aggregate purchase price of $35 million, or approximately $4.51 per share. Incyte will own approximately 11% of the outstanding shares of Agenus common stock after such purchase. Under the Stock Purchase Agreement, Incyte

has agreed not to dispose of any of the Shares for a period of 12 months and Agenus has agreed to register the Shares for resale under the Securities Act of 1933, as amended (the “Securities Act”). Closing under the Stock Purchase

Agreement is subject to customary closing conditions, as well as continued effectiveness of the Collaboration Agreement and clearance under the HSR Act.

The foregoing descriptions of the Agreements do not purport to be complete and are qualified in

their entirety by reference to the text of the Agreements, which will be filed as exhibits to Agenus’ Annual Report on Form 10-K for the year ending December 31, 2014.

On January 9, 2015, Agenus issued a press release relating to the Agreements. A copy of this press release is attached hereto as Exhibit

99.1 and is incorporated herein by reference.

| Item 3.02 |

Unregistered Sales of Equity Securities. |

The information contained above in

Item 1.01 is hereby incorporated by reference into this Item 3.02 in its entirety. The Shares are to be sold to Incyte Corporation in reliance upon an exemption from registration afforded by Section 4(2) of the Securities Act of,

and Rule 506 of Regulation D promulgated thereunder, as the transaction does not involve any public offering. Incyte has represented to Agenus that it is an “accredited investor” within the meaning of Regulation D.

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

|

|

| 99.1 |

|

Press release issued by Incyte Corporation and Agenus Inc. dated January 9, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

| Date: January 9, 2015 |

|

|

|

AGENUS INC. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Garo H. Armen |

|

|

|

|

|

|

Garo H. Armen |

|

|

|

|

|

|

Chairman and CEO |

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description of Exhibit |

|

|

| 99.1 |

|

Press release issued by Incyte Corporation and Agenus Inc. dated January 9, 2015. |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Incyte and Agenus Announce Global Alliance to Develop

Novel Immuno-Oncology Antibodies

| |

• |

|

Alliance to initially focus on four checkpoint modulator programs directed at GITR, OX40, TIM-3 and LAG-3 |

| |

• |

|

Incyte to have access to Agenus’ proprietary Retrocyte Display™ platform for the discovery of additional therapeutic antibodies |

| |

• |

|

Agenus to receive $60 million comprised of a $25 million technology and program access fee under the collaboration plus $35 million equity investment in Agenus at $4.51/share |

| |

• |

|

Agenus eligible to receive up to $350 million in development, regulatory and commercial milestones across the four lead programs |

WILMINGTON, DE and LEXINGTON, MA – January 9, 2015 – Incyte Corporation (Nasdaq: INCY) and Agenus Inc. (Nasdaq: AGEN) today announced a global

license, development and commercialization agreement focused on novel immuno-therapeutics using Agenus’ proprietary Retrocyte Display™ antibody discovery platform.

The alliance will initially focus on the development of checkpoint modulator antibodies directed against GITR, OX40, LAG-3 and TIM-3. Agenus and Incyte will

share all costs and profits for the GITR and OX40 antibody programs on a 50:50 basis, with Agenus eligible for potential milestones; TIM-3 and LAG-3 are royalty-bearing programs to be funded by Incyte, with Agenus eligible for potential milestones

and royalties. The first clinical trials are expected to be initiated in 2016.

“This alliance with Agenus adds therapeutic antibody capabilities to

our proven small molecule discovery expertise, significantly expands the landscape of potential immuno-oncology targets available to us, and strengthens our ability to identify and advance novel therapeutic combinations,” said Hervé

Hoppenot, President and CEO of Incyte.

“Incyte’s track record of success in oncology development and commercialization, together with our

therapeutic antibody expertise and the commonality of our objectives, speak to the compelling strategic rationale for this alliance,” said Garo H. Armen, Ph.D., Chairman and CEO of Agenus. “Our Retrocyte Display™ technology has

produced high quality antibody candidates and offers significant advantages over competing technologies. With Incyte, we believe we have an ideal partner to help define the evolving treatment paradigm of cancer immunotherapies.”

Under the terms of the agreements between the parties, Incyte will make upfront payments to Agenus totaling $25

million and invest $35 million by purchasing approximately 7.76 million newly issued shares of Agenus common stock at a price of $4.51 per share. In addition to the initial four target programs in the alliance, the parties have an option to

jointly nominate and pursue additional targets within the framework of the multi-year collaboration. Terms also include:

| |

• |

|

For each royalty-bearing product, Agenus will be eligible to receive up to $155 million in future contingent development, regulatory and commercialization milestones. |

| |

• |

|

Also for royalty-bearing products, Agenus will be eligible to receive tiered royalties on global net sales ranging from mid-single to low-double digit rates, and has reserved the right to elect to co-fund 30% of

development costs for increased royalties. |

| |

• |

|

For products from any additional programs that the parties elect to bring into the collaboration, Agenus may opt to designate them as profit-share products. |

| |

• |

|

For each profit-share product, Agenus will be eligible to receive up to $20 million in future contingent development milestones. |

Retrocyte Display™ is a proprietary retroviral technology that enables a highly diverse library

(>1x109) of human IgG molecules to be displayed on the surface of B-lineage cells. This innovative cell-displayed expression platform permits the rapid generation of fully human and humanized

therapeutic antibodies with high affinity and target specificity.

The closing of the transaction is conditioned on the expiration or termination of the

waiting period under the Hart-Scott-Rodino Antitrust Improvements Act.

About Incyte

Incyte Corporation is a Wilmington, Delaware-based biopharmaceutical company focused on the discovery, development and commercialization of proprietary small

molecule drugs, primarily for oncology. For additional information on Incyte, please visit the Company’s website at www.incyte.com.

About

Agenus

Agenus is an immuno-oncology company developing a portfolio of checkpoint modulators (CPMs), heat shock protein peptide-based vaccines and

adjuvants. Agenus’ checkpoint modulator programs target GITR, OX40, CTLA-4, LAG-3, TIM-3 and PD-1. The company’s proprietary discovery engine Retrocyte DisplayTM is used to generate

fully human and humanized therapeutic antibody drug candidates. The Retrocyte DisplayTM platform uses a high-throughput approach incorporating IgG format human antibody libraries expressed in

mammalian B-lineage cells. Agenus’ heat shock protein-based vaccines for cancer and infectious disease have completed Phase 2 studies in glioblastoma multiforme, and in the

treatment of herpes simplex viral infection. The company’s QS-21 Stimulon® adjuvant platform is extensively partnered with

GlaxoSmithKline and Janssen Sciences Ireland UC and includes several vaccine candidates in Phase 2, as well as shingles and malaria vaccines which have successfully completed Phase 3 clinical trials. For more information, please visit

www.agenusbio.com, or connect with the company on Facebook, LinkedIn, Twitter and Google+.

Incyte Forward-Looking Statements

Except for the historical information set forth herein, the matters set forth in this press release, including without limitation statements with respect to

the initial focus of the alliance, the potential benefits of the alliance and the expectation that the first clinical trials under the alliance will be initiated in 2016, contain predictions and estimates and are forward-looking statements within

the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on Incyte’s current expectations and subject to risks and uncertainties that may

cause actual results to differ materially, including the high degree of risk associated with drug development, results of further research and development, unanticipated delays, other market or economic factors and technological advances, regulatory

approval of the transaction and other risks detailed from time to time in Incyte’s filings with the Securities and Exchange Commission, including its Quarterly Report on Form 10-Q for the quarter ended September 30, 2014. Incyte disclaims

any intent or obligation to update these forward-looking statements.

Agenus Forward-Looking Statements

This press release contains forward-looking statements that are made pursuant to the safe harbor provisions of the federal securities laws, including

statements regarding the initial focus of the alliance between Agenus and Incyte, the potential benefits of the alliance and the expectation that the first clinical trials under the alliance will be initiated in 2016. These forward-looking

statements are subject to risks and uncertainties that could cause actual results to differ materially from those projected. These risks and uncertainties include, among others, regulatory approval of the transaction, unanticipated delays and other

market or economic factors, as well as the factors described under the Risk Factors section of our most recently filed Quarterly Report on Form 10-Q with the Securities and Exchange Commission. Agenus cautions investors not to place considerable

reliance on the forward-looking statements contained in this release. These statements speak only as of the date of this press release, and Agenus undertakes no obligation to update or revise the statements, other than to the extent required by law.

All forward-looking statements are expressly qualified in their entirety by this cautionary statement.

Incyte Contact:

Pamela M. Murphy

Vice President, Investor Relations &

Corporate Communications

302/498 6944

Agenus Contact:

Media:

Brad Miles / BMC Communications

646/513-3125

bmiles@bmccommunications.com

Investors:

Andrea Rabney / Argot Partners

212/600-1902

andrea@argotpartners.com

# # #

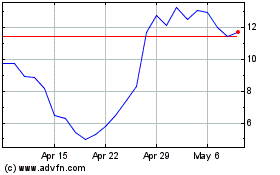

Agenus (NASDAQ:AGEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

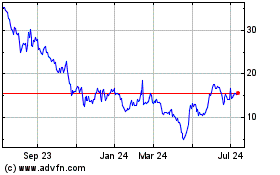

Agenus (NASDAQ:AGEN)

Historical Stock Chart

From Apr 2023 to Apr 2024